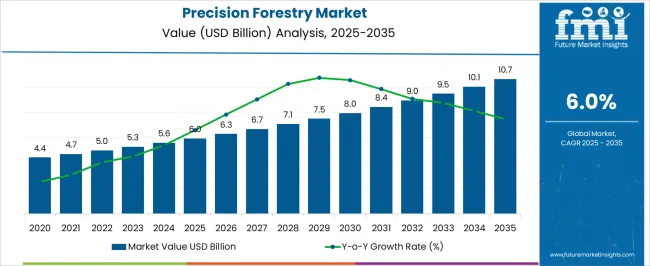

The precision forestry market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 10.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The market demonstrates a clear progression through the maturity curve and adoption lifecycle, transitioning from early adoption to scaling and eventually approaching consolidation. During the early adoption phase, prior to 2025, precision forestry technologies were gradually introduced, with limited uptake driven primarily by innovative forestry operators and pilot projects emphasizing remote sensing, GPS-enabled harvesting, and data-driven forest management.

From 2025 to 2030, the market enters the scaling phase, characterized by accelerated deployment across commercial forestry operations. The incremental annual growth from USD 6.0 billion to USD 8.0 billion within this period indicates broader acceptance of precision mapping, autonomous machinery, and real-time monitoring solutions. Technology adoption expands as operators recognize efficiency gains, reduced waste, and improved yield forecasting, which encourages investment in integrated digital forestry systems.

Post-2030, the market progresses toward consolidation, with adoption stabilizing as leading solutions become industry standards. Revenues approach USD 10.7 billion by 2035, reflecting widespread integration of UAV-based surveys, LiDAR mapping, and AI-driven analytics. Competition consolidates around a few established technology providers, while incremental growth is fueled by software enhancements, sensor upgrades, and regulatory compliance. The market maturity curve thus highlights a structured lifecycle, moving from experimental adoption to broad-scale industry integration, and eventually to a consolidation stage where innovation continues to optimize operational efficiency.

| Metric | Value |

|---|---|

| Precision Forestry Market Estimated Value in (2025 E) | USD 6.0 billion |

| Precision Forestry Market Forecast Value in (2035 F) | USD 10.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The precision forestry market is experiencing a transformative shift driven by increasing demand for sustainable forest management and the integration of advanced technologies. The market's growth trajectory is being influenced by the rising emphasis on environmental conservation, real-time forest data acquisition, and regulatory frameworks promoting responsible forestry practices.

Recent developments in satellite imaging, drone-based surveys, and machine learning algorithms have accelerated the adoption of data-centric decision-making processes across forest ecosystems. Annual reports and press statements from leading environmental and geospatial firms suggest that stakeholders are leveraging precision technologies to optimize yield, monitor biodiversity, and minimize deforestation risks.

The future outlook is shaped by growing investments in climate-smart forestry, increased funding from public and private sectors, and the alignment of forestry operations with carbon offset goals As global attention intensifies on forest conservation and climate resilience, the market is expected to expand further, offering scalable solutions that balance productivity with sustainability objectives.

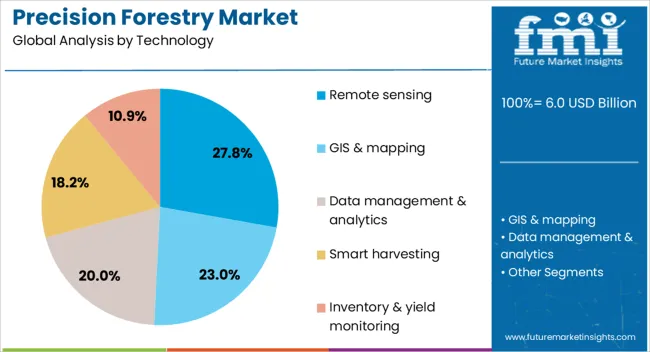

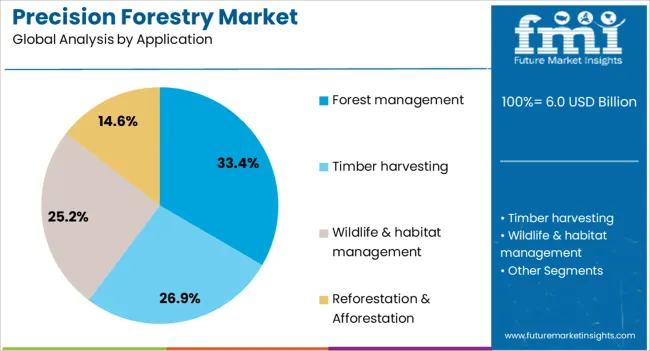

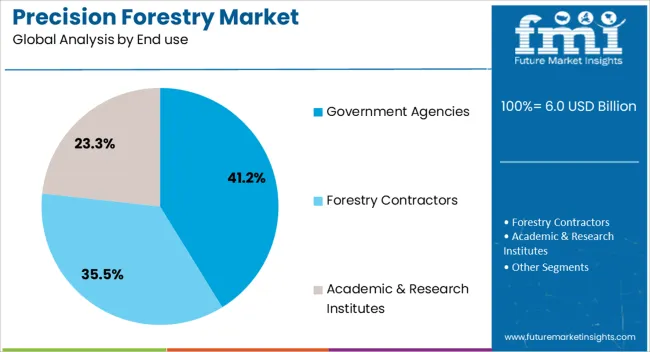

The precision forestry market is segmented by technology, application, end use, and geographic regions. By technology, the market is divided into remote sensing, GIS & mapping, data management & analytics, smart harvesting, and inventory & yield monitoring. In terms of application, the market is classified into forest management, timber harvesting, wildlife & habitat management, and reforestation & afforestation. Based on end use, the precision forestry market is segmented into government Agencies, forestry contractors, and academic & research institutes. Regionally, the precision forestry industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The remote sensing technology segment is expected to account for 27.8% of the precision forestry market revenue share in 2025, making it the leading technology segment. This position is being supported by the widespread deployment of satellite imagery, drones, and aerial surveillance systems to gather high-resolution forest data. According to industry journals and technology updates from geospatial solution providers, remote sensing enables efficient mapping of forest areas, early detection of disease or pest outbreaks, and tracking of illegal logging activities.

Government and commercial forestry operators have increasingly adopted this technology to improve decision-making and reduce manual survey costs. Its ability to provide consistent data over large and inaccessible areas has further strengthened its appeal.

Remote sensing technologies have also been aligned with carbon stock measurement and environmental reporting requirements, enabling compliance with international standards These attributes have collectively established the segment’s dominance within the technology landscape of precision forestry.

The forest management application segment is projected to hold 33.4% of the precision forestry market revenue share in 2025, emerging as the leading application area. This leadership is being driven by the increasing focus on optimizing forest operations, conserving biodiversity, and enhancing resource planning. Forest management solutions integrated with precision technologies allow stakeholders to analyze soil quality, tree health, and growth rates with greater accuracy, as highlighted in environmental policy documents and forestry association publications.

The segment has also gained traction due to its role in reducing operational inefficiencies and promoting reforestation programs. Real-time data analytics, supported by remote sensing and IoT-based tools, have enabLED dynamic decision-making in thinning, harvesting, and replanting activities.

The ability to monitor carbon sequestration and report forest performance metrics has further supported the segment’s expansion These factors have contributed to the continued prominence of forest management as a key application within the precision forestry ecosystem.

The government agencies segment is expected to dominate the precision forestry market with a 41.2% revenue share in 2025. This dominance is being attributed to the growing involvement of national and regional governments in forest conservation, biodiversity protection, and climate action initiatives. As outlined in government project announcements and public policy reviews, agencies are deploying precision forestry tools to enhance surveillance, support policy enforcement, and improve disaster response planning.

These organizations have prioritized investments in satellite-based monitoring, AI-driven forest modeling, and geospatial databases to improve land use efficiency and sustainability reporting. The segment’s growth has also been supported by international collaborations and funding programs aimed at curbing deforestation and promoting afforestation.

Government agencies are leveraging precision forestry to comply with international climate commitments and carbon offset protocols These strategic imperatives have established the segment as a cornerstone of demand, ensuring its continued leadership in the precision forestry market.

The market has been expanding due to the increasing adoption of technology-driven solutions for forest management, timber production, and ecosystem monitoring. Geographic information systems (GIS), drones, satellite imagery, and sensors are being leveraged to optimize forest operations and improve resource utilization. Data-driven decision-making allows for enhanced planning, disease detection, and sustainable harvesting. Growing investments in automated machinery, remote sensing technologies, and forestry analytics platforms have supported market growth. Both commercial timber enterprises and government agencies have increasingly relied on precision forestry tools to enhance efficiency and operational intelligence.

The adoption of drones, remote sensors, and satellite imagery has transformed forest management practices within the precision forestry market. High-resolution aerial and satellite data are utilized to monitor tree health, detect disease outbreaks, and estimate biomass and carbon stocks. GIS-based platforms enable spatial mapping, yield forecasting, and risk assessment for fire, pests, or extreme weather events. Automated machinery guided by precise geospatial data has optimized planting, thinning, and harvesting operations. Data analytics and AI algorithms have enhanced predictive capabilities, allowing forestry managers to anticipate challenges and allocate resources efficiently. The integration of multiple technologies has provided actionable insights for operational efficiency and environmental management. Consequently, technological convergence has become a cornerstone of precision forestry adoption, ensuring sustainable practices while supporting commercial objectives.

Regulatory frameworks and environmental initiatives have significantly influenced the growth of precision forestry solutions. Policies promoting sustainable forestry, carbon sequestration, and biodiversity conservation have created demand for monitoring and management tools. Compliance with national and international standards for timber production, such as certification schemes, has necessitated precise tracking of forest resources. Government incentives for climate-smart forestry practices and public-private partnerships have further accelerated adoption. Agencies and organizations have relied on precision forestry technologies to monitor reforestation, afforestation, and conservation efforts. Real-time data collection and reporting have facilitated regulatory compliance and transparent operations. As a result, environmental and policy-driven initiatives have emerged as critical factors encouraging investment in technology-enabled forest management practices.

Commercial timber and pulp industries have been key drivers for precision forestry adoption. Accurate assessment of tree growth, species distribution, and timber volume allows for optimized harvesting schedules, cost reduction, and yield maximization. Data-driven insights have improved supply chain management, reducing wastage and enabling better planning for transportation and storage. Forestry operations in remote or challenging terrains have benefited from unmanned aerial vehicles (UAVs) and sensor-based monitoring. By applying predictive analytics, operators have been able to forecast wood quality and market readiness. The growing demand for high-quality timber products and efficient resource utilization has strengthened the business case for precision forestry solutions. Consequently, commercial forestry requirements have reinforced the integration of technology across operational and strategic levels.

The market has been strengthened by developments in analytics, machine learning, and automation. Predictive models for yield forecasting, disease detection, and environmental impact assessment have enabled informed decision-making. Automated logging equipment and robotic systems guided by geospatial data have improved operational efficiency and safety. Cloud-based platforms have facilitated real-time monitoring, remote management, and centralized data analysis for large-scale forest operations. Integration with IoT sensors has enhanced continuous monitoring of soil, moisture, and tree health parameters. These advancements have reduced operational risk, improved productivity, and supported sustainability initiatives. By combining data analytics with automation, forestry managers are now able to optimize workflows and minimize environmental impact, driving consistent demand for precision forestry technologies globally.

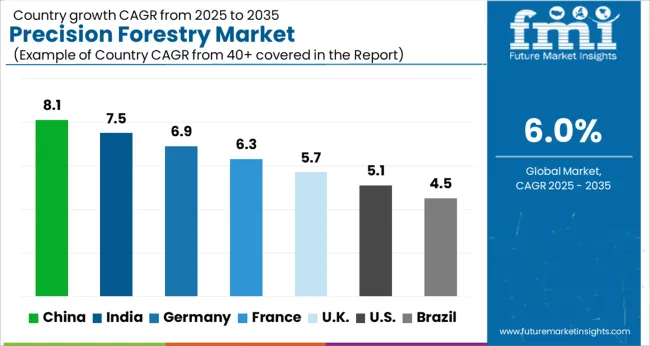

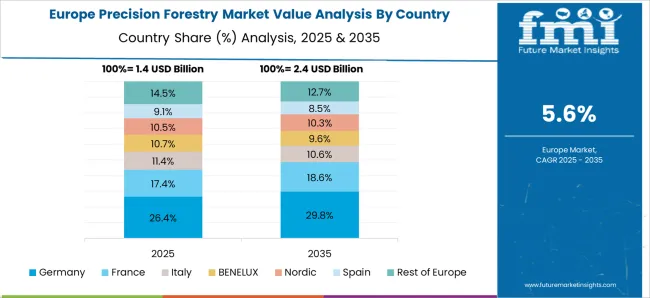

The market is expected to grow at a CAGR of 6.0% from 2025 to 2035, driven by the adoption of digital forestry technologies, remote sensing, and automated harvesting solutions. China leads with an 8.1% CAGR, fueled by large-scale forestry modernization and adoption of drone and satellite monitoring systems. India follows at 7.5%, supported by government initiatives promoting sustainable forest management and mechanized operations. Germany, at 6.9%, benefits from advanced forestry technology integration and precision logging practices. The UK, growing at 5.7%, focuses on smart forest management and eco-friendly harvesting methods. The USA, at 5.1%, witnesses steady demand from precision monitoring systems and data-driven forest management strategies. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to expand at a CAGR of 8.1% in the market from 2025 to 2035, driven by government-supported forest management programs and adoption of remote sensing technologies. The use of drones, GPS mapping, and automated machinery is increasing efficiency in plantation management and timber harvesting. Domestic technology providers are innovating integrated forestry solutions to optimize yield and monitor environmental impact. Collaboration between forestry agencies and tech firms is enhancing operational accuracy and sustainability. Growth is further supported by rising investments in reforestation projects and advanced monitoring systems.

India is forecast to grow at a CAGR of 7.5% in the market between 2025 and 2035. Expansion is supported by initiatives for forest conservation, afforestation programs, and adoption of digital forestry tools. Use of GIS mapping and remote sensing is improving plantation monitoring and timber yield prediction. Partnerships between government agencies and private technology providers are facilitating modernized forest management solutions. Increased awareness about forest productivity and environmental monitoring is contributing to market development.

Germany is anticipated to grow at a CAGR of 6.9% in the precision forestry market from 2025 to 2035. Adoption is fueled by national policies promoting sustainable forest management and technological modernization. German forestry operations are implementing drone surveys, sensor-based monitoring, and automated logging equipment. Investment in environmental monitoring systems and operational efficiency is supporting market demand. Strategic collaborations between technology providers and forestry agencies are enabling precision applications.

The United Kingdom is projected to expand at a CAGR of 5.7% in the precision forestry market during 2025 to 2035. Growth is driven by adoption of GPS-enabled machinery, environmental monitoring, and reforestation initiatives. Forestry management is being enhanced by digital solutions that optimize yield and reduce operational inefficiencies. Collaboration between private providers and government agencies is facilitating implementation of modern forestry systems.

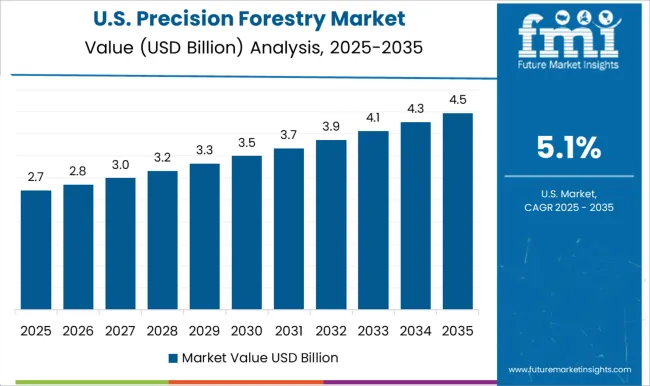

The United States is forecast to grow at a CAGR of 5.1% in the market between 2025 and 2035. Expansion is supported by federal programs promoting forest management efficiency, adoption of IoT-enabLED devices, and remote sensing for environmental monitoring. Private forestry operators are investing in drone mapping, sensor integration, and automated logging systems to enhance operational productivity.

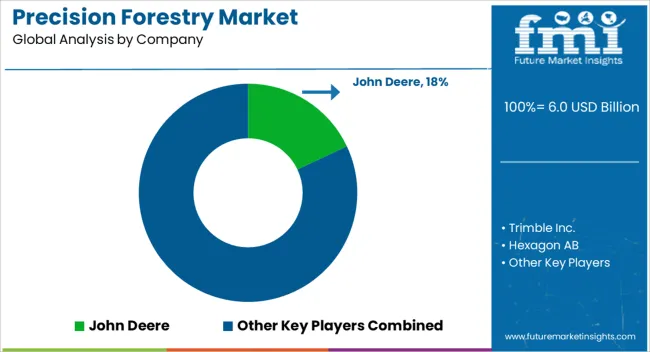

The market is characterized by a mix of established heavy machinery manufacturers, technology integrators, and specialized forestry solution providers offering advanced equipment and digital tools for efficient forest management. John Deere remains a dominant player with integrated precision forestry machinery and software solutions that enhance productivity, mapping, and harvesting accuracy. Trimble Inc. and Hexagon AB contribute through sophisticated GPS-enabLED data analytics, remote sensing technologies, and asset management platforms tailored for forestry operations.

Topcon Corporation and Ponsse Plc strengthen the market with automated harvesting systems, real-time monitoring tools, and vehicle telematics that improve operational efficiency while reducing resource wastage. Komatsu Ltd. provides advanced machinery with onboard sensors and data logging capabilities, supporting optimized workflow and sustainable resource utilization.

Emerging companies like Treemetrics focus on digital forestry solutions, offering predictive analytics, yield forecasting, and terrain analysis to streamline decision-making. Silvacom Ltd. supports precision forestry through integrated consulting, software, and data-driven management services, facilitating ecosystem monitoring and regulatory compliance. The market remains challenging for new entrants due to high capital investment requirements, regulatory standards, and the technical complexity of integrating hardware with software analytics. Continuous product launches, R&D initiatives, and strategic partnerships drive competitive differentiation, enabling providers to offer innovative solutions that enhance efficiency, accuracy, and overall productivity in forestry operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 billion |

| Technology | Remote sensing, GIS & mapping, Data management & analytics, Smart harvesting, and Inventory & yield monitoring |

| Application | Forest management, Timber harvesting, Wildlife & habitat management, and Reforestation & Afforestation |

| End use | Government Agencies, Forestry Contractors, and Academic & Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | John Deere, Trimble Inc., Hexagon AB, Topcon Corporation, Ponsse Plc, Komatsu Ltd., Treemetrics, Hitachi Construction Machinery Co., Ltd., and Silvacom Ltd |

| Additional Attributes | Dollar sales by equipment type and application segment, demand dynamics across timber harvesting, plantation management, and forest conservation, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in GPS-guided machinery, LiDAR mapping, and drone-based monitoring, environmental impact of sustainable logging practices, soil preservation, and reduced fuel consumption, and emerging use cases in carbon credit verification, wildlife habitat protection, and automated forest inventory management. |

The global precision forestry market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the precision forestry market is projected to reach USD 10.7 billion by 2035.

The precision forestry market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key technology types in precision forestry market are remote sensing, gis & mapping, data management & analytics, smart harvesting and inventory & yield monitoring.

In terms of application, forest management segment to command 33.4% share in the precision forestry market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA