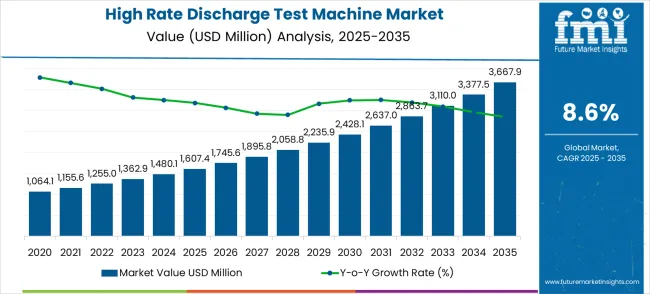

The high rate discharge test machine market is valued at USD 1,607.4 million in 2025 and is anticipated to reach USD 3,667.9 million by 2035, with a CAGR of 8.6%. From 2021 to 2025, the market grows from USD 1,064.1 million to USD 1,607.4 million, passing through intermediate values of USD 1,155.6 million, USD 1,255.0 million, USD 1,362.9 million, and USD 1,480.1 million. This early-stage growth is driven by the increasing demand for high rate discharge test machines in industries such as automotive, aerospace, and energy storage. These machines are essential for testing the performance and safety of batteries, especially in applications like electric vehicles (EVs) and renewable energy storage, where battery efficiency and durability are critical.

Between 2026 and 2030, the market is expected to continue expanding from USD 1,607.4 million to USD 2,428.1 million, with intermediate values of USD 1,745.6 million, USD 1,895.8 million, and USD 2,058.8 million. This period sees a more pronounced growth rate, driven by the increased adoption of electric vehicles and the ongoing development of large-scale energy storage systems. The growing focus on battery performance optimization and safety further accelerates the demand for high rate discharge testing equipment. By 2030, the market will reach USD 2,637.0 million, with continued expansion as industries prioritize enhanced testing capabilities. From 2031 to 2035, the market is projected to grow to USD 3,667.9 million, with intermediate values of USD 3,110.0 million, USD 3,377.5 million, and USD 3,667.9 million, driven by technological advancements and the increasing adoption of high-performance testing systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,607.4 million |

| Forecast Value in (2035F) | USD 3668 million |

| Forecast CAGR (2025 to 2035) | 9% |

Market expansion is being supported by the rapid growth of electric vehicle production worldwide and the corresponding need for comprehensive battery testing systems that can validate performance, safety, and reliability characteristics under various operating conditions. Modern electric vehicle batteries require extensive testing to ensure optimal performance, extended lifecycle, and safety compliance across diverse environmental conditions and usage patterns. High rate discharge test machines provide the necessary testing capabilities to evaluate battery performance under extreme conditions and validate design specifications for commercial applications.

The growing complexity of energy storage systems and increasing emphasis on battery safety are driving demand for advanced testing equipment that can simulate real-world operating conditions and identify potential failure modes. Battery manufacturers are implementing comprehensive testing protocols to ensure product quality, regulatory compliance, and customer satisfaction while minimizing warranty claims and safety incidents. Regulatory requirements and industry standards are establishing stringent testing protocols that require specialized equipment with validated performance characteristics and comprehensive documentation capabilities.

The High Rate Discharge Test Machine market, projected to grow from USD 1.6 billion in 2025 to USD 3.7 billion by 2035 at a robust 9% CAGR, is accelerating in response to the electrification wave, rising energy storage adoption, and stringent quality testing requirements for advanced batteries. Together, these trends unlock USD 2.0–2.2 billion in incremental revenue opportunities by 2035.

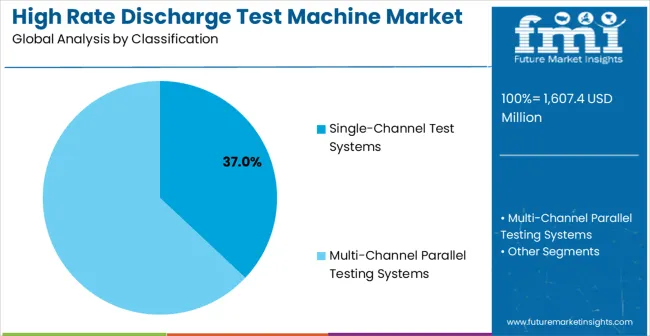

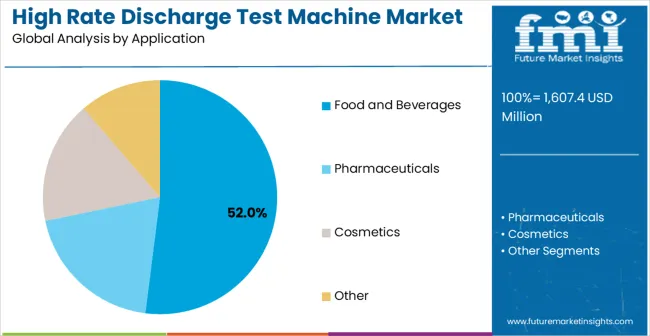

The market is segmented by system type, end-use industry, and region. By system type, the market is divided into single-channel test systems and multi-channel parallel testing systems. Based on end-use industry, the market is categorized into food and beverages, pharmaceuticals, cosmetics, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

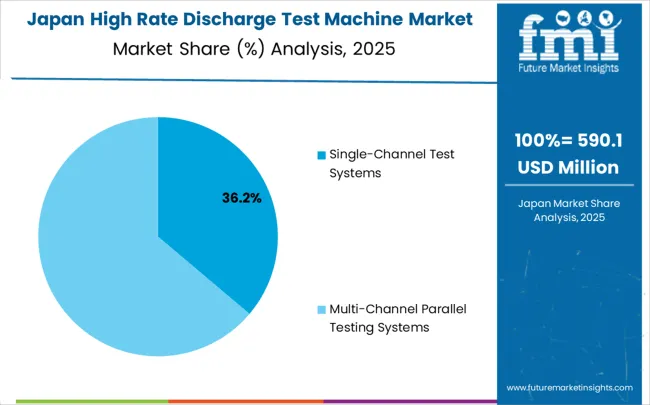

Single-channel test systems are projected to account for 37% of the high rate discharge test machine market in 2025. This leading share is supported by the cost-effectiveness and flexibility of single-channel solutions for research and development applications, quality control testing, and specialized battery evaluation programs. Single-channel systems provide comprehensive testing capabilities while maintaining lower capital costs and operational complexity compared to multi-channel alternatives. The segment benefits from widespread adoption in academic research institutions, battery development laboratories, and small to medium-scale manufacturing operations that require precise testing capabilities without high-volume throughput requirements.

Single-channel test system technology continues advancing through integration of sophisticated control algorithms, enhanced measurement precision, and comprehensive data analytics capabilities that support advanced battery research and development activities. The segment growth reflects increasing demand for flexible testing solutions that can accommodate diverse battery types, testing protocols, and research requirements while maintaining competitive cost structures. Manufacturers are developing next-generation single-channel systems with modular architectures, enhanced connectivity, and comprehensive software integration that support evolving testing requirements and emerging battery technologies.

Food and beverages applications are expected to represent 52% of high rate discharge test machine demand in 2025. This dominant share reflects the extensive use of battery-powered devices in food and beverage processing, packaging, and distribution operations that require reliable power sources for mobile equipment, sensors, and monitoring systems. Modern food and beverage facilities implement comprehensive battery testing programs to ensure optimal performance of portable equipment, wireless sensor networks, and automated handling systems that depend on reliable battery performance for operational continuity.

Food and beverage industry transformation toward automation and digitalization is driving significant high rate discharge test machine demand as manufacturers implement more sophisticated battery-powered systems for process monitoring, quality control, and supply chain management. The segment expansion reflects increasing emphasis on food safety, traceability, and operational efficiency that depend on reliable battery-powered equipment and comprehensive testing protocols. Advanced food processing applications are incorporating Internet of Things devices, mobile robotics, and wireless monitoring systems that require sophisticated battery technologies with validated performance characteristics and extended operational life.

The high rate discharge test machine market is advancing steadily due to increasing battery technology complexity and growing emphasis on performance validation across diverse applications. The market faces challenges including high equipment costs, complex calibration requirements, and need for specialized technical expertise. Technological advancement efforts and industry standardization programs continue to influence product development and market expansion patterns.

The growing integration of artificial intelligence and machine learning technologies into high rate discharge test machines is enabling predictive analytics, automated fault detection, and intelligent test optimization that enhance overall testing efficiency and data quality. AI-powered testing systems provide real-time performance analysis, automated anomaly detection, and comprehensive data interpretation that support advanced battery development and quality control programs. These technological advances enable manufacturers to achieve higher levels of testing precision and operational efficiency while reducing analysis time and improving decision-making capabilities.

Test equipment manufacturers are developing modular system architectures and scalable testing platforms that enable flexible configuration, easy expansion, and cost-effective implementation across diverse testing requirements. Modular testing solutions provide enhanced flexibility for research and development applications while supporting efficient scaling for production testing environments. This trend supports broader market adoption by reducing initial investment requirements and providing upgrade pathways that accommodate evolving testing needs and emerging battery technologies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| Brazil | 9.0% |

| United States | 8.2% |

| United Kingdom | 7.3% |

| Japan | 6.5% |

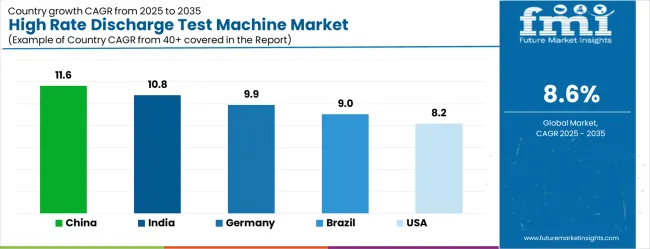

The high rate discharge test machine market demonstrates varied growth patterns across key countries, with China leading at an 11.6% CAGR through 2035, driven by massive electric vehicle production expansion, government support for battery technology development, and growing consumer electronics manufacturing capabilities. India follows at 10.8%, supported by increasing electronics manufacturing, expanding renewable energy deployment, and growing automotive sector development. Germany records 9.9% growth, emphasizing advanced automotive technologies, precision engineering excellence, and comprehensive battery research programs. Brazil shows steady growth at 9.0%, developing renewable energy storage capabilities and expanding electronics manufacturing infrastructure. The United States maintains 8.2% growth, focusing on electric vehicle technology leadership and energy storage innovation. The United Kingdom demonstrates 7.3% expansion, supported by renewable energy programs and advanced battery research initiatives. Japan records 6.5% growth, leveraging technological leadership and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The high rate discharge test machine market in China is projected to expand at the highest growth rate with a CAGR of 11.6% through 2035, driven by unprecedented electric vehicle manufacturing capacity expansion, government support for new energy vehicle development, and growing consumer electronics production requirements. The country's comprehensive electric vehicle industry development strategy includes massive investments in battery manufacturing facilities, charging infrastructure, and supporting technology that require sophisticated testing equipment for quality assurance and performance validation. Major automotive manufacturers and battery companies are establishing comprehensive testing capabilities that support domestic production and technology development across diverse battery applications.

Revenue from high rate discharge test machines in India is projected to grow at a CAGR of 10.8%, supported by rapid electronics manufacturing development, increasing renewable energy deployment, and growing automotive sector modernization initiatives. The country's emphasis on becoming a global electronics manufacturing hub is driving demand for comprehensive testing equipment that supports battery production, quality control, and performance validation across diverse applications. Government programs promoting electronics manufacturing are creating favorable conditions for testing equipment adoption and technology development. Major international companies are establishing manufacturing facilities that require comprehensive testing infrastructure and technical support services.

Demand for high rate discharge test machines in Germany is projected to expand at a CAGR of 9.9%, supported by the country's leadership in automotive technology development, comprehensive battery research programs, and emphasis on precision engineering excellence. German manufacturers are implementing sophisticated testing solutions that meet stringent performance standards while supporting advanced battery development across automotive, industrial, and energy storage applications. The country's extensive automotive industry is driving significant testing equipment demand for electric vehicle battery validation and quality assurance programs. Advanced manufacturing partnerships are facilitating technology development and knowledge sharing across diverse industrial sectors.

The high rate discharge test machine market in Brazil is expected to grow at a CAGR of 9.0%, driven by expanding renewable energy storage capabilities, growing electronics manufacturing sector, and increasing emphasis on energy independence initiatives. Brazilian manufacturers are investing in testing equipment to support battery production and energy storage system validation while meeting domestic market requirements and export opportunities. Government programs supporting renewable energy development are facilitating access to advanced testing technologies and technical expertise. Regional manufacturing centers are developing specialized capabilities that support diverse testing applications across renewable energy, automotive, and electronics industries.

Demand for high rate discharge test machines in the United States is expanding at a CAGR of 8.2%, driven by electric vehicle technology leadership, energy storage system development, and ongoing battery innovation initiatives. American manufacturers are implementing advanced testing solutions to maintain global competitiveness while supporting cutting-edge research and development programs across automotive, aerospace, and energy sectors. The renewable energy sector is driving significant testing equipment demand for grid-scale energy storage applications and residential battery system validation. Government initiatives supporting domestic battery manufacturing are creating substantial demand for comprehensive testing infrastructure and technical support services.

The high rate discharge test machine market in the United Kingdom is projected to grow at a CAGR of 7.3%, supported by expanding renewable energy programs, advanced battery research initiatives, and increasing emphasis on energy storage system development. British manufacturers are investing in testing solutions to support energy storage projects, electric vehicle development, and advanced battery research programs. The country's strong academic research base is facilitating technology development and application innovation across diverse testing requirements. Government initiatives supporting clean energy development are creating favorable conditions for testing equipment adoption and technology advancement.

Revenue from high rate discharge test machines in Japan is forecasted to expand at a CAGR of 6.5%, supported by advanced battery technology development, comprehensive manufacturing expertise, and emphasis on precision engineering principles. Japanese manufacturers are implementing sophisticated testing solutions that demonstrate superior performance characteristics while supporting diverse high-technology applications across automotive, electronics, and energy sectors. The country's electronics and automotive industries are driving demand for advanced testing technologies that support precision manufacturing processes and stringent quality control requirements. Collaborative research programs between industry and academic institutions are developing innovative testing technologies that maintain Japan's competitive advantage in global battery and electronics markets.

The high rate discharge test machine market in Europe is projected to expand from USD 435.2 million in 2025 to USD 993.4 million by 2035, registering a CAGR of 9% over the forecast period. Germany is expected to maintain its leadership with 34.6% market share in 2025, projected to grow to 35.1% by 2035, supported by its extensive automotive manufacturing infrastructure and advanced battery technology development capabilities. France follows with 19.7% market share in 2025, expected to reach 20.1% by 2035, driven by renewable energy initiatives and electric vehicle manufacturing expansion.

The Rest of Europe region is projected to maintain stable share at 16.8% throughout the forecast period, attributed to emerging battery manufacturing initiatives in Eastern European countries and expanding energy storage project developments. United Kingdom contributes 15.2% in 2025, projected to reach 15.0% by 2035, supported by energy storage system deployment and battery technology research programs. Italy maintains 13.7% share in 2025, expected to decline slightly to 13.8% by 2035, while other European countries demonstrate steady growth patterns reflecting regional industrial development and technology advancement initiatives.

The high rate discharge test machine market is characterized by competition among specialized test equipment manufacturers, battery technology providers, and precision measurement companies. Companies are investing in advanced testing technologies, comprehensive software integration, automated testing capabilities, and technical support services to deliver reliable, accurate, and efficient testing solutions. Strategic partnerships, technological innovation, and application expertise development are central to strengthening product portfolios and market presence.

Chroma ATE Inc., Taiwan-based, offers comprehensive high rate discharge test systems with focus on automotive applications, advanced measurement capabilities, and integrated software solutions. Arbin Instruments, U.S., provides specialized testing equipment emphasizing research applications, flexible configurations, and comprehensive data analysis capabilities. Neware Technology, China, delivers advanced testing solutions with focus on battery manufacturing, automated testing systems, and cost-effective implementations.

Bitrode Corporation, U.S., focuses on high-performance testing systems with emphasis on precision measurement, reliability, and comprehensive technical support. MACCOR Inc., U.S., provides specialized testing equipment for research and production applications with advanced control capabilities. Kikusui Electronics, Japan, emphasizes precision measurement and reliable testing solutions for diverse applications. Other key players including Hioki E.E. Corporation contribute specialized expertise and technical capabilities across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1,607.4 million |

| System Type | Single-Channel Test Systems and Multi-Channel Parallel Testing Systems |

| End-use Industry | Food and Beverages, Pharmaceuticals, Cosmetics, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Chroma ATE Inc., Arbin Instruments, Neware Technology, Bitrode Corporation, MACCOR Inc., Kikusui Electronics, Hioki E.E. Corporation, SOVEMA Group, ZKE Tech, Blue Power Energy Systems, Megger |

| Additional Attributes | Dollar sales by system type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established test equipment manufacturers and specialized technology providers, buyer preferences for single-channel versus multi-channel testing solutions, integration with battery manufacturing processes and quality control systems, innovations in automated testing capabilities and artificial intelligence applications |

The global semiconductor fingerprint collector market is estimated to be valued at USD 514.3 million in 2025.

The market size for the semiconductor fingerprint collector market is projected to reach USD 1,370.9 million by 2035.

The semiconductor fingerprint collector market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in semiconductor fingerprint collector market are pressure sensor and temperature sensor.

In terms of application, government agencies segment to command 43.0% share in the semiconductor fingerprint collector market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA