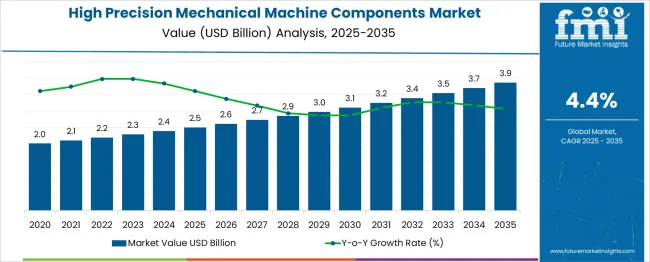

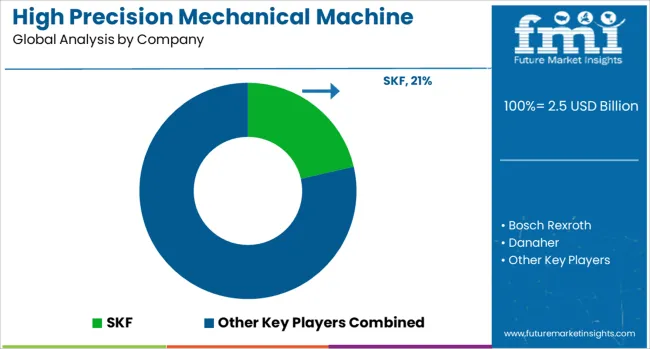

The High Precision Mechanical Machine Components Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| High Precision Mechanical Machine Components Market Estimated Value in (2025 E) | USD 2.5 billion |

| High Precision Mechanical Machine Components Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The high precision mechanical machine components market is advancing due to increasing demand for reliable and durable parts in complex machinery across various sectors. The emphasis on improving machine performance and operational efficiency has led manufacturers to focus on precision components that can withstand high stress and maintain tight tolerances.

Growing automation in industrial and manufacturing settings has further driven the need for components that ensure consistent functionality and reduce downtime. Technological advancements in manufacturing processes have enabled the production of parts with enhanced precision and quality.

Additionally, rising investments in sectors such as automotive, aerospace, and heavy machinery have expanded the demand base. The market outlook remains positive, with growth supported by the adoption of stainless steel materials known for their corrosion resistance and strength. Segmental growth is expected to be led by Bearings as the key component type, stainless steel as the preferred material, and industrial and manufacturing industries as the primary end users.

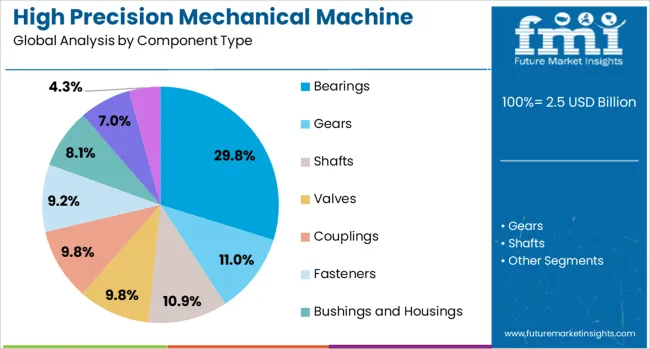

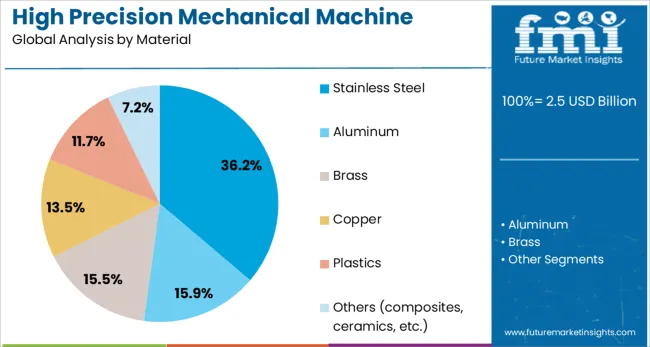

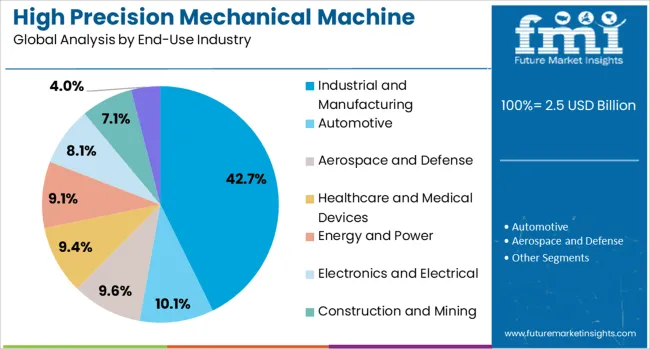

The high precision mechanical machine components market is segmented by component type, material, end-use industry, and distribution channel and geographic regions. The high precision mechanical machine components market is divided by component type into Bearings, Gears, Shafts, Valves, Couplings, Fasteners, Bushings and Housings, Spindles, and Other components (cams, clutches, etc.). The high precision mechanical machine components market is classified by material into Stainless Steel, Aluminum, Brass, Copper, Plastics, and Others (composites, ceramics, etc.). The high precision mechanical machine components market is segmented by end-use industry into Industrial and Manufacturing, Automotive, Aerospace and Defense, Healthcare and Medical Devices, Energy and Power, Electronics and Electrical, Construction and Mining, and Others (marine, railway, etc.). The distribution channel of the high-precision mechanical machine components market is segmented into Direct and Indirect. Regionally, the high precision mechanical machine components industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Bearings segment is projected to contribute 29.8% of the market revenue in 2025, maintaining its position as the leading component type. The critical role bearings drive this segment’s prominence play in reducing friction and wear in rotating machinery parts. Bearings are essential for enhancing the lifespan and efficiency of mechanical systems, making them indispensable in precision machinery.

The demand has been further increased by the adoption of high-speed machinery and the need for components that can operate reliably under variable loads. Industries have prioritized bearings that deliver consistent performance to minimize maintenance costs and avoid unexpected breakdowns.

As machinery complexity increases, the importance of reliable bearing components is expected to keep this segment in a leading market position.

The Stainless Steel segment is expected to hold 36.2% of the market revenue in 2025, establishing itself as the dominant material category. Stainless steel has been favored for its excellent resistance to corrosion, high strength, and durability under harsh operating conditions. These properties make stainless steel components suitable for diverse environments, including high-temperature and chemically aggressive settings.

Manufacturers have increasingly used stainless steel to enhance the reliability and longevity of mechanical parts, reducing replacement frequency and operational downtime. The material’s adaptability in machining and finishing processes also supports its widespread use in precision components.

Given the ongoing need for durable and maintenance-friendly materials, stainless steel is projected to maintain its dominance in the market.

The Industrial and Manufacturing segment is forecasted to represent 42.7% of the market revenue in 2025, remaining the largest end-use sector. This segment’s growth is tied to the continuous expansion and modernization of industrial facilities, requiring high-precision components to optimize machinery efficiency and product quality.

The increasing automation of manufacturing processes has elevated the demand for components that meet strict quality and tolerance standards. Additionally, industries focused on heavy machinery, automotive, and aerospace rely heavily on precision components to ensure operational reliability and safety.

Investments in infrastructure and equipment upgrades have further boosted component demand in this sector. As industrial production scales up globally, the Industrial and Manufacturing segment is expected to sustain its leading market share.

High precision mechanical machine components are increasingly adopted for automation-enabled production systems and stringent tolerance requirements in aerospace, defense, and automotive sectors. Material advancements and surface optimization strategies are reinforcing durability, performance, and lifecycle efficiency across critical applications.

Demand for high precision mechanical machine components has been driven by their integration into automation-centric production lines and advanced manufacturing environments. Sectors such as aerospace, defense, and automotive prioritize components with exceptional dimensional accuracy and tolerance stability to ensure uninterrupted robotic operations. Reliable performance under high-load conditions has been critical for process efficiency, enabling predictive maintenance and minimizing downtime. Manufacturers are increasingly focusing on CNC machining, precision grinding, and advanced heat treatment methods to meet rigorous quality requirements. This alignment with automated workflows has promoted large-scale procurement of components engineered for compatibility with robotics and programmable systems, influencing sourcing strategies across industries seeking operational excellence.

There has been a strong emphasis on materials offering superior durability, corrosion resistance, and thermal stability in mechanical components. The shift toward advanced alloys, ceramics, and composite materials expands the rising demand for wear-resistant solutions in precision-driven operations. Surface treatment techniques such as coating applications, hard anodizing, and micro-finishing have gained prominence for improving fatigue resistance and extending component life cycles. The requirement for lightweight yet resilient parts in aerospace and high-precision medical sectors has accelerated this trend. Suppliers investing in R&D for metallurgical improvements and process innovations have established competitive differentiation, enabling delivery of components suited for high-stress, temperature-sensitive, and mission-critical applications.

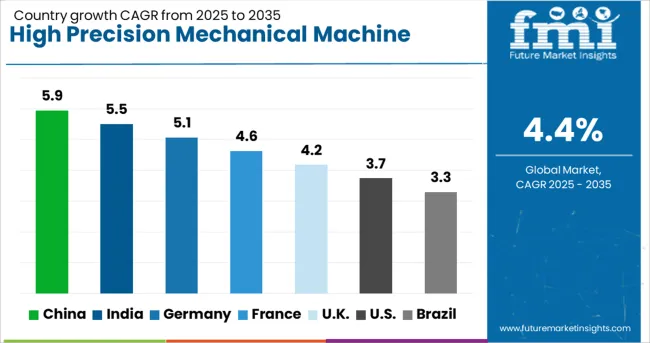

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The high precision mechanical machine components market, projected to grow at a global CAGR of 4.4% from 2025 to 2035, is demonstrating diverse growth dynamics across key economies. China, a BRICS nation, leads with a CAGR of 5.9%, driven by industrial automation investments, advanced manufacturing initiatives, and adoption of high-accuracy components in robotics and aerospace. India follows at 5.5%, supported by growing machine tool production, infrastructure-led manufacturing programs, and increasing demand for precision parts in automotive and electronics sectors. Germany records 5.1%, benefiting from strong engineering capabilities, integration of precision components in Industry 4.0 systems, and high adoption in advanced machinery. The UK posts 4.2%, influenced by investments in precision machining for aerospace and defense, though restrained by elevated production costs. The USA trails at 3.7%, shaped by demand from defense and industrial automation but moderated by reliance on imports for ultra-high precision parts. BRICS economies are fueling growth through scale and cost competitiveness, while OECD markets focus on innovation, tolerance accuracy, and advanced materials to meet emerging technological requirements. The report provides a detailed analysis of 40+ countries, with the five leading markets presented for reference.

The market in China demonstrated a CAGR of around 4.6% during 2020–2024 and improved to 5.9% for the 2025–2035 period, exceeding the global benchmark of 4.4%. This acceleration was supported by the strong adoption of automation-enabled manufacturing systems in automotive and aerospace clusters, particularly in provinces like Jiangsu and Zhejiang. Rising investments in precision machining facilities and the expansion of local component manufacturing under state-driven industrial modernization programs enhanced market performance. Robotics integration into production lines and the localization of supply chains further contributed to growth, making China the top performer in component standardization and export capability across East Asia.

India witnessed an increase in CAGR from approximately 4.8% during 2020–2024 to 5.5% for 2025–2035, indicating an upward momentum with domestic manufacturing growth. This change was driven by aggressive investments in industrial corridors and localized machining units under government-led manufacturing initiatives. Precision parts for defense, automotive, and process equipment applications recorded strong procurement as manufacturers focused on indigenous production with minimal import dependency. Competitive pricing and investments in CNC-based processes by SMEs enabled consistent supply expansion, while the establishment of tool rooms under public-private partnerships boosted regional output. This demand surge has shifted the shift toward high-quality engineered components in both primary and export markets.

Germany registered a CAGR near 4.2% between 2020–2024, which escalated to 5.1% during 2025–2035, fueled by the dominance of engineering-intensive industries such as automotive and industrial machinery. The adoption of advanced machining practices in high-value sectors, supported by precision-focused SMEs, contributed to this growth. Rising automation in Tier 1 supplier networks and integration of zero-defect manufacturing programs further drove procurement. Increased investment in hybrid material machining and coating techniques improved component durability, serving aerospace and defense projects in compliance with strict EU norms. Germany’s role as an exporter of engineered components strengthened due to enhanced metallurgical innovations and precision measurement standards.

The CAGR in the UK moved from 3.5% during 2020–2024 to 4.2% in 2025–2035, still below the global benchmark of 4.4% but showing steady recovery. This improvement is attributed to a shift in local production priorities, where investments targeted advanced machining capabilities for aerospace and medical-grade components. Although early adoption was constrained by higher input costs and supply chain disruptions, the expansion of additive manufacturing facilities post-2026 boosted capacity. Increased collaboration between OEMs and specialized machining service providers enabled precision component customization, primarily for the energy and defense sectors. This rising focus on export-compliant specifications and quality certifications supported incremental growth in the upcoming decade.

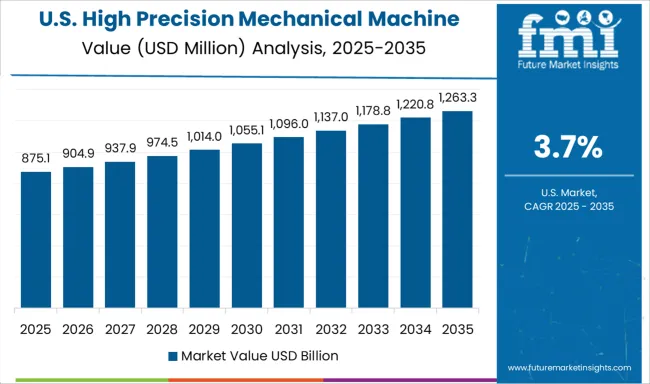

The USA market showed a CAGR of nearly 3.2% during 2020–2024, which climbed to 3.7% for 2025–2035, indicating a moderate yet steady rise. This upward movement is consistent with demand from aerospace and oilfield equipment manufacturers emphasizing dimensional precision. Increased investment in smart machining systems and integration of predictive maintenance into industrial setups influenced procurement strategies. Supply chain localization in response to geopolitical trade uncertainties improved domestic sourcing of key components. Moreover, high-value projects in semiconductor and defense manufacturing utilized ultra-precision parts, creating specialized demand. The gradual recovery in capital expenditure within industrial automation systems further supported a sustainable market outlook across multiple verticals.

In the high-precision mechanical components market, leading companies are focusing on material optimization, CNC machining capabilities, and automation-ready designs to meet the stringent demands of aerospace, defense, and automotive sectors. Firms like SKF, Bosch Rexroth, and Timken have invested in smart manufacturing solutions that ensure superior tolerance and reliability. Companies such as Danaher and Hexagon are integrating digital metrology systems for precision validation, while Mitsubishi Heavy Industries and Parker Hannifin emphasize component innovation for industrial equipment and energy applications. NSK, NTN, and THK remain key players in motion control and bearing technologies, expanding their portfolios for robotics and high-load operations. Emerging leaders like Renishaw and Rexnord are leveraging additive manufacturing and advanced coating processes for enhanced product longevity. Schaeffler and GKN have reinforced their presence in global supply chains through hybrid material advancements and component engineering for mission-critical environments.

In April 2024, Bosch Rexroth launched new electromechanical drive systems for hydrogen compressors and subsea actuators at Hannover Messe 2024.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Component Type | Bearings, Gears, Shafts, Valves, Couplings, Fasteners, Bushings and Housings, Spindles, and Other components (cams, clutches, etc.) |

| Material | Stainless Steel, Aluminum, Brass, Copper, Plastics, and Others (composites, ceramics, etc.) |

| End-Use Industry | Industrial and Manufacturing, Automotive, Aerospace and Defense, Healthcare and Medical Devices, Energy and Power, Electronics and Electrical, Construction and Mining, and Others (marine, railway, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SKF, Bosch Rexroth, Danaher, GKN, Hexagon, JTEKT, Mitsubishi Heavy Industries, NSK, NTN, Parker Hannifin, Renishaw, Rexnord, Schaeffler, THK, and Timken |

| Additional Attributes | Dollar sales by component type, share across end-use industries, competitive benchmarking, regional demand patterns, pricing dynamics, procurement trends, and growth drivers for automation-ready and material-optimized components. |

The global high precision mechanical machine components market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the high precision mechanical machine components market is projected to reach USD 3.9 billion by 2035.

The high precision mechanical machine components market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in high precision mechanical machine components market are bearings, gears, shafts, valves, couplings, fasteners, bushings and housings, spindles and other components (cams, clutches, etc.).

In terms of material, stainless steel segment to command 36.2% share in the high precision mechanical machine components market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA