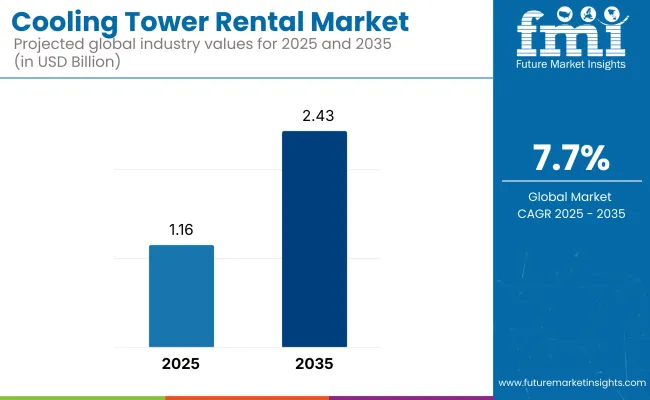

The cooling tower rental market is projected to grow from USD 1.16 billion in 2025 to USD 2.43 billion by 2035, registering a CAGR of 7.7%. This growth is driven by increasing demand from industries such as power generation, chemicals, and data centers, particularly in North America, China, and India. Temporary cooling solutions are becoming critical amid rising infrastructure upgrades, equipment failures, and heatwave emergencies.

Stricter environmental mandates across the USA and Europe are prompting end-users to shift toward water-efficient and energy-saving rental towers. This is further reinforced by the rising adoption of IoT and AI-integrated cooling systems that allow for predictive maintenance and operational efficiency. Hybrid towers-combining wet and dry technologies-are gaining traction in regions with water constraints, notably in Europe and parts of the USA

Looking ahead, modular and compact cooling systems are expected to dominate demand in space-constrained industrial zones in Japan and South Korea. Meanwhile, emerging economies such as China and India are witnessing the highest growth due to rapid industrialization, data center expansion, and evolving emission control norms.

Companies are investing in fast-deployment fleets and smart-enabled cooling units to address shifting customer priorities around sustainability, compliance, and cost.

Furthermore, the competitive landscape is witnessing consolidation and vertical integration as major players seek to control raw material sourcing, resin formulation, and component fabrication under one roof. Leading manufacturers are forming joint ventures with automotive OEMs, aerospace contractors, and renewable energy firms to secure long-term contracts and reduce supply volatility.

In addition, investments in recycling technologies-such as pyrolysis and solvolysis-are gaining momentum to address regulatory concerns and circular economy goals. This convergence of material science innovation, sustainability compliance, and strategic partnerships will define the next decade of growth in the carbon fiber composites industry.

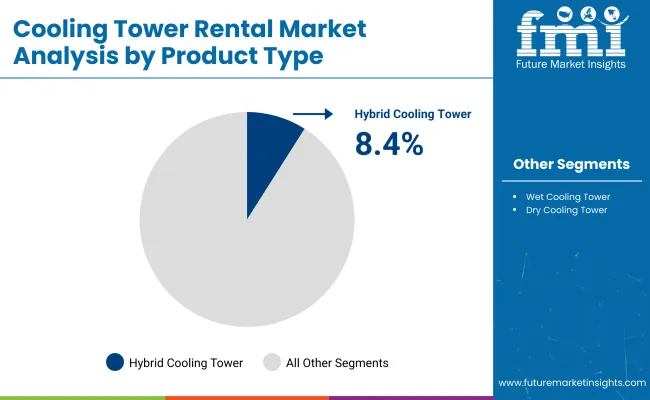

Wet cooling towers currently dominate due to their high cooling efficiency and widespread use across power generation, petrochemical, and manufacturing sectors. However, growing concerns about water usage and stricter environmental regulations are creating strong momentum for hybrid cooling towers.

These systems, which blend wet and dry cooling mechanisms, offer a sustainable solution for regions facing water scarcity and stringent efficiency norms. Their ability to reduce water consumption while maintaining performance makes them the fastest-growing segment, especially in the USA, Europe, and Australia.

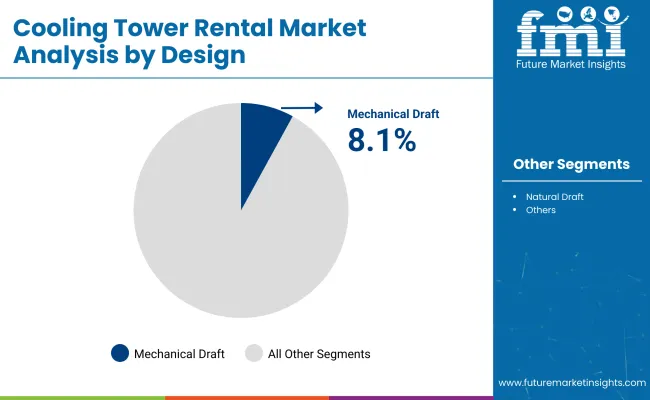

Mechanical draft towers lead the market owing to their fan-assisted high airflow efficiency and adaptability across industries like chemicals, refineries, and data centers. Their modularity and lower land requirements make them preferable over natural draft systems.

With increasing demand for predictive maintenance and smart energy use, IoT-enabled mechanical draft towers are seeing accelerated adoption. The integration of digital technologies in mechanical systems is expected to set new benchmarks for performance and uptime in industrial applications.

The industrial sector holds the largest share, driven by long-standing usage across power plants, petrochemical refineries, and pharmaceutical manufacturing. However, the commercial segment is projected to grow at the fastest pace due to the rising demand from data centers, malls, and office complexes.

Rapid digitization and urban expansion-especially in North America, Europe, and Southeast Asia-are fueling this surge. Rental cooling systems are also preferred in commercial buildings for seasonal peak loads and emergency situations, making them a strategic choice for facility managers.

Regional Variance

ROI Perspectives: Converging and diverging

75% of USA stakeholders viewed automation as a high-value investment; however, 37% of Japanese stakeholders were hesitant due to perceived initial high costs.

Consensus

Corrosion-resistant components: 68% of global stakeholders selected reinforced fiberglass or stainless steel due to durability and cost savings over time.

Regional Differences

Shared Challenges

87% cited rising material and energy costs as a factor impacting rental prices.

Regional Differences

Manufacturers

Distributors

End Users (Industrial Operators)

Alignment Across Regions

70% of global manufacturers plan to invest in IoT-based cooling towers for efficiency improvement.

Divergence in Priorities

High Consensus

Efficiency, cost containment, and regulatory compliance are global problems.

Key Variances

While the data focuses on market-wide performance, companies must develop region-specific adaptation strategies to penetrate highly differentiated markets. The USA has a penchant for high-tech automation; Europe is toward green cooling, and in Asia, low-cost, space-saving designs are the focus.

| Countries | Government Regulations and Mandatory Certifications |

|---|---|

| The United States | The USA Environmental Protection Agency (EPA) provides guidelines for cooling tower operations to minimize environmental impact and public health risks, particularly concerning Legionella bacteria proliferation. These guidelines recommend best practices for water treatment, system design, and maintenance. Additionally, state regulations vary; for example, California emphasizes water conservation and mandates regular maintenance and water quality testing. In New York City, cooling tower registration is mandatory prior to operation, with annual certifications required to confirm compliance with maintenance and testing protocols. |

| United Kingdom | The Health and Safety Executive (HSE) issues safety notices emphasizing the proper management of risks associated with Legionella in cooling towers. Compliance with these notices is crucial for legal operation, focusing on regular maintenance, risk assessments, and implementation of control measures to prevent bacterial growth. |

| Germany | Germany imposes stringent regulations on short-term rentals to protect residential housing, requiring permits for such activities. However, specific regulations for cooling tower rentals are not detailed in the provided sources. |

| India | The Cooling Technology Institute (CTI) certification is a significant credential in India, ensuring cooling towers meet stringent standards in thermal performance, sound levels, airflow efficiency, water distribution, and drift eliminator efficiency. Achieving CTI certification demonstrates compliance with international quality and performance benchmarks. |

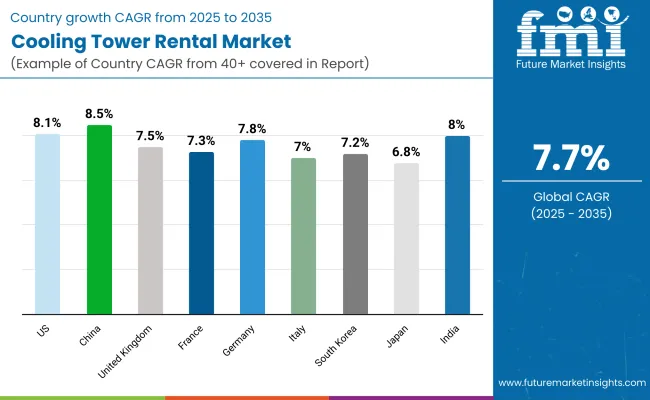

On the strength of active industry and stringent environmental regulations, the USA cooling tower rent market will advance at an 8.1% CAGR, outpacing the world average. The heat-producing industries, such as power generation, oil & gas, and data centers, which require effective cooling, anchor the demand.

Stringent EPA Clean Water Act (CWA) regulations are also motivating businesses to pursue green alternatives for cooling. The adoption of IoT-enabled cooling towers is thus on the rise, helping in real-time monitoring and predictive maintenance. Additionally, official substations for energy-conserving assets and expanding large-scale enterprises will likewise drive the United States rental cooling market.

The UK market will witness growth at a 7.5% CAGR owing to stringent environmental regulations coupled with the increasing adoption of energy-efficient cooling systems. Legionella cannot infiltrate a workplace, making maintenance and rental facilities essential for the industry.

Portable air conditioners have seen a rise in prevalence in manufacturing, construction, food processing, and other industries. In addition, building regulations Part L and BREEAM certification are promoting low-emission, water-saving cooling towers. However, another significant factor driving the demand for rental cooling systems is the growth of the data center industry.

The rental cooling tower market is expected to grow at a 7.3% CAGR in France, primarily due to industrial sustainability drives and stringent ICPE environmental laws. As the government places increasing emphasis on HQE (Haute Qualité Environnementale) certification, industries are integrating water-conserving and low-emission cooling towers.

Rental cooling solutions are the major consumers of food and beverages, chemicals, and pharmaceuticals. In addition, Legionella prevention regulations require the cooling system to be serviced regularly and temporarily replaced. The EU directives that aim for carbon neutrality by 2050 and energy-saving goals will also provide impetus to market growth.

The market for cooling tower rentals in Germany is anticipated to grow at the rate of 7.8% during the forecast period, owing to the high industrial demand and high emission control regulations. Demand for energy-efficient rental cooling equipment is propelled by stringent cooling tower emissions regulations under the TA Luft (Technical Instructions on Air Quality Control) and the Federal Emission Control Act (BImSchG).

Large chemical, automotive, and data center industries drive market growth. Moreover, Blue Angel Certification encourages businesses to go green with their cooling systems. With Germany leading the way in the transition to renewable energy in Europe, rental cooling towers are increasingly being used in temporary industrial cooling processes.

While the Italy rental cooling tower market will grow at a 7.0% CAGR, the growth will be mainly attributable to the introduction of Legionella Control Laws (D.Lgs 81/2008 & UNI 8884) and Integrated Environmental Authorisation (AIA) legislation. Rental cooling towers play a crucial role in temporary and emergency cooling for the pharmaceutical, textile, and food processing industries.

In Italy, low-energy cooling is being driven by a compliance focus with the EU Energy Efficiency Directive. However, growth is limited by the slow take-up of intelligent cooling technology, a trend that will be reversed as industrial automation accelerates.

A source of South Korean cooling towers is projected to develop at a 7.2% CAGR on the back of government regulations for commercial emissions reduction and energy-efficiency improvement. Acts of rationalization under the Clean Air system drive the high costs of high-cost, low-emission, and high-efficiency cooling systems in various industries.

As precision cooling occupies an important position in manufacturing, the electronics and semiconductor industry is a crucial demand driver for cooling towers. In addition, increasing urban data centers and smart factory automation are boosting the need for IoT-integrated cooling tower rental markets.

Japan's heating and cooling tower rental market is anticipated to expand at a CAGR of 6.8%, slightly below the global average, attributed to strong reliance on traditional systems and sluggish adoption of novel cooling systems. Compliance with laws such as the Water Pollution Control Act and JIS B 8623 Certification ensures environmental and safety standards.

The expense and need for long-term investment in stationary cooling systems, however, limit growth in the rental segment. Nonetheless, growth in compact cooling systems for space-limited industrial facilities and data center construction in urban areas is expected to create opportunities in the coming years.

The rental cooling tower market in China will be growing with a CAGR of 8.5%, the highest growth rate for any of the largest economies across the globe, because of strong industrialization and growth in data centers, as well as stringent emission control regulations. Increased stringent industrial emissions regulations under the Air Pollution Prevention and Control Action Plan will boost the green rental cooling tower market share.

The chemical, power generation, and manufacturing sectors predominantly use rental cooling solutions. In China, The Green Building Evaluation Standards (GBES) and China Compulsory Certification (CCC) encourage low-emission and energy-efficiency cooling systems, which further increases the market.

India's demand for cooling towers will see a CAGR of 8.0% in the rental market as there is rapid industrial growth, urbanization, and a rise in environmental standards. A combination of CPCB norms driving more stringent industrial emission norms and companies choosing short-term compliant cooling solutions is awakening the market. Manufacturing, power generation, and pharmaceutical industries are experiencing an increase in demand.

All of these initiatives are driving green rental cooling adoption through energy efficiency incentives and BEE Star Rating for Cooling Towers. The challenges posed by the water shortage for industry are significant and increasing, which provides a strong business case for hybrid and water-conserving cooling solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market experienced extended growth due to rising industrialization, particularly in the power generation, oil and gas, and manufacturing industries. | Industry growth would become faster as industries would adopt energy-conscious, water-conscious, and IoT-based cooling systems driven by lower environmental regulations. |

| Due to the disruption caused by COVID-19, industrial activities saw a short-term depletion in 2020, which impacted cooling tower rental demand. Still, the market recovered in 2021 to 2022 owing to increased investment in infrastructure and manufacturing. | Industrialization 3.0: Demand will continue to be driven by post-pandemic industrial growth and economic recovery, with the big growth markets emerging as developing economies, such as India, China, and Southeast Asia. |

| The market was dominated by the USA, China, and Europe, with an emphasis on meeting environmental regulations and increasing energy efficiency. | Although North America and Europe will still lead the overall market, the highest growth rate will be in the Asia-Pacific region due to advanced industrialization and increasing rule enforcement. |

| Hybrid cooling towers and dry cooling technologies began to be adopted, particularly in water-scarce regions. | As sustainability measures and water conservation regulations tighten in the commercial and industrial sectors, hybrid cooling towers will see the largest growth. |

| Automatic mechanical draught cooling towers remained the most popular choice as the most efficient and lowest cost -of-ownership solution-especially in industrial settings. | The adoption of IoT-based smart cooling towers will rise, enabling predictive maintenance, real-time monitoring, and automation, which will help reduce operational expenses. |

The global cooling tower rental market's growth is attributed to industrial development, infrastructure growth, climate policy, and technology. Demand is rising as economies recover from the pandemic, manufacturing activity increases, data centers multiply, and environmental regulations tighten. Governments worldwide are mandating carbon reduction targets, water conservation policies, and energy efficiency standards, which lead fields to invest in short-term, high-efficiency chillers.

This is also influencing the development of the market due to the trend towards IoT-enabled smart cooling solutions and green cooling technologies. Emerging markets like India, China, and Southeast Asia are also growing due to urbanization and industrialization. At the same time, supply chain constraints and inflationary pressures may play into pricing trends. Shortages of water and energy, in addition to strict rules on energy efficiency, will drive growth in the long term, in addition to a rising demand for climate-friendly cooling solutions.

The industry is fragmented into wet cooling towers, dry cooling towers, and hybrid cooling towers.

It is segmented into mechanical draft, natural draft, and other Designs.

Is fragmented into industrial and commercial uses.

The industry is segmented into the North American Market, Latin America Market, Europe Market, East Asia Market, South Asia and Pacific Market, and the Middle East and Africa (MEA) Market.

Rentals reduce costs, increase flexibility, and allow for immediate deployment for short-term or seasonal cooling applications.

There is a high demand for cooling energy efficiency standards for data centers, power generators, petrochemicals, and manufacturing.

Sustainable brands are leaving hybrid and green solutions due to stricter water-use policies and energy efficiency mandates.

The combination of IoT-based remote monitoring, AI-enabled predictive maintenance, and modular Design is revolutionizing efficiency and reliability.

Industrialization and cooling climate needs are driving growth in the Asia-Pacific, Middle East, and Latin America.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Grain Cooling Spear Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA