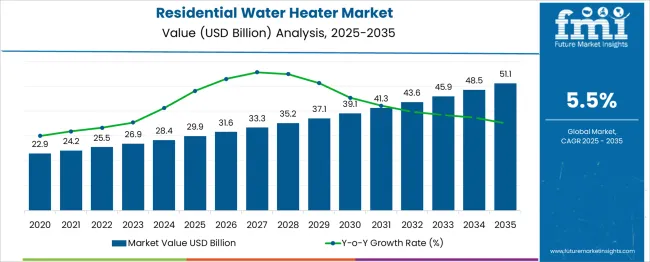

The residential water heater market is estimated to be valued at USD 29.9 billion in 2025 and is projected to reach USD 51.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. During the early adoption phase (2020-2024), the market grows from USD 22.9 billion to USD 28.4 billion, driven primarily by innovative Electric Hydraulic units and EPS (Expanded Polystyrene) models, which offer energy efficiency and lower installation costs.

Early adopters, including urban households and environmentally conscious buyers, lead the uptake of these technologies, while traditional Hydraulic heaters maintain a steady but slower growth. Between 2025 and 2030, the market enters the scaling phase, expanding from USD 29.9 billion to USD 37.1 billion. Here, Hydraulic and Electric Hydraulic units achieve mainstream acceptance, supported by government incentives, energy efficiency regulations, and rising urbanization.

EPS-based models gain traction in mid- and low-income segments due to affordability and insulation benefits. By 2030 to 2035, the market will enter a period of consolidation, reaching USD 51.1 billion, where adoption will plateau, competition will intensify, and the focus will shift to after-sales services, product differentiation, and hybrid solutions. In this phase, Hydraulic heaters dominate mature technology segments, Electric Hydraulic units occupy the growth segment, and EPS remains a niche but steadily growing market, indicating stable demand and market saturation.

| Metric | Value |

|---|---|

| Residential Water Heater Market Estimated Value in (2025 E) | USD 29.9 billion |

| Residential Water Heater Market Forecast Value in (2035 F) | USD 51.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The residential water heater market is witnessing sustained growth as urbanization, rising disposable incomes, and increasing demand for energy-efficient appliances shape consumer preferences. Growth in residential construction and renovation activities has amplified the need for reliable and efficient hot water solutions.

Advances in technology, coupled with rising awareness about energy conservation, are prompting consumers to adopt products that offer both performance and sustainability. Regulatory norms aimed at reducing carbon emissions and encouraging efficient water heating systems are further influencing purchasing patterns.

Future growth is anticipated to be supported by innovations in smart water heating technologies, integration with renewable energy sources, and enhanced durability and design aesthetics that cater to evolving lifestyles and environmental considerations.

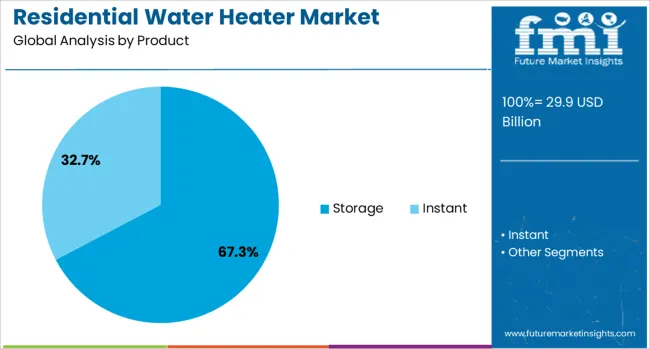

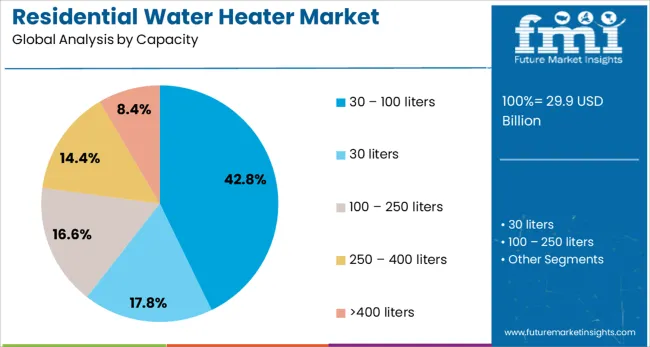

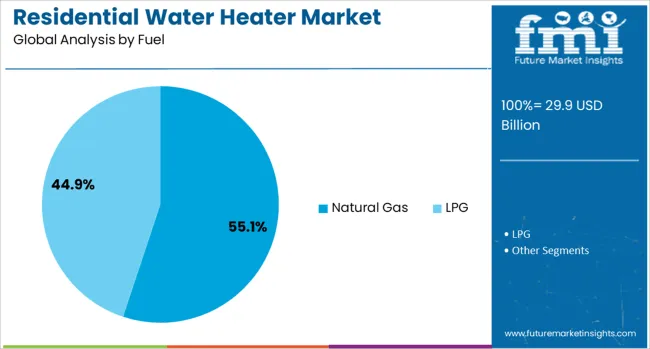

The residential water heater market is segmented by product, capacity, fuel type, and geographic region. By product, the residential water heater market is divided into Storage and Instant. In terms of capacity of the residential water heater market is classified into 30 - 100 liters, 30 liters, 100 - 250 liters, 250 - 400 liters>400 liters. Based on fuel, the residential water heater market is segmented into Natural gas and LPG. Regionally, the residential water heater industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the storage segment is expected to hold 67.3% of the total market revenue in 2025, establishing itself as the leading product category. This leadership is attributed to its ability to supply a continuous and adequate amount of hot water to meet household needs efficiently.

Storage water heaters have been preferred owing to their relatively lower upfront costs and proven reliability in diverse climatic conditions. Manufacturers have improved the insulation and energy efficiency of storage units, making them more appealing in regions where energy costs and peak demand charges are concerns.

The ease of installation and compatibility with both traditional and modern household plumbing systems have further strengthened the segment's dominance in the market.

In terms of capacity, the 30 to 100 liters segment is projected to capture 42.8% of the market revenue in 2025, positioning it as the top capacity category. This dominance has been driven by its suitability for typical household usage, balancing water heating requirements for multiple family members while maintaining energy efficiency.

This capacity range has been favored for its ability to accommodate space constraints in urban homes without compromising on performance. The segment has also benefited from the increasing availability of models equipped with enhanced safety features, improved heating elements, and better temperature control options.

Its compatibility with both apartments and standalone homes has reinforced its widespread acceptance among consumers.

When segmented by fuel, natural gas is forecast to account for 55.1% of the market revenue in 2025, making it the leading fuel type. This segment’s leadership has been strengthened by the cost-effectiveness and efficiency of natural gas compared to electricity and other alternatives.

Consumers have favored natural gas water heaters for their faster heating times and lower operating costs, especially in regions with well-developed gas infrastructure. Advances in burner technology, improved heat exchangers, and low-emission designs have enhanced the appeal of natural gas units among environmentally conscious buyers.

The relatively stable and affordable pricing of natural gas, coupled with government initiatives to expand natural gas access, has solidified this segment’s prominence in the residential water heater market.

The residential water heater market is growing as homeowners seek energy-efficient, reliable, and convenient hot water solutions. Rising urbanization, expansion of housing infrastructure, and demand for improved comfort and hygiene drive adoption. Tank-based, tankless, and hybrid water heaters are gaining popularity, offering diverse heating capacities and installation options. Energy efficiency regulations and incentive programs in North America and Europe support market expansion, while Asia-Pacific shows high growth potential due to increasing residential construction and modernization. Consumer preference for smart and connected appliances is encouraging manufacturers to integrate advanced controls, remote monitoring, and automated safety features. Product differentiation through faster heating, durable materials, and low maintenance requirements enhances adoption. Market growth is further supported by replacement demand for older units and awareness of cost savings associated with energy-efficient water heaters.

Homeowners are increasingly adopting water heaters that provide consistent hot water supply, energy savings, and easy installation. Tankless and point-of-use water heaters are gaining traction for space-saving and on-demand water heating benefits. Hybrid systems that combine traditional storage with heat pump technology offer improved efficiency and reduced operational costs. Rising awareness of energy bills, environmental impact, and appliance longevity is shaping purchasing decisions. Smart water heaters with Wi-Fi connectivity, leak detection, and automated temperature management are becoming preferred choices in urban households. Additionally, consumer demand for low-noise, compact, and aesthetically pleasing designs drives innovation. Manufacturers offering warranties, maintenance services, and user-friendly controls build brand trust. Residential water heaters are increasingly viewed as long-term investments, fostering consistent market growth in both new housing and retrofit segments.

Advancements in water heater technology are enhancing performance, efficiency, and user convenience. Innovations include improved insulation materials, corrosion-resistant tanks, energy-efficient heating elements, and rapid recovery systems. Integration of smart sensors and digital controls enables precise temperature management, leak detection, and remote operation. Hybrid heat pump systems reduce electricity consumption while maintaining comfort. Manufacturers focus on durability, safety certifications, and eco-friendly refrigerants to meet regulatory standards and consumer expectations. Efficient designs reduce water waste, improve flow rates, and optimize energy use. Consistent product quality and high performance enhance adoption in residential settings. Continuous innovation, coupled with testing for reliability and energy ratings, helps brands differentiate offerings and meet evolving consumer demands in a competitive market.

Efficient supply chains, widespread distribution networks, and reliable installation services are critical for market expansion. Manufacturers leverage regional production facilities, strategic partnerships, and dealer networks to ensure timely product availability. Seasonal demand fluctuations, driven by colder months, require careful inventory management. Professional installation and after-sales support enhance customer satisfaction and encourage repeat purchases. OEMs and distributors focus on training programs for installers to maintain service quality and compliance with safety regulations. Packaging, transportation, and storage considerations for heavy water heaters influence operational efficiency. Companies offering bundled services, extended warranties, and preventive maintenance support strengthen market position. Streamlined logistics and robust service networks are essential for capturing residential water heater market growth across both urban and suburban regions.

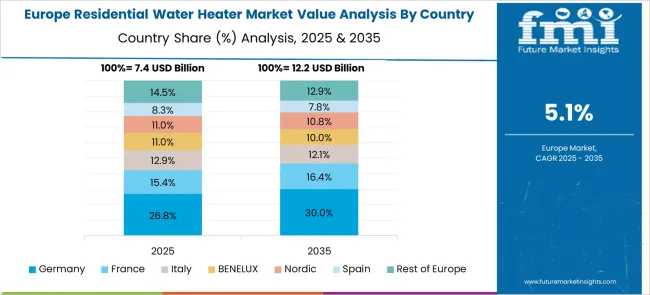

North America and Europe lead the residential water heater market due to stringent energy efficiency standards, mature housing infrastructure, and widespread adoption of advanced heating systems. Asia-Pacific is emerging as a high-growth region driven by expanding urban populations, rising disposable income, and modernization of residential buildings. Latin America and the Middle East are witnessing gradual adoption with increasing awareness of energy-efficient solutions. Regional preferences influence water heater types, such as tankless systems in space-constrained homes and hybrid models in energy-conscious markets. Manufacturers tailor product specifications, installation services, and marketing strategies according to local climate, energy pricing, and consumer behavior. Growing government incentives, rebates, and awareness campaigns further support regional adoption, ensuring a steady increase in global residential water heater demand.

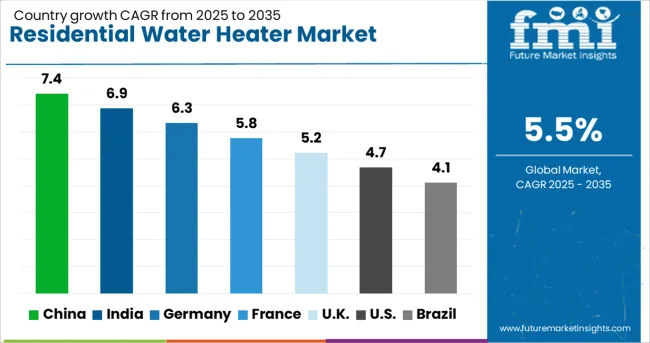

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The residential water heater market is projected to grow at a CAGR of 5.5%, driven by rising demand for energy-efficient and convenient water heating solutions in homes worldwide. China leads with 7.4% growth, supported by large-scale urban residential development and increasing consumer preference for advanced water heating systems. India follows at 6.9%, as the middle-class population expands and access to modern housing increases. Germany records 6.3% growth, with adoption of smart and eco-friendly water heaters gaining traction. The UK shows 5.2% growth, reflecting steady residential construction and retrofitting of energy-efficient appliances. The USA demonstrates 4.7% growth, supported by modernization of existing housing infrastructure and a shift toward electric and hybrid water heaters. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the residential water heater market with 7.4% growth. Increasing urbanization, rising disposable incomes, and government initiatives for energy-efficient appliances drive demand. Compared to India, China benefits from widespread adoption of electric and gas water heaters in urban households. Technological innovations, including smart controls and energy-saving features, enhance product appeal. Manufacturers invest in research to develop durable, eco-friendly, and cost-effective solutions. Expansion in e-commerce and retail distribution channels improves product accessibility. Rapid growth in residential construction and housing projects further supports market expansion. Rising consumer awareness about energy efficiency encourages adoption of advanced water heaters. Overall, China combines technological innovation, infrastructure growth, and sustainability focus to lead the residential water heater market.

India’s residential water heater market grows at 6.9%, driven by rising disposable income and urban housing expansion. Compared to Germany, India emphasizes affordable electric water heaters for middle-income households. Adoption is increasing in tier-1 and tier-2 cities with growing residential construction. Manufacturers focus on energy-efficient and long-lasting products to meet consumer demand. Government programs promoting renewable energy and efficient appliances boost market potential. E-commerce and retail networks expand product reach in urban and semi-urban areas. Rising awareness of water heating convenience and comfort encourages wider adoption. The market also benefits from small-scale industrial production of cost-effective appliances. Overall, India combines affordability, infrastructure growth, and energy efficiency to strengthen its residential water heater market.

Germany exhibits steady growth at 6.3% in the residential water heater market. Stringent energy efficiency regulations and sustainability standards drive demand for modern appliances. Compared to the United Kingdom, Germany emphasizes eco-friendly, high-performance water heaters for residential and commercial buildings. Advanced technologies, such as smart thermostats and solar integration, enhance energy savings. Manufacturers invest in R&D to maintain compliance with strict environmental standards. Urban households and renovation projects create consistent market demand. Expansion in distribution channels, including online platforms, ensures wider availability. Export opportunities within Europe also contribute to market resilience. Overall, Germany combines sustainability, technological advancement, and regulatory focus to maintain a stable residential water heater market.

The United Kingdom market grows at 5.2%, driven by residential renovation and new housing projects. Compared to the United States, the UK emphasizes compliance with environmental standards and energy-efficient technologies. Homeowners increasingly adopt water heaters with smart temperature control, durability, and lower energy consumption. Government initiatives promoting energy efficiency encourage purchase of advanced appliances. Expansion in retail and online distribution channels improves accessibility. Rising awareness about convenience, safety, and energy savings supports market growth. Manufacturers focus on developing eco-friendly, reliable, and affordable water heaters. Overall, the UK combines sustainability, technological adoption, and residential construction trends to strengthen the residential water heater market.

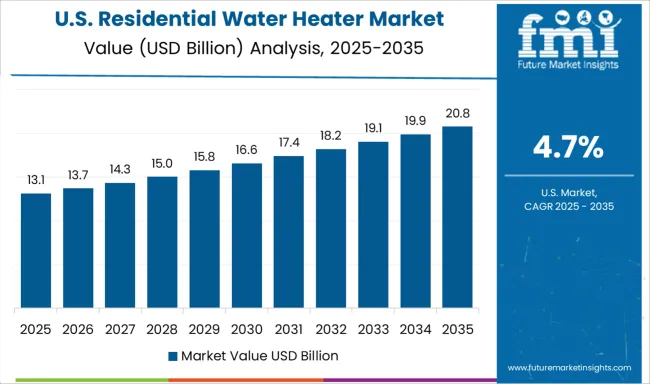

The United States advances at 4.7% in the residential water heater market. Demand is fueled by new residential construction, home renovations, and replacement of older units. Compared to China, the US emphasizes high-efficiency, smart, and tankless water heaters. Consumers prefer energy-saving and durable models for long-term cost reduction. Expansion in e-commerce and traditional retail channels increases product accessibility nationwide. Government incentives for energy-efficient appliances encourage adoption. Manufacturers invest in R&D to enhance safety, efficiency, and environmental performance. Overall, the United States combines innovation, energy efficiency, and residential growth to maintain steady market expansion.

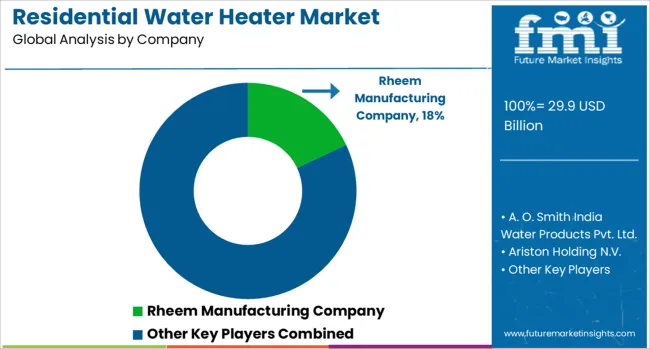

The residential water heater market is characterized by a combination of global appliance giants and specialized regional manufacturers, each leveraging unique strategies to capture share. A.O. Smith Corporation leads the way with advanced water heating technologies, including high-efficiency condensing and hybrid electric-gas models, complemented by robust distribution networks in North America, China, and India. Rheem Manufacturing emphasizes integrated smart-home connectivity and rapid service support, targeting both new construction and replacement markets. Bradford White differentiates by providing dealer-exclusive models, localized production, and extended warranty programs, enabling deeper penetration into professional installation networks. Ariston Thermo focuses on compact electric storage solutions and heat pump water heaters, particularly in European and Asia-Pacific urban markets, leveraging design flexibility and regulatory alignment with energy efficiency codes.

Emerging and regional players, including Haier, Midea, and Bosch Thermotechnology, compete by optimizing prices, utilizing modular designs, and leveraging digital-enabled maintenance tracking, thereby addressing mid-tier and budget-sensitive segments. The competitive matrix highlights differentiation in energy type (electric, gas, hybrid), technology integration (IoT and smart controls), service model (dealer-exclusive, OEM direct), and regional customization, with global players emphasizing scale, R&D intensity, and brand loyalty, while regional players leverage cost-efficiency, rapid deployment, and localized after-sales support. Strategic focus has shifted from purely product innovation toward service, connectivity, and regulatory compliance, enabling market leaders to reinforce their positions in mature and emerging residential sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.9 Billion |

| Product | Storage and Instant |

| Capacity | 30 – 100 liters, 30 liters, 100 – 250 liters, 250 – 400 liters, and >400 liters |

| Fuel | Natural Gas and LPG |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rheem Manufacturing Company, A. O. Smith India Water Products Pvt. Ltd., Ariston Holding N.V., American Standard Water Heaters, Bosch Thermotechnology Corp., Bradford White Corporation, USA, Ferroli S.p.A, GE Appliances, Haier Inc., Havells India Ltd., Lennox International Inc., NORITZ Corporation, Racold, Rinnai America Corporation, State Industries, Vaillant, and Westinghouse Electric Corporation |

| Additional Attributes | Dollar sales in the Residential Water Heater Market vary by type including tank, tankless, and heat pump water heaters, fuel type such as electric, gas, and solar, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising residential construction, energy efficiency regulations, and increasing demand for on-demand hot water solutions. |

The global residential water heater market is estimated to be valued at USD 29.9 billion in 2025.

The market size for the residential water heater market is projected to reach USD 51.1 billion by 2035.

The residential water heater market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in residential water heater market are storage and instant.

In terms of capacity, 30 – 100 liters segment to command 42.8% share in the residential water heater market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Water Metering Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Electric Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

South America Residential Water Treatment Equipment Market Trends – Growth & Forecast 2022 to 2032

Commercial Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA