The RFconnectors market is projected to expand from USD 37.1 billion in 2025 to USD 77.9 billion by 2035, reflecting a CAGR of 7.7%. Contribution analysis by technology indicates that coaxial connectors, fiber optic connectors, and waveguide connectors will collectively drive market growth. However, their individual adoption trajectories vary due to application-specific requirements and technological evolution.

Coaxial connectors are expected to maintain a dominant contribution, owing to their established use in telecommunications, broadband networks, and consumer electronics, where reliability, frequency range, and signal integrity remain critical performance metrics. Fiber optic connectors are anticipated to show significant incremental growth, driven by increasing deployment of high-speed data networks, 5G infrastructure, and data centers requiring low-loss and high-bandwidth transmission.

Advanced technologies such as LC, SC, and MPO/MTP connector variants are projected to account for a growing share of total market value, particularly in Asia-Pacific and North America, where fiber penetration is accelerating. Waveguide connectors will continue to contribute moderately, primarily in defense, aerospace, and satellite communications applications that demand high-frequency performance and environmental resilience. By 2035, coaxial technology is estimated to contribute roughly 55% of market revenue, fiber optic connectors nearly 35%, and waveguide connectors the remaining 10%. The technological contribution landscape underscores a shift toward high-speed, high-frequency, and low-loss connectivity solutions, reflecting industry trends toward advanced communication and data transfer requirements, shaping investment priorities and product development strategies across major regions.

| Metric | Value |

|---|---|

| RF Connectors Market Estimated Value in (2025 E) | USD 37.1 billion |

| RF Connectors Market Forecast Value in (2035 F) | USD 77.9 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The RF Connectors Market is advancing steadily, supported by the growing deployment of wireless communication infrastructure, rising data transmission demands, and the proliferation of IoT and 5G technologies. The current market scenario is characterized by increased integration of RF connectors in defense, aerospace, automotive, and telecommunication sectors, where reliable signal transmission is critical.

Industry journals and corporate statements highlight the preference for precision-engineered connectors that offer low insertion loss, high durability, and performance consistency across frequencies. Future growth prospects are likely to be influenced by innovations in miniaturized designs and the increasing use of high-speed RF components in consumer electronics and industrial automation.

The global expansion of 5G networks, coupled with increasing R&D investments by connector manufacturers, is expected to create new application areas and enhance the market's overall competitiveness. As industries continue to prioritize signal integrity and system reliability, RF connectors are expected to remain indispensable across advanced electronic ecosystems, securing a vital role in next-generation communication networks.

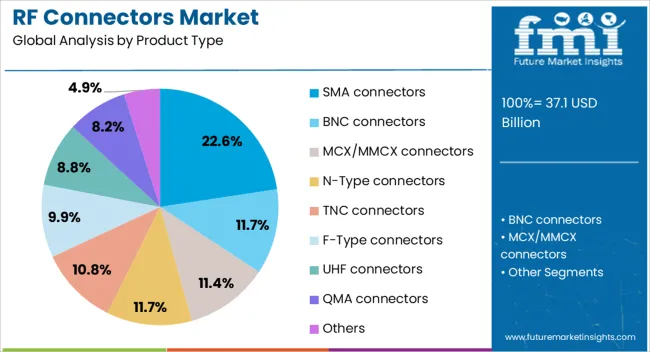

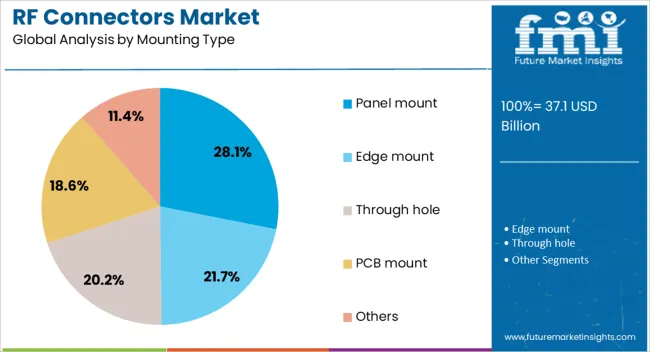

The RF connectors market is segmented by product type, frequency range, mounting type, material, plating, application, end-use industry, and geographic regions. By product type, the RF connectors market is divided into SMA connectors, BNC connectors, MCX/MMCX connectors, N-Type connectors, TNC connectors, F-Type connectors, UHF connectors, QMA connectors, and Others. In terms of frequency range, the RF connectors market is classified into Medium frequency (1-6 GHz), Low frequency ( 1 GHz), and High frequency (> 6 GHz). Based on the mounting type, the RF connectors market is segmented into Panel mount, Edge mount, Through hole, PCB mount, and Others.

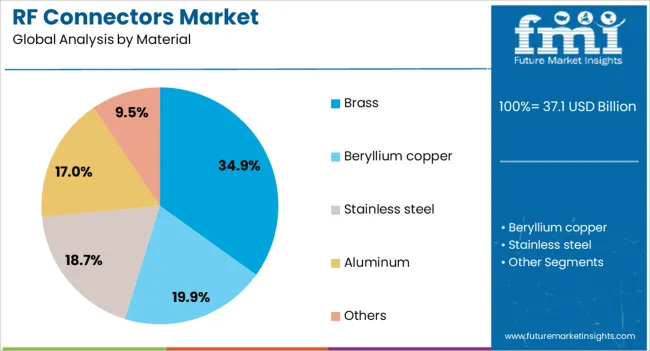

By material, the RF connectors market is segmented into Brass, Beryllium copper, Stainless steel, Aluminum, and Others. By plating, the RF connectors market is segmented into Gold, Silver, Nickel, and Others. The RF connectors market is segmented into Wireless infrastructure, Test & measurement equipment, Satellite communication, Broadcast equipment, Antenna systems, IoT devices, Medical devices, and Others. By end-use industry, the RF connectors market is segmented into Telecommunications, Aerospace & defense, Consumer electronics, Automotive, Industrial, IT & networking, Healthcare, and Others. Regionally, the RF connectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The SMA connectors segment is projected to hold 22.6% of the RF Connectors Market revenue share in 2025, positioning it as a key product type. Its growth is being attributed to strong demand in both commercial and defense applications due to its compact design, high-frequency performance, and durability under harsh environmental conditions. Product datasheets and technical bulletins emphasize the connector’s capacity to handle frequencies up to 18 GHz with low reflection and stable impedance, making it ideal for precision signal transmission.

The segment has also been favored due to widespread standardization and compatibility across various RF devices, ensuring ease of integration in existing systems. Industry press releases have noted its increasing application in test and measurement equipment, wireless base stations, and aerospace systems.

The connector’s mechanical stability and secure threaded coupling mechanism have contributed to long-term use across mission-critical environments. These characteristics, along with global availability and manufacturer reliability, have supported its leading position within the RF Connectors Market.

The panel mount segment is expected to account for 28.1% of the RF Connectors Market revenue share in 2025, making it the leading segment by mounting type. This dominance has been attributed to the secure and fixed positioning these connectors offer in equipment, providing robust support for high-vibration and high-density applications. Industry sources highlight that panel mounts are widely integrated in industrial, automotive, and telecommunication enclosures, where reliable connectivity is essential over extended operating cycles.

Their ease of installation and enhanced strain relief capabilities have made them preferred choices for device manufacturers focused on long-term mechanical stability and performance. Investor updates and manufacturer portfolios show consistent development in low-profile and sealed panel mount variants, catering to demand from outdoor and rugged environments.

Additionally, the flexibility to accommodate various connector types within standardized panel cutouts has enhanced adoption. These benefits have enabled the panel mount segment to maintain a dominant share in the evolving RF connector landscape.

The medium frequency range segment is forecasted to command 37.4% of the RF Connectors Market revenue share in 2025, solidifying its lead in the frequency range classification. This share is being driven by extensive deployment of RF systems operating between 1 to 6 GHz across telecommunications, consumer electronics, satellite communication, and automotive radar applications. Technical documentation and engineering publications cite that connectors supporting this range balance performance with cost-efficiency, making them suitable for mainstream commercial applications.

The segment has gained traction due to its compatibility with 4G and early 5G network components, wireless LANs, and GPS devices. Manufacturers have prioritized this frequency band for its wide applicability, investing in scalable connector designs that support repeatable performance under moderate frequencies.

Additionally, the segment benefits from regulatory stability and availability of mature component ecosystems, which reduce design complexity and speed up product development cycles. These factors collectively contribute to its strong market share and continued preference in RF system design.

The market has expanded due to increasing demand for reliable signal transmission in telecommunications, aerospace, defense, and wireless communication systems. High-frequency connectors are used to ensure signal integrity, minimize losses, and support high-speed data transfer across coaxial, fiber optic, and printed circuit applications. Growth has been driven by the proliferation of 5G networks, satellite communication, IoT devices, and high-performance test and measurement equipment. Technological innovations, compact designs, and materials enhancements have reinforced adoption across both commercial and industrial RF applications globally.

Advancements in design, materials, and manufacturing have strengthened the RF connectors market by improving high-frequency performance, durability, and reliability. Low-loss dielectrics, gold-plated contacts, and precision-machined interfaces have been employed to minimize signal attenuation and reflection in critical applications. Compact and lightweight designs have facilitated integration into space-constrained devices, while modular connector systems allow flexible configurations for diverse network and testing requirements. Automation in production and advanced quality control measures have enhanced consistency and reduced failure rates. The weatherproof and corrosion-resistant coatings have expanded outdoor and industrial applicability. Collectively, these technological improvements have ensured signal integrity, extended operational lifespan, and increased adoption of RF connectors in telecommunications, aerospace, and wireless communication networks globally.

The expansion of telecommunications infrastructure and deployment of 5G networks have fueLED demand for high-performance RF connectors. Base stations, small cells, antennas, and distributed network nodes require connectors capable of supporting high-frequency signals, low insertion loss, and consistent impedance matching. The rise in mobile data traffic and wireless device proliferation has increased the need for reliable interconnect solutions in both urban and rural network expansions. OEMs and network operators have prioritized connectors that can withstand environmental stress, temperature fluctuations, and high mechanical cycles. The adoption of Massive MIMO systems and IoT applications has further reinforced the importance of precision RF connectors. Consequently, telecommunications modernization and 5G rollouts have emerged as primary drivers for market growth globally.

Industrial, aerospace, and defense sectors have contributed significantly to RF connector demand due to high-performance requirements. Connectors are utilized in radar systems, navigation equipment, satellite communication, avionics, and industrial automation networks. Extreme operating conditions, including temperature variations, vibration, and moisture exposure, necessitate ruggedized designs with high mechanical and electrical reliability. Custom connectors for specific military and aerospace applications have been developed with specialized plating, sealing, and locking mechanisms. Industrial automation and robotics have also increased usage of RF connectors in sensors, communication modules, and control systems. Adoption across these high-performance and safety-critical applications has reinforced the market by emphasizing durability, precision, and consistent signal integrity in challenging environments worldwide.

The market has been influenced by trends in miniaturization, integration, and system optimization. Devices such as smartphones, tablets, wearables, and compact IoT modules require connectors that occupy minimal space while maintaining high signal performance. High-density connectors and micro-coaxial solutions have been developed to address space constraints and enable multi-channel interconnectivity. Integration with printed circuit boards and hybrid assemblies has facilitated seamless connectivity in modern electronics. The advancements in connector modularity and standardization have simplified system design and maintenance. The combination of miniaturization, high-performance integration, and compatibility with emerging wireless technologies has accelerated adoption, driving RF connectors’ relevance in consumer electronics, communication devices, and industrial applications globally.

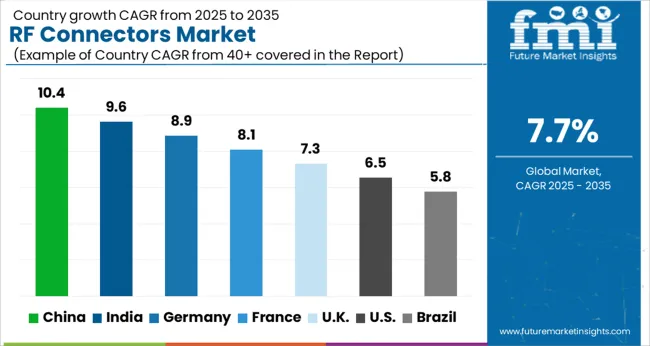

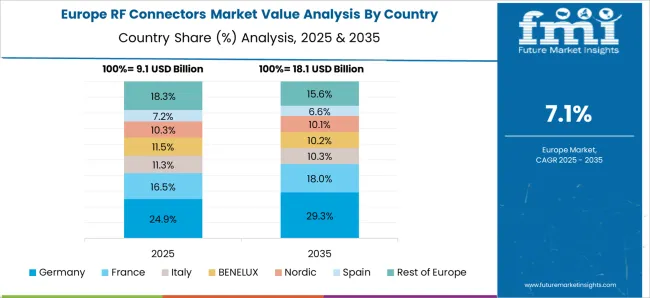

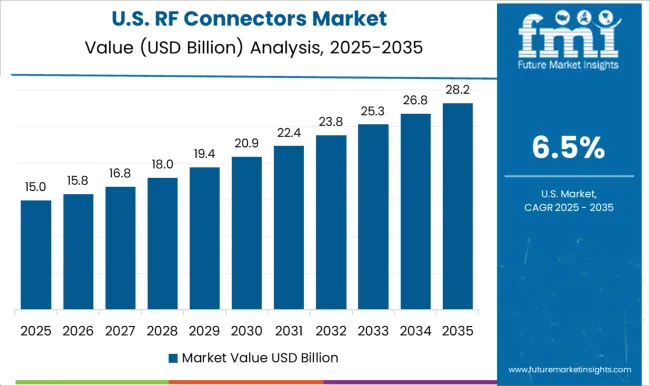

The market is anticipated to expand at a CAGR of 7.7% between 2025 and 2035, driven by increasing demand for high-frequency communication, wireless networks, and advanced electronic devices. China leads with a 10.4% CAGR, supported by large-scale telecommunications deployment and domestic connector production capabilities. India follows at 9.6%, fueled by rapid expansion of 5G infrastructure and electronics manufacturing. Germany, at 8.9%, benefits from precision engineering and high-quality industrial applications. The UK, growing at 7.3%, focuses on telecommunications upgrades and research in high-performance connectors. The USA, at 6.5%, witnesses steady adoption driven by wireless communication growth and technological innovation in aerospace and defense sectors. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to grow at a CAGR of 10.4% in the market from 2025 to 2035, driven by rapid expansion of 5G networks and high-speed data transmission infrastructure. Domestic manufacturers are focusing on miniaturization, high-frequency performance, and reliability improvements. Telecom, automotive, and industrial electronics sectors are generating strong demand for precision RF connectors. Strategic partnerships between local and international technology providers are accelerating product innovation and deployment.

India is anticipated to grow at a CAGR of 9.6% in the industry from 2025 to 2035, driven by expanding telecommunications infrastructure and increasing mobile broadband usage. The demand for reliable, high-performance connectors in automotive electronics and industrial applications is rising. Manufacturers are investing in advanced plating techniques and corrosion-resistant materials. Government initiatives supporting smart city projects are further encouraging adoption of precision RF solutions.

Germany is forecast to expand at a CAGR of 8.9% in the market from 2025 to 2035, propelled by industrial automation, automotive, and aerospace applications. Precision connectors with enhanced signal integrity and high-frequency performance are in demand. Manufacturers are emphasizing stringent quality standards and long product lifespans. Collaborations between research institutes and industry are fostering advanced material development and miniaturization techniques.

The United Kingdom is projected to grow at a CAGR of 7.3% in the market from 2025 to 2035, supported by upgrades in telecommunications infrastructure and emerging IoT applications. Demand for compact, high-performance connectors in defense, aerospace, and industrial electronics is increasing. Suppliers are focusing on modular designs and reliability under extreme environmental conditions. Technology partnerships and innovation hubs are accelerating product development.

The United States is expected to expand at a CAGR of 6.5% in the industry from 2025 to 2035, driven by advancements in 5G, defense communications, and aerospace systems. Emphasis on high-frequency performance, durability, and miniaturization is shaping the market. Strategic collaborations with global component suppliers are supporting technology integration and quality improvement. Investments in private networks and industrial IoT applications are fostering steady adoption.

The market is driven by manufacturers specializing in high-frequency connectivity solutions for telecommunications, aerospace, defense, and industrial applications. Amphenol Corporation and TE Connectivity Ltd. are recognized for their broad portfolios of durable and high-performance connectors, offering solutions across diverse frequency ranges.

Hirose Electric Co., Ltd. and Molex, LLC leverage precision engineering to provide compact, reliable connectors suitable for space-constrained and high-density applications. AVX Corporation and Radiall SA focus on developing innovative connector designs that reduce signal loss and improve electromagnetic compatibility, meeting rigorous industry standards. Belden Inc., HUBER+SUHNER, and Rosenberger Hochfrequenztechnik GmbH & Co. KG enhance their market presence through global distribution networks and strategic collaborations with system integrators.

Anritsu Corporation and Carlisle Interconnect Technologies emphasize R&D investments to address evolving requirements in 5G, IoT, and aerospace sectors, offering custom solutions for complex environments. Emerging players such as Johanson Technology, Inc., L-com Global Connectivity, and Pasternack Enterprises Inc. target niche applications with specialized RF connectors, emphasizing high-frequency performance, miniaturization, and enhanced durability. Entry barriers remain high due to advanced manufacturing requirements, strict quality certifications, and capital-intensive production processes, restricting new entrants while fostering innovation among established companies and sustaining competitive differentiation in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.1 Billion |

| Product Type | SMA connectors, BNC connectors, MCX/MMCX connectors, N-Type connectors, TNC connectors, F-Type connectors, UHF connectors, QMA connectors, and Others |

| Frequency Range | Medium frequency (1-6 GHz), Low frequency ( 1 GHz), and High frequency (> 6 GHz) |

| Mounting Type | Panel mount, Edge mount, Through hole, PCB mount, and Others |

| Material | Brass, Beryllium copper, Stainless steel, Aluminum, and Others |

| Plating | Gold, Silver, Nickel, and Others |

| Application | Wireless infrastructure, Test & measurement equipment, Satellite communication, Broadcast equipment, Antenna systems, IoT devices, Medical devices, and Others |

| End Use Industry | Telecommunications, Aerospace & defense, Consumer electronics, Automotive, Industrial, IT & networking, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amphenol Corporation, Anritsu Corporation, AVX Corporation, Belden Inc., Bomar Interconnect Products, Inc., Carlisle Interconnect Technologies, Corning Optical Communications, Delta Electronics, Inc., Digi-Key Electronics, Hirose Electric Co., Ltd., HUBER+SUHNER, JAE (Japan Aviation Electronics Industry, Ltd.), Johanson Technology, Inc., L-com Global Connectivity, Molex, LLC, Pasternack Enterprises Inc., Radiall SA, RF Industries, Ltd., Rosenberger Hochfrequenztechnik GmbH & Co. KG, Samtec Inc., Smiths Interconnect, TE Connectivity Ltd., and W.L. Gore & Associates, Inc. |

| Additional Attributes | Dollar sales by connector type and application segment, demand dynamics across telecommunications, aerospace, defense, and consumer electronics, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in high-frequency performance, miniaturization, and corrosion-resistant materials, environmental impact of metal usage, electronic waste, and manufacturing processes, and emerging use cases in 5G infrastructure, IoT devices, and high-speed data transmission systems. |

The global rf connectors market is estimated to be valued at USD 37.1 billion in 2025.

The market size for the rf connectors market is projected to reach USD 77.9 billion by 2035.

The rf connectors market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in rf connectors market are sma connectors, bnc connectors, mcx/mmcx connectors, n-type connectors, tnc connectors, f-type connectors, uhf connectors, qma connectors and others.

In terms of frequency range, medium frequency (1-6 ghz) segment to command 37.4% share in the rf connectors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID in Pharmaceuticals Market – Trends & Forecast through 2034

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA