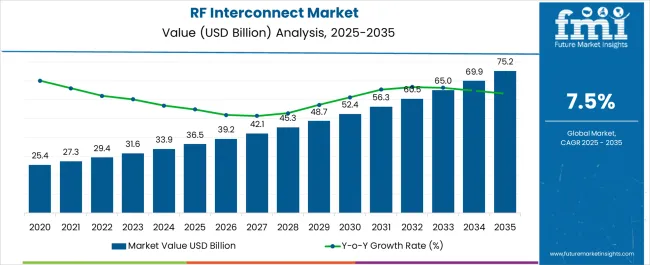

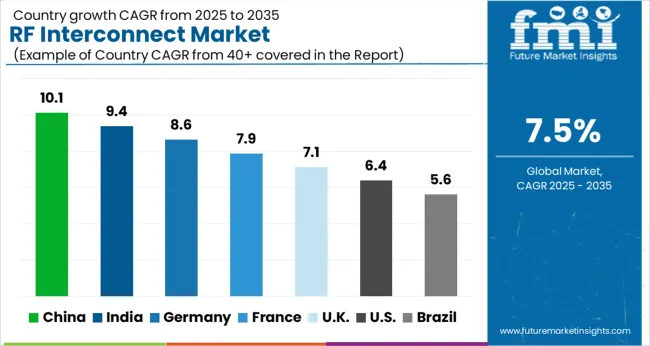

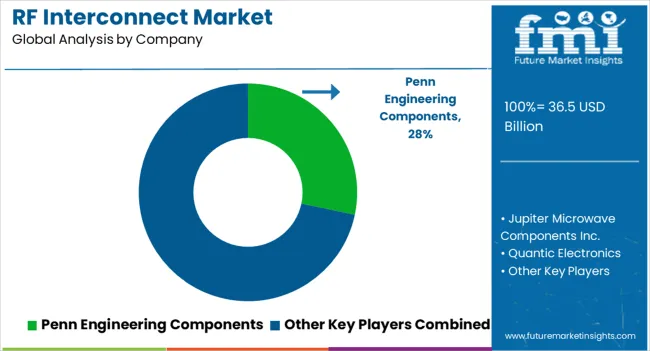

The RF interconnect market is estimated to be valued at USD 36.5 billion in 2025 and is projected to reach USD 75.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

RF engineers evaluate interconnect specifications based on frequency response characteristics, insertion loss performance, and impedance matching requirements when designing communication systems, radar installations, and test equipment configurations. Component selection involves analyzing connector types, cable assemblies, and adapter configurations while considering environmental sealing, mechanical durability, and temperature stability necessary for reliable signal transmission throughout varying operational conditions. Procurement decisions balance initial component costs against performance metrics including signal fidelity, power handling capacity, and long-term reliability that influence overall system effectiveness and maintenance requirements.

Manufacturing processes require precision machining operations, electroplating procedures, and assembly techniques that achieve consistent electrical performance while maintaining mechanical integrity throughout demanding operational environments. Production coordination involves managing raw material sourcing, quality control testing, and certification compliance while maintaining dimensional tolerances and electrical specifications across diverse connector families and cable configurations. Quality assurance protocols address electrical testing, mechanical validation, and environmental stress screening that ensure reliable performance throughout extended operational lifecycles under varying temperature, vibration, and moisture conditions.

Cross-functional coordination involves RF design engineers, mechanical specialists, and test technicians collaborating to optimize interconnect solutions that balance electrical performance with mechanical reliability while addressing specific application requirements including frequency bandwidth, power levels, and environmental exposure conditions. Manufacturing processes encompass connector assembly, cable preparation, and final testing procedures while coordinating with quality control, packaging, and shipping operations. Testing protocols establish electrical verification, mechanical stress assessment, and environmental qualification that validate interconnect performance throughout demanding application scenarios.

Service relationships involve coordination between interconnect manufacturers, distribution networks, and technical support organizations to establish comprehensive supply chains that address custom engineering requirements, rapid prototyping, and volume production throughout diverse application development cycles. Contract negotiations include performance specifications, delivery guarantees, and technical support provisions that protect customer investments while ensuring reliable component supply throughout product development and manufacturing programs. Partnership development encompasses collaboration with cable manufacturers, test equipment providers, and system integrators to deliver integrated RF solutions that optimize interconnect performance while supporting customer application requirements.

Innovation trends emphasize 6G technology preparation, terahertz frequency support, and quantum communication compatibility that advance RF interconnect technology while supporting emerging communication paradigms including satellite internet constellations, autonomous vehicle networks, and Internet of Things deployments requiring revolutionary interconnect solutions throughout next-generation wireless infrastructure supporting global connectivity advancement and technological innovation acceleration.

| Metric | Value |

|---|---|

| RF Interconnect Market Estimated Value in (2025 E) | USD 36.5 billion |

| RF Interconnect Market Forecast Value in (2035 F) | USD 75.2 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The RF interconnect market is experiencing consistent growth driven by the expansion of high speed communication networks, rapid advancements in 5G infrastructure, and increasing reliance on connected devices across industries. Rising demand for efficient transmission systems in mission critical applications has created strong opportunities for RF cables, connectors, and assemblies.

Continuous innovation in material science and precision engineering has enhanced product performance, durability, and frequency handling capacity. Additionally, aerospace and defense modernization programs along with the proliferation of satellite communication networks are reinforcing the importance of high quality RF interconnect solutions.

The outlook remains positive as the market continues to benefit from advancements in wireless technologies, stringent quality requirements, and increasing adoption across both commercial and defense domains.

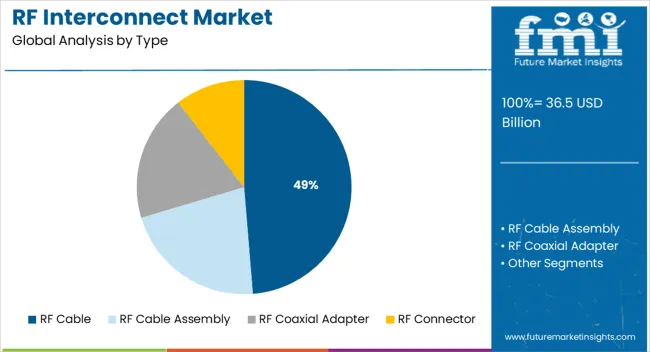

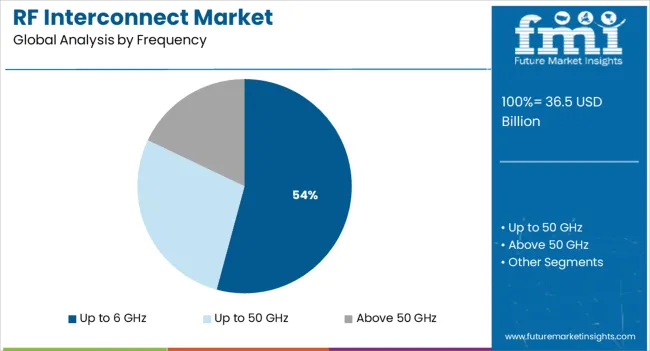

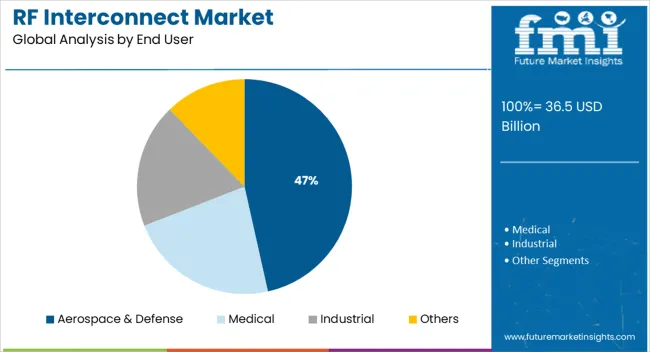

The market is segmented by Type, Frequency, and End User and region. By Type, the market is divided into RF Cable, RF Cable Assembly, RF Coaxial Adapter, and RF Connector. In terms of Frequency, the market is classified into Up to 6 GHz, Up to 50 GHz, and Above 50 GHz. Based on End User, the market is segmented into Aerospace & Defense, Medical, Industrial, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The RF cable segment is expected to account for 48.70% of total revenue by 2025 within the type category, establishing itself as the leading segment. Its dominance is attributed to wide usage in communication systems, broadcasting, and critical signal transmission applications.

RF cables offer low signal loss, flexibility, and high shielding effectiveness, which are essential for ensuring transmission reliability. Continuous developments in cable materials and insulation technologies have further boosted their adoption.

The versatility of RF cables across industries ranging from telecommunications to defense has reinforced their market leadership, making them the preferred choice in the type category.

The up to 6 GHz frequency segment is projected to hold 54.20% of overall revenue within the frequency category, positioning it as the largest segment. This is driven by its widespread use in cellular communication, Wi Fi, and defense applications that require stable and efficient frequency performance.

The increasing rollout of 5G networks and demand for enhanced bandwidth have accelerated adoption in this range. Moreover, its compatibility with widely deployed communication infrastructure ensures cost efficiency and scalability.

The segment’s broad applicability across commercial and military communication systems has reinforced its strong market share.

The aerospace and defense segment is estimated to capture 46.50% of total revenue by 2025 under the end user category, highlighting its dominant position. This leadership is due to increasing defense modernization initiatives, expansion of satellite communication programs, and growing reliance on secure, high frequency transmission systems.

RF interconnect solutions are vital for applications such as radar systems, electronic warfare, and avionics, where performance and reliability are critical. Continuous government investments in defense infrastructure and the rising importance of advanced communication networks in aerospace operations are driving demand.

As a result, aerospace and defense remain the cornerstone end user of the RF interconnect market.

The RF interconnect market was worth USD 25.4 billion in 2020; from 2020 to 2024, it recorded growth at a rate of 6.55%, reaching roughly USD 6.66 billion.

The global market is anticipated to rise as a result of an increase in demand for high-speed connectors and compact, thinner connectors. The demand for RF interconnect for high frequency and high data transmission, as well as connector downsizing, is likely to increase RF interconnect production.

The epidemic has had a negative impact on the market for RF interconnects worldwide. The pandemic has had a detrimental impact on the sales and operating results of the key businesses operating in the market in the fiscal year 2024.

Mission-critical Military Electronic Systems Rely on RF Cable Assemblies for their Operation

RF cable assemblies are crucial in mission-critical military electronic systems. Since they offer quick transmission and little loss, RF cables are commonly employed in stressful and hazardous conditions.

Due to their dependability and speed, RF cable assemblies are employed in laboratory and test measuring equipment. These advantages are propelling the use of RF cables in military applications, as well as the RF interconnect market expansion.

Internet of Things (IoT) Innovation Bolstered by Swift Evolutions in Connectivity and New Apps

Information and communication technologies (ICT) are used in smart cities to improve administrative effectiveness, improve citizen welfare and governmental services, and disseminate information to the general public. With the use of data analysis and smart technologies, a smart city's main objective is to boost economic development, streamline municipal operations, and improve the quality of life for its inhabitants.

New applications in the RF interconnect market are being created, and innovation is being sped up by quick developments in data analysis, the internet of things, and greater connection. The way people live, work, play, and commute are changing as a result of the adoption of new technology in cities around the world.

Numerous sensors and data collection devices are being used, which makes RF technology crucial for the infrastructure of smart technology. Across many industries, using real-time information improves efficiency. Nearly all smart city projects that require wireless connectivity for data transmission can be made possible via RF adapters, cable assemblies, and connectors.

Cost of Installation and Operational Risks to Restrict Growth

The pace of the market for radio frequency cables may be slowed down by the fact that few radiofrequency cables are typically large and require a lot of room for installation in limited spaces. Large and inflexible construction of these items makes them expensive to integrate over longer distances as well, which poses a serious threat to their prospective demand in the RF interconnect market.

| Attributes | Details |

|---|---|

| RF Cable Assembly - Segment Share | 33% |

| RF Cable Assembly - Segment CAGR | 6% |

| RF Coaxial Adapter - Segment CAGR | 8.7% |

The RF cable assembly segment commanded the RF interconnect market as a whole, acquiring a revenue share of over 33% during the projection period and experiencing a CAGR of over 6%.

One or more cables that are assembled and contained in a single tube are referred to as cables. Connectors are used to install the ends, while adapters are used to link them. When RF signals need to go from one part of a system to another, RF cable assemblies act as transmission lines.

These connections, which are mechanically coupled to a coaxial cable, are typically seen in this cable arrangement. Designing radio frequency coaxial cable assemblies requires taking into account several factors, such as mechanical concerns, environmental issues, shielding efficacy, electrical performance, frequency, connection types, and materials and construction.

With a CAGR of 8.7%, the RF coaxial adapter is predicted to expand at a swift rate. These passive coaxial parts are used to transmit signals between connector interfaces. They can be used to switch signals between Threaded Neill Concelman (TNC) connections and Bayonet Neill Concelman (BNC) connectors at the interface of Sub-Miniature A (SMA) connectors.

Connectors and adapters both perform comparable functions. These are also employed to connect various devices throughout a network. Male RF adapters have a hole created for attaching the pin or plug on female connections, which is used to connect the two separate pieces. Female RF adapters are typically identified by their pin. Jacks are the name for male RF adapters.

| Attributes | Details |

|---|---|

| Up to 50 GHz - Segment Share | 41.9% |

| Up to 50 GHz - Segment CAGR | 7% |

| Up to 6 GHz - Segment CAGR | 8.5% |

With an RF interconnect market share of 41.9% between 2025 and 2035 and a CAGR of 7.0% during the projection period, the up to 50 GHz category dominated the total market.

The term ‘super high frequency’ refers to this band of frequencies (SHF). The International Telecommunication Union (ITU) refers to radio frequency (RF) frequencies between 3 and 50 gigahertz as SHF. This frequency band is also known as the centimeter band or centimeter wave, since the wavelengths extend from one to 10 centimeters.

Since the radio waves at these frequencies lie within the microwave band, SHF is sometimes known as a microwave. Since microwaves have a short wavelength, they can be focused by aperture antennas into narrow beams, making them ideal for radar, data lines, and point-to-point communication.

This frequency range is used by the vast majority of satellite phones (S-band), satellite communication, wireless LANs, microwave radio relay lines, radar transmitters, and several short-range terrestrial data links. In addition, they are used for medical diathermy, industrial microwave heating, and microwave hyperthermia for the treatment of cancer.

With a CAGR of 8.5% throughout the forecast period, the category up to 6GHz is predicted to develop at a swift rate. Ultra High Frequency refers to this band of frequencies (UHF). Radiofrequency connectors known as UHFs are used to transfer signals at frequencies up to 6 GHz. These connectors, which have non-constant surge impedance, are frequently used in amateur radio, marine VHF radio, and other radio applications.

| Attributes | Details |

|---|---|

| Others Segment Share | 61.7% |

| Others Segment CAGR | 7.4% |

| Industrial Segment CAGR | 8.7% |

Through 2035, the ‘others’ sector in the RF interconnect market is predicted to lead, acquiring a 61.7% revenue share on the way. The other sector covers sectors including manufacturing, consumer electronics, consumer technology, construction, and telecommunication. Over the forecast period, it is envisaged that the others section may expand at a CAGR of 7.4%.

Due to the continued development of high-tech products and the rising demand for HVAC equipment with advanced features, the consumer electronics sector is predicted to offer significant growth potential to the worldwide radio frequency cable business.

The prognosis for the aerospace and defense market is anticipated to be supported by the rising demand for adaptable, incredibly resilient, and high-performance RF systems for effective signal processing in military applications. It is anticipated that rising investments in digitization projects across industries may increase demand for power transmission and distribution networks.

The industrial sector is anticipated to grow at a swift rate between 2025 and 2035, with a CAGR of 8.7%. Connectors for transmitting at extremely high frequencies are used to join cables, printed circuit boards, and equipment. Small to large and heavy connections are available on the market.

Connectors are not only required to enable current and future technologies; they also need to be able to withstand ever-increasing transmission rates, adapt to changing economic and ecological conditions, and consistently meet the demand for reliability and performance, even under adverse circumstances.

| Attributes | Details |

|---|---|

| Market Share | 44.02% |

With a 44.02% revenue share, Asia Pacific dominated the RF interconnect market from 2025 to 2035. The increasing demand for RF interconnect components in the Asia Pacific area is being driven by evolving manufacturing facilities, supportive government efforts, expanding construction activities, and rising investments in new infrastructures, among other factors.

| Attributes | Details |

|---|---|

| Market Share | 44.02% |

With a CAGR of 8.3% throughout the projected period, the North America RF interconnect market is expected to experience significant development. Some of the key elements influencing the growth of the RF connection in the North American region include the increasing interest of various administrations in offering citizens high-speed internet access, new oil and gas development potential, and strict legislation for RF systems.

The division has also put into practice many regulations and keeps an eye on the installations by using specialized software to detect radio frequency density close to broadcasting towers.

The RF interconnect market is highly competitive, driven by rapid advancements in high-frequency communication technologies, 5G infrastructure, and aerospace and defense applications. Amphenol RF (Amphenol Corporation), Smiths Interconnect Ltd., and Samtec Inc. lead the market with extensive product portfolios covering RF connectors, adapters, and cable assemblies designed for superior performance across high-speed and high-power applications. Their focus on reliability, miniaturization, and advanced materials has strengthened their dominance across global communication networks and military-grade systems.

Penn Engineering Components, Ducommun Incorporated, and Cobham Advanced Electronic Solutions bring deep engineering expertise in custom RF interconnect solutions, supporting mission-critical applications in defense, aerospace, and satellite communication. Their innovations in low-loss and high-density interconnect designs enhance system integrity and signal performance under extreme environments.

Delta Electronics Inc., ETL Systems Ltd., and Quantic Electronics focus on integrating RF components into broader communication ecosystems, offering high-frequency connectivity solutions that support next-generation radar, IoT, and wireless infrastructure. Corning Incorporated and DigiLens Inc. contribute through advancements in optical and waveguide-based RF interconnect technologies, merging photonics with RF systems to enable faster, more efficient data transmission.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 36.5 billion |

| Type | RF Cable, RF Cable Assembly, RF Coaxial Adapter, RF Connector |

| Frequency | Up to 6 GHz, Up to 50 GHz, Above 50 GHz |

| End User | Aerospace & Defense, Medical, Industrial, Telecommunications, Consumer Electronics, Automotive, Others (Construction, Energy, Research) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Germany, France, United Kingdom, China, Japan, India, South Korea, Brazil, and 40+ countries |

| Key Companies Profiled |

Penn Engineering Components, Jupiter Microwave Components Inc., Quantic Electronics, Amphenol RF (Amphenol Corporation), Delta Electronics Inc., Samtec Inc., Cobham Advanced Electronic Solutions, Ducommun Incorporated, ETL Systems Ltd., Smiths Interconnect Ltd., DigiLens Inc., Corning Incorporated |

| Additional Attributes | Dollar sales by type, frequency, and end user; rising demand for high-speed and high-frequency transmission; growth driven by 5G and satellite connectivity; defense modernization and radar system upgrades; miniaturization of RF components; IoT integration across industries; increased use of smart city infrastructure; and sustained R&D investments in precision and low-loss RF materials. |

The global rf interconnect market is estimated to be valued at USD 36.5 billion in 2025.

The market size for the rf interconnect market is projected to reach USD 75.2 billion by 2035.

The rf interconnect market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in rf interconnect market are rf cable, rf cable assembly, rf coaxial adapter and rf connector.

In terms of frequency, up to 6 ghz segment to command 54.2% share in the rf interconnect market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA