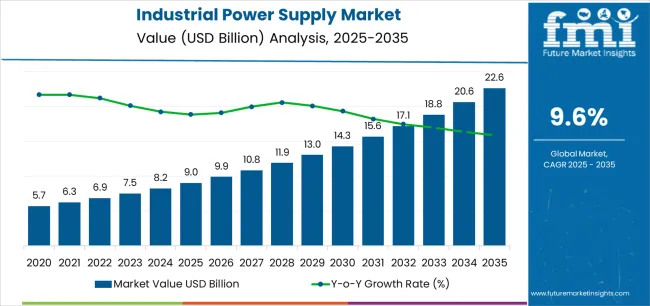

The Industrial Power Supply Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 22.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period.

The industrial power supply market is witnessing sustained expansion, driven by the rising demand for reliable energy conversion systems across automation, semiconductor manufacturing, and industrial processing sectors. Increasing deployment of smart factories, growth in renewable integration, and advancements in power management technologies are shaping the market landscape.

Manufacturers are focusing on compact, energy-efficient designs with enhanced thermal performance and high reliability for continuous industrial operations. The trend toward digital control systems and predictive maintenance has encouraged the adoption of power supplies with integrated monitoring and communication capabilities.

As industries transition toward electrification and automation, the market outlook remains positive, supported by growing investment in high-performance power infrastructure and sustainable production technologies.

| Metric | Value |

|---|---|

| Industrial Power Supply Market Estimated Value in (2025 E) | USD 9.0 billion |

| Industrial Power Supply Market Forecast Value in (2035 F) | USD 22.6 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

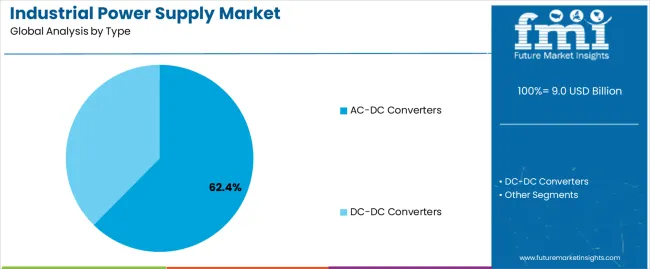

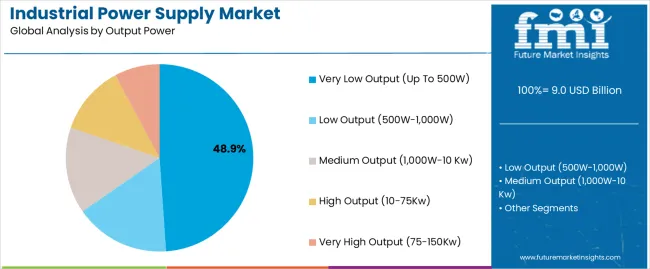

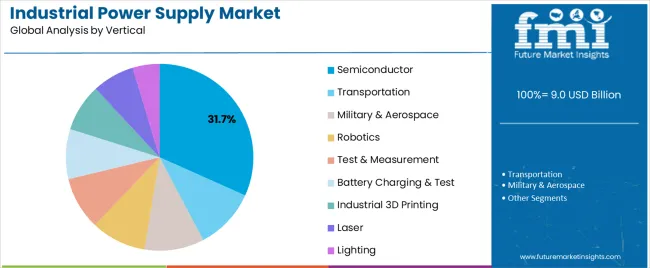

The market is segmented by Type, Output Power, and Vertical and region. By Type, the market is divided into AC-DC Converters and DC-DC Converters. In terms of Output Power, the market is classified into Very Low Output (Up To 500W), Low Output (500W-1,000W), Medium Output (1,000W-10 Kw), High Output (10-75Kw), and Very High Output (75-150Kw). Based on Vertical, the market is segmented into Semiconductor, Transportation, Military & Aerospace, Robotics, Test & Measurement, Battery Charging & Test, Industrial 3D Printing, Laser, and Lighting. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC-DC converters segment leads the type category, holding approximately 62.4% share, supported by its essential role in transforming alternating current into direct current for use in industrial electronics and automation systems. The segment benefits from wide applicability in control systems, power distribution units, and semiconductor equipment where stable DC power is critical.

Technological advancements in efficiency, thermal management, and miniaturization have enhanced product performance and reliability. Increased adoption in data centers and communication infrastructure further supports growth.

With continuous innovation in wide-bandgap semiconductors and energy-efficient conversion technologies, the AC-DC converters segment is expected to retain its leading position in the market.

The very low output (up to 500W) segment dominates the output power category, accounting for approximately 48.9% share. Its prominence is driven by widespread use in compact industrial devices, automation controllers, and test equipment that require low to moderate power levels.

The segment’s demand is bolstered by the expansion of small-scale manufacturing units and the miniaturization of electronic components. Improved design efficiency and high power density have allowed manufacturers to produce compact units suitable for space-constrained installations.

As industrial applications increasingly require distributed power architectures, the demand for low-output, high-efficiency power supplies is expected to continue rising, sustaining this segment’s market share.

The semiconductor segment holds approximately 31.7% share in the vertical category, driven by high precision and reliability requirements in semiconductor fabrication and testing processes. Stable power supply systems are crucial for maintaining production quality and yield in cleanroom environments.

The segment benefits from the ongoing expansion of semiconductor manufacturing capacity worldwide and the rapid adoption of advanced process nodes that demand precise voltage regulation. Manufacturers have been developing specialized power supplies capable of maintaining consistent performance under dynamic load conditions.

With the global semiconductor industry experiencing sustained investment and capacity expansion, the semiconductor vertical is projected to remain a key contributor to the industrial power supply market.

From 2020 to 2025, the industrial power supply market experienced a CAGR of 13.2%. The industrial power supply market is witnessing significant growth propelled by the widespread adoption of industrial automation, the surge in Industry 4.0 initiatives, and the global expansion of manufacturing and industrial infrastructure.

The expansion of the industrial power supply market is bolstered by the incorporation of renewable energy sources, continuous technological advancements, and a dedicated emphasis on energy efficiency.

The increasing electrification of industrial processes, the proliferation of Industrial Internet of Things (IIoT) technologies, and the overarching global trends of urbanization and industrialization are driving the heightened demand for industrial power supplies.

The industrial power supply market experiences continuous technological advancements, including improvements in power density, efficiency, and the integration of smart features.

These innovations contribute to enhanced performance and functionality in industrial power systems. Projections indicate that the global industrial power supply market is expected to experience a CAGR of 10.1% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 13.2% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 10.1% |

The provided table highlights the top five countries in terms of revenue, with South Korea and Japan leading the list. The government's initiatives to promote Industry 4.0 and smart manufacturing have further fueled the adoption of industrial automation, leading to an increased need for high-quality power supply solutions in South Korea.

With a strong emphasis on innovation and advanced manufacturing technologies, Japanese industries are increasingly adopting energy-efficient solutions, including power supplies.

| Attributes | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.4% |

| The United Kingdom | 10.8% |

| China | 9.2% |

| Japan | 11.5% |

| South Korea | 12.0% |

The increasing focus on renewable energy sources in the United States, coupled with government initiatives and incentives contribute to the growth of the industrial power supply market as industries integrate renewable energy into their power systems. The industrial power supply market in the United States is expected to grow with a CAGR of 10.4% from 2025 to 2035.

The adoption of automation technologies and Industry 4.0 practices is a global trend, and the United States is no exception. As industries in the United States invest in smart manufacturing and automation, there is likely an increased demand for advanced industrial power supply solutions.

Ongoing infrastructure development projects, especially in sectors like energy, transportation, and telecommunications, can drive the demand for industrial power supplies to support the power needs of these projects.

The industrial power supply market in the United Kingdom is expected to grow with a CAGR of 10.8% from 2025 to 2035. There is a growing emphasis in the United Kingdom, both by the government and businesses, on enhancing energy efficiency to align with sustainability objectives.

This heightened focus is anticipated to stimulate the adoption of more advanced and energy-efficient solutions in the industrial power supply sector. Industries may prioritize eco-friendly and energy-efficient industrial power supply solutions to align with environmental goals.

Advances in power electronics, digital control, and smart features may influence the adoption of more efficient and technologically advanced industrial power supplies. The increasing embrace of automation and smart manufacturing practices within United Kingdom industries is expected to generate a rising demand for power supply solutions that are technologically advanced and capable of meeting the evolving needs of these modern industrial processes.

The industrial power supply market in China is expected to grow with a CAGR of 9.2% from 2025 to 2035. China is a global manufacturing hub, and the industrial power supply market in the country is significantly influenced by the expansive manufacturing sector.

The demand for reliable and efficient power supplies for various industrial applications is high.

Government initiatives and policies in China play a significant role in shaping the industrial power supply market. Policies related to energy efficiency, environmental sustainability, and technological development can influence market trends.

The industrial power supply market in Japan benefits from continuous innovations in power electronics, digital control, and smart technologies, leading to the adoption of cutting-edge power supply solutions. The industrial power supply market in japan is expected to grow with a CAGR of 11.5% from 2025 to 2035.

Manufacturing industries in the country demand reliable and efficient power supplies for various applications. The precision and quality standards in Japanese manufacturing contribute to the demand for high-performance industrial power supplies.

The industrial power supply market in South Korea is expected to grow with a CAGR of 12% from 2025 to 2035. South Korea has been exploring and integrating renewable energy sources, such as solar and wind power.

The transition to cleaner energy may influence the demand for industrial power supplies capable of handling diverse energy inputs. Government initiatives to promote energy efficiency and sustainability can impact the industrial power supply market. Policies encouraging the adoption of advanced power supply solutions may contribute to market growth.

The demand for reliable and efficient power supplies is high in manufacturing sector, especially in electronics and automobiles. The industrial power supply market in the country benefits from continuous technological innovation, leading to the adoption of cutting-edge power supply solutions.

The below section shows the leading segment. The AC-DC converters segment is to grow at a CAGR of 9.8% from 2025 to 2035. Based on output power, the very low output (Up to 500W) segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 9.5% from 2025 to 2035.

| Category | CAGR |

|---|---|

| AC-DC Converters | 9.8% |

| Very Low Output (Up to 500W) | 9.5% |

Based on the product types, the AC- DC converters segment is anticipated to thrive at a CAGR of 9.8% from 2025 to 2035. The power grid and many industrial facilities distribute power in the form of alternating current (AC). AC-DC converters bridge this gap by converting AC power to the DC power required by industrial machinery.

AC-DC converters come in various types and configurations, offering flexibility in terms of voltage and current output. This versatility allows them to be customized to meet the specific power requirements of diverse industrial applications.

Modern AC-DC converters are designed to be highly efficient, minimizing energy losses during the conversion process. This is particularly important in industrial settings where energy efficiency is a key concern. High-performance converters help reduce overall energy consumption and operational costs.

AC-DC converters often provide electrical isolation between input and output, which helps in minimizing electrical noise and interference. This feature is crucial in industrial environments where sensitive electronic equipment needs protection from electrical disturbances that can impact performance.

Based on output power, very low output (Up To 500W) segment is anticipated to thrive at a CAGR of 9.5% from 2025 to 2035. Many industrial applications, especially in control and instrumentation systems, require low power for sensors, actuators, and electronic control components.

These systems often operate on lower power levels, and power supplies with outputs up to 500W are suitable for these applications.

Various sensors and measurement devices used in industrial settings operate on low power. These devices play a crucial role in monitoring and controlling processes, and power supplies with outputs up to 500W are well-suited for these applications.

As industries focus on energy efficiency, there is a trend toward designing and implementing systems that operate on lower power levels. Power supplies with very low output power contribute to the overall energy efficiency of industrial processes.

DCS in industrial automation often involves numerous distributed components that require lower power. Power supplies with outputs up to 500W are commonly used to provide power to these distributed control elements.

Leading companies in the industrial power supply market are focusing on continuous innovation to develop technologically advanced and efficient power supply solutions. The market players are also introducing new products that align with industry trends, such as increased demand for compact, high-power density, and energy-efficient solutions.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 9.0 billion |

| Projected Market Valuation in 2035 | USD 22.6 billion |

| Value-based CAGR 2025 to 2035 | 9.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Product Types, Output Power, Verticles, Region |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

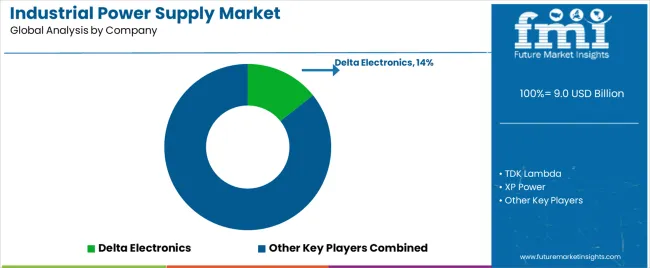

| Key Companies Profiled | TDK Lambda; Delta Electronics; XP Power; Siemens; Murata Power Solutions; Advanced Energy; Bel Fuse; Cosel; MEAN WELL |

The global industrial power supply market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the industrial power supply market is projected to reach USD 22.6 billion by 2035.

The industrial power supply market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in industrial power supply market are ac-dc converters and dc-dc converters.

In terms of output power, very low output (up to 500w) segment to command 48.9% share in the industrial power supply market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA