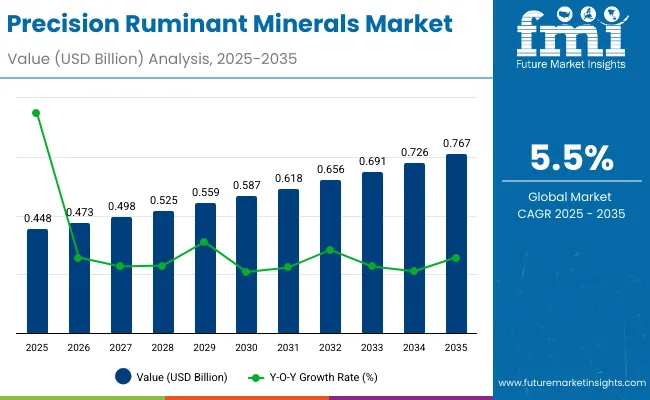

The Precision Ruminant Minerals Market is expected to record a valuation of USD 0.45 billion in 2025 and USD 0.77 billion in 2035, with an increase of USD 0.32 billion, representing a 1.7X expansion in market size over the decade. The overall growth corresponds to a 5.5% CAGR from 2025 to 2035.

Precision Ruminant Minerals Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 0.45 billion |

| Market Forecast Value in (2035F) | USD 0.77 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

During the first five-year period from 2025 to 2030, the market is expected to increase from USD 0.45 billion to USD 0.59 billion, adding nearly USD 0.14 billion, which accounts for about 45% of the total decade growth. This phase records steady adoption in dairy nutrition, reproductive health improvement, and milk quality optimization, driven by the growing precision-feeding culture. Macro minerals dominate this period as they remain critical for metabolic and structural balance across ruminant herds.

The second half from 2030 to 2035 contributes an additional USD 0.18 billion, equal to 55% of total growth, as the market rises from USD 0.59 billion to USD 0.77 billion. This acceleration is powered by the widespread integration of precision livestock farming technologies, digital ration formulation platforms, and sustainability-linked feed programs. Specialty and functional minerals, along with chelated organic formulations, are projected to capture a larger share by the end of the decade. Analytics-driven supplementation and compliance-based programs are also expected to add recurring value across markets.

From 2020 to 2024, the precision minerals space advanced steadily, though broader mineral supplementation remained commodity-focused. During this period, the market structure was led by macro and inorganic minerals controlling the bulk of volume, with companies like Alltech, Zinpro, and Cargill dominating supply chains. Differentiation relied largely on feed-grade consistency and cost optimization, while value-added solutions such as chelated forms and hydroxy trace minerals represented emerging niches.

Demand for precision ruminant minerals is set to expand to USD 0.45 billion in 2025, with the revenue mix shifting toward chelated and specialty minerals that enhance bioavailability and sustainability outcomes. Traditional bulk mineral suppliers face rising competition from players offering data-driven, farm-specific solutions, AI-assisted ration tools, and sustainability certifications. Established vendors are pivoting to hybrid models that combine raw mineral supply with digital analytics and traceability platforms. Competitive advantage is shifting away from low-cost provisioning to ecosystem-based offerings, compliance-readiness, and performance-linked outcomes.

Advances in feed formulation technologies have improved mineral bioavailability and delivery precision, enabling more efficient nutrient absorption across diverse ruminant production systems. Macro and trace minerals are increasingly being formulated into chelated and functional forms, ensuring higher uptake and reduced antagonistic interactions. The rising adoption of precision livestock farming tools has contributed to real-time monitoring of mineral intake and animal health parameters, reinforcing demand for tailored supplementation programs. Dairy and beef producers are driving demand for precision mineral solutions that can integrate seamlessly with TMR systems, premixes, and digital ration balancing software.

The expansion of automated feeding systems and compliance-linked nutritional strategies has further fueled market growth. Innovations in delivery formats such as boluses, liquid supplements, and water-soluble applications are opening new opportunities for targeted supplementation. Segment growth is expected to be led by macro minerals in overall volume, while organic/chelated minerals are expected to advance rapidly due to sustainability benefits, better traceability, and improved efficiency across dairy, beef, and small ruminants.

The Precision Ruminant Minerals Market is segmented by mineral type, source form, functionality, livestock type, delivery format, application method, sales channel, and region. Mineral type covers macro minerals, trace minerals, and specialty or functional minerals, reflecting their vital roles in growth, reproduction, immunity, and metabolic balance. Source form is classified into inorganic options such as oxides, sulfates, carbonates, and chlorides, as well as organic or chelated formats including amino acid chelates, proteinates, complexed minerals, hydroxy trace minerals, and nano minerals. Functionality segmentation spans areas such as growth and weight gain, milk production and quality, reproductive health, hoof and bone strength, immunity support, heat stress reduction, and metabolic efficiency, underlining the diverse applications of precision supplementation.

By livestock type, the market encompasses dairy cattle, beef cattle, sheep, goats, and buffalo, each presenting distinct nutritional requirements. Delivery format is categorized into premixes or mineral mixes, lick blocks, boluses or capsules, loose powders, and liquid supplements, offering flexibility in on-farm administration. Application method includes feed inclusion within TMR or compound feed, free-choice supplementation, and water-soluble applications, highlighting the adaptability of precision minerals to modern feeding systems. Sales channel segmentation spans direct supply to farms, distribution through feed manufacturers or integrators, and networks of distributors and dealers. Regionally, the market scope extends across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa, with South Asia and Pacific emerging as a key growth cluster due to rising herd populations and increasing adoption of precision nutrition practices.

| Mineral Type Segment | Value Share (%) |

|---|---|

| Calcium | 18.50% |

| Phosphorus | 14.20% |

| Magnesium | 10.50% |

| Potassium | 8.40% |

| Sodium | 7.10% |

| Sulfur | 5.90% |

| Chloride | 4.80% |

| Zinc | 9.60% |

| Copper | 6.40% |

| Manganese | 5.20% |

| Iron | 3.90% |

| Iodine | 2.80% |

| Selenium | 1.80% |

| Cobalt | 0.90% |

| Chromium | 0.70% |

| Molybdenum | 0.50% |

| Boron | 0.30% |

| Silicon | 0.30% |

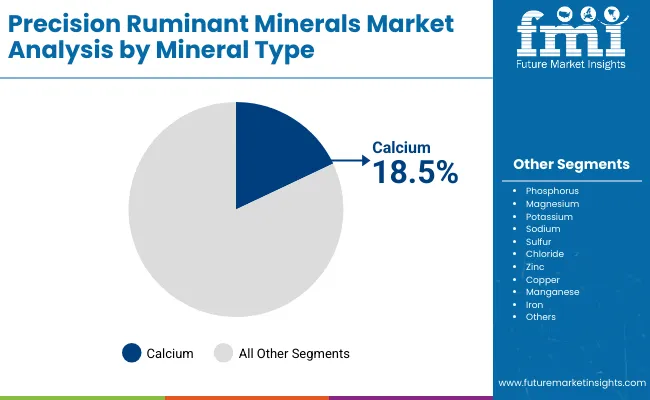

The mineral type segment is dominated by Calcium, accounting for 18.5% of market value share in 2025, reflecting its essential role in bone development, milk production, and metabolic stability in ruminants. Calcium demand continues to be prioritized as dairy systems expand and precision feeding practices reinforce the need for balanced structural minerals. Phosphorus follows with 14.2% share, driven by its role in energy metabolism and reproduction efficiency, while Magnesium (10.5%) and Zinc (9.6%) contribute significantly due to their relevance in enzyme activation, immune support, and stress mitigation.

The segment’s growth is supported by rising adoption of multi-mineral blends that combine macro and trace minerals to deliver targeted functional benefits across cattle, sheep, goats, and buffalo. Investments in organic and chelated forms of calcium, phosphorus, and zinc are enhancing absorption rates, thereby reducing wastage and environmental excretion. The growing emphasis on sustainability, animal welfare, and precision supplementation strategies ensures that Calcium is expected to retain its leading position throughout the forecast period, with strong reinforcement from phosphorus and zinc as complementary pillars of the mineral nutrition market.

| Source Form Type Segment | Value Share (%) |

|---|---|

| Inorganic Minerals | 64.50% |

| Oxides | 18.00% |

| Sulfates | 16.50% |

| Carbonates | 15.00% |

| Chlorides | 15.00% |

| Organic / Chelated Minerals | 25.50% |

| Amino Acid Chelates | 10.50% |

| Proteinates | 9.20% |

| Complexed Minerals | 5.80% |

| Hydroxy Trace Minerals | 6.80% |

| Nano Minerals | 3.20% |

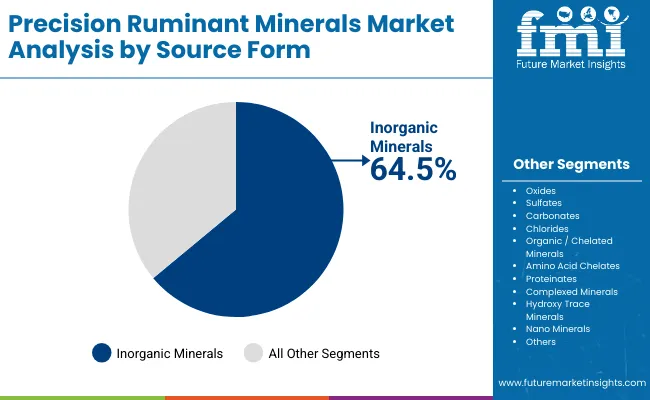

The source form segment is led by Inorganic Minerals, which capture 64.5% of the market value in 2025. This dominance is attributed to their widespread availability, lower cost, and long-standing use in bulk feed supplementation programs. Within this category, Oxides (18.0%), Sulfates (16.5%), Carbonates (15.0%), and Chlorides (15.0%) remain the core formats, valued for consistency in supply and cost-effectiveness. Their growth continues to be reinforced by large-scale dairy and beef operations seeking reliable inputs for baseline mineral requirements.

However, the segment is undergoing a gradual shift toward Organic and Chelated Minerals, which collectively account for 25.5% of the market share. Sub-categories such as Amino Acid Chelates (10.5%) and Proteinates (9.2%) are gaining traction due to their superior bioavailability and reduced antagonistic interactions in ruminant diets. Hydroxy trace minerals (6.8%) and Nano minerals (3.2%) represent emerging high-value niches, reflecting innovation aimed at improving absorption, animal performance, and environmental outcomes.

As sustainability-linked feeding strategies become more prevalent, the balance between inorganic affordability and organic efficacy is expected to define purchasing decisions. Inorganic minerals are projected to retain their leading position in absolute terms, but organic formats are expected to expand more rapidly, gradually reshaping the competitive structure of the source form landscape.

| Functionality Segment | Value Share (%) |

|---|---|

| Growth & Weight Gain | 28.40% |

| Milk Production & Quality | 24.50% |

| Reproductive Health | 14.20% |

| Hoof & Bone Strength | 10.10% |

| Immunity Support | 9.80% |

| Heat Stress Reduction | 7.00% |

| Metabolic Efficiency | 6.00% |

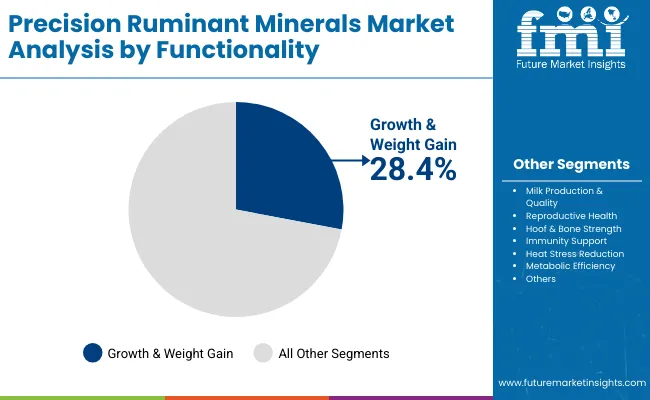

The functionality segment is dominated by Growth & Weight Gain, accounting for 28.4% of the market share in 2025. This leadership reflects the consistent priority placed on achieving optimal feed-to-weight conversion in beef production systems and ensuring steady growth performance in dairy replacements. The emphasis on carcass yield and finishing efficiency continues to sustain demand for precision mineral supplementation targeted at growth outcomes.

Milk Production & Quality, with a 24.5% share, represents the second-largest segment, underpinned by the critical role of minerals in enhancing lactation efficiency, milk yield, and component quality. The Reproductive Health segment, at 14.2%, is expected to gain momentum as fertility metrics and conception rates are increasingly tied to mineral balance and trace element adequacy.

Meanwhile, Hoof & Bone Strength (10.1%) and Immunity Support (9.8%) are growing in relevance as producers seek to minimize health-related losses and improve animal welfare standards. Functional categories such as Heat Stress Reduction (7.0%) and Metabolic Efficiency (6.0%) are emerging as forward-looking niches, particularly in tropical and high-temperature geographies, where environmental stress poses a direct risk to productivity.

Adoption of precision ruminant minerals is being shaped by economic pressures, regulatory mandates, and nutritional science advances, even as producers pursue efficiency gains. Market outcomes are increasingly linked to sustainability objectives, digital ration analytics, and farm-level validation of mineral utilization efficiency.

Integration of Digital Nutrition Platforms

The integration of digital nutrition platforms into livestock feeding operations is expected to fundamentally transform precision mineral adoption. Ration-balancing tools, supported by real-time biomarker monitoring and milk component analytics, are being deployed to validate mineral utilization with measurable outcomes. By embedding mineral optimization within digital herd management dashboards, producers are projected to align supplementation strategies directly with reproductive performance, milk yield, and health metrics. This integration is anticipated to shift minerals from a cost-input category to a performance-linked investment. Over the forecast period, the credibility established through digital traceability is projected to strengthen adoption among progressive dairy and beef operations.

Sustainability-Linked Nutritional Compliance

Sustainability-linked nutritional compliance is being positioned as a defining trend in the precision minerals market. Policymakers are tightening thresholds for phosphorus runoff, trace element excretion, and greenhouse gas emissions, while processors and cooperatives are linking premium payments to environmental performance indicators. Precision mineral strategies, particularly organic and chelated forms, are being recognized as tools for lowering waste and reducing ecological footprints without compromising productivity. As compliance frameworks become harmonized with carbon accounting and animal welfare audits, precision minerals are expected to gain traction as compliance enablers. This evolution is anticipated to strengthen supplier differentiation and enhance long-term market resilience.

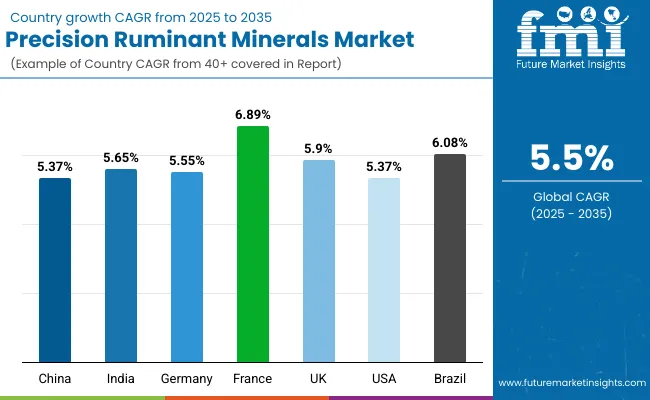

| Countries | CAGR |

|---|---|

| China | 5.37% |

| India | 5.65% |

| Germany | 5.55% |

| France | 6.89% |

| UK | 5.90% |

| USA | 5.37% |

| Brazil | 6.08% |

The global Precision Ruminant Minerals Market shows a pronounced regional disparity in adoption speed, strongly influenced by livestock intensification, sustainability mandates, and feed modernization. Asia-Pacific emerges as the fastest-growing region, anchored by China at 5.4% CAGR and India at 5.7% CAGR. China’s trajectory is being reinforced by government-backed sustainability programs, stricter nutrient management policies, and expanding dairy and beef herds that demand high-precision mineral balancing. India’s growth reflects modernization of cooperatives, buffalo-focused supplementation, and increasing use of digital ration tools to improve productivity and export competitiveness.

Europe maintains a strong growth profile, led by Germany, France, and the UK, where stringent EU phosphorus runoff regulations, animal welfare compliance, and widespread adoption of digital feeding platforms accelerate precision mineral demand. Strong regulatory frameworks and investments in feed analytics keep Europe ahead of North America in terms of compliance-driven adoption. North America demonstrates moderate but steady expansion, with the USA at 6.1% CAGR, reflecting maturity in supplementation practices but rising adoption of premium chelated formulations and sustainability-linked milk pricing models.

Growth in North America is expected to be more solution-driven, with increasing reliance on digital nutrition platforms and farm-level data integration rather than sheer volume expansion. Latin America, anchored by Brazil, contributes selectively through feedlot intensification and structured mineral programs tied to beef exports.

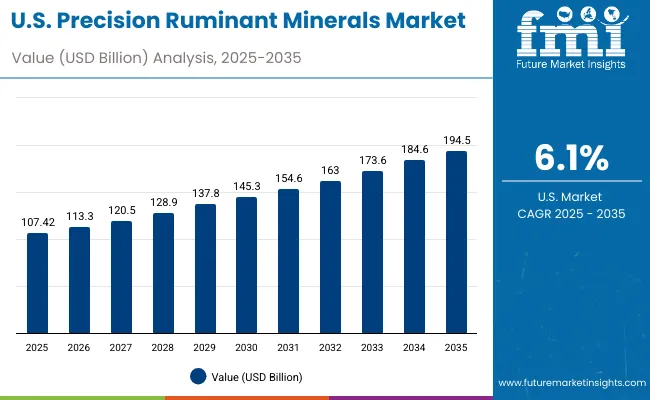

| Year | USA Precision Ruminant Minerals Market (USD Billion) |

|---|---|

| 2025 | 107.42 |

| 2026 | 113.3 |

| 2027 | 120.5 |

| 2028 | 128.9 |

| 2029 | 137.8 |

| 2030 | 145.3 |

| 2031 | 154.6 |

| 2032 | 163.0 |

| 2033 | 173.6 |

| 2034 | 184.6 |

| 2035 | 194.5 |

The Precision Ruminant Minerals Market in the United States is projected to grow at a CAGR of 6.1%, supported by advanced dairy and beef production systems and increasing integration of digital nutrition platforms. Year-on-year growth has been notable in reproductive health and immunity-focused supplementation, particularly among progressive dairy herds adopting precision mineral balancing for fertility and milk component optimization. The beef feedlot sector has also been expanding structured mineral programs, with chelated trace elements increasingly used to improve feed conversion and carcass yield.

The dairy industry, supported by sustainability-linked pricing models, is prioritizing mineral programs that align with nutrient excretion regulations and milk quality standards. Adoption is further expanding into small-ruminant and specialty herds, where tailored mineral strategies are improving productivity and resilience. The integration of digital ration-balancing software and compliance-driven traceability systems is creating opportunities for bundled mineral-analytics solutions and long-term supplier partnerships in USA livestock nutrition.

The Precision Ruminant Minerals Market in the United Kingdom is projected to grow at a CAGR of 5.8%, shaped by environmental compliance frameworks, dairy intensification, and consumer-driven sustainability standards. Adoption is being reinforced by government-backed programs targeting nutrient runoff reduction, while large cooperatives are linking milk pricing to mineral-based herd health improvements. Universities and research centers are collaborating with feed manufacturers to validate bioavailability advantages of chelated and hydroxy trace minerals. These efforts are enhancing confidence in premium formulations and creating opportunities for suppliers offering traceability solutions. As the livestock sector faces increasing pressure from carbon accounting and welfare audits, precision minerals are being positioned not only as productivity enhancers but also as compliance tools.

India’s Precision Ruminant Minerals Market is forecast to expand at a CAGR of 5.7% through 2035, supported by the world’s largest dairy herd and increasing modernization of cooperative-led production systems. Buffalo populations, which play a central role in milk output, are increasingly targeted with tailored mineral programs to improve fertility and yield efficiency. Cost-effective premixes are being adopted across Tier-2 cities and rural markets, supported by extension services and awareness campaigns promoting balanced mineral intake. Government-backed nutrition initiatives and partnerships with veterinary institutions are fostering structured adoption, particularly in regions with high reproductive inefficiencies. Over the next decade, India’s mineral market is expected to evolve from basic supplementation toward precision-driven solutions integrated with milk procurement and quality monitoring.

The Precision Ruminant Minerals Market in China is expected to grow at a CAGR of 5.4%, the highest among leading economies, driven by rapid dairy intensification, feedlot expansion, and government policies targeting sustainable livestock production. Large-scale dairy clusters are adopting digital feeding systems that incorporate mineral balancing to enhance feed efficiency while meeting emission reduction requirements. Chelated and organic mineral formulations are gaining prominence as regulators impose stricter controls on phosphorus and trace mineral excretion. Domestic feed manufacturers are investing in competitive formulations, enabling both affordability and compliance alignment. Municipal initiatives promoting sustainable farming practices, alongside processor-driven sustainability audits, are reinforcing the shift toward precision nutrition. This dynamic is positioning China as both a volume and innovation leader in the global precision mineral space.

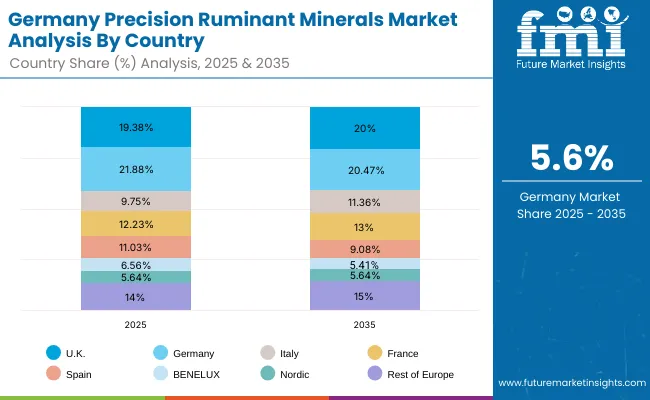

| Countries | 2025 |

|---|---|

| UK | 19.38% |

| Germany | 21.88% |

| Italy | 9.75% |

| France | 12.23% |

| Spain | 11.03% |

| BNELUX | 6.56% |

| Nordic | 5.64% |

| Rest of Europe | 14% |

| Countries | 2035 |

|---|---|

| UK | 20.00% |

| Germany | 20.47% |

| Italy | 11.36% |

| France | 13.00% |

| Spain | 9.08% |

| BNELUX | 5.41% |

| Nordic | 5.64% |

| Rest of Europe | 15% |

The Precision Ruminant Minerals Market in Germany is projected to grow at a CAGR of 5.6%, supported by the country’s leadership in advanced dairy operations, stringent EU compliance, and innovation in feed technology. German farms are integrating precision mineral programs into digital herd management systems, enabling real-time monitoring of reproductive health, immunity, and metabolic efficiency. Dairy cooperatives are linking mineral supplementation to sustainability metrics and traceability requirements, reinforcing adoption across both large-scale and family-owned herds. Research institutes and veterinary networks are validating the performance of chelated minerals in improving absorption efficiency, positioning premium formulations as compliance-ready solutions. With strict EU nutrient excretion regulations and climate-related sustainability targets, Germany is expected to remain a frontrunner in Europe’s precision mineral adoption.

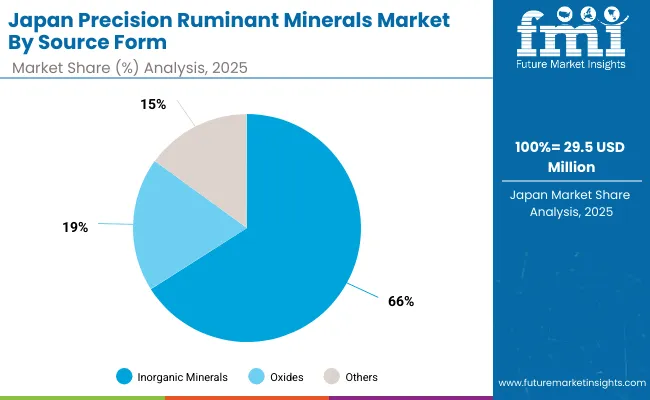

| Source Form Segment | Market Value Share, 2025 |

|---|---|

| Inorganic Minerals | 66.00% |

| Oxides | 19.00% |

| Sulfates | 17.20% |

| Carbonates | 15.20% |

| Chlorides | 14.60% |

| Organic / Chelated Minerals | 24.00% |

| Amino Acid Chelates | 9.80% |

| Proteinates | 8.60% |

| Complexed Minerals | 5.60% |

| Hydroxy Trace Minerals | 6.50% |

| Nano Minerals | 3.50% |

The Precision Ruminant Minerals Market in Japan is projected at USD 29.5 million in 2025. Inorganic minerals contribute 66%, while organic and chelated minerals account for 24%, reflecting a gradual value transition toward premium formulations that improve bioavailability and compliance outcomes. This growing emphasis on organics is being shaped by the rising complexity of nutritional management, where sustainability metrics, herd health efficiency, and regulatory compliance require advanced solutions beyond traditional bulk supplementation. Organic and chelated forms provide recurring opportunities through long-term herd health benefits and reduced environmental excretion, unlike inorganic formats that are often viewed as low-cost, one-time inputs.

The increasing integration of digital ration-balancing platforms and sustainability-linked nutrition programs is a major catalyst, as these applications demand precise mineral efficiency and traceable outcomes. Japanese dairy systems also emphasize high-value milk quality and nutrient compliance, which further amplifies the adoption of chelated and nano mineral formulations. As farm automation deepens, integrated feeding strategies that combine mineral optimization with digital monitoring will define the competitive landscape in Japan.

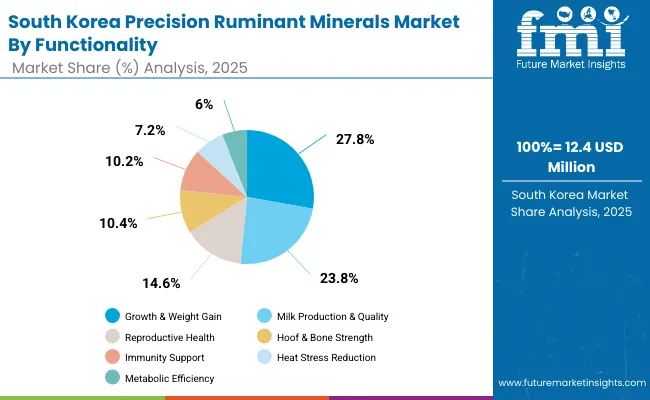

The Precision Ruminant Minerals Market in South Korea is valued at USD 12.4 million in 2025, with Growth & Weight Gain leading at 27.8%, followed by Milk Production & Quality at 23.8%, and Reproductive Health at 14.6%.The dominance of growth-focused functionality reflects South Korea’s livestock structure, where feed efficiency and carcass quality are prioritized in beef and dairy operations. Precision supplementation for milk production is also expanding as cooperatives emphasize high-value dairy exports and compliance with nutritional quality standards. Increasing attention to reproductive health highlights a shift toward reducing fertility losses and improving herd sustainability.

This advantage positions functionality-driven mineral programs as critical enablers of productivity, health, and regulatory alignment. Niche areas such as immunity support (10.2%)and heat stress reduction (7.2%)are emerging as strategic focus points in response to climate-related stress and disease risks. As Industry 4.0 frameworks extend into livestock management, digital rationing and biomarker-driven supplementation are expected to further enhance adoption.

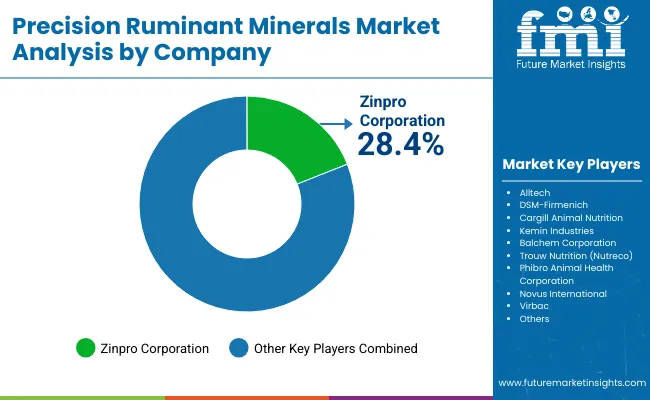

The Precision Ruminant Minerals Market is moderately fragmented, with multinational nutrition giants, specialized mineral innovators, and region-focused suppliers competing across dairy, beef, and small-ruminant nutrition. Global leaders such as Zinpro Corporation, DSM-Firmenich, and Cargill Animal Nutrition hold significant market share, supported by diversified portfolios, advanced chelated trace mineral technologies, and deep integration with digital feeding platforms. Their strategies increasingly emphasize sustainability-linked supplementation, farm-level data analytics, and end-to-end nutrition programs validated through measurable outcomes.

Mid-sized players, including Alltech, Balchem Corporation, and Trouw Nutrition (Nutreco), cater to targeted demand for organic and hydroxy trace minerals. These firms are advancing adoption through farmer-focused extension services, hybrid distribution models, and bundled offerings that combine minerals with functional feed additives. Their strength lies in bioavailability validation and alignment with regulatory compliance requirements.

Specialist providers such as Phibro Animal Health, Novus International, and Virbac focus on cost-effective, application-specific solutions, particularly in reproductive health, immunity support, and niche ruminant categories. Their differentiation is tied to product customization, regional adaptability, and value-added services rather than global scale.

Competitive differentiation is shifting away from commodity mineral supply toward integrated ecosystems that include digital ration optimization, sustainability certifications, and subscription-based nutrition services, positioning precision minerals as a strategic enabler of productivity and compliance.

Key Developments in Precision Ruminant Minerals Market

| Item | Value |

|---|---|

| Quantitative Units | USD Billion (Value) |

| Mineral Type | Macro Minerals (Calcium, Phosphorus, Magnesium, Potassium, Sodium, Sulfur, Chloride) and Trace Minerals (Zinc, Copper, Manganese, Iron, Iodine, Selenium, Cobalt) along with Specialty/Functional Minerals (Chromium, Molybdenum, Boron, Silicon) |

| Source Form | Inorganic Minerals (Oxides, Sulfates, Carbonates, Chlorides) and Organic/Chelated Minerals (Amino Acid Chelates, Proteinates, Complexed Minerals, Hydroxy Trace Minerals, Nano Minerals) |

| Functionality | Growth & Weight Gain, Milk Production & Quality, Reproductive Health, Hoof & Bone Strength, Immunity Support, Heat Stress Reduction, Metabolic Efficiency |

| Livestock Type | Dairy Cattle, Beef Cattle, Sheep, Goats, Buffalo |

| Delivery Format | Premix / Mineral Mix, Lick Blocks, Boluses / Capsules, Loose Powders, Liquid Supplements |

| Application Method | Feed Inclusion (TMR, Compound Feed), Free-choice Supplementation, Water-soluble Application |

| Sales Channels | Direct to Farms (B2B), Through Feed Manufacturers / Integrators, Distributors & Dealers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zinpro Corporation, Alltech, DSM- Firmenich, Cargill Animal Nutrition, Kemin Industries, Balchem Corporation, Trouw Nutrition (Nutreco), Phibro Animal Health Corporation, Novus International, Virbac |

| Additional Attributes | Dollar sales by mineral type, functionality, and livestock category; adoption of chelated and organic minerals; sector-specific growth in dairy, beef, and small ruminants; digital rationing and precision feeding trends; regulatory drivers around nutrient excretion and sustainability compliance; regional dynamics shaped by cooperative systems, farm size, and climate stress; innovations in hydroxy trace minerals, nano minerals, and bioavailability-enhancing technologies. |

The global Precision Ruminant Minerals Market is estimated to be valued at USD 0.45 billion in 2025.

The market size for the Precision Ruminant Minerals Market is projected to reach USD 0.77 billion by 2035.

The Precision Ruminant Minerals Market is expected to grow at a CAGR of 5.5% between 2025 and 2035.

The key mineral types in the Precision Ruminant Minerals Market are Macro Minerals, Trace Minerals, and Specialty/Functional Minerals.

In terms of functionality, Growth & Weight Gain is projected to command the largest share at 28.4% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA