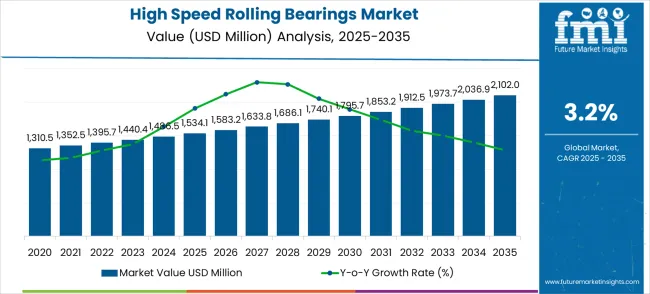

The high-speed rolling bearings market demonstrates steady expansion over the decade from 2025 to 2035, rising from USD 1,534.1 million to USD 2,102.0 million at a CAGR of 3.2%. During the first half of the period, 2025 to 2030, the market experiences moderate growth, driven by increasing adoption in automotive, aerospace, and industrial machinery sectors. Rising demand for precision, reduced friction, and longer service life of equipment supports early momentum. Manufacturers focus on innovations in bearing materials, such as hybrid ceramic designs, to improve efficiency and reliability in high-speed applications.

Between 2030 and 2035, growth continues as industries increasingly prioritize energy efficiency and automation, particularly in electric vehicles, robotics, and renewable energy machinery. Expansion in emerging economies, supported by industrialization and infrastructure projects, contributes further to market gains. The comparative analysis of the two halves of the decade highlights a slightly slower yet steady growth pace, reflecting market maturity in developed regions and ongoing adoption in emerging markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,534.1 million |

| Forecast Value in (2035F) | USD 2,102.0 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The high-speed rolling bearings market is divided across automotive and motorsports at 35%, aerospace and aviation at 27%, industrial machinery at 18%, energy and power generation at 12%, and railways and high-speed transportation at 8%. Automotive dominates as high-speed engines require precision bearings to lower friction, boost fuel efficiency, and enhance total performance. Aerospace and aviation sectors depend on them for turbines, rotors, and propulsion systems, where reliability under extreme conditions is essential. Industrial machinery uses high-speed bearings in spindles, compressors, and specialized tools. Energy applications deploy them in turbines and generators, while railways and high-speed transit systems require bearings designed for durability, low maintenance, and stable operation under continuous high-speed conditions. Key trends include the adoption of ceramic and hybrid bearings to increase speed tolerance and reduce thermal expansion.

Smart bearings with integrated sensors for predictive maintenance, vibration analysis, and real-time monitoring are gaining traction. Expanding applications in electric vehicles, high-speed rail, aerospace, and renewable energy turbines are driving demand. Advanced lubrication techniques, surface coatings, and precision manufacturing improve reliability and operational efficiency. Partnerships between bearing manufacturers and OEMs enable solutions tailored for extreme-speed environments. The push for lower friction, extended service life, and energy-efficient operation continues to shape global market growth while maintaining compliance and performance standards.

Market expansion is being supported by the increasing global demand for high-performance mechanical components and the corresponding need for specialized bearing solutions that can operate reliably at elevated rotational speeds while maintaining precision and durability across various industrial applications. Modern equipment manufacturers and operators are increasingly focused on implementing bearing solutions that can support high-speed operations, reduce vibration and noise, and provide consistent performance under demanding conditions. High-speed rolling bearings' proven ability to deliver superior rotational performance, enhanced operational efficiency, and reliable service life makes them essential components for contemporary automotive, aerospace, and industrial machinery applications.

Industrial operators' preference for components that combine high-speed capability with operational reliability and reduced maintenance requirements is creating opportunities for innovative bearing implementations. The rising influence of electric vehicle adoption, industrial automation, and precision manufacturing is also contributing to increased demand for high-speed rolling bearings that can provide exceptional performance in demanding high-speed applications.

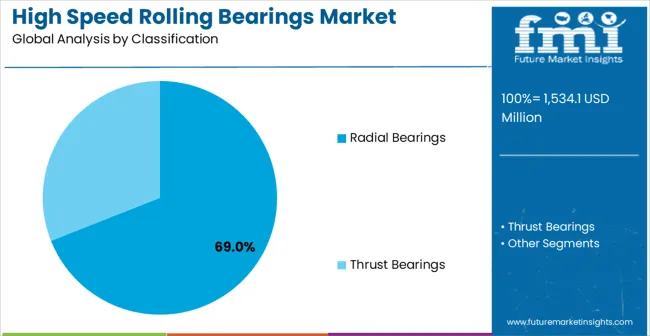

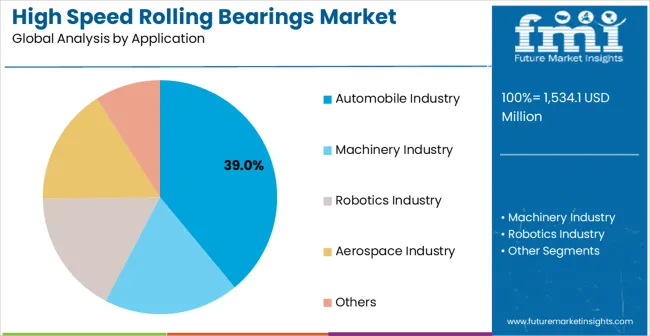

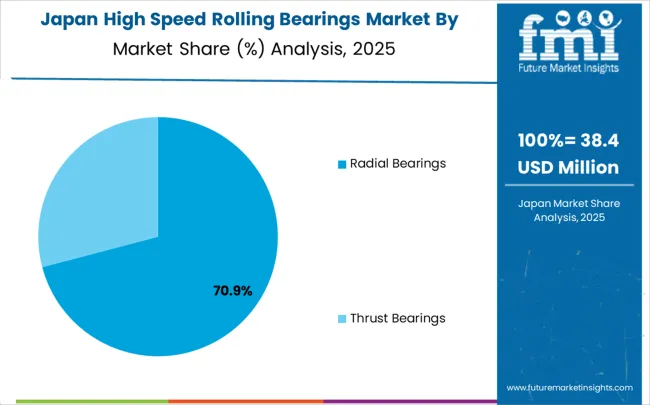

The high-speed rolling bearings market is growing due to demand for components capable of handling high rotational speeds with reliability and precision. Radial bearings dominate the bearing type segment with approximately 69% of the market share, reflecting their suitability for applications requiring high-speed rotation and load capacity. In terms of application, the automobile industry leads with around 39% of the market, driven by increasing vehicle production and the need for efficient drivetrain and engine systems. These segments indicate strong opportunities for investment in durable, high-performance bearings that enhance operational efficiency and reduce maintenance in high-speed environments.

Radial bearings account for roughly 69% of the bearing type segment, making them the most widely used solution in high-speed applications. They are preferred for their ability to carry radial loads at high rotational speeds while maintaining low friction and accuracy. Leading manufacturers include SKF, NSK, Timken, and Schaeffler. Radial bearings deliver extended service life, energy efficiency, and stable performance under varying operational conditions. Their adaptability to automotive, industrial machinery, and precision equipment ensures they remain the dominant choice for applications requiring high-speed rotation and reliability.

The automobile industry holds about 39% of the application market, making it the largest segment for high-speed rolling bearings. Bearings are essential in engines, transmissions, wheel hubs, and drivetrain components, where precision and durability are critical. Manufacturers such as SKF, NSK, Timken, and Schaeffler provide bearings optimized for high-speed operation, load capacity, and energy efficiency. Growth in this segment is driven by rising vehicle production, adoption of electric and hybrid vehicles, and demand for components that improve fuel efficiency and performance. The automobile sector continues to be the primary market driver for high-speed rolling bearings.

The high-speed rolling bearings market is advancing steadily due to increasing demand for high-performance mechanical components and growing adoption of precision engineering technologies that provide enhanced operational capabilities and reliability in high-speed applications across diverse industrial sectors. The market faces challenges, including high precision manufacturing requirements, complexity of high-speed lubrication systems, and competition from alternative bearing technologies for specific applications. Innovation in advanced materials and precision manufacturing continues to influence product development and market expansion patterns.

The growing adoption of electric vehicles and high-performance automotive systems is driving demand for high-speed rolling bearings that can support electric motor applications, high-speed transmissions, and advanced automotive systems requiring precise motion control at elevated speeds. Advanced automotive applications require specialized bearing solutions while enabling more efficient power transmission and enhanced vehicle performance across various automotive subsystems and components. Manufacturers are increasingly recognizing the competitive advantages of automotive-specific high-speed bearing capabilities for market expansion and technology leadership.

Modern high-speed rolling bearing producers are incorporating advanced materials, including ceramic elements and specialized surface treatments, to enhance high-speed performance, reduce friction, and improve operational life for demanding industrial and automotive applications. These technologies improve bearing performance while enabling new applications, including aerospace systems and precision manufacturing equipment requiring exceptional speed capabilities. Advanced material integration also allows manufacturers to support sophisticated performance requirements and operational reliability beyond traditional bearing capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| UK | 2.7% |

| Japan | 2.4% |

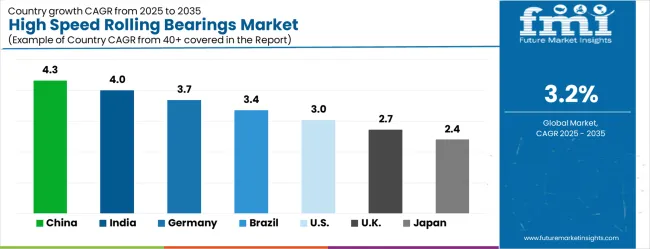

The high-speed rolling bearings market is experiencing steady growth globally, with China leading at a 4.3% CAGR through 2035, driven by the expanding manufacturing sector, growing automotive production, and significant investment in high-speed machinery and industrial automation. India follows at 4.0%, supported by rapid industrialization, increasing automotive manufacturing, and growing emphasis on precision engineering and manufacturing efficiency. Germany shows growth at 3.7%, priortizing technological innovation and advanced precision engineering solutions. Brazil records 3.4%, focusing on automotive industry expansion and industrial modernization programs. The USA demonstrates 3.0% growth, driven by aerospace industry development and advanced manufacturing technology adoption. The UK exhibits 2.7% growth, supported by industrial automation and precision manufacturing advancements.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China is projected to grow at 4.3% CAGR from 2025 to 2035. Adoption is focused in Jiangsu, Guangdong, and Shandong due to automotive, high-speed rail, and robotics manufacturing hubs. Manufacturers such as NSK, SKF, and Schaeffler are introducing low-friction, high-precision bearings capable of withstanding high rotational speeds in industrial machinery. Electric vehicle production is pushing demand for compact, energy-efficient bearings. Advanced predictive maintenance solutions are being integrated to extend operational life and reduce unscheduled downtime. Emerging applications in renewable energy turbines, robotics, and aerospace components are further driving growth. Local suppliers are collaborating with international manufacturers to enhance supply chain efficiency, ensuring high availability and rapid deployment for industrial projects.

India records a CAGR of 4.0%, driven by industrial hubs in Maharashtra, Gujarat, and Tamil Nadu. Adoption is led by automotive assembly, rail manufacturing, and high-speed machinery sectors. SKF and NTN supply bearings designed for elevated speed and load conditions. The expansion of electric vehicle infrastructure and industrial automation supports growing demand. Condition-monitoring integration is being widely applied to optimize bearing performance and avoid costly maintenance. Infrastructure projects such as metro rail and power generation turbines are creating new market avenues. Lightweight, high-efficiency bearings are preferred for space-constrained assembly lines. Local manufacturing partnerships are helping international suppliers meet rapid demand growth while maintaining quality standards.

Germany posts 3.7% CAGR, driven by adoption in Bavaria, Baden-Württemberg, and North Rhine-Westphalia. High-speed bearings are used in automotive, precision machinery, and wind energy sectors. Companies such as Schaeffler, SKF, and FAG supply low-vibration, durable bearings for industrial automation lines and high-speed trains. Adoption is further accelerated by strict industrial safety and efficiency regulations. Compact and high-precision bearings are in demand for advanced manufacturing and turbine installations. Integration with remote monitoring and predictive maintenance reduces operational downtime. German manufacturers are also investing in bearings suitable for robotics and automated assembly lines, enhancing adoption in next-generation production facilities.

Brazil shows a CAGR of 3.4%, concentrated in São Paulo, Minas Gerais, and Rio de Janeiro. Adoption is primarily driven by mining equipment, steel production, and sugarcane machinery. Suppliers such as SKF and Timken are introducing bearings capable of withstanding high loads in abrasive environments. The energy sector, particularly hydroelectric and biomass turbines, is expanding the market for specialized high-speed bearings. Remote monitoring and predictive maintenance solutions are increasingly applied in industrial plants to enhance equipment reliability. Modular and corrosion-resistant designs are preferred for tropical climate applications. Growth is supported by modernization projects in manufacturing plants and mining operations, where efficiency and reduced downtime are key priorities.

The USA market grows at 3.0% CAGR. Adoption is centered in Michigan, Ohio, and Texas due to automotive, aerospace, and industrial machinery hubs. Suppliers like Timken, NSK, and SKF provide bearings for high-speed engines, gas turbines, and industrial robotics. Demand is fueled by electric vehicle production, defense sector upgrades, and automation of manufacturing lines. Bearings with integrated sensors for vibration and temperature monitoring are increasingly applied to prevent equipment failure. Advanced aerospace components and high-speed railway systems also contribute to demand. Compact, durable designs are preferred in manufacturing plants where space and precision are critical.

The UK shows a 2.7% CAGR. Adoption is concentrated in West Midlands, Yorkshire, and Greater London where rail, automotive, and industrial manufacturing dominate. SKF and NTN supply bearings engineered for low-friction, high-speed applications. Rail network modernization and renewable energy turbines are creating new market opportunities. Bearings with enhanced load tolerance and vibration control are widely applied in industrial automation and high-speed assembly lines. Predictive monitoring systems help optimize maintenance schedules. Compact bearings are preferred for retrofit projects and older facilities where space is constrained.

Japan records 2.4% CAGR. Adoption is focused in Tokyo, Osaka, and Nagoya, driven by automotive, industrial robotics, and high-speed rail sectors. NSK, NTN, and JTEKT provide compact, durable bearings for high-speed, space-constrained machinery. Adoption is fueled by automation in factories, EV production, and next-generation rail systems. IoT-based predictive maintenance ensures continuous operation while reducing labor dependency. Bearings optimized for precision and minimal vibration are preferred for industrial robots and high-speed turbines. Space-efficient designs allow deployment in urban manufacturing facilities.

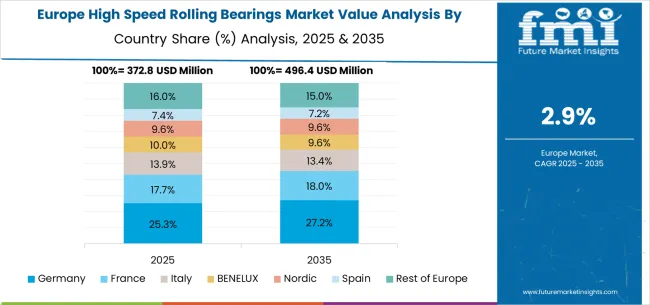

The high-speed rolling bearings market in Europe is projected to grow from USD 356.2 million in 2025 to USD 488.5 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 31.8% market share in 2025, moderating slightly to 31.5% by 2035, supported by its strong automotive industry, advanced manufacturing capabilities, and comprehensive precision engineering networks serving major European markets.

The United Kingdom follows with a 22.1% share in 2025, projected to reach 22.3% by 2035, driven by robust industrial automation initiatives, an established precision manufacturing sector, and strong demand for advanced bearing solutions across automotive and industrial applications. France holds a 17.6% share in 2025, rising to 17.8% by 2035, supported by automotive industry development and increasing adoption of precision engineering technologies in manufacturing operations. Italy records 13.4% in 2025, inching to 13.5% by 2035, with growth underpinned by manufacturing sector modernization and increasing focus on operational efficiency in industrial facilities. Spain contributes 8.9% in 2025, moving to 9.0% by 2035, supported by expanding automotive activities and industrial development programs. The Netherlands maintains a 2.7% share in 2025, growing to 2.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 3.5% to 3.1% by 2035, attributed to increasing adoption of advanced manufacturing technologies in Nordic countries and growing industrial activities across Eastern European markets implementing modernization programs.

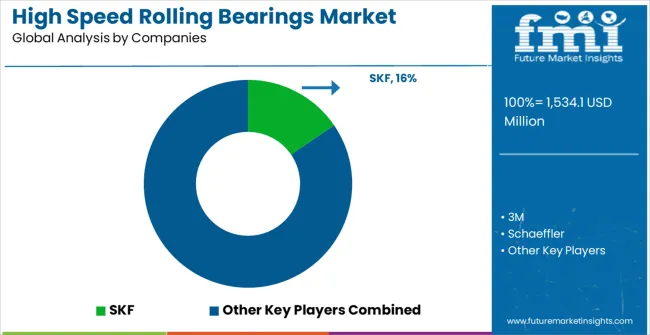

The high-speed rolling bearings market is characterized by competition among established bearing manufacturers, specialized precision engineering companies, and integrated mechanical component providers. Companies are investing in advanced materials research, precision manufacturing enhancement, high-speed technology development, and comprehensive product portfolios to deliver consistent, high-performance, and reliable bearing solutions. Innovation in bearing design, advanced materials, and high-speed optimization technologies is central to strengthening market position and competitive advantage.

SKF leads the market with a strong market share, offering comprehensive bearing solutions with a focus on advanced engineering and high-speed performance capabilities. 3M provides specialized bearing products with priority on industrial applications and advanced materials technology. Schaeffler delivers innovative bearing technologies with a focus on automotive and industrial high-speed markets. Simatec specializes in precision bearing solutions with focus on high-performance applications and operational reliability. GRW focuses on advanced bearing systems and specialized engineering solutions for demanding high-speed applications.

High-speed rolling bearings represent a precision mechanical component segment within automotive and industrial machinery applications, projected to grow from USD 1,534.1 million in 2025 to USD 2,102.0 million by 2035 at a 3.2% CAGR. These specialized bearing systems primarily radial bearing configurations for versatile load handling enable reliable high-RPM operation in automobile industry applications (USD 570.5 million in 2025), machinery, robotics, aerospace, and other precision mechanical systems requiring superior rotational performance at elevated speeds. Market expansion is driven by increasing automotive performance requirements, growing electric vehicle adoption, rising industrial automation demands, and advancing aerospace technologies requiring enhanced precision and reliability at high rotational speeds.

How Bearing Industry Standards Organizations Could Advance Technology Standards and Performance Verification?

How Automotive Manufacturers Could Optimize Vehicle Performance and Reliability?

How Bearing Manufacturers Could Drive Innovation and Market Leadership?

How Industrial Equipment Manufacturers Could Enhance Machinery Performance and Efficiency?

How Aerospace and Defense Organizations Could Advance High-Performance Applications?

How Investors and Financial Enablers Could Support Market Development and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,534.1 million |

| Bearing Type | Radial Bearings, Thrust Bearings |

| Application | Automobile Industry, Machinery Industry, Robotics Industry, Aerospace Industry, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SKF, 3M, Schaeffler, Simatec, GRW, and FAG |

| Additional Attributes | Dollar sales by bearing type and application category, regional demand trends, competitive landscape, technological advancements in bearing systems, material innovation, high-speed technology development, and performance optimization |

The global high speed rolling bearings market is estimated to be valued at USD 1,534.1 million in 2025.

The market size for the high speed rolling bearings market is projected to reach USD 2,102.0 million by 2035.

The high speed rolling bearings market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in high speed rolling bearings market are radial bearings and thrust bearings.

In terms of application, automobile industry segment to command 39.0% share in the high speed rolling bearings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA