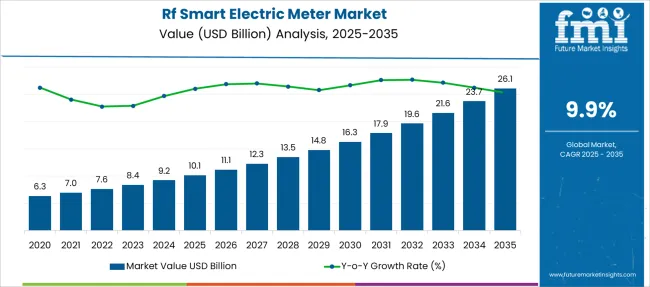

The RF Smart Electric Meter Market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 26.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

| Metric | Value |

|---|---|

| RF Smart Electric Meter Market Estimated Value in (2025E) | USD 10.1 billion |

| RF Smart Electric Meter Market Forecast Value in (2035F) | USD 26.1 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

Growing investment in smart grid modernization and demand response programs has encouraged the adoption of connected meter solutions across both developed and emerging economies. Regulatory mandates for energy efficiency and grid reliability have driven utilities to deploy RF-enabled systems at scale.

Additionally, software-defined platforms that support over-the-air updates and integration with home energy management systems have enhanced system flexibility and lowered lifecycle costs. As sustainability goals and consumer expectations continue to rise, innovation in edge computing and communication protocols is expected to support further penetration.

The market outlook is strengthened by ongoing collaborations between meter manufacturers, telecom providers, and analytics firms. Forecasts suggest continued adoption momentum through the decade with intelligent metering serving as a cornerstone of decarbonization and demand optimization initiatives..

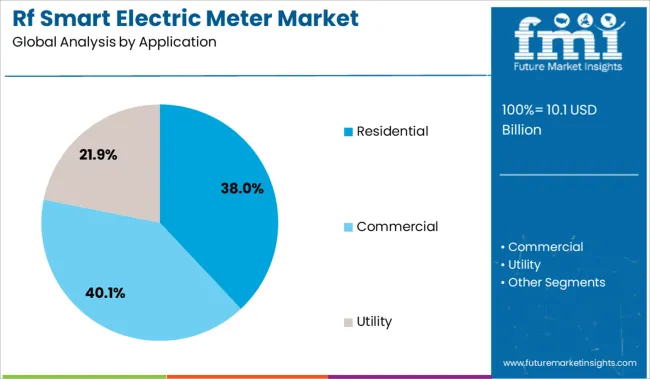

The market is segmented by Application, Phase, and region. By Application, the market is divided into Residential, Single family, Multi family, Commercial, Education, Healthcare, Retail, Logistics & transportation, Offices, Hospitality, Others, and Utility.

In terms of Phase, the market is classified into Single and Three. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The residential application segment has been projected to hold 38% of the RF Smart Electric Meter market revenue share in 2025, establishing it as the leading application. This dominance has been supported by rising deployment of smart meters in households, where real time consumption insights and remote billing are highly valued. Homeowners have been empowered to monitor usage patterns and optimize energy consumption through interactive portals and mobile applications.

Residential utilities have also benefited from streamlined meter reading and demand response integration. Deployment has been facilitated by government incentive schemes supporting residential smart meter rollouts.

As energy costs continue to fluctuate, residential uptake has been boosted by consumer interest in managing bills and reducing carbon footprints. Over-the-air updates and interoperability with home automation systems have further strengthened the value proposition, reinforcing the leadership of the residential application segment within the overall smart meter market.

The artificial neural network component segment has been forecast to represent 37% of the RF Smart Electric Meter market revenue share in 2025, positioning it as the primary intelligence mechanism. Growth within this segment has been supported by its ability to detect anomalous consumption patterns and forecast load with greater accuracy than traditional algorithms. Neural networks have been embedded at the edge to enable predictive maintenance and fraud detection without cloud dependency.

Their flexibility for software-based retraining and model refinement has made them particularly attractive in rapidly changing grid environments. Utilities have begun leveraging these capabilities to optimize demand response and manage distributed energy resources.

As smart meter hardware becomes more capable of running AI in real time, the artificial neural network component has emerged as a key differentiator. It has been enabling enhanced operational efficiency and grid resilience, contributing to its dominance in the component landscape.

The industrial manufacturing industry segment is expected to account for 31% of the RF Smart Electric Meter market revenue share in 2025, marking it as the leading end-use industry. This segment has been driven by the need for real-time energy monitoring in production facilities to optimize utility costs and support sustainability initiatives. Manufacturers have been implementing smart meters to track energy usage across different production lines, enabling benchmarking and improvement in process efficiency.

Integration with facility management and predictive analytics systems has been supported by RF smart metering platforms that offer granular data and rapid communication. Energy-intensive industries, in particular, have been leveraging these insights to reduce peak demand charges and enforce compliance with environmental targets. The ability to configure meters remotely and update analytics capabilities via software has further enhanced appeal.

Increasing investments in smart grid infrastructure have been supported by policy mandates and financial incentives in multiple countries. Smart meters featuring RF communication are being deployed to enable advanced metering infrastructure that provides real-time consumption data and remote connectivity.

As the focus on energy efficiency, demand response, and outage detection intensifies, smart electric meters are being increasingly preferred over legacy analog systems. Manufacturers are expanding their offerings with integrated modules, cybersecurity protections, and scalable software platforms that support firmware upgrades and remote diagnostics.

With rising global deployment targets and growing consumer awareness around energy usage, strong adoption trends are being projected for the coming decade. The combination of regulatory pressure, grid modernization efforts, and digital transformation in utilities has ensured that RF Smart Electric Meters will continue to secure their role in next-generation metering architecture.

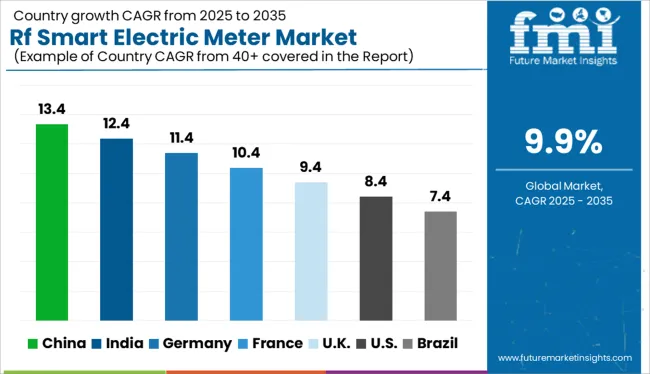

| Country | CAGR |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| France | 10.4% |

| UK | 9.4% |

| USA | 8.4% |

| Brazil | 7.4% |

The residential application segment has been projected to hold 38% of the RF Smart Electric Meter market revenue share in 2025, making it the leading usage category. Growth in this segment has been driven by consumer demand for greater transparency in energy consumption and cost savings. Smart meters in homes have been adopted to support real time billing, load control notifications and integration with home energy management platforms.

Utilities have prioritized residential deployments to meet regulatory targets and improve demand forecasting. Additionally, remote meter reading and reduced operational expenses have increased deployment scalability.

Interoperability with smart thermostats, electric vehicle chargers and solar installations has also enhanced the appeal of RF smart meters in residential settings. As households seek improved energy efficiency and smarter consumption insights, adoption in the residential segment has been strengthened by clear economic and environmental advantages..

The single-phase segment has been projected to hold 42% of the RF Smart Electric Meter market revenue share in 2025, emerging as the dominant meter configuration. Single-phase meters have been deployed extensively in residential and small commercial settings where power demands do not necessitate three-phase infrastructure. The simplicity and lower cost associated with single-phase installations have supported their widespread adoption.

Manufacturers have benefitted from economies of scale and streamlined production to meet rising demand. Integration of RF communication modules into single phase designs has allowed utilities to modernize existing grids without major hardware modifications.

Firmware upgrade capability and real time data delivery have further enhanced performance. As deployment efforts continue to focus on residential and small business locations, single phase smart meters have been prioritized to maximize return on investment through large volume rollouts and standardized implementation approaches..

The RF smart electric meter market has been shaped by increased reliance on real-time diagnostics, demand-response capabilities, and grid-wide data transparency. From 2023 to 2025, RF meters were increasingly integrated into cloud-based systems to support predictive alerts, dynamic pricing, and remote servicing. These meters have shifted from passive measurement tools to intelligent grid components, offering utilities a strategic pathway to improve operational efficiency, customer interaction, and service reliability.

Significant investment in smart grid infrastructure across multiple regions has been catalyzing RF smart electric meter adoption. In 2023, utility operators began upgrading aging grid systems with RF-enabled meters to enable faster outage detection and automated billing. By 2024, mandates were increasingly issued for automated meter reading and demand-response readiness, reinforcing market expansion. In 2025, progress in RF mesh networking was being applied to support two-way communication and remote diagnostics, enabling utilities to streamline maintenance cycles and improve system visibility. These trends have shifted RF smart meters from pilot projects to core smart grid architecture

As cloud-based platforms have been increasingly adopted, RF smart electric meters were integrated into remote diagnostics and grid management systems in 2023. By 2024, real-time data consumption monitoring and predictive outage alerts were being implemented via RF networks to improve service resilience and reduce manual inspection needs. In 2025, two-way RF mesh deployments have been leveraged to support advanced demand-response transactions and time-of-use tariff programs, enabling utilities to optimize load balancing and customer engagement. These deployments have shown that RF smart meters can evolve into central grid intelligence assets rather than mere consumption trackers, positioning providers for deeper engagement within utility ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.1 Billion |

| Application | Residential, Single family, Multi family, Commercial, Education, Healthcare, Retail, Logistics & transportation, Offices, Hospitality, Others, and Utility |

| Phase | Single and Three |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

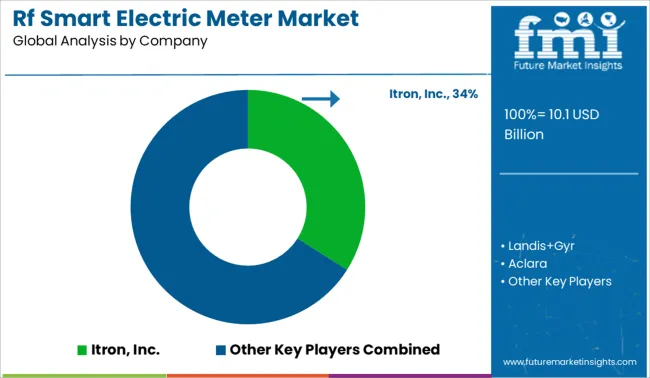

| Key Companies Profiled | Itron, Inc., Landis+Gyr, Aclara, Siemens AG, Schneider Electric, and Others (e.g., GE, Honeywell, Sensus) |

| Additional Attributes | Dollar sales by equipment type (air dryers, filters, condensate drains, aftercoolers, separators), Dollar Dollar sales by meter type (residential, commercial, industrial), Dollar sales by communication technology (RF mesh, cellular, PLC), Trends in low-power wireless and IoT-enabled metering, Use of two-way data analytics and remote firmware updates, Growth in smart grid integration and demand-response programs, Regional deployment patterns across North America, Europe, and APAC. |

The global rf smart electric meter market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the rf smart electric meter market is projected to reach USD 26.1 billion by 2035.

The rf smart electric meter market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in rf smart electric meter market are residential, single family, multi family, commercial, education, healthcare, retail, logistics & transportation, offices, hospitality, others and utility.

In terms of phase, single segment to command 42.0% share in the rf smart electric meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA