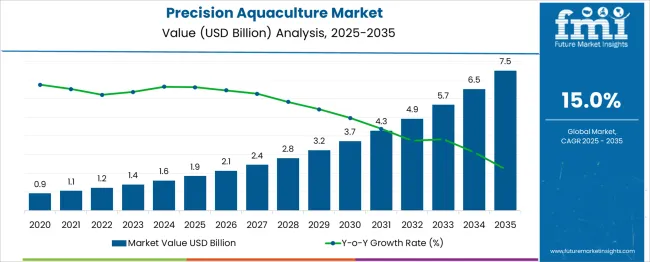

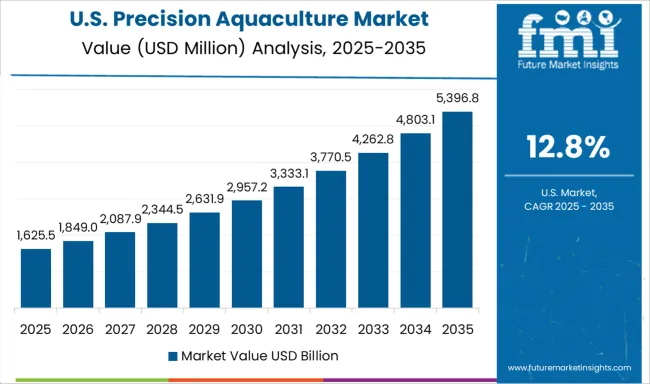

The Precision Aquaculture Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period. Applying breakpoint analysis to this data reveals distinct phases where growth accelerates or stabilizes, offering valuable insights into market evolution. The early phase, spanning 2025 to 2028, shows steady growth as the market increases from USD 1.9 billion to USD 2.8 billion. This period corresponds to initial adoption driven by technological advancements and increasing integration of digital tools in aquaculture operations. The incremental increases signal cautious but consistent market acceptance. Between 2029 and 2032, the market exhibits a pronounced acceleration, rising from USD 3.2 billion to USD 4.9 billion.

This breakpoint marks a shift where precision aquaculture solutions gain broader adoption across regions and segments. Factors such as improved data analytics, automation, and sustainability-oriented practices contribute to this surge, indicating growing confidence among producers and investors. From 2033 to 2035, growth maintains momentum, expanding from USD 5.7 billion to USD 7.5 billion, though at a slightly moderated pace. This stage reflects market maturation, with increased penetration and incremental technological refinements sustaining expansion. The breakpoint analysis highlights the market’s transition from cautious uptake to rapid growth, followed by steady maturation, which can guide strategic investment and development planning within the precision aquaculture sector.

| Metric | Value |

|---|---|

| Precision Aquaculture Market Estimated Value in (2025 E) | USD 1.9 billion |

| Precision Aquaculture Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The precision aquaculture market is witnessing sustained momentum, underpinned by the global need to optimize fish production efficiency while reducing environmental impact. Advancements in sensor technology, real-time monitoring systems, and AI-based analytics have enabled aquaculture operations to transition from traditional to data-driven farming practices.

As food security becomes a strategic concern, governments and private stakeholders are investing in digital infrastructure to enhance yield forecasting, disease detection, and resource optimization. Increasing regulatory scrutiny over water usage and carbon emissions is driving adoption of automated systems that enable better control of feeding, oxygenation, and biomass management.

Moreover, the rising cost of manual labor and feed inputs is encouraging aquafarm operators to adopt precision tools that support profitability and compliance. With climate volatility threatening traditional aquaculture productivity, technology-led systems are expected to form the backbone of resilient and scalable fish farming solutions.

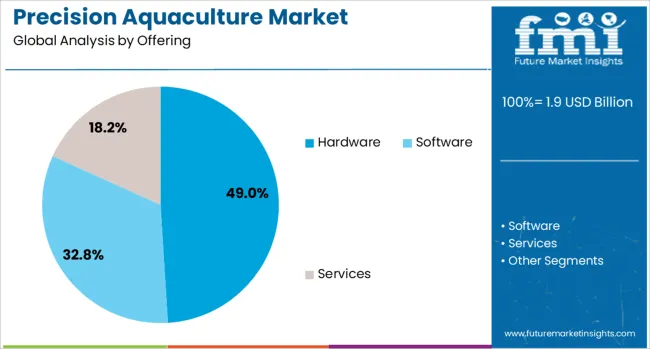

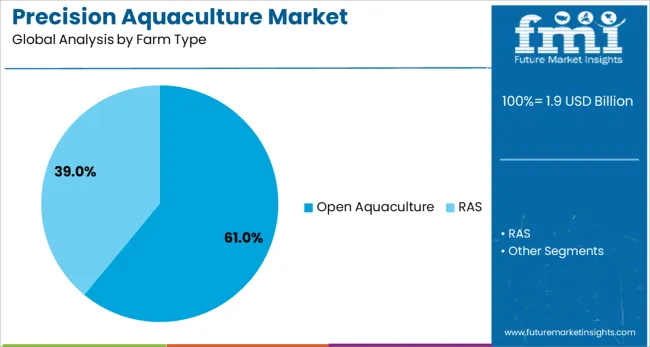

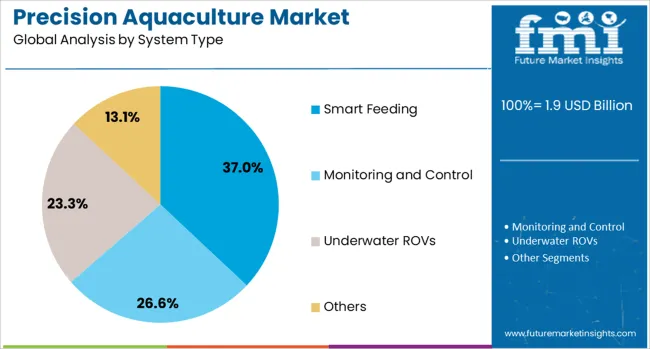

The precision aquaculture market is segmented by offering, farm type, system type, application, and geographic regions. The precision aquaculture market is divided into Hardware, Software, and Services. In terms of farm type, the precision aquaculture market is classified into Open Aquaculture and RAS. Based on system type, the precision aquaculture market is segmented into Smart Feeding, Monitoring and Control, Underwater ROVs, and others. The precision aquaculture market is segmented into Feed Optimization, Monitoring and Surveillance, Yield Analysis and Measurement, and others. Regionally, the precision aquaculture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to account for 49.00% of the total revenue in 2025, making it the leading offering in the precision aquaculture market. Its dominance is being driven by increasing deployment of underwater cameras, sensors, smart cages, and automated feeders.

These components serve as the foundational layer of intelligent aquaculture systems by enabling data collection on fish behavior, water quality, and feeding patterns. Demand for robust and corrosion-resistant hardware is rising as farms scale operations across diverse aquatic environments.

High initial investment in physical infrastructure, especially in offshore and large-scale operations, continues to drive revenue concentration in this segment. Integration readiness with cloud platforms and AI analytics has further enhanced the relevance of hardware, positioning it as a critical enabler of productivity and operational transparency in aquaculture.

Open aquaculture is expected to dominate the market with a 61.00% revenue share in 2025. This segment's lead position is being driven by its wide adoption across coastal and inland farming operations, particularly in regions with strong seafood export economies.

Lower initial capital requirements and established infrastructure support have made open systems a viable choice for fish farming at scale. Precision technologies are increasingly being integrated into open setups to mitigate risks from environmental fluctuations and predation, especially in sea-based farms.

Advancements in remote sensing, telemetry, and net monitoring have enabled open farms to improve survival rates and optimize feed utilization. As sustainability benchmarks tighten globally, operators of open aquaculture systems are adopting precision tools to demonstrate traceability, minimize ecological impact, and meet evolving certification standards.

Smart feeding systems are projected to lead the system type segment with a 37.00% market share in 2025. The segment’s growth is being driven by increasing pressure to improve feed conversion ratios (FCRs), which represent a major cost component in aquaculture.

Real-time data on fish appetite, biomass, and behavior is enabling dynamic feeding adjustments that reduce waste and enhance growth rates. Integration of acoustic sensors, AI-driven algorithms, and machine vision is improving decision-making accuracy in feed delivery.

With feed costs accounting for more than half of total operational expenditure in many farms, smart feeding is being viewed as a cost-reduction tool with direct ROI implications. Regulatory pressure on sustainable aquaculture practices is also pushing adoption, as these systems reduce nutrient runoff and improve environmental compliance.

Precision aquaculture has emerged as a transformative approach within the aquaculture industry, integrating advanced technologies such as sensors, data analytics, artificial intelligence, and automation to optimize fish farming operations. These innovations have been utilized to monitor water quality, feed efficiency, and fish health in real time, enabling improved productivity and reduced environmental impact. The adoption of precision aquaculture has been accelerated by the increasing demand for sustainable seafood, regulatory pressures on resource management, and the need to minimize operational costs.

The integration of IoT sensors, drones, and underwater cameras has enabled continuous monitoring of key parameters such as oxygen levels, temperature, pH, and fish behavior. Data collected through these devices is processed using AI algorithms to detect anomalies, optimize feeding schedules, and predict disease outbreaks before they escalate. Automated feeding systems dispense feed precisely based on fish appetite and growth stage, reducing waste and feed costs. Cloud-based platforms allow stakeholders to access real-time analytics, facilitating remote farm management and proactive maintenance. These technologies have increased operational efficiency by minimizing manual labor, improving stock health, and maximizing yield per unit area. Consequently, precision aquaculture has enhanced sustainability by optimizing resource utilization and reducing environmental footprint.

Environmental regulations targeting water quality, effluent discharge, and species conservation have compelled aquaculture operators to adopt precision technologies. Real-time monitoring and reporting capabilities have enabled compliance with stringent regulatory frameworks, reducing risks of fines and operational interruptions. Precision aquaculture systems facilitate adherence to sustainable farming practices by minimizing overfeeding, controlling disease spread, and optimizing water usage. These capabilities have aligned with increasing consumer demand for responsibly sourced seafood products, encouraging certification and traceability initiatives. Governments and industry bodies have promoted adoption through subsidies and research partnerships, recognizing precision aquaculture as a pathway to sustainable food production and ecosystem protection. The ability to demonstrate environmental stewardship has become a competitive advantage for market participants.

Despite clear benefits, the precision aquaculture market has faced challenges related to the high initial investment and technical complexity of deploying integrated systems. Small-scale and traditional farmers have encountered barriers due to limited access to capital, technological literacy, and reliable internet connectivity in remote coastal areas. Maintenance of sensor networks and data management platforms requires skilled personnel, adding to operational expenses. Integration of disparate technologies from multiple vendors has presented interoperability issues, complicating system adoption. Additionally, concerns over data privacy and cybersecurity have emerged as potential risks. Overcoming these challenges will require affordable modular solutions, user-friendly interfaces, training programs, and collaborative platforms that lower entry barriers and support widespread adoption.

Global seafood consumption has steadily increased, driven by population growth, rising incomes, and shifting dietary preferences favoring protein-rich and healthy options. This trend has propelled investments in aquaculture modernization and precision farming solutions to boost productivity and quality. Startups and established technology providers have introduced innovations such as AI-powered disease detection, blockchain-based supply chain traceability, and advanced biofloc systems to enhance farm management. Collaborative efforts among technology developers, research institutions, and industry stakeholders have accelerated product development and deployment. Emerging markets in Asia-Pacific, Latin America, and Africa have shown strong potential due to expanding aquaculture activities and supportive governmental policies. These factors are expected to sustain robust market growth and further embed precision aquaculture in global seafood production systems.

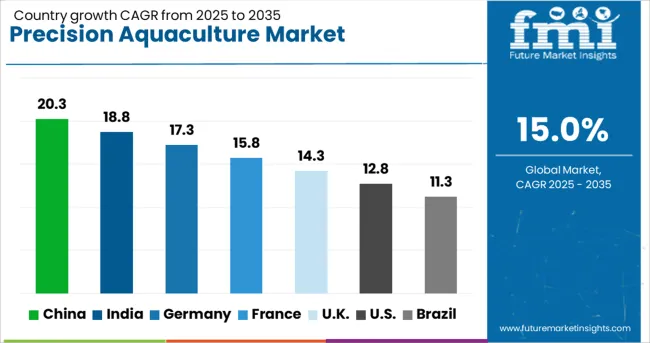

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The market is projected to grow at a CAGR of 15.0% from 2025 to 2035, driven by increasing demand for sustainable seafood production, advanced monitoring technologies, and automation in fish farming. China leads with a 20.3% CAGR, supported by large-scale aquaculture infrastructure and government investments in digital solutions. India follows at 18.8%, fueled by growing aquaculture production and adoption of sensor-based systems. Germany, with a 17.3% growth rate, benefits from technological innovations and integration of AI in aquaculture management. The U.K., expanding at 14.3%, focuses on smart farming solutions and regulatory support. The U.S., growing at 12.8%, advances with precision monitoring tools and increasing offshore aquaculture activities. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 20.3% between 2025 and 2035 in the precision aquaculture market, driven by government initiatives promoting smart farming techniques. Investment in IoT-enabled sensors, automated feeding systems, and real-time water quality monitoring is expanding rapidly. Leading aquaculture companies are collaborating with tech startups to implement AI-driven predictive analytics for disease management and yield optimization. The push for sustainable seafood production is also encouraging adoption of precision technologies in both freshwater and marine farms. Expansion in coastal regions and integration with export supply chains are strengthening market demand.

India is forecasted to achieve a CAGR of 18.8% in the precision aquaculture market, supported by initiatives to provide affordable sensor technology and data analytics to small and medium-sized farmers. Government programs are facilitating training on digital farming tools and mobile applications for real-time farm management. Expansion of inland freshwater farms and shrimp hatcheries is catalyzing the use of automated feeders and water quality sensors. Public-private partnerships are enabling wider technology dissemination to rural areas with high aquaculture potential.

Germany is projected to grow at a CAGR of 17.3% in the precision aquaculture market, focusing on advanced automation, robotic monitoring, and compliance with strict environmental standards. The adoption of integrated farm management platforms enables precise control over feed use, water parameters, and health monitoring. Research institutions are collaborating with industry to develop sensor arrays that detect early signs of stress and disease in fish populations. The market is supported by demand from high-value species farming and export-oriented aquaculture producers.

The United Kingdom is anticipated to grow at a CAGR of 14.3% in the precision aquaculture market, driven by technological innovation and increasing exports of high-quality seafood products. Investment in AI-powered feeding and health monitoring systems is growing, particularly in salmon and shellfish farms. Collaboration between aquaculture firms and technology providers is facilitating development of customized solutions for local environmental conditions. The market is also supported by government-backed R&D programs aimed at reducing operational costs and improving product traceability for export compliance.

The United States is projected to expand at a CAGR of 12.8% in the precision aquaculture market, with large-scale operations adopting precision tools to optimize resource use and improve sustainability metrics. The use of underwater drones, remote sensing, and data analytics platforms is increasing across salmon, catfish, and shellfish farms. The rising demand for traceable, high-quality seafood in domestic and international markets is incentivizing technology adoption. Collaborations between industry and academia are facilitating innovations in feed efficiency and disease control.

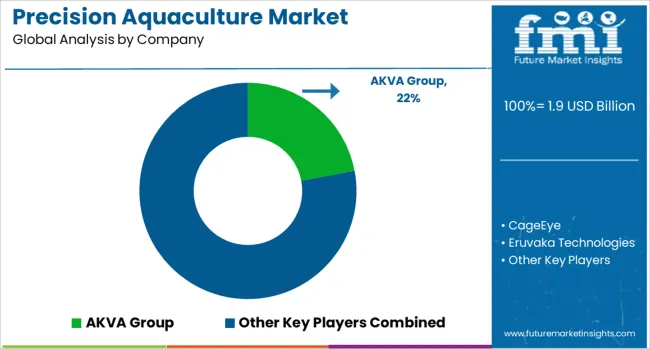

The market focuses on integrating advanced technologies such as sensors, data analytics, artificial intelligence, and automation to optimize fish farming efficiency, health monitoring, and environmental management. These solutions support real-time decision-making aimed at improving yield, reducing feed waste, and enhancing disease prevention while minimizing environmental impact. The market is driven by the need for sustainable and cost-effective aquaculture practices amid rising global seafood demand and regulatory pressures. AKVA Group is a key player offering comprehensive farm management systems that combine hardware and software for automated feeding, water quality monitoring, and fish behavior analysis. Innovasea provides integrated solutions including tracking devices and robotics for offshore and onshore aquaculture operations.

Aquabyte employs computer vision and machine learning technologies to deliver accurate fish health diagnostics and biomass estimation. CageEye focuses on sensor-based monitoring systems that track feeding efficiency and fish activity in cages. Eruvaka Technologies and XpertSea deliver digital platforms that combine IoT devices with AI-driven analytics to enhance productivity and farm transparency. Aquaculture Systems Technologies, LLC (AST) specializes in precision monitoring and control systems aimed at optimizing water conditions and operational workflows. The competitive environment emphasizes technological innovation, scalability, and seamless integration with existing farm infrastructure. Companies that provide user-friendly, data-driven solutions enabling cost reduction and sustainability will continue to capture expanding market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Offering | Hardware, Software, and Services |

| Farm Type | Open Aquaculture and RAS |

| System Type | Smart Feeding, Monitoring and Control, Underwater ROVs, and Others |

| Application | Feed Optimization, Monitoring and Surveillance, Yield Analysis and Measurement, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AKVA Group, CageEye, Eruvaka Technologies, Innovasea, Aquabyte, XpertSea, and Aquaculture Systems Technologies, LLC (AST) |

| Additional Attributes | Dollar sales by technology type and application area, demand dynamics across fish farming, shellfish cultivation, and aquaponics systems, regional trends in adoption across Asia-Pacific, Europe, and North America, innovation in IoT-enabled monitoring, AI-driven feed optimization, and automated disease detection, environmental impact of water quality management, energy consumption, and waste reduction, and emerging use cases in integrated multi-trophic aquaculture, sustainable seafood certification, and real-time ecosystem health tracking. |

The global precision aquaculture market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the precision aquaculture market is projected to reach USD 7.5 billion by 2035.

The precision aquaculture market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in precision aquaculture market are hardware, _sensors, _monitoring devices, _feeding devices, _underwater cameras, software, _data analytics platforms, _farm management software, services, _installation & maintenance and _consulting & training.

In terms of farm type, open aquaculture segment to command 61.0% share in the precision aquaculture market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquaculture Prebiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Aquaculture Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA