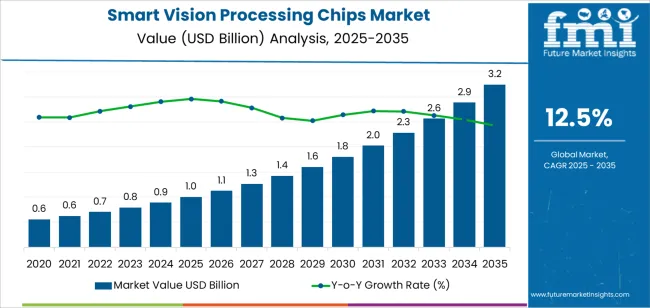

The global smart vision processing chips market is valued at USD 1.0 billion in 2025. It is slated to reach USD 3.2 billion by 2035, recording an absolute increase of USD 2.2 billion over the forecast period. This translates into a total growth of 224.7%, with the market forecast to expand at a CAGR of 12.5% between 2025 and 2035. The overall market size is expected to grow by nearly 3.2X during the same period, supported by increasing adoption of artificial intelligence-powered surveillance systems, growing deployment of smart cameras in residential and commercial security applications, and rising emphasis on edge computing capabilities and real-time video analytics across diverse smart home, automotive vision, and intelligent monitoring applications.

Between 2025 and 2030, the smart vision processing chips market is projected to expand from USD 1.0 billion to USD 1.8 billion, resulting in a value increase of USD 0.8 billion, which represents 35.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing smart city infrastructure deployments and intelligent surveillance requirements, rising adoption of doorbell cameras and residential security systems, and growing demand for advanced driver assistance systems utilizing vision processing capabilities. Camera manufacturers and security system integrators are expanding their smart vision processing chip capabilities to address the growing demand for intelligent video analysis solutions that ensure object recognition accuracy and energy efficiency.

From 2030 to 2035, the market is forecast to grow from USD 1.8 billion to USD 3.2 billion, adding another USD 1.4 billion, which constitutes 64.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of autonomous vehicle vision systems and multi-camera processing architectures, the development of neuromorphic computing approaches and event-based vision sensors, and the growth of specialized applications for smart retail analytics and industrial quality inspection systems. The growing adoption of privacy-preserving edge intelligence and distributed vision processing strategies will drive demand for smart vision processing chips with enhanced computational efficiency and neural network acceleration features.

Between 2020 and 2025, the smart vision processing chips market experienced steady growth, driven by increasing demand for intelligent surveillance solutions and growing recognition of smart vision processing chips as essential components for enabling real-time video analytics and object detection in diverse security, automotive, and consumer electronics applications. The market developed as system designers and product engineers recognized the potential for smart vision processing chip technology to reduce cloud processing costs, improve response latency, and support privacy objectives while meeting demanding performance requirements. Technological advancement in neural network acceleration and low-power design began emphasizing the critical importance of maintaining computational efficiency and thermal management in compact device form factors.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.0 billion |

| Forecast Value in (2035F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

Market expansion is being supported by the increasing global demand for intelligent surveillance and security solutions driven by smart city development initiatives and rising crime prevention requirements, alongside the corresponding need for advanced processing technologies that can enable real-time object detection, support facial recognition capabilities, and maintain operational efficiency across various network camera, doorbell camera, automotive vision, and smart display applications. Modern security equipment manufacturers and automotive suppliers are increasingly focused on implementing smart vision processing chip solutions that can execute complex neural networks, reduce power consumption, and provide consistent performance in demanding deployment scenarios.

The growing emphasis on edge computing and data privacy is driving demand for smart vision processing chips that can perform on-device analytics, minimize cloud bandwidth requirements, and ensure comprehensive privacy protection. Consumer electronics manufacturers' preference for processing solutions that combine artificial intelligence acceleration with energy efficiency and compact form factors is creating opportunities for innovative smart vision processing chip implementations. The rising influence of autonomous driving development and advanced driver assistance systems is also contributing to increased adoption of smart vision processing chips that can provide superior computational capabilities without compromising power budgets or thermal constraints.

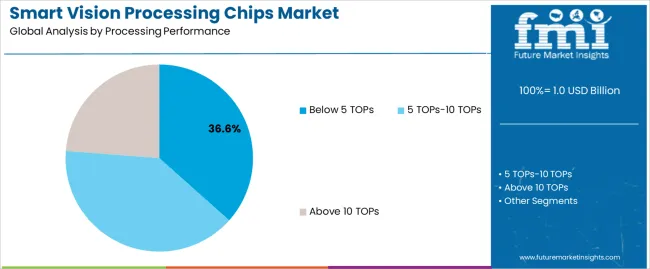

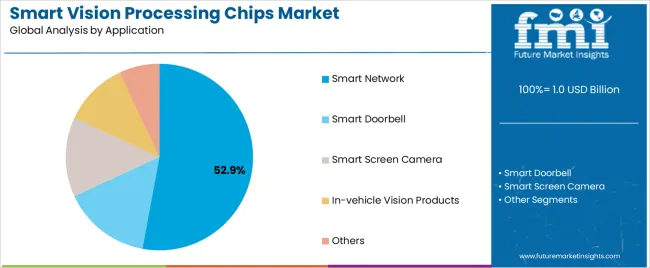

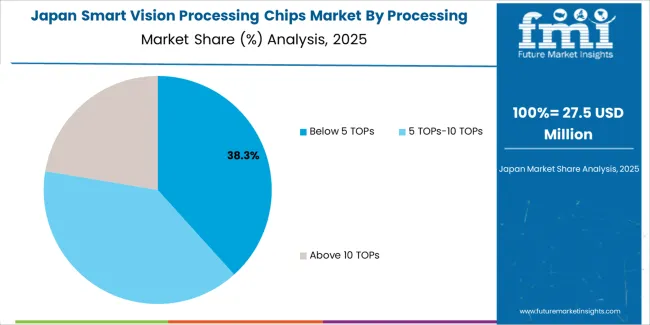

The market is segmented by processing performance, application, and region. By processing performance, the market is divided into below 5 TOPs, 5 TOPs-10 TOPs, and above 10 TOPs. Based on application, the market is categorized into smart network camera, smart doorbell, smart screen camera, in-vehicle vision products, and others. Regionally, the market is divided into China, India, Germany, Brazil, United States, United Kingdom, and Japan.

The below 5 TOPs segment is projected to maintain its leading position in the smart vision processing chips market in 2025 with a 36.6% market share, reaffirming its role as the preferred processing capability for residential security cameras and entry-level smart vision applications. Camera manufacturers and device designers increasingly utilize below 5 TOPs chips for their balanced performance characteristics, excellent power efficiency, and proven effectiveness in executing basic object detection and motion analysis while maintaining affordable price points. Below 5 TOPs processing technology's proven effectiveness and application versatility directly address the industry requirements for cost-effective smart camera production and mass-market security solutions across diverse residential and small commercial deployment categories.

This processing segment forms the foundation of mainstream smart camera adoption, as it represents the performance level with the greatest contribution to market volume and established cost-effectiveness across multiple camera applications and price segments. Consumer electronics investments in accessible smart home technologies continue to strengthen adoption among camera manufacturers and security system providers. With market pressures requiring competitive pricing and acceptable battery life, below 5 TOPs chips align with both affordability objectives and functionality requirements, making it the central component of comprehensive smart vision democratization strategies.

The smart network camera application segment is projected to represent the largest share of smart vision processing chip demand in 2025 with a 52.9% market share, underscoring its critical role as the primary driver for smart vision processing chip adoption across residential security systems, commercial surveillance installations, and smart city monitoring infrastructure. Security camera manufacturers prefer smart vision processing chips for network cameras due to their exceptional analytics capabilities, edge processing benefits, and ability to perform person detection and behavior analysis while supporting bandwidth optimization and privacy protection objectives. Positioned as essential components for modern surveillance systems, smart vision processing chips offer both intelligence advantages and operational efficiency.

The segment is supported by continuous innovation in camera technology and the growing availability of advanced chip architectures that enable superior detection accuracy with enhanced object classification and reduced false alarm rates. Security system providers are investing in comprehensive artificial intelligence integration programs to support increasingly sophisticated threat detection requirements and user demand for intelligent monitoring solutions. As smart city deployments accelerate and security standards increase, the smart network camera application will continue to dominate the market while supporting advanced analytics utilization and surveillance system optimization strategies.

The smart vision processing chips market is advancing steadily due to increasing demand for intelligent video analytics driven by smart city infrastructure investments and growing adoption of residential security cameras that require specialized processing technologies providing enhanced object recognition and energy efficiency benefits across diverse surveillance, doorbell, automotive, and display applications. The market faces challenges, including intense price competition and margin pressure in consumer applications, thermal management constraints in compact device designs, and supply chain dependencies related to advanced semiconductor manufacturing capacity limitations. Innovation in neural network optimization techniques and heterogeneous computing architectures continues to influence product development and market expansion patterns.

The growing deployment of smart city projects is driving demand for specialized smart vision processing chips that address unique infrastructure requirements including large-scale camera networks, centralized management systems, and distributed analytics processing for traffic monitoring and public safety applications. Smart city surveillance systems require advanced vision processing solutions that deliver superior scalability across thousands of camera endpoints while maintaining cost-effectiveness and reliability. System integrators are increasingly recognizing the competitive advantages of edge vision processing integration for reducing network bandwidth and cloud infrastructure costs, creating opportunities for innovative chip designs specifically optimized for municipal deployment scenarios.

Modern smart vision processing chip developers are incorporating neuromorphic computing principles and event-based vision sensor compatibility to enhance power efficiency, reduce data bandwidth, and support comprehensive real-time processing objectives through biologically inspired architectures and sparse data representation. Leading companies are developing spiking neural network accelerators for event cameras, implementing asynchronous processing pipelines for temporal information extraction, and advancing chip architectures that minimize energy consumption per inference operation. These technologies improve battery-powered operation viability while enabling new deployment opportunities, including always-on monitoring applications, ultra-low-latency response systems, and energy-constrained wearable devices. Advanced neuromorphic integration also allows manufacturers to support comprehensive sustainability objectives and extended operational lifetime beyond traditional frame-based processing approaches.

The expansion of autonomous driving applications, robotics platforms, and augmented reality devices is driving demand for smart vision processing chips with integrated sensor fusion capabilities and heterogeneous computing resources combining vision processing with radar data interpretation and lidar point cloud analysis. These advanced applications require specialized chip architectures with multiple processing domains that exceed single-modality vision requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in domain-specific accelerator integration and unified memory architectures to serve emerging mobility applications while supporting innovation in advanced driver assistance, robotic perception, and spatial computing industries.

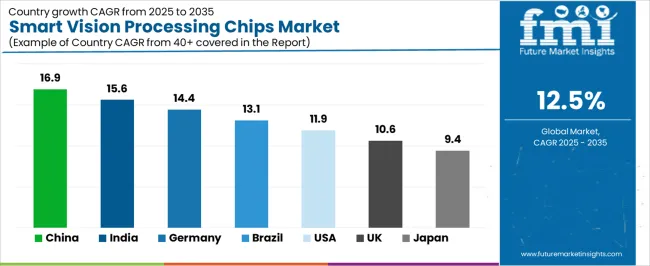

| Country | CAGR (2025-2035) |

|---|---|

| India | 15.6% |

| China | 16.9% |

| Brazil | 13.1% |

| United States | 11.9% |

| Germany | 14.4% |

| United Kingdom | 10.6% |

| Japan | 9.4% |

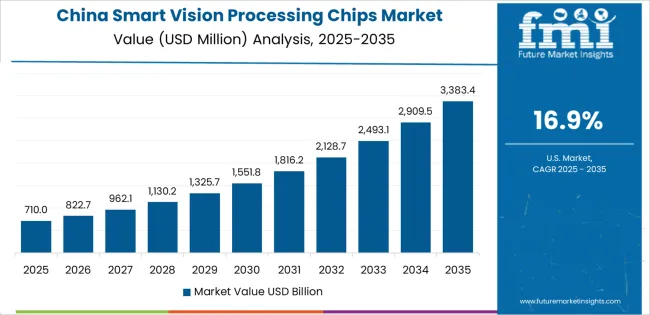

The smart vision processing chips market is experiencing solid growth globally, with China leading at a 16.9% CAGR through 2035, driven by massive smart city deployments, expanding surveillance camera production, and increasing adoption of intelligent security systems across residential and commercial sectors. India follows at 15.6%, supported by smart city mission initiatives, growing residential security awareness, and increasing demand for affordable smart cameras in urban areas. Germany shows growth at 14.4%, emphasizing automotive vision systems, industrial quality inspection, and privacy-compliant surveillance solutions. Brazil demonstrates 13.1% growth, supported by urban security requirements, residential gated community installations, and expanding retail surveillance applications. The United States records 11.9%, focusing on advanced driver assistance systems, smart home integration, and high-performance surveillance analytics. The United Kingdom exhibits 10.6% growth, emphasizing smart city programs and residential security adoption. Japan shows 9.4% growth, supported by automotive safety systems and precision manufacturing inspection applications.

The report covers an in-depth analysis of 40 countries, with top-performing countries highlighted below.

Revenue from smart vision processing chips in China is projected to exhibit exceptional growth with a CAGR of 16.9% through 2035, driven by extensive smart city infrastructure projects and rapidly expanding surveillance camera manufacturing supported by government safe city initiatives and urban management modernization programs. The country's massive camera production capacity and increasing investment in artificial intelligence technologies are creating substantial demand for smart vision processing chip solutions. Major camera manufacturers and semiconductor companies are establishing comprehensive chip development capabilities to serve both domestic markets and international export opportunities.

Government support for smart city development and public safety infrastructure is driving demand for smart vision processing chips throughout major urban centers and industrial zones across surveillance networks, traffic management systems, and community security installations. Strong camera manufacturing growth and an expanding network of security system integrators are supporting the rapid adoption of artificial intelligence-enabled vision processing technologies among manufacturers seeking enhanced analytics capabilities and competitive differentiation.

Demand for smart vision processing chips in India is expanding at a CAGR of 15.6%, supported by the country's ambitious smart city mission program, expanding middle-class residential security adoption, and increasing demand for affordable intelligent cameras in apartment complexes and commercial establishments. The country's growing urban population and rising security awareness are driving sophisticated smart vision processing adoption throughout metropolitan areas. Leading camera manufacturers and system integrators are establishing extensive distribution networks to address growing domestic demand and regional export markets.

Rising smartphone penetration and expanding internet connectivity are creating opportunities for smart vision processing chip deployment across wireless security cameras, video doorbell systems, and mobile-integrated monitoring solutions in major cities and suburban developments. Growing government focus on urban safety initiatives and traffic management systems is driving adoption of intelligent vision processing technologies among municipal authorities seeking enhanced monitoring capabilities and incident response efficiency.

Revenue from smart vision processing chips in Germany is growing at a CAGR of 14.4%, supported by the country's leadership in automotive technology, expanding advanced driver assistance system adoption, and strong manufacturing sector utilizing vision processing for quality control and robotic guidance applications. The nation's advanced automotive infrastructure and emphasis on safety innovation are driving sophisticated smart vision processing capabilities throughout mobility sectors. Leading automotive suppliers and industrial automation companies are investing extensively in vision processing technologies and sensor fusion systems.

Advanced automotive safety requirements and autonomous driving development are creating demand for high-performance smart vision processing chips among automotive manufacturers seeking superior object detection and pedestrian recognition capabilities. Strong engineering expertise and growing focus on Industry 4.0 applications are supporting the adoption of vision-enabled inspection systems in manufacturing facilities and automated production lines across major industrial regions.

Demand for smart vision processing chips in Brazil is anticipated to expand at a CAGR of 13.1%, supported by the country's growing urban security concerns, expanding residential condominium developments, and increasing emphasis on crime prevention systems in commercial and retail establishments. The nation's comprehensive urbanization and security market growth are driving demand for intelligent camera solutions. Security system integrators and camera distributors are investing in product portfolio expansion and technical training to serve both residential and commercial market segments.

Advanced security requirements and retail loss prevention needs are creating demand for smart vision processing capabilities among security providers seeking superior facial recognition and behavior analysis features. Strong residential security market and growing retail surveillance adoption are driving deployment of intelligent cameras in gated communities, shopping centers, and public transportation facilities across major metropolitan areas.

Revenue from smart vision processing chips in the United States is projected to grow at a CAGR of 11.9%, supported by the country's focus on advanced driver assistance system penetration, established smart home market, and growing emphasis on autonomous vehicle development requiring multi-camera vision processing architectures. The nation's comprehensive automotive technology sector and consumer electronics market are driving demand for sophisticated smart vision processing solutions. Automotive suppliers and smart home device manufacturers are investing in chip integration and system optimization to serve both transportation and residential applications.

Advanced automotive safety regulations and autonomous driving initiatives are creating demand for reliable smart vision processing platforms among vehicle manufacturers seeking superior environmental perception and collision avoidance capabilities. Strong smart home adoption and growing video doorbell popularity are driving integration of vision processing chips in residential security devices and home automation systems across suburban and urban markets.

Demand for smart vision processing chips in the United Kingdom is expanding at a CAGR of 10.6%, driven by the country's established smart city programs, sophisticated surveillance infrastructure, and strong emphasis on privacy-compliant video analytics supporting edge processing adoption for data protection compliance. The United Kingdom's urban technology sophistication and regulatory framework are driving smart vision processing capabilities throughout municipal sectors. Local authorities and security service providers are establishing comprehensive privacy-preserving surveillance programs for public safety and traffic management.

Advanced privacy regulations and data protection requirements are creating demand for edge-based smart vision processing technologies among surveillance operators seeking enhanced compliance capabilities and audit-ready architectures. Strong privacy awareness culture and growing smart city investments are supporting the adoption of on-device analytics throughout public camera networks and transportation monitoring systems.

Revenue from smart vision processing chips in Japan is growing at a CAGR of 9.4%, supported by the country's leadership in automotive safety systems, precision manufacturing applications, and strong emphasis on quality inspection requiring validated vision processing for production line monitoring. Japan's technological precision and automotive excellence are driving demand for high-reliability smart vision processing products. Leading automotive manufacturers and industrial automation companies are investing in specialized capabilities for safety-critical vision applications.

Advanced automotive safety standards and manufacturing quality requirements are creating opportunities for certified smart vision processing chips throughout vehicle production facilities and automotive component inspection systems. Strong quality culture and operational discipline are driving adoption of vision-enabled inspection technologies in semiconductor fabrication equipment and precision assembly operations meeting rigorous performance and reliability standards.

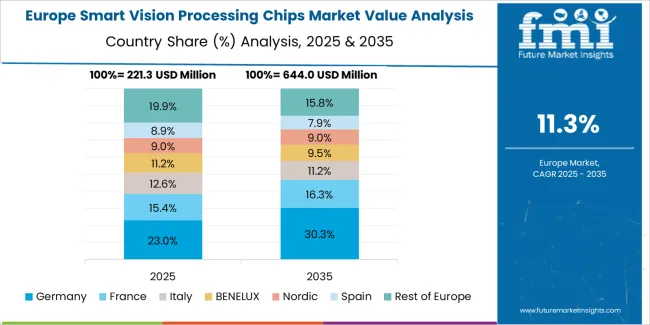

The smart vision processing chips market in Europe is projected to grow from USD 366.1 million in 2025 to USD 852.0 million by 2035, registering a CAGR of 8.8% over the forecast period. Germany is expected to maintain leadership with a 31.7% market share in 2025, moderating to 30.4% by 2035, supported by automotive vision system leadership, industrial automation applications, and strong engineering-focused chip development.

The United Kingdom follows with 23.4% in 2025, projected at 22.8% by 2035, driven by smart city infrastructure, surveillance modernization, and privacy-compliant edge processing adoption. France holds 18.9% in 2025, reaching 19.3% by 2035 on the back of smart city initiatives and automotive safety system integration. Italy commands 12.6% in 2025, rising slightly to 12.9% by 2035, while Spain accounts for 8.1% in 2025, reaching 8.4% by 2035 aided by smart building deployments and urban security projects. The Netherlands maintains 5.3% in 2025, up to 6.2% by 2035 due to smart infrastructure investments and logistics automation. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 0.0% in 2025 and 0.0% by 2035, reflecting concentrated deployment in major technology and automotive manufacturing centers.

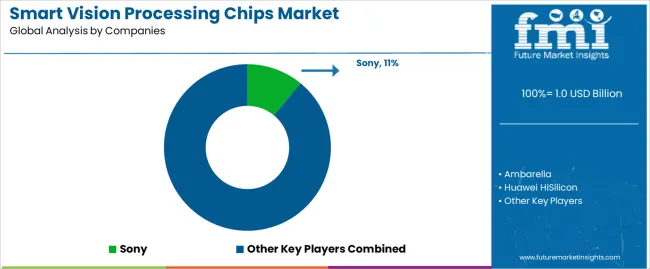

The smart vision processing chips market is characterized by competition among established semiconductor manufacturers, specialized vision processing companies, and emerging artificial intelligence chip startups. Companies are investing in neural network optimization, power efficiency improvement, product portfolio expansion, and application-specific architecture development to deliver high-performance, energy-efficient, and cost-effective smart vision processing chip solutions. Innovation in heterogeneous computing integration, neuromorphic design principles, and advanced packaging technologies is central to strengthening market position and competitive advantage.

Sony leads the market with an 11.0% share, offering comprehensive smart vision processing chip solutions with a focus on image sensor integration, automotive vision applications, and power-efficient neural network acceleration across diverse camera and sensing applications. The company provides advanced sensor-processor integration leveraging its imaging technology expertise and artificial intelligence capabilities. Ambarella provides specialized vision processing solutions with emphasis on high-resolution video compression and computer vision acceleration.

Huawei HiSilicon delivers integrated system-on-chip solutions with focus on surveillance camera applications and edge artificial intelligence processing. Nextchip offers automotive-focused vision processing chips with emphasis on advanced driver assistance system requirements. Goke Microelectronics specializes in security camera processors for consumer and commercial surveillance markets. Rockchip Electronics provides cost-effective vision processing solutions for smart home and Internet of Things applications. Axera Semiconductor focuses on edge artificial intelligence chips with vision processing capabilities. Shanghai TaskOrientedAI develops specialized neural network accelerators for vision applications. Vimicro Technology Corporation offers multimedia processing chips including vision analytics capabilities. Shanghai Visinex Technology specializes in smart camera processors for security applications. Shanghai Timesintel provides vision processing solutions for intelligent monitoring systems. Shanghai NextVPU delivers neural processing units for computer vision applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.0 billion |

| Processing Performance | Below 5 TOPs, 5 TOPs-10 TOPs, Above 10 TOPs |

| Application | Smart Network Camera, Smart Doorbell, Smart Screen Camera, In-vehicle Vision Products, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Sony, Ambarella, Huawei HiSilicon, Nextchip, Goke Microelectronics, Rockchip Electronics, Axera Semiconductor, Shanghai TaskOrientedAI, Vimicro Technology Corporation, Shanghai Visinex Technology, Shanghai Timesintel, Shanghai NextVPU |

| Additional Attributes | Dollar sales by processing performance and application category, regional demand trends, competitive landscape, technological advancements in neural network acceleration, power efficiency optimization, edge computing innovation, and vision analytics performance enhancement |

The global smart vision processing chips market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the smart vision processing chips market is projected to reach USD 3.2 billion by 2035.

The smart vision processing chips market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in smart vision processing chips market are below 5 tops , 5 tops-10 tops and above 10 tops.

In terms of application, smart network segment to command 52.9% share in the smart vision processing chips market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA