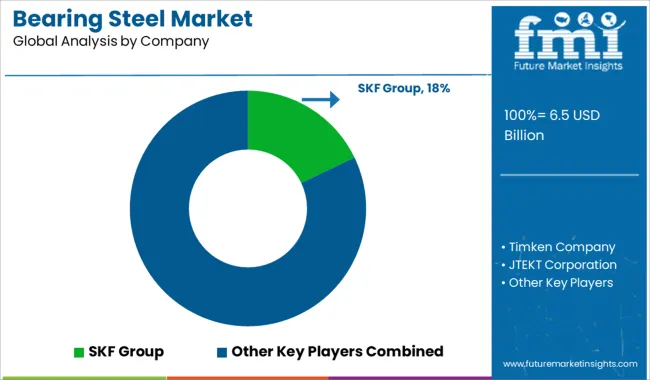

The Bearing Steel Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Bearing Steel Market Estimated Value in (2025 E) | USD 6.5 billion |

| Bearing Steel Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The bearing steel market is experiencing sustained growth, driven by increased demand for high-performance mechanical components across automotive, industrial, and aerospace sectors. Bearing steels are valued for their exceptional hardness, fatigue strength, and wear resistance, making them critical in applications requiring precise motion and high durability.

Rising automotive production and the growing deployment of advanced machinery in manufacturing and infrastructure projects are key contributors to market expansion. Additionally, the shift toward electric vehicles and renewable energy systems has further amplified demand for specialized bearings, intensifying the need for premium steel grades.

Technological improvements in steel processing and heat treatment methods continue to enhance material properties, enabling broader application and longer service life. The market outlook remains strong, supported by continuous investment in high-efficiency components and global infrastructure development, positioning bearing steel as a vital material across multiple high-growth industries.

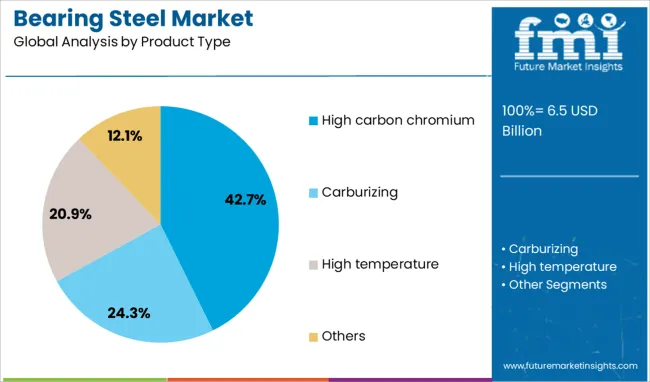

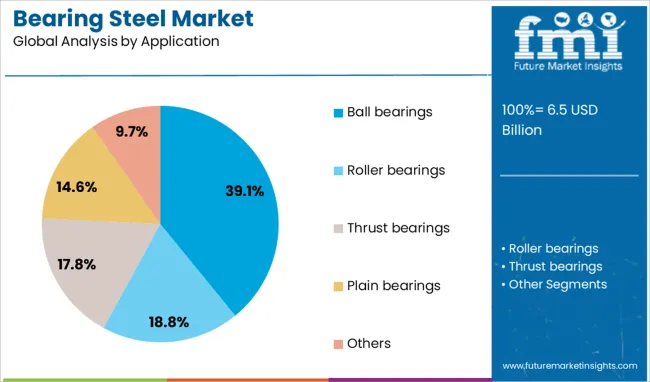

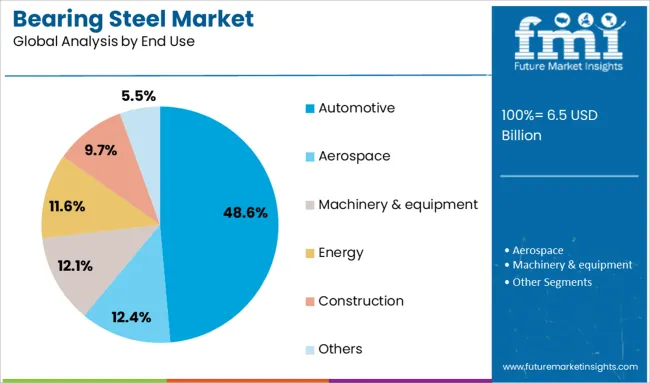

The bearing steel market is segmented by product type, application, end use and geographic regions. The bearing steel market is divided by product type into high-carbon chromium, Carburizing, high-temperature, and Others. The bearing steel market is classified into Ball bearings, Roller bearings, Thrust bearings, Plain bearings, and Others. Based on end use, the bearing steel market is segmented into Automotive, Aerospace, Machinery & equipment, Energy, Construction, and Others. Regionally, the bearing steel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high carbon chromium segment holds the leading position in the product type category with a 42.7% market share, attributed to its superior hardness, high wear resistance, and dimensional stability. This steel type is extensively used in manufacturing bearing components exposed to high loads and rotational speeds, especially in demanding environments.

Its widespread adoption is supported by consistent metallurgical performance and compatibility with heat treatment processes, ensuring longevity and operational reliability. Industries including automotive, heavy machinery, and wind energy prefer high carbon chromium steel due to its cost efficiency and proven service record.

Continuous advancements in refining techniques and quality control have enhanced material uniformity and fatigue life, driving increased use across global supply chains. The segment is expected to maintain dominance as OEMs prioritize performance and lifecycle value in bearing applications.

The ball bearings segment leads the application category with a 39.1% market share, supported by its extensive use in rotating equipment across diverse industries. Ball bearings require high-grade steel to ensure low friction, high precision, and consistent performance under varying operational conditions.

Their application spans from automotive components to electric motors, where efficiency and reduced maintenance are critical. The segment benefits from increasing automation, the miniaturization of mechanical systems, and the expansion of industrial production.

As energy efficiency and operational reliability become key engineering objectives, the demand for precisely engineered ball bearings using advanced bearing steel continues to rise. Innovations in sealing, lubrication, and cage materials complement the growth of this segment, ensuring its continued expansion within the overall market.

The automotive segment dominates the end use category with a commanding 48.6% share, driven by the sector’s consistent need for reliable, high-performance bearing components. Bearings play a critical role in various automotive subsystems including engines, transmissions, wheels, and electric drivetrains, all of which demand materials with exceptional fatigue strength and thermal stability.

The ongoing evolution of the automotive industry marked by increased vehicle electrification, higher efficiency standards, and extended warranty requirements has further emphasized the use of premium bearing steel. Suppliers are focusing on innovation and customization to meet specific OEM standards and regional regulatory expectations.

Additionally, the rising global vehicle parc and emphasis on aftermarket servicing support the segment’s long-term growth. As the automotive sector continues to modernize, its demand for advanced bearing steel solutions is expected to remain robust.

The bearing steel market is experiencing consistent growth driven by increasing demand from automotive, aerospace, industrial machinery, and wind energy sectors. Bearing steel, known for its high wear resistance and fatigue strength, is critical in producing precision components. As manufacturing activity accelerates globally, particularly in Asia-Pacific and Europe, consumption of bearing steel continues to rise. The push for longer-lasting components in high-speed applications is prompting greater investment in metallurgical refinement, process automation, and product standardization across industry players.

Manufacturers of bearing steel face rising challenges in meeting strict quality and performance standards imposed by various regulatory bodies. Testing protocols for fatigue resistance, cleanliness, and dimensional stability have grown more complex across different industries. This extends product development cycles, especially for high-performance applications such as aerospace and electric vehicle components. Each steel batch must undergo detailed inspection involving microstructure verification, surface defect analysis, and hardness testing to ensure durability in extreme environments. For smaller producers, these requirements are costly and time-consuming, often requiring external laboratory validation or long-term certifications. In global supply chains, varying regional standards further complicate compliance, slowing product approvals and customer onboarding. Companies must invest in in-house labs or strategic partnerships to stay competitive. The pressure to meet tighter tolerances and longer operating lifetimes increases the demand for consistent material properties, making quality compliance not only a regulatory issue but also a commercial differentiator in the marketplace.

The bearing steel market faces significant restraint from raw material price fluctuations, particularly for high-purity iron, chromium, and alloying elements. These inputs are essential for maintaining the strength and fatigue properties that bearing steels require. Price instability impacts profit margins and complicates procurement planning, especially for smaller producers who lack long-term sourcing contracts. Import restrictions, trade tariffs, and logistics disruptions further intensify cost unpredictability. In response, some manufacturers explore alternative alloys or adjust batch sizes, but this often compromises material performance or consistency. Buyers in price-sensitive markets may shift toward lower-cost alternatives, limiting premium steel adoption. Producers must balance quality retention with cost control, a challenge amplified when energy prices rise or supply chains are disrupted. This volatility discourages expansion efforts and delays investment in capacity upgrades. Until input prices stabilize, market growth may remain moderate, especially in regions where production costs heavily influence customer decisions and supply chain strategies.

Growing demand from electric vehicles, industrial machinery, and renewable energy infrastructure is expanding the need for specialized bearing steel. In the automotive industry, electric motors, gearboxes, and transmission systems require high-strength bearings capable of withstanding elevated rotational speeds and loads. Similarly, wind turbines and solar tracking systems demand bearing components with long service life and resistance to environmental stresses. These applications prioritize durability, minimal maintenance, and thermal stability. Industrial sectors such as mining, railways, and construction equipment also contribute to rising consumption due to the growing need for robust rotating assemblies. Manufacturers who can deliver tailored grades with enhanced fatigue resistance, surface finish, and corrosion protection are better positioned to secure long-term supply agreements. Strategic partnerships between steelmakers, bearing manufacturers, and end users help optimize compositions for specific performance goals. This expanding application diversity supports stable long-term growth for bearing steel producers focused on delivering quality and consistency across a wide range of industries.

A significant trend in the bearing steel market is the adoption of advanced processing technologies to enhance performance and reliability. Techniques such as vacuum degassing, electroslag remelting, and precise heat treatment help reduce impurities and improve microstructural uniformity. These methods result in higher fatigue resistance, better surface hardness, and longer component life. Digital quality monitoring systems are being integrated into production lines, enabling real-time defect detection and process control. Steelmakers are also refining grain structures through thermo-mechanical treatments, allowing tighter dimensional tolerances and greater consistency in mechanical behavior. The use of clean steels with minimized inclusions is especially important for aerospace and high-speed rail bearings. These innovations reduce the likelihood of failure under dynamic loads and extend replacement intervals. Manufacturers who adopt these advanced metallurgical processes can offer premium products that meet evolving customer expectations. As competition increases, processing capabilities have become a key differentiator in securing contracts across industrial and mobility applications.

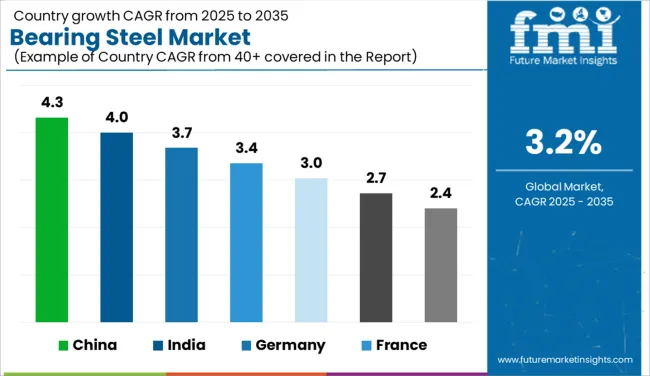

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

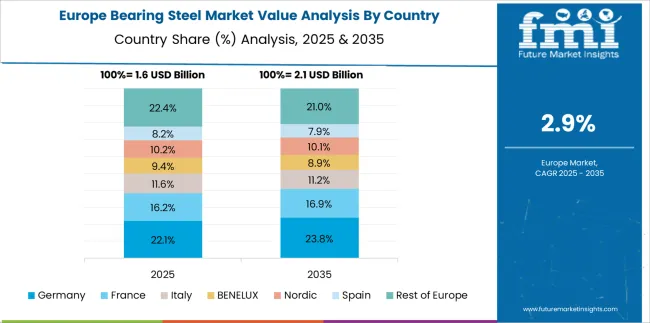

The global bearing steel market is projected to grow at a CAGR of 3.2% through 2035, supported by steady demand in automotive, aerospace, and industrial machinery sectors. Among BRICS nations, China leads with 4.3% growth, driven by expanded output in rolling components and large-volume bearing applications. India follows at 4.0%, where increased domestic production has been directed toward transport and heavy equipment sectors. In the OECD region, Germany reports 3.7% growth, reflecting consistent use in high-precision machinery and mechanical assemblies. The United Kingdom, at 3.0%, maintains supply for mid-volume industrial bearings and export-grade mechanical parts. The United States, at 2.7%, remains a mature market with emphasis on metallurgical standards and specialty grades. Market development has been shaped by fatigue resistance criteria, heat treatment regulations, and dimensional tolerance certification. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Strong interest has been shown in high-durability steel grades within China, where the bearing steel market has progressed at a 4.3% CAGR. Steady investment has supported capacity expansion across specialty steel mills producing low inclusion content materials for precision bearings. Railway axle manufacturers have relied on clean vacuum arc remelted grades to ensure fatigue resistance under dynamic loading. Production clusters in provinces like Hebei and Jiangsu have served industrial transmission and automotive hub demand. Metallurgical enhancements, including chromium and molybdenum additions, have helped extend service life in demanding applications. Machinery exporters have required dimensional stability and heat-treated consistency, further boosting downstream usage. End-use growth has been reflected across bearing cages, rollers, and outer raceways. Quality control facilities have been upgraded to validate uniformity in high-load mechanical environments.

Increased attention has been directed toward reliability and material longevity across India's machinery sectors, resulting in a 4.0% CAGR for the bearing steel market. Local bearing manufacturers have adopted through-hardened and case-hardened grades to support electric motor and vehicle component production. Strengthened procurement from railway and construction equipment firms has created sustained demand for wear-resistant, low-distortion steels. Integration of controlled heat treatment and forging processes has occurred at manufacturing sites in Maharashtra and Tamil Nadu. Suppliers have emphasized compliance with fatigue-life standards suitable for tapered and cylindrical roller bearings. Enhanced cold working and spheroidizing treatments have been introduced to improve machinability. Usage in agricultural gearboxes and two-wheeler drive trains has also expanded. Distribution networks have aligned with OEMs and aftermarket suppliers across industrial zones.

Sustained demand from automotive and mechanical systems has supported a 3.7% CAGR in Germany’s bearing steel market. High-purity alloy steels have been processed for use in wind turbines, robotics, and internal combustion engines. Domestic metallurgists have focused on achieving uniform carbide distribution and tight microstructural control for roller-bearing components. Advanced heat treatment protocols, including bainitic hardening and cryogenic tempering, have gained preference. Regional hubs in Bavaria and Baden-Württemberg have coordinated material supply to Tier-1 automotive suppliers. Aerospace bearing units have required narrow dimensional tolerances and vacuum arc remelted quality. Additional requirements for corrosion-resistant and thermally stable grades have been met through chromium-rich formulations. Export shipments of bearing rings and forged blanks have also contributed to market value.

Targeted improvements in mechanical performance have underpinned a 3.0% CAGR in the bearing steel market across the United Kingdom. Local steelmakers have supplied quenched and tempered grades to manufacturers of aerospace bearing assemblies, precision tools, and heavy-duty axles. Integration with powertrain assembly units has driven specifications for consistent hardness and high rolling contact fatigue strength. Investment in non-destructive testing and micro-cleanliness inspection has been reported across steel finishing units in Yorkshire and South Wales. Railway rolling stock and precision machining firms have maintained interest in medium-carbon alloy grades suitable for case hardening. Procurement preferences have shifted toward domestically certified suppliers offering fine-grain materials with traceability. Bearing ring exporters have also supported market activity, especially toward North American clients.

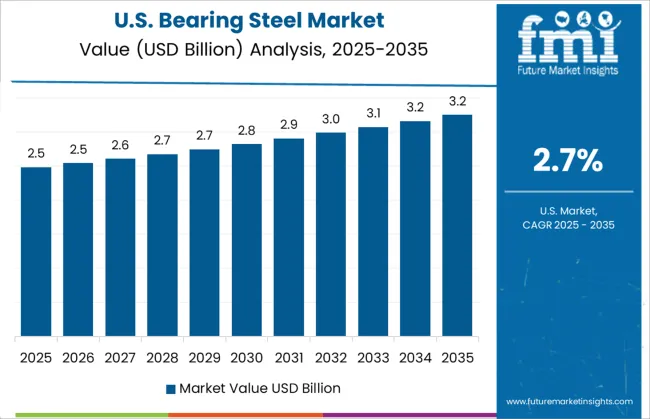

The bearing steel market in the United States has recorded a 2.7% CAGR, driven by demand from heavy industrial and defense sectors. Alloy steel producers have delivered high-strength grades for aircraft engine bearings, precision instruments, and transmission shafts. Strict adherence to ANSI and AISI standards has shaped melt practices and inclusion control protocols. Domestic forging plants have utilized bar and tube stock for bearing races and rolling components across construction and military vehicle fleets. Heat-treated material with uniform grain size has been prioritized for aerospace and locomotive wheel hub applications. Metallurgical research centers have studied stress cracking and residual stress behavior in carburized surfaces. Component traceability and performance documentation have been emphasized for critical-load bearings. Distribution partners have supplied stock to repair and overhaul service centers nationwide.

The bearing steel market is dominated by a blend of global steel manufacturers and precision bearing producers who specialize in high-purity, fatigue-resistant alloys used in critical motion applications. SKF Group is a leading force, utilizing in-house bearing-grade steel to manufacture high-performance bearings used across automotive, aerospace, and industrial machinery sectors. Timken Company integrates steel production and bearing design, supplying carburizing and through-hardened steel known for its superior wear resistance and dimensional control. JTEKT Corporation, through its Koyo brand, not only manufactures bearings but also produces bearing steel that supports high-speed, high-load applications, particularly in automotive drivetrains. Nippon Steel Corporation plays a crucial role as a raw material supplier, offering ultra-clean bearing steel grades engineered to reduce inclusion content and improve rolling contact fatigue life. Schaeffler Group, a major bearings supplier, collaborates closely with steel producers to secure alloys that meet the demands of electric mobility and high-efficiency industrial systems. Ovako Group, known for its expertise in engineering steels, produces bearing-grade steels with consistent microstructures and toughness, often preferred for wind turbines, mining, and railway applications. TATA Steel contributes significantly to regional markets by offering custom compositions suited for high-load bearing assemblies. Meanwhile, Steel India caters to cost-sensitive sectors with reliable, locally processed bearing steels used in medium-precision machinery and automotive components. The market’s competitiveness hinges on purity, fatigue strength, and steel-processing technologies that ensure long service life under extreme operating conditions.

As mentioned in the official joint announcement by SKF and voestalpine on July 10, 2024, the companies unveiled the prototype bearing made with hydrogen direct reduced iron (H‑DRI) steel. This marks a major step toward low-carbon bearing production, combining sustainability with uncompromised performance standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Product Type | High carbon chromium, Carburizing, High temperature, and Others |

| Application | Ball bearings, Roller bearings, Thrust bearings, Plain bearings, and Others |

| End Use | Automotive, Aerospace, Machinery & equipment, Energy, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SKF Group, Timken Company, JTEKT Corporation, Nippon Steel Corporation, Schaeffler Group, Ovako Group, TATA Steel, and Steel India |

| Additional Attributes | Dollar sales by bearing steel type including carbon steel and stainless steel variants, by application across automotive, energy & power, industrial machinery, aerospace, and electrical & electronics industries, and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by automotive production, EV and wind turbine deployment, and infrastructure expansion; innovation in high-carbon chromium alloys and powder metallurgy; costs influenced by alloying element prices and manufacturing complexity. |

The global bearing steel market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the bearing steel market is projected to reach USD 8.9 billion by 2035.

The bearing steel market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in bearing steel market are high carbon chromium, carburizing, high temperature and others.

In terms of application, ball bearings segment to command 39.1% share in the bearing steel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bearing Steel Balls for New Energy Vehicles Market Size and Share Forecast Outlook 2025 to 2035

High Carbon Bearing Steel Market Growth 2025 to 2035

Bearing Installation Tool Kit Market Size and Share Forecast Outlook 2025 to 2035

Bearing Isolators Market

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Plain Bearing Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Bridge Bearing Market Growth – Trends & Forecast 2025-2035

Thrust Bearings Market

Linear Bearings Market

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Between Bearing Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Bearing Market Growth - Trends & Forecast 2025 to 2035

Sliding Bearing Market Growth - Trends & Forecast 2025 to 2035

Camshaft Bearings Market

Magnetic Bearing Market

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Bearing and Clutch Component Aftermarket Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA