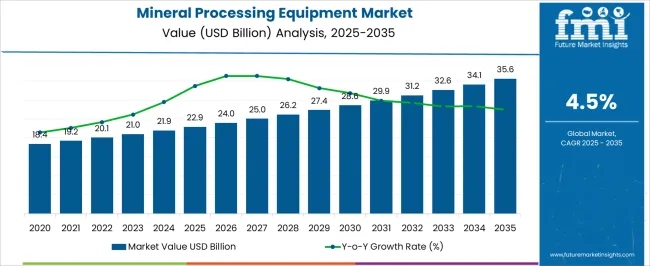

The mineral processing equipment market is projected to grow from USD 22.9 billion in 2025 to USD 35.6 billion in 2035, reflecting a CAGR of 4.5%. During the early adoption phase (2020–2024), the market expanded from USD 18.4 billion to USD 22.9 billion as equipment was introduced and tested in mining operations. Pilot installations were conducted to evaluate efficiency, throughput, and operational reliability. By 2025, the market is expected to reach USD 22.9 billion, with broader adoption across metallic and non-metallic mineral extraction projects. Initial procurement and integration are being supported by strategic planning and investment by mining companies and industry stakeholders. From 2025 to 2035, the market is projected to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market is forecast to surpass USD 27.4 billion, driven by expanded deployment in large-scale mining operations and optimized production lines. During the consolidation phase, growth is expected to moderate toward USD 35.6 billion by 2035 as leading equipment manufacturers strengthen their presence and smaller players consolidate or exit. The 4.5% CAGR indicates steady expansion, establishing the market as a standard solution for mineral extraction, processing efficiency, and operational optimization across global mining operations.

| Metric | Value |

|---|---|

| Mineral Processing Equipment Market Estimated Value in (2025 E) | USD 22.9 billion |

| Mineral Processing Equipment Market Forecast Value in (2035 F) | USD 35.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The mineral processing equipment market is influenced by several parent markets, each contributing to overall growth. The global mining industry is estimated to drive approximately 35%, as equipment is deployed for extraction and processing of metallic and non-metallic minerals. Mining machinery and heavy equipment manufacturing is considered responsible for 20%, as crushers, mills, and separators are produced and supplied. Mineral beneficiation and processing services are assessed to account for 15%, as ores are treated and refined using specialized equipment. Research and consulting services are estimated to influence 10%, as operational assessments, process optimization, and efficiency studies are conducted. Mining infrastructure and logistics contribute around 7%, as transportation, storage, and material handling support equipment deployment. Environmental monitoring and compliance services are evaluated at 5%, as water, dust, and waste management are monitored during processing. Spare parts and maintenance services account for 5%, as machinery uptime and performance are maintained. Lastly, digital solutions and monitoring systems are estimated at 3%, as process control, automation, and real-time monitoring are implemented to optimize operations.

The Mineral Processing Equipment market is witnessing robust growth driven by increasing demand for efficient and automated mineral extraction processes. The market is currently shaped by the adoption of advanced machinery that enhances productivity, reduces operational costs, and improves recovery rates across the mining and metallurgy sectors. Growing global demand for metals and minerals, coupled with rising industrialization in emerging economies, is creating significant opportunities for high-capacity processing equipment.

Investments in modern mining infrastructure and the need for environmentally compliant processing systems are further propelling market expansion. In addition, the integration of digital monitoring, predictive maintenance, and intelligent control systems has enabled operators to optimize equipment performance and energy consumption.

As global mineral consumption continues to rise, particularly for construction and industrial applications, the market is expected to witness steady growth Future opportunities are likely to emerge from equipment that supports modular upgrades, increased automation, and sustainable operations while meeting evolving regulatory and environmental standards.

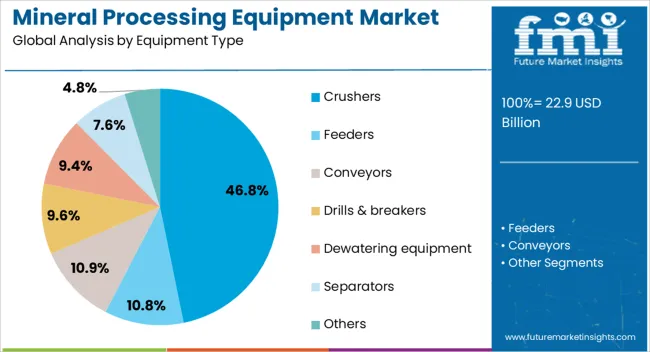

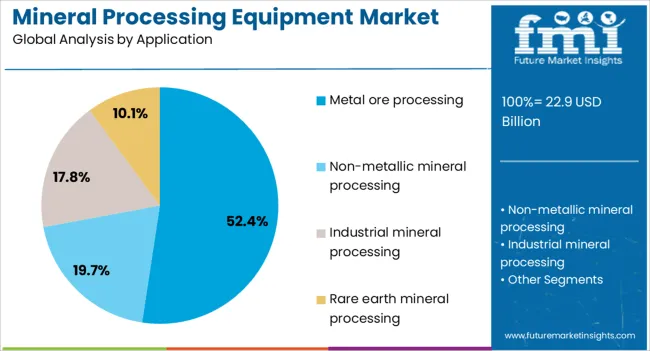

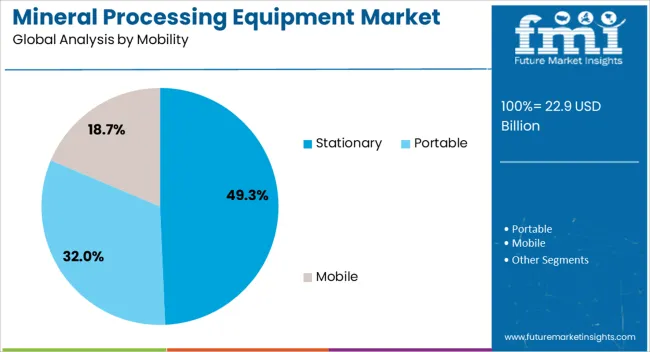

The mineral processing equipment market is segmented by equipment type, application, mobility, end-user industry, and geographic regions. By equipment type, mineral processing equipment market is divided into Crushers, Feeders, Conveyors, Drills & breakers, Dewatering equipment, Separators, and Others. In terms of application, mineral processing equipment market is classified into Metal ore processing, Non-metallic mineral processing, Industrial mineral processing, and Rare earth mineral processing. Based on mobility, mineral processing equipment market is segmented into Stationary, Portable, and Mobile. By end-user industry, mineral processing equipment market is segmented into Mining, Metallurgy, Construction, and Others. Regionally, the mineral processing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Crushers equipment type is projected to hold 46.8% of the Mineral Processing Equipment market revenue share in 2025, making it the leading equipment category. This dominance is being attributed to the critical role crushers play in reducing the size of raw materials for subsequent processing, ensuring uniformity and efficiency throughout the mineral processing chain. The adoption of advanced crushers has been accelerated by their ability to handle large volumes of ore with high precision, supporting high recovery rates and energy-efficient operation.

Their robust design and capability to operate under continuous heavy-duty conditions make them preferable in both large-scale and mid-sized mining operations. The demand for crushers has been further reinforced by the need for automated systems that minimize human intervention while improving safety and operational reliability.

Additionally, compatibility with emerging digital and monitoring technologies has allowed crushers to be integrated into intelligent process workflows, enabling predictive maintenance and real-time performance optimization The growth of construction, metallurgical, and industrial sectors continues to sustain demand, solidifying the crushers segment as the market leader.

The Metal Ore Processing application segment is expected to capture 52.4% of the Mineral Processing Equipment market revenue in 2025, establishing it as the dominant application category. This leadership has been driven by the global expansion of the metal industry, which requires efficient processing solutions to extract metals such as iron, copper, aluminum, and gold. Equipment for metal ore processing has been favored due to its ability to ensure high-quality outputs with minimal losses, supporting operational efficiency and cost reduction.

Increasing industrialization and infrastructure development across emerging economies have amplified the demand for metal ores, further propelling investments in advanced processing equipment. The adoption of energy-efficient and automated systems has allowed operators to improve throughput, reduce downtime, and achieve consistent performance.

Rising environmental and regulatory requirements for sustainable mineral processing have also contributed to the preference for sophisticated metal ore processing equipment As the need for metals continues to grow in construction, automotive, and electronics industries, the segment is expected to maintain its leading position, with opportunities for technology-driven enhancements that improve yield and reduce operational risks.

The Stationary mobility type is projected to hold 49.3% of the Mineral Processing Equipment market revenue share in 2025, making it the largest segment within mobility classifications. This prominence is being attributed to its high suitability for large-scale, continuous operations in processing plants where consistent throughput and stability are critical. Stationary equipment provides robust structural support, high processing capacity, and enhanced precision in mineral separation and crushing operations.

The segment has grown significantly due to the operational advantages of fixed installations, including optimized workflow, better energy efficiency, and reduced risk of mechanical failure during heavy-duty operation. Furthermore, stationary systems allow for seamless integration with process automation, monitoring, and control technologies, supporting predictive maintenance and operational analytics.

Their adaptability to modular upgrades without replacing core infrastructure has made them attractive for long-term capital investment in mineral processing plants With rising industrial demand and growing adoption in metallurgical and construction material production, stationary equipment is expected to continue dominating the market, driven by efficiency, reliability, and cost-effectiveness.

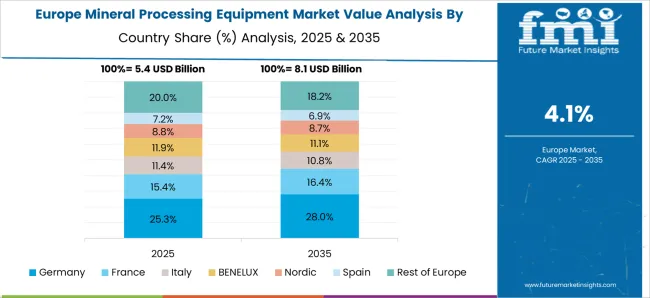

The mineral processing equipment market is growing due to rising global demand for metals and minerals, increased mining activities, and technological advancements in ore beneficiation. North America and Europe lead with high-efficiency crushers, grinders, and flotation systems for base and precious metals. Asia-Pacific shows rapid growth driven by large-scale mining operations and industrialization. Manufacturers differentiate through automation, energy efficiency, throughput, and durability. Regional variations in ore type, mining regulations, and operational infrastructure influence adoption, equipment customization, and competitive positioning globally.

Adoption of mineral processing equipment depends heavily on efficiency and throughput capacity. North America and Europe emphasize high-capacity crushers, grinders, and flotation units that optimize ore recovery while minimizing energy consumption and operational costs. Asia-Pacific markets prioritize reliable, scalable equipment to handle high-volume mining operations for industrial and precious minerals. Differences in equipment efficiency and throughput directly affect processing costs, productivity, and profitability. Leading suppliers invest in energy-optimized designs, advanced materials, and modular configurations for premium applications, while regional manufacturers focus on robust, low-cost alternatives. Equipment efficiency and throughput contrasts shape adoption, operational performance, and market competitiveness across global mineral processing operations.

Automation and integrated process control are critical for modern mineral processing. North America and Europe focus on automated monitoring, predictive maintenance, and real-time process optimization to improve recovery rates and reduce downtime. Asia-Pacific adoption emphasizes semi-automated or modular control systems suitable for emerging mining operations and cost-sensitive environments. Differences in automation sophistication impact labor dependency, process consistency, and operational accuracy. Suppliers providing intelligent, fully integrated systems gain higher adoption, while regional players offer practical, adaptable solutions. Automation and process control contrasts drive operational efficiency, safety, and competitive differentiation in the global mineral processing equipment market.

Durability, maintenance needs, and material selection are crucial for equipment adoption. North America and Europe demand corrosion-resistant, high-wear-capacity equipment to handle abrasive ores and ensure long operational lifespans in harsh mining conditions. Asia-Pacific markets adopt robust, cost-efficient machines that balance durability with maintainability for high-volume processing. Differences in maintenance complexity and material resilience affect downtime, repair costs, and process continuity. Leading suppliers provide advanced alloys, modular components, and extended service programs, while regional manufacturers focus on durable yet affordable alternatives. Durability and maintenance contrasts shape adoption, operational continuity, and competitiveness across global mineral processing operations.

Environmental regulations, workplace safety standards, and mining approvals significantly impact equipment deployment. North America and Europe enforce strict compliance for emissions, dust control, and noise levels, influencing equipment design and operational protocols. Asia-Pacific regulations vary; advanced regions follow international standards, while emerging markets emphasize local compliance with practical implementation. Differences in regulatory requirements affect procurement, installation, and operational procedures. Suppliers offering certified, environmentally compliant, and safe equipment gain higher adoption, while regional producers focus on cost-effective solutions that meet basic local regulations. Regulatory contrasts shape adoption, market accessibility, and competitive positioning in the global mineral processing equipment industry.

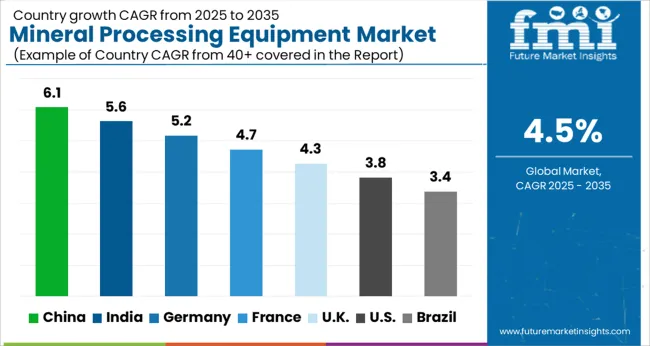

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global mineral processing equipment market was projected to grow at a 4.5% CAGR through 2035, driven by demand in mining, metallurgical, and resource extraction applications. Among BRICS nations, China recorded 6.1% growth as large-scale manufacturing and deployment facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 5.6% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 5.2% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 4.3% relied on moderate-scale operations for mining and mineral processing applications. The USA, expanding at 3.8%, remained a mature market with steady demand across commercial and industrial mining segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Mineral processing equipment market in India is being expanded at a CAGR of 5.6% as demand from mining, cement, and metal processing sectors rises. Crushers, mills, flotation cells, and screens are being adopted to enhance productivity, efficiency, and quality. Manufacturers are being focused on producing reliable, cost-effective, and high performance systems. Distribution through authorized suppliers, industrial distributors, and service providers is being ensured. Government regulations and mining modernization initiatives are being followed. Training programs and awareness campaigns for proper usage and maintenance are being conducted. Increasing industrial projects and construction activity are being considered primary drivers of market growth in India.

The mineral processing equipment market in Germany is being driven at a CAGR of 5.2% due to demand from the mining, metallurgy, and chemical industries. Equipment such as crushers, grinding mills, flotation cells, and screening machines is being adopted to ensure high efficiency and precise mineral separation. Manufacturers are being encouraged to provide automated, durable, and energy efficient solutions. Distribution through industrial suppliers, OEMs, and service partners is being maintained. Research and development in advanced materials, automation, and high capacity processing is being conducted. Compliance with industrial and environmental standards is being ensured. Germany’s industrial focus on mining efficiency and precision processing is being considered a major factor supporting growth in the mineral processing equipment market.

The United Kingdom mineral processing equipment market is being expanded at a CAGR of 4.3% with growing demand from mining, construction, and recycling industries. Crushers, grinding mills, flotation devices, and screening equipment are being adopted to improve processing efficiency and material recovery. Manufacturers are being focused on producing high performance, durable, and energy efficient equipment. Distribution through industrial suppliers, OEMs, and authorized dealers is being ensured. Awareness programs and training workshops are being conducted to support proper usage and safety. Mining operations, construction activity, and resource recovery initiatives are being considered key factors supporting market growth in the United Kingdom.

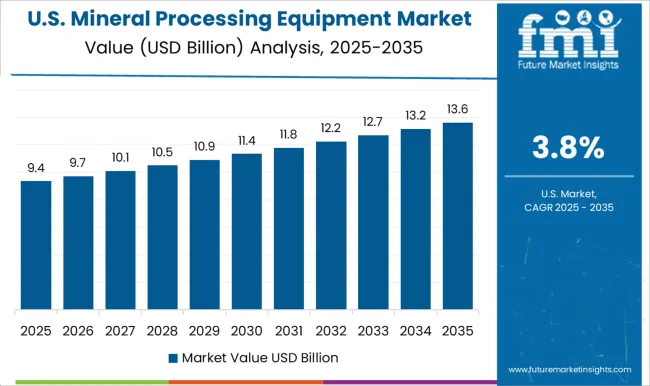

The United States mineral processing equipment market is being driven at a CAGR of 3.8% due to demand from mining, metallurgical, and chemical processing industries. Crushers, grinding mills, flotation cells, and screens are being adopted to enhance ore recovery, efficiency, and precision. Manufacturers are being encouraged to supply high quality, automated, and energy efficient equipment. Distribution through industrial suppliers, OEMs, and service partners is being maintained. Research and development in automated systems, high capacity processing, and energy efficient solutions is being conducted. Growing mining operations, metal production, and construction projects are being considered key growth drivers for the mineral processing equipment market in the United States.

The mineral processing equipment market in China is being driven at a CAGR of 6.1% due to the growing demand from mining, metallurgy, and construction industries. Crushers, grinding mills, flotation cells, and screening equipment are being adopted to improve ore extraction efficiency and processing accuracy. Manufacturers are being encouraged to produce high performance, durable, and energy efficient equipment. Distribution through authorized suppliers, industrial dealers, and online platforms is being maintained. Government policies supporting mining modernization and industrial growth are being followed. Research and development in automated, high capacity, and low energy consumption systems is being undertaken. Rising demand for metals, minerals, and construction materials is being considered a key factor driving the adoption of mineral processing equipment in China.

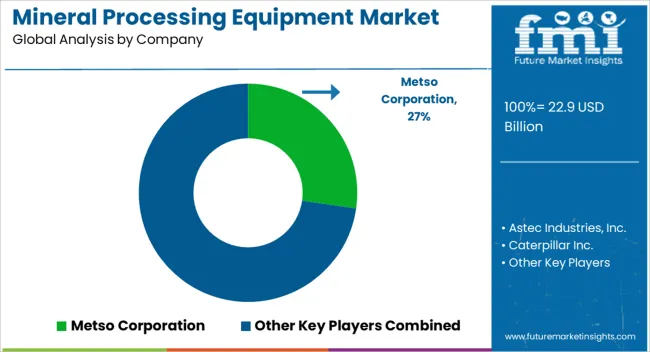

The mineral processing equipment market is being driven by the increasing demand for minerals, metals, and industrial raw materials, which has led to significant investments in mining and mineral processing operations worldwide. Key suppliers in this market include Metso Corporation, Astec Industries, Inc., Caterpillar Inc., Derrick Corporation, Eagle Crusher, FEECO International, Inc., FLSmidth A/S, Kemper Equipment, Kleemann GmbH, Komatsu Ltd., McLanahan Corporation, Multotec Pty Ltd., and Sandvik AB. These companies design, manufacture, and supply advanced machinery to enhance efficiency, throughput, and sustainability in mining operations. Crushing, grinding, screening, and separation equipment are produced and deployed by suppliers like Metso Corporation, Sandvik AB, and FLSmidth A/S to support the processing of ores and minerals. Conveying systems, feeders, and material handling equipment are engineered and delivered by Astec Industries, Inc., Caterpillar Inc., and Komatsu Ltd. to optimize operational workflows in both large-scale and small-scale mining sites. Emphasis is placed on reliability, energy efficiency, and durability to withstand harsh operational conditions. Furthermore, specialized equipment for filtration, classification, and dewatering processes is provided by McLanahan Corporation, Multotec Pty Ltd., Derrick Corporation, and FEECO International, Inc. These products are designed and tested to improve mineral recovery rates while reducing environmental impact. Innovation and research focus on automation, predictive maintenance, and integration of digital monitoring systems, enabling real-time data collection and improved decision-making in mineral processing operations. With global mining activities expanding and resource demand increasing, these leading suppliers continue to provide critical solutions that support productivity, safety, and sustainability in the mineral processing sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.9 Billion |

| Equipment Type | Crushers, Feeders, Conveyors, Drills & breakers, Dewatering equipment, Separators, and Others |

| Application | Metal ore processing, Non-metallic mineral processing, Industrial mineral processing, and Rare earth mineral processing |

| Mobility | Stationary, Portable, and Mobile |

| End-user Industry | Mining, Metallurgy, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Metso Corporation, Astec Industries, Inc., Caterpillar Inc., Derrick Corporation, Eagle Crusher, FEECO International, Inc., FLSmidth A/S, Kemper Equipment, Kleemann GmbH, Komatsu Ltd., McLanahan Corporation, Multotec Pty Ltd., and Sandvik AB |

| Additional Attributes | Dollar sales vary by equipment type, including crushers, grinders, flotation cells, magnetic separators, and classifiers; by application, such as ore beneficiation, mineral extraction, and recycling; by end-use industry, spanning mining, metallurgy, and construction; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising demand for minerals, industrialization, and mining automation. |

The global mineral processing equipment market is estimated to be valued at USD 22.9 billion in 2025.

The market size for the mineral processing equipment market is projected to reach USD 35.6 billion by 2035.

The mineral processing equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in mineral processing equipment market are crushers, feeders, conveyors, drills & breakers, dewatering equipment, separators and others.

In terms of application, metal ore processing segment to command 52.4% share in the mineral processing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aggregate Mining And Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Mineral Feed Market Analysis - Growth, Demand & Livestock Nutrition

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Mineral Adsorbent Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA