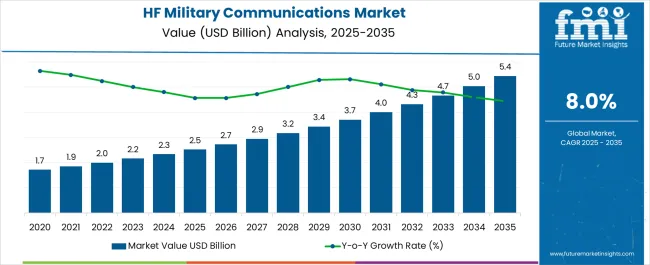

The high frequency military communications market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The high-frequency military communications market is projected to reach USD 2.5 billion by 2025 and grow to USD 5.4 billion by 2035, representing a CAGR of 8.0%. This market’s expansion is primarily driven by the growing need for secure, long-range communication systems in defense and military operations. High-frequency communication systems are integral for military units, providing reliable communication in both strategic and tactical environments, especially where traditional communication methods fail. As global military capabilities continue to evolve, the demand for these systems is expected to rise significantly, particularly in regions prioritizing national defense and technological advancements.

The market will likely experience steady growth in the first half of the forecast period, with annual increments reflecting investments in both infrastructure and advanced communication technologies. In the latter years, from 2028 to 2030, the rate of growth is expected to accelerate, spurred by increasing military budgets and strategic partnerships.

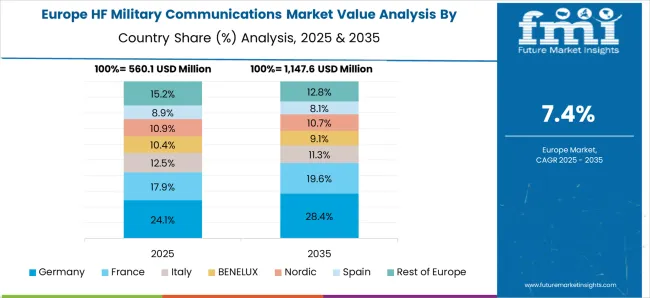

By the mid-2030s, the market will likely see more consistent and robust growth as key defense markets, such as North America, Europe, and the Asia Pacific, continue to modernize their communication networks. With ongoing technological developments and the rising demand for more reliable and advanced military communication systems, the high-frequency communication market is set for substantial long-term growth.

| Metric | Value |

|---|---|

| High Frequency Military Communications Market Estimated Value in (2025 E) | USD 2.5 billion |

| High Frequency Military Communications Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The high-frequency military communications market is closely influenced by several parent markets, each contributing significantly to its growth and development. The largest contributor is the defense and military communications sector, holding approximately 40% of the market share. This dominance is driven by the crucial need for secure, long-range communication systems in military operations. As nations modernize their defense infrastructure, the demand for high-frequency systems continues to rise, particularly in regions with complex security challenges. The satellite communications market is another major player, contributing around 25% to the overall market. High-frequency communication systems integrated into satellite networks enable reliable communication in remote and inaccessible areas, where traditional communication infrastructures are limited.

The aerospace and aviation market adds about 15%, driven by the need for robust communication between military aircraft and ground stations or other aircraft. High-frequency systems play a vital role in ensuring reliable air-to-ground and air-to-air communication during missions. The cybersecurity and encryption markets contribute approximately 10%, reflecting the rising emphasis on secure communications within defense sectors. As cyber threats continue to evolve, military communications must remain impervious to interception or hacking. Lastly, the wireless communication market accounts for around 10%, with technological advancements in frequency modulation and spectrum management improving the efficiency and scalability of high-frequency communication systems for military applications. These interconnected markets form a strong foundation for the continued growth and expansion of the high-frequency military communications sector.

The high frequency military communications market is experiencing sustained growth due to rising defense modernization programs, expanding requirements for long range and beyond line of sight communication, and the strategic importance of secure channels for operational command. Increasing geopolitical tensions and multinational military collaborations are driving investments in advanced HF systems capable of maintaining connectivity in contested and remote environments.

Technological advancements such as adaptive waveform management, improved encryption, and software defined radios are enhancing both performance and security. Additionally, the integration of HF systems with satellite and other tactical communication infrastructures is expanding their operational scope.

With ongoing emphasis on interoperability, resilience, and cost effectiveness, the demand for advanced HF communication solutions is expected to remain strong across both developed and emerging defense markets.

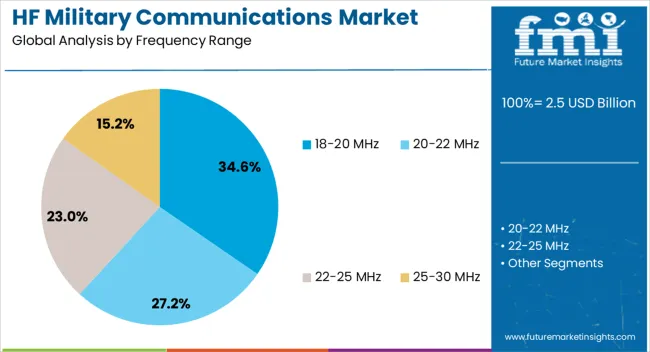

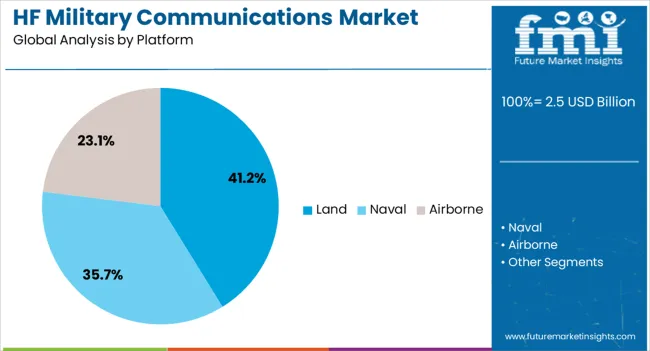

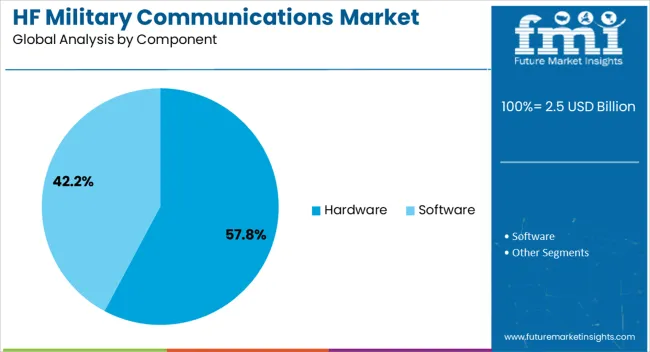

The high frequency military communications market is segmented by frequency range, platform, component, application, and geographic regions. By frequency range, high frequency military communications market is divided into 18-20 MHz, 20-22 MHz, 22-25 MHz, and 25-30 MHz. In terms of platform, high frequency military communications market is classified into land, naval, and airborne. Based on component, high frequency military communications market is segmented into hardware and software. By application, high frequency military communications market is segmented into command & control, intelligence, surveillance, reconnaissance, routine operations, and others. Regionally, the high frequency military communications industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 18-20 MHz frequency range segment is projected to account for 34.6% of total revenue by 2025 within the frequency range category, making it the most significant segment. Its dominance is driven by the ability to provide stable and clear long distance communication, even in challenging atmospheric conditions.

This range is highly valued for strategic and tactical missions where reliability and minimal infrastructure dependency are essential.

Enhanced propagation characteristics and compatibility with modern HF systems have further reinforced its adoption across defense operations.

The land platform segment is expected to hold 41.2% of total revenue by 2025, positioning it as the leading platform type. Growth in this segment is supported by the expanding use of mobile and stationary HF communication systems in ground force operations, border surveillance, and command centers.

The segment benefits from the need for secure communication in diverse terrains where satellite connectivity may be unreliable or unavailable.

Investment in ruggedized and highly portable HF systems has strengthened its prominence in land-based defense strategies.

The hardware segment is anticipated to represent 57.8% of total market revenue by 2025, making it the largest component category. This leadership is attributed to the necessity of physical communication equipment such as transmitters, receivers, and antennas in establishing and maintaining HF communication networks.

Continuous upgrades in hardware capabilities, durability, and compatibility with digital and software-based enhancements have further driven adoption.

The segment’s critical role in ensuring operational readiness and reliability keeps it at the forefront of investment priorities within the market.

The high-frequency military communications market is driven by secure communication needs, military modernization efforts, satellite integration, and advancements in encryption. These dynamics are crucial for enhancing defense operations and global security.

The rising demand for secure communication systems is a key driver of growth in the high-frequency military communications market. With evolving threats to national security, defense agencies worldwide are prioritizing advanced, encrypted communication systems that can withstand cyber-attacks and other vulnerabilities.

High-frequency systems, known for their ability to deliver long-range, secure transmission, are essential for military operations in conflict zones and remote areas. The increasing complexity of modern warfare, including hybrid and asymmetric warfare, requires reliable communication networks. As global security concerns rise, nations continue to invest in securing their communication channels, further propelling the demand for high-frequency systems.

Military modernization efforts across various countries significantly contribute to the market’s expansion. Governments and defense contractors are focused on upgrading their communication infrastructure to support next-generation defense operations. High-frequency communication systems offer advantages such as better range and resilience, which are critical for military operations. Programs aimed at modernizing national defense, including the development of advanced military systems, contribute to the adoption of high-frequency technologies. This modernization trend, along with rising defense budgets, plays a significant role in the continued growth of the high-frequency military communications market, as nations seek to enhance operational effectiveness.

The increasing integration of high-frequency communication systems with satellite networks plays a vital role in shaping the market. Satellites are essential for providing reliable communication in remote and inaccessible regions, where traditional ground-based infrastructure is not feasible. High-frequency systems ensure that military personnel can maintain uninterrupted communication, even in areas lacking conventional communication networks. This trend is anticipated to grow as military forces continue to deploy satellite-based communication systems to support critical operations, surveillance, and reconnaissance. The synergy between high-frequency communications and satellite technology strengthens the market, addressing the operational needs of modern military forces.

Advancements in encryption technologies and security protocols are essential dynamics in the high-frequency military communications market. As cyber threats become more sophisticated, there is a growing need for communications systems that guarantee the confidentiality, integrity, and availability of military data. High-frequency systems are increasingly equipped with robust encryption features to safeguard sensitive information. The continuous improvement in encryption standards, along with the adoption of secure communication protocols, ensures that military communication networks remain resilient against hacking and unauthorized access. These developments are critical as they directly impact the operational success and security of defense forces worldwide.

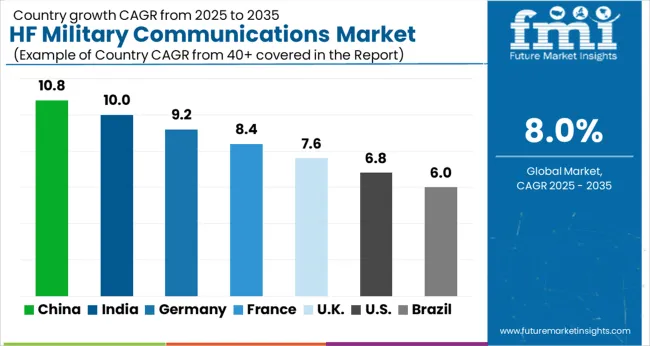

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global high-frequency military communications market is expected to grow at a CAGR of 8.0% between 2025 and 2035. China leads the market growth with a share of 10.8%, followed by India at 10.0%, and Germany at 9.2%. The United Kingdom holds a share of 7.6%, while the United States accounts for 6.8%. Growth is driven by the rising demand for secure, long-range communication systems in defense sectors worldwide. In particular, China and India, with their growing military investments and modernization programs, are spearheading demand. On the other hand, advanced economies like Germany, the UK, and the USA continue to emphasize military upgrades, secure communication infrastructure, and strategic defense initiatives, ensuring their role in driving innovation and adoption. The analysis covers over 40+ countries, with the leading markets detailed below.

The high-frequency military communications market in China is projected to grow at a CAGR of 10.8% from 2025 to 2035, supported by the government’s heavy investments in defense modernization and electronic warfare capabilities. Secure long-range communication systems are being prioritized by the People’s Liberation Army for naval and air operations. The adoption of software-defined radios is creating more resilient communication networks across border regions. Domestic manufacturers are expanding production capacity to meet rising military procurement requirements, while collaborations with academic institutions are strengthening research in high-frequency antenna technology. Satellite-backed HF communication systems are also gaining traction to enhance redundancy and security in joint operations.

The Indian market is expected to expand at a CAGR of 10.0% from 2025 to 2035, fueled by rising defense budgets and increasing border surveillance needs. The Indian Army and Air Force are investing in high-frequency systems for long-range communication in mountainous terrain and maritime zones. Indigenous defense contractors are producing HF radios with frequency-hopping and anti-jamming capabilities. Collaboration with global defense suppliers is helping accelerate access to advanced components and integration know-how. The push for self-reliance under the “Make in India” initiative is shaping procurement policies, with a growing focus on deploying secure tactical communication networks across all military branches.

The high-frequency military communications market in Germany is forecasted to grow at a CAGR of 9.2% through 2035, driven by NATO commitments and the country’s defense modernization programs. German armed forces are investing in secure high-frequency radios for interoperability across NATO missions. The focus on encrypted communication channels is intensifying due to cybersecurity concerns in defense operations. Defense contractors in Germany are working on advanced HF antennas and transceivers to improve reliability in contested environments. The market is also benefiting from collaborative European defense projects that aim to standardize secure communication protocols across multiple countries.

The high-frequency military communications market in the United Kingdom is projected to grow at a CAGR of 7.6% between 2025 and 2035, supported by investments in electronic warfare, naval communications, and intelligence gathering. The Royal Navy and Air Force are adopting HF radios for secure long-distance operations. Upgrades to tactical communication systems are being implemented to maintain interoperability with NATO allies. Local defense companies are enhancing HF system design with advanced signal processing capabilities. Growing focus on Arctic and maritime operations has also increased the demand for resilient HF solutions capable of functioning in remote environments with minimal infrastructure support.

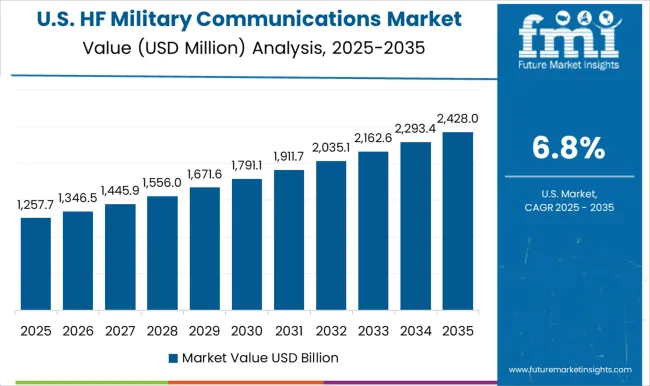

The United States market is projected to grow at a CAGR of 6.8% during 2025 to 2035, with demand largely shaped by the Department of Defense and homeland security agencies. High-frequency systems are being deployed for command-and-control functions across joint operations. The emphasis is on developing secure, anti-jamming, and frequency-agile radios for contested environments. Integration of HF communication with satellite and cyber defense infrastructure is strengthening overall resilience. American defense contractors are leading innovation by combining HF technologies with AI-driven signal analysis to improve threat detection and response capabilities. Strong military spending and export opportunities further position the USA as a key player.

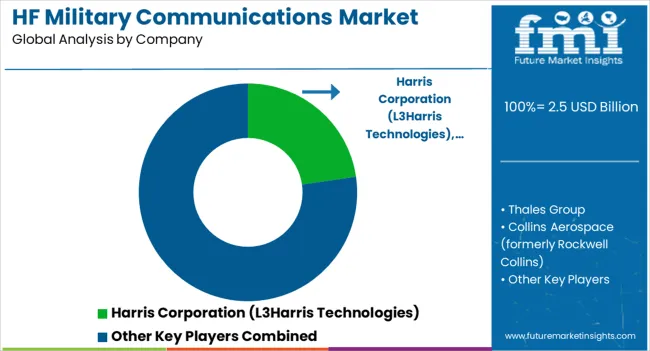

Competition in the high-frequency (HF) military communications market is shaped by secure connectivity, operational range, and system resilience in contested environments. L3Harris Technologies holds a leading position, backed by its strong legacy in defense-grade radios, tactical communication systems, and proven field deployments. Thales Group remains a prominent competitor with a wide portfolio of HF radios and encrypted solutions designed for interoperability across NATO and allied forces.

Collins Aerospace, formerly Rockwell Collins, is distinguished by its expertise in avionics and advanced HF communication equipment, supporting both airborne and ground platforms. Elbit Systems brings regional strength with tailored HF solutions focused on land and naval operations, offering anti-jamming and frequency-hopping capabilities to meet modern defense requirements. Leonardo DRS emphasizes USA and allied defense programs with strong positioning in tactical radios and integrated communication networks. Strategies among these companies revolve around software-defined radios, modular architectures, and advanced encryption to ensure secure battlefield connectivity.

Interoperability across allied forces is prioritized, with a focus on NATO standards and coalition readiness. Cybersecurity integration, AI-driven signal processing, and resilient antenna systems are marketed as differentiators. Hybrid communication frameworks, combining HF with satellite or VHF/UHF bands, are being promoted to expand coverage and enhance redundancy. Product portfolios highlight ruggedized HF radios, lightweight manpack systems, and vehicle-mounted transceivers designed for field durability.

Features such as frequency agility, anti-jamming protocols, and secure voice/data channels are consistently emphasized. Integrated networking capabilities are promoted for joint operations, while cloud-enabled monitoring platforms and real-time spectrum management tools are positioned as value-adds. Development kits, training packages, and lifecycle support programs are highlighted to strengthen defense partnerships and long-term adoption across military branches worldwide.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Frequency Range | 18-20 MHz, 20-22 MHz, 22-25 MHz, and 25-30 MHz |

| Platform | Land, Naval, and Airborne |

| Component | Hardware and Software |

| Application | Command & Control, Intelligence, Surveillance, reconnaissance, Routine operations, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harris Corporation (L3Harris Technologies), Thales Group, Collins Aerospace (formerly Rockwell Collins), Elbit Systems, and Leonardo DRS |

| Additional Attributes | Dollar sales, share, regional demand growth, emerging defense alliances, and long-term government contracts to gauge opportunities and competitive positioning in key markets. |

The global high frequency military communications market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the high frequency military communications market is projected to reach USD 5.4 billion by 2035.

The high frequency military communications market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in high frequency military communications market are 18-20 mhz, 20-22 mhz, 22-25 mhz and 25-30 mhz.

In terms of platform, land segment to command 41.2% share in the high frequency military communications market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA