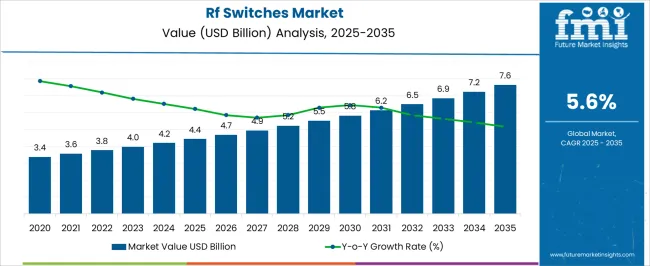

The RF switches market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The chart below displays the growth projection for the RF switches market from 2025 to 2035. Starting at USD 4.4 billion in 2025, the market value climbs steadily each year, reaching USD 7.6 billion by 2035. This consistent increase signals a positive outlook for the industry, fueled by ongoing technological advancements and rising demand across telecommunications and electronics sectors.

Year-over-year growth rate trends show a gradual decline over the period, with the highest rates in the earlier years slowly tapering off as the market matures. Despite the downward slope in growth rate, the market maintains positive expansion annually. The compound annual growth rate for the global market is marked at 5.6%, indicating steady, reliable growth. This forecast suggests that the RF switches market will continue to expand through 2035, driven by innovation, evolving networking needs, and the proliferation of connected devices. While the pace of growth moderates over time, the market remains strong and offers substantial opportunities for manufacturers and solution providers.

The year-over-year (YoY) growth rate trend for the RF switches market offers nuanced insights into the market's trajectory. The chart shows that the YoY growth percentage steadily declines from 2025 to 2035, despite the market’s rising total value. This decreasing slope is indicative of a maturing industry, where initial sharp gains in technology adoption are eventually replaced by incremental improvements and expansion.

Early on, a combination of new deployments in 5G infrastructure and rising consumer electronics demand drives higher YoY rates, reflecting rapid scale-up and new customer acquisition. However, as adoption becomes mainstream, the market’s pace lessens, a sign that saturation is approaching in major segments like mobile and wireless communication. This moderation suggests competition intensifies and innovation cycles take longer to translate into significant new value. The annual growth rate curve shows that while emerging markets and new applications keep the market expanding, existing sectors begin to experience diminishing returns over time. Such trends are typical when a technology transitions from growth phase to sustained demand, requiring companies to focus on differentiation, cost optimization, and advanced features rather than pure volume growth.

| Metric | Value |

|---|---|

| RF Switches Market Estimated Value in (2025 E) | USD 4.4 billion |

| RF Switches Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The RF switches market is primarily driven by the telecommunications and wireless infrastructure sector, which accounts for around 45% of the market share, as switches are essential for routing high-frequency signals in base stations, 5G networks, and mobile communication systems. The aerospace and defense segment contributes about 22%, using RF switches in radar, satellite communication, and electronic warfare applications.

The automotive sector represents close to 15%, integrating RF switches in advanced driver-assistance systems (ADAS), infotainment, and vehicle-to-everything (V2X) communication. Industrial automation and instrumentation account for roughly 10%, deploying switches in testing, measurement, and IoT-enabled systems. The remaining 8% comes from medical equipment and consumer electronics, where RF switches support wireless connectivity, imaging systems, and smart devices. The market is advancing with innovations in high-frequency performance, miniaturization, and low-power operation. Solid-state and MEMS-based RF switches are gaining traction for higher reliability, faster switching speeds, and reduced insertion loss. Integration with 5G and next-generation wireless networks is driving demand for multi-band and broadband-capable switches.

Manufacturers are focusing on compact, modular designs compatible with printed circuit boards (PCBs) and automated assembly processes. Strategic collaborations with telecom operators, automotive OEMs, and defense contractors are expanding deployment. Rising global adoption of wireless communication, IoT, and connected vehicles continues to drive growth in the RF switches market.

The RF switches market is witnessing robust growth driven by increased demand for high frequency communication systems, rising adoption of 5G infrastructure, and expansion in wireless technologies across consumer and industrial applications. These switches play a critical role in signal routing, frequency band selection, and antenna tuning within advanced electronic systems.

With the growing need for faster data transfer and high performance RF systems, manufacturers are focusing on developing compact, low insertion loss, and high isolation switch technologies. Technological advancements in semiconductor materials and the integration of RF front end modules in smartphones, base stations, and IoT devices are further accelerating the market.

Additionally, the shift toward automation and remote connectivity in industrial settings continues to support the adoption of RF switches, especially in mission critical communication environments. The outlook remains positive as industries prioritize efficient spectrum management and performance optimization in increasingly complex RF architectures.

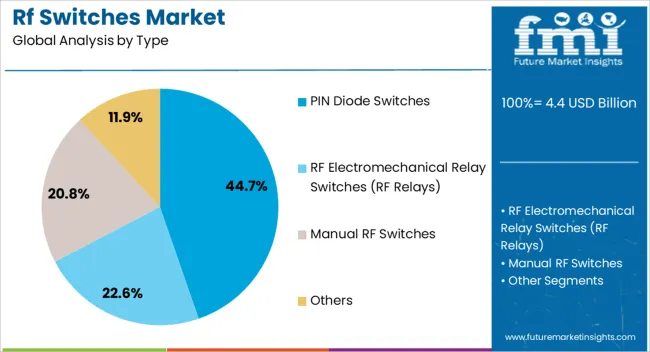

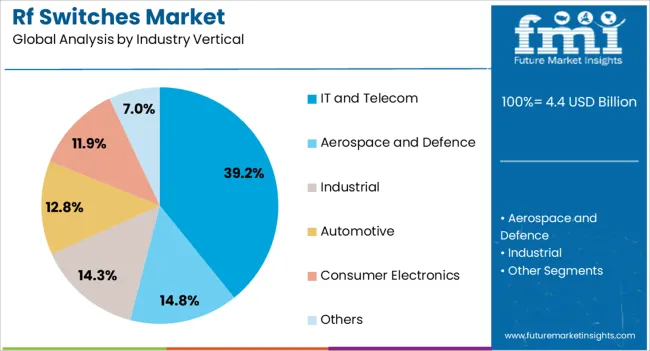

The RF switches market is segmented by type, industry vertical, and geographic regions. By type, the RF switches market is divided into PIN Diode Switches, RF Electromechanical Relay Switches (RF Relays), Manual RF Switches, and Others. In terms of industry vertical, the RF switches market is classified into IT and Telecom, Aerospace and Defence, Industrial, Automotive, Consumer Electronics, and Others. Regionally, the RF switches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PIN diode switches segment is projected to hold 44.70% of the total market revenue by 2025 under the type category, making it the leading segment. This dominance is attributed to the switches’ ability to handle high frequency signals with minimal distortion, making them ideal for RF and microwave applications.

Their fast switching speed, durability, and ability to operate at high power levels are key advantages across defense, aerospace, and telecom infrastructures. PIN diode switches are particularly effective in environments requiring rapid signal routing and robust performance under harsh conditions.

Their widespread use in radar systems, satellite communications, and radio frequency instrumentation has further reinforced their leadership in the type segment. As demand for reliable and scalable RF systems continues to rise, this switch type remains essential for performance-driven RF circuit design.

The IT and telecom segment is expected to account for 39.20% of total market revenue by 2025, positioning it as the dominant industry vertical. This growth is primarily driven by the global rollout of 5G networks, increasing mobile data consumption, and the proliferation of connected devices.

RF switches are fundamental to optimizing signal integrity and enhancing communication efficiency within mobile devices, base stations, and satellite infrastructure. The sector’s continuous need for low-latency and high-bandwidth solutions is accelerating the integration of advanced RF switch configurations.

Additionally, rising investments in network infrastructure modernization and demand for multi-band connectivity are supporting the segment’s expansion. The strategic focus on improving network performance and reducing interference has further elevated the importance of RF switches in the IT and telecom ecosystem.

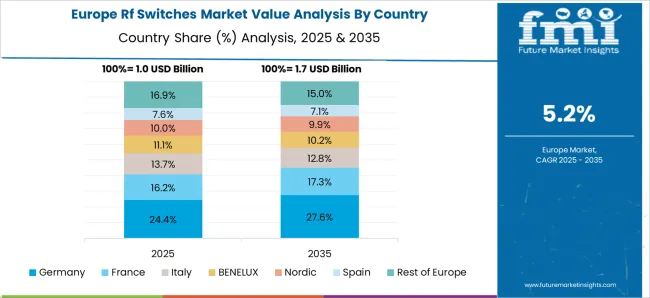

The RF switches market is expanding due to growing adoption of 5G infrastructure, satellite communication, and wireless devices. Asia Pacific leads at USD 3.2 billion in 2024, with China (USD 1.7 billion), Japan (USD 0.9 billion), and South Korea (USD 0.6 billion). Europe contributes USD 2.5 billion, led by Germany (USD 1 billion), France (USD 0.8 billion), and U.K. (USD 0.7 billion). North America holds USD 2.3 billion, mainly the U.S., while Latin America and Middle East & Africa together represent USD 0.7 billion. Applications include telecommunications (50%), aerospace & defense (25%), and consumer electronics (25%).

Market growth is driven by rising demand for high-speed wireless communication, satellite systems, and IoT devices. Telecommunication applications account for 50% of deployment, aerospace & defense 25%, and consumer electronics 25%. Asia Pacific leads at USD 3.2 billion, Europe USD 2.5 billion, and North America USD 2.3 billion. The global rollout of 5G networks covering over 180 countries requires millions of RF switches annually. Satellite communication systems, including LEO and GEO constellations, contribute USD 800–1,000 million in annual demand. Miniaturization of consumer devices has increased adoption of MEMS-based RF switches by 20–25% in smartphones and wearable devices.

Key trends include MEMS-based switches, GaN technology, and multi-band switching. MEMS RF switches, representing 35% of new designs, reduce insertion loss to below 1 dB and occupy less PCB space. GaN-based RF switches, deployed in 20% of 5G base stations, offer higher power handling up to 100 W. Multi-band switches, used in 25% of telecom and aerospace applications, enable operation across 1–40 GHz frequencies. Integration with low-noise amplifiers and tunable filters improves signal integrity. Asia Pacific and Europe lead in deployment of advanced switches, particularly for 5G infrastructure and satellite communication projects.

Opportunities exist in 5G networks, satellite communication, defense radar, and connected consumer devices. Telecommunication applications account for 50% of adoption, aerospace & defense 25%, and consumer electronics 25%. Asia Pacific is projected to reach USD 4.1 billion by 2027, Europe USD 3.1 billion, and North America USD 2.8 billion. Global 5G infrastructure investment exceeds USD 70 billion annually, increasing RF switch demand. Satellite systems, including over 3,000 LEO satellites planned by 2027, create additional opportunities. Expansion of wearable electronics, IoT devices, and connected vehicles further drives market potential for compact, high-performance RF switching solutions.

High component costs, signal interference, and manufacturing complexity restrict adoption. MEMS-based RF switches cost USD 20–60 per unit, while GaN-based switches range from USD 150–300 per unit. High-frequency operation above 20 GHz requires stringent design tolerances, increasing production costs by 15–20%. Integration into complex telecom or defense systems can raise assembly expenses by USD 5–10 per switch. Supply chain disruptions for gallium and specialty semiconductors can delay production by 4–6 weeks. Performance degradation in extreme temperature and high-vibration environments requires rigorous testing, adding USD 1,000–2,000 per batch in quality assurance.

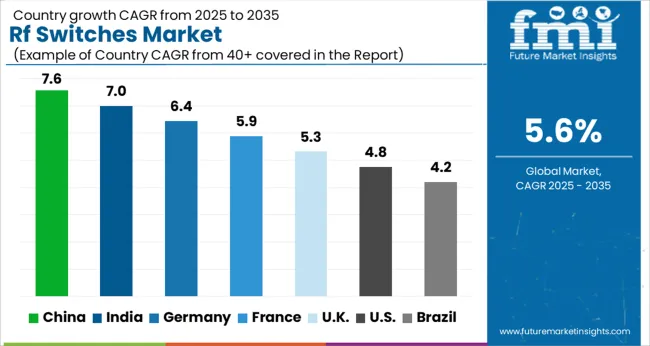

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| U.K. | 5.3% |

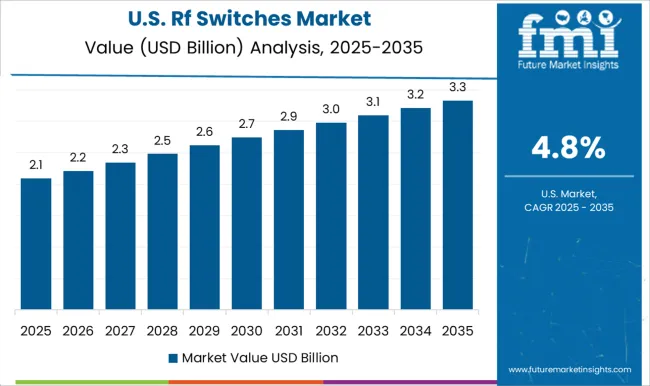

| U.S. | 4.8% |

| Brazil | 4.2% |

The RF switches market is projected to grow at a global CAGR of 5.6% through 2035, driven by increasing adoption in telecommunications, mobile devices, and aerospace applications. China leads at 7.6%, a 1.36× multiple over the global benchmark, supported by BRICS-driven expansion in 5G infrastructure, consumer electronics manufacturing, and industrial automation. India follows at 7.0%, a 1.25× multiple of the global rate, reflecting rising mobile connectivity, telecom upgrades, and electronics production.

Germany records 6.4%, a 1.14× multiple of the benchmark, shaped by OECD-backed innovation in high-performance switches, defense applications, and industrial electronics. The United Kingdom posts 5.3%, 0.95× the global rate, with demand focused on telecom infrastructure, R&D in RF components, and specialty applications. The United States stands at 4.8%, 0.86× the benchmark, with steady uptake in mobile communications, aerospace, and industrial automation. BRICS economies drive most of the market volume, OECD nations emphasize advanced technology and reliability, while ASEAN countries contribute through expanding telecom networks and electronics manufacturing.

The RF switches market in China is projected to grow at a CAGR of 7.6%, driven by increasing deployment in 5G networks, wireless communication infrastructure, and consumer electronics. Domestic suppliers such as Huawei, ZTE, and Hangzhou Silan Microelectronics provide high-performance RF switches with low insertion loss, high isolation, and compact form factors. Technological developments focus on miniaturization, high-frequency performance, and energy efficiency. Adoption is concentrated in telecom networks, base stations, and smartphone devices.

The RF switches market in India is expected to grow at a CAGR of 7.0%, supported by expanding telecommunications infrastructure, increasing smartphone penetration, and deployment of wireless IoT devices. Key suppliers such as AllGo Embedded, Tejas Networks, and STMicroelectronics India provide compact and high-efficiency RF switches for mobile and network applications. Technological improvements focus on frequency stability, low power consumption, and high isolation. Adoption is concentrated in mobile communications, base stations, and IoT-enabled devices.

Germany’s RF switches market is projected to grow at a CAGR of 6.4%, influenced by demand in telecommunications, industrial wireless systems, and automotive connectivity. Suppliers such as Infineon, NXP, and Rohde & Schwarz provide high-frequency RF switches designed for reliability, low power consumption, and precision performance. Adoption is concentrated in telecom networks, industrial automation, and automotive communication modules.

The RF switches market in the United Kingdom is expected to grow at a CAGR of 5.3%, driven by telecom infrastructure upgrades, 5G deployment, and increasing demand for high-performance consumer electronics. Suppliers focus on compact, low-loss, and high-isolation switches for mobile, IoT, and communication networks. Adoption is concentrated in mobile devices, base stations, and enterprise wireless networks.

The RF switches market in the United States is projected to grow at a CAGR of 4.8%, supported by deployment in smartphones, telecom infrastructure, and industrial wireless networks. Key suppliers such as Skyworks, Qorvo, and Analog Devices provide RF switches optimized for high-frequency performance, low power consumption, and integration in compact modules. Adoption is concentrated in telecom networks, smartphones, and industrial communication systems.

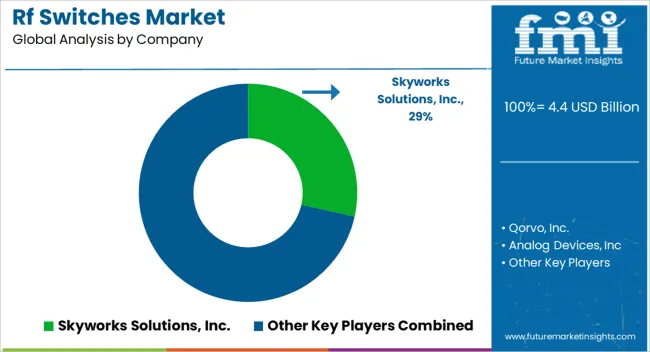

Competition in the RF switches market is being shaped by signal integrity, switching speed, and reliability across telecommunications, aerospace, defense, and industrial applications. Market positions are being reinforced through advanced semiconductor designs, low insertion loss, and robust integration capabilities that support high-frequency performance. Skyworks Solutions, Inc. and Qorvo, Inc. are being represented with RF switches engineered for mobile devices, wireless infrastructure, and high-performance connectivity systems.

Analog Devices, Inc. and Honeywell International Inc. are being promoted with solutions structured for aerospace, defense, and industrial automation, delivering precise signal routing and low power consumption. Infineon Technologies AG and Amphenol Corporation are being applied with components optimized for automotive, 5G, and IoT applications, ensuring stable switching and environmental resilience. Renesas Electronics Corporation is being showcased with switches engineered for compact system integration, high reliability, and compatibility with advanced RF circuits. Strategies in the market are being centered on reducing insertion loss, improving isolation, and supporting multi-band operation for next-generation wireless networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Type | PIN Diode Switches, RF Electromechanical Relay Switches (RF Relays), Manual RF Switches, and Others |

| Industry Vertical | IT and Telecom, Aerospace and Defence, Industrial, Automotive, Consumer Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Skyworks Solutions, Inc., Qorvo, Inc., Analog Devices, Inc, Honeywell International Inc., Infineon Technologies AG, Amphenol Corporation., and Renesas Electronics Corporation |

| Additional Attributes | Dollar sales by switch type and end use, demand dynamics across telecom, aerospace, and defense sectors, regional trends in wireless connectivity adoption, innovation in low-loss, high-frequency, and compact designs, environmental impact of electronic waste, and emerging use cases in 5G networks, IoT devices, and satellite communications. |

The global RF switches market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the RF switches market is projected to reach USD 7.6 billion by 2035.

The RF switches market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in the RF switches market are pin diode switches, RF electromechanical relay switches (RF relays), manual RF switches and others.

In terms of industry vertical, the IT and telecom segment is expected to command 39.2% share in the RF switches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA