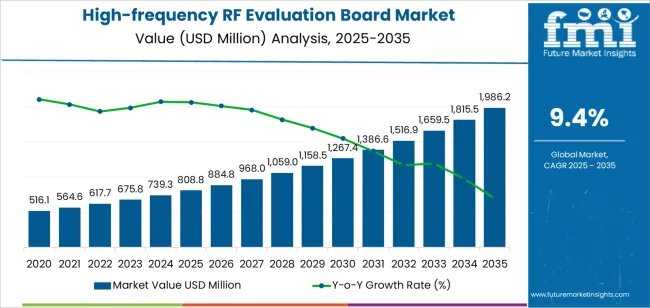

The global high-frequency RF evaluation board market is projected to reach USD 1,986.2 million by 2035, recording an absolute increase of USD 1,177.3 million over the forecast period. The market is valued at USD 808.8 million in 2025 and is set to rise at a CAGR of 9.4% during the assessment period. The overall market size is expected to grow by nearly 2.5 times during the same period, supported by increasing demand for wireless communication infrastructure worldwide, driving demand for efficient RF testing solutions and increasing investments in 5G deployment and IoT device development projects globally.

Between 2025 and 2030, the high-frequency RF evaluation board market is projected to expand from USD 808.8 million to USD 1,267.4 million, resulting in a value increase of USD 458.6 million, which represents 39.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for 5G network infrastructure and wireless connectivity solutions, product innovation in integrated RF testing platforms and multi-band evaluation systems, as well as expanding integration with automotive radar and vehicle-to-everything communication technologies. Companies are establishing competitive positions through investment in advanced semiconductor testing capabilities, miniaturized evaluation board designs, and strategic market expansion across telecommunications, automotive electronics, and industrial IoT applications.

From 2030 to 2035, the market is forecast to grow from USD 1,267.4 million to USD 1,986.2 million, adding another USD 718.7 million, which constitutes 61.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized RF evaluation systems, including millimeter-wave testing platforms and integrated multi-protocol evaluation solutions tailored for specific wireless standards, strategic collaborations between semiconductor manufacturers and equipment designers, and an enhanced focus on testing efficiency and development cycle acceleration. The growing emphasis on 6G research initiatives and advanced wireless technologies will drive demand for sophisticated, high-performance RF evaluation board solutions across diverse electronic device development applications. Component supply constraints and increasing technical complexity may pose challenges to market expansion.

Structural Growth Enablers in the High-frequency RF Evaluation Board Market (2025–2035)

| Growth Enabler | Market Influence | Expected Outcome by 2035 |

|---|---|---|

| Software-defined Test Architecture | Enables multi-protocol validation via firmware upgrades | Cuts prototype validation time by 30–40% |

| AI-driven Measurement Automation | Optimizes RF tuning and error detection | Improves testing efficiency and yield accuracy |

| Collaborative R&D Programs | Links chipmakers, universities, and tool vendors | Expands innovation capacity and design accessibility |

| Integrated Cloud-based Platforms | Centralizes test data and analytics | Enhances traceability and remote validation workflows |

| Miniaturized High-frequency Modules | Aligns with compact 5G/6G device architectures | Spurs demand for ultra-compact evaluation boards |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 808.8 million |

| Market Forecast Value (2035) | USD 1,986.2 million |

| Forecast CAGR (2025-2035) | 9.4% |

The high-frequency RF evaluation board market grows by enabling engineers and product developers to accelerate wireless device design cycles and validate RF performance specifications before mass production. Electronic manufacturers face mounting pressure to reduce time-to-market for wireless products and ensure regulatory compliance, with RF evaluation board solutions typically providing 30-40% reduction in development timelines compared to custom testing setups, making these platforms essential for competitive product launches. The 5G infrastructure buildout and expanding IoT ecosystem create demand for advanced evaluation solutions that can characterize multi-band RF circuits, validate signal integrity, and ensure interoperability across diverse wireless communication protocols.

Semiconductor manufacturers' need for comprehensive testing platforms drives adoption in telecommunications equipment, automotive electronics, and consumer device applications, where RF performance has a direct impact on product reliability and market acceptance. The global shift toward wireless connectivity in industrial automation and smart home systems accelerates RF evaluation board demand as developers require reliable tools to prototype and optimize wireless transceivers, power amplifiers, and antenna matching networks. Technology advancement trends toward integrated evaluation platforms with embedded measurement capabilities, software-defined radio configurations, and automated testing workflows enable next-generation product development processes.

Government initiatives promoting spectrum efficiency and wireless infrastructure modernization drive adoption in telecommunications and defense applications, where stringent performance standards require rigorous validation during development phases. The proliferation of connected devices across automotive, healthcare, and industrial sectors creates sustained demand for RF evaluation boards that support emerging wireless standards including Wi-Fi 6E, Bluetooth 5.3, and ultra-wideband technologies. However, high initial costs for advanced evaluation platforms and technical expertise requirements may limit adoption rates among smaller design houses and regions with underdeveloped electronics engineering capabilities.

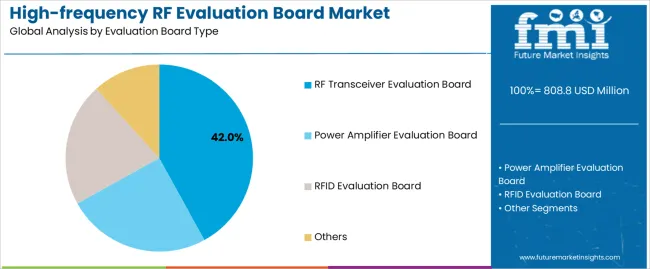

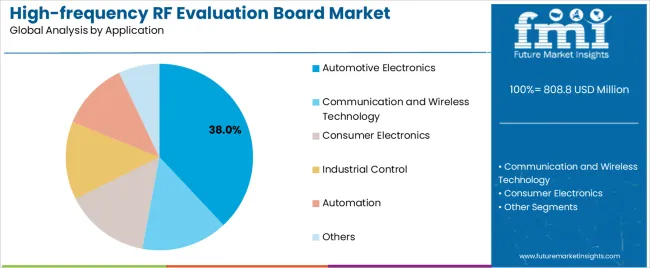

The market is segmented by evaluation board type, application, and region. By evaluation board type, the market is divided into RF transceiver evaluation board, power amplifier evaluation board, RFID evaluation board, and others. Based on application, the market is categorized into automotive electronics, communication and wireless technology, consumer electronics, industrial control, automation, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

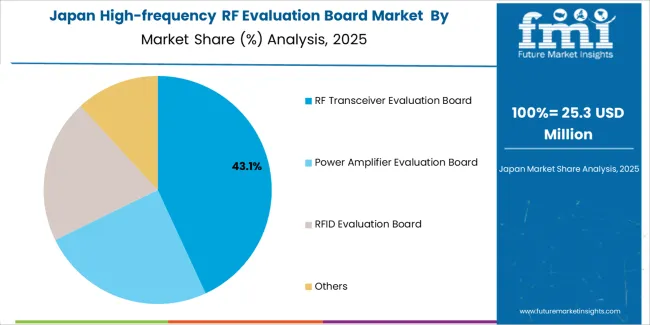

The RF transceiver evaluation board segment represents the dominant force in the high-frequency RF evaluation board market, capturing approximately 42% of total market share in 2025. This advanced category encompasses integrated platforms featuring transmit-receive functionality, multi-band operation capabilities, and comprehensive protocol support, delivering complete wireless communication validation solutions with flexible configuration options. The RF transceiver segment's market leadership stems from its essential role in developing modern wireless devices that require simultaneous transmission and reception capabilities, compatibility with multiple wireless standards, and sophisticated signal processing validation during prototype phases.

The power amplifier evaluation board segment maintains a substantial 28.0% market share, serving engineers who require specialized testing platforms for output power optimization, linearity characterization, and efficiency validation in wireless transmission systems. The RFID evaluation board segment accounts for 18.0% market share, featuring near-field communication testing, passive tag characterization, and reader module validation capabilities. The others segment holds 12.0% market share, encompassing specialized platforms including filter evaluation boards, antenna matching networks, and frequency synthesizer testing systems. Key advantages driving the RF transceiver segment include comprehensive functionality enabling complete wireless system validation, support for emerging communication standards including 5G NR and Wi-Fi 6E, integrated measurement interfaces reducing external equipment requirements, and compatibility with rapid prototyping workflows accelerating product development cycles.

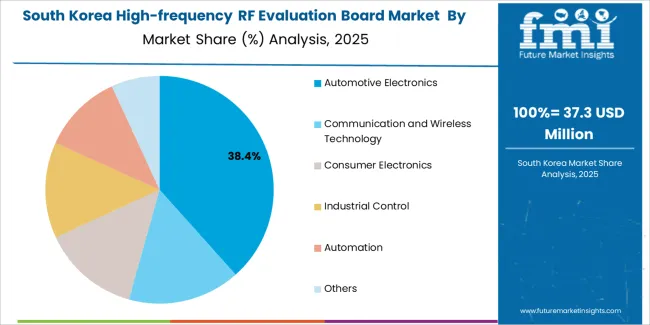

Communication and wireless technology applications dominate the high-frequency RF evaluation board market with approximately 38% market share in 2025, reflecting the critical role of RF evaluation platforms in developing next-generation telecommunications infrastructure and wireless connectivity solutions. The segment's market leadership is reinforced by widespread adoption across 5G base station development, wireless backhaul systems, and millimeter-wave communication equipment, which require extensive RF characterization and performance optimization during design validation phases.

The automotive electronics segment represents 24.0% market share through specialized applications including vehicle radar systems, V2X communication modules, and wireless infotainment platforms that demand rigorous RF testing to ensure safety and reliability standards. Consumer electronics accounts for 20.0% market share, driven by smartphone development, wireless audio devices, and smart home connectivity products requiring comprehensive RF validation. Industrial control holds 10.0% market share, encompassing wireless sensor networks and industrial IoT applications. Automation captures 5.0% market share through robotics communication systems and factory automation wireless links. Others represent 3.0% market share, covering defense electronics and medical device applications. Key market dynamics supporting application preferences include communication technology's continuous innovation cycle driving sustained evaluation board demand, automotive safety requirements necessitating extensive RF testing and validation, consumer electronics' rapid product refresh cycles creating recurring development tool needs, and industrial applications' emphasis on reliability requiring thorough prototype characterization.

The market is driven by three concrete demand factors tied to wireless technology advancement and development efficiency requirements. First, 5G network deployment creates increasing requirements for RF testing solutions capable of validating millimeter-wave frequencies and massive MIMO configurations, with global 5G infrastructure investments exceeding USD 200 billion annually in major markets worldwide, requiring sophisticated evaluation platforms for equipment development and network optimization. Second, automotive electrification and autonomous driving technologies drive demand for radar and V2X communication evaluation boards, with RF systems in modern vehicles increasing from 15-20 RF components per vehicle to 40-60 components in connected and autonomous platforms, necessitating comprehensive testing capabilities during automotive electronics development. Third, IoT device proliferation across industrial, healthcare, and smart home applications accelerates adoption of low-power wireless evaluation platforms, with global IoT connections projected to exceed 30 billion devices by 2030, requiring efficient prototyping tools for diverse wireless connectivity solutions.

Market restraints include high acquisition costs affecting evaluation platform accessibility, particularly for advanced millimeter-wave and multi-band testing systems where complete evaluation kits range from USD 2,000 to USD 15,000 per platform, creating barriers for small design teams and academic institutions operating on limited budgets. Technical complexity of modern RF evaluation boards poses adoption challenges, as engineers require specialized training in vector network analysis, spectrum characterization, and protocol-specific testing methodologies to fully utilize advanced platform capabilities during development cycles. Component availability constraints impact evaluation board production timelines, especially during semiconductor shortage periods when critical RF integrated circuits experience extended lead times, creating supply chain disruptions that delay evaluation platform availability for time-sensitive development projects.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where government electronics manufacturing initiatives and expanding telecommunications infrastructure investments drive demand for RF development tools supporting domestic product design capabilities. Technology advancement trends toward integrated software-defined evaluation platforms with automated measurement routines, cloud-connected data analysis capabilities, and machine learning-enhanced optimization algorithms are transforming traditional RF testing workflows. Miniaturization efforts produce compact evaluation boards with integrated power management, onboard measurement interfaces, and reduced footprint designs that facilitate benchtop testing in space-constrained development environments. However, the market thesis could face disruption if virtual RF simulation tools achieve sufficient accuracy to replace physical prototyping for initial design validation, potentially reducing evaluation board requirements during early development phases while maintaining demand for final validation testing.

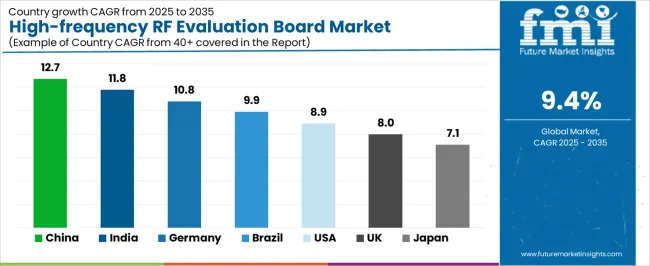

| Country | CAGR (2025-2035) |

|---|---|

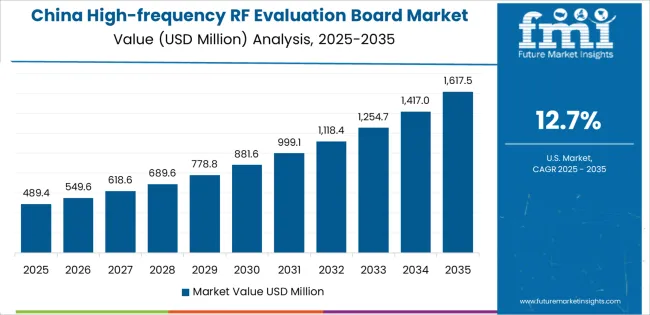

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| Brazil | 9.9% |

| USA | 8.9% |

| UK | 8.0% |

| Japan | 7.1% |

The high-frequency RF evaluation board market is gaining momentum worldwide, with China taking the lead thanks to aggressive 5G infrastructure deployment and domestic semiconductor development initiatives. Close behind, India benefits from expanding electronics manufacturing capabilities and government digitalization programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where automotive electronics innovation and Industry 4.0 implementation strengthen its role in European technology supply chains. Brazil demonstrates robust growth through telecommunications modernization and emerging IoT application development, signaling continued investment in wireless technology infrastructure. The USA maintains solid expansion through continued 5G deployment and advanced wireless research programs, while the UK records consistent progress driven by telecommunications innovation and defense electronics development. Meanwhile, Japan stands out for its automotive electronics leadership and precision manufacturing expertise. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

How Is Advanced 5G Infrastructure Expansion Accelerating Market Growth in China?

China demonstrates the strongest growth potential in the High-frequency RF Evaluation Board Market with a CAGR of 12.7% through 2035. The country's leadership position stems from comprehensive 5G network deployment programs, intensive domestic semiconductor industry development initiatives, and aggressive technology self-sufficiency targets driving adoption of RF testing and validation platforms. Growth is concentrated in major technology centers, including Shenzhen, Beijing, Shanghai, and Chengdu, where telecommunications equipment manufacturers, consumer electronics developers, and automotive electronics suppliers are implementing RF evaluation systems for product development and regulatory compliance verification. Distribution channels through semiconductor distributors, electronics design service providers, and direct manufacturer relationships expand deployment across telecommunications infrastructure projects and consumer device development facilities. The country's Made in China 2025 strategy provides policy support for domestic electronics capabilities, including subsidies for RF testing equipment adoption and engineering talent development programs.

Key market factors include telecommunications infrastructure intensity with comprehensive 5G and emerging 6G development programs spanning nationwide deployment initiatives, government support through integrated circuit industry development funds and technology import substitution policies providing 20-30% cost support for domestic evaluation equipment, comprehensive ecosystem including established semiconductor design houses and contract manufacturers with proven RF development capabilities, and technology integration featuring automated testing platforms, software-defined radio configurations, and artificial intelligence-enhanced optimization systems deployed across major electronics manufacturing clusters.

Why Is Electronics Manufacturing Modernization Boosting Market Adoption in India?

In Bangalore, Hyderabad, Pune, and Delhi NCR regions, the adoption of RF evaluation board systems is accelerating across telecommunications equipment development, consumer electronics manufacturing, and automotive electronics design, driven by electronics manufacturing expansion and government digitalization initiatives. The market demonstrates strong growth momentum with a CAGR of 11.8% through 2035, linked to comprehensive electronics production capabilities expansion and increasing focus on domestic product development solutions. Indian engineers are implementing RF testing platforms and wireless protocol validation systems to improve product quality while meeting international certification requirements in key export markets including North America, Europe, and Asia-Pacific regions. The country's Production Linked Incentive schemes for electronics manufacturing create sustained demand for development tools, while increasing emphasis on 5G deployment drives adoption of advanced RF characterization platforms that enable domestic telecommunications equipment production.

Leading technology development regions, including Karnataka, Telangana, Maharashtra, and Tamil Nadu, driving RF evaluation board system adoption with government incentive programs enabling 25-40% cost support for manufacturing equipment and design tool procurement. Technology collaboration agreements accelerate deployment with international semiconductor manufacturers establishing design centers and providing technical support for RF development platforms. Policy support through National Electronics Policy and Atmanirbhar Bharat initiatives linked to electronics self-sufficiency promotion creates favorable conditions for evaluation board market expansion across telecommunications, consumer electronics, and automotive sectors.

How Does Automotive Innovation Strengthen Market Leadership in Germany?

Germany's advanced engineering sector demonstrates sophisticated implementation of RF evaluation board systems, with documented case studies showing 25-35% development cycle reduction for automotive radar systems and industrial wireless modules through advanced testing platform utilization. The country's technology infrastructure in major engineering centers, including Munich, Stuttgart, Dresden, and Hamburg, showcases integration of RF evaluation technologies with existing product development workflows, leveraging expertise in automotive electronics and industrial automation systems. German manufacturers emphasize quality standards and regulatory compliance, creating demand for reliable RF testing solutions that support safety certifications and electromagnetic compatibility requirements. The market maintains strong growth through focus on automotive innovation and Industry 4.0 implementation, with a CAGR of 10.8% through 2035.

Key development areas include automotive electronics leadership enabling comprehensive radar and V2X communication system development with extensive RF validation requirements, technical excellence culture providing engineering workforce with advanced RF testing expertise and systematic development methodologies, strategic partnerships between semiconductor manufacturers and automotive suppliers expanding evaluation platform deployment across vehicle electronics development programs, and integration of automated testing infrastructure and comprehensive quality assurance systems for wireless module validation supporting stringent automotive safety standards.

Why Is Telecommunications Modernization Supporting Market Expansion in Brazil?

Brazil's developing electronics sector demonstrates increasing implementation of RF evaluation board systems, with growing telecommunications infrastructure modernization and expanding IoT application development driving demand for wireless prototyping tools. The market shows solid potential with a CAGR of 9.9% through 2035, driven by telecommunications network upgrades and increasing consumer electronics manufacturing capabilities across major industrial regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul. Brazilian engineers are adopting RF evaluation platforms for compliance with ANATEL regulatory standards, particularly in wireless communication devices requiring certification and in telecommunications equipment supporting network infrastructure expansion. Technology deployment channels through electronics distributors, engineering service providers, and direct supplier relationships expand coverage across diverse wireless product development operations.

Leading market segments include telecommunications equipment development for 5G network deployment and wireless backhaul systems, consumer electronics manufacturing focusing on mobile devices and wireless connectivity modules, and automotive electronics design for connected vehicle systems. Technology partnerships with international semiconductor companies provide access to advanced evaluation platforms and technical support programs, while strategic collaborations between universities and industry create engineering talent pipeline supporting RF development capabilities. Focus on domestic manufacturing capabilities and import substitution initiatives drive investment in product development infrastructure including RF testing and validation platforms.

How Are Wireless Research Programs Driving Market Development in United States?

The USA market leads in advanced RF evaluation board innovation based on integration with automated testing systems and sophisticated development environments for enhanced engineering productivity. The country shows solid potential with a CAGR of 8.9% through 2035, driven by continued 5G deployment, defense electronics modernization, and advanced wireless research programs across major technology centers, including Silicon Valley, Boston, Austin, and San Diego. American engineers are adopting integrated RF evaluation platforms for compliance with FCC regulations and industry standards, particularly in telecommunications equipment requiring extensive validation and in defense applications demanding rigorous performance characterization. Technology deployment channels through authorized distributors, manufacturer direct sales, and online procurement platforms expand coverage across diverse electronics development operations.

Leading market segments include telecommunications infrastructure development for 5G and emerging 6G research programs, defense electronics applications requiring secure wireless communication systems, aerospace programs implementing advanced radar and communication technologies, and consumer electronics development focused on wireless connectivity innovations. Technology partnerships with semiconductor manufacturers provide comprehensive evaluation ecosystems including software tools, measurement equipment integration, and technical support services. Strategic collaborations between industry and research institutions advance RF testing methodologies and next-generation wireless technology validation approaches.

How Is Telecommunications Innovation Enhancing Market Potential in United Kingdom?

The United Kingdom's RF evaluation board market demonstrates focused implementation across telecommunications innovation, defense electronics development, and industrial IoT applications, with documented integration supporting advanced wireless system prototyping in established engineering centers. The country maintains steady growth momentum with a CAGR of 8.0% through 2035, driven by telecommunications sector innovation and defense technology development programs emphasizing secure wireless communications. Major technology regions, including Cambridge, London, Bristol, and Manchester, showcase deployment of RF evaluation platforms that integrate with existing product development infrastructure and sophisticated testing methodologies supporting stringent performance requirements.

Key market characteristics include telecommunications innovation leadership through mobile network technology development and wireless infrastructure modernization programs, defense electronics emphasis creating demand for secure communication system evaluation and validation platforms, technology partnerships between semiconductor suppliers and UK-based design houses enabling access to advanced RF testing capabilities, and collaboration through innovation centers and technology clusters fostering engineering expertise development in wireless system design and validation methodologies supporting competitive product development.

How Does Precision Engineering Support Market Consistency in Japan?

Japan's RF evaluation board market demonstrates mature implementation focused on automotive electronics systems and precision consumer devices, with documented integration of RF testing platforms achieving superior quality standards in domestic high-technology manufacturing. The country maintains steady growth through automotive safety system development and advanced manufacturing capabilities, with a CAGR of 7.1% through 2035, driven by emphasis on reliability and producers' commitment to quality assurance principles aligned with continuous improvement philosophies. Major technology centers, including Tokyo, Nagoya, Osaka, and Fukuoka, showcase advanced deployment of RF evaluation systems that integrate seamlessly with existing product development processes and comprehensive testing protocols.

Key market characteristics include automotive electronics leadership driving millimeter-wave radar and V2X communication development requiring extensive RF validation, precision manufacturing culture emphasizing thorough testing and characterization during product development cycles, technology partnerships between domestic semiconductor companies and equipment manufacturers ensuring integrated evaluation platform ecosystems, and emphasis on miniaturization and integration supporting compact evaluation board designs for space-constrained development environments.

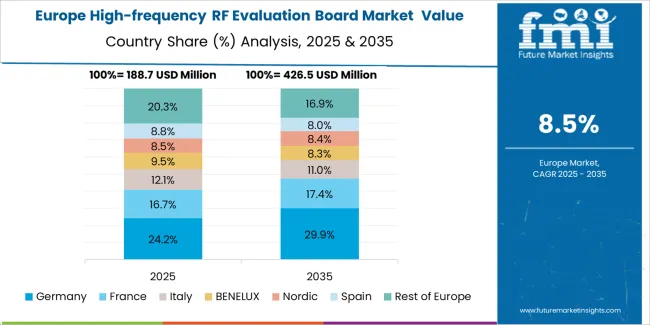

How Are Regional Technology Programs Shaping Market Evolution Across Europe?

The high-frequency RF evaluation board market in Europe is projected to grow from USD 185.4 million in 2025 to USD 401.2 million by 2035, registering a CAGR of 8.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its automotive electronics excellence and major engineering centers, including Munich, Stuttgart, and Dresden technology clusters.

France follows with a 18.2% share in 2025, projected to reach 18.5% by 2035, driven by telecommunications infrastructure development and aerospace electronics programs. The United Kingdom holds a 16.8% share in 2025, expected to reach 16.5% by 2035, backed by telecommunications innovation and defense electronics development. Italy commands a 11.5% share in both 2025 and 2035, driven by industrial automation and consumer electronics design. Spain accounts for 8.3% in 2025, rising to 8.5% by 2035 on telecommunications modernization and IoT application expansion. The Netherlands maintains 6.2% in 2025, reaching 6.4% by 2035 on semiconductor industry presence and wireless technology development. The Rest of Europe region is anticipated to hold 10.5% in 2025, expanding to 14.8% by 2035, attributed to increasing RF evaluation board adoption in Nordic countries and emerging Central & Eastern European electronics manufacturing programs.

How Does Precision Engineering Support Market Consistency in Japan?

The Japanese RF evaluation board market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of transceiver evaluation platforms with existing automotive electronics development infrastructure across major manufacturers, tier-1 suppliers, and specialized wireless module producers. Japan's emphasis on quality assurance and reliability testing drives demand for comprehensive RF evaluation solutions that support rigorous validation protocols and stringent performance specifications in automotive safety systems and precision consumer devices. The market benefits from strong partnerships between international semiconductor manufacturers and domestic electronics companies including major automotive suppliers and consumer electronics brands, creating comprehensive technical support ecosystems that prioritize measurement accuracy and development efficiency. Technology centers in Tokyo, Nagoya, Osaka, and other major engineering regions showcase advanced RF development implementations where evaluation platforms achieve thorough characterization through systematic testing methodologies and integrated measurement systems.

The South Korean RF evaluation board market is characterized by strong international semiconductor manufacturer presence, with companies maintaining significant positions through comprehensive technical support and reference design capabilities for telecommunications equipment and consumer electronics applications. The market demonstrates increasing emphasis on 5G infrastructure development and advanced wireless technologies, as Korean engineers increasingly demand integrated RF evaluation platforms that support domestic telecommunications standards and sophisticated testing requirements deployed across major electronics manufacturing complexes. Domestic semiconductor companies are expanding market participation through strategic partnerships with international platform providers, offering specialized services including Korean regulatory compliance support and application-specific reference designs for telecommunications equipment and mobile device development. The competitive landscape shows increasing collaboration between multinational semiconductor companies and Korean technology specialists, creating hybrid support models that combine international RF expertise with local market knowledge and rapid technical response capabilities.

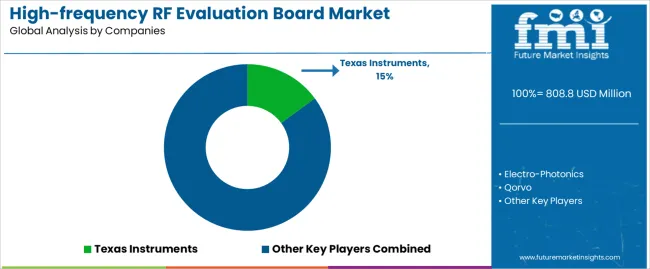

The high-frequency RF evaluation board market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established semiconductor portfolios and comprehensive technical support infrastructure. Competition centers on platform capability breadth, measurement accuracy, software tool integration, and technical documentation quality rather than price competition alone. Texas Instruments leads with approximately 15.0% market share through its extensive RF and wireless connectivity evaluation board portfolio spanning multiple wireless standards and frequency bands.

Market leaders include Texas Instruments, Qorvo, and STMicroelectronics, which maintain competitive advantages through vertical integration in semiconductor manufacturing, comprehensive reference design libraries, and deep expertise in RF circuit design supporting diverse wireless applications across telecommunications, automotive, and consumer electronics. These companies leverage research and development capabilities in advanced packaging technologies, integrated measurement interfaces, and ongoing technical support relationships to defend market positions while expanding into emerging wireless standards including Wi-Fi 7, ultra-wideband, and millimeter-wave applications.

Challengers encompass Electro-Photonics and Renesas Electronics Corporation, which compete through specialized RF solutions and strong regional presence in key technology markets supporting telecommunications infrastructure and automotive electronics development. Product specialists, including Akoustis, SemiCML Microcircuits, and Ampleon, focus on specific RF technologies or frequency bands, offering differentiated capabilities in acoustic wave filters, low-noise amplifiers, and high-power RF devices with corresponding evaluation platforms supporting niche applications.

Regional players and emerging RF technology providers create competitive pressure through specialized testing capabilities and rapid response to evolving wireless standards, particularly in high-growth markets including China and India, where local semiconductor companies provide evaluation platforms optimized for domestic wireless infrastructure requirements and regulatory compliance needs. Market dynamics favor companies that combine broad RF product portfolios with comprehensive development ecosystems including simulation tools, automated testing software, and extensive technical documentation that accelerate customer product development cycles from initial design through production validation.

High-frequency RF evaluation boards represent essential development tools that enable engineers to achieve 30-40% reduction in wireless product development cycles compared to custom testing approaches, delivering accelerated time-to-market and validated RF performance with comprehensive characterization capabilities in demanding electronics design applications. With the market projected to grow from USD 808.8 million in 2025 to USD 1,986.2 million by 2035 at a 9.4% CAGR, these testing platforms offer compelling advantages - development cycle acceleration, regulatory compliance validation, and design optimization capabilities - making them essential for communication and wireless technology development, automotive electronics applications, and engineering teams seeking reliable tools for RF circuit validation before production commitment. Scaling market adoption and capability enhancement requires coordinated action across semiconductor manufacturers, testing equipment providers, engineering education institutions, telecommunications operators, and technology investment capital.

Electronics Manufacturing Support Programs should include RF testing equipment in technology development incentive schemes, provide grants for engineering tool acquisition supporting domestic product design capabilities, and establish shared testing facilities at technology parks reducing equipment access barriers for small design teams. Research & Innovation Funding must support university research on advanced RF testing methodologies, wireless protocol validation techniques, and automated characterization systems while investing in industry-academic partnerships that advance practical engineering knowledge for emerging wireless technologies including 6G research and quantum communication systems. Infrastructure Development Incentives should provide support for establishing electronics design centers with comprehensive RF testing capabilities, offer technical training programs for engineers requiring specialized RF measurement expertise, and support ecosystem development that ensures engineering talent pipeline for wireless technology advancement.

Spectrum Management & Standards Development needs to allocate testing frequencies for evaluation purposes without licensing requirements, harmonize wireless certification standards reducing redundant testing across markets, and establish technical working groups that align evaluation methodologies with emerging wireless standards facilitating efficient product development. Education & Workforce Development should integrate RF engineering principles in university curricula with hands-on evaluation board experience, fund laboratory equipment acquisition enabling student access to modern testing platforms, and support industry internship programs that develop practical skills in wireless system validation and characterization methodologies supporting technology sector workforce requirements.

Technical Standards & Methodologies should define standardized testing protocols for common wireless technologies enabling consistent evaluation approaches across different platforms, establish performance benchmarks for evaluation board capabilities ensuring minimum functionality for specific applications, and create interoperability guidelines that facilitate multi-vendor evaluation ecosystems supporting comprehensive development environments. Best Practices Documentation must develop comprehensive guides for RF measurement techniques, characterization methodologies, and troubleshooting approaches ensuring engineers effectively utilize evaluation platforms, while establishing training certification programs that validate engineering competencies in wireless system testing and validation supporting professional development.

Ecosystem Integration Standards need to create compatibility frameworks for evaluation boards interfacing with test equipment, simulation tools, and development environments that streamline engineering workflows, while establishing data format standards that enable seamless measurement data exchange between testing platforms and analysis software supporting efficient development processes. Technical Training & Knowledge Transfer should establish workshops on emerging wireless technologies and corresponding testing approaches, develop online resources including application notes and video tutorials demonstrating evaluation board utilization, and facilitate knowledge sharing forums where engineers exchange practical experience with RF testing methodologies supporting continuous learning.

Advanced Evaluation Platforms should develop next-generation integrated systems with embedded spectrum analyzers, network analyzers, and protocol testers reducing external equipment requirements while maintaining measurement accuracy, create software-defined platforms enabling flexible configuration for multiple wireless standards through firmware updates rather than hardware changes, and implement automated testing capabilities that accelerate characterization through scripted measurement sequences reducing manual testing time. Technical Documentation & Support must provide comprehensive user guides with detailed measurement procedures, application notes addressing common design challenges, and reference designs demonstrating best practices for specific wireless applications while maintaining responsive technical support teams that assist engineers troubleshooting complex RF validation issues.

Educational Partnerships should collaborate with universities providing evaluation platforms for engineering laboratories enabling student hands-on experience with professional testing tools, support curriculum development that integrates modern RF testing methodologies, and sponsor student design competitions that demonstrate evaluation board utilization in real-world wireless product development fostering next-generation engineering talent. Cloud-Connected Capabilities need to develop remote testing platforms enabling distributed engineering teams to access evaluation systems through network connections, implement automated data analysis with machine learning algorithms that identify optimization opportunities from measurement results, and create shared measurement databases that enable cross-project learning from accumulated characterization data supporting organizational knowledge retention.

Application-Focused Platform Development should create specialized evaluation boards for communication and wireless technology applications optimizing testing workflows for 5G infrastructure and wireless connectivity devices, automotive electronics platforms supporting radar and V2X communication development requirements, and consumer electronics solutions addressing mobile device and IoT product validation needs with formulations optimized for each application's specific testing requirements. Geographic Market Strategy must establish distribution partnerships in high-growth markets like China and India ensuring evaluation platform availability and local technical support, while maintaining comprehensive support infrastructure in established markets like USA and Europe through direct technical teams and authorized distribution networks.

Technology Differentiation should invest in proprietary measurement algorithms enhancing characterization accuracy and repeatability, develop intuitive software interfaces reducing learning curves for evaluation platform adoption, and create integrated development ecosystems that combine evaluation boards with simulation tools and automated testing software providing comprehensive wireless product development solutions enabling superior engineering productivity. Customer Partnership Models need to develop long-term relationships with telecommunications equipment manufacturers, automotive electronics suppliers, and consumer device developers through collaborative reference design programs, application-specific testing protocols, and performance optimization services that strengthen customer loyalty while providing market intelligence guiding product roadmap development.

Semiconductor Evaluation Platform Companies should finance established RF evaluation board manufacturers for platform capability enhancement, software tool development, and technical support infrastructure expansion serving growing demand in communication and wireless technology and automotive electronics markets enabling comprehensive market coverage. Distribution & Support Infrastructure must provide capital for establishing regional technical support centers, training facilities, and inventory management systems that ensure evaluation platform availability and responsive customer service across diverse geographic markets supporting market penetration.

Innovation & Testing Technology should back engineering tool startups developing automated RF characterization systems, cloud-connected testing platforms, and artificial intelligence-enhanced optimization tools that improve testing efficiency while addressing engineering productivity requirements and development cycle acceleration demands. Market Consolidation & Integration needs to support strategic partnerships between evaluation board providers and test equipment manufacturers creating comprehensive testing ecosystems, finance acquisitions that expand technology portfolios and market coverage, and enable vertical integration that combines semiconductor design capabilities with evaluation platform development supporting end-to-end wireless product development solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 808.8 million |

| Evaluation Board Type | RF Transceiver Evaluation Board, Power Amplifier Evaluation Board, RFID Evaluation Board, Others |

| Application | Automotive Electronics, Communication and Wireless Technology, Consumer Electronics, Industrial Control, Automation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Texas Instruments, Electro-Photonics, Qorvo, STMicroelectronics, Renesas Electronics Corporation, Akoustis, SemiCML Microcircuits, Ampleon, 3D RF Energy Corp, Frontier, Johanson Technology, MACOM (Metelics), NXP, Sangshin |

| Additional Attributes | Dollar sales by evaluation board type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with semiconductor manufacturers and testing platform providers, technical specifications and measurement capabilities, integration with wireless development tools and testing equipment, innovations in automated characterization systems and software-defined platforms, and development of specialized evaluation boards with enhanced measurement accuracy and multi-protocol support capabilities. |

The global high-frequency rf evaluation board market is estimated to be valued at USD 808.8 million in 2025.

The market size for the high-frequency rf evaluation board market is projected to reach USD 1,986.2 million by 2035.

The high-frequency rf evaluation board market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in high-frequency rf evaluation board market are rf transceiver evaluation board, power amplifier evaluation board, rfid evaluation board and others.

In terms of application, automotive electronics segment to command 38.0% share in the high-frequency rf evaluation board market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID in Pharmaceuticals Market – Trends & Forecast through 2034

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA