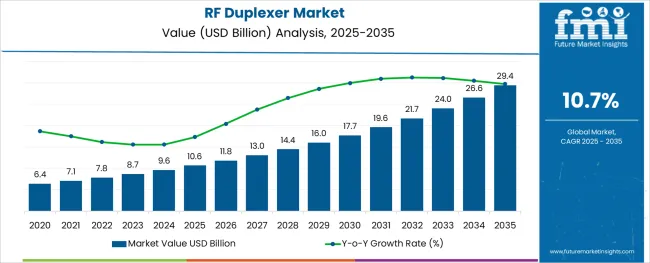

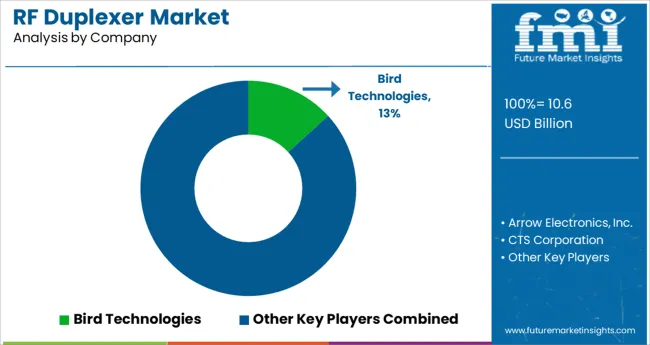

The RF Duplexer Market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 29.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

The RF duplexer market is witnessing sustained momentum as the global shift toward high-speed wireless communication intensifies. With the rollout of 5G, private LTE, and IoT networks, demand for compact, low-loss duplexing components capable of managing uplink and downlink frequencies simultaneously has accelerated.

Manufacturers are focusing on miniaturization, improved isolation, and thermal stability to support expanding applications across defense, consumer electronics, industrial automation, and telecommunications. Innovations in bulk acoustic wave (BAW) and surface acoustic wave (SAW) technologies are allowing more efficient frequency allocation and device integration. Additionally, industry-wide emphasis on spectrum optimization and regulatory compliance has placed RF duplexers at the core of signal chain design.

As the number of connected devices grows and bandwidth requirements rise, the market is expected to benefit from increasing deployments in small cells, routers, automotive radar systems, and industrial monitoring infrastructure, particularly in high-frequency bands.

The market is segmented by Product Type, End-User, Pollutant Type, and Sampling Method and region. By Product Type, the market is divided into Indoor Monitor and Outdoor Monitor. In terms of End-User, the market is classified into Petrochemicals, Residential, Commercial, Power Generation, and Other End Users. Based on Pollutant Type, the market is segmented into Physical Pollutants, Chemical Pollutants, and Biological Pollutants. By Sampling Method, the market is divided into Manual, Continuous, and Intermittent. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

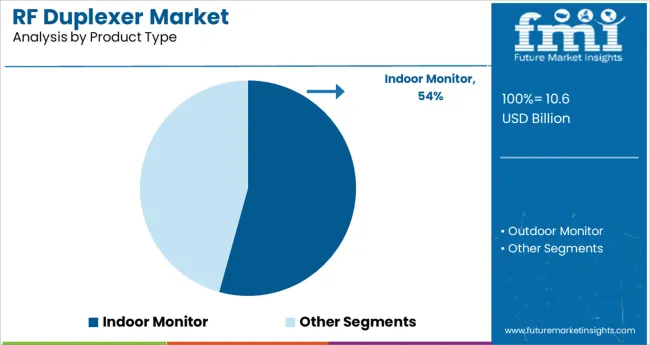

The indoor monitor category is expected to lead the RF duplexer market with a 54.3% revenue share in 2025, reflecting its dominant application in signal management within enclosed communication environments. This leadership is attributed to the increasing adoption of indoor base stations, distributed antenna systems, and smart building infrastructures that require robust duplexing for uninterrupted signal performance.

Indoor environments pose challenges such as signal reflection, interference, and attenuation, which has increased reliance on precision duplexers to maintain signal integrity. The trend toward remote workspaces, indoor public Wi-Fi expansion, and enterprise-grade private 5G deployments has further reinforced demand.

Manufacturers are tailoring indoor duplexer designs to meet compact, low-power, and multi-band requirements, allowing seamless integration into small-form-factor devices and building management systems. This has positioned the indoor monitor subsegment as the cornerstone of indoor connectivity solutions.

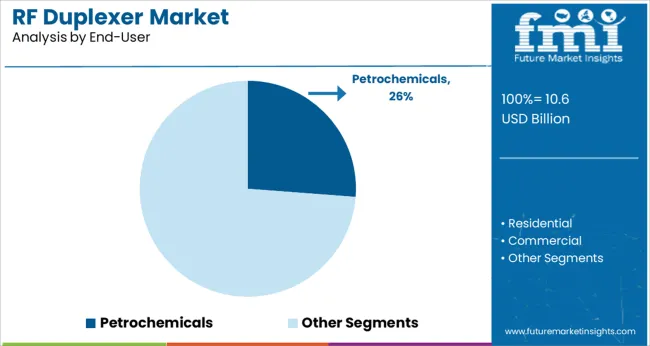

Within the end-user landscape, the petrochemicals industry is projected to account for 26.2% of the RF duplexer market revenue in 2025. This share is supported by the industry's increasing reliance on advanced wireless communication systems for operational safety, remote monitoring, and process automation. In hazardous and high-interference environments such as petrochemical plants, RF duplexers are deployed in industrial wireless sensors, control systems, and communication networks to ensure uninterrupted, interference-free transmission.

The growing adoption of explosion-proof, IoT-enabled infrastructure in petrochemical refineries is amplifying demand for high-performance, rugged duplexers that operate reliably under extreme temperature and electromagnetic conditions.

As digital transformation accelerates across the petrochemical sector, with a focus on asset tracking, predictive maintenance, and worker safety, the integration of RF duplexers into mission-critical wireless networks is expected to further strengthen this segment’s market position.

In terms of end users, the petrochemicals segment is projected to contribute 26.2% of total revenue in 2025, making it a key driver of RF duplexer adoption. This leadership is supported by the need for secure and interference-free communication in hazardous and signal-congested industrial environments. Duplexers are being increasingly integrated into communication modules used in monitoring, remote operations, and safety protocols across petrochemical plants

The rugged nature of duplexers and their ability to perform under harsh environmental conditions have made them suitable for high-frequency telemetry and SCADA systems.

As the industry continues to invest in real-time process control and predictive maintenance, the need for uninterrupted and high-integrity wireless communication systems is rising. The segment’s reliance on automation, coupled with rising safety compliance mandates, has made RF duplexers indispensable in enabling stable and interference-resistant communication networks within petrochemical operations.

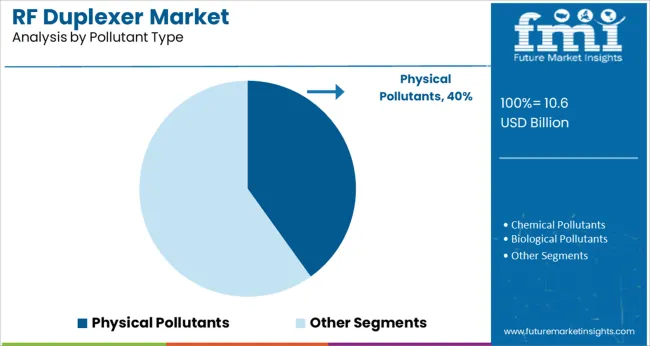

The physical pollutants segment is expected to account for 40.1% of total revenue by 2025 in the pollutant type category, making it the leading subsegment. This share reflects growing integration of RF duplexers in systems monitoring airborne particulate matter and physical contaminants in manufacturing and industrial zones.

Physical pollutant detection systems rely heavily on uninterrupted wireless data transfer from sensors to control systems, requiring duplexers to manage bi-directional RF communication with minimal interference. The use of RF-based monitoring systems in air quality control, mining, and heavy manufacturing has necessitated the deployment of robust duplexer modules.

Their role in supporting high-speed, low-noise transmission from dust, vibration, and acoustic sensors has increased, particularly in enclosed environments where wireless interference is prevalent. The critical need for stable RF communication in pollution monitoring and reporting systems continues to drive preference for high-performance duplexers in this application area.

One of the major factors driving the RF duplexer market is the expanding communications sector, along with consumer electronics usage across the globe. Additionally, the proliferation of smartphones has led to increasing demand for RF duplexers to enhance performance, extend battery life, and offer compatibility with features based on Artificial Intelligence (AI).

The integration of Internet of Things (IoT) solutions across a range of applications in the industrial, residential, and consumer sectors is also driving the global RF duplexer market growth. RF duplexers are used in the manufacturing of drones, smart wearables, smart home devices, driverless cars, and smart manufacturing tools in the electronic sector.

Major growth-inducing factors for the RF duplexer market include technological advancements in the wireless communication sector and the deployment of 5G networks. The rising deployment of LTE networks and increasing demand for RF duplexers in many wireless communication devices are expected to boost the RF duplexer market.

The development of mobile computing devices with advanced functions and multiple frequency bands has created complexity in RF devices. This complexity in RF devices can be a restraining factor for the RF duplexer market. The emergence of automated and integrated solutions in electronic devices is the upcoming trend in the RF duplexer market. Moreover, a rise in infrastructural development in developing countries will create ample opportunities for the RF duplexer market.

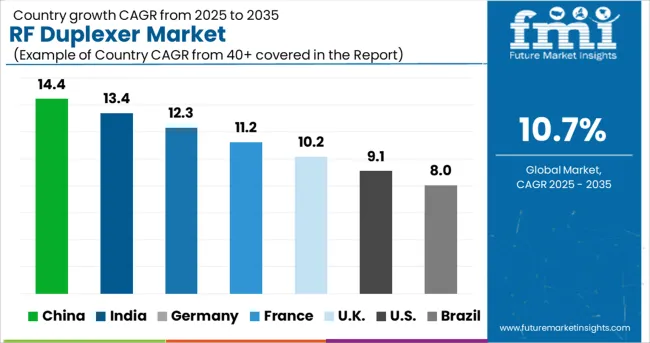

Regionally, the global RF duplexer market can be segmented into North America, Latin America, Western Europe, Eastern Europe, Middle East & Africa (MEA), Asia Pacific excluding Japan (APEJ), and Japan.

North America is expected to hold the largest share of the RF duplexer market and will continue to flourish in its trend of dominance during the forecast period. Due to the increasing wireless communication industry and services in this region, North America will dominate the global RF duplexer market share.

North America is anticipated to control an RF duplexer market share of 34.2% in 2025. Among the total market share of the global RF duplexer market, it is also predicted to maintain steady growth throughout the forecasted period.

Europe’s RF duplexer market is predicted to experience significant growth and hold a market share of 24.3% in 2025, due to the presence of RF duplexer providers in countries such as Italy, the UK, and Germany.

Asia Pacific is the fastest-growing region due to technological advancement in the wireless industry that creates huge opportunities in the cellular segment which is expected to contribute to major growth in the RF duplexer market. There are many countries including the United States, Canada, India, and China. These economies are some of the fastest-growing economies.

How is the Start-up Ecosystem in the RF Duplexer Market?

The start-up ecosystem in the RF duplexer market is clouded with multiple players trying to make a breakthrough as LTE networks are deployed more widely, the market for RF duplexers is expected to grow.

RF duplexers are predicted to gain popularity in the coming years as wireless communication devices like tablets and cell phones become more prevalent. However, the complexity of RF devices is expected to harm the RF duplexer market. Even so, the emerging automation trend is likely to open new doors for the RF duplexer market.

What is the Competition Landscape in the RF Duplexer Market?

A few prominent players in the RF Duplexer market include Bird Technologies, Arrow Electronics, Inc., CTS Corporation, Qorvo, Inc., Wainwright Instruments GmbH, Anatech Electronics, Inc., Microwave Filter Company Inc., Renaissance Electronics & Communications, LLC, TDK Corporation, DFINE Technology Co., Ltd., Westell Technologies, Inc., and Broadcom Ltd.

Emerging Trends in the RF duplexer market are brought about as a result of the major players' adoption of several growth strategies, including product launches, acquisitions, and collaborations.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, End User, Pollutant Type, Sampling Method, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Bird Technologies; Arrow Electronics, Inc.; CTS Corporation; Qorvo, Inc.; Wainwright Instruments GmbH; Anatech Electronics, Inc.; Microwave Filter Company Inc.; Renaissance Electronics & Communications; LLC; TDK Corporation; DEFINE Technology Co., Ltd.; Westell Technologies, Inc.; Broadcom Ltd. |

| Customization | Available Upon Request |

The global rf duplexer market is estimated to be valued at USD 10.6 billion in 2025.

It is projected to reach USD 29.4 billion by 2035.

The market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types are indoor monitor and outdoor monitor.

petrochemicals segment is expected to dominate with a 26.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA