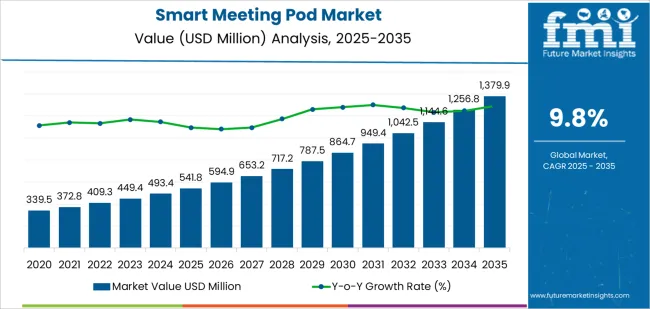

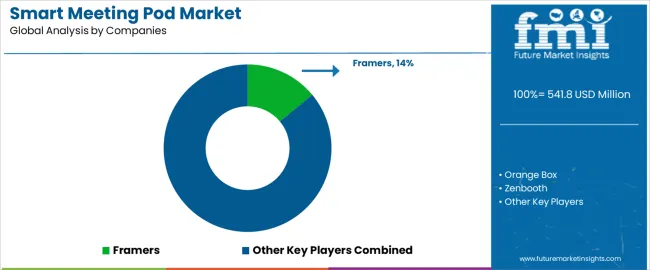

The smart meeting pod market is valued at USD 541.8 million in 2025 and is expected to reach USD 1,380.1 million by 2035, recording a CAGR of 9.8%. A seasonality or cyclicality detection assessment shows that the market follows a relatively steady annual growth pattern rather than short-term seasonal swings. Demand increases are largely tied to organizational budget cycles, workspace renovation timelines, and multi-year facility-planning strategies rather than recurring seasonal peaks. This places the market in a low-seasonality category, with spending distributed evenly across the year in most regions.

Cyclicality is more apparent when viewed over multi-year intervals. Investment tends to rise during periods of corporate expansion, hybrid-work adoption, and office-space reconfiguration, creating medium-intensity business cycles aligned with broader economic conditions. During slower economic periods, procurement decisions extend over longer timelines, producing mild cyclical dips rather than sharp contractions. Across the full forecast horizon, the market demonstrates predictable, structurally driven growth with only moderate cyclical variation tied to capital-expenditure planning and corporate real estate investment cycles.

Between 2025 and 2030, the Smart Meeting Pod Market rises from USD 541.8 million to USD 864.8 million, showing a strong peak-to-trough progression driven by rapid workspace transformation and demand for sound-isolated collaboration units. The trough period occurs around 2025 to 2026, when annual additions remain moderate at USD 33.3 million (2025-2026) and USD 36.5 million (2026 to 2027). During this early phase, adoption is mainly tied to corporate workspace optimization, hybrid-meeting integration, and early replacements of traditional meeting rooms. The first peak appears by 2029-2030, where yearly gains exceed USD 77 million, supported by high-density office reconfiguration, growth in flexible coworking spaces, and increased installation of modular acoustic pods across technology, consulting, and financial sectors.

From 2030 to 2035, the market climbs from USD 864.8 million to USD 1,380.1 million, displaying a second, stronger peak-to-trough pattern. The trough shifts to 2030-2031 with an increase of USD 84.7 million, before building toward consecutive annual gains above USD 100 million. By 2034-2035, the market reaches its peak, with a rise of USD 123.2 million as organizations scale advanced pods equipped with occupancy analytics, air-quality sensors, integrated conferencing hardware, and sound-level optimization systems. Late-cycle demand is reinforced by global adoption of hybrid office frameworks, campus-wide privacy pods, and renovation-driven replacement cycles, creating a clearly defined upward peak-to-trough growth rhythm across the decade.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 541.8 million |

| Market Forecast Value (2035) | USD 1,380.1 million |

| Forecast CAGR (2025 to 2035) | 9.8% |

Demand for smart meeting pods is rising as organizations adopt flexible workspace strategies to support hybrid schedules, reduce room-booking congestion, and improve acoustic privacy in open offices. Smart pods integrate sound insulation, ventilation, occupancy sensors, displays, and video-conferencing hardware to create controlled micro-environments suitable for calls, interviews, and focused work. Companies use pods to expand meeting capacity without undertaking major construction, enabling rapid deployment during office redesigns.

Manufacturers refine LED lighting, airflow balance, and interior ergonomics to maintain comfort during extended sessions. As employers transition to activity-based working models, modular pods offer predictable acoustic performance and reduce noise transfer across shared work zones, supporting consistent usage in technology, consulting, healthcare administration, and financial-services offices.

Market expansion is also driven by institutions seeking decentralized collaboration spaces, including universities, libraries, and public buildings. Smart pods integrate with scheduling systems, network-management platforms, and access-control tools, enabling administrators to monitor utilization and maintain compliance with occupancy policies. Providers enhance fire-safety materials, cable-routing options, and maintenance access to meet facility-management requirements across high-traffic environments.

Increased focus on employee well-being encourages adoption of pods with improved air-filtration modules and adjustable lighting designed to reduce fatigue during virtual meetings. Although high acquisition costs can limit adoption for small organizations, leasing models and modular manufacturing help lower entry barriers. Continued emphasis on hybrid work, distributed teams, and high-quality video collaboration ensures sustained demand for smart meeting pods across global commercial and institutional facilities.

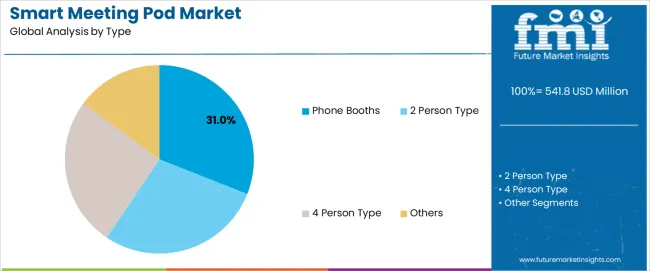

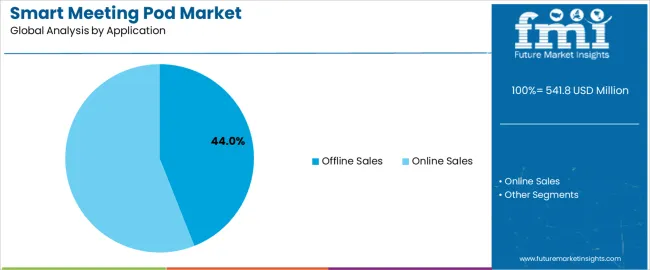

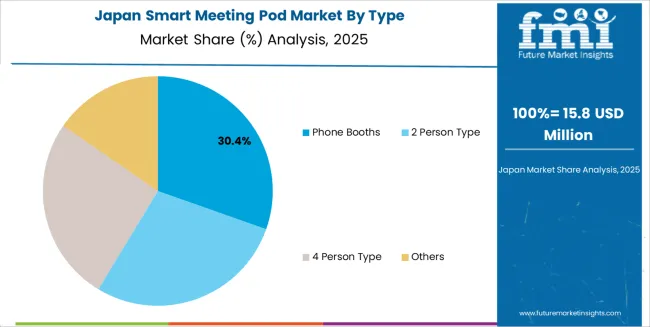

The smart meeting pod market is segmented by type, application, and region. By type, the market is divided into phone booths, 2-person pods, 4-person pods, and other models. Based on application, it is categorized into offline sales and online sales. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in workspace layouts, procurement preferences, and regional adoption of modular meeting solutions.

The phone booth segment accounts for approximately 31.0% of the global smart meeting pod market in 2025, making it the leading type category. This position reflects steady demand for compact privacy pods that support individual calls, virtual meetings, and focused work within open-plan offices. Phone booths meet acoustic needs for noise isolation without requiring large installation areas, making them practical for organizations facing space constraints or incremental workspace adjustments. Their small footprint simplifies placement in corridors, shared zones, or existing office clusters.

Manufacturers design these units with ventilation systems, acoustic panels, integrated lighting, and connectivity ports that support routine communication tasks. Organizations adopt phone booths as part of workspace redesign strategies intended to improve call privacy and reduce noise spillover in high-density layouts. Adoption is strong in North America and Europe, where hybrid-work patterns and open-plan offices drive recurring demand for individual privacy spaces. The segment also appeals to co-working operators that require modular installations suited to varied user turnover. The phone booth category maintains its lead because it aligns with daily communication needs, offers installation flexibility, and delivers acoustic performance suited to modern collaborative environments.

The offline sales segment represents about 44.0% of the total smart meeting pod market in 2025, making it the dominant application category. This position reflects the need for physical evaluation of pod dimensions, acoustic quality, structural materials, and integration features before procurement. Buyers often rely on showrooms, vendor demonstrations, and in-person assessments to confirm comfort levels, ventilation effectiveness, and internal layout suitability. Smart meeting pods are high-value, space-dependent items, so many organizations prefer traditional procurement channels that allow direct inspection.

Offline sales also support project-based purchasing, where pods are selected during broader office renovation or expansion activities managed by design firms or facility planners. Regional adoption is notable in Europe and North America, where workspace-planning services commonly coordinate pod selection alongside furniture and acoustic treatments. Manufacturers reinforce offline channels through installation support, delivery coordination, and customized fit-out options. The segment holds its leading position because organizations often require tangible evaluation and coordinated on-site planning to ensure that pods integrate properly into existing workspaces and meet operational expectations for privacy and acoustic performance.

The smart meeting pod market is growing as organizations seek flexible, private and technology-enabled spaces to support hybrid work and distributed teams. Smart pods provide acoustic isolation, integrated lighting, ventilation and connectivity features that allow quick setup of focused work areas or small meeting zones without major construction. Growth is supported by shifting office layouts, rising demand for video-ready spaces and the need to optimize real estate. Adoption is limited by high unit costs, space constraints and maintenance demands. Manufacturers are advancing modular designs, improved soundproofing and enhanced digital integration to meet evolving workspace needs.

Demand rises as organizations redesign offices to support frequent video calls, small group collaboration and quiet work zones. Smart pods offer immediate deployment without structural renovation, making them suitable for both large headquarters and flexible satellite offices. Hybrid work increases the need for semi-private areas equipped with reliable acoustics and AV compatibility. Companies use pods to reduce meeting-room bottlenecks and provide consistent environments for digital communication. As work patterns continue shifting toward mobility and shared spaces, pods become an effective way to balance privacy with open-plan efficiency.

Adoption is limited by high upfront cost, which can be difficult for small businesses or budget-restricted departments. Pods require adequate floor space, power access and ventilation support, which may challenge older buildings or high-density layouts. Some organizations hesitate due to concerns about long-term durability, cleaning needs and acoustic performance that varies by model. Integration with existing IT and AV systems adds further complexity. These factors slow uptake in offices that rely on low-cost partitions or existing meeting rooms.

Key trends include improved sound isolation materials, customizable pod sizes and integrated sensors that monitor occupancy, air quality and energy use. Pods are increasingly equipped with built-in video conferencing setups, wireless connectivity and adaptive lighting to support high-quality remote collaboration. Manufacturers are developing modular, reconfigurable formats that allow quick relocation as office needs change. Interest is growing in eco-friendly materials and low-energy ventilation systems. As organizations adopt activity-based workplace models, smart pods continue shifting toward enhanced digital features, ergonomic layouts and scalable installation options.

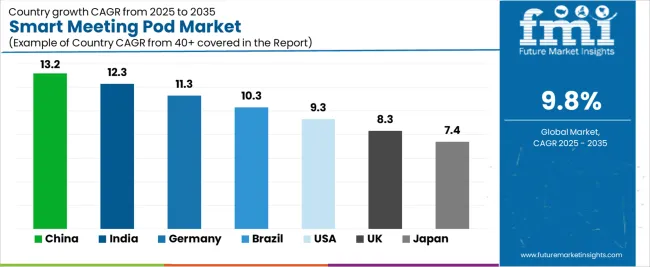

| Country | CAGR (%) |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| Brazil | 10.3% |

| USA | 9.3% |

| UK | 8.3% |

| Japan | 7.4% |

The Smart Meeting Pod Market is experiencing strong global growth, with China leading at a 13.2% CAGR through 2035, driven by rapid workplace modernization, rising adoption of modular private spaces, and increased demand for acoustic, tech-enabled collaboration units. India follows at 12.3%, supported by fast-growing corporate infrastructure, expanding coworking ecosystems, and demand for flexible, soundproof meeting environments.

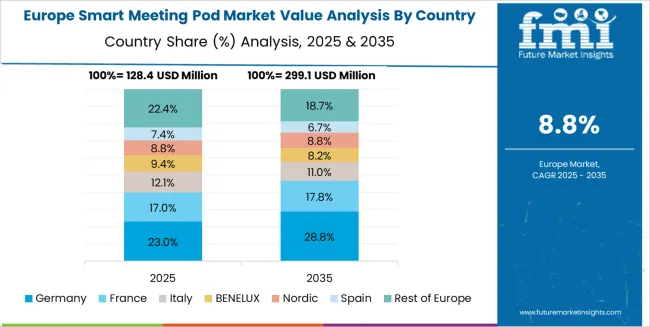

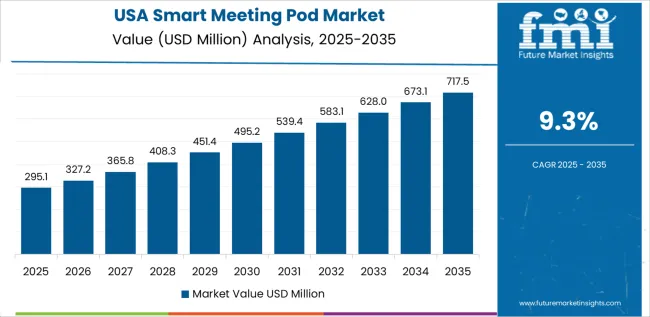

Germany records 11.3%, reflecting high standards in design engineering, sustainability, and demand for advanced workspace solutions. Brazil grows at 10.3%, benefitting from rising corporate investments and increasing adoption of hybrid work models. The USA, at 9.3%, remains a major market emphasizing smart connectivity, ergonomic design, and integrated AV systems, while the UK (8.3%) and Japan (7.4%) focus on compact, high-quality pods optimized for dense office environments and tech-enabled collaboration.

China is projected to grow at a CAGR of 13.2% through 2035 in the smart meeting pod market. Expanding office construction, rising adoption of modular spaces, and increased use of enclosed meeting areas strengthen the need for engineered pod systems. Enterprises request pods supporting voice clarity, virtual meetings, and controlled acoustics. Vendors deliver integrated lighting, ventilation, and sensor modules for productivity. Coworking facilities adopt pods to organise space allocation while supporting hybrid work patterns. Demand expands further as companies standardise private discussion zones for interviews, team calls, and confidential collaboration across busy office environments.

India is projected to grow at a CAGR of 12.3% through 2035 in the smart meeting pod market. Growth in coworking centres, expanding technology campuses, and rising demand for quiet discussion areas increases interest in self-contained pods. Enterprises adopt pods to manage noise, support online meetings, and optimise space usage. Providers supply pods with integrated communication tools, structured ventilation, and lighting control for longer sessions. Hybrid work models encourage companies to set dedicated spaces for small discussions and interviews. Market expansion aligns with broader development of organised work environments supporting controlled acoustic and ergonomic needs.

Germany is projected to grow at a CAGR of 11.3% through 2035 in the smart meeting pod market. Structured workspace planning, advanced engineering expectations, and interest in organised private meeting zones increase pod deployment. Companies implement pods to provide controlled acoustic conditions for internal discussions, virtual calls, and confidential reviews. Vendors deliver systems featuring insulated panels, efficient airflow, and calibrated lighting. Facilities managers use pods to enhance spatial flexibility within established office layouts. Market progression reflects increased reliance on modular structures supporting predictable performance for meetings requiring privacy and clarity across regulated industry environments.

Brazil is projected to rise at a CAGR of 10.3% through 2035 in the smart meeting pod market. Expanding corporate renovation projects, increasing demand for enclosed meeting zones, and broader adoption of virtual collaboration tools elevate pod usage. Providers offer pods equipped with acoustic walls, integrated microphones, and controlled ventilation. Companies seek compact units that address noise management and maintain consistent meeting conditions. Hybrid teams benefit from predictable spaces for calls and planning sessions. Market activity reflects the growing role of structured meeting environments across business hubs adopting flexible workspace arrangements.

USA is projected to expand at a CAGR of 9.3% through 2035 in the smart meeting pod market. Consolidated office layouts, increased reliance on virtual meetings, and rising interest in enclosed discussion zones support pod adoption. Enterprises use pods to organise confidential meetings, interviews, and hybrid communication sessions. Vendors deliver enhanced acoustic protection, ergonomic seating, and integrated controls for lighting and ventilation. Technology companies integrate pods into collaborative environments requiring flexible, reservable spaces. Market growth aligns with advanced workspace planning focused on predictable performance for frequent digital and in-person interactions.

UK is projected to grow at a CAGR of 8.3% through 2035 in the smart meeting pod market. Dense office layouts, increased hybrid work adoption, and demand for efficient enclosed spaces drive pod usage. Businesses implement pods to manage noise and provide consistent meeting areas suitable for structured discussions. Suppliers offer integrated acoustic materials, controlled environmental systems, and communication-ready configurations. Pods help offices reorganise limited floor space without structural changes. Market interest strengthens as organisations standardise small meeting zones for frequent short-duration conversations and remote coordination.

Japan is projected to increase at a CAGR of 7.4% through 2035 in the smart meeting pod market. High workspace density, strong demand for quiet meeting zones, and structured corporate environments encourage pod adoption. Companies use pods to support focused calls, internal discussions, and short planning sessions. Vendors supply compact pods with calibrated acoustics, space-efficient seating, and reliable ventilation suited to narrow layouts. Demand rises as firms enhance office functionality without extensive renovation. Market expansion reflects ongoing adjustments toward organised enclosed spaces supporting communication needs across diverse work environments.

The global smart meeting pod market shows moderate fragmentation, shaped by manufacturers supplying enclosed acoustic spaces for offices, coworking centers, and hybrid-work environments. Framers and Orange Box maintain strong positions with modular pods designed for controlled acoustics, ergonomic interiors, and integration with corporate workspace layouts. Zenbooth and Room support a wide user base through lightweight, easy-to-install pods suited for video calls, focused work, and private meetings.

DEMVOX and WhisperRoom contribute deeper acoustic engineering expertise, offering high-isolation structures for environments requiring advanced noise control. MECART and MEAVO strengthen mid-tier competition with pods built around durable panel systems and optional ventilation, lighting, and connectivity enhancements. Across this tier, competition is shaped by sound isolation, build quality, and installation flexibility.

Hushoffice, BUSYPOD, Kubebooth, and Dancoo broaden the market through designs emphasizing compact footprints, energy-efficient ventilation, and user-friendly interior features that support short-duration meetings or individual focus sessions. Guangzhou Cyspace increases regional supply with scalable production and customizable pod formats for growing Asian office markets. Competitive dynamics are influenced by acoustic performance, airflow management, fire-safety compliance, and the ability to support digital tools such as integrated displays and occupancy sensors.

Strategic differentiation depends on modularity, sustainability of materials, and adaptability to evolving hybrid-work patterns. As organizations redesign office layouts to support privacy, video conferencing, and noise mitigation, manufacturers delivering reliable acoustics, quick installation, and technology-ready configurations are positioned to strengthen long-term market presence.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Phone booths, 2-person pods, 4-person pods, Others |

| Application | Offline sales, Online sales |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Framers, Orange Box, Zenbooth, Room, DEMVOX, WhisperRoom, MECART, MEAVO, Hushoffice, BUSYPOD, Kubebooth, Dancoo, Guangzhou Cyspace |

| Additional Attributes | Unit sales by pod type and application, offline vs online procurement patterns, occupancy & air-quality sensor penetration, acoustic performance metrics, integrated AV & conferencing hardware, ventilation & fire-safety compliance, leasing vs purchase models, modularity & reconfigurability, regional installation & maintenance cost drivers, sustainability/material choices, integration with workplace scheduling/management systems |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global smart meeting pod market is estimated to be valued at USD 541.8 million in 2025.

The market size for the smart meeting pod market is projected to reach USD 1,379.9 million by 2035.

The smart meeting pod market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in smart meeting pod market are phone booths, 2 person type, 4 person type and others.

In terms of application, offline sales segment to command 44.0% share in the smart meeting pod market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA