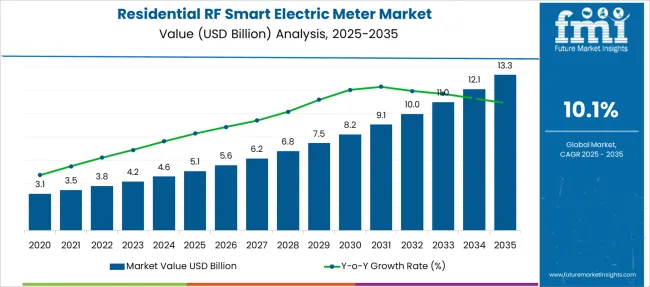

The Residential RF Smart Electric Meter Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

| Metric | Value |

|---|---|

| Residential RF Smart Electric Meter Market Estimated Value in (2025 E) | USD 5.1 billion |

| Residential RF Smart Electric Meter Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

The residential RF smart electric meter market is witnessing significant expansion driven by increasing demand for real-time energy monitoring, remote meter reading capabilities, and enhanced grid responsiveness. Governments and utilities are prioritizing smart grid deployments to reduce technical losses, improve billing accuracy, and manage peak demand more effectively.

Residential users are adopting RF-enabled smart meters to gain visibility into consumption patterns and optimize energy usage. Advancements in communication protocols and integration with demand response systems are further enhancing the value proposition for RF-based meters in household settings.

Regulatory frameworks promoting energy efficiency and digital utility infrastructure have accelerated installation mandates, particularly in urban and suburban housing developments. Future opportunities are expected to emerge from the integration of smart meters with home automation platforms, distributed energy resource monitoring, and two-way communication systems enabling dynamic pricing and consumption control across the residential segment.

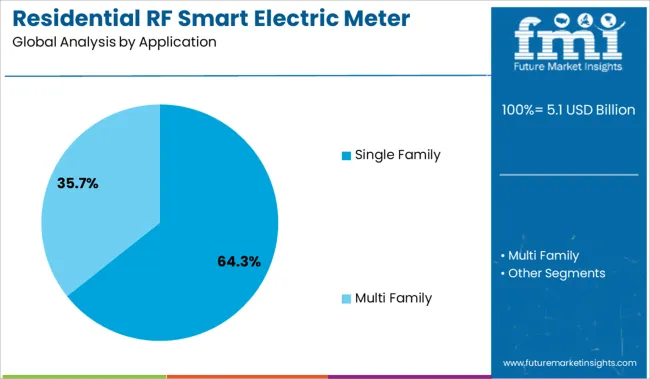

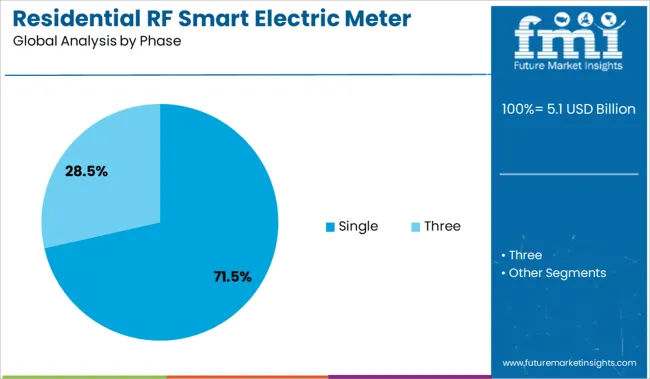

The market is segmented by Application, Phase, and region. By Application, the market is divided into Single Family and Multi Family. In terms of Phase, the market is classified into Single and Three. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single family segment is projected to account for 64.3% of the total market revenue by 2025 under the application category, making it the leading use case. This dominance is being driven by widespread deployment of RF smart meters in detached and semi-detached homes where utility access points are individually metered.

The need for accurate consumption tracking, real-time billing updates, and remote disconnection capabilities has led utilities to prioritize single family installations. These households typically demonstrate higher electricity usage due to HVAC systems, electric vehicles, and multiple appliances, making energy optimization a high priority.

Additionally, targeted government subsidies and utility-driven programs aimed at improving grid efficiency in residential neighborhoods have favored smart meter rollouts in this segment. The installation process in single family homes is also less complex, supporting faster adoption and contributing to the segment’s leading share.

The single phase category is expected to hold 71.5% of revenue share in 2025 under the phase segmentation, positioning it as the dominant electrical configuration for residential RF smart electric meters. This leadership is primarily due to the widespread use of single phase connections in residential dwellings where electricity requirements are relatively moderate and balanced across lighting, heating, and basic appliances.

Single phase smart meters are cost effective, easy to install, and compatible with standard residential wiring systems, making them the preferred choice for utility providers across urban and semi-urban regions. Their compatibility with low voltage infrastructure and ability to support two-way RF communication has made them essential to smart metering upgrades.

Utility providers have increasingly standardized single phase smart meter models to streamline deployment processes and reduce technical complexity, ensuring this segment retains its significant share in residential applications.

The residential RF smart electric meter market is gaining momentum as utilities modernize grid systems and seek real-time energy usage visibility. These meters support wireless communication, detect anomalies, and align with home automation tools. Growing interest in connected living has prompted manufacturers to enhance interoperability with solar panels, EV chargers, and energy apps, improving household energy responsiveness and consumer control.

Residential RF smart meters are being widely installed as utilities upgrade grid systems to enable two-way communication, remote diagnostics, and real-time monitoring. Governments and energy providers are prioritizing advanced metering infrastructure to replace outdated analog systems. This shift has been driven by the need to detect tampering, apply time-based tariffs, and enable demand-side energy management. RF-enabled systems also support automated meter reading, which helps cut operational costs and improves billing accuracy. The integration of these meters with home automation platforms has become increasingly vital, particularly in regions focused on optimizing residential energy use. As rollout programs continue expanding, meter vendors are under pressure to offer scalable and interoperable solutions that meet utility compliance standards.

IoT integration has emerged as a pivotal growth opportunity in the residential RF smart meter space. These meters now interface with mobile apps, in-home displays, and smart energy dashboards, allowing users to visualize usage patterns and make informed decisions. As communication technologies like RF mesh and NB-IoT evolve, there is growing emphasis on developing secure, flexible platforms compatible with a wide array of smart home devices. Manufacturers offering meters with seamless connectivity to thermostats, EV charging stations, and rooftop solar systems are better positioned to gain adoption. This approach not only fosters consumer engagement but also strengthens grid reliability by promoting load balancing and energy responsiveness at the household level.

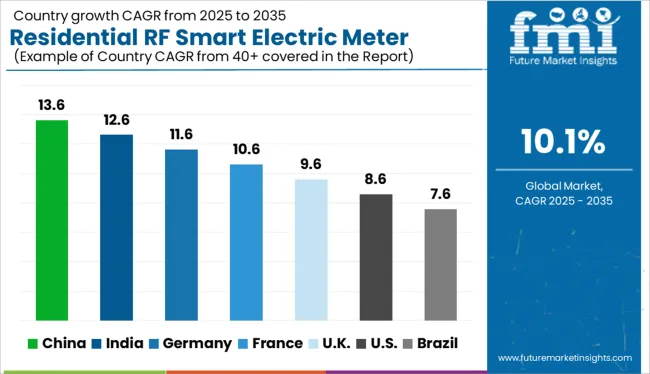

| Country | CAGR |

|---|---|

| India | 12.6% |

| Germany | 11.6% |

| France | 10.6% |

| UK | 9.6% |

| USA | 8.6% |

| Brazil | 7.6% |

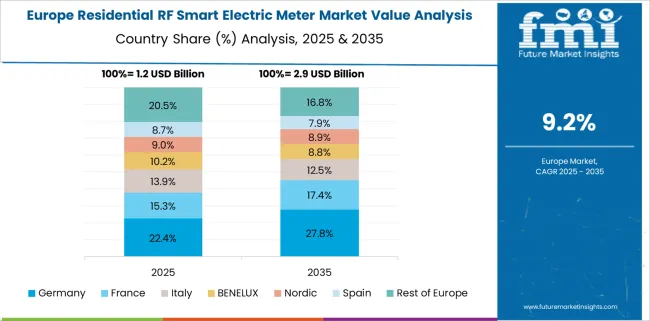

The global residential RF smart electric meter market is projected to expand at a CAGR of 10.1% through 2035, though national growth trajectories differ based on grid modernization, rollout mandates, and vendor alignment. China leads at 13.6%, exceeding the global average by 3.5 percentage points. Rapid digitization of residential grids in Tier-2 cities and scaled deployments by the State Grid Corporation have positioned China as a production and export hub. India follows at 12.6%, where smart metering programs under RDSS are driving bulk procurement, aided by local manufacturing under Make-in-India policies. Germany records 11.6%, propelled by EU-mandated smart meter targets and cybersecurity protocols. Rollouts are centralized, and integration with home energy management systems is prioritized. France posts 10.6%, slightly above the global pace, due to ongoing Linky meter installations and stronger compliance with data transmission standards. The United Kingdom trails at 9.6%, below the global average, as interoperability issues and consumer pushback on rollout timelines affect volume. This spread reflects BRICS-driven volume execution, while OECD countries focus on standardization, data privacy, and back-end interoperability.These five countries represent strategic benchmarks from a wider 40+ country analysis.

The UK residential RF smart electric meter market is estimated to grow at a CAGR of 9.6% from 2025 to 2035. Despite slower growth than its European peers, the market is seeing momentum from ongoing smart meter rollouts supported by Ofgem frameworks. British utility companies are integrating RF-enabled meters to support two-way communication for dynamic pricing and energy optimization. Demand has been shaped by regulatory mandates for consumer transparency and real-time consumption feedback. Suppliers are enhancing meter resilience for damp climates and suburban housing infrastructure.

Germany is projected to record a CAGR of 11.6% in the residential RF smart electric meter market. The demand is shaped by grid modernization efforts and Bundesnetzagentur mandates. RF mesh and point-to-point (P2P) networks are being adopted to enable intelligent load balancing in urban apartment blocks and rural homes. German energy providers are seeking secure, tamper-resistant smart meters with remote firmware upgrade capabilities. Vendors are differentiating through open architecture RF modules to ensure cross-vendor interoperability in multi-unit housing projects.

The China market is expected to grow at a CAGR of 13.6%, the fastest among all major economies. Expansion of smart grid infrastructure across provinces has accelerated demand for RF smart meters in residential zones. The State Grid Corporation and Southern Grid are mandating RF-compatible systems for future-proofed load management. Local manufacturers are embedding RF chips into low-cost meters targeted at urban vertical housing and semi-urban settlements. Utilities are also deploying RF gateways to facilitate sub-metering and neighborhood-level data aggregation.

France is anticipated to register a CAGR of 10.6% over the next decade. The Linky program led by Enedis has already laid the groundwork for nationwide RF smart meter deployment. Current focus has shifted to software-layer upgrades and enhanced meter analytics. Demand is being driven by the need to automate meter readings and enable faster switching between suppliers. French suppliers are now developing RF systems with fault diagnostics, remote shutdown, and alert modules for outage detection in single-family homes.

Sales of residential RF smart electric meters in India are growing at a CAGR of 12.6%, driven by large-scale digital metering programs under RDSS (Revamped Distribution Sector Scheme). Public utilities are deploying RF-enabled meters to enable tamper alerts, consumption profiling, and remote disconnection for overdue accounts. The use of RF over PLC (power line communication) has risen due to performance issues in congested electrical environments. Indigenous meter makers are receiving subsidies and incentives to expand RF meter production and field calibration services.

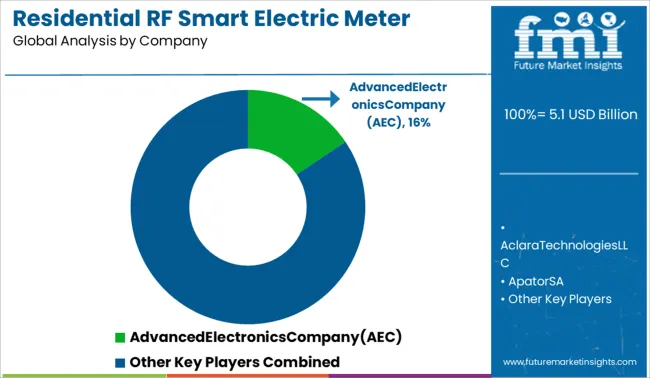

The residential RF smart electric meter market features a blend of legacy electrical conglomerates and communication-focused specialists. Itron, Aclara Technologies, Sensus, and Landis+Gyr have built deep expertise in RF mesh networks, offering robust two-way communication, demand response capabilities, and grid-aware metering. Siemens, Schneider Electric, General Electric, and Honeywell integrate RF smart meters into broader energy automation and smart grid portfolios, aligning with utility modernization strategies. Companies such as Kamstrup, Iskraemeco, and Apator cater to regional markets in Europe and Asia, emphasizing interoperability, consumption analytics, and lifecycle management. Mitsubishi Electric, Osaki Electric, and Advanced Electronics Company serve Asia and the Middle East, with local regulatory compliance and modular deployments. Meanwhile, Cisco Systems and CyanConnode bring communication protocol expertise, enabling flexible RF architecture integration. Circutor, Trinity Energy, and Larsen & Toubro focus on sub-metering, retrofit models, and project-based deployment, particularly in fast-growing residential corridors.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Application | Single Family and Multi Family |

| Phase | Single and Three |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AdvancedElectronicsCompany(AEC), AclaraTechnologiesLLC, ApatorSA, CiscoSystems,Inc., Circutor, CyanConnode, GeneralElectric, HoneywellInternationalInc., IskraemecoGroup, ItronInc., Kamstrup, Larsen&ToubroLimited, MitsubishiElectricCorporation, OsakiElectricCo.,Ltd., Sensus, SchneiderElectric, Siemens, and TrinityEnergySystemsPvt.Ltd. |

| Additional Attributes | Dollar sales by single and multi-family residential segments, shift toward three-phase RF metering in multi-dwelling units, rise in smart grid compatibility with RF mesh networks, integration of consumption analytics and outage alerts, compliance with AMI protocols, increased retrofit activity in aging single-phase installations |

The global residential rf smart electric meter market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the residential rf smart electric meter market is projected to reach USD 13.3 billion by 2035.

The residential rf smart electric meter market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in residential rf smart electric meter market are single family and multi family.

In terms of phase, single segment to command 71.5% share in the residential rf smart electric meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA