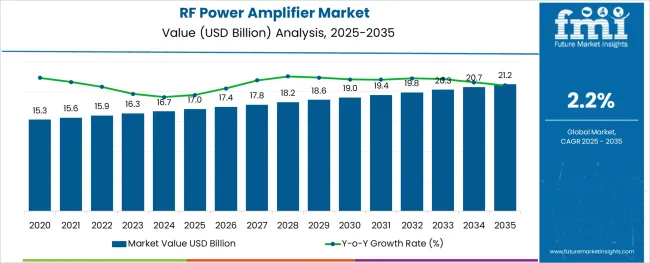

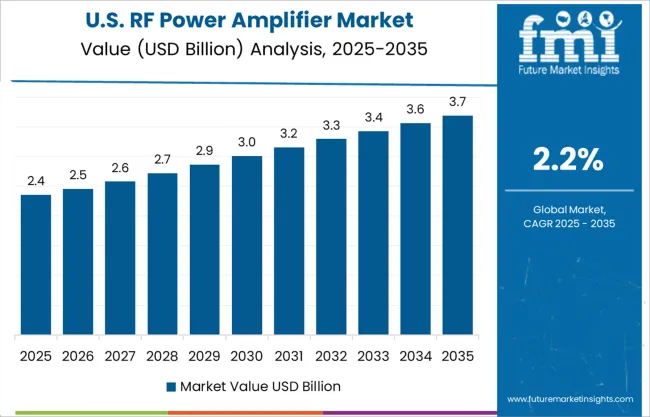

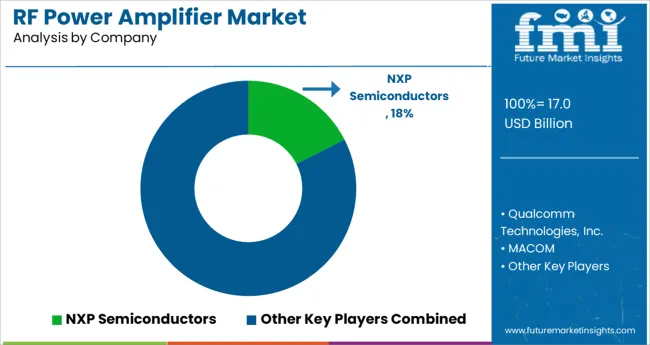

The RF Power Amplifier Market is estimated to be valued at USD 17.0 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.2% over the forecast period.

The RF power amplifier market is undergoing significant expansion, driven by the escalating demand for high-frequency transmission in telecommunications, aerospace, and defense sectors. As 5G networks and satellite communications evolve, the need for reliable, energy-efficient, and compact RF amplification has intensified. Manufacturers are investing in advanced semiconductor technologies and power-efficient architectures to support low-noise, high-linearity transmission across various frequencies.

Shifts toward gallium-based materials and linear amplifier classes are enabling better thermal performance and higher gain, especially in mission-critical applications. Government-led infrastructure modernization and private sector initiatives in IoT, radar systems, and defense electronics are generating consistent demand.

Future opportunities are expected to be unlocked through scalable designs compatible with emerging mmWave bands, along with continued integration of AI-enabled performance optimization and smart cooling systems, which will enhance operational life and minimize downtime in power-sensitive environments.

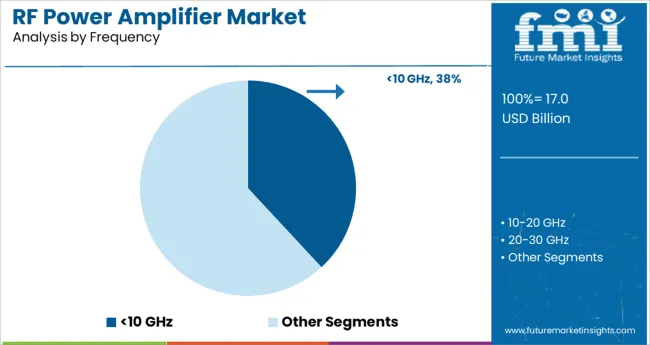

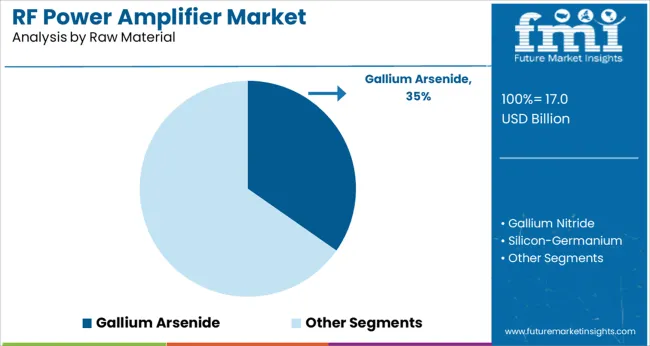

The market is segmented by Frequency, Raw Material, Operation Mode, Packaging Type, Industry Verticals, and Application and region. By Frequency, the market is divided into <10 GHz, 10-20 GHz, 20-30 GHz, and 30+ GHz. In terms of Raw Material, the market is classified into Gallium Arsenide, Gallium Nitride, Silicon-Germanium, and Others.

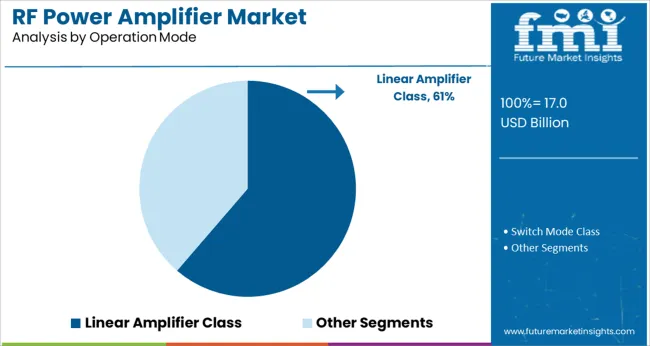

Based on Operation Mode, the market is segmented into Linear Amplifier Class and Switch Mode Class. By Packaging Type, the market is divided into Surface Mount, Stand Alone/Rack Mount, Die, and Others. By Industry Verticals, the market is segmented into Aerospace & Defence, Consumer Electronics, Automotive Medical, and Others.

By Application, the market is segmented into Wireless Transmitters, Broadcast Transmitters, Wireless Receivers, High Audio System, CD Players, and Audio Tape Players. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The frequency segment below 10 GHz is anticipated to hold 38.1% of revenue share in 2025, making it the most dominant frequency range. This leadership is being driven by the extensive use of sub-10 GHz frequencies in commercial communication infrastructure, including 4G LTE, early-phase 5G deployments, and Wi-Fi connectivity.

The technical maturity and cost-effectiveness of amplifiers operating in this range have contributed to their widespread adoption across base stations, broadcasting, and mobile communication devices. Additionally, this frequency range enables efficient signal penetration and broad coverage, which is critical for consumer applications and urban network deployment.

The demand for reliable signal amplification at these frequencies, coupled with high-volume deployment in telecom networks, has maintained this segment’s dominant position within the overall frequency landscape.

Gallium arsenide is projected to account for 34.7% of revenue share within the raw material category in 2025, reinforcing its role as a preferred semiconductor substrate. Its prominence stems from superior electron mobility and thermal performance characteristics, which are crucial for high-frequency and high-efficiency RF amplification.

The material’s ability to support stable performance under extreme temperatures and high-voltage conditions has made it vital for aerospace, defense, and satellite communication applications. Additionally, gallium arsenide-based devices offer high gain and low noise, factors critical for radar and electronic warfare systems.

Ongoing advancements in wafer processing and supply chain optimization have further supported cost competitiveness, securing gallium arsenide’s substantial share in the evolving RF amplifier ecosystem.

The linear amplifier class segment is forecast to capture 61.3% of market revenue in 2025 under the operation mode category, affirming its position as the leading amplifier architecture. This dominance is explained by the necessity for linear signal amplification in applications where signal integrity and low distortion are paramount.

The class is widely adopted in wireless communication, broadcasting, and instrumentation where amplitude and phase linearity must be preserved. Its compatibility with digitally modulated signals used in modern communication standards has further accelerated its adoption.

Improvements in linear amplifier efficiency and thermal management have also contributed to broader deployment, particularly in environments where power consumption and reliability are critical. As network operators prioritize high-quality transmission and regulatory compliance, the demand for linear operation amplifiers is expected to remain strong and sustain its market leadership.

Globally, cellular network expansion has increased the demand for RF power amplifiers. Consumer electronics, tablets, smartphones, laptops, and other personal electronic devices are the primary market drivers of the RF power amplifier market.

Technological advancements and increasing investment by private companies in product development contribute to the growth of the market.

As the RF power amplifier market grows, it is driven by the intensive use of RF power amplifiers in crucial industries such as aerospace, manufacturing, and consumer electronics. Another driver of the RF power amplifier market growth is the introduction of patent methods that eliminate waste heat. These methods eliminate the need for bulky heat sinks, fans, or cooling liquids.

Several factors, such as the miniaturization of RF power amplifiers for wireless technology, increased energy efficiency, and the introduction of 5G technology drive the RF power amplifiers market growth.

Additionally, proliferating penetration of 4G technology and the emergence of next-generation wireless networks, such as 5G, would also drive the demand and growth of the RF power amplifier market.

Wireless sensors with tiny battery-operated transceivers will be deployed in these cells with the Internet of Things (IoT). RF power amplifiers provide a high-quality transmission that allows this efficiency to be achieved. Miniaturization of RF power amplifiers will be a major factor in integrating them into mobile transceivers.

Thus, requires multiple RF power amplifiers in the wireless sensors of each cell. RF power amplifiers are driving market growth because of their increased power efficiency.

High costs associated with RF power amplifiers act as a primary restraint for the global RF power amplifier market, limiting its adoption. In addition to this, large size, high-power consumption, lower profit margins, complex designs, and engineering to attain better efficiency are also a challenge, hampering the growth of RF power amplifiers.

Manufacturers of RF power amplifiers are challenged by the functional properties of the components, such as overall RF design, gain values, noise factors, crosstalk attenuation, and the non-functional properties, such as long-term reliability of the chip, package, and board due to thermal constraints.

These factors are complicating the overall manufacturing process, which is also considered a major market restraint for RF power amplifiers.

Power amplifiers are heavily influenced by established market players; however, the need for higher initial investments during a declining economy poses a challenge for emerging market players. On the other hand, the need for innovation and technology for the further growth of RF power amplifiers is also affecting the overall growth of the RF power amplifier market.

As a result of the linearity issue, RF power amplifiers tend to back off the RF output power, which increases power consumption and reduces battery life.

North America is expected to hold the largest share of the RF Power Amplifier market and will continue to flourish in its trend owing to the increasing demand for smartphones and smart devices. RF power amplifiers are enhancing the overall functional properties of smartphones.

North America is anticipated to control an RF power amplifier market share of 28.4% in 2025. Among the total market share of the global RF power amplifier market, it is also predicted to maintain steady growth throughout the forecasted period.

The increasing adoption of new technologies in the healthcare and pharmaceutical industries has increased the RF power amplifier market share.

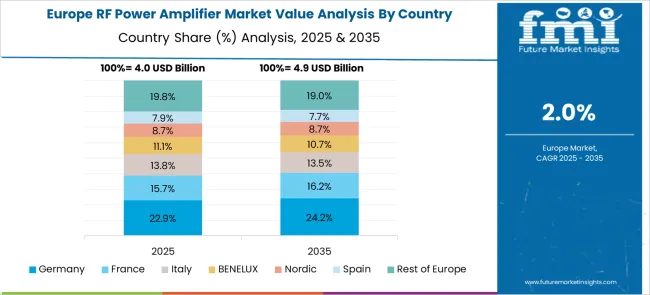

The European countries including the UK, Italy, and Germany have combined to attain a global RF power amplifier market share of 18.3% in the forecast period. The growing demand for energy-efficient devices and the presence of major key players in the Europe region are providing significant opportunities for the RF power amplifier market.

Asia Pacific is the largest revenue-generating region for the RF power amplifier market globally. The Asia Pacific region is an important market for consumer electronics, automobiles, and industrial products.

Asia Pacific is the fastest-growing region due to technological advancement in the wireless industry that creates huge opportunities in the cellular segment which is expected to contribute to major growth in the RF power amplifier market.

Huge investments and business development opportunities have been attracted to this region. With high-quality infrastructure and low labor costs, Taiwan, China, India, and Korea are becoming global hubs for large investments and business expansion.

How is the Start-up Ecosystem in the RF Power Amplifier Market?

The start-up ecosystem in the RF Power Amplifier market is clouded with multiple players trying to make a breakthrough as LTE networks are deployed more widely, the market for RF power amplifiers is expected to grow.

RF Power Amplifiers are predicted to gain popularity in the coming years as wireless communication devices like tablets and cell phones become more prevalent. However, the complexity of RF devices is expected to harm the RF power amplifier market. Even so, the emerging automation trend is likely to open new doors for the RF power amplifier market.

Some of the key players in the RF Power Amplifier market are NXP Semiconductors, Qualcomm Technologies, Inc., MACOM, BONN Elektronik GmbH, OPHIR RF, Infineon Technologies AG, CML Microsystems Plc, Broadcom, Analog Devices, Inc., ETL Systems Ltd, Analogic Corporation, ETS-Lindgren and Murata Manufacturing Co., Ltd.

Emerging Trends in the RF Power Amplifier market are brought about as a result of the major players' adoption of several growth strategies, including product launches, acquisitions, and collaborations.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 14.2% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Frequency, Raw Material, Operation Mode, Packaging Type, Industry, Application, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled |

United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled |

NXP Semiconductors; Qualcomm Technologies, Inc.; MACOM; BONN Elektronik GmbH; OPHIR RF; Infineon Technologies AG; CML Microsystems PLC; Broadcom; Analog Devises Inc.; ETL Systems Ltd; Analogic Corporation; ETS-Lindgren; Murata Manufacturing Co., Ltd. |

| Customization | Available Upon Request |

The global rf power amplifier market is estimated to be valued at USD 17.0 billion in 2025.

It is projected to reach USD 21.2 billion by 2035.

The market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types are <10 ghz, 10-20 ghz, 20-30 ghz and 30+ ghz.

gallium arsenide segment is expected to dominate with a 34.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA