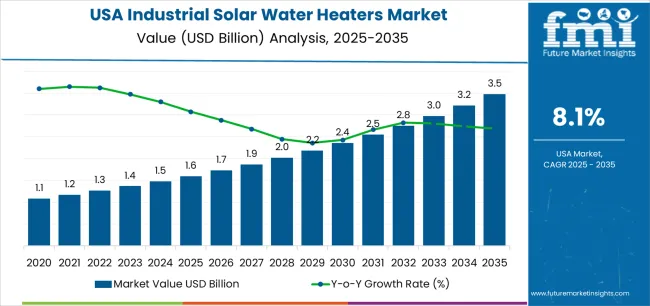

The USA industrial solar water heaters demand is valued at USD 1.6 billion in 2025 and is estimated to reach USD 3.5 billion by 2035, reflecting a CAGR of 8.1%. Demand is shaped by the increased use of thermal energy systems in industrial facilities, aimed at reducing fuel consumption and stabilizing operating costs. Solar water-heating installations support process heating requirements across food processing, chemical production, textiles, and light industrial operations, where hot-water loads remain consistent throughout the year. Regulatory emphasis on lowering emissions and expanding renewable-energy deployment further influences procurement decisions.

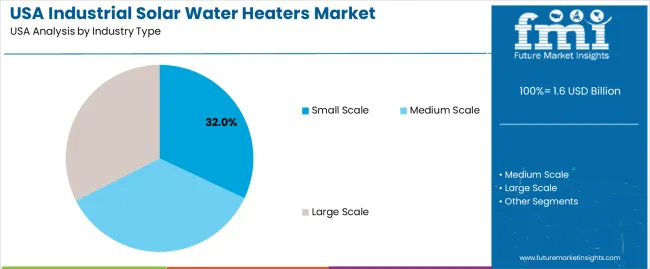

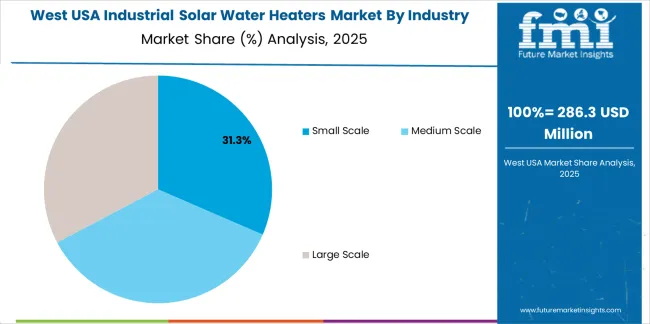

Medium-scale facilities represent the leading industry type. These sites typically operate with predictable thermal loads, making solar water-heating systems suitable for offsetting conventional energy demand. Their system configuration supports integration with existing boilers and storage tanks, enabling hybrid energy use and improved operational reliability.

The West, South, and Northeast continue to record the strongest demand due to favourable solar resources, large industrial clusters, and state-level incentives that support renewable-energy adoption. Regional growth is also influenced by expanding sustainability programs within manufacturing and commercial operations. ATR Solar, SunEarth, Racold, Heliodyne, Inc., and Alternate Energy Technologies LLC are the principal suppliers. Their portfolios include flat-plate collectors, evacuated-tube systems, and engineered thermal arrays designed for industrial hot-water applications requiring consistent temperature performance and durable materials.

Breakpoint analysis shows two distinct structural shifts across the forecast period. The first breakpoint appears between 2026 and 2028, when industrial facilities expand thermal-energy substitution to reduce fuel costs and align with corporate sustainability requirements. During this phase, adoption accelerates as food processing, pharmaceuticals, textiles, and light manufacturing integrate large-surface solar-thermal collectors into existing hot-water and process-heat circuits. This marks a transition from pilot installations to scaled operational use.

The second breakpoint emerges between 2030 and 2032, when deployment patterns stabilise and procurement shifts toward system optimisation rather than capacity addition. By this stage, large factories and institutional users have already installed primary collector arrays. Growth becomes tied to component upgrades, higher-efficiency absorbers, corrosion-resistant storage systems, and improved control units. Expansion in the late period is steady but more predictable as regulatory incentives mature and thermal-storage configurations standardise. The breakpoint pattern reflects a transition from an early investment-driven phase to a mature operational stage shaped by lifecycle management and stable industrial-heat requirements across U.S. facilities.

| Metric | Value |

|---|---|

| USA Industrial Solar Water Heaters Sales Value (2025) | USD 1.6 billion |

| USA Industrial Solar Water Heaters Forecast Value (2035) | USD 3.5 billion |

| USA Industrial Solar Water Heaters Forecast CAGR (2025 to 2035) | 8.1% |

Demand in the USA for industrial solar water heaters is increasing because commercial and industrial facilities seek to reduce energy costs and carbon emissions as operational and regulatory pressures rise. Systems that use solar thermal collectors for hot water or process-heat applications offer long-term savings and align with corporate ecofriendly goals. States with strong solar resource potential and incentive programs are seeing higher uptake of these systems. Technological improvements in collector efficiency, storage integration and heat-recovery options support broader application in industries such as food processing, hotels, laundries and manufacturing.

Incentives like tax credits and renewable-energy mandates help de-risk capital investment in solar-thermal solutions. Growth is constrained by high upfront system cost, integration complexity with existing infrastructure and limited awareness of solar thermal technologies compared with solar photovoltaics. Some projects may face long pay-back periods or logistical challenges such as space for rooftop installation and performance variability in colder climates.

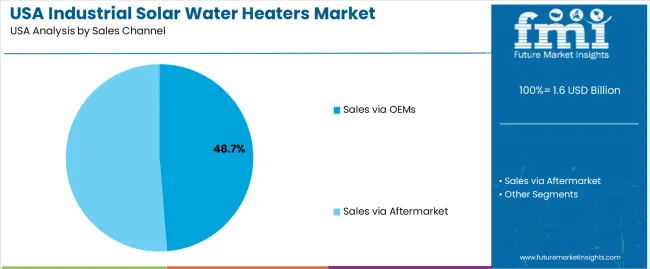

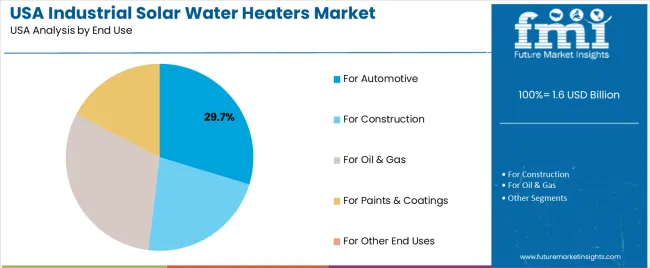

Demand for industrial solar water heaters in the United States reflects operational-heating needs across small, medium, and large industrial facilities. Adoption patterns vary with plant size, thermal-load requirements, and integration feasibility. Sales-channel distribution indicates how organisations procure systems either through original-equipment manufacturers or aftermarket suppliers supporting replacement and expansion activities. End-use distribution shows how sectors with high thermal intensity incorporate solar-heated water into daily operations.

Medium-scale facilities hold 35.5% of national demand and represent the leading industry type. These operations often balance moderate space availability with consistent thermal loads, making solar-water-heating integration suitable for process support, cleaning cycles, and auxiliary heating tasks. Large-scale facilities represent 32.5%, using solar-thermal systems to offset high hot-water consumption in energy-intensive operations. Small-scale facilities account for 32.0%, using solar heaters for routine utility needs in workshops and compact industrial spaces. Industry-type distribution reflects differences in heat-demand patterns, installation capacity, and operational continuity across USA industrial environments.

Key drivers and attributes:

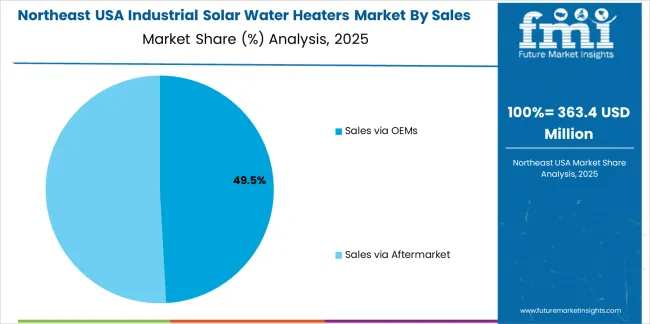

Aftermarket supply holds 51.3% of national demand and forms the dominant sales channel. Industrial operators source systems, replacements, and expansions through aftermarket networks that support varied installation conditions, component compatibility, and ongoing maintenance. Sales via OEMs represent 48.7%, supporting integration during new equipment installation or facility expansion projects. OEM procurement ensures alignment with system specifications and structured configuration during first-time deployment. Sales-channel distribution reflects the balance between lifecycle replacement needs and new-build installations across industrial facilities that depend on stable solar-thermal performance.

Key drivers and attributes:

Oil and gas operations hold 30.8% of national demand and represent the largest end-use category. Facilities use solar-heated water for cleaning processes, equipment maintenance, and auxiliary heating tasks that reduce reliance on conventional fuel. Automotive applications represent 29.7%, using solar-thermal energy for parts cleaning, coating preparation, and workshop utility needs. Construction accounts for 22.2%, supporting site-level heating and material-processing tasks. Paints and coatings hold 17.3%, where controlled warm-water supply assists formulation and cleaning cycles. Other end uses comprise the remaining share, reflecting niche industrial tasks. End-use distribution reflects thermal-load patterns, operational cycles, and energy-offset goals across USA industries.

Key drivers and attributes:

Increasing energy-cost pressures, regulatory incentives for renewable thermal systems, and growth in industrial process heating are driving demand.

In the United States, demand for industrial solar water heaters is rising as manufacturing plants, food processing facilities, breweries and large-capacity laundries seek to reduce energy costs and greenhouse-gas emissions associated with conventional boilers and fossil-fuel systems. State and federal incentives for solar thermal installations, renewable-energy credits and carbon-reduction targets make solar water-heating systems more financially attractive. Expansion in sectors with continuous hot-water or steam demand increases interest in solar-driven alternatives that can pre-heat or fully replace conventional thermal loads.

High upfront cost, site integration complexity and intermittent solar resource limitations restrain industry growth.

Industrial solar water-heating systems require significant capital investment, include large collector arrays, storage tanks, heat exchangers and integration with existing plant heat systems. Some industrial sites may find it challenging to integrate solar thermal systems into existing infrastructure or control systems, which can extend pay-back periods. Solar water-heating performance is subject to solar-irradiance availability which may reduce reliability during certain weather conditions, thus some operators prefer hybrid systems or stick with conventional heat sources. These factors moderate adoption in some industrial applications.

Trend toward hybrid solar-thermal systems, adoption in food and beverage and textile process industries, and growth of solar-thermal leasing/finance models define industry direction.

Manufacturers are adopting solar water-heating systems that combine solar collectors with backup gas or electric heaters, ensuring consistent hot‐water delivery while maximising renewable fraction. The food & beverage, textile and laundry sectors are emerging as key adopters because they have high thermal loads and can justify system investment. Solar-thermal equipment providers increasingly offer leasing or energy-service-company models where the operator pays for hot-water delivered rather than owning the system outright, reducing upfront cost barriers. These trends support further growth of industrial solar water-heating solutions in the U.S. industry.

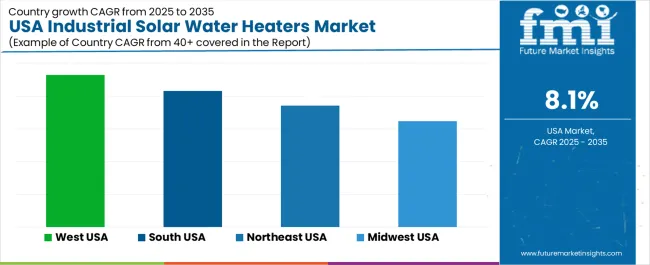

Demand for industrial solar water heaters in the USA is rising through 2035 as manufacturing plants, food-processing facilities, dairy units, hospitality operations, and commercial laundries increase the use of solar-thermal systems to reduce fuel consumption and stabilize energy costs. Industrial users adopt evacuated-tube collectors, flat-plate collectors, and integrated thermal-storage units to meet heating requirements for cleaning, processing, pasteurization, sanitation, and equipment washdowns. Growth is also shaped by decarbonization programs, rising natural-gas prices, and state-level incentives that support solar-thermal installation. Adoption levels vary by region based on sunlight availability, industrial density, and regulatory support. The West leads at 9.3%, followed by the South (8.3%), the Northeast (7.4%), and the Midwest (6.5%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 9.3% |

| South | 8.3% |

| Northeast | 7.4% |

| Midwest | 6.5% |

The West grows at 9.3% CAGR, driven by strong solar availability, industrial modernization, and energy-efficiency regulations across California, Arizona, and Nevada. Food-processing plants, beverage facilities, and dairy operations adopt solar-thermal systems for consistent hot-water generation used in cleaning, sterilization, and pasteurization processes. Commercial laundries and hospitality operators deploy large-capacity systems to reduce dependence on natural-gas boilers. Facilities in high-irradiation zones combine solar collectors with thermal-storage tanks to maintain heat availability during peak-load periods. State incentives and strict energy-efficiency standards encourage industrial users to integrate solar-thermal systems into existing utility networks.

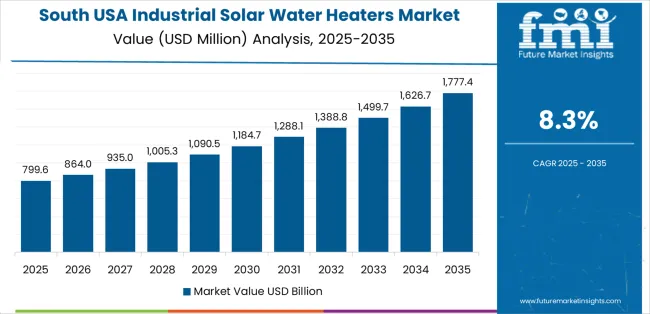

The South grows at 8.3% CAGR, supported by favorable climate conditions, extensive industrial activity, and strong interest in reducing fuel dependency across Texas, Florida, Georgia, and the Carolinas. Food-processing facilities adopt solar-thermal units for equipment washdowns and sanitation tasks, while beverage and poultry plants use them to offset high water-heating loads. Industrial laundries and commercial kitchens adopt large collector arrays to stabilize operating costs. Facilities in coastal and high-temperature regions benefit from consistent solar radiation, enabling year-round system efficiency. State-level energy programs and corporate ecofriendly commitments further reinforce adoption.

The Northeast grows at 7.4% CAGR, driven by industrial decarbonization goals, high fuel costs, and steady demand in food-processing, institutional, and commercial facilities across New York, Pennsylvania, and Massachusetts. Although solar intensity is lower, modern evacuated-tube collectors provide reliable heating performance in colder climates. Facilities use solar-thermal systems to offset boiler loads during peak utility-cost periods. Hospitals, universities, and commercial laundries adopt solar-assisted heating to manage continuous hot-water consumption. Industrial sites incorporate hybrid systems that combine solar-thermal units with high-efficiency boilers for consistent output.

The Midwest grows at 6.5% CAGR, supported by essential heating requirements in food-processing plants, dairy facilities, and industrial washdown operations across Illinois, Ohio, Wisconsin, and Minnesota. Although the region experiences lower annual solar exposure, industrial users adopt evacuated-tube systems capable of maintaining output in colder temperatures. Facilities use solar-thermal heating to reduce operating costs associated with natural-gas boilers and electric water-heating systems. Industrial laundries and equipment-maintenance centers integrate solar units to support intensive cleaning operations. Growth is steady due to strong industrial demand and interest in lowering long-term energy expenditures.

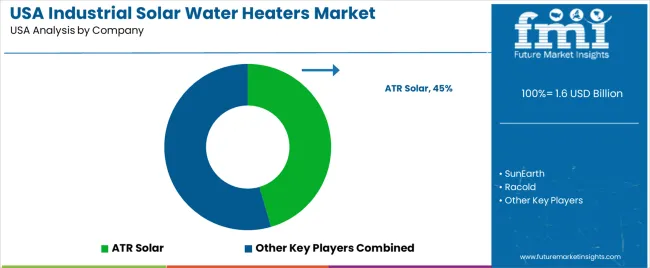

Demand for industrial solar water heaters in the USA is shaped by a concentrated group of thermal-energy system suppliers supporting manufacturing, food processing, commercial laundries, and institutional facilities. ATR Solar holds the leading position with an estimated 45.5% share, supported by controlled collector efficiency, stable thermal-output performance, and long-term integration with industrial hot-water and process-heat systems. Its position is reinforced by predictable durability, corrosion-resistant construction, and consistent field performance in high-load applications.

SunEarth and Racold follow as significant participants. SunEarth offers flat-plate and evacuated-tube systems characterized by dependable heat-transfer performance and strong suitability for U.S. climatic conditions. Racold supports industrial applications requiring stable high-temperature output and consistent system reliability across continuous-duty operations. Heliodyne, Inc. maintains a notable presence through engineered solar-thermal systems with controlled flow characteristics and predictable collector behaviour under varying solar-radiation conditions. Alternate Energy Technologies LLC contributes capability with large-format collectors and modular thermal systems designed for industrial facilities seeking scalable solutions and consistent energy displacement.

Competition across this segment centers on collector efficiency, thermal-cycle stability, material durability, installation flexibility, and long-term operational reliability. Demand continues to be supported by industrial cost-reduction efforts, facility decarbonisation initiatives, and adoption of high-efficiency solar-thermal systems capable of delivering stable hot-water and process-heat output with reduced dependence on conventional fuel sources across U.S. industrial operations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Industry Type | Small Scale, Medium Scale, Large Scale |

| Sales Channel | Sales via OEMs, Sales via Aftermarket |

| End Use | For Automotive, For Construction, For Oil & Gas, For Paints & Coatings, For Other End Uses |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | ATR Solar, SunEarth, Racold, Heliodyne, Inc., Alternate Energy Technologies LLC |

| Additional Attributes | Dollar sales by industry type, sales channel, and end-use categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of industrial solar thermal system manufacturers; advancements in evacuated tube collectors, flat plate collectors, and hybrid solar heating; integration with industrial process heating, facility utilities, construction equipment cleaning, automotive workshops, and oil & gas operational heating requirements in the USA. |

The global demand for industrial solar water heaters in USA is estimated to be valued at USD 1.6 billion in 2025.

The market size for the demand for industrial solar water heaters in USA is projected to reach USD 3.5 billion by 2035.

The demand for industrial solar water heaters in USA is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in demand for industrial solar water heaters in USA are small scale, medium scale and large scale.

In terms of sales channel, sales via oems segment to command 48.7% share in the demand for industrial solar water heaters in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

USA Sea Water Pumps Market Trends – Growth, Demand & Forecast 2025-2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Industrial Water Analysis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Cooling System Market Growth – Trends & Forecast 2025-2035

Industrial Wastewater Treatment Chemical Market Insights - Growth & Demand 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Demand for Water Ionizer in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Electrolyzed Water Generator in USA Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA