The boron minerals and chemicals market is expanding steadily due to rising applications across construction, electronics, agriculture, and energy storage. The market is shifting from traditional mineral extraction to refined boron-based compounds that offer greater thermal stability, chemical resistance, and structural reinforcement.

Growth is primarily supported by the increasing use of boron compounds in specialty glass, fiberglass insulation, advanced ceramics, and metal alloys—materials essential for producing energy-efficient and environmentally durable infrastructure. The rapid development of battery technologies, particularly for electric vehicles and renewable energy storage, is further stimulating demand for boron-based electrolytes and additives.

Regulatory initiatives promoting sustainable manufacturing and green chemistry are also encouraging the use of boron chemicals as performance enhancers. Future market growth is expected to be influenced by strategic investments in borate mining, vertically integrated refining, and innovations in material science that target high-strength, lightweight, and heat-resistant applications.

| Metric | Value |

|---|---|

| Boron Minerals and Chemicals Market Estimated Value in (2025 E) | USD 13.5 billion |

| Boron Minerals and Chemicals Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The boron minerals and chemicals market is expanding steadily due to rising applications across construction, electronics, agriculture, and energy storage. The market is shifting from traditional mineral extraction to refined boron-based compounds that offer greater thermal stability, chemical resistance, and structural reinforcement.

Growth is primarily supported by the increasing use of boron compounds in specialty glass, fiberglass insulation, advanced ceramics, and metal alloys—materials essential for producing energy-efficient and environmentally durable infrastructure. The rapid development of battery technologies, particularly for electric vehicles and renewable energy storage, is further stimulating demand for boron-based electrolytes and additives.

Regulatory initiatives promoting sustainable manufacturing and green chemistry are also encouraging the use of boron chemicals as performance enhancers. Future market growth is expected to be influenced by strategic investments in borate mining, vertically integrated refining, and innovations in material science that target high-strength, lightweight, and heat-resistant applications.

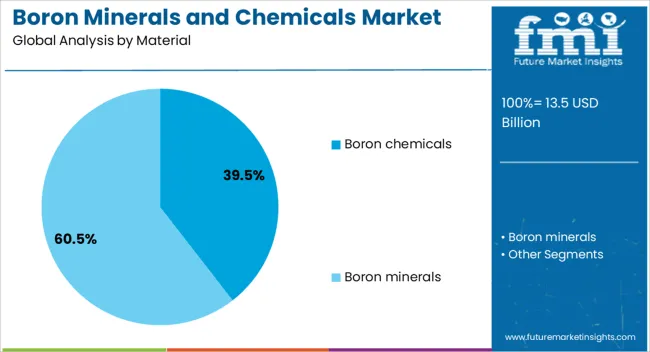

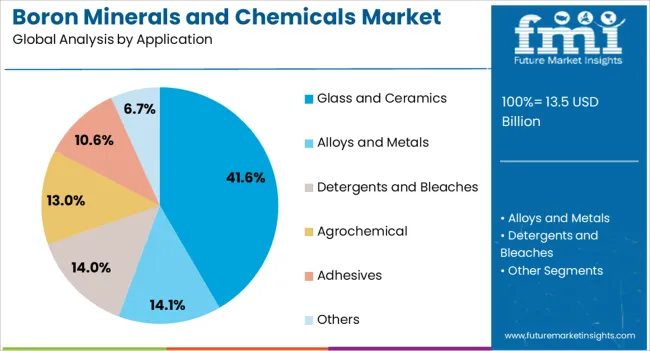

The boron minerals and chemicals market is segmented by material, application, and geographic regions. By material, the boron minerals and chemicals market is divided into boron chemicals, boron minerals, boron hydrides, boron carbide, and boron nitride. In terms of application, the boron minerals and chemicals market is classified into glass and ceramics, alloys and metals, detergents and bleaches, agrochemicals, adhesives, and others.

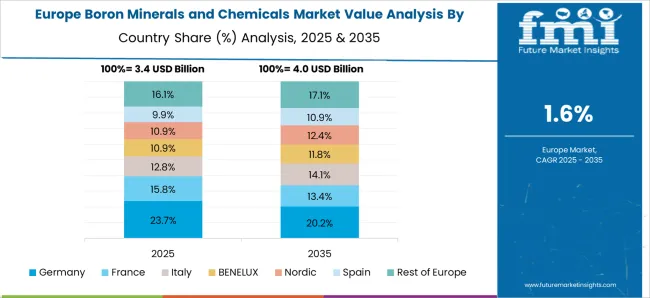

Regionally, the boron minerals and chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Boron chemicals are projected to account for 39.5% of the total revenue share in 2025, making them the leading material segment. Their wide industrial adaptability and demand for refined, thermally stable compounds underpin this dominance. These chemicals are commonly used in flame retardants, detergents, wood preservatives, metallurgy, and agricultural micronutrients.

Their compatibility with polymers and resins has driven continued industrial preference, while scalable production and compositional flexibility have supported their widespread use. The rapid adoption of electric vehicles and solar technologies has increased demand for boron-based chemicals in battery-grade electrolytes and solar glass coatings. Advanced refining processes and efficient supply chain integration across major production regions have reinforced the strength of this category.

The glass and ceramics application segment is expected to represent 41.6% of total market revenue in 2025, positioning it as the dominant application area. This leadership stems from rising demand for heat-resistant, lightweight, and durable materials in architectural, industrial, and consumer applications.

Boron compounds enhance thermal expansion control, chemical stability, and mechanical strength in glass and ceramics, making them essential additives in specialty production. The growing use of boron-based glass in automotive and solar panel manufacturing has further driven market expansion.

Compatibility with high-temperature sintering processes and improvements in transparency and structural integrity make these compounds vital for advanced material development. As innovations in smart glass and ceramic composites continue, this segment is expected to sustain long-term growth across multiple high-performance industries.

The boron minerals and chemicals market is expanding steadily, supported by growing demand for boron-based compounds across glass, ceramics, agriculture, and chemical manufacturing. Boron derivatives are valued for their thermal, chemical, and structural properties, making them indispensable in products such as fiberglass, borosilicate glass, detergents, fertilizers, and flame retardants.

Market growth is reinforced by advances in mining, refining, and synthesis technologies, as well as rising industrialization and infrastructure development. Continuous research in high-performance materials and functional additives positions boron compounds as key inputs in modern industrial ecosystems worldwide.

Adoption of boron compounds in glass and ceramics manufacturing remains a major growth driver. Materials such as borax, boric acid, and boron oxide are critical for producing borosilicate glass, fiberglass, ceramic glazes, and enamel coatings. Manufacturers rely on these compounds to enhance heat resistance, durability, and optical clarity, while ceramic producers use them to improve mechanical strength and surface finish.

The expansion of the construction, automotive, and consumer appliance sectors has further fueled demand for boron additives. Advanced formulations incorporating boron have enabled production of high-performance glass and ceramics for industrial, scientific, and household applications. As global infrastructure development and urbanization accelerate, consumption of boron materials is expected to rise steadily.

Technological innovation has strengthened the market through improved extraction, refining, and chemical processing efficiency. Modern techniques such as solvent extraction, flotation, and crystallization have enhanced product purity and yield. Automation and energy-efficient operations have also reduced costs and minimized environmental impact.

Chemical synthesis technologies, including hydrothermal and high-temperature fusion processes, now enable production of specialized boron derivatives with higher stability and performance. Ongoing research in nano-boron materials and high-purity additives continues to expand their industrial applications. These advancements ensure reliable supply and support compliance with stringent environmental and safety regulations globally.

The agricultural and cleaning industries have become key secondary demand drivers. Boron-based fertilizers are used to enhance soil nutrient levels, crop yield, and plant growth. With increasing focus on precision farming and sustainable agriculture, boron micronutrients have gained prominence.

In the detergent sector, boron compounds function as water softeners, pH stabilizers, and cleaning enhancers, improving overall product efficiency. Collaboration between chemical manufacturers, agritech firms, and research institutions has driven the development of advanced boron-enriched formulations that balance productivity and environmental safety. This cross-sector adoption has solidified the role of boron compounds as functional materials in both industrial and consumer applications.

Despite steady growth, the industry faces challenges related to environmental impact, regulatory compliance, and operational safety. Mining and processing activities require careful waste management and adherence to environmental protection standards to prevent soil and water contamination. Strict global frameworks governing chemical transport, worker exposure, and emission control add to production costs.

Manufacturers are responding through automated systems, process optimization, and advanced effluent treatment technologies to ensure compliance and minimize ecological disruption. Sustained progress in responsible mining, waste recycling, and worker safety remains essential to maintaining the industry’s long-term growth and reputation.

| Countries | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The market is expected to grow at a CAGR of 3.3% from 2025 to 2035, driven by applications in glass, ceramics, agriculture, and detergents. China leads with a 4.5% CAGR, expanding through large-scale production and industrial utilization. India follows at 4.1%, supported by increasing agricultural and industrial consumption. Germany, at 3.8%, benefits from advanced manufacturing processes and high-value chemical applications. The UK, growing at 3.1%, focuses on specialty chemical development and niche applications. The USA, at 2.8%, experiences steady demand from industrial and consumer sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The Chinese market is projected to grow at a 4.5% CAGR, driven by strong demand in glass manufacturing, ceramics, fertilizers, and detergents. Domestic producers are investing in high-purity boron compounds to meet industrial and export standards.

Rising investments in construction, automotive, and chemical sectors continue to support market expansion, while government-led initiatives to modernize mining and chemical refining further strengthen supply chains. Compliance with environmental and safety standards has improved reliability and product acceptance across regional and international markets.

India’s market is anticipated to expand at a 4.1% CAGR, supported by increasing demand in agriculture, glass, and detergent production. Manufacturers are focusing on high-quality boron products and more efficient processing techniques to strengthen local and export competitiveness.

Collaborations between chemical producers and research institutions are fostering innovation in boron derivatives. Growing consumption from construction and industrial sectors, along with government initiatives promoting fertilizer modernization and chemical industry expansion, are expected to sustain long-term growth.

Germany’s market is forecast to grow at a 3.8% CAGR, driven by demand for high-purity boron compounds in glass, ceramics, and chemical synthesis. Producers emphasize precision processing and quality control to meet Europe’s strict industrial standards.

R&D into boron-based catalysts and advanced materials is creating new commercial opportunities, particularly in electronics and renewable energy applications. Exports to neighboring European markets continue to reinforce stability and scale.

The UK market is expected to grow at a 3.1% CAGR, driven by expanding use in glass, ceramics, and chemical processing. Domestic producers are emphasizing manufacturing efficiency and product purity to maintain competitiveness in regional markets.

Strategic partnerships between manufacturers and research organizations are enabling faster innovation and application development. Emerging opportunities in catalysts and energy storage applications are expected to provide additional growth momentum.

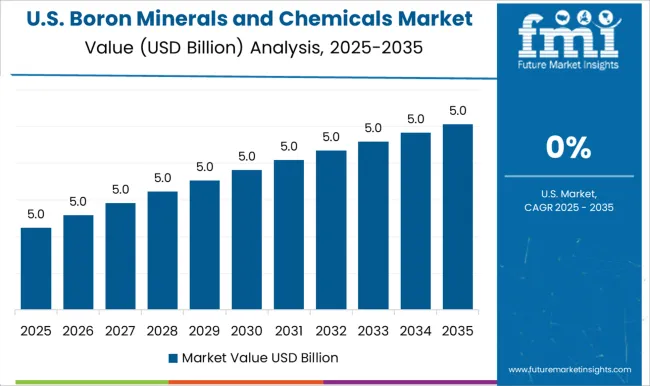

The US market is projected to expand at a 2.8% CAGR, supported by demand in agriculture, glass, ceramics, and specialty chemicals. Producers are focusing on stability, scalability, and product purity to meet the requirements of industrial users and research applications.

Investment in R&D for catalysts, energy storage, and electronic materials is contributing to innovation and new revenue streams. Steady consumption in construction and consumer goods sectors, combined with exports to Europe and Asia, supports continued growth.

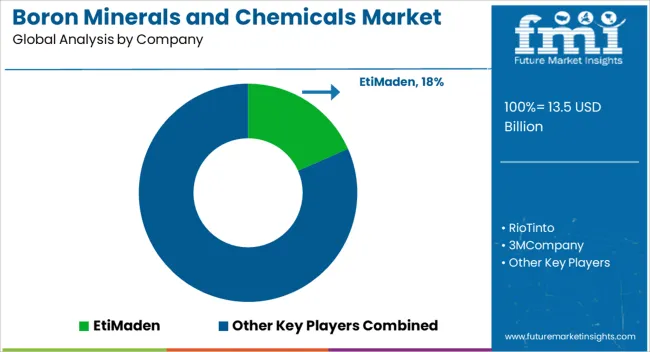

The global boron and borates market continues to expand steadily, supported by increasing demand from the glass, ceramics, agriculture, detergents, and advanced materials industries. Eti Maden İşletmeleri Genel Müdürlüğü (Eti Maden), Rio Tinto Group (Rio Tinto Borates), and 3M Company dominate global production and innovation, supplying high-purity boron compounds and refined minerals for a broad range of industrial and commercial applications. Their focus on large-scale extraction efficiency, process sustainability, and global logistics integration ensures stable supply chains and consistent product quality for downstream users across North America, Europe, and Asia-Pacific.

Orocobre Limited (now Allkem Limited), American Borate Company, Minera Santa Rita S.R.L., and Inkabor S.A. hold strong regional positions, particularly in South America and North America, producing refined borates, boric acid, and boron-based chemicals used in fertilizers, high-performance glass, detergents, and flame retardants. These companies are enhancing competitiveness through process optimization, purity upgrades, and energy-efficient refining technologies, aligning production with increasingly strict environmental and quality standards.

Searles Valley Minerals Inc., Gremont Chemical Company, and Boron Specialties LLC address specialty and high-value boron segments, supplying tailored products for chemical synthesis, semiconductors, and energy storage materials. Their activities emphasize advanced boron chemistry, custom formulation, and high-purity niche applications, including battery-grade boron compounds and boron-based nanomaterials.

Collectively, these companies are advancing the boron and borates industry through a blend of mining expertise, refining innovation, and chemical specialization. Competitive strategies increasingly focus on sustainable mining practices, circular resource management, and product diversification to meet the growing global demand for eco-efficient and high-performance boron materials. The integration of boron into renewable energy systems, electric vehicles, and advanced composites is expected to remain a key driver of long-term market growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.5 Billion |

| Material | Boron chemicals, Boron minerals, Boron Hydrides, Boron Carbide, and Boron Nitride |

| Application | Glass and Ceramics, Alloys and Metals, Detergents and Bleaches, Agrochemical, Adhesives, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eti Maden İşletmeleri Genel Müdürlüğü (Eti Maden); Rio Tinto Group (Rio Tinto Borates); 3M Company; Orocobre Limited (now Allkem Limited); American Borate Company; Minera Santa Rita S.R.L.; Inkabor S.A.; Searles Valley Minerals Inc.; Gremont Chemical Company; Boron Specialties LLC. |

| Additional Attributes | Dollar sales by mineral and chemical type, demand dynamics across glass, agriculture, and detergent sectors, regional trends in mining and processing, innovation in extraction and purification techniques, environmental impact of mining and chemical production, and emerging use cases in high-performance materials and renewable energy applications. |

The global boron minerals and chemicals market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the boron minerals and chemicals market is projected to reach USD 18.7 billion by 2035.

The boron minerals and chemicals market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in boron minerals and chemicals market are boron chemicals, _boric acid, _anhydrous borates, _borax, _anhydrous borax, _boron halides, __boron trichloride, __boron trifluoride, __boron tribromide, _others, _boric acid esters, boron minerals, _colemanite, _ulexite, _tourmaline, boron hydrides, _closo borane, _nido borane, _arachno borane, boron carbide, boron nitride, _hexagonal boron nitride, _cubic boron nitride and _wurtzite boron nitride.

In terms of application, glass and ceramics segment to command 41.6% share in the boron minerals and chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Arsenide Bas Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Boron Trifluoride and Complexes Market 2025 to 2035

Boron Carbide Market Analysis & Trends 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Trace Minerals in Feed Market Analysis by Type, Livestock, Chelate Type, Form and Region through 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Sulphur Chemicals Market

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA