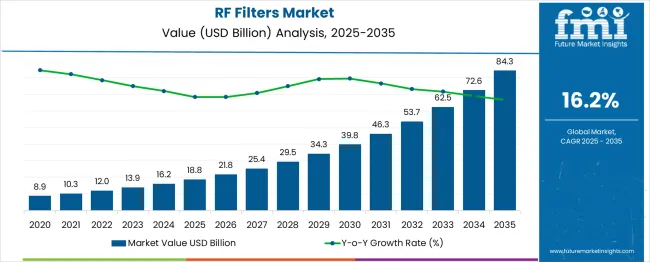

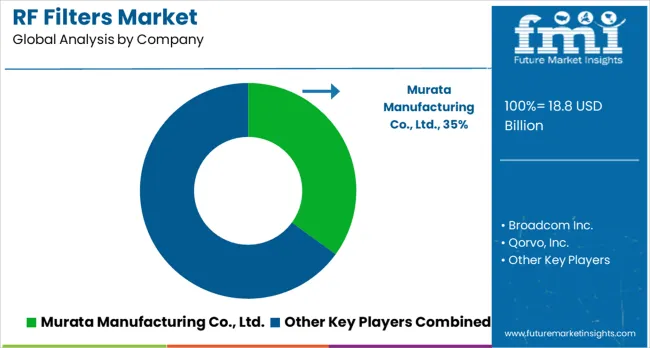

The global RF filters market is anticipated to grow from USD 18.8 billion in 2025 to approximately USD 84.3 billion by 2035, recording an absolute increase of USD 65.5 billion over the forecast period. This translates into a total growth of 348.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 16.2% between 2025 and 2035. The overall market size is expected to grow by nearly 4.48X during the same period, supported by increasing deployment of 5G networks, rising demand for wireless connectivity solutions, and growing adoption of IoT devices across various industries.

Between 2025 and 2030, the RF filters market is projected to expand from USD 18.8 billion to USD 38.5 billion, resulting in a value increase of USD 19.7 billion, which represents 30.1% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating 5G network deployments, increasing smartphone penetration in emerging markets, and growing demand for high-frequency communication systems. Telecommunications equipment manufacturers are expanding their RF filter portfolios to address the growing complexity of wireless communication standards and frequency band requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 18.8 billion |

| Forecast Value in (2035F) | USD 84.3 billion |

| Forecast CAGR (2025 to 2035) | 16.2% |

From 2030 to 2035, the market is forecast to grow from USD 38.5 billion to USD 84.3 billion, adding another USD 45.8 billion, which constitutes 69.9% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of 6G technology preparations, integration of RF filters in autonomous vehicles and smart city infrastructure, and development of advanced filtering solutions for satellite communications. The growing demand for millimeter-wave applications and the expansion of private 5G networks will drive demand for sophisticated RF filtering technologies with enhanced performance characteristics.

Between 2020 and 2025, the RF filters market experienced substantial expansion, driven by the global rollout of 5G networks and increasing demand for wireless communication devices. The market developed as network operators and equipment manufacturers recognized the critical role of RF filters in managing spectrum efficiency and reducing signal interference. The COVID-19 pandemic accelerated digital transformation initiatives, and the importance of robust wireless infrastructure supported by advanced RF filtering solutions.

Market expansion is being supported by the exponential growth in wireless data traffic and the increasing complexity of modern communication systems requiring sophisticated filtering solutions. The deployment of 5G networks globally is creating unprecedented demand for RF filters capable of handling multiple frequency bands simultaneously while maintaining signal integrity. Advanced filtering technologies are essential for managing the dense spectrum environment created by the proliferation of wireless devices and services.

The automotive industry's transformation toward connected and autonomous vehicles is driving demand for automotive-grade RF filters that can operate reliably in harsh environments. The integration of multiple wireless technologies in vehicles, including V2X communications, infotainment systems, and advanced driver assistance systems, requires sophisticated filtering solutions. The expansion of IoT ecosystems across industrial, healthcare, and consumer applications is creating opportunities for miniaturized, high-performance RF filters that enable reliable wireless connectivity in diverse deployment scenarios.

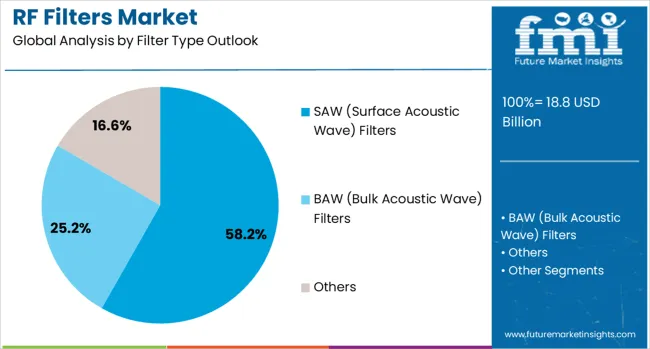

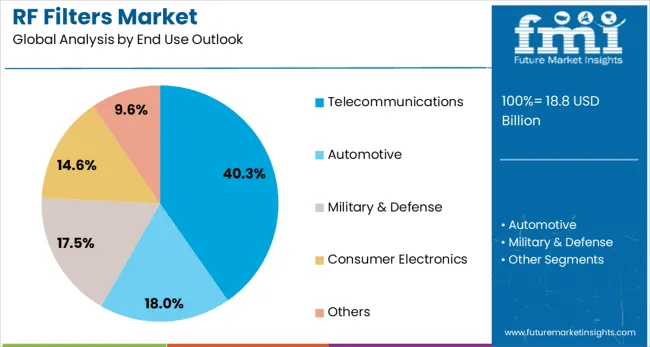

The market is segmented by filter type and end use. By filter type, the market is divided into SAW (Surface Acoustic Wave) filters, BAW (Bulk Acoustic Wave) filters, and others. Based on end use, the market is categorized into telecommunications, automotive, military & defense, consumer electronics, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The SAW (Surface Acoustic Wave) filters segment is projected to account for 58.2% of the RF filters market in 2025, reaffirming its position as the dominant filtering technology in wireless communications. SAW filters offer an optimal balance of performance, cost-effectiveness, and miniaturization, making them ideal for high-volume applications such as smartphones, tablets, and wireless base stations. Their ability to provide excellent selectivity and insertion loss characteristics at frequencies up to 2.5 GHz addresses the requirements of most current wireless communication standards.

This filter type continues to evolve with technological advancements including temperature-compensated SAW (TC-SAW) and innovative packaging techniques that enhance performance while reducing form factor. The mature manufacturing ecosystem and established supply chains for SAW filters ensure consistent quality and competitive pricing. With the ongoing expansion of 4G LTE networks in emerging markets and the continued relevance of sub-6 GHz frequencies in 5G deployments, SAW filters maintain their critical role in enabling global wireless connectivity.

Telecommunications applications are projected to represent 40.3% of RF filter demand in 2025, underscoring the sector's role as the primary driver of market growth. The telecommunications industry's continuous evolution from 4G to 5G and beyond creates demand for advanced filtering solutions across network infrastructure and user equipment. Base stations, small cells, and distributed antenna systems require high-performance RF filters to manage multiple frequency bands, minimize interference, and optimize spectrum utilization.

The segment benefits from massive investments in network infrastructure upgrades and the deployment of new communication technologies. Mobile network operators' focus on improving network capacity, coverage, and quality of service drives demand for sophisticated filtering solutions. As telecommunications networks become increasingly complex with the integration of multiple wireless standards and frequency bands, RF filters play an essential role in ensuring reliable, high-speed connectivity that meets growing consumer and enterprise demands for wireless services.

The RF filters market is advancing rapidly due to accelerating 5G network deployments and growing demand for wireless connectivity across multiple industries. The market faces challenges including design complexity for multi-band applications, cost pressures in consumer electronics, and supply chain constraints for specialized components. Innovation in filter materials, manufacturing processes, and integration technologies continues to influence product development and market expansion patterns.

The development of new piezoelectric materials and advanced manufacturing processes is enabling the production of RF filters with superior performance characteristics. Innovations in bulk acoustic wave (BAW) technology and film bulk acoustic resonator (FBAR) designs are addressing the requirements of high-frequency applications above 2.5 GHz. These technological advancements support the development of filters capable of handling the demanding specifications of 5G networks and emerging wireless standards.

Modern RF filter manufacturers are incorporating artificial intelligence and machine learning algorithms to optimize filter design and performance. These technologies enable rapid prototyping, predictive modeling of filter behavior, and automated optimization of complex multi-band filter architectures. AI-driven design tools reduce development time and improve filter performance while addressing the increasing complexity of modern wireless communication systems.

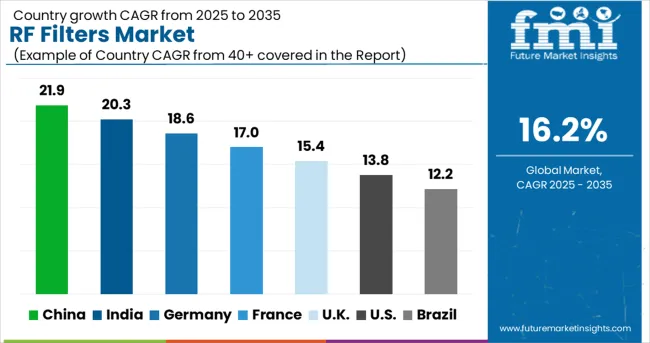

| Countries | CAGR (2025-2035) |

|---|---|

| China | 21.9% |

| India | 20.2% |

| Germany | 18.6% |

| France | 17.0% |

| UK | 15.4% |

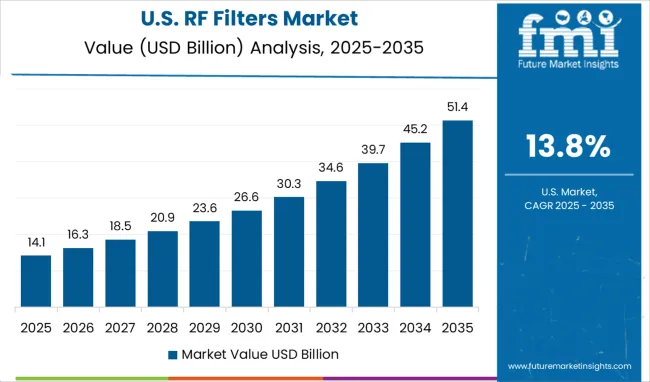

| USA | 13.8% |

| Brazil | 12.2% |

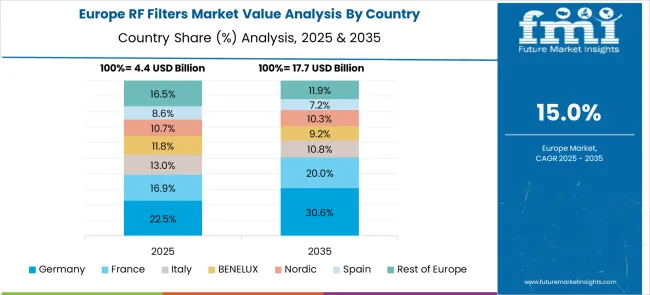

The RF filters market is experiencing strong growth globally, with China leading at a 21.9% CAGR through 2035, driven by massive 5G network deployments, expanding smartphone manufacturing, and growing IoT ecosystem development. India follows at 20.2%, supported by rapid telecommunications infrastructure expansion, increasing smartphone adoption, and growing electronics manufacturing capabilities. Germany shows robust growth at 18.6%, focusing automotive applications and industrial automation. France records 17.0%, focusing on aerospace, defense, and telecommunications sectors. The UK demonstrates 15.4% growth, prioritizing 5G deployment and wireless innovation. The USA maintains steady expansion at 13.8%, driven by advanced telecommunications infrastructure and defense applications.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from RF filters in China is projected to exhibit exceptional growth with a CAGR of 21.9% through 2035, driven by the world's largest 5G network deployment and thriving consumer electronics manufacturing ecosystem. The country's strategic focus on telecommunications infrastructure development and digital economy transformation creates unprecedented demand for RF filtering solutions. Major domestic and international manufacturers are expanding production capabilities to serve the growing requirements of network equipment providers and smartphone manufacturers.

Revenue from RF filters in India is expanding at a CAGR of 20.2%, supported by accelerating 4G network expansion, upcoming 5G deployments, and growing smartphone penetration. The country's digital transformation initiatives and increasing focus on electronics manufacturing are driving demand for RF filtering solutions. Government programs promoting domestic manufacturing and telecommunications infrastructure development are creating significant opportunities for RF filter suppliers.

Demand for RF filters in the USA is projected to grow at a CAGR of 13.8%, supported by continuous innovation in wireless technologies, advanced defense applications, and robust telecommunications infrastructure. American companies lead in developing next-generation filtering technologies for emerging wireless standards and specialized applications. The market is characterized by strong demand for high-performance filters supporting advanced communication systems.

Revenue from RF filters in Germany is projected to grow at a CAGR of 18.6% through 2035, driven by the country's leadership in automotive technology and industrial automation. German manufacturers are at the forefront of developing RF filtering solutions for connected vehicles, industrial IoT applications, and advanced manufacturing systems. The country's focuses on Industry 4.0 and automotive innovation creates demand for sophisticated filtering technologies.

Revenue from RF filters in France is projected to grow at a CAGR of 17.0% through 2035, supported by the country's strong aerospace and defense sector requiring specialized filtering solutions. French companies excel in developing high-reliability RF filters for satellite communications, military systems, and critical infrastructure applications. The telecommunications sector's modernization also contributes to market growth.

Revenue from RF filters in the UK is projected to grow at a CAGR of 15.4% through 2035, supported by the country's focus on telecommunications innovation and early adoption of advanced wireless technologies. British companies and research institutions contribute to developing next-generation filtering solutions for 5G and beyond. The market benefits from strong collaboration between industry and academia in wireless technology development.

Revenue from RF filters in Brazil is projected to grow at a CAGR of 12.2% through 2035, supported by telecommunications infrastructure modernization and increasing wireless connectivity adoption. The country's focus on bridging the digital divide and expanding network coverage creates demand for RF filtering solutions. Growing automotive manufacturing and industrial sectors also contribute to market expansion.

The RF filters market is characterized by competition among established component manufacturers, specialized filter companies, and emerging technology providers. Companies are investing in advanced materials research, miniaturization technologies, integration capabilities, and manufacturing automation to deliver high-performance, cost-effective, and reliable filtering solutions. Technology leadership, manufacturing scale, and customer relationships are central to strengthening product portfolios and market position.

Murata Manufacturing Co., Ltd., Japan-based, leads the market with 35.0% global value share, offering comprehensive RF filter portfolios spanning multiple technologies and applications with a focus on miniaturization and integration. Broadcom Inc., USA, provides advanced filtering solutions for wireless infrastructure and consumer applications with a focus on high-frequency performance. Qorvo, Inc., USA, delivers innovative RF filtering technologies for mobile devices and network infrastructure with a strong focus on 5G applications. Skyworks Solutions, Inc., USA, offers broad RF filter portfolios supporting multiple wireless standards and frequency bands. TDK Corporation, Japan, provides advanced filtering solutions leveraging proprietary materials and manufacturing technologies. Kyocera AVX Components Corporation delivers specialized RF filters for automotive, industrial, and telecommunications applications. Taiyo Yuden Co., Ltd., Japan, offers high-performance SAW and FBAR filters for mobile devices and wireless infrastructure. Tai-Saw Technology Co., Ltd., Taiwan, specializes in SAW filter production for consumer electronics and telecommunications. Akoustis Technologies Inc., USA, focuses on next-generation BAW filter technologies for 5G and WiFi applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.8 billion |

| Filter Type | SAW (Surface Acoustic Wave) Filters, BAW (Bulk Acoustic Wave) Filters, Others |

| End Use | Telecommunications, Automotive, Military & Defense, Consumer Electronics, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., Broadcom Inc., Qorvo, Inc., Skyworks Solutions, Inc., TDK Corporation, Kyocera AVX Components Corporation, Taiyo Yuden Co., Ltd., Tai-Saw Technology Co., Ltd., and Akoustis Technologies Inc. |

| Additional Attributes | Dollar sales by filter technology and frequency range, regional demand trends, competitive landscape, buyer preferences for integration levels, innovations in materials science, temperature compensation technologies, and manufacturing process optimization |

The global RF filters market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the RF filters market is projected to reach USD 84.3 billion by 2035.

The RF filters market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in RF filters market are saw (surface acoustic wave) filters, baw (bulk acoustic wave) filters and others.

In terms of end use outlook, telecommunications segment to command 40.3% share in the RF filters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interference Mitigation Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

RF Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

RF Duplexer Market Size and Share Forecast Outlook 2025 to 2035

RF-over-fiber Market – Connectivity & 5G Trends 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

RF Transceivers Market by Type, Application, Vertical & Region Forecast till 2035

RFID Blood Monitoring Systems Market Insights - Trends & Forecast 2024 to 2034

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA