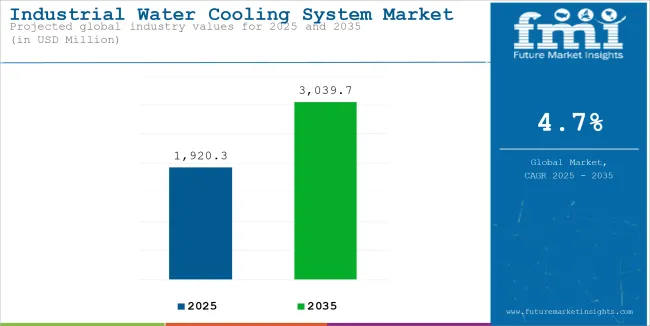

The global sales of industrial water cooling system are estimated to be worth USD 1,920.3 million in 2025 and are anticipated to reach a value of USD 3,039.7 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. The revenue generated by industrial water cooling system in 2024 was USD 1,834.1 million. The industry is anticipated to exhibit a Y-o-Y growth of 4.3% in 2025.

Water is the foremost chemical compound used in almost all industrial sectors, be it manufacturing, power generation, or petrochemical sector. Water is utilized in these industries for the purpose of processing, fabricating, cooling, diluting, product transportation, cleaning, and as a heat exchange medium.

The utilization of water for various industrial processes makes it unclean and increases its temperature, which has to be cooled down to optimal working temperature so that it can be recycled and reutilized for various purposes. Industrial water cooling system comes into the picture as far as water cooling in industries is concerned. Some of the methods adopted by such industries include but are not limited to industrial-scale chillers, large-scale cooling towers, and heat exchangers.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 1,920.3 million |

| Market Value, 2035 | USD 3,039.7 million |

| Value CAGR (2025 to 2035) | 4.7% |

The industrial water cooling system is used for the elimination of excess heat in industrial processes so that the equipment operates in an optimal temperature range. This is an important component in most power generation and chemical manufacturing operations as well as in metal processing industries, in which maintaining controlled temperatures is critical for efficiency and safety in operations. These systems commonly include cooling towers, heat exchangers, and recirculation pumps to dissipate heat either through cooling by evaporation or direct cooling mechanisms. These systems offer better thermal conductivity using water as the cooling medium and are very necessary for processes in which high heat loads will be developed.

Industrial Water Cooling Systems demand is expected to grow steadily as emerging economies increasingly require energy-efficient cooling solutions. As the size of industries grows and environmental regulations become more stringent, the trend is shifting toward adopting effective cooling systems that are also sustainable. Closed-loop cooling systems and hybrid cooling technologies are expected to witness a significant increase in demand. Advanced technologies available in such systems offer savings of water along with improved thermal efficiency, a feature that reflects the global inclination toward sustainable industries. The incremental opportunity in this market is seen at USD 1,119.4 million and is poised to grow 1.6X by 2035, reflecting the strategic importance of such systems in the future industrial setting.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the industrial water cooling system market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 4.5%, followed by a slightly higher growth rate of 4.7% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 4.5% (2024 to 2034) |

| H2 | 4.7% (2024 to 2034) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.6% in the first half and remain relatively moderate at 4.8% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Industrial Expansion in Emerging Economies Driving Demand for Water Cooling Systems

Industrial expansion in the emerging economies, particularly in the region of Brazil, is a prime factor driving the demand for industrial water cooling systems. Scaling up of the manufacturing sectors to meet local as well as global market demands is forcing large production facilities like automobile and chemical plants to install efficient cooling systems capable of meeting the high thermal loads and complexities in the process.This is not only promoting the advancement of advanced cooling technologies but is also creating avenues for manufacturers to improve and innovate upon cooling processes.

For example, in Brazil, the government is encouraging industrial production and foreign investment in manufacturing. This creates an ever-growing demand for heavy-duty cooling systems. When industries are scaled up in fields like petrochemicals, steel, and electronics, industrial water-cooled systems become increasingly necessary to provide ideal operating conditions, which comes with efficiency and higher productivity.

Shift Towards Hybrid Cooling Systems Optimizing Water Use and Efficiency in Industrial Water Cooling

The increasing focus on sustainability and water saving is forcing the industries to adapt to hybrid cooling systems more. Hybrid cooling technologies combine the best of wet and dry cooling to provide a perfect balance between water efficiency and optimal cooling performance. Hybrid systems reduce water usage while maintaining high thermal performance, making them highly suitable for water-scarce regions and industries that have fluctuating cooling demands. This also makes them switch between wet and dry modes based on environmental conditions and operational requirements, which further increases their appeal.

Companies like Johnson Controls and SPX Cooling Technologies are leaders in the adoption of hybrid cooling technologies. For instance, the firm Johnson Controls presents a hybrid portfolio of cooling with the brand name York, that maximizes the energy efficiency, and minimizes the use of water. In fact, the products are suited for large-scale industrial applications including power generation and petrochemical plants, as the cooling demand is high there.

Integrating Renewable Energy with Industrial Water Cooling Systems for Sustainable Operations

An industrial water cooling system integrated with renewable energy sources opens up a strategic opportunity for further sustainability and operation efficiency. Its utilization with solar, wind, or waste heat power helps to minimize dependency on traditional sources of energy while decreasing carbon footprints. In line with international goals for sustainability, this is one of the biggest opportunities toward potential cost saving due to the decrease in consumption of energy.

BECIS is one of the companies that lead in this innovation in developing cooling solutions that utilize renewable energy. Thermally driven chillers, for instance, use solar energy or waste heat to operate, which makes them highly suitable for use with renewable energy sources. Motivair liquid cooling systems, for instance, offer improved energy efficiency and can be used with renewable energy sources for sustainable data center operations.

The global industrial water cooling system market recorded a CAGR of 4.3% during the historical period between 2020 and 2024. The growth of industrial water cooling system market was positive as it reached a value of USD 1,834.1 million in 2024 from USD 1,547.0 million in 2020.

Between 2020 and 2024, the Industrial Water Cooling System market faced significant challenges, including increasing environmental concerns, stringent regulatory frameworks, and enhanced water efficiency requirements. The rising focus on decreasing industrial water usage and minimizing the environmental impact forced companies to review their cooling strategy.

The market witnessed a transition towards adopting closed-loop cooling systems and hybrid cooling technologies, which were characterized by higher water efficiency and lower environmental footprint. The COVID-19 pandemic also resulted in supply chain disruptions and delays in projects; however, this industry proved its resilience by quick technological adaptation, along with digital monitoring solutions integrated to optimize the performance of systems and reduce the maintenance costs.

The Industrial Water Cooling System market has a long future ahead for further growth up until 2025 to 2035, along with the rapid increase in expansion across the industrial segment and enhanced growth in focusing toward sustainable cooling. The adaptation in the diversifying market of the use of modular cooling systems along with energy-efficient towers will demand stronger scalable as well as more friendly solutions for a greener world.

Growing investments in Asia-Pacific and Latin America will emerge as key growth opportunities, as these invest in modernizing industrial infrastructure to meet global environmental standards. Smart technologies, focusing on predictive maintenance and real-time performance optimization, would be emphasized further to shape the market in a direction suitable for strong growth over the next ten years.

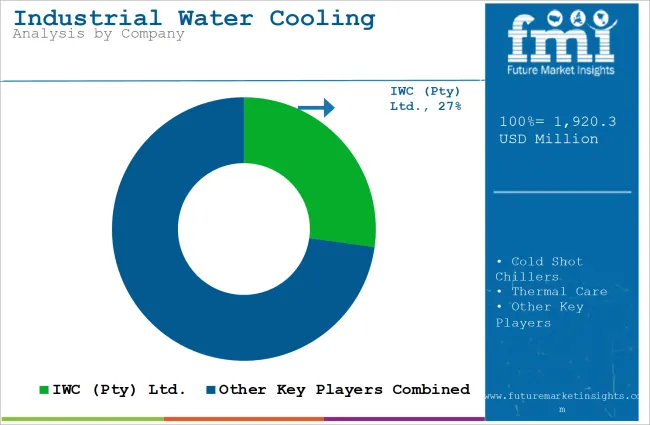

Tier 1 companies comprise market leaders with a market revenue of above USD 80 million capturing a significant market share of 40-45% in the industrial water cooling system market. These market leaders are characterized by extensive expertise in manufacturing across a range of packaging formats and have a wide geographic reach, with a strong foundation of consumers.

They offer an extensive range of series, which includes recycling and manufacturing with the latest technology to meet regulatory requirements and deliver quality. Prominent companies within Tier 1 include IWC (Pty) Ltd., Cold Shot Chillers, Thermal Care and Parker Hannifin Corporation.

Tier 2 and other includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 80 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 2 share segment.

They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the industrial water cooling system market for different countries. Market demand analysis on key countries is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 61.2% through 2035. In East Asia, China is projected to witness a CAGR of 3.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

| UK | 5.2% |

| China | 3.8% |

| Japan | 4.4% |

| India | 4.9% |

The USA petrochemical industry is witnessing strong growth primarily due to the plentiful supply of shale gas, which provides an inexpensive feedstock for the petrochemicals industry. The expansion is very evident along the Gulf Coast where multiple facilities are under development to exploit this locational advantage. The United States has about 311 petrochemical facilities with the largest number of these in Texas and Louisiana. This proliferation of plants necessitates substantial industrial water cooling systems to manage the heat generated during production processes, thereby driving demand in the sector.

Several large-scale petrochemical projects are on the horizon, so there is growing demand for high-tech cooling solutions. For instance, CPChem has built a new petrochemical complex in Orange, Texas. The production from this complex will start at the end of 2026. Shell has initiated operations at its new petrochemical complex with a 1.5 million tons/year cracker and three polyethylene plants at a combined capacity of 1.6 million tons/year. These developments trace a continuation course of growth in the USA petrochemical industry, thereby increasing the requirement for industrial water cooling systems to maintain performance while still keeping the environment safe.

Demand in Germany's power generation sector, specifically for the sector's shift toward renewable energy, is going to be a massive one for industrial water cooling systems. Germany continues to phase out coal and expands natural gas and renewable energy plants; therefore, it will need effective cooling systems in order to control the heat that will be generated in power generation, especially since CHP plants will be integrated into this sector.

For example, there is a 1,000 MW natural gas-fired power plant planned in Brunsbüttel that is set to come on line by 2025. That project will require the installation of state-of-the-art cooling systems capable of withstanding environmental restrictions while improving power plant operating performance. In this respect, stringent regulations concerning the consumption of water and thermal discharge from Germany's power plants are likely to push further closed-loop and hybrid cooling solutions for power applications.

The metalworking industry is among the largest parts of Germany's manufacturing sector and experiences an increased demand for Industrial Water Cooling Systems because of the requirement for energy efficiency and optimized production. Germany is one of the largest aluminum and steel producers in Europe, and cooling will be more essential in such processes since metalworking generates heat. The food and beverage industry, with its rising demand for temperature control in food processing and storage, will continue to experience growth in water cooling systems.

For instance, a medium-to-large food processing plant can consume 2,000 to 5,000 tons of cooling capacity. Considering the business size and volumes of companies operating in Germany like Nestlé or Coca-Cola, the cooling need for all the installed facilities is highly likely to exceed 10,000 to 20,000 tons of cooling power. This only accounts for such general cooling for refrigeration needs and process use, which should be multiplied more with the help of the still-increasing sustainability and energy-effective systems.

The Indian pharmaceutical industry is growing robustly, with a rising domestic demand and a very strong export market. Such growth requires sophisticated industrial water cooling systems to ensure accurate temperature control during the manufacturing of sensitive products like vaccines and biologics.The pharmaceutical industry has huge consumption of cooling power, amounting to 30% of the total cooling power of the sector's usage, which is greater than combined commercial cooling. This enormous usage underscores the great importance of good cooling systems that would enable offering quality products complying with the most stringent regulatory conditions.

Indian automobile industry is said to grow multifold, which is estimated at a compound annual growth rate (CAGR) of 6.79% for the period from 2024 to 2029. Growth in this area is expected to boost the requirement for automotive cooling systems, among which industrial water cooling solutions, will be on the rise for vehicle production based on advanced technologies of engines.

The growth in the automotive sector is expected to be particularly high in areas such as Maharashtra, Tamil Nadu, and Haryana. Major automotive manufacturing hubs are established in these places. Increased volumes of production along with new technologies will require cooling systems that would provide optimal operating conditions and conform to environmental standards.

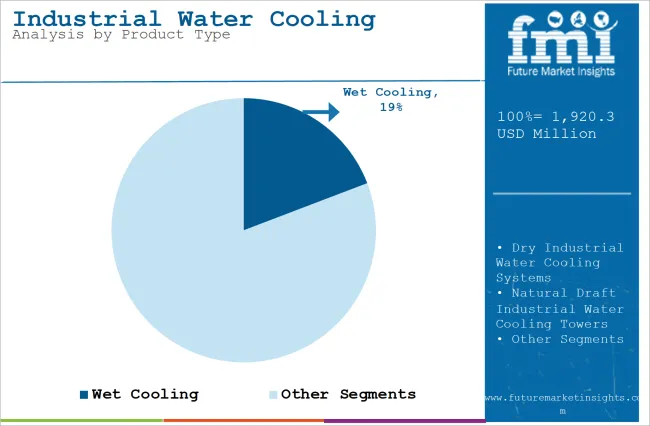

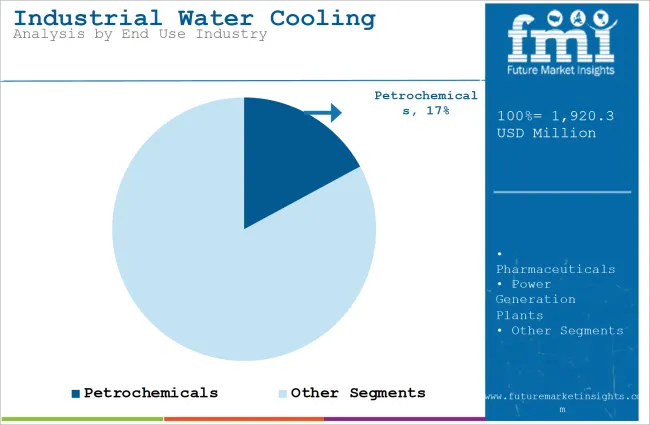

The section contains information about the leading segments in the industry. By product type, wet cooling segment is estimated to grow at a CAGR of 3.9% throughout 2035. Additionally, Petrochemicals End Use Industry is projected to expand at 4% by 2035.

| Product Type | Value Share (2035) |

|---|---|

| Wet Cooling | 19.2% |

The wet cooling system, especially the cooling tower, is known to have excellent thermal efficiency. In wet systems, a 30-40% saving in energy compared to other cooling technologies has been reported. This is because of the use of high heat capacity in water that allows for great efficiency in heat exchange and dissipation. By utilizing evaporative cooling, wet systems can operate at lower temperatures, thereby saving energy on cooling. On the contrary, dry cooling systems have the advantage, especially in arid regions; however, they are less energy-efficient, since they rely on air to cool down water rather than liquid in itself.

In comparison with other systems, including mechanical draft cooling towers or condensers, energy efficiency is another factor on which wet cooling has taken a strong lead. Mechanical draft systems can offer moderate energy savings but still use large amounts of electrical power for fan operations. Wet cooling towers exploit ambient conditions like humidity and air temperatures for reduction in the energy consumed. Hybrid wet/dry cooling towers are a mix of elements from the two concepts, but they never even come close to true wet cooling with maximum energy savings. So, wet cooling systems are very much natural since they have been offering far better energy savings than dry cooling directly through the utilization of water; industries simply can't afford to do that in cases where good, effective cooling is necessary.

| End Use Industry | Value Share (2035) |

|---|---|

| Petrochemicals | 17.1% |

Increasing demand for petrochemical products, growing consumption worldwide, and better technology to produce them make industrial water cooling systems necessary to cool down large production volumes in petrochemical plants. Because the plants expand their production scale to meet those demands, it is likely to see an upsurge in the use of large-scale cooling systems, 50,000-150,000 tons of refrigeration (TR). Such processes of cracking and distillation that can have temperatures well above 800°F necessitate efficient and reliable cooling systems further fueling this demand.

The demand for cooling will also remain strong as energy production from power generation plants increases to meet rising electricity needs. The pharmaceutical and food and beverage industries have relatively smaller-scale cooling needs, but the growing demand for temperature-sensitive products will lead to an increase in cooling system adoption. This expansion across sectors will collectively drive the growth of the industrial water cooling systems market.

The Industrial Water Cooling System market is driven by the rising demand for efficient heat management solutions across various industrial sectors. Industries such as power generation, manufacturing, and chemical processing require robust cooling systems to maintain operational efficiency and prevent equipment overheating. The shift towards sustainable practices is also pushing companies to adopt advanced water cooling systems that offer improved energy efficiency and lower environmental impact.

Technological advancements are playing a crucial role in shaping the market dynamics. Innovations such as hybrid cooling systems, which combine the benefits of both wet and dry cooling, are gaining traction due to their enhanced performance and reduced water consumption. Additionally, the integration of IoT and smart monitoring solutions in water cooling systems is enabling real-time performance tracking and predictive maintenance, which minimizes downtime and operational costs.

Regionally, the market is witnessing significant growth in Asia-Pacific, driven by rapid industrialization and the expansion of manufacturing sectors in countries like China and India. North America and Europe are also important markets, with a strong focus on upgrading existing infrastructure to meet stringent environmental regulations. The competitive landscape is characterized by strategic collaborations and mergers as companies aim to expand their product portfolios and strengthen their market presence.

Recent Industry Developments:

In terms of product type, the industry is divided into Dry Cooling, Natural Draft Cooling Towers, Mechanical Draft Cooling Towers, Wet Cooling, Condensers, Hybrid Cooling, Water Chillers and Heat Exchangers.

In terms of application, the industry is divided into Petrochemicals, Pharmaceuticals, Power Generation Plants, Metal Working, Food and Beverage, Automotive and Other Applications (HVACR etc.).

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

The global industrial water cooling system industry is projected to witness a CAGR of 4.7% between 2025 and 2035.

The global industrial water cooling system industry stood at USD 1,920.3 million in 2025.

The global industrial water cooling system industry is anticipated to reach USD 3,039.7 million by 2035 end.

The key players operating in the global industrial water cooling system industry IWC (Pty) Ltd., Cold Shot Chillers and Thermal Care.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Furnace Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Industrial Absorbent Market Size and Share Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA