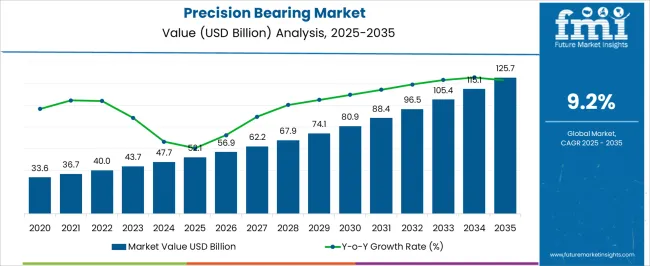

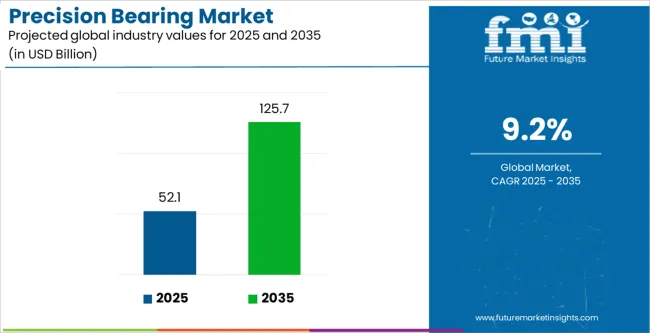

The Precision Bearing Market is estimated to be valued at USD 52.1 billion in 2025 and is projected to reach USD 125.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Precision Bearing Market Estimated Value in (2025 E) | USD 52.1 billion |

| Precision Bearing Market Forecast Value in (2035 F) | USD 125.7 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Precision Bearing market is experiencing steady growth, driven by increasing demand for high-performance components in machinery, automotive systems, and industrial equipment. The current market scenario reflects a strong adoption of precision-engineered bearings that enhance efficiency, reduce friction, and support higher operational speeds in complex mechanical systems. The future outlook is influenced by rising investments in automotive technologies, industrial automation, and machinery modernization programs.

Growing requirements for durability, load-bearing capacity, and rotational accuracy are encouraging manufacturers to adopt advanced bearing technologies. Additionally, the market is benefiting from a shift toward predictive maintenance and reliability-focused engineering, where precision bearings are critical for reducing downtime and extending equipment lifespan.

With the expansion of automated production lines, high-performance industrial machinery, and electric and hybrid vehicles, the Precision Bearing market is positioned for continued growth Opportunities are expected in the development of advanced bearing materials, improved tolerance standards, and integration with smart monitoring systems, which will enhance operational efficiency and reliability across multiple industries.

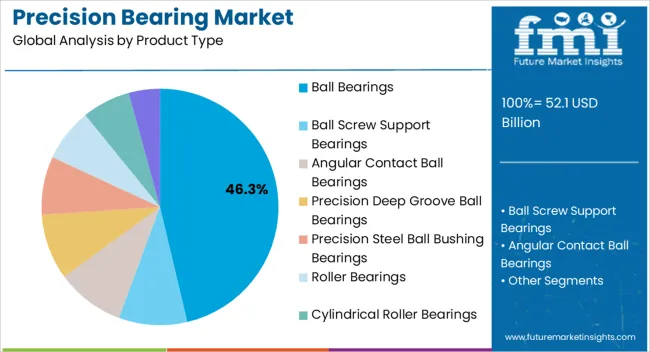

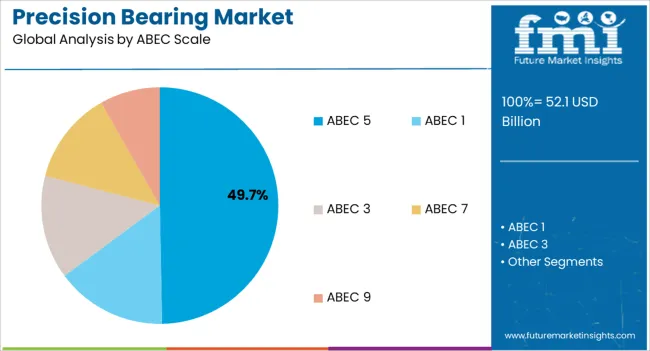

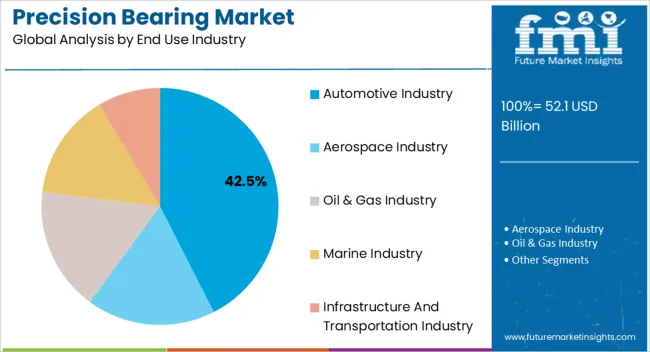

The precision bearing market is segmented by product type, abec scale, end use industry, and geographic regions. By product type, precision bearing market is divided into Ball Bearings, Ball Screw Support Bearings, Angular Contact Ball Bearings, Precision Deep Groove Ball Bearings, Precision Steel Ball Bushing Bearings, Roller Bearings, Cylindrical Roller Bearings, and Spherical Bearings. In terms of abec scale, precision bearing market is classified into ABEC 5, ABEC 1, ABEC 3, ABEC 7, and ABEC 9. Based on end use industry, precision bearing market is segmented into Automotive Industry, Aerospace Industry, Oil & Gas Industry, Marine Industry, and Infrastructure And Transportation Industry. Regionally, the precision bearing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ball Bearings product type is projected to hold 46.30% of the Precision Bearing market revenue share in 2025, making it the leading product type. This dominance is being attributed to its widespread applicability across diverse mechanical systems and industries requiring low-friction rotational components. Ball bearings are highly preferred due to their ability to maintain high rotational accuracy, withstand radial and axial loads, and deliver consistent performance over extended operational cycles.

Growth in this segment has been reinforced by their adoption in automotive, industrial, and aerospace machinery, where precision, reliability, and maintenance efficiency are critical. The modularity of ball bearing designs allows easy integration into complex assemblies and supports rapid scaling of production lines.

Additionally, improvements in materials and heat treatment processes have increased load capacity and operational lifespan, which further reinforces their market leadership The consistent demand for high-efficiency, low-maintenance, and cost-effective solutions is expected to continue driving growth in the ball bearing segment.

The ABEC 5 precision tolerance segment is expected to account for 49.70% of the market revenue share in 2025, establishing it as the dominant tolerance rating in the Precision Bearing market. This leadership is being driven by the balance between manufacturing cost, performance, and rotational precision offered by ABEC 5 bearings. These bearings are widely utilized in applications that require high-speed operation with minimal vibration and precise alignment, including automotive engines, industrial machinery, and robotics.

The growth of this segment has been further accelerated by the adoption of advanced engineering standards and predictive maintenance programs, which rely on reliable and consistent bearing performance. Manufacturers have increasingly favored ABEC 5 bearings due to their compatibility with higher tolerance requirements without the premium cost of ultra-precision ratings.

Additionally, the ability to operate efficiently under varying loads and speeds makes ABEC 5 bearings suitable for a broad range of industrial applications Continued advancements in materials, lubrication technologies, and production processes are expected to reinforce the segment’s dominance and support sustainable market growth.

The Automotive Industry end-use segment is projected to hold 42.50% of the Precision Bearing market revenue share in 2025, positioning it as the leading sector. This growth has been driven by the rising demand for high-performance, fuel-efficient vehicles that require precision-engineered bearings for engines, transmissions, drivetrains, and suspension systems.

The adoption of electric and hybrid vehicles has further increased the need for reliable, low-friction bearings capable of supporting high rotational speeds and extended operational life. Additionally, precision bearings are being leveraged to reduce noise, vibration, and harshness in automotive systems, improving overall vehicle quality and customer satisfaction.

Growth in this segment is also influenced by the increasing complexity of automotive components and the integration of automated manufacturing processes that demand high-accuracy, standardized bearing components With the continued expansion of automotive production globally, coupled with technological advancements in vehicle design and electrification, the automotive industry segment is expected to remain the primary driver of demand for precision bearings in the coming decade.

A precision bearing is type of bearing which is manufactured according to the set standards given by Annular Bearing Engineering Committee (ABEC) of the American Bearing Manufacturers Association (ABMA). According to the tolerance of a bearing it is classified under ABEC scale from the largest to the smallest tolerance bearing. There are five classes in ABEC standard scale such as, ABEC 1, ABEC 3, ABEC 5, ABEC 7, and ABEC 9. The high class precision bearing provides, greater speed capabilities, and better efficiency.

Furthermore, the precision bearing have applications in many end-use industries. High class precision bearing is used in aerospace industry, and other class precision bearing is used for majority of applications in different industries such as, automotive industries, marine industry, infrastructure and transportation industry etc.

Additionally, the precision bearing comes in different types as per the requirement and end-use application such as, ball bearing, roller bearing and spherical bearing are some of the major types of precision bearing.

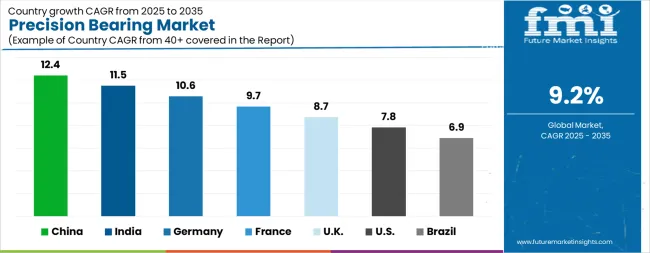

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The Precision Bearing Market is expected to register a CAGR of 9.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.4%, followed by India at 11.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.9%, yet still underscores a broadly positive trajectory for the global Precision Bearing Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.6%. The USA Precision Bearing Market is estimated to be valued at USD 19.1 billion in 2025 and is anticipated to reach a valuation of USD 40.5 billion by 2035. Sales are projected to rise at a CAGR of 7.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.4 billion and USD 1.5 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 52.1 Billion |

| Product Type | Ball Bearings, Ball Screw Support Bearings, Angular Contact Ball Bearings, Precision Deep Groove Ball Bearings, Precision Steel Ball Bushing Bearings, Roller Bearings, Cylindrical Roller Bearings, and Spherical Bearings |

| ABEC Scale | ABEC 5, ABEC 1, ABEC 3, ABEC 7, and ABEC 9 |

| End Use Industry | Automotive Industry, Aerospace Industry, Oil & Gas Industry, Marine Industry, and Infrastructure And Transportation Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

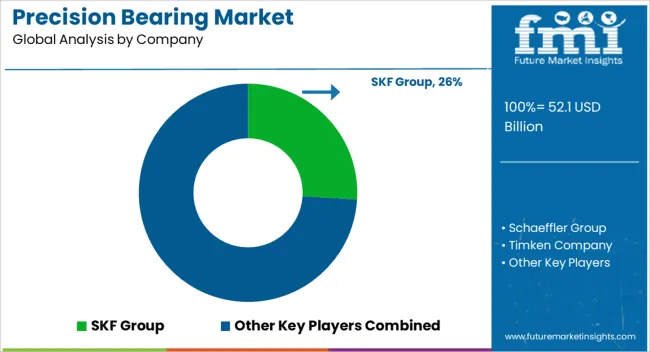

| Key Companies Profiled | SKF Group, Schaeffler Group, Timken Company, NSK Ltd., NTN Corporation, JTEKT Corporation, Kaman Corporation, and Cixing Group Co., Ltd |

The global precision bearing market is estimated to be valued at USD 52.1 billion in 2025.

The market size for the precision bearing market is projected to reach USD 125.7 billion by 2035.

The precision bearing market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in precision bearing market are ball bearings, ball screw support bearings, angular contact ball bearings, precision deep groove ball bearings, precision steel ball bushing bearings, roller bearings, cylindrical roller bearings and spherical bearings.

In terms of abec scale, abec 5 segment to command 49.7% share in the precision bearing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA