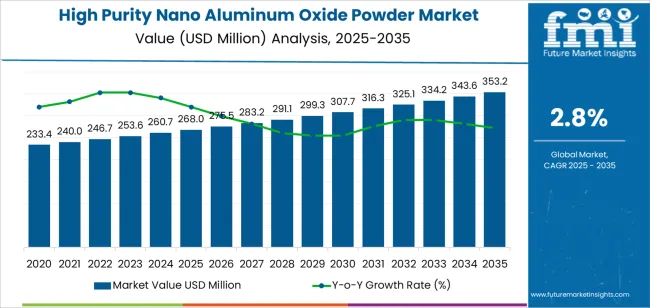

The high purity nano aluminum oxide powder market is valued at USD 267.99 million in 2025 and is set to reach USD 353.22 million by 2035, recording an absolute increase of USD 85.23 million over the forecast period. This translates into a total growth of 31.8%, with the high purity nano aluminum oxide powder market forecast to expand at a CAGR of 2.8% between 2025 and 2035. The high purity nano aluminum oxide powder market size is expected to grow by approximately 1.3X during the same period, supported by increasing demand for advanced electronic materials, growing adoption of high-performance ceramic components, and rising requirements for precision manufacturing applications across semiconductor, aerospace, electronics, and advanced materials sectors.

The high purity nano aluminum oxide powder market is projected to expand from USD 267.99 million to USD 307.67 million, resulting in a value increase of USD 39.68 million, which represents 46.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing demand for semiconductor manufacturing materials, rising electronics miniaturization enabling advanced substrate applications, and growing availability of ultra-pure processing technologies across integrated circuit production facilities and advanced ceramic manufacturing operations.

The high purity nano aluminum oxide powder market is forecast to grow from USD 307.67 million to USD 353.22 million during 2030 to 2035, adding another USD 45.55 million, which constitutes 53.4% of the overall ten-year expansion. This period is expected to be characterized by the advancement of next-generation electronic devices, the integration of artificial intelligence chip manufacturing, and the development of premium-grade materials across diverse high-tech applications. The growing emphasis on performance optimization and contamination control will drive demand for ultra-high purity varieties with enhanced crystalline structures, improved particle size distribution, and superior chemical stability profiles.

High Purity Nano Aluminum Oxide Powder Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 267.99 million |

| Forecast Value in (2035F) | USD 353.22 million |

| Forecast CAGR (2025 to 2035) | 2.8% |

Between 2020 and 2024, the high purity nano aluminum oxide powder market experienced steady growth, driven by increasing semiconductor manufacturing activity and growing recognition of nano aluminum oxide's effectiveness in delivering exceptional electrical insulation properties across electronic and advanced materials applications. The high purity nano aluminum oxide powder market developed as manufacturers recognized the potential for high purity grades to deliver operational excellence while meeting modern requirements for contamination-free processing and high-precision component manufacturing. Technological advancement in purification processes and particle size control began emphasizing the critical importance of maintaining consistent quality while enhancing material performance and improving manufacturing yield rates.

From 2030 to 2035, the high purity nano aluminum oxide powder market is forecast to grow from USD 307.67 million to USD 353.22 million, adding another USD 45.55 million, which constitutes 53.4% of the ten-year expansion. This period is expected to be characterized by the advancement of quantum computing materials, the integration of advanced packaging technologies for semiconductor devices, and the development of specialized nano-scale formulations for enhanced thermal management. The growing emphasis on material purity and crystalline perfection will drive demand for premium varieties with enhanced trace metal control, improved morphological characteristics, and superior dispersibility properties.

Between 2020 and 2024, the high purity nano aluminum oxide powder market experienced robust growth, driven by increasing awareness of advanced materials benefits and growing recognition of nano aluminum oxide systems' effectiveness in supporting efficient manufacturing operations across semiconductor fabrication facilities and precision electronics assembly services.

The high purity nano aluminum oxide powder market developed as users recognized the potential for specialized formulations to deliver productivity advantages while meeting modern requirements for contamination control and reliable processing performance. Technological advancement in synthesis processes and quality control systems began emphasizing the critical importance of maintaining purity standards while extending material shelf life and improving customer satisfaction across diverse high-tech applications.

Market expansion is being supported by the increasing global demand for advanced electronic materials and the corresponding shift toward high-performance nano powders that can provide superior operational characteristics while meeting user requirements for material purity and cost-effective processing systems.

Modern electronics manufacturers are increasingly focused on incorporating powder systems that can enhance device performance while satisfying demands for consistent, precisely controlled particle characteristics and optimized thermal management properties. High purity nano aluminum oxide powder's proven ability to deliver electrical insulation excellence, thermal stability, and diverse application possibilities makes them essential materials for semiconductor manufacturers and quality-conscious electronics professionals.

The growing emphasis on miniaturization and performance optimization is driving demand for high-performance powder systems that can support distinctive electronic outcomes and comprehensive device protection across integrated circuits, advanced ceramics, and specialty coating applications. User preference for materials that combine functional excellence with processing flexibility is creating opportunities for innovative implementations in both traditional and emerging electronic applications. The rising influence of artificial intelligence chip manufacturing and advanced semiconductor technologies is also contributing to increased adoption of specialized powders that can provide authentic performance benefits and reliable material characteristics.

The high purity nano aluminum oxide powder market is segmented by purity grade, application, particle size, processing method, and region. By purity grade, the high purity nano aluminum oxide powder market is divided into 99.995% purity, 99.999% purity, 99.9995% purity, and others. Based on application, the high-purity nano aluminum oxide powder market is categorized into semiconductor manufacturing, aerospace components, advanced ceramics, electronic substrates, and others. By particle size, the high purity nano aluminum oxide powder market includes 10-30 nm, 30-50 nm, 50-100 nm, and custom sizes. By processing method, the high purity nano aluminum oxide powder market encompasses sol-gel synthesis, hydrothermal processing, plasma synthesis, and chemical vapor deposition. Regionally, the high purity nano aluminum oxide powder market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and other regions.

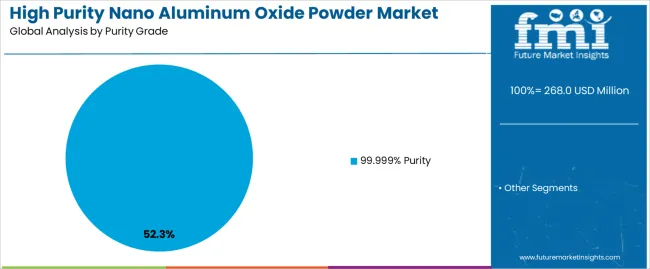

The 99.999% purity segment is projected to account for 52.3% of the high purity nano aluminum oxide powder market in 2025, reaffirming its position as the leading product category. Electronics manufacturers and semiconductor professionals increasingly utilize 99.999% purity grade for their superior contamination control characteristics, established performance standards, and essential functionality in diverse electronic applications across multiple device types. 99.999% purity grade's proven material characteristics and established cost-effectiveness directly address user requirements for reliable processing operation and optimal device performance in commercial applications.

This product segment forms the foundation of modern semiconductor manufacturing patterns, as it represents the purity category with the greatest performance impact potential and established compatibility across multiple processing systems. Business investments in advanced purification technology and quality optimization continue to strengthen adoption among precision-conscious manufacturers. With users prioritizing contamination control and material reliability, 99.999% purity grade aligns with both performance objectives and quality requirements, making them the central material of comprehensive electronics strategies.

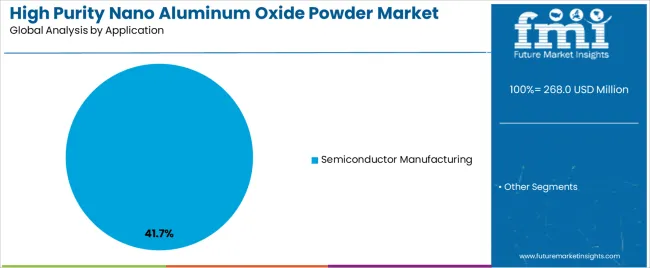

Semiconductor manufacturing is projected to represent 41.7% of the high purity nano aluminum oxide powder market in 2025, underscoring its critical role as the primary application for quality-focused manufacturers seeking superior material purity benefits and enhanced device performance credentials. Chip manufacturers and electronics professionals prefer semiconductor applications for their established volume requirements, proven market demand, and ability to maintain exceptional electrical properties while supporting versatile processing requirements during diverse manufacturing operations. Positioned as essential applications for performance-conscious manufacturers, semiconductor offerings provide both operational excellence and competitive positioning advantages.

The segment is supported by continuous improvement in chip technology and the widespread availability of established processing standards that enable quality assurance and premium positioning at the manufacturer level. Semiconductor companies are optimizing material selections to support device differentiation and competitive performance strategies. As chip technology continues to advance and manufacturers seek efficient processing methods, semiconductor applications will continue to drive market growth while supporting business development and customer satisfaction strategies.

The high purity nano aluminum oxide powder market is advancing rapidly due to increasing electronics miniaturization consciousness and growing need for precision material solutions that emphasize superior purity outcomes across semiconductor segments and advanced applications. The high purity nano aluminum oxide powder market faces challenges, including competition from alternative ceramic materials, processing complexity requirements, and material cost pressures affecting operational economics. Innovation in purification technology integration and advanced synthesis continues to influence market development and expansion patterns.

Expansion of Semiconductor and Electronics Applications

The growing adoption of high purity nano aluminum oxide powder in semiconductor manufacturing and electronics development is enabling manufacturers to develop processing strategies that provide distinctive purity benefits while commanding competitive positioning and enhanced device performance characteristics. Semiconductor applications provide superior electrical insulation while allowing more sophisticated contamination control features across various device categories. Users are increasingly recognizing the operational advantages of powder positioning for premium electronic outcomes and precision-conscious manufacturing integration.

Integration of Advanced Purification and Quality Control Systems

Modern high purity nano aluminum oxide powder manufacturers are incorporating advanced purification technologies, automated contamination monitoring systems, and real-time quality tracking to enhance material consistency, improve processing reliability, and meet commercial demands for ultra-pure electronic materials. These systems improve operational effectiveness while enabling new applications, including next-generation chip manufacturing and advanced ceramic processing protocols. Advanced purification integration also allows manufacturers to support technology leadership positioning and quality assurance beyond traditional material processing operations.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 3.8% |

| India | 3.5% |

| Germany | 3.2% |

| Brazil | 2.9% |

| USA | 2.7% |

| UK | 2.4% |

| Japan | 2.1% |

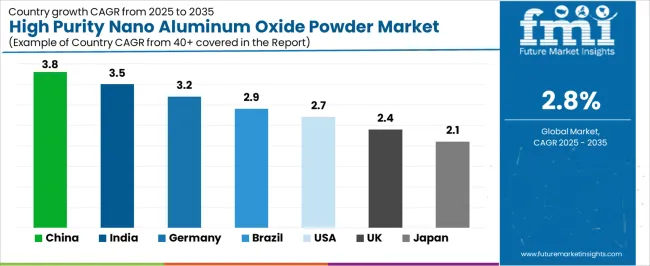

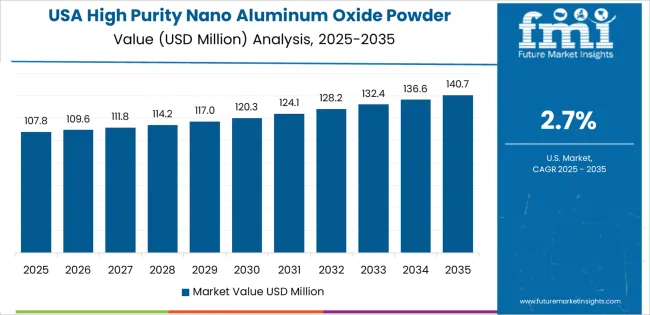

The high purity nano aluminum oxide powder market is experiencing robust growth globally, with China leading at a 3.8% CAGR through 2035, driven by the expanding semiconductor industry, growing electronics manufacturing requirements, and increasing adoption of advanced materials processing systems. India follows at 3.5%, supported by rising technology development, expanding electronics sector, and growing acceptance of high-performance materials solutions. Germany shows growth at 3.2%, emphasizing established manufacturing capabilities and comprehensive materials technology development. Brazil records 2.9%, focusing on electronics expansion and industrial materials growth. The USA demonstrates 2.7% growth, prioritizing advanced semiconductor technologies and materials optimization.

The report covers an in-depth analysis of 40+ countries, with top-performing countries are highlighted below.

Revenue from high purity nano aluminum oxide powder consumption and sales in China is projected to exhibit exceptional growth with a CAGR of 3.8% through 2035, driven by the country's rapidly expanding electronics sector, favorable government policies toward semiconductor development, and initiatives promoting advanced materials technologies across major industrial regions. China's position as a leading electronics manufacturing hub and increasing focus on high-tech materials systems are creating substantial demand for high-quality nano aluminum oxide powder in both domestic and export markets. Major electronics companies and materials processors are establishing comprehensive powder capabilities to serve growing demand and emerging market opportunities.

Demand for high purity nano aluminum oxide powder products in India is expanding at a CAGR of 3.5%, supported by rising technology investment, growing electronics development, and expanding materials processing capabilities. The country's developing semiconductor sector and increasing commercial investment in advanced materials technologies are driving demand for nano aluminum oxide powder across both traditional and modern electronics applications. International materials companies and domestic distributors are establishing comprehensive operational networks to address growing market demand for quality powders and efficient processing solutions.

Revenue from high purity nano aluminum oxide powder products in Germany is projected to grow at a CAGR of 3.2% through 2035, supported by the country's mature electronics sector, established materials standards, and leadership in processing technology. Germany's sophisticated industrial infrastructure and strong support for advanced materials systems are creating steady demand for both traditional and innovative powder varieties. Leading materials manufacturers and specialty distributors are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Demand for high purity nano aluminum oxide powder products in Brazil is anticipated to expand at a CAGR of 2.9% through 2035, driven by the country's emphasis on electronics expansion, industrial development, and growing materials processing capabilities. Brazilian manufacturers and electronics companies consistently seek commercial-grade powders that enhance production efficiency and support operational excellence for both traditional and modern electronics applications. The country's position as a Latin American electronics leader continues to drive innovation in specialized powder applications and commercial materials standards.

Revenue from high purity nano aluminum oxide powder products in the USA is projected to grow at a CAGR of 2.7% through 2035, supported by the country's emphasis on semiconductor technology advancement, materials optimization, and advanced manufacturing integration requiring efficient powder solutions. American manufacturers and electronics users prioritize performance reliability and operational precision, making specialized powders essential materials for both traditional and modern electronics applications. The country's comprehensive technology leadership and advancing semiconductor patterns support continued market expansion.

Demand for high purity nano aluminum oxide powder products in the UK is growing at a CAGR of 2.4% through 2035, supported by established materials standards, mature electronics markets, and emphasis on processing reliability across commercial and industrial sectors. British manufacturers and electronics professionals prioritize quality performance and operational consistency, creating steady demand for premium powder solutions. The country's comprehensive market maturity and established electronics practices support continued development in specialized applications.

Revenue from high purity nano aluminum oxide powder products in Japan is projected to exapnd at a CAGR of 2.1% through 2035, supported by the country's emphasis on precision manufacturing, quality excellence, and advanced technology integration requiring efficient powder solutions. Japanese businesses and electronics users prioritize technical performance and manufacturing precision, making specialized powders essential materials for both traditional and modern electronics applications. The country's comprehensive quality leadership and advancing electronics patterns support continued market expansion.

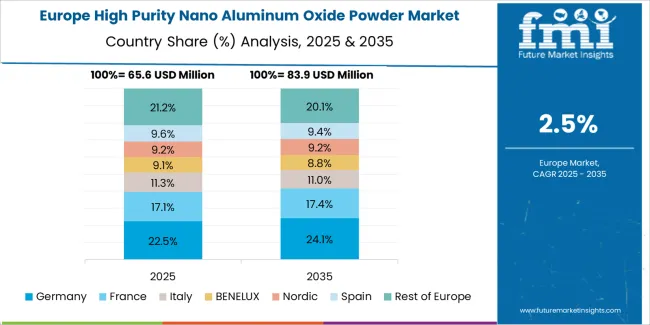

The Europe high purity nano aluminum oxide powder market is projected to grow from USD 78.4 million in 2025 to USD 102.9 million by 2035, recording a CAGR of 2.8% over the forecast period. Germany leads the region with a 38.7% share in 2025, moderating slightly to 38.2% by 2035, supported by its strong electronics manufacturing base and demand for premium, technically advanced nano materials. The United Kingdom follows with 22.1% in 2025, easing to 21.8% by 2035, driven by a mature electronics market and emphasis on materials reliability and performance optimization. France accounts for 15.8% in 2025, rising to 16.3% by 2035, reflecting steady adoption of advanced materials solutions and operational efficiency enhancement.

Italy holds 11.4% in 2025, expanding to 12.1% by 2035 as electronics manufacturing and specialty materials applications grow. Spain contributes 7.2% in 2025, growing to 7.5% by 2035, supported by expanding electronics sector and materials modernization. The Nordic countries rise from 3.8% in 2025 to 4.1% by 2035 on the back of strong technology adoption and advanced processing methodologies. BENELUX remains at 1.0% share across both 2025 and 2035, reflecting mature, precision-focused electronics markets.

The high purity nano aluminum oxide powder market is characterized by competition among established materials manufacturers, specialized powder producers, and integrated electronics solution companies. Companies are investing in advanced purification technologies, nano-scale processing systems, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable nano aluminum oxide powder systems. Innovation in purity enhancement, particle size optimization, and application-specific product development is central to strengthening market position and customer satisfaction.

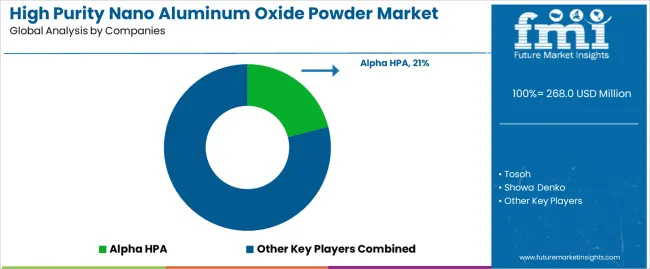

Alpha HPA leads the high purity nano aluminum oxide powder market with a strong focus on high purity materials innovation and comprehensive nano aluminum oxide powder solutions, offering commercial powder systems with emphasis on manufacturing excellence and technological heritage. Tosoh provides specialized electronic materials with a focus on semiconductor market applications and performance engineering networks. Showa Denko delivers integrated materials solutions with a focus on manufacturer positioning and operational efficiency. Sinocera specializes in comprehensive nano powder materials with an emphasis on precision applications. Fujimi focuses on comprehensive advanced materials with premium design and superior positioning capabilities.

The success of high purity nano aluminum oxide powder in meeting commercial electronics demands, manufacturer-driven efficiency requirements, and performance integration will not only enhance device quality outcomes but also strengthen global materials manufacturing capabilities. It will consolidate emerging regions' positions as hubs for efficient powder production and align advanced economies with commercial electronics systems. This calls for a concerted effort by all stakeholders - governments, industry bodies, manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the high purity nano aluminum oxide powder market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 267.99 million |

| Purity Grade | 99.995% Purity, 99.999% Purity, 99.9995% Purity, Others |

| Application | Semiconductor Manufacturing, Aerospace Components, Advanced Ceramics, Electronic Substrates, Others |

| Particle Size | 10-30 nm, 30-50 nm, 50-100 nm, Custom Sizes |

| Processing Method | Sol-Gel Synthesis, Hydrothermal Processing, Plasma Synthesis, Chemical Vapor Deposition |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Alpha HPA, Tosoh, Showa Denko, Sinocera, Fujimi, and other leading nano aluminum oxide powder companies |

| Additional Attributes | Dollar sales by purity grade, application, particle size, processing method, and region; regional demand trends, competitive landscape, technological advancements in purification engineering, precision manufacturing initiatives, quality enhancement programs, and premium product development strategies |

The global high purity nano aluminum oxide powder market is estimated to be valued at USD 268.0 million in 2025.

The market size for the high purity nano aluminum oxide powder market is projected to reach USD 353.2 million by 2035.

The high purity nano aluminum oxide powder market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in high purity nano aluminum oxide powder market are 99.999% purity .

In terms of application, semiconductor manufacturing segment to command 41.7% share in the high purity nano aluminum oxide powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA