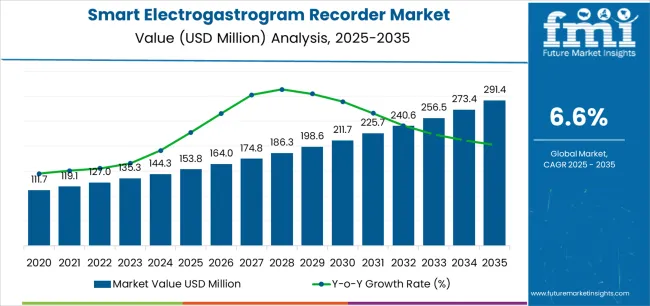

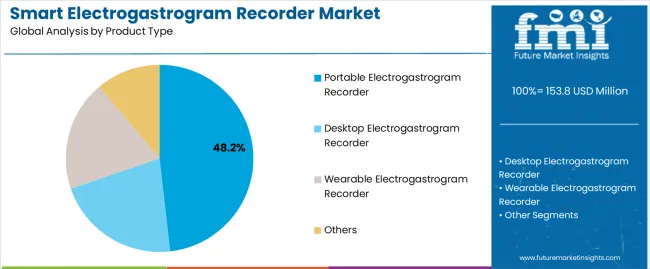

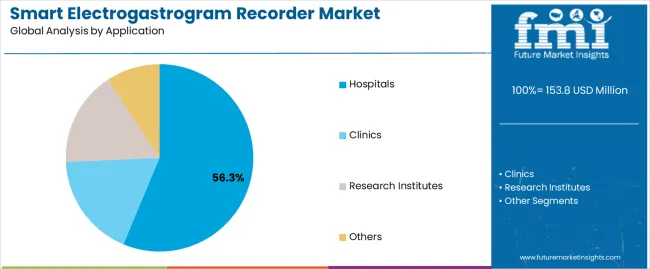

The smart electrogastrogram recorder market moves into the next decade with strong expansion supported by rising global demand for non-invasive gastrointestinal diagnostics and wider integration of digital monitoring technologies across clinical practice. Valued at USD 153.8 million in 2025, the market is set to reach USD 291.4 million by 2035, adding USD 137.6 million and growing by 89.4% at a 6.6% CAGR. This trajectory nearly doubles market size to 1.9X over the forecast window, driven by increasing prevalence of functional gastrointestinal disorders including gastroparesis, dyspepsia, and IBS, which require objective motility assessment rather than symptom-based evaluation. Hospitals remain the dominant end-use environment with 56.3% share, supported by established gastroenterology infrastructure and reimbursement access, while portable recorders lead the product mix at 48.2%, reflecting demand for flexible diagnostic workflows and expanding outpatient care models.

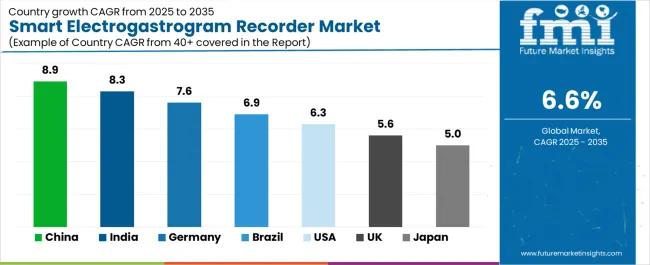

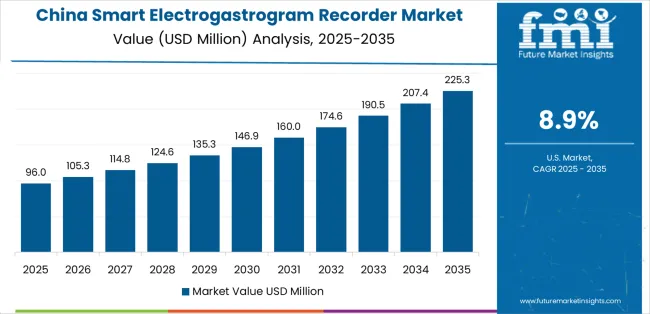

Technology advancement plays a central role, with improvements in wireless data transmission, wearable sensor design, and signal-processing algorithms enhancing diagnostic accuracy and enabling long-term ambulatory monitoring outside controlled laboratory settings. North America and Europe sustain leadership due to mature gastroenterology programs and structured diagnostic reimbursement, while Asia Pacific accelerates through healthcare modernization and growing awareness of motility disorders. China leads with 8.9% CAGR, followed by India at 8.3% and Germany at 7.6%, reflecting expanding specialty gastroenterology services and increased investment in motility testing capabilities.

Regional variations in healthcare infrastructure maturity and gastroenterology specialty care access significantly influence market development patterns. North American and European markets maintain leadership through established gastroenterology programs and comprehensive diagnostic reimbursement frameworks supporting advanced motility testing procedures. Asian markets demonstrate accelerating growth driven by healthcare modernization initiatives and expanding awareness of functional gastrointestinal disorders requiring objective diagnostic assessment. The shift toward outpatient diagnostic testing and home-based monitoring protocols is creating demand for portable and wearable electrogastrogram recorders optimized for patient comfort and extended recording durations.

Manufacturing consolidation continues among medical device companies pursuing regulatory compliance capabilities and clinical validation requirements. Supply chain integration between sensor manufacturers, signal processing developers, and diagnostic equipment distributors is improving product availability and technical support infrastructure. Quality standards enforcement by regulatory authorities in major markets creates barriers for smaller manufacturers while ensuring consistent device performance and diagnostic reliability outcomes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 153.8 million |

| Market Forecast Value (2035) | USD 291.4 million |

| Forecast CAGR (2025-2035) | 6.6% |

| HEALTHCARE DIAGNOSTIC TRENDS | CLINICAL REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Product Type | Portable Electrogastrogram Recorder, Desktop Electrogastrogram Recorder, Wearable Electrogastrogram Recorder, Others |

| By Application | Hospitals, Clinics, Research Institutes, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Portable Electrogastrogram Recorder |

|

| Desktop Electrogastrogram Recorder |

|

| Wearable Electrogastrogram Recorder |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hospitals |

|

| Clinics |

|

| Research Institutes |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| Brazil | 6.9% |

| United States | 6.3% |

| United Kingdom | 5.6% |

| Japan | 5.0% |

Revenue from Smart Electrogastrogram Recorder in China is projected to exhibit strong growth with a market value of USD 55.4 million by 2035, driven by expanding gastroenterology department capabilities and comprehensive hospital modernization programs creating substantial opportunities for diagnostic equipment suppliers across tertiary hospitals, specialty digestive disease centers, and emerging research institutions. The country's healthcare infrastructure development initiatives and growing middle-class populations seeking advanced gastrointestinal care are creating significant demand for both conventional and smart diagnostic technologies. Major hospital systems and medical equipment distributors are establishing comprehensive local distribution networks to support large-scale facility operations and meet growing demand for sophisticated diagnostic solutions.

Revenue from Smart Electrogastrogram Recorder in India is expanding to reach USD 131.0 million by 2035, supported by healthcare infrastructure development and comprehensive gastroenterology specialty growth creating sustained demand for diagnostic equipment across diverse hospital categories and emerging specialty digestive disease centers. The country's expanding healthcare access and growing awareness of functional gastrointestinal disorders are driving demand for diagnostic solutions that provide objective clinical assessment while supporting cost-effective care delivery requirements. Medical equipment importers and domestic distributors are investing in local technical support capabilities to support growing hospital operations and diagnostic procedure volumes.

Demand for Smart Electrogastrogram Recorder in Germany is projected to reach USD 155.3 million by 2035, supported by the country's leadership in gastroenterology research and advanced diagnostic technologies requiring sophisticated electrogastrography systems for functional gastrointestinal disorder assessment and gastric motility research applications. German hospitals and research institutions are implementing high-quality equipment procurement systems that support advanced diagnostic protocols, operational efficiency, and comprehensive quality standards. The market is characterized by focus on clinical evidence, diagnostic accuracy, and compliance with stringent medical device and patient safety regulations.

Revenue from Smart Electrogastrogram Recorder in Brazil is growing to reach USD 77.7 million by 2035, driven by healthcare coverage expansion programs and increasing gastrointestinal disorder awareness creating sustained opportunities for equipment suppliers serving both public hospital networks and private healthcare operators. The country's developing gastroenterology infrastructure and expanding health insurance penetration are creating demand for diagnostic equipment that supports diverse clinical requirements while maintaining cost-effective performance specifications. Medical equipment importers and local distributors are developing procurement strategies to support hospital operational efficiency and regulatory compliance requirements.

Demand for Smart Electrogastrogram Recorder in United States is projected to reach USD 111.7 million by 2035, expanding at a CAGR of 6.3%, driven by advanced motility disorder programs and specialty gastroenterology capabilities supporting comprehensive functional gastrointestinal disorder assessment and research investigation. The country's established gastroenterology leadership and sophisticated healthcare delivery systems are creating demand for premium diagnostic equipment that supports clinical performance and evidence-based practice standards. Equipment manufacturers and specialty distributors are maintaining comprehensive clinical support capabilities to support diverse hospital requirements and evolving diagnostic protocols.

Revenue from Smart Electrogastrogram Recorder in United Kingdom is expanding to reach USD 119.1 million by 2035, supported by National Health Service diagnostic pathway modernization and gastroenterology service enhancement programs. British hospitals maintain established procurement frameworks emphasizing clinical evidence and cost-effectiveness while developing specialized motility assessment capabilities serving regional populations.

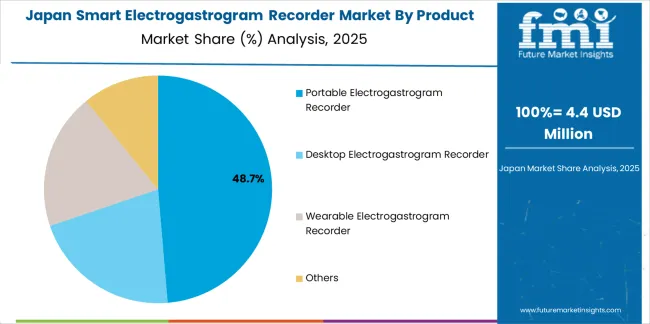

Demand for Smart Electrogastrogram Recorder in Japan is projected to reach USD 126.9 million by 2035, expanding at a CAGR of 5.0%, driven by precision diagnostic excellence and advanced gastroenterology capabilities supporting functional gastrointestinal disorder assessment and research applications. Japanese hospitals including University of Tokyo Hospital, Kyoto University Hospital, and National Center for Global Health and Medicine maintain comprehensive diagnostic equipment qualification processes ensuring consistent performance and clinical reliability across gastroenterology departments.

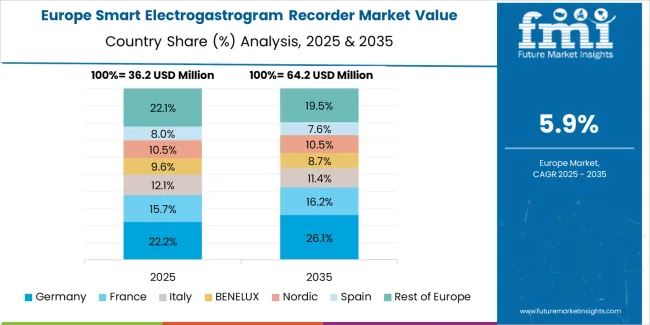

The smart electrogastrogram recorder market in Europe is projected to grow from USD 38.2 million in 2025 to USD 81.7 million by 2035, registering a CAGR of 7.9% over the forecast period. Germany is expected to maintain its leadership position with a 33.6% market share in 2025, declining slightly to 32.4% by 2035, supported by its advanced gastroenterology research infrastructure and major motility disorder centers including Charite University Hospital and University Hospital Munich.

France follows with a 22.1% share in 2025, projected to reach 22.8% by 2035, driven by comprehensive gastroenterology department capabilities at Paris hospitals and regional digestive disease centers implementing advanced diagnostic protocols. The United Kingdom holds a 18.4% share in 2025, expected to decrease to 17.7% by 2035 due to National Health Service budget constraints affecting diagnostic equipment procurement. Italy commands a 15.2% share, while Spain accounts for 10.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 11.3% to 12.1% by 2035, attributed to increasing electrogastrography adoption in Nordic countries and emerging Eastern European gastroenterology departments implementing motility assessment program expansions.

Japanese Smart Electrogastrogram Recorder operations reflect the country's exacting medical equipment standards and sophisticated clinical expectations. Major hospital systems including University of Tokyo Hospital, Kyoto University Hospital, and National Center for Global Health and Medicine maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive clinical validation, device testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium clinical positioning and diagnostic reliability objectives.

The Japanese market demonstrates unique application preferences, with significant demand for compact diagnostic systems tailored to Japanese gastroenterology department workflows and patient examination protocols. Hospitals require specific signal processing algorithms and user interface characteristics that differ from Western applications, driving demand for customized software development and language localization supporting clinical adoption.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive clinical validation and performance documentation requirements that surpass most international standards. The medical device approval system requires detailed clinical study data and comparative effectiveness evidence, creating advantages for suppliers with transparent development processes and peer-reviewed publication records supporting diagnostic claims.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese hospitals typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing technical support and clinical collaboration over price competition. This stability supports investment in localized product development and clinical education programs tailored to Japanese gastroenterology practice patterns.

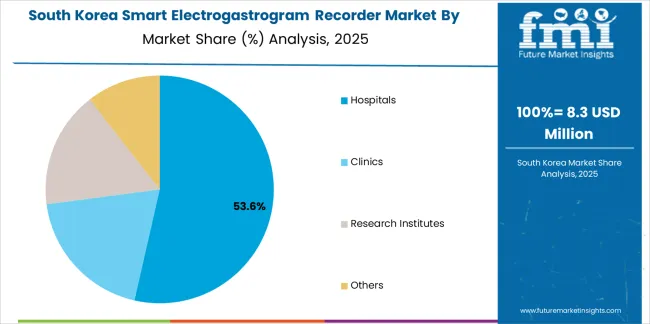

South Korean Smart Electrogastrogram Recorder operations reflect the country's advanced healthcare sector and innovation-focused medical technology adoption. Major hospital systems including Seoul National University Hospital, Asan Medical Center, and Samsung Medical Center drive sophisticated equipment procurement strategies, establishing relationships with international manufacturers while supporting domestic medical device industry development through research collaborations and clinical validation programs.

The Korean market demonstrates particular strength in adopting digital health technologies, with hospitals integrating electrogastrogram recorders into comprehensive electronic medical record systems and telemedicine platforms designed for optimal clinical workflow efficiency. This technology integration approach creates demand for specific connectivity specifications and data exchange protocols supporting seamless integration with existing hospital information systems, requiring suppliers to demonstrate interoperability capabilities.

Regulatory frameworks emphasize medical device safety and clinical validation, with Ministry of Food and Drug Safety standards often exceeding international requirements. This creates barriers for smaller equipment suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with international quality certifications and comprehensive clinical evidence portfolios documenting diagnostic accuracy and clinical utility.

Supply chain efficiency remains critical given Korea's import dependence for specialized diagnostic equipment. Hospitals increasingly pursue relationships with established international manufacturers while evaluating domestic alternatives as Korean medical device companies develop competitive products. Technical support infrastructure and rapid response maintenance capabilities influence procurement decisions given clinical service continuity requirements.

The market faces pressure from healthcare cost containment initiatives and competition among diagnostic modalities for limited gastroenterology department budgets, driving value-based procurement models emphasizing clinical outcomes and cost-effectiveness. The premium positioning of Korean gastroenterology programs internationally continues to support demand for advanced diagnostic equipment meeting stringent performance specifications and clinical validation standards.

Profit pools are consolidating around manufacturers with regulatory approval portfolios and established clinical validation evidence. Value is migrating from basic recording systems to integrated diagnostic platforms offering wireless connectivity, artificial intelligence analysis, and telemedicine integration supporting comprehensive patient assessment. Several archetypes set the pace: global medical device conglomerates leveraging distribution networks and product portfolio breadth; specialized gastrointestinal diagnostic companies with clinical expertise and physician relationships; digital health innovators targeting wearable and remote monitoring applications; and research-focused manufacturers serving academic institutions and pharmaceutical development programs.

Switching costs remain substantial through clinical validation requirements, physician training investments, and hospital formulary processes, stabilizing market shares for incumbent suppliers while creating barriers for new entrants. Supply shocks from component availability, regulatory approval delays, and clinical evidence requirements periodically impact market entry timelines. Clinical outcome data increasingly influences purchasing decisions as hospitals adopt evidence-based procurement models emphasizing diagnostic accuracy and clinical utility validation.

Consolidation pressures affect smaller manufacturers lacking resources for regulatory compliance and clinical validation studies. Strategic partnerships between device manufacturers and software developers enable enhanced functionality and telemedicine integration. Digital health companies entering from adjacent markets bring consumer technology approaches potentially disrupting traditional medical device business models.

Lock long-term hospital contracts through clinical collaboration programs and comprehensive training initiatives; establish multi-region regulatory approval portfolios; option to develop artificial intelligence-enhanced analysis platforms and telemedicine integration capabilities with documented clinical validation supporting reimbursement justification and adoption acceleration.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global device conglomerates | Distribution scale, regulatory infrastructure, financial resources | Long-term hospital contracts, bundled equipment offerings, clinical education programs |

| Specialized GI diagnostic companies | Clinical expertise, physician relationships, application knowledge | Physician training, clinical collaboration, peer-reviewed publications |

| Digital health innovators | Technology differentiation, consumer experience, data analytics | Telemedicine integration, patient engagement platforms, remote monitoring services |

| Research-focused manufacturers | Clinical validation, academic partnerships, customization capabilities | Research collaborations, grant-funded studies, specialized applications |

| Items | Values |

|---|---|

| Quantitative Units | USD 153.8 million |

| Product | Portable Electrogastrogram Recorder, Desktop Electrogastrogram Recorder, Wearable Electrogastrogram Recorder, Others |

| Application | Hospitals, Clinics, Research Institutes, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, United Kingdom, Japan, and other 40+ countries |

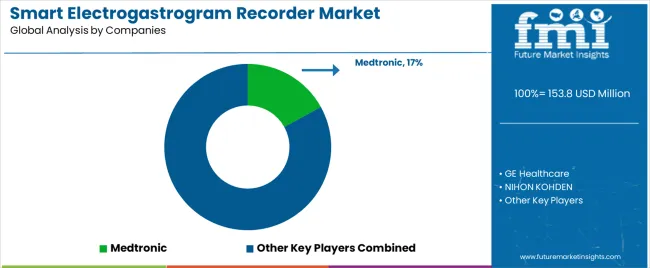

| Key Companies Profiled | Medtronic, GE Healthcare, NIHON KOHDEN, Schiller AG, Philips Healthcare, Natus Medical Incorporated, Compumedics Limited, Cadwell Industries, Noraxon USA Inc, BioPac Systems Inc |

| Additional Attributes | Dollar sales by product type/application, regional demand (NA, EU, APAC), competitive landscape, hospital vs. clinic adoption, wireless technology integration, and artificial intelligence capabilities driving diagnostic accuracy, clinical utility, and patient monitoring efficiency |

The global smart electrogastrogram recorder market is estimated to be valued at USD 153.8 million in 2025.

The market size for the smart electrogastrogram recorder market is projected to reach USD 291.4 million by 2035.

The smart electrogastrogram recorder market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in smart electrogastrogram recorder market are portable electrogastrogram recorder, desktop electrogastrogram recorder, wearable electrogastrogram recorder and others.

In terms of application, hospitals segment to command 56.3% share in the smart electrogastrogram recorder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA