The between bearing pumps market is forecast to expand from USD 2.2 billion in 2025 to USD 3.1 billion by 2035, registering a CAGR of 3.5% over the forecast period. Demand is being supported by long-term investments in energy, petrochemicals, and water infrastructure projects. These pumps are being favored in high-capacity, continuous-duty applications where reliability and efficiency are critical, particularly in refinery, power generation, and desalination plants.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.2 billion |

| Market Value (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 3.5% |

As of 2025, the between bearing pumps market accounts for a focused yet vital share across several major industrial equipment markets. Within the global centrifugal pumps market, it holds an estimated 6-8%, as these pumps are commonly used for high-capacity operations in oil, gas, and chemical sectors. In the broader industrial pumps market, the share stands at around 4-5%, due to its specialization in high-flow, high-pressure applications.

Within the oil and gas equipment market, between bearing pumps contribute approximately 3-4%, driven by upstream and midstream fluid transport needs. In the power generation equipment market, its share is about 2-3%, especially in cooling and boiler feed systems. In the water and wastewater treatment equipment market, it accounts for roughly 1-2%, primarily in large-scale municipal and industrial plants.

Manufacturers are integrating diagnostic sensors and predictive maintenance tools into pump assemblies, allowing operators to monitor performance metrics in real time and prevent system failures. Design enhancements such as low NPSH (Net Positive Suction Head) configurations and advanced impeller geometry are helping improve hydraulic performance and energy efficiency.

As legacy infrastructure is replaced and capacity expansions proceed across energy-intensive sectors, between bearing pumps are expected to remain a cornerstone of industrial fluid handling operations.

The between bearing pumps market is segmented by product type into axially split and radially split pumps, with further divisions into single-stage and multi-stage configurations. By orientation, the market includes horizontal and vertical pumps. By pressure rating, it is segmented into pumps rated up to 25 bar, up to 100 bar, and above 100 bar.

By flow rate, categories include low flow, medium flow, high flow, and ultra-high flow systems. By end use, the market includes oil and gas, power, water and wastewater, mining, marine, and others. Geographically, the market is distributed across North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Axially split, single-stage pumps are expected to dominate the product type segment, accounting for 25% of the global market share by 2025. These pumps are widely recognized for their ease of maintenance and robust design, especially in high-volume fluid handling environments.

Horizontal between bearing pumps are projected to dominate the orientation segment, holding 80% of the global market share by 2025. Their alignment supports easier installation and space optimization in plant-level setups.

Between bearing pumps rated up to 25 bar are expected to lead the pressure segment, securing 40% of the global market share by 2025. These models offer optimal pressure control for medium-duty industrial operations.

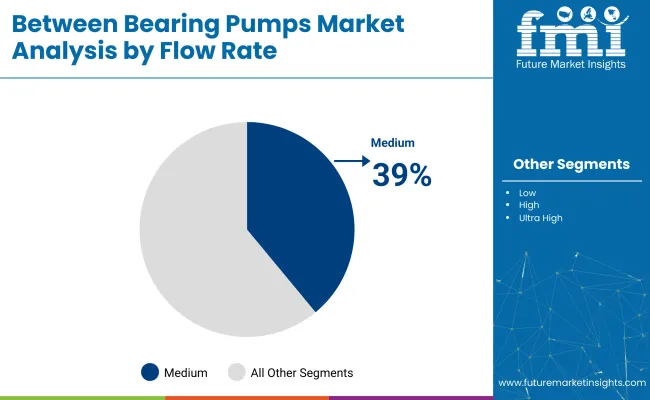

Medium flow between bearing pumps are projected to dominate the flow rate segment, accounting for 39% of the market share by 2025. These pumps offer the ideal balance between volume handling and energy efficiency in various operational setups.

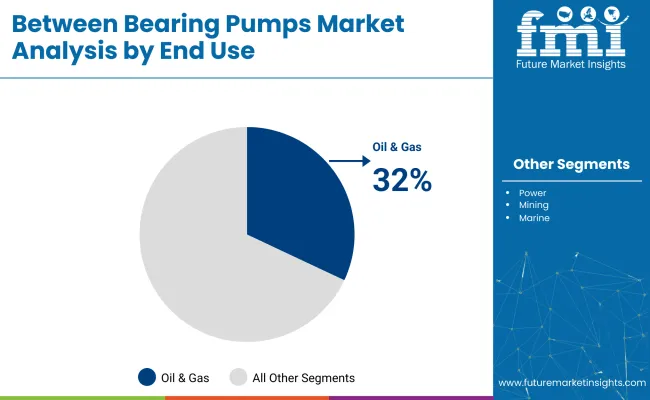

The oil & gas industry is expected to dominate the end-use segment, capturing 32% of the global market share by 2025. Demand from upstream, midstream, and downstream operations has driven the adoption.

The market is expanding steadily due to rising demand from industries requiring high-capacity, high-pressure fluid handling. Key sectors such as oil & gas, power generation, water treatment, and chemical processing rely on these pumps for their reliability, stability, and ease of maintenance in continuous operations.

Robust Demand from Oil & Gas and Petrochemical Industries

Between bearing pumps are widely used in upstream and downstream oil & gas applications due to their ability to handle high-flow volumes and aggressive fluids. They are deployed in crude oil transport, refinery circulation, and offshore platforms where reliability and minimal vibration are essential. API 610 compliance is a standard requirement, particularly in petrochemical environments where operational safety is critical.

Increased Use in Power Plants and Industrial Water Handling

Between bearing pumps are extensively used in thermal and nuclear power plants for boiler feed, condensate extraction, and cooling water circulation. Their horizontal split-case design allows for easy maintenance and long service intervals, making them suitable for 24/7 operations. Water treatment facilities also rely on between bearing pumps for large-scale intake and discharge systems, where reliability and energy efficiency are essential.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.2% |

| China | 4.0% |

| Brazil | 3.6% |

| United States | 3.3% |

| Germany | 3.1% |

The global market is expected to grow at a moderate pace between 2025 and 2035, driven by the expansion of petrochemical plants, thermal power stations, and industrial fluid transfer systems. These pumps are favored for their robust construction, high flow capacities, and suitability for heavy-duty applications in refineries and energy facilities.

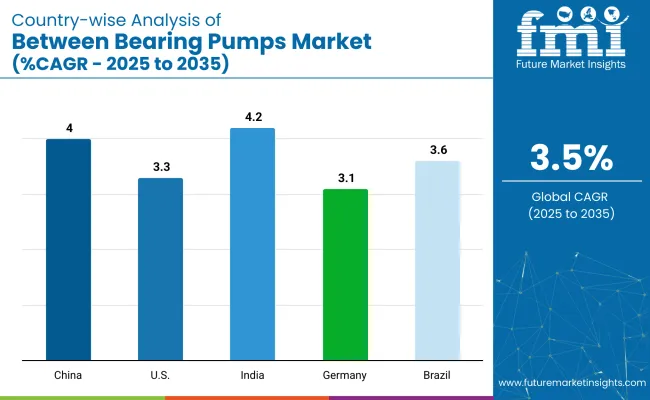

Among top-performing countries, India leads with a CAGR of 4.2%, followed closely by China at 4.0%. Brazil is growing at 3.6%, supported by downstream investments. Mature industrial economies such as the United States (3.3%) and Germany (3.1%) are witnessing demand from retrofit and energy modernization projects.

BRICS countries like China, India, and Brazil are scaling their process industries and investing in new installations. OECD nations such as the USA and Germany are modernizing legacy systems with more efficient, low-maintenance pump solutions. The report includes data from over 40 countries. The five below are profiled for their strategic impact and market development.

Indian market is forecast to grow at a CAGR of 4.2%, driven by expanding oil refining capacity, fertilizer production, and thermal power development. Public and private investments in process industries are boosting demand for pumps that can handle high flow rates and aggressive fluids.

India is also emphasizing indigenization of rotating equipment for critical industries, which is encouraging domestic manufacturing of large multistage pump assemblies. Regional EPC contractors are increasingly sourcing API 610-compliant pumps from local suppliers for infrastructure and energy projects.

China’s market is expected to expand at a CAGR of 4.0%, supported by continued growth in petrochemical infrastructure, wastewater treatment, and thermal energy facilities. Large state-owned companies are driving procurement of heavy-duty multistage pumps for applications requiring high reliability and low downtime.

China's push to modernize energy efficiency in existing plants is also fueling replacement demand. Domestic pump producers are investing in CNC-based fabrication and testing capabilities to meet tighter performance standards.

Brazil’s market is growing at a CAGR of 3.6%, supported by downstream oil and gas investments and infrastructure upgrades in the energy and water sectors. The country is prioritizing the expansion of pipeline networks and refinery upgrades, where between bearing pumps are favored for their ability to handle high flow rates over long distances.

Domestic energy companies are sourcing pumps designed for tropical operating conditions, with emphasis on corrosion-resistant materials and simplified maintenance protocols.

The USA between market is projected to grow at a CAGR of 3.3%, driven by maintenance upgrades in mature industrial plants and refinery modernization efforts. Aging infrastructure in the chemical and energy sectors is creating demand for more energy-efficient multistage pump systems.

USA manufacturers are leading in API-compliant pump designs that prioritize low-vibration operation and modularity. The aftermarket service segment is also expanding, with a focus on predictive maintenance technologies and OEM-certified refurbishments.

Germany’s market is forecast to grow at a CAGR of 3.1%, supported by process industry automation and high environmental compliance standards. German industries, especially in chemicals and food processing, require precision-engineered pumps that offer long lifecycle performance and energy savings.

Local pump producers are focusing on magnetic coupling and low-pulsation technologies to align with national efficiency regulations. The country’s energy transition initiatives are also prompting upgrades in district heating and biomass power plants, contributing to moderate but consistent pump demand.

The industry is moderately consolidated, with major players such as Sulzer, Flowserve, KSB, and Ebara dominating through strong global distribution networks and diversified pump technologies. Sulzer stands out for its high-efficiency centrifugal pumps designed for the oil & gas, chemical, and power sectors.

Flowserve provides a broad range of API-compliant between bearing pumps tailored for high-pressure and high-temperature applications. KSB is known for its robust BB1 and BB2 series pumps that deliver reliability in water and industrial processing plants, while Ebara offers precision-engineered models suited for both clean water and aggressive fluids.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.2 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Axially Split (Single-Stage, Multi-Stage), Radially Split (Single-Stage, Multi-Stage) |

| Orientations Analyzed (Segment 2) | Horizontal, Vertical |

| Pressure Ratings Analyzed (Segment 3) | Up to 25 Bar, Up to 100 Bar, Above 100 Bar |

| Flow Rates Analyzed (Segment 4) | Low Flow, Medium Flow, High Flow, Ultra High Flow |

| End Uses Analyzed (Segment 5) | Oil & Gas, Power, Water & Wastewater, Mining, Marine, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Ruhrpumpen, Sulzer, KSB, Ebara, Flowserve, Trillium Flow Technologies, Wilo |

| Additional Attributes | Dollar sales by configuration and end use, stable demand from energy and water infrastructure, increasing upgrades in industrial pumping systems, and regional investments in high-pressure operations. |

The market is segmented by product type into axially split and radially split pumps. Each of these categories is further divided into single-stage and multi-stage configurations.

Based on orientation, the market includes horizontal and vertical pumps.

In terms of pressure handling, the market is categorized into pumps rated up to 25 bar, up to 100 bar, and above 100 bar.

The market is segmented by flow rate into low flow, medium flow, high flow, and ultra high flow systems.

Key end-use industries include oil and gas, power, water and wastewater, mining, marine, and others.

Geographically, the market is distributed across North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market size is projected to be USD 2.2 billion in 2025.

The global market is projected to reach USD 3.1 billion by 2035.

The market is expected to grow at a CAGR of 3.5% during the forecast period.

Medium flow pumps are the leading flow rate segment, accounting for 39% of the market share in 2025.

India is forecast to grow at the highest CAGR of 4.2% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bearing Steel Balls for New Energy Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Bearing Installation Tool Kit Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Bearing Steel Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Bearing Isolators Market

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Plain Bearing Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Bridge Bearing Market Growth – Trends & Forecast 2025-2035

Thrust Bearings Market

Linear Bearings Market

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA