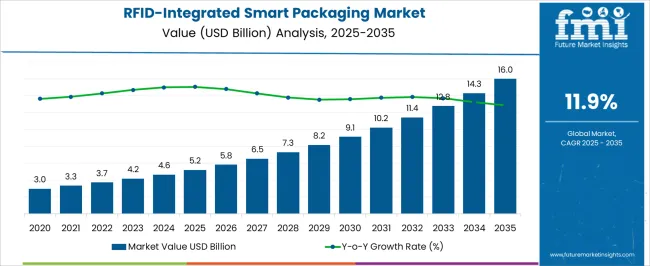

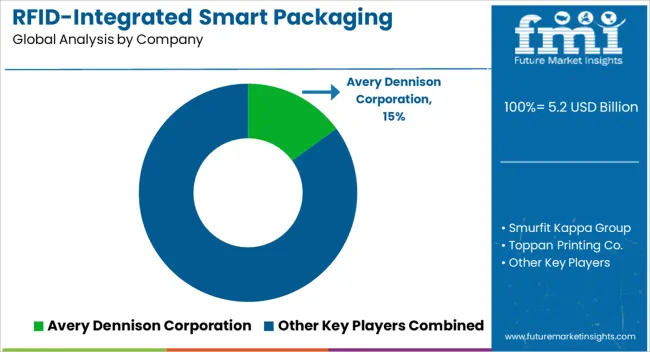

A valuation of USD 5.2 billion is projected for the RFID-integrated smart packaging market in 2025, with expansion expected to reach USD 15.6 billion by 2035. This growth represents an absolute increase of USD 10.4 billion across the decade, reflecting a compound annual growth rate (CAGR) of 11.9%. The trajectory signals a three-fold enlargement in overall market size within the forecast horizon.

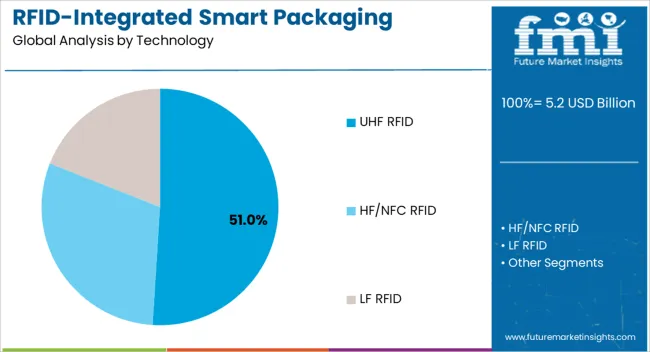

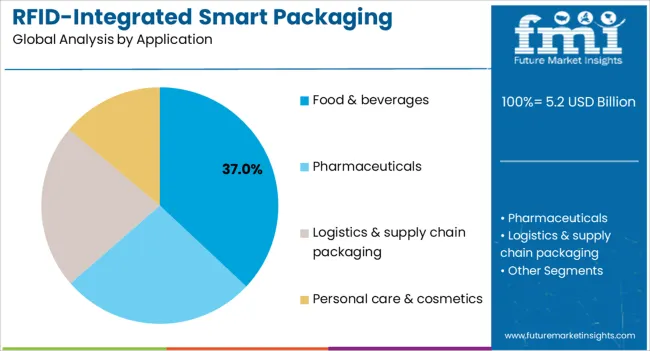

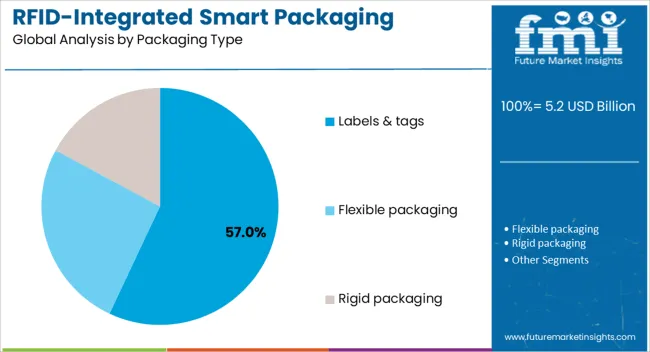

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 5.2 billion to USD 9.2 billion, adding nearly USD 4.0 billion, equal to about 38% of the total decade expansion. This stage is anticipated to be shaped by greater adoption of UHF RFID systems in food and beverage applications, where supply chain transparency and anti-counterfeiting remain central. UHF RFID, commanding a 51.0% share in 2025, is positioned to anchor growth momentum, while labels & tags are set to maintain their lead with a 57.0% share.

In the latter half from 2030 to 2035, acceleration is expected as valuations rise from USD 9.2 billion to USD 15.6 billion, adding USD 6.4 billion or 62% of total growth. This period is projected to be reinforced by strong pharmaceutical demand, where serialization and track-and-trace formulations are set to expand above market average. Personal care & cosmetics are also anticipated to strengthen their contribution, supported by premium brand protection segments growing at over 12.0% CAGR.

| Metric | Value |

|---|---|

| RFID-Integrated Smart Packaging Market Estimated Value in (2025E) | USD 5.2 Billion |

| RFID-Integrated Smart Packaging Market Forecast Value in (2035F) | USD 15.6 Billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

Between 2020 and 2024, the RFID-integrated smart packaging market expanded steadily, supported by food and beverage manufacturers adopting smart packaging to achieve consistent supply chain visibility and reduce counterfeiting in processed products. During this period, global suppliers dominated, controlling the majority of industry revenues by leveraging wide technology portfolios and strong distribution networks. Differentiation was largely based on tag reliability, regulatory compliance, and cost efficiency, while digital integration services and real-time tracking capabilities remained in their development stages, contributing minimally to total value.

Demand is forecast to reach USD 5.2 billion in 2025, and the revenue structure is expected to shift as pharmaceuticals and logistics accelerate. Traditional packaging leaders are projected to face rising competition from technology-first suppliers offering integrated RFID solutions with comprehensive data analytics positioning. Leading incumbents are anticipated to pivot toward hybrid models by integrating advanced sensors, blockchain connectivity, and AI-powered analytics platforms to retain their relevance. Emerging participants focusing on sustainability and circular economy applications are forecast to gain share, particularly in Asia-Pacific where demand for smart logistics and brand protection is expanding rapidly.

Growth in the RFID-integrated smart packaging market is being supported by supply chain transparency requirements and anti-counterfeiting needs across food, pharmaceutical, logistics, and personal care applications. Increased consumer awareness regarding product authenticity, track-and-trace capabilities, and regulatory compliance has been translated into higher usage of UHF RFID, HF/NFC RFID, and integrated sensor technologies within smart packaging formulations.

A shift toward digital supply chains is being reinforced by regulatory scrutiny of pharmaceutical serialization, encouraging manufacturers to prioritize verified, technology-enabled tracking systems. Demand for logistics & supply chain packaging, particularly in e-commerce and retail distribution, is accelerating the adoption of specialized RFID-integrated solutions. Food & beverages sectors are integrating smart packaging for freshness monitoring and inventory management benefits, further supporting momentum. Technological advances in miniaturization and cost reduction are enabling greater accessibility and adoption, ensuring long-term application viability.

The RFID-integrated smart packaging market has been segmented across technology type, application, packaging type, end use industry, and region. Each category reflects the diverse adoption pathways and performance priorities driving demand across industries. Technology type segmentation includes UHF RFID, HF/NFC RFID, and LF RFID. By application, the market spans food & beverages, pharmaceuticals, logistics & supply chain packaging, and personal care & cosmetics, each representing unique demand drivers. In terms of packaging type, the market is divided into labels & tags, flexible packaging, and rigid packaging. Based on end-use industry, the market is divided into food & beverage manufacturing, pharmaceutical companies, logistics & distribution, personal care manufacturers, and retail & e-commerce. Regionally, the market is analyzed across Europe, North America, Asia-Pacific, and rest of world.

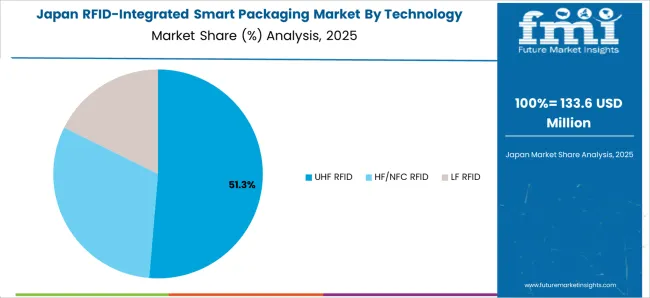

UHF RFID is projected to dominate with a 51.0% share of the market in 2025, outpacing other technologies due to superior reading range and bulk scanning capabilities. Growth will be driven by supply chain applications requiring inventory management across large warehouses and distribution centers, where long-range reading provides operational efficiency advantages. A CAGR of 12.5% is anticipated for UHF RFID through 2035, making it the leading growth engine of the category. HF/NFC RFID, while maintaining relevance for consumer-facing applications, is expected to grow more moderately at 11.2%. As automation and large-scale deployment gain importance, UHF RFID is expected to solidify its role as the backbone of smart packaging innovation.

The food and beverages segment is anticipated to lead with a 37.0% share in 2025, supported by continuous demand for supply chain transparency, freshness monitoring, and inventory optimization. Cold chain management, expiration tracking, and anti-counterfeiting applications will sustain demand, reinforced by rising consumption of packaged and processed foods. Pharmaceuticals are expected to post faster growth at a CAGR of 12.8%, particularly within serialization and track-and-trace requirements. Personal care & cosmetics, though smaller at 14.0% share, are projected to expand at 12.3%, making them a high-potential growth avenue. As regulatory compliance and brand protection accelerate globally, applications in healthcare and premium consumer goods are expected to increasingly complement the dominance of traditional food and beverage uses.

Labels & tags are forecast to maintain their lead with a 57.0% market share in 2025, favored for their compatibility with existing packaging infrastructure and cost-effective integration across multiple product categories. Their ease of application, scalability, and ability to retrofit existing packaging lines make labels & tags the preferred format for manufacturers. While labels & tags dominate, flexible packaging is projected to record a faster CAGR of 12.4%, driven by technological advancements that improve RFID integration with films and pouches. Rigid packaging will continue to serve specialized applications in pharmaceuticals and electronics, yet labels & tags will remain the most scalable and cost-effective solution. As personalized packaging and advanced supply chain tracking expand, labels & tags are expected to maintain their leadership position while complementing other packaging innovations.

Regulatory shifts, evolving supply chain requirements, and technology advancement are reshaping the RFID-integrated smart packaging market. While transparency mandates and anti-counterfeiting measures support expansion, implementation costs, infrastructure limitations, and integration complexity introduce barriers that companies must strategically navigate through 2035.

The RFID-integrated smart packaging market is being reinforced by integration into comprehensive supply chain digitalization frameworks, where smart packaging serves as data collection points for end-to-end visibility. Retailers and manufacturers are increasingly embedding RFID technology into packaging to enable real-time inventory management, reduce shrinkage, and improve demand forecasting accuracy.

Pharmaceutical companies are leveraging integrated solutions for serialization compliance, creating detailed audit trails from manufacturing to patient delivery. As digital supply chain platforms expand, RFID packaging with cloud connectivity and analytics capabilities are expected to become strategic differentiators across consumer goods and healthcare portfolios.

Market growth is being constrained by high initial implementation costs and infrastructure requirements that particularly affect small and medium enterprises. RFID integration requires specialized printing equipment, reader infrastructure, and software systems that represent significant capital expenditure beyond traditional packaging investments.

Technical expertise requirements for system integration, tag programming, and data management create additional barriers for companies without dedicated IT resources. Legacy packaging equipment compatibility issues further complicate adoption, particularly for manufacturers with established production lines. This cost structure is anticipated to limit adoption rates among smaller players, potentially concentrating market growth within larger enterprises with sufficient resources for comprehensive technology integration.

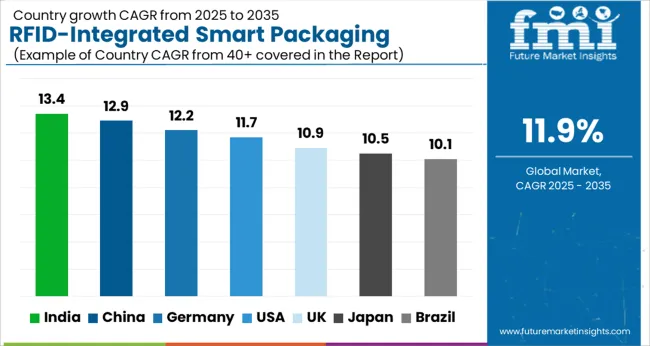

| Country | CAGR |

|---|---|

| China | 12.9% |

| India | 13.4% |

| Germany | 12.2% |

| USA | 11.7% |

| UK | 10.9% |

| Japan | 10.5% |

| Brazil | 10.1% |

A varied country trajectory is observed for the RFID-integrated smart packaging market, reflecting regulatory frameworks, digitalization maturity, and supply chain complexity. Asia's momentum is projected to be led by India (13.4% CAGR) and China (12.9%), where pharmaceutical traceability mandates, food retail digitization, and e-commerce security requirements are expected to scale under supportive policy and expanding manufacturing capabilities. The United States is anticipated to advance at 11.7% CAGR, with steady uptake across pharmaceuticals and food sectors as FDA regulations and supply chain security initiatives gain prominence. Europe is set to remain a high-value hub with Germany leading at 12.2% CAGR, driven by EU pharmaceutical serialization requirements and sustainability tracking mandates. The UK at 10.9% CAGR is positioned for retail-driven adoption, while Japan's 10.5% CAGR reflects technology integration in pharmaceuticals and consumer electronics. Brazil's 10.1% CAGR positions it as Latin America's anchor, aided by anti-counterfeit programs in food and beverages.

The RFID-integrated smart packaging market in the United States is forecasted to grow from USD 1.2 billion in 2025 to USD 3.7 billion by 2035, reflecting a CAGR of 11.7%. Growth momentum is expected to remain robust, with annual increases ranging from 10.8% to 12.5%, demonstrating resilience across pharmaceutical, food & beverage, and logistics sectors.

The expansion is being driven by FDA DSCSA traceability regulations requiring pharmaceutical serialization and comprehensive supply chain documentation. Food safety mandates are projected to strengthen adoption as manufacturers focus on contamination prevention, recall efficiency, and inventory optimization. The logistics & supply chain sector is also expected to integrate RFID solutions at an accelerated pace, aligning with e-commerce growth and warehouse automation trends.

A transition toward comprehensive data analytics platforms integrated with RFID packaging is anticipated, as manufacturers emphasize real-time visibility and predictive capabilities. Strategic collaborations between packaging manufacturers and technology providers are expected to improve market penetration across mid-sized enterprises. By 2035, the United States is projected to maintain its position as a technology leader, supported by regulatory frameworks encouraging supply chain digitalization and advanced tracking solutions.

The RFID-integrated smart packaging market in India is expected to advance at the fastest CAGR globally of 13.4% between 2025 and 2035, supported by government mandates on pharmaceutical traceability and rapid digitization of food retail infrastructure. Strong policy support for digital supply chains and manufacturing technology adoption is anticipated to create significant market momentum. Government initiatives requiring drug serialization and anti-counterfeiting measures are projected to drive pharmaceutical sector demand, while expanding organized retail and e-commerce platforms will accelerate food & beverage applications.

Growth is expected to be reinforced by domestic manufacturing capabilities in RFID technology and packaging materials, reducing import dependency and improving cost competitiveness. The country's large pharmaceutical manufacturing base and growing consumer goods sector provide substantial addressable markets for smart packaging solutions. Technology transfer programs and foreign direct investment in manufacturing are likely to enhance local production capabilities and reduce implementation costs.

Infrastructure development in logistics and cold chain management is projected to create additional demand for temperature-sensitive and inventory management applications.

Digital payment systems integration and consumer awareness campaigns about product authenticity are expected to support market acceptance. By 2035, India is forecasted to emerge as a key production hub for RFID-integrated packaging solutions, serving both domestic and export markets.

The RFID-integrated smart packaging market in China is projected to grow at a CAGR of 12.9% from 2025 to 2035, driven by supply chain security requirements in pharmaceuticals and e-commerce sectors. The country's position as a global manufacturing hub and technology leader is expected to accelerate domestic adoption while supporting export-oriented production capabilities. Strong government support for digital infrastructure and Industry 4.0 initiatives provides favorable policy framework for smart packaging implementation.

E-commerce platforms and logistics companies are anticipated to be primary adoption drivers, implementing RFID solutions for inventory management, authenticity verification, and delivery optimization. The pharmaceutical sector faces increasing regulatory pressure for product serialization and supply chain transparency, creating substantial demand for integrated tracking solutions. Consumer goods manufacturers are expected to adopt smart packaging for brand protection and consumer engagement applications.

Technology integration capabilities and manufacturing scale advantages position China as a cost-effective supplier for global markets. Research and development investments in sensor technology, data analytics, and packaging materials are likely to enhance product innovation and competitive positioning. Export opportunities in developing markets where Chinese packaging solutions offer favorable cost-performance ratios are expected to supplement domestic demand.

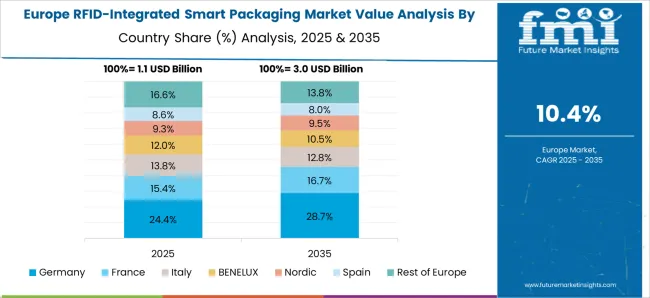

The RFID-integrated smart packaging market in Germany is expected to expand at a CAGR of 12.2% between 2025 and 2035, driven by EU pharmaceutical serialization requirements and sustainability tracking mandates. The country's leadership in manufacturing technology and regulatory compliance creates favorable conditions for advanced packaging solutions adoption. Strong automotive, pharmaceutical, and consumer goods industries provide diverse application opportunities across multiple sectors.

EU Falsified Medicines Directive compliance requirements are projected to drive pharmaceutical sector demand, while sustainability reporting obligations create opportunities for supply chain transparency applications. German manufacturers' focus on Industry 4.0 and digital transformation initiatives supports integration of smart packaging solutions with existing production systems. Premium consumer goods companies are expected to adopt RFID packaging for brand protection and consumer engagement purposes.

Technology development capabilities in sensors, embedded systems, and data analytics position Germany as an innovation leader in smart packaging solutions. Export opportunities within the EU market and developing economies where German engineering reputation provides competitive advantages are anticipated to supplement domestic growth. Collaboration between packaging manufacturers, technology providers, and end-user industries creates comprehensive ecosystem development supporting market expansion.

The RFID-integrated smart packaging market in Japan is expected to expand at a CAGR of 10.5% between 2025 and 2035, driven by stringent food safety regulations, advanced logistics infrastructure, and rising consumer expectations for product authenticity and quality assurance. Japan’s leadership in electronics, sensor technologies, and miniaturization creates strong foundations for widespread adoption of RFID-enabled packaging solutions. Key sectors including pharmaceuticals, food & beverages, automotive, and high-value consumer electronics provide diverse application opportunities.

Government initiatives promoting food traceability, pharmaceutical safety, and sustainable packaging practices are expected to accelerate market uptake. Japan’s focus on Society 5.0 and digital transformation policies supports the integration of RFID with IoT, AI, and blockchain platforms for real-time supply chain transparency. High consumer preference for premium, safe, and sustainable products encourages adoption among food brands, luxury goods, and personal care industries.

Japan’s technology-driven innovation ecosystem, combined with its global leadership in electronics and semiconductor components, positions the country as a key hub for RFID smart packaging R&D. Export opportunities across Asia-Pacific, where Japanese quality and precision manufacturing hold strong reputations, are expected to supplement domestic growth. Strategic collaborations among packaging companies, tech providers, and logistics operators foster an integrated ecosystem supporting RFID adoption.

The RFID-integrated smart packaging market is moderately fragmented, with global leaders, established packaging companies, and technology specialists competing across diverse application segments. Global leaders such as Avery Dennison Corporation, Smurfit Kappa Group, and CCL Industries hold significant market positions, supported by comprehensive technology portfolios, integrated manufacturing capabilities, and established customer relationships across multiple industries. Their approaches are increasingly centered on complete solution offerings combining RFID hardware, software platforms, and application support services.

Established technology companies including Zebra Technologies, Checkpoint Systems, and SATO Holdings are actively addressing demand for specialized RFID readers, software integration, and data management platforms. Their strengths are anchored in technical expertise, system integration capabilities, and vertical market specialization in retail, healthcare, and logistics applications. Value-added services including consulting, training, and ongoing technical support are being leveraged to strengthen customer relationships and increase solution adoption rates.

Specialized packaging providers and regional technology companies focus on application-specific solutions for pharmaceutical serialization, food safety, and brand protection applications. Their adaptability in customizing solutions for specific industry requirements and addressing local regulatory compliance needs provides competitive advantages despite limited global scale.

Competitive differentiation is expected to continue shifting toward integrated ecosystems combining hardware reliability, software functionality, and data analytics capabilities, ensuring comprehensive supply chain visibility and regulatory compliance for end-user customers.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 billion |

| Technology Type | UHF RFID, HF/NFC RFID, LF RFID |

| Application | Food & Beverages, Pharmaceuticals, Logistics & Supply Chain Packaging, Personal Care & Cosmetics |

| Packaging Type | Labels & Tags, Flexible Packaging, Rigid Packaging |

| End-use Industry | Food & Beverage Manufacturing, Pharmaceutical Companies, Logistics & Distribution, Personal Care Manufacturers, Retail & E-commerce |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Avery Dennison Corporation, Smurfit Kappa Group, Toppan Printing Co., Sealed Air Corporation, Zebra Technologies, Checkpoint Systems, SATO Holdings, Identiv Inc., UPM Raflatac, CCL Industries |

| Additional Attributes | Dollar sales by packaging type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging startups, buyer preferences for sustainable versus conventional materials, integration with AI-driven design and digital manufacturing platforms, innovations in multi-material packaging capabilities and closed-loop recycling systems, and adoption of smart packaging solutions with embedded sensors, QR codes, and interactive features for enhanced consumer engagement. |

The global RFID-integrated smart packaging market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the RFID-integrated smart packaging market is projected to reach USD 16.0 billion by 2035.

The RFID-integrated smart packaging market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in RFID-integrated smart packaging market are uhf RFID, hf/nfc RFID and lf RFID.

In terms of application, food & beverages segment to command 37.0% share in the RFID-integrated smart packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA