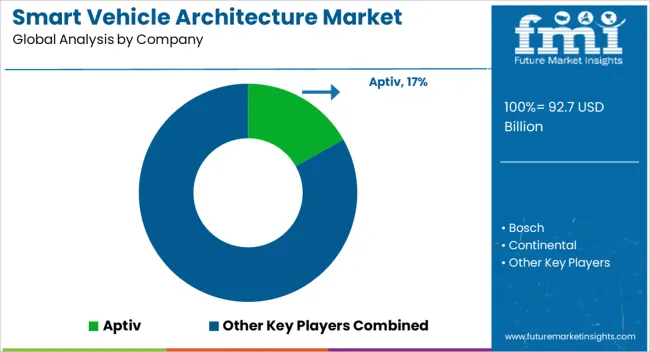

The smart vehicle architecture market is valued at USD 92.7 billion in 2025 and is expected to reach USD 493.3 billion by 2035, with a CAGR of 18.2%. From 2021 to 2025, the market grows from USD 40.2 billion to USD 92.7 billion, passing through values of USD 47.5 billion, USD 56.1 billion, USD 66.3 billion, and USD 78.4 billion. This early phase reflects strong growth driven by advancements in connected technologies, autonomous driving features, and increasing demand for smart mobility solutions.

As vehicle manufacturers adopt more advanced architectures to enable smarter and more efficient systems, the market experiences a significant acceleration in demand. Between 2026 and 2030, the market experiences robust expansion, rising from USD 92.7 billion to USD 213.8 billion, with values progressing through USD 109.5 billion, 129.5 billion, and 153.0 billion. The peak of this phase highlights the widespread adoption of integrated smart vehicle solutions, driven by the rapid advancements in autonomous systems, vehicle-to-everything (V2X) communication, and AI-powered systems. From 2031 to 2035, the market continues to rise sharply, reaching USD 493.3 billion, with intermediate values of USD 180.9 billion, USD 213.8 billion, USD 252.7 billion, USD 298.7 billion, and USD 353.1 billion. This period marks the market's peak, driven by the continued integration of advanced technologies in every aspect of automotive design, thereby solidifying the importance of smart vehicle architectures in the global automotive industry.

| Metric | Value |

|---|---|

| Smart Vehicle Architecture Market Estimated Value in (2025 E) | USD 92.7 billion |

| Smart Vehicle Architecture Market Forecast Value in (2035 F) | USD 493.3 billion |

| Forecast CAGR (2025 to 2035) | 18.2% |

The automotive electronics market is the largest contributor, accounting for approximately 35-40%, as the smart vehicle architecture heavily relies on advanced electronic components like sensors, controllers, and infotainment systems. These electronics are critical for creating connected and intelligent vehicles, fueling the demand for smarter architectures. The electric vehicle (EV) market follows with around 25-30%, as the shift toward electric vehicles requires sophisticated vehicle architectures to optimize battery management systems, electric drivetrains, and charging infrastructure. The rapid growth of the EV market drives this segment's expansion.

The autonomous vehicle market contributes about 15-18%, as the rise of autonomous driving technologies necessitates advanced smart vehicle architectures that integrate sensors, AI systems, and V2X communication technologies to ensure vehicle safety and operation. The vehicle telematics market accounts for approximately 10-12%, as telematics systems play a key role in connected vehicle infrastructure. These systems enable real-time data exchange, navigation, and vehicle performance tracking, contributing to the adoption of smart vehicle architecture. The automotive IoT market contributes around 8-10%, as IoT integration into vehicles supports vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication.

The smart vehicle architecture market is undergoing rapid evolution, driven by the convergence of electrification, automation, and connectivity within the automotive industry. Increasing demand for intelligent, software-defined vehicles has shifted OEM focus toward scalable and flexible architecture systems that can support over-the-air updates, real-time diagnostics, and advanced data processing.

Rising consumer expectations for safety, comfort, and digital features have necessitated a reconfiguration of traditional vehicle systems into centralized or zonal architectures that enable seamless integration of sensors, ECUs, and software modules. The market is expected to witness accelerated adoption of smart architectures as regulatory mandates on safety and emissions grow more stringent globally.

Future growth will be reinforced by the expansion of autonomous driving programs and the proliferation of electric vehicles, both of which require robust, adaptive, and high-bandwidth vehicle architecture platforms capable of managing complex operational demands and data-driven performance enhancements

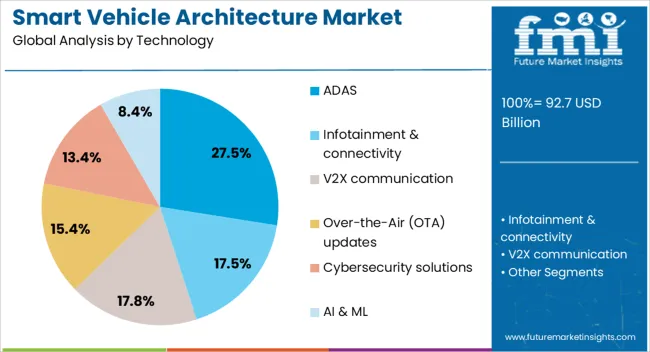

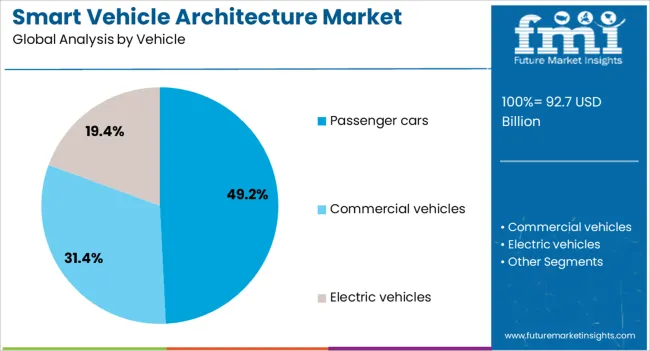

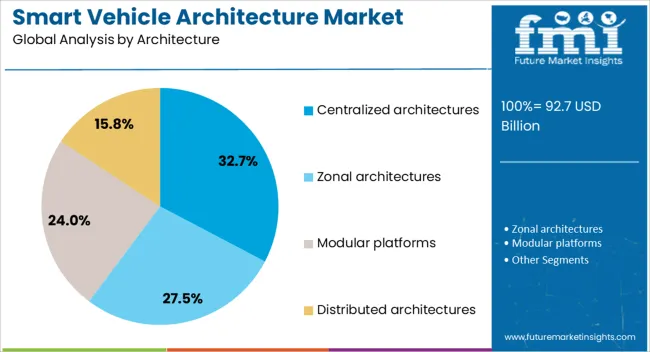

The smart vehicle architecture market is segmented by technology, vehicle, architecture, application, and geographic regions. By technology, smart vehicle architecture market is divided into ADAS, Infotainment & connectivity, V2X communication, Over-the-Air (OTA) updates, Cybersecurity solutions, and AI & ML. In terms of vehicle, smart vehicle architecture market is classified into Passenger cars, Commercial vehicles, and Electric vehicles. Based on architecture, smart vehicle architecture market is segmented into Centralized architectures, Zonal architectures, Modular platforms, and Distributed architectures. By application, smart vehicle architecture market is segmented into Autonomous driving, Infotainment & user experience, Safety & security, Fleet management, and Energy management. Regionally, the smart vehicle architecture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ADAS technology segment holds a prominent 27.5% share in the smart vehicle architecture market, highlighting its foundational role in transforming vehicle safety and automation capabilities. Advanced driver-assistance systems depend heavily on integrated vehicle architecture that enables rapid data exchange between sensors, actuators, and central processing units.

The growth of this segment is fueled by rising consumer awareness and regulatory initiatives mandating technologies like lane departure warnings, automatic emergency braking, and adaptive cruise control. To accommodate these features, automakers are investing in architectures that support sensor fusion and low-latency communication.

The increasing use of AI and machine learning in ADAS functionality further necessitates robust computing environments enabled by advanced architecture designs. As vehicles evolve toward higher levels of autonomy, the reliance on optimized architectural frameworks to deliver ADAS functionality will continue to intensify, reinforcing its position within the market

Passenger cars represent the leading vehicle category with a 49.2% share in the smart vehicle architecture market, driven by the high adoption rate of connected and automated technologies among consumer vehicles. As OEMs prioritize differentiation through digital interfaces, safety features, and in-car connectivity, smart vehicle architecture becomes critical to efficiently manage complex electronic systems.

The segment benefits from rising demand for electric and hybrid passenger cars, which require integrated architectures capable of managing propulsion, battery management, infotainment, and safety systems simultaneously. Consumers’ increasing preference for seamless user experiences, including digital cockpit functions and voice-controlled systems, further underscores the importance of cohesive architecture.

Automakers are transitioning from legacy distributed systems to centralized or zonal configurations within passenger cars to reduce wiring complexity, enhance computational efficiency, and streamline software updates, ensuring the segment's sustained dominance

Centralized architectures account for 32.7% of the smart vehicle architecture market, reflecting the growing industry shift away from fragmented electronic control units toward unified, high-performance computing systems. Centralized configurations enable enhanced control, simplified wiring, and greater software scalability, addressing the demands of modern automotive applications such as ADAS, electrification, and connected services.

This segment is expanding as OEMs seek to reduce development complexity and improve vehicle efficiency through consolidated processing platforms. The architecture supports advanced features like autonomous driving and digital twins by offering high-speed data processing and seamless communication across vehicle domains.

As software content in vehicles continues to grow, centralized systems provide a future-proof foundation that allows easier integration of new functionalities and faster deployment of updates. With scalability and cost-efficiency emerging as critical design priorities, centralized architectures are expected to play a pivotal role in shaping next-generation vehicle platforms

Smart vehicle architecture (SVA) serves as a framework that integrates hardware, software, and communication networks within a vehicle to enable features such as autonomous driving, electric propulsion, advanced driver-assistance systems (ADAS), and enhanced infotainment. The market is driven by the growing demand for electric and connected vehicles, advancements in automation, and the need for more efficient vehicle designs. However, challenges such as high development costs, complex system integration, and cybersecurity concerns may hinder market growth. Opportunities lie in the continuous development of EVs, autonomous driving technologies, and the demand for integrated systems that offer better user experiences and operational efficiency.

The increasing demand for connected and autonomous vehicles is a primary driver of the smart vehicle architecture market. As consumers demand more advanced features in their vehicles, automotive manufacturers are investing in next-generation technologies that integrate AI, machine learning, and real-time data processing. Autonomous driving systems, which rely heavily on smart vehicle architectures, are at the forefront of this transformation, offering improved safety and convenience. The rise of electric vehicles (EVs) has created a need for more efficient and integrated vehicle systems that optimize power distribution, connectivity, and overall performance. As the automotive industry focuses on improving the driving experience through smart technologies, the demand for sophisticated vehicle architecture continues to rise.

The integration of multiple advanced technologies, such as autonomous systems, electric propulsion, and advanced infotainment, requires substantial R&D investment and a high level of technical expertise. Integrating these systems into existing vehicle platforms without compromising performance, safety, or cost is a significant challenge. Regulatory concerns, especially around data privacy, cybersecurity, and vehicle safety standards, add complexity to the development and deployment of smart vehicle architectures. Manufacturers must adhere to stringent regulations, which vary across regions, to ensure compliance and consumer trust. These challenges create barriers to entry but also present opportunities for companies that can offer seamless integration, cost-effective solutions, and robust compliance with regulatory standards.

The smart vehicle architecture market presents significant opportunities in the growing electric vehicle (EV) and autonomous driving sectors. As EV adoption increases, there is a rising demand for innovative vehicle architectures that can optimize energy efficiency, enhance battery management, and support vehicle-to-grid communication. Smart vehicle architecture plays a crucial role in ensuring seamless integration between the vehicle’s powertrain, battery systems, and charging infrastructure. Similarly, the advancement of autonomous driving technologies offers further opportunities, as these vehicles require highly sophisticated architectural systems to process vast amounts of data from sensors, cameras, and radar. Companies focusing on electric vehicle platforms, autonomous driving solutions, and integrated vehicle systems that offer enhanced user experiences are well-positioned to capitalize on the growth of these sectors.

5G connectivity is crucial for enabling real-time data exchange between vehicles, infrastructure, and cloud systems, facilitating better vehicle-to-everything (V2X) communication and supporting advanced ADAS features. AI is being integrated into smart vehicle architectures to enable autonomous decision-making, predictive maintenance, and personalized user experiences. Additionally, over-the-air (OTA) updates allow manufacturers to remotely update vehicle software, ensuring that vehicles are always equipped with the latest features and safety enhancements.

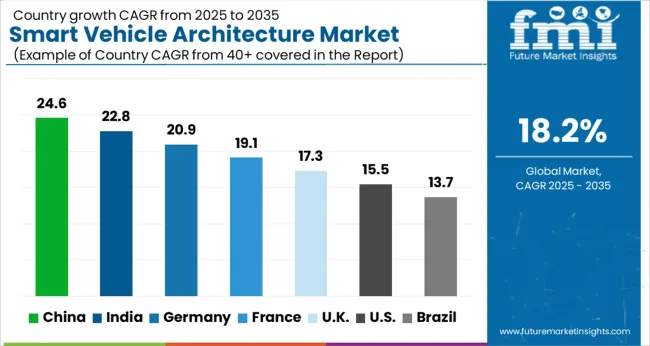

| Country | CAGR |

|---|---|

| China | 24.6% |

| India | 22.8% |

| Germany | 20.9% |

| France | 19.1% |

| UK | 17.3% |

| USA | 15.5% |

| Brazil | 13.7% |

The global smart vehicle architecture market is expected to grow at a CAGR of 18.2% from 2025 to 2035, with China leading at 24.6%, followed by India at 22.8% and France at 19.1%. The UK and USA show more moderate growth rates of 17.3% and 15.5%, respectively. The market is driven by the increasing adoption of electric vehicles, autonomous driving technologies, and the demand for enhanced connectivity and in-vehicle safety features. Government support for EVs and smart mobility, along with advancements in automotive technologies, further accelerates market growth. The analysis spans over 40+ countries, with the leading markets shown below.

The smart vehicle architecture market in China is expected to grow at a CAGR of 24.6% from 2025 to 2035. The rapid advancements in autonomous driving technologies and the government’s strong focus on electric vehicles (EVs) are key factors driving this market. As the world’s largest automobile market, China is witnessing a significant shift towards smart, connected vehicles, and smart vehicle architecture plays a pivotal role in enabling seamless communication between different in-vehicle systems. The increasing demand for advanced driver assistance systems (ADAS) and integrated in-car connectivity is also fueling the adoption of smart vehicle architecture. With automakers and tech companies collaborating on new technologies, including 5G connectivity, artificial intelligence, and IoT solutions, China’s automotive industry is well-positioned to lead the global smart vehicle market.

The smart vehicle architecture market in India is expected to grow at a CAGR of 22.8% from 2025 to 2035. The country’s rapidly growing automotive sector, coupled with the increasing adoption of electric vehicles and connected car technologies, is driving the demand for smart vehicle architectures. The government’s push for smart mobility solutions and EV incentives is fueling market growth, particularly in the electric and hybrid vehicle segments. As India transitions towards a more connected and intelligent automotive ecosystem, automakers are investing heavily in smart vehicle architectures that enhance vehicle safety, performance, and connectivity. The rising middle class, along with an increasing focus on safety features such as ADAS, is boosting consumer demand for smarter, more advanced vehicles.

The smart vehicle architecture market in France is forecasted to grow at a CAGR of 19.1% from 2025 to 2035. The country’s commitment to innovation in the automotive sector and its rising adoption of electric vehicles are contributing to the market’s growth. With increasing interest in connected and autonomous vehicles, France is expected to see higher demand for smart vehicle architecture to support seamless integration of different technologies. Automakers in France are focusing on enhancing in-vehicle connectivity, infotainment systems, and safety features, which require advanced smart vehicle architecture solutions. The government’s role in supporting EV adoption and promoting connected transportation solutions is also a key growth driver.

The UK smart vehicle architecture market is projected to grow at a CAGR of 17.3% from 2025 to 2035. The UK is embracing innovations in automotive technology, including electric vehicles, autonomous driving systems, and smart vehicle architecture. With rising consumer demand for connected vehicles, automakers in the UK are increasingly focused on enhancing in-car technologies, improving safety, and optimizing performance. The country’s growing emphasis on green transportation and the government’s support for electric vehicle adoption are expected to further boost the demand for smart vehicle architectures. The shift towards sustainable transportation and the development of advanced driver assistance systems are also contributing to the market’s growth.

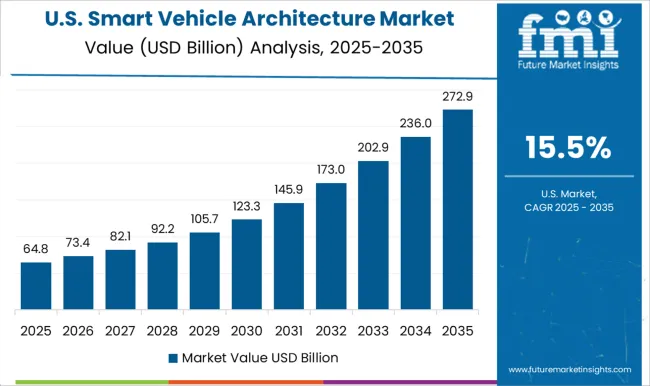

The USA smart vehicle architecture market is expected to grow at a CAGR of 15.5% from 2025 to 2035. The country’s automotive industry is experiencing a rapid shift towards smarter, more connected vehicles, and this is driving the demand for advanced vehicle architectures. The growing popularity of autonomous vehicles, coupled with increasing consumer demand for enhanced safety and infotainment features, is pushing automakers to adopt smart vehicle architecture solutions. The USA is also witnessing an increase in electric vehicle adoption, with automakers investing in innovative technologies to optimize EV performance. The country’s leadership in automotive R&D and the push for smart city infrastructure are contributing to the market’s growth.

The smart vehicle architecture market is highly competitive, driven by advancements in automotive electronics, connectivity, and autonomous driving technologies. Aptiv stands out with its advanced electrical architecture solutions designed to enable safer and smarter vehicles. Their strategy focuses on integrating cutting-edge technologies that support autonomous driving, connected systems, and advanced driver-assistance systems (ADAS). Bosch competes by offering comprehensive solutions for smart vehicle architectures, providing hardware and software that enable vehicle connectivity, infotainment, and advanced driver assistance. Bosch’s focus is on developing innovative control units, sensors, and integrated solutions that improve the functionality of modern vehicles. Continental has a strong presence, focusing on integrating electronics and software into vehicle systems, with an emphasis on autonomous driving, powertrain control, and infotainment systems. Their solutions are known for scalability, allowing automakers to implement smart features and systems as they transition toward fully autonomous vehicles.

Denso competes by providing a range of components, from sensors to electronic control units, that support the development of intelligent and connected vehicle architectures. Denso's solutions are designed to enhance vehicle safety, fuel efficiency, and connectivity, aligning with the growing trend of electric and autonomous vehicles. Infineon Technologies focuses on power semiconductors, microcontrollers, and sensors that enable intelligent vehicle systems. Their products play a critical role in the development of electric vehicles (EVs) and ADAS. Magna, a leader in automotive technology, supplies a variety of components for vehicle architecture, including advanced powertrains, ADAS, and infotainment solutions. Qualcomm focuses on enabling connectivity and telematics for smart vehicles, with products that enhance in-car communication systems, navigation, and infotainment. Valeo competes by offering a wide range of smart vehicle solutions, including sensors, lighting systems, and ADAS technologies that enhance vehicle performance and safety. ZF Friedrichshafen specializes in advanced chassis, safety systems, and vehicle control technologies, playing a pivotal role in the transition toward smart, autonomous, and electrified vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 92.7 Billion |

| Technology | ADAS, Infotainment & connectivity, V2X communication, Over-the-Air (OTA) updates, Cybersecurity solutions, and AI & ML |

| Vehicle | Passenger cars, Commercial vehicles, and Electric vehicles |

| Architecture | Centralized architectures, Zonal architectures, Modular platforms, and Distributed architectures |

| Application | Autonomous driving, Infotainment & user experience, Safety & security, Fleet management, and Energy management |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aptiv, Bosch, Continental, Denso, Infineon Technologies, Magna, Qualcomm, Valeo, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by product type (autonomous driving systems, connectivity solutions, infotainment systems, energy-efficient powertrain components), application (passenger vehicles, commercial vehicles, electric vehicles), and vehicle type (traditional, electric, hybrid). Demand dynamics are influenced by the growing focus on electric vehicles (EVs), autonomous driving technologies, and in-car connectivity. Regional trends indicate strong growth in North America and Europe, where regulatory pressures are accelerating the shift to electric and connected vehicles. The Asia-Pacific region is also seeing significant adoption due to the rapid development of electric and autonomous vehicles in emerging markets. |

The global smart vehicle architecture market is estimated to be valued at USD 92.7 billion in 2025.

The market size for the smart vehicle architecture market is projected to reach USD 493.3 billion by 2035.

The smart vehicle architecture market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types in smart vehicle architecture market are adas, infotainment & connectivity, v2x communication, over-the-air (ota) updates, cybersecurity solutions and ai & ml.

In terms of vehicle, passenger cars segment to command 49.2% share in the smart vehicle architecture market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA