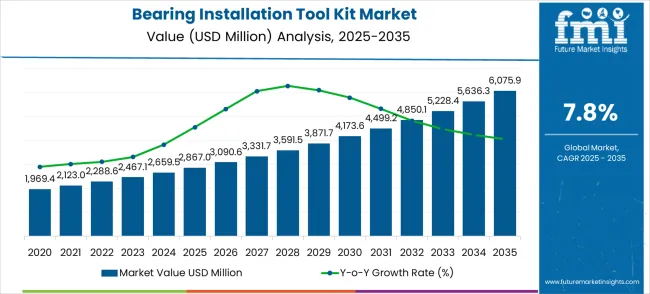

The global bearing installation tool kit market is projected to reach USD 6,076 million by 2035, recording an absolute increase of USD 3,208.9 million over the forecast period. The market is valued at USD 2,867.0 million in 2025 and is set to rise at a CAGR of 8% during the assessment period. The overall market size is expected to grow by nearly 2.12X during the same period, supported by increasing industrial automation and manufacturing modernization initiatives across automotive and heavy machinery sectors. However, market growth faces constraints from high initial investment costs for advanced hydraulic systems and skilled technician availability for complex bearing installation procedures.

Between 2025 and 2030, the bearing installation tool kit market is projected to expand from USD 2,867.0 million to USD 4,173.7 million, resulting in a value increase of USD 1,306.7 million, which represents 40.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for precision installation equipment, product innovation in hydraulic and mechanical systems, and expanding distribution through industrial supply chains and service networks. Companies are establishing competitive positions through investment in advanced manufacturing technologies, specialized application development, and strategic market expansion across automotive service centers, industrial maintenance facilities, and heavy equipment operations.

From 2030 to 2035, the market is forecast to grow from USD 4,173.7 million to USD 6,076 million, adding another USD 1,902.2 million, which constitutes 59.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of automated installation systems, including computerized hydraulic units and digital torque monitoring tools tailored for specific bearing applications, strategic collaborations between tool manufacturers and bearing producers, and premium positioning with enhanced precision and quality control features. The growing emphasis on predictive maintenance and condition monitoring will drive demand for sophisticated installation tool kits across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,867 million |

| Market Forecast Value (2035) | USD 6,076 million |

| Forecast CAGR (2025-2035) | 8% |

The bearing installation tool kit market is growing because proper bearing installation reduces machinery downtime and prevents costly premature failures in industrial equipment. Key demand drivers include increasing industrial automation requiring precise bearing installation procedures, expanding automotive aftermarket services demanding specialized tools, growth in renewable energy infrastructure needing heavy-duty bearing installation equipment, and rising focus on preventive maintenance across manufacturing industries. Automobile manufacturing and repair facilities represent the priority segment, while Asia Pacific emerges as the fastest-growing region due to rapid industrialization and manufacturing expansion. Market growth faces realistic constraints from the high switching costs associated with replacing existing tool inventories and potential economic downturns affecting capital equipment investments in industrial sectors.

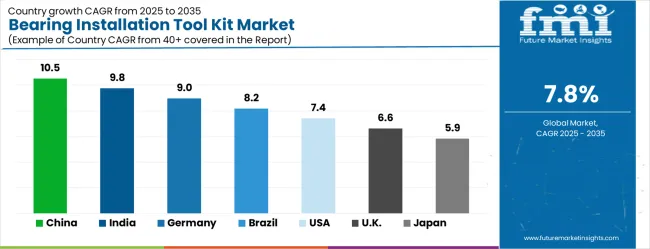

The bearing installation tool kit market (USD 2,867.0M → 6,075.9M by 2035, CAGR ~8%) is driven by surging demand in automobile manufacturing & repair, energy and heavy industry, and industrial automation, where precision bearing mounting is essential to improve machinery uptime and reduce maintenance costs. Segmentation spans hydraulic tool kits, mechanical tool kits, and other specialized solutions, addressing varied load and installation requirements. Growth is led by China (10.5% CAGR), India (9.8%), and Germany (9.0%), while mature markets such as the U.S. and U.K. continue steady adoption through aftermarket repair networks. Together, these drivers unlock ~USD 3,208.9M incremental opportunities by 2035.

Strong uptake in China, India, and Brazil for large-scale machinery, turbines, and heavy equipment assembly where hydraulic precision tools reduce downtime.

Key players: ENERPAC, Holmatro, SKF. Largest pool: USD 1,200–1,300M.

High adoption in Germany, Japan, and U.S. automotive OEMs and aftermarket repair shops, focusing on cost-effective yet accurate bearing installation.

Companies: Schaeffler, Timken, NSK, NTN. Incremental pool: USD 950–1,050M.

Rising demand in Europe and East Asia as factories automate bearing-intensive machinery. Focus on ergonomic designs, modular tool sets, and easy calibration.

Leaders: STAHLWILLE, JTEKT, MinebeaMitsumi. Regional pool: USD 600–700M.

Emerging digital integration with predictive maintenance platforms and sensor-based monitoring for precision installation validation, especially in North America and advanced European markets.

Innovators: SKF, Zarges, NTN. Expected pool: USD 250–300M.

Growing traction for rental, subscription, and pay-per-use models in India, Latin America, and Southeast Asia where workshops seek low-cost access to premium tool kits.

Enablers: SKF, Timken, regional distributors. Innovation pool: USD 150–200M.

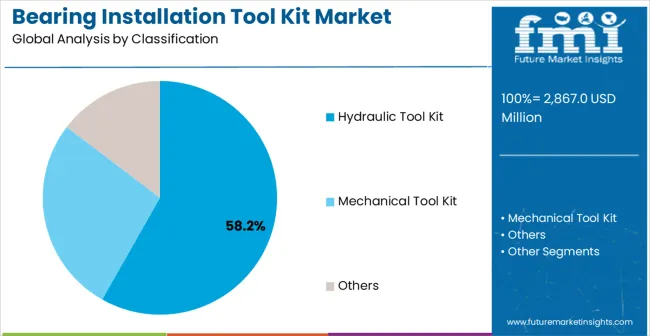

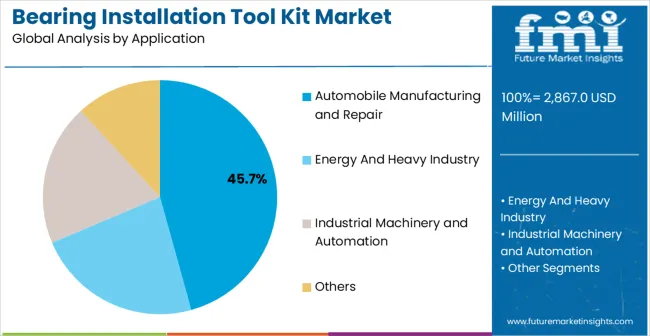

The market is segmented by tool type, end-use industry, and region. By tool type, the market is divided into hydraulic tool kits, mechanical tool kits, and others. By end-use industry, the market is categorized into automobile manufacturing and repair, energy and heavy industry, industrial machinery and automation, and othrs. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Hydraulic tool kits are forecast to hold 58.2% of the global bearing installation tool kit market in 2025, positioning them as the leading product type. Their popularity stems from the ability to deliver superior force, controlled pressure, and precision required for installing large bearings in demanding industrial environments. Hydraulic kits ensure proper seating and alignment, reducing the risk of bearing damage and minimizing costly downtime associated with installation errors. They also help extend bearing life and improve machine reliability, factors that are increasingly important in industries where operational efficiency is a priority.

Advancements in hydraulic systems have further accelerated adoption. Modern hydraulic tool kits now integrate automated pressure controls, digital monitoring systems, and built-in safety mechanisms that prevent overloading and excessive force application. This technological sophistication reduces the need for extensive operator expertise while ensuring consistent results. The shift toward portable hydraulic kits also supports maintenance in remote locations, including wind farms, construction sites, and mining operations. Their ability to handle diverse bearing sizes across multiple applications adds to their appeal. With industries focusing on reducing technician fatigue, improving workplace safety, and maximizing productivity, hydraulic tool kits are expected to remain the dominant solution in the coming years.

The automobile manufacturing and repair industry is projected to represent 45.7% of total market demand for bearing installation tool kits in 2025. This dominance is largely due to the extensive application of bearings in vehicle assemblies, including wheels, engines, transmissions, drivetrains, and suspension systems. Automotive OEMs require high-volume installation tools that can provide precision and speed to meet production line efficiency goals, while repair and maintenance facilities depend on versatile kits that support a wide range of vehicle models.

The increasing complexity of modern vehicles has amplified the need for advanced installation solutions. Incorrect bearing installation can result in premature failures, safety risks, and costly repairs, making precision tools indispensable. In addition, the rapid growth of electric vehicles (EVs) is creating new opportunities for specialized tool kits designed for EV motors, gearboxes, and drivetrains, where tolerances are even tighter than in conventional vehicles. Dealership service centers and independent garages alike are investing in hydraulic and mechanical kits to meet these evolving demands. Moreover, the global focus on enhancing vehicle safety, performance, and energy efficiency ensures that proper bearing installation will remain a top priority. As a result, the automobile manufacturing and repair sector will continue to be a cornerstone of demand in the overall bearing installation tool kit market.

The bearing installation tool kit market is supported by several concrete demand drivers linked to industrial productivity and equipment performance. First, the continued expansion of industrial automation is a major growth catalyst, as precise bearing installation is essential for maintaining high reliability in automated systems and preventing costly unplanned downtime. Second, the rapid growth of the global automotive aftermarket creates sustained demand for versatile installation tools that enhance service bay efficiency and reduce labor time per repair. These kits help mechanics achieve proper seating and alignment of bearings across diverse vehicle models, ensuring improved performance and extended bearing life. Third, rising investments in energy infrastructure—particularly in wind turbines, power generation equipment, and heavy industrial machinery—are fueling adoption of advanced hydraulic tool kits capable of handling large bearings. These tools support documented installation procedures that are often required for warranty compliance, making them indispensable in energy and heavy industry maintenance.

Despite strong demand drivers, the market faces several restraints. Budget sequencing remains a key challenge, as facility managers often delay upgrading installation tools during periods of economic uncertainty. Integration complexity with existing maintenance workflows can slow adoption of advanced systems, while the availability of substitute manual methods for smaller bearings creates competitive pressure at the low end of the market. Furthermore, a shortage of skilled technicians hinders wider adoption of sophisticated hydraulic systems that require specialized training and certification.

Key trends indicate a shift toward renewable energy maintenance and electric vehicle manufacturing, where precision installation requirements surpass traditional standards. Digital torque monitoring, automated pressure control, and modular tool designs are increasingly incorporated to enhance accuracy, versatility, and traceability. However, long-term market expansion could be disrupted if bearing manufacturers develop self-installing solutions or if predictive maintenance technologies significantly reduce the frequency of bearing replacements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| Brazil | 8.2% |

| United States | 7.4% |

| United States | 6.6% |

| Japan | 5.9% |

The bearing installation tool kit market is gathering pace worldwide, with China taking the lead thanks to massive industrial expansion and manufacturing modernization programs. Close behind, India benefits from growing automotive production and infrastructure development projects, positioning itself as a strategic growth hub. Germany shows steady advancement, where precision engineering excellence strengthens its role in the regional supply chain. Brazil is sharpening focus on energy sector development and industrial equipment maintenance, signaling an ambition to capture niche opportunities. Meanwhile, the United States stands out for its established industrial base, and the United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China is the largest and fastest-growing market for bearing installation tool kits, driven by its advanced manufacturing ecosystem, government-backed industrial modernization initiatives, and rapidly expanding automotive and renewable energy sectors. Revenue is projected to grow at a CAGR of 10.5% through 2035, reflecting strong adoption of hydraulic and mechanical installation tools across automotive assembly lines, wind turbine manufacturing, and industrial machinery production hubs such as Shanghai, Guangzhou, and Shenzhen. Chinese manufacturers prioritize precision installation to improve equipment reliability, reduce downtime, and comply with international quality standards for both domestic use and export. The government’s focus on promoting industrial automation, smart factories, and digital manufacturing technologies further accelerates the adoption of advanced installation systems. Growing demand for high-volume bearing installations in automotive clusters and large-scale renewable energy projects ensures that China remains the leading market. The combination of industrial expansion, export-oriented manufacturing, and infrastructure investment underpins sustained growth for hydraulic, mechanical, and digitally monitored installation tools in China.

India is emerging as a high-potential market for bearing installation tool kits due to rapid growth in automotive production, industrial machinery, and large-scale infrastructure development. The market is projected to expand at a CAGR of 9.8% through 2035, with key automotive hubs such as Chennai, Pune, and Mumbai driving strong demand for hydraulic and mechanical installation tools that ensure precision, reliability, and compliance with international quality standards. Ongoing infrastructure initiatives, including railways, ports, and industrial facilities, increase the need for heavy-duty installation systems capable of handling large industrial bearings safely and efficiently. Preventive maintenance practices across sectors further support adoption, reducing equipment downtime and enhancing operational efficiency. The growing automotive aftermarket sector also fuels demand for versatile bearing installation kits suitable for diverse vehicle types and repair requirements. India’s combination of industrial expansion, automotive growth, and infrastructure projects makes it a strategically important market for global and domestic tool manufacturers.

Germany remains a key market for bearing installation tool kits in Europe, supported by its globally recognized precision engineering, advanced manufacturing practices, and stringent quality standards. Market growth is projected at a CAGR of 9.0% through 2035, driven by automotive production in hubs like Stuttgart and Munich, industrial machinery manufacturing, and chemical processing plants. German manufacturers require advanced hydraulic and mechanical installation tools to ensure precise bearing placement, reduce operational errors, and maintain production efficiency. Heavy industry applications, particularly in machinery and process plants, demand specialized equipment capable of complex bearing installations with minimal downtime. Germany’s focus on innovation, automation, and digital monitoring accelerates the adoption of modular and technologically advanced installation systems. Additionally, export-oriented manufacturing and adherence to international quality standards further reinforce the demand for premium-grade bearing installation tools. With automotive, industrial, and export-driven requirements, Germany continues to play a pivotal role in shaping the European market.

Brazil demonstrates steady growth in the bearing installation tool kit market, driven by industrial modernization, renewable energy expansion, automotive production, and mining sector requirements. The market is expected to grow at a CAGR of 8.2% through 2035, particularly across industrial hubs in São Paulo and Rio de Janeiro. Heavy-duty hydraulic and mechanical installation tools are increasingly adopted for wind turbines, hydroelectric plants, and large-scale industrial machinery installations, where precision and reliability are critical. Automotive assembly lines also drive demand for high-volume installation equipment, ensuring production efficiency and quality. Mining and heavy industries further support adoption, requiring robust tools for safe and accurate bearing installation. Brazil’s continued investment in energy infrastructure, industrial equipment modernization, and large-scale automotive projects creates a long-term opportunity for global and domestic tool manufacturers. The combination of energy, automotive, and industrial sectors ensures steady demand and sustained market expansion for hydraulic, mechanical, and digital installation systems.

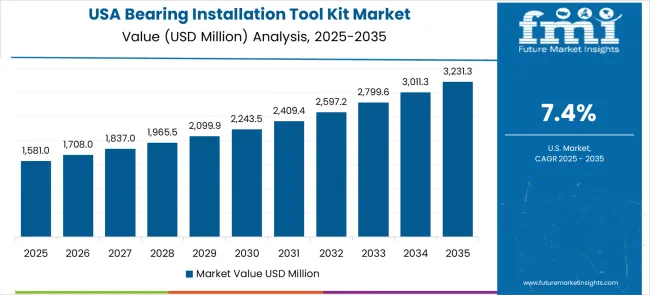

The United States maintains a strong position in the bearing installation tool kit market due to its technological innovation, mature industrial infrastructure, and diverse sector applications. The market is projected to grow at a CAGR of 7.4% through 2035, driven by aerospace, defense, automotive, and renewable energy industries. Advanced hydraulic and mechanical installation tools with digital monitoring, automated pressure controls, and quality documentation capabilities are increasingly adopted to ensure precision, reliability, and regulatory compliance. Aerospace and defense sectors require exacting standards for bearing installation to guarantee operational safety and performance, while the automotive aftermarket demands versatile tool kits for servicing a variety of vehicle types. Renewable energy facilities, including wind and solar power plants, drive demand for heavy-duty and precision hydraulic tools capable of installing large bearings efficiently. Well-established distribution networks, technical support, and skilled workforce infrastructure further support market adoption. The combination of innovation, advanced manufacturing applications, and service support ensures the United States remains a key growth market for bearing installation tool kits.

The United Kingdom exhibits steady growth in the bearing installation tool kit market, with projected CAGR of 6.6% through 2035. Growth is driven by automotive manufacturing, industrial maintenance programs, and offshore renewable energy development in England and Scotland. British industries emphasize hydraulic and mechanical tools that deliver high accuracy, operational reliability, and documented quality compliance to meet regulatory and production standards. Digitally monitored, modular systems allow for precision installation while reducing labor time and minimizing errors. Automotive production lines demand high-performance installation tools for efficiency and quality assurance, while industrial maintenance initiatives focus on reliable, long-lasting bearing placement. Offshore wind farms create additional opportunities for specialized hydraulic systems designed for heavy-duty bearing installation in challenging environments. Strong technical support networks and training programs further encourage adoption across industrial and service sectors. The UK’s combination of manufacturing excellence, service infrastructure, and renewable energy projects ensures continued demand for advanced installation solutions.

Japan continues to be a leading market for bearing installation tool kits, supported by its mature industrial infrastructure, precision technology, and stringent quality standards. Revenue is projected to grow at a CAGR of 5.9% through 2035, driven by automotive production, industrial machinery, and heavy equipment manufacturing in Tokyo, Osaka, and Nagoya. Advanced hydraulic and mechanical installation tools, featuring digital monitoring, automated pressure control, and modular design, are widely adopted to ensure precise bearing placement, reduce operational downtime, and maintain equipment reliability. Automotive manufacturers focus on high-performance vehicles, requiring tools that meet strict tolerances, while industrial machinery sectors demand systems capable of handling complex and large-bearing installations. Japan’s commitment to quality management, operational efficiency, and innovation ensures sustained adoption of premium-grade installation equipment. The combination of mature infrastructure, technology leadership, and adherence to precision manufacturing standards solidifies Japan’s position as a critical market for global bearing installation tool manufacturers.

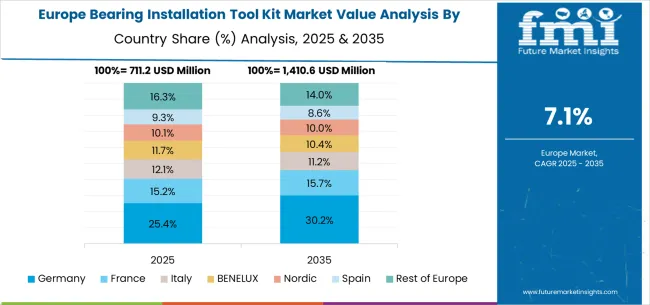

The bearing installation tool kit market in Europe demonstrates mature industrial development with Germany leading through precision engineering capabilities and comprehensive automotive manufacturing infrastructure, accounting for approximately 31.2% of regional market share. The United Kingdom follows with 24.8% share, supported by established industrial maintenance programs and automotive aftermarket services. France maintains 18.5% regional share through advanced automotive production and aerospace applications requiring precision installation equipment. Italy contributes 12.4% share with growing industrial machinery sector and automotive component manufacturing. Spain accounts for 8.7% share with expanding renewable energy projects and industrial development initiatives. BENELUX countries provide 4.4% share through advanced chemical processing and logistics industries requiring specialized installation tools.

The bearing installation tool kit market is characterized by competition among established bearing manufacturers, specialized tool producers, and industrial equipment companies. The market demonstrates moderate concentration with approximately 15-20 meaningful players globally, where the top five companies control roughly 45-50% of total market value through scale advantages, technical expertise, and established distribution networks. Competition focuses on product innovation, technical support capabilities, and comprehensive solution offerings that combine installation tools with bearing products and services.

Market leaders include SKF, Schaeffler, and Timken, who leverage their bearing manufacturing expertise to develop specialized installation tools optimized for their bearing products. These companies maintain competitive advantages through extensive technical knowledge, established customer relationships, and comprehensive global service networks. Their integrated approach combining bearings and installation tools creates customer convenience and ensures compatibility across product lines.

Challenger companies such as ENERPAC, Holmatro, and Wheeler-Rex focus on hydraulic and mechanical tool specialization, offering superior force generation capabilities and precision control features that appeal to demanding industrial applications. These companies compete through technical innovation, specialized application expertise, and flexible customization capabilities for unique installation requirements.

Specialist providers including NSK, NTN, JTEKT, and regional players like Zarges and STAHLWILLE serve specific geographic markets or application niches through focused product development, localized service capabilities, and competitive pricing strategies. These companies often develop innovative solutions for emerging applications such as renewable energy installations or electric vehicle manufacturing requirements.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2,867 million |

| Tool Type | Hydraulic Tool Kit, Mechanical Tool Kit, Others |

| End-Use Industry | Automobile Manufacturing and Repair, Energy And Heavy Industry, Industrial Machinery and Automation, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SKF, Zarges, Schaeffler, Wheeler-Rex, Timken, NSK, NTN, ENERPAC, Holmatro, JTEKT, STAHLWILLE, MinebeaMitsumi, Koyo |

| Additional Attributes | Dollar sales by tool type and end-use industry, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established bearing manufacturers and specialized tool producers, adoption patterns for hydraulic versus mechanical installation systems, integration with predictive maintenance programs and condition monitoring systems, innovations in digital torque monitoring and automated pressure control, and development of modular tool configurations with enhanced precision capabilities for diverse bearing applications. |

The global bearing installation tool kit market is estimated to be valued at USD 2,867.0 million in 2025.

The market size for the bearing installation tool kit market is projected to reach USD 6,075.9 million by 2035.

The bearing installation tool kit market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in bearing installation tool kit market are hydraulic tool kit, mechanical tool kit and others.

In terms of application, automobile manufacturing and repair segment to command 45.7% share in the bearing installation tool kit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bearing Steel Balls for New Energy Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Bearing Steel Market Size and Share Forecast Outlook 2025 to 2035

Bearing Isolators Market

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Plain Bearing Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Bridge Bearing Market Growth – Trends & Forecast 2025-2035

Thrust Bearings Market

Linear Bearings Market

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Between Bearing Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Bearing Market Growth - Trends & Forecast 2025 to 2035

Sliding Bearing Market Growth - Trends & Forecast 2025 to 2035

Camshaft Bearings Market

Magnetic Bearing Market

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Bearing and Clutch Component Aftermarket Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Elastomeric Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA