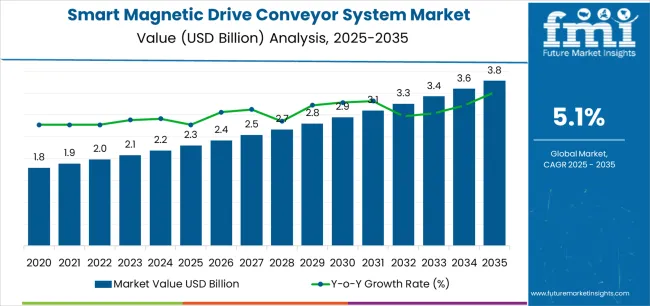

The global smart magnetic drive conveyor system market is valued at USD 2.3 billion in 2025. It is slated to reach USD 3.9 billion by 2035, recording an absolute increase of USD 1.5 billion over the forecast period. Demand translates into a total growth of 64.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.64X during the same period, supported by increasing manufacturing automation requirements, growing adoption of flexible production systems, and rising emphasis on precision material handling and energy efficiency across diverse food and beverage, pharmaceutical, automotive, and electronics manufacturing applications.

Between 2025 and 2030, the smart magnetic drive conveyor system market is projected to expand from USD 2.3 billion to USD 2.9 billion, resulting in a value increase of USD 517.0 million, which represents 34.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing Industry 4.0 adoption and smart factory implementation, rising demand for cleanroom-compatible conveyor solutions in pharmaceutical and electronics manufacturing, and growing requirements for individualized product tracking and flexible line changeover capabilities. Manufacturing equipment suppliers and automation integrators are expanding their magnetic conveyor capabilities to address the growing demand for intelligent material handling solutions that enable mass customization and real-time production optimization.

From 2030 to 2035, the market is forecast to grow from USD 2.9 billion to USD 3.9 billion, adding another USD 996.2 million, which constitutes 65.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence integration enabling predictive maintenance and autonomous production control, the development of modular magnetic conveyor platforms supporting rapid reconfiguration, and the growth of eco-friendly manufacturing initiatives requiring energy-efficient material handling systems. The growing adoption of digital twin technologies and cyber-physical production systems will drive demand for smart magnetic drive conveyors with enhanced connectivity and advanced control capabilities.

Between 2020 and 2025, the smart magnetic drive conveyor system market experienced steady growth, driven by increasing recognition of magnetic drive technology as superior alternative to mechanical conveyor systems and growing acceptance of intelligent conveyors as essential infrastructure for flexible manufacturing in mass customization and high-mix production environments. The market developed as manufacturing engineers and production managers recognized the potential for magnetic conveyor technology to eliminate mechanical wear, enable individual product control, and support dynamic production routing while meeting stringent hygiene requirements. Technological advancement in linear motor technology and distributed control systems began emphasizing the critical importance of maintaining precise positioning accuracy and enabling seamless integration with manufacturing execution systems in demanding production applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.3 billion |

| Forecast Value in (2035F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

Market expansion is being supported by the increasing global manufacturing automation trend driven by labor cost pressures and quality consistency requirements, alongside the corresponding need for intelligent material handling systems that can enable flexible production layouts, support individualized product control, and maintain hygienic operation across various pharmaceutical packaging, food processing, beverage bottling, and electronics assembly applications. Modern manufacturing engineers and automation specialists are increasingly focused on implementing smart magnetic conveyor solutions that can eliminate mechanical friction, provide precise position control, and enable seamless integration with manufacturing execution and enterprise resource planning systems.

The growing emphasis on mass customization and flexible manufacturing is driving demand for magnetic conveyor systems that can support dynamic product routing, enable rapid changeover between different products, and ensure comprehensive traceability throughout production processes. Manufacturing operators' preference for material handling solutions that combine operational flexibility with minimal maintenance requirements and extended service life is creating opportunities for innovative magnetic conveyor implementations. The rising influence of green manufacturing initiatives and energy efficiency requirements is also contributing to increased adoption of magnetic drive technology that can reduce power consumption without compromising positioning accuracy or throughput capabilities.

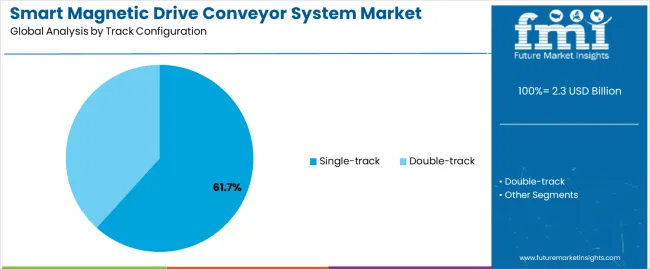

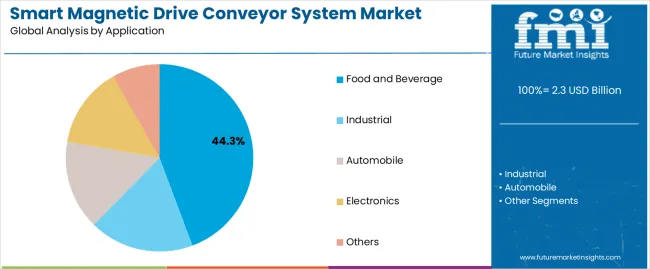

The market is segmented by track configuration, application, and region. By track configuration, the market is divided into single-track and double-track. Based on application, the market is categorized into food and beverage, industrial, automobile, electronics, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The single-track segment is projected to maintain its leading position in the smart magnetic drive conveyor system market in 2025 with a 61.7% market share, reaffirming its role as the preferred configuration for straightforward material flow applications and cost-effective flexible conveyor implementations. Manufacturing facilities and production line integrators increasingly utilize single-track magnetic conveyors for their simplified system architecture, reduced infrastructure requirements, and proven effectiveness in delivering independent product control with optimized space utilization. Single-track technology's proven effectiveness and installation efficiency directly address the manufacturing requirements for flexible material handling and space-constrained production environments across diverse industrial sectors and facility layouts.

This configuration segment forms the foundation of accessible magnetic conveyor adoption, as it represents the system type with the greatest contribution to entry-level implementation and established cost-effectiveness record across multiple manufacturing applications and production scales. Manufacturing automation investments in flexible production capabilities and quality improvement initiatives continue to strengthen adoption among manufacturers transitioning from conventional mechanical conveyors. With production facilities prioritizing space efficiency and manufacturers seeking cost-competitive magnetic conveyor entry points, single-track systems align with both technical requirements and capital investment constraints, making them the central component of initial magnetic conveyor deployment strategies.

The food and beverage application segment is projected to represent the largest share of smart magnetic drive conveyor system demand in 2025 with a 44.3% market share, underscoring its critical role as the primary driver for magnetic conveyor adoption across beverage bottling, food packaging, dairy processing, and confectionery production requiring hygienic material handling. Food and beverage manufacturers prefer magnetic drive conveyor systems due to their contactless drive technology eliminating contamination risks, stainless steel construction supporting washdown procedures, and proven capability in meeting stringent food safety regulations while enabling flexible production configurations. Positioned as essential equipment for modern food manufacturing, magnetic conveyors offer both hygiene compliance and operational flexibility benefits.

The segment is supported by continuous growth in packaged food consumption and the expanding availability of flexible packaging formats requiring versatile conveyor systems adapting to diverse product dimensions. Food and beverage manufacturers are investing in comprehensive automation programs incorporating intelligent material handling systems supporting traceability requirements and production efficiency objectives. As food safety regulations intensify globally and consumer demand for product variety increases, the food and beverage application will continue to dominate the market while supporting advanced manufacturing practices and quality assurance optimization strategies.

The smart magnetic drive conveyor system market is advancing steadily due to increasing manufacturing flexibility requirements driven by mass customization trends and product variety expansion necessitating adaptable material handling systems supporting rapid changeover capabilities, and growing pharmaceutical and food processing industry emphasis on hygienic design requiring contactless drive technology eliminating contamination risks across diverse production, packaging, and assembly applications. The market faces challenges, including high initial capital investment creating adoption barriers for small and medium manufacturers, technical complexity related to system integration and specialized programming requirements, and competition from conventional mechanical conveyor systems with established infrastructure and proven reliability. Innovation in modular system architectures and simplified commissioning tools continues to influence market accessibility and adoption acceleration patterns.

The growing adoption of Industry 4.0 principles and digital manufacturing transformation is driving increased demand for intelligent magnetic conveyor systems offering comprehensive connectivity, real-time data collection, and seamless integration with manufacturing execution systems enabling predictive maintenance and production optimization. Manufacturing facilities are successfully implementing magnetic conveyor networks with embedded sensors, distributed intelligence, and cloud connectivity that provide unprecedented visibility into material flow patterns, equipment performance metrics, and production bottlenecks supporting continuous improvement initiatives. Automation suppliers are increasingly recognizing the strategic value of magnetic conveyor integration within broader smart factory ecosystems, creating opportunities for advanced system offerings combining material handling with quality inspection, process monitoring, and autonomous decision-making capabilities. Digital transformation initiatives continue to position magnetic conveyors as fundamental infrastructure elements enabling data-driven manufacturing and adaptive production control.

Modern magnetic conveyor manufacturers are incorporating modular system architectures and standardized interface specifications that enable rapid production line reconfiguration, support efficient capacity scaling, and facilitate straightforward maintenance through component-level replacement strategies. Leading equipment suppliers are developing magnetic conveyor platforms with plug-and-play modules, standardized track segments, and software-defined routing capabilities that dramatically reduce commissioning time, minimize customization requirements, and enable manufacturers to adapt production layouts matching demand fluctuations without major capital expenditure. These modular approaches improve investment flexibility while enabling manufacturers to incrementally expand conveyor networks, test alternative production configurations, and optimize material flow patterns through iterative refinement rather than comprehensive system redesign. Advanced modularity also allows equipment suppliers to reduce inventory requirements and accelerate customer order fulfillment through configurable standard products rather than engineered-to-order custom systems.

The advancement of optimized linear motor designs, regenerative braking capabilities, and intelligent power management algorithms is driving demand for next-generation magnetic conveyor systems delivering substantial energy consumption reductions compared to conventional mechanical conveyors and pneumatic handling systems. Equipment manufacturers are investing in development programs exploring permanent magnet motor technologies, standby power minimization, and dynamic energy optimization that reduce operational costs while supporting corporate eco-friendliness commitments and environmental performance objectives. These energy-efficient innovations create opportunities for differentiated product positioning emphasizing total cost of ownership advantages, carbon footprint reduction, and regulatory compliance supporting manufacturer environmental responsibility reporting and green manufacturing certifications. Successful energy efficiency demonstration enables market expansion among environmentally conscious manufacturers and facilities operating under strict energy consumption limitations or carbon reduction mandates.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

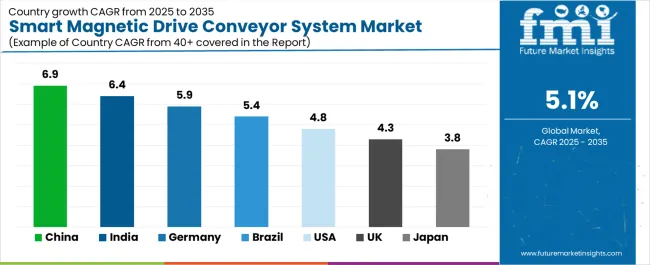

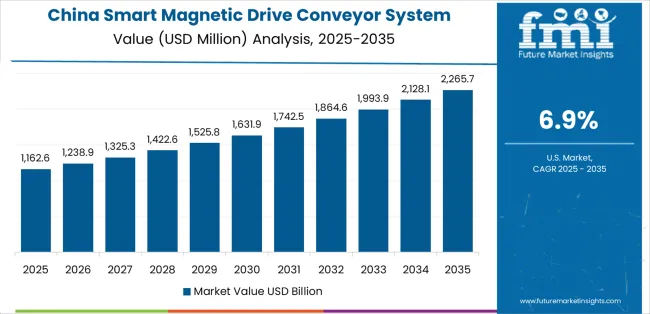

The smart magnetic drive conveyor system market is experiencing solid growth globally, with China leading at a 6.9% CAGR through 2035, driven by massive manufacturing automation investment, expanding pharmaceutical and food processing capacity, and government support for intelligent manufacturing transformation. India follows at 6.4%, supported by growing manufacturing sector, expanding pharmaceutical exports, and increasing adoption of automated production systems in food and beverage industries. Germany shows growth at 5.9%, emphasizing advanced manufacturing technology leadership, automotive production automation, and comprehensive Industry 4.0 implementation.

Brazil demonstrates 5.4% growth, supported by expanding food processing industry, pharmaceutical manufacturing development, and industrial automation adoption. The United States records 4.8%, focusing on pharmaceutical production automation, food safety compliance, and advanced manufacturing reshoring initiatives. The United Kingdom exhibits 4.3% growth, emphasizing pharmaceutical manufacturing excellence and food processing automation. Japan shows 3.8% growth, supported by advanced automation culture and precision manufacturing requirements.

The report covers an in-depth analysis of 40+ countries; with top-performing countries highlighted below.

Revenue from smart magnetic drive conveyor systems in China is projected to exhibit exceptional growth with a CAGR of 6.9% through 2035, driven by massive manufacturing automation investment under Made in China 2025 initiatives, expanding pharmaceutical and food processing production capacity, and comprehensive smart factory implementation across major industrial regions. The country's extensive manufacturing infrastructure and rapid technological advancement are creating substantial demand for intelligent conveyor solutions. Major automation equipment manufacturers and domestic technology companies are establishing comprehensive production capabilities to serve growing domestic market requirements.

Revenue from smart magnetic drive conveyor systems in India is expanding at a CAGR of 6.4%, supported by the country's growing manufacturing sector, expanding pharmaceutical production serving domestic and export markets, and increasing adoption of automated material handling systems addressing labor challenges and quality requirements. The country's developing automation infrastructure and cost-competitive manufacturing environment are driving magnetic conveyor demand throughout pharmaceutical and food processing sectors. Leading automation suppliers and domestic equipment manufacturers are establishing market presence through technology partnerships and local production capabilities.

Revenue from smart magnetic drive conveyor systems in Germany is expanding at a CAGR of 5.9%, supported by the country's advanced manufacturing technology leadership, comprehensive Industry 4.0 implementation, and sophisticated automation capabilities throughout automotive, pharmaceutical, and precision manufacturing sectors. The nation's engineering excellence and emphasis on manufacturing innovation are driving advanced magnetic conveyor utilization across diverse industrial applications. Leading automation equipment manufacturers and system integrators maintain strong market presence through technological innovation and comprehensive customer support.

Revenue from smart magnetic drive conveyor systems in Brazil is expanding at a CAGR of 5.4%, supported by the country's expanding food processing industry serving domestic and export markets, growing pharmaceutical manufacturing sector, and increasing industrial automation adoption addressing productivity challenges. The nation's resource-based economy and developing manufacturing capabilities are driving demand for intelligent material handling solutions. Automation equipment suppliers and system integrators are investing in market development addressing diverse industrial sectors.

Revenue from smart magnetic drive conveyor systems in the United States is expanding at a CAGR of 4.8%, supported by the country's sophisticated pharmaceutical manufacturing sector, stringent food safety regulations requiring advanced hygiene compliance, and growing manufacturing reshoring initiatives emphasizing automation and productivity. The nation's advanced manufacturing capabilities and technological leadership are driving consistent magnetic conveyor demand. Major automation suppliers and specialized equipment manufacturers maintain extensive market presence through established customer relationships and technical support networks.

Revenue from smart magnetic drive conveyor systems in the United Kingdom is expanding at a CAGR of 4.3%, supported by the country's pharmaceutical manufacturing excellence, established food processing industry, and growing emphasis on automated production systems addressing labor challenges and quality consistency requirements. The UK's advanced manufacturing sector and regulatory compliance culture are driving stable magnetic conveyor demand. Automation equipment suppliers and system integrators maintain market presence through established industry relationships and technical expertise.

Revenue from smart magnetic drive conveyor systems in Japan is growing at a CAGR of 3.8%, driven by the country's advanced automation culture, precision manufacturing capabilities, and comprehensive quality standards emphasizing superior equipment reliability and operational excellence. Japan's technological sophistication and emphasis on manufacturing perfection are supporting demand for high-specification magnetic conveyor systems. Leading automation equipment manufacturers and precision machinery companies maintain market presence through technical excellence and quality-focused product development.

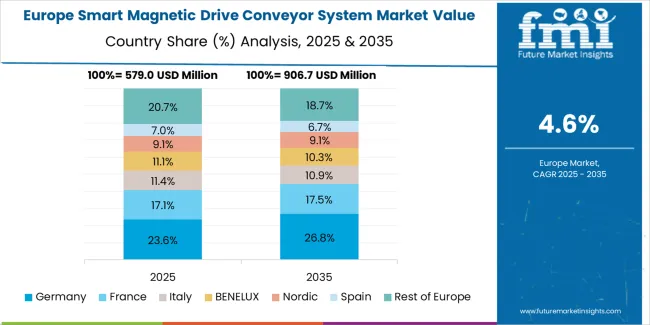

The smart magnetic drive conveyor system market in Europe is projected to grow from USD 642.8 million in 2025 to USD 1.0 billion by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain leadership with a 34.6% market share in 2025, moderating to 33.8% by 2035, supported by advanced manufacturing technology, automotive production automation, and comprehensive Industry 4.0 implementation.

France follows with 18.2% in 2025, projected at 18.7% by 2035, driven by pharmaceutical manufacturing, food processing automation, and luxury goods production. The United Kingdom holds 14.6% in 2025, expected to reach 15.1% by 2035 supported by pharmaceutical excellence and food processing industry. Italy commands 12.3% in 2025, rising slightly to 12.6% by 2035, while Spain accounts for 8.7% in 2025, reaching 9.1% by 2035 aided by food processing and pharmaceutical manufacturing. Switzerland maintains 4.9% in 2025, up to 5.2% by 2035 due to pharmaceutical and precision manufacturing requirements. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.7% in 2025 and 5.5% by 2035, reflecting varied manufacturing automation maturity and industrial development across diverse national markets.

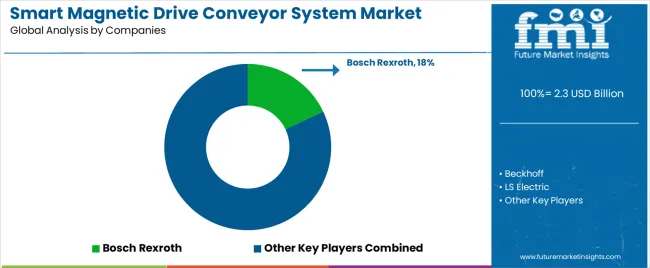

The smart magnetic drive conveyor system market is characterized by competition among established automation equipment manufacturers, specialized conveyor technology companies, and emerging intelligent manufacturing solution providers. Companies are investing in modular system development, Industry 4.0 integration capabilities, energy efficiency optimization, and comprehensive service offerings to deliver flexible, intelligent, and reliable smart magnetic conveyor solutions. Innovation in artificial intelligence integration, predictive maintenance capabilities, and simplified commissioning tools is central to strengthening market position and competitive advantage.

Bosch Rexroth leads the market as a major automation technology supplier offering comprehensive magnetic conveyor systems with emphasis on Industry 4.0 integration, modular design architecture, and global support capabilities serving diverse manufacturing sectors. Beckhoff provides advanced automation solutions including magnetic conveyor technologies with focus on PC-based control integration and scalable system architectures. LS Electric offers industrial automation equipment including magnetic drive conveyor systems serving Asian and global markets. Rockwell International delivers comprehensive manufacturing automation solutions with intelligent conveyor system offerings. B&R Industrial specializes in automation technology including sophisticated magnetic transport systems for precision applications.

Guangzhou Yinuo Intelligent Technology focuses on intelligent conveyor systems serving Chinese manufacturing market. Shanghai Golytec Automation Technology provides automated material handling solutions including magnetic conveyor systems. Suzhou Zongwei Automation offers industrial automation equipment and intelligent conveyor technologies. Shenzhen Yinghe Technology specializes in intelligent manufacturing equipment including advanced conveyor systems. Ruisong Intelligent Technology focuses on smart manufacturing solutions for diverse industrial applications. TUKU Singapore provides automation equipment and intelligent material handling systems serving Asian markets.

Smart magnetic drive conveyor systems represent an advanced material handling segment within manufacturing automation industries, projected to grow from USD 2.3 billion in 2025 to USD 3.9 billion by 2035 at a 5.1% CAGR. These intelligent transport systems, primarily single-track and double-track magnetic linear motor configurations for flexible material handling, serve as enabling technologies in modern manufacturing where individual product control, hygienic operation, and dynamic routing capabilities are essential for mass customization and quality-critical production environments. Market expansion is driven by accelerating Industry 4.0 adoption across manufacturing sectors, increasing pharmaceutical and food safety regulations requiring hygienic material handling, growing demand for flexible production systems supporting mass customization, and rising emphasis on energy-efficient automation technologies reducing operational costs and environmental impact.

How Industrial Regulators Could Strengthen Standards and Safety Requirements?

How Industry Associations Could Advance Technology Standards and Market Development?

How Equipment Manufacturers Could Drive Innovation and Market Leadership?

How Manufacturing End-Users Could Optimize System Performance and Value Realization?

How Research Institutions Could Enable Technology Advancement?

How Financial and Investment Communities Could Support Market Expansion?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.3 billion |

| Track Configuration | Single-track, Double-track |

| Application | Food and Beverage, Industrial, Automobile, Electronics, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Bosch Rexroth, Beckhoff, LS Electric, Rockwell International, B&R Industrial, Guangzhou Yinuo Intelligent Technology |

| Additional Attributes | Dollar sales by track configuration and application category, regional demand trends, competitive landscape, technological advancements in linear motor technology, Industry 4.0 integration, energy efficiency optimization, and flexible manufacturing implementation |

The global smart magnetic drive conveyor system market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the smart magnetic drive conveyor system market is projected to reach USD 3.8 billion by 2035.

The smart magnetic drive conveyor system market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in smart magnetic drive conveyor system market are single-track and double-track.

In terms of application, food and beverage segment to command 44.3% share in the smart magnetic drive conveyor system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA