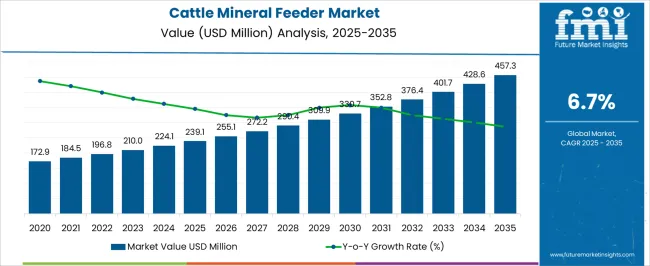

The Cattle Mineral Feeder Market is estimated to be valued at USD 239.1 million in 2025 and is projected to reach USD 457.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Cattle Mineral Feeder Market Estimated Value in (2025 E) | USD 239.1 million |

| Cattle Mineral Feeder Market Forecast Value in (2035 F) | USD 457.3 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Cattle Mineral Feeder market is experiencing significant growth due to increased emphasis on improving livestock health and enhancing nutrient delivery efficiency. The demand for optimized feeding systems has been rising in both developed and emerging economies, as livestock producers seek to minimize feed wastage and maximize productivity. Advancements in material science and agricultural equipment manufacturing have further supported the adoption of durable, cost-effective feeders.

Additionally, awareness about the benefits of mineral supplementation in cattle diets has been growing, leading to greater adoption of specialized feeder solutions across commercial and small-scale farms. Government initiatives to support sustainable livestock farming, along with rising demand for meat and dairy products, have also contributed to the expansion of the market.

The future outlook remains strong as farmers continue to invest in infrastructure that improves herd health, productivity, and operational efficiency These trends are expected to create steady growth opportunities for manufacturers and distributors of cattle mineral feeders in the coming years.

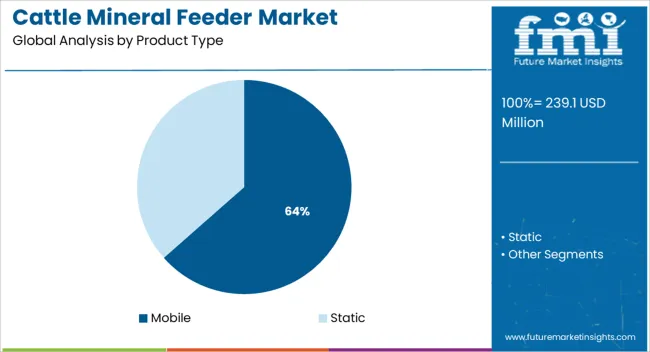

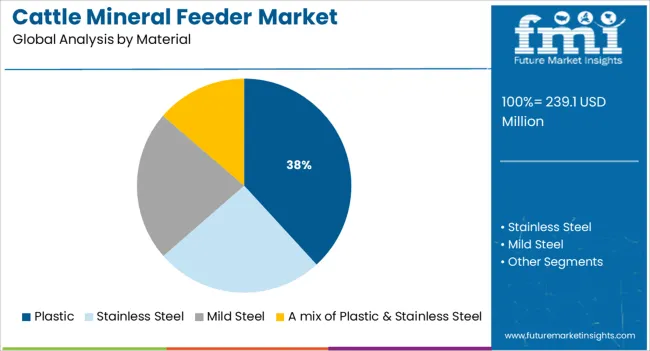

The market is segmented by Product Type and Material and region. By Product Type, the market is divided into Mobile and Static. In terms of Material, the market is classified into Plastic, Stainless Steel, Mild Steel, and A mix of Plastic & Stainless Steel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile product type segment is anticipated to account for 63.5% of the Cattle Mineral Feeder market revenue share in 2025, making it the most dominant product category. This leading position has been supported by its operational flexibility, ease of relocation, and suitability for rotational grazing practices. It has been observed that mobile feeders are preferred by livestock producers who require adaptable feeding systems to accommodate seasonal movement of cattle across pastures.

The durability and weather-resistance of mobile designs have also contributed to their increased usage in variable farm environments. Their ability to reduce labor requirements while ensuring consistent mineral intake has led to higher adoption, particularly in large-scale and commercial farming operations.

Additionally, the integration of user-friendly features such as wheels and adjustable heights has improved ease of use and efficiency These advantages have strengthened the mobile segment’s role in driving overall market revenue and securing its leading share position.

The plastic material segment is expected to hold 38.2% of the Cattle Mineral Feeder market revenue share in 2025, maintaining a strong position among material types. Its growth has been driven by the rising demand for lightweight, corrosion-resistant, and low-maintenance feeding equipment across varied farm settings. Plastic feeders have gained traction due to their affordability and ease of cleaning, which are key considerations for maintaining hygiene in livestock environments.

Their resistance to rust and chemical degradation has increased their durability, making them well-suited for outdoor use throughout the year. Additionally, advancements in polymer technology have enabled manufacturers to produce robust designs that can withstand physical impact and environmental stress without compromising functionality.

The growing focus on cost-effective and long-lasting feeding solutions has further supported the segment’s expansion These factors have collectively contributed to the plastic segment’s substantial share in the market and its continued relevance for farmers prioritizing efficiency and ease of use.

The increased emphasis on farm animal nutrition is a result of the industrialization of livestock production. This is taking place to fulfill the rising need for animal protein sources. This is likely to increase the sales of cattle mineral feed. This trend is predicted to propel the global market for cattle mineral feeders to a healthy rate of development. The feeder is crucial when dealing with loose minerals, particularly for weather protection.

Farm animals do not receive enough minerals from their typical diet, thus feed supplements are required to meet their needs. It is anticipated that the demand for premium meat from the meat processing sector would increase feed mineral consumption even further. Rising consumer demand for animal products such as meat, milk, cotton, and beef has also stimulated the market for mineral feed additives. This in turn is likely to open up opportunities for the cattle mineral feeder market players.

| Attributes | Details |

|---|---|

| Cattle Mineral Feeder Market Value (2025) | USD 239.1 million |

| Cattle Mineral Feeder Market Expected Value (2035) | USD 457.3 million |

| Cattle Mineral Feeder Market Projected CAGR (2025 to 2035) | 6.7% |

The cattle mineral feeder market is expected to thrive at a CAGR of 6.7% between 2025 and 2035. Historically, the market value of cattle mineral feeders showed decent growth from 2020 to 2025, exhibiting a CAGR of 6.0%.

One of the main reasons propelling the growth of the feed mineral feeder market is the rise of feed production across the globe. The population's growing concern for the welfare of animals and the standardization of meat products both have an impact on the market.

| Historical CAGR (2020 to 2025) | 6.0% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.7% |

Short Term (2025 to 2029): The cattle mineral feeder market is expected to be impacted by advances in animal husbandry and increasing demand for better-quality animal products.

Medium Term (2029 to 2035): Market participants are likely to profit from the rising demand for nutritional supplements for monogastric animals and a trend toward natural growth boosters. This is expected to increase the adoption of mineral feeders for cattle.

Long Term (2035 to 2035): Market expansion is expected to accelerate by rising livestock-based product demand and consumption as well as the use of cutting-edge animal husbandry techniques to enhance the quality of meat.

On the back of these aspects, the cattle mineral feeder market is expected to develop nearly 2X between 2025 and 2035. As per the FMI market analyst, a valuation of USD 402 by 2035 end is projected for the market.

| Year | Valuation |

|---|---|

| 2020 | USD 138.8 Million |

| 2024 | USD 185.7 Million |

| 2025 | USD 196.8 Million |

| 2025 | USD 210 Million |

| 2035 | USD 402 Million |

North America led the global cattle mineral feeder market in 2025, and it is anticipated to continue to do so over the forecast period. The region's need for meals containing animal-sourced protein is being driven by the expanding fast food and food processing industries. This tendency is expected to continue. This will raise the need for feed additives because they offer nutritive advantages and help avoid animal illnesses. Thus, the adoption of cattle mineral feeders is anticipated to rise as a result.

In addition to being the market leader in North America, the United States is a prominent player in the global dairy industry. The organic dairy industry in the US is now being driven by several causes. Consumers in the country are switching to organic dairy products as a result of their increased health consciousness.

| Country | United States |

|---|---|

| Market Share (2025) | 26.5% |

| Market Value (2025) | USD 52.1 Million |

The United States is a significant producer of livestock and other animal-based goods in North America, which is one of the world's greatest producers overall. Growing production and consumption of animals and goods derived from livestock in this nation. This has made it possible for livestock farmers to use feed and feed minerals. These are very successful in encouraging healthy animal growth and increasing fertility. Hence, the US cattle mineral feeder market has great potential for market players.

The expansion of the USA cattle mineral feeder market is anticipated to be also fueled by dairy farmers' growing awareness of the safety of animal feed. The market in the United States is anticipated to increase quickly because of the focus placed by governments and international organizations like the Food and Agricultural Organization (FAO) on guaranteeing the safety and health of animal-based commodities for human consumption.

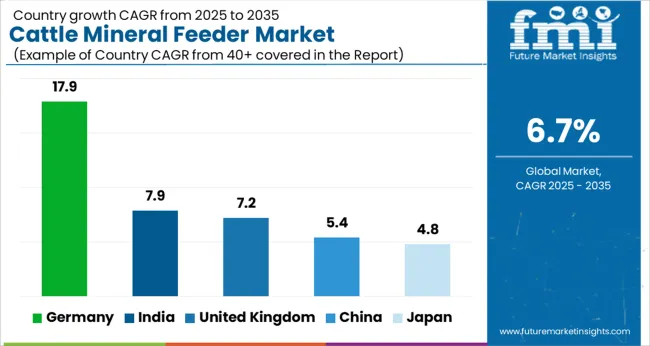

German cattle mineral feeder market is the largest in Europe. The demand for dairy and meat products is rising in Germany. The consumer preference for a diet high in protein is the reason why consumption is increasing quickly. The market is also driven by rising livestock production and a well-established dairy industry. The increased demand for dairy and cattle products has given mineral feed producers a chance to boost cattle productivity. Cattle mineral feeder market expansion will be fueled as a result.

| Country | Germany |

|---|---|

| Market Share (2025) | 17.9% |

| Market Value (2025) | USD 35.2 Million |

Selenium insufficiency is pervasive in German livestock herds, according to research that was published in the MDPI journal "Animals" in June 2024. According to the report, more than one-third of the herds under investigation had insufficiency. German livestock farmers now have a greater understanding of the dietary requirements of animals. The focus on livestock mineral feed and feeders for adequate nutrient intake of animals in Germany is anticipated to expand as a result. This is anticipated to drive the growth of the German cattle mineral feeder market during the anticipated period.

In the UK, virus outbreaks on livestock are a common occurrence. This is motivating farmers to supplement feed with minerals to boost the immune system. As a result, the sales of mineral feed additives have been increasing over the past several years as a result of the increase in animal output and frequent disease outbreaks. This has led to a rise in the sales of cattle animal feeders to provide cattle with proper nutrition in a systematic way.

| Country | United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 7.2% |

| Market Share (2025) | 9.6% |

| Market Value (2025) | USD 18.9 Million |

| Market Value (2035) | USD 37.8 Million |

Moreover, over the forecast period, an increase in dairy farming is anticipated in the nation. The usage of cattle mineral feed and feeders is anticipated to rise as a result. The UK cattle mineral feeder market has a sizable portion of the European market as a result of the country's growing health consciousness and dairy consumption. The country's well-established dairy sectors and technical advancements in the animal feed sector are projected to drive the market in the upcoming years. Increasing public knowledge of the benefits of mineral feed for cattle is also a significant driver expected to force market growth.

China's cattle industry has seen a substantial transition during the past three decades. It has had a tremendous effect on both the domestic and international food supply. In fewer than 30 years, the number of livestock units in China tripled. Additionally, a trend toward high protein food consumption has been brought on by the increase in per capita income. As a result, the cattle industry has been stimulated, leading to a concurrent increase in the demand for cattle mineral feed. Hence, the Chinese cattle mineral feeder market to effect positively as a result of this throughout the forecast period.

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 5.4% |

| Market Share (2025) | 9.1% |

| Market Value (2025) | USD 17.87 Million |

| Market Value (2035) | USD 30.2 Million |

According to FMI research, China's government policies are now having a significant impact on the feed additives business. One of the main drivers propelling the market's growth is the nation's attempts to modernize and discover efficiencies in its methods and structure. Moreover, the rising demand for cattle products to fulfill the population's rising protein demands also led to the adoption of cattle mineral feeders along with the mineral feed.

India produces the highest quantity of milk across the globe. However, milk outputs per cow are poor, and Indian farmers feed their animals with raw agricultural wastes like cotton cake or husks. In the next years, the requirement for mineral feed is projected to rise to boost cattle productivity and satisfy the nation's rising milk demand. This is likely to fuel the market for cattle mineral feeders.

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 7.9% |

| Market Share (2025) | 3.6% |

| Market Value (2025) | USD 7.0 Million |

| Market Value (2035) | USD 15.0 Million |

India has the most livestock animals, such as dairy cattle, according to the FAO agency. The consumption of mineral feed for cattle is a result of the continued rise in demand for milk products and the excessive use of ruminant animals for milk production. The Indian cattle mineral feeder market will continue to increase as a result in the future years. Market expansion in the nation is anticipated to be further aided by rising awareness of cattle health issues, organic cattle products, and advanced feeding equipment.

Furthermore, market participants benefit financially from the proliferation of e-commerce networks in India. Numerous types of cow-feeding equipment, including mineral feeders, are available on websites like Indiamart. As a result, the Indian cattle mineral feeder market offers huge potential to market participants.

According to Livestock Statistics, a report from the Ministry of Agriculture, Forestry, and Fisheries, the entire population of dairy cattle and calves increased by 0.3% yearly as of February 2024. Local farmers are under pressure to expand production to fulfill the rising demand for dairy and meat.

| Country | Japan |

|---|---|

| Market Share (2025) | 4.8% |

| Market Value (2025) | USD 9.4 Million |

Animal husbandry is experiencing a high growth rate at present in Japan. The demand for mineral feed and feeders is anticipated to increase in these conditions. As a result, market players stand to benefit greatly from the Japanese cattle mineral feeders market.

The global market for cattle mineral feeders is segmented based on product type, material, and region.

Stainless Steel Cattle Mineral Feeders are Popular

The best and safest material for feeding cattle is stainless steel. Preference for stainless steel cattle mineral feeders is growing among farmers owing to the huge advantages it provides. The optimum mix of qualities can be found in stainless steel. It is hygienic, which means that no germs will grow on its surface, and it is easily cleanable with soap and water. Also, it is incredibly robust. The stainless steel's adequate corrosion resistance is another advantage. Its durability and capacity to endure heat and fire are unmatched by any other material. Cattle mineral feeders made of stainless steel are becoming ever more popular since they are sustainable and give long-term value.

The desire for dairy products among consumers worldwide is expected to increase demand for equipment used in dairy farming. Cattle mineral feeders are one of them. Similar to other markets, the cattle mineral feeder market is quite fragmented. In order to succeed in this cutthroat industry, recent newcomers to the cattle mineral feeder industry believe that sharpening their competitive edge is essential.

Top Startup to Pay Attention to

MicroFeeder - Europe

Through a network of distributors, MicroFeeder provides mineral feeders to livestock farmers in Europe and other countries. Its feeders come in variants for use inside stables and outside during grazing and include cutting-edge IoT solutions with personalized dosing as well as free-choice feeders. Its feeders are designed to increase production, improve animal welfare, and increase profitability for livestock owners.

In addition to producing new mineral feeders for cattle, manufacturers work to enhance the products they currently provide on the market. They are also establishing fruitful connections with other businesses engaged in related fields. In order to boost their chances of entering lucrative enterprises, they are forming alliances with other companies.

Sioux Steel Company

Grain bins, bunker walls, structures, and livestock equipment are all produced by Sioux Steel Company. The business provides a variety of feeder alternatives for cattle. The most well-known of its products are its upright and ground mineral feeders.

Century Products

Feeders from Century Products are made of polyethylene and include stainless steel hardware for long-lasting use. To assist them to endure strain and stress, the hay ring ends of the livestock hay feeders are fused together utilizing a butt fusion method. Poly feeders from Century Products are the ideal addition to the stall-feeding apparatus.

AmeriAg

In 1989, T&R Farms in North Carolina's Southern Alamance County was the precursor to AmeriAg. In 1991, T&R Farms started selling supplies and feed for animals. Its livestock mineral feeders are compact, reliable, weatherproof, windproof, inexpensive, multifunctional, and dynamic.

JFC Agri

The JFC Agri Mineral Rocker Supplement Feeder features a self-raising feature. No matter how much the animals jostle it, the feeder always returns to an upright position. The feeder has a high front lip and does not spill its stock of mineral feed. Strong PEHD material is used to create the Mineral Rocker. A cast iron contra weight at the bottom provides the self-raising functionality.

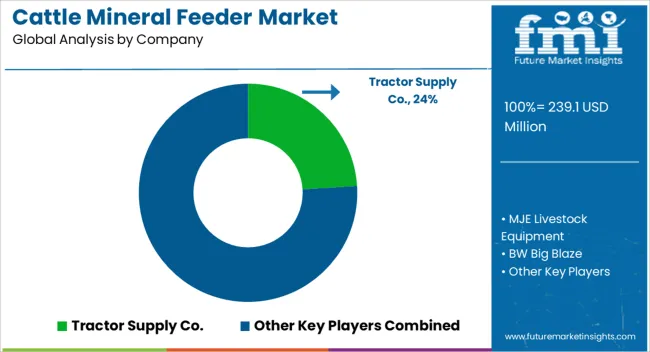

The global cattle mineral feeder market is estimated to be valued at USD 239.1 million in 2025.

The market size for the cattle mineral feeder market is projected to reach USD 457.3 million by 2035.

The cattle mineral feeder market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in cattle mineral feeder market are mobile and static.

In terms of material, plastic segment to command 38.2% share in the cattle mineral feeder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Smart Cattle Market

Dairy Cattle Feed Market

Automatic Cattle Waterer Market – Trends & Growth Forecast 2025 to 2035

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA