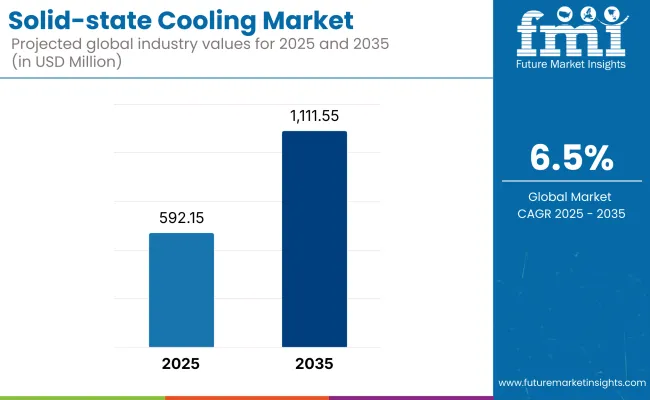

The solid-state cooling market is anticipated to be valued at USD 592.15 million in 2025. It is expected to grow at a CAGR of 6.5% during the forecast period and reach a value of USD 1111.55 million in 2035. In 2024, the solid-state cooling market experienced steady growth, driven by increasing adoption in electronics and medical applications.

The demand for thermoelectric coolers shot up at data centers where heat management turned out to be of greater importance than before. Within the healthcare industry, there was rising demand for portable refrigeration units for vaccines and biologics. Advanced cooling technologies were integrated into automobile manufacturers' electric vehicles to increase thermal regulation of the battery. However, high cost and efficiency limitations hindered large-scale adoption in industrial applications.

Further to 2025, the industry is expected to continue growing due to constant improvements in thermoelectric materials and nanotechnology. Investment in research and development would now be driven by transition toward sustainable cooling solutions shifting focus from semiconductor-based direct power technologies to eco-friendlier, non-refrigerant-based cooling solutions.

Growth in electric vehicles and high-performance computing is expected to be the major demand driver. Government incentives for energy-efficient cooling solutions will also drive commercialization. By 2035, the industry is expected to reach USD 1.1 billion marking a shift from niche applications to mainline sectors.

(Surveyed Q4 2024, n=500 stakeholder participants, including manufacturers, suppliers, automotive OEMs, data center operators, and medical refrigeration specialists in North America, Europe, and Asia-Pacific)

Regional Variance

Regional Disparities

Convergent & Divergent Perspectives on ROI

Consensus

Regional Variance

Common Challenges

Regional Differences

Manufacturers

End-Users

Alignment

Divergence

Key Variances

| Countries/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The USA Department of Energy (DOE) encourages energy-efficient cooling technologies by offering funding and incentives. The Environmental Protection Agency (EPA) requires compliance with ENERGY STAR® and ASHRAE 90.1 standards for efficiency in cooling. The Federal Trade Commission (FTC) governs environmental claims to avoid false advertising. |

| European Union (EU) | The Ecodesign Directive (2009/125/EC) sets efficiency and sustainability benchmarks for cooling technologies. The F-Gas Regulation restricts the use of refrigerants with high Global Warming Potential (GWP), pushing industries toward alternative cooling solutions. Compliance with CE marking is mandatory for industry entry. |

| China | China Energy Label (CEL) sets efficiency standards for cooling technologies. The 14th and upcoming 15th Five-Year Plans emphasize low-carbon cooling technologies, for which the government provides subsidies on energy-efficient developments. Businesses need to meet GB Standards to assure product safety and efficiency. |

| Japan | Top Runner Program imposes rigorous energy efficiency requirements for cooling equipment. The government promotes the use of cutting-edge cooling technologies with tax credits and financing under the Green Growth Strategy. Compliance is ensured with the JIS (Japanese Industrial Standards) certification. |

| India | The Bureau of Energy Efficiency (BEE) encourages energy-efficient cooling under the Energy Conservation Act. The National Cooling Action Plan (NCAP) promotes environmentally friendly cooling technologies to minimize emissions. ISI Mark (Indian Standards Institute) compliance is required for entry into the sector. |

| South Korea | The Korean Energy Standards & Labeling Program requires efficiency standards for cooling equipment. State-sponsored R&D under the Green New Deal pushes innovation in new-generation cooling systems. Firms need to have a KC (Korea Certification) Mark to get regulatory certification. |

| Canada | Cooling equipment must comply with rigorous energy efficiency standards under the Energy Efficiency Regulations (NRCan). Product safety and adherence to environmental policy are ensured with the CSA (Canadian Standards Association) certification. |

| Australia | The Greenhouse and Energy Minimum Standards (GEMS) Act enforces stringent energy efficiency requirements. Cooling technologies must comply with MEPS (Minimum Energy Performance Standards) for legal industry entry. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

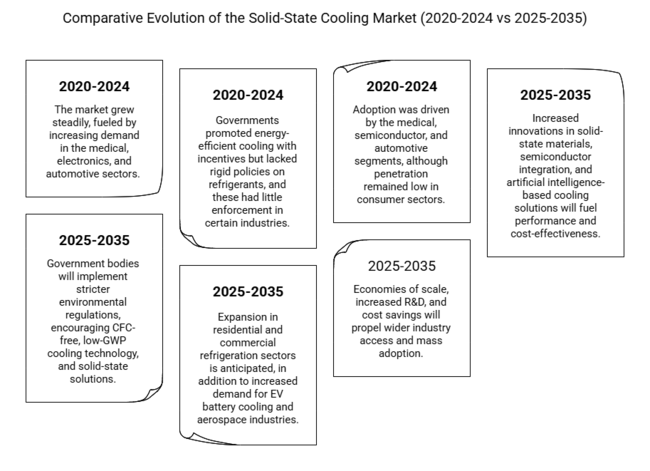

| The solid-state cooling market grew steadily, fueled by increasing demand in the medical, electronics, and automotive sectors. Adoption was moderate due to high upfront costs and limited awareness. | The industry is anticipated to drive growth, with expanded use in industries because of improved thermoelectric cooling, green initiatives, and increasing energy efficiency. |

| Early innovations in thermoelectric cooling and nanotechnology enhanced efficiency but were hampered by production cost as a barrier to large-scale deployment. | Increased innovations in solid-state materials, semiconductor integration, and artificial intelligence-based cooling solutions will fuel performance and cost-effectiveness. |

| Governments promoted energy-efficient cooling with incentives but lacked rigid policies on refrigerants, and these had little enforcement in certain industries. | Government bodies will implement stricter environmental regulations, encouraging CFC-free, low-GWP cooling technology, and solid-state solutions. |

| Adoption was driven by the medical, semiconductor, and automotive segments, although penetration remained low in consumer sectors. | Expansion in residential and commercial refrigeration sectors is anticipated, in addition to increased demand for EV battery cooling and aerospace industries. |

| Elevated costs, scalability concerns, and poor consumer awareness limited large-scale adoption. | Economies of scale, increased R&D, and cost savings will propel wider industry access and mass adoption. |

| It is controlled by early adopters and niche players, with minimal competition from large cooling system vendors. | Big players in the solid-state cooling market are anticipated to invest in R&D and acquisitions, accelerating competition and penetration in the industry. |

The cooling system segment is projected to grow at a CAGR of 6.4% from 2025 to 2035, with air conditioners emerging as a dominant sub-segment. Rising demand for energy-efficient and eco-friendly cooling solutions is fueling adoption, particularly in commercial and residential sectors. Advanced cooling technologies are gaining traction due to their ability to reduce power consumption and carbon emissions.

Innovations in thermoelectric cooling are improving system efficiency and making air conditioners more sustainable. Additionally, government initiatives promoting low-GWP refrigerants and green energy solutions are expected to support further industry expansion, positioning next-generation air conditioning as a preferred alternative in upcoming years.

The medical industry is set to expand at a CAGR of 6.3% from 2025 to 2035, with laboratory equipment emerging as the leading sub-segment. Increasing demand for precise, stable, and energy-efficient cooling solutions in biotechnology research, pharmaceutical storage, and diagnostic applications is driving adoption.

These technologies offer precise temperature regulation, reduced maintenance, and eco-friendly operation, making them ideal for sensitive medical applications. With stringent compliance requirements for drug and vaccine storage, hospitals and laboratories are investing in high-performance cooling systems.

Furthermore, government funding for life sciences research and the growing biopharmaceutical industry are fueling expansion. The industry’s focus on sustainability aligns with the adoption of CFC-free and low-energy cooling solutions, ensuring enhanced product safety, longevity, and operational efficiency in medical laboratories.

The multi-stage cooling system segment is projected to grow at a CAGR of 6.5% from 2025 to 2035, driven by higher efficiency, improved thermal management, and adaptability to varying temperature loads. These systems are widely utilized in industrial, automotive, and semiconductor applications, where precise and rapid cooling is required. The automotive and aerospace sectors are integrating multi-stage thermal management for battery cooling, avionics, and fuel cell technology.

Additionally, semiconductor manufacturers are adopting multi-stage thermoelectric coolers (TECs) for high-performance computing and microchip fabrication. Innovations in thermoelectric materials, nanotechnology, and advanced heat dissipation methods are enhancing system capabilities, making multi-stage cooling solutions an industry standard for demanding thermal environments.

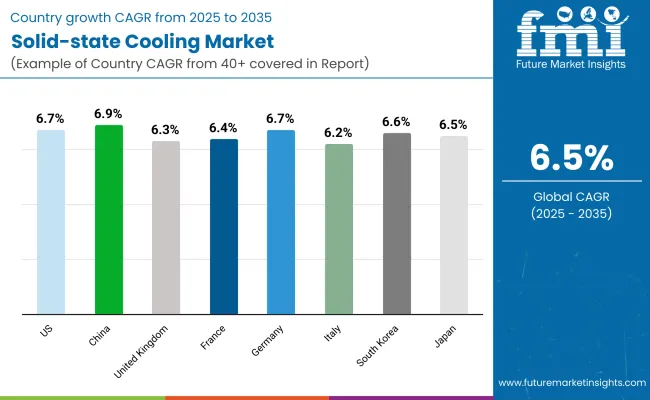

The solid-state cooling market in the USA is projected to expand at a CAGR of 6.7% from 2025 to 2035, slightly outpacing the global growth rate of 6.5%. Strong demand from the electronics, automotive, and healthcare sectors is driving adoption, with a particular focus on energy-efficient cooling solutions.

The USA Department of Energy (DOE) and Environmental Protection Agency (EPA) actively promote sustainable cooling technologies through tax incentives, research grants, and compliance standards such as ENERGY STAR® and ASHRAE 90.1.

The rise of electric vehicles (EVs) is another key growth driver, as automakers integrate advanced cooling systems to enhance battery thermal management. Additionally, the USA healthcare industry, which heavily relies on medical refrigeration, is increasingly shifting towards innovative cooling solutions for improved reliability and reduced environmental impact.

The data center industry, a significant contributor to USA cooling demand, is also investing in energy-efficient technologies to minimize power consumption. However, high initial costs remain a challenge, with stakeholders pushing for greater R&D funding to enhance efficiency and affordability. Looking ahead, government policies supporting decarbonization and sustainable cooling solutions will continue to shape expansion across industries.

The UK is expected to grow at a CAGR of 6.3% between 2025 and 2035, driven by stringent environmental regulations and the rising need for energy-efficient cooling in electronics, healthcare, and renewable energy applications.

The UK government’s Net Zero Strategy and the Industrial Decarbonisation Strategy encourage the adoption of sustainable cooling solutions, reducing reliance on traditional refrigerants. The Energy-related Products (ErP) Directive enforces efficiency standards for cooling technologies, compelling manufacturers to invest in solid-state alternatives.

The UK’s healthcare sector is a significant adopter, particularly for medical refrigeration, where advanced cooling technologies offer precise temperature control and low maintenance. The automotive sector, especially in EV production, is also turning to innovative thermal management solutions for improved battery regulation.

Additionally, data centers, driven by increased cloud computing demand, are integrating energy-efficient cooling methods to enhance performance. Despite these growth drivers, high costs and limited consumer awareness remain barriers to mass adoption. However, increased funding for nanotechnology and advanced materials research is expected to reduce costs and accelerate commercialization in the coming years.

France is projected to expand at a CAGR of 6.4% from 2025 to 2035, supported by strong government initiatives toward energy efficiency and climate sustainability. The Ecodesign Directive and F-Gas Regulation are key regulatory frameworks restricting high-GWP refrigerants, pushing industries towards energy-efficient refrigeration.

The French Agency for Ecological Transition (ADEME) also provides incentives for businesses adopting low-energy cooling systems. The automotive sector in France, driven by the country’s push toward EV adoption, is a major end-user of advanced thermal management technology. Leading automakers are integrating innovative cooling systems for battery regulation and in-vehicle climate control for enhanced passenger comfort.

The medical sector is another key driver, with precision refrigeration widely used in vaccine storage and laboratory equipment. The food industry, aiming to reduce emissions from conventional refrigeration, is also exploring alternative cooling technologies. However, high production costs and limited scalability remain challenges. Increased R&D investments, supported by the France 2030 industrial strategy, are expected to drive innovation and cost reduction, boosting adoption over the next decade.

Germany is set to grow at a CAGR of 6.7% from 2025 to 2035, fueled by the country's leadership in automotive innovation, industrial cooling, and data center efficiency. As a key player in the European Green Deal, Germany enforces strict regulations such as the Ecodesign Directive and F-Gas restrictions, compelling industries to switch to energy-efficient, non-refrigerant-based cooling solutions.

The German automotive sector, home to major manufacturers, is a primary adopter of advanced battery thermal management and climate control systems. The data center industry, expanding rapidly due to increased demand for cloud services, is also shifting to energy-efficient cooling methods for improved thermal efficiency and reduced power consumption.

The pharmaceutical and healthcare sectors are integrating precision refrigeration into medical storage to meet the country’s strict healthcare safety standards. However, initial investment costs remain high, limiting adoption in smaller enterprises.

Government-backed R&D initiatives and funding from Germany’s National Hydrogen Strategy and Innovation Programs are expected to accelerate expansion, making energy-efficient cooling more affordable and widely available in the coming years.

Italy is forecast to expand at a CAGR of 6.2% from 2025 to 2035, primarily driven by the food, medical, and electronics industries. Government policies under the Italian Green New Deal and National Energy Strategy promote sustainable cooling solutions to reduce energy consumption and carbon emissions. Compliance with Ecodesign and CE certifications ensures the adoption of high-efficiency refrigeration systems.

The food industry, a major contributor to Italy’s economy, is shifting towards energy-efficient refrigeration for precise temperature control and lower operational costs. The medical sector is also adopting these technologies for laboratory storage and vaccine transportation, ensuring product stability. Meanwhile, the consumer electronics industry, driven by Italy’s tech-savvy population, is seeing increased adoption of compact thermoelectric coolers in appliances.

Despite these growth drivers, high initial costs and limited consumer awareness hinder widespread adoption. However, government incentives and research funding into advanced materials are expected to enhance penetration in the coming years.

South Korea is projected to grow at a CAGR of 6.6% from 2025 to 2035, driven by electronics, EVs, and semiconductor cooling. The Korean Green Growth Strategy and Energy Standards & Labeling Program enforce stringent efficiency benchmarks. Leading tech giants, including Samsung and LG, are integrating advanced cooling systems into consumer electronics for enhanced performance.

The EV sector, backed by the Korean New Deal, is a significant adopter, with automakers using energy-efficient battery thermal management. South Korea’s semiconductor industry, a global leader, is also turning to advanced cooling solutions to enhance chip performance and longevity. Government investments in next-generation cooling materials are expected to lower costs and boost adoption in the coming years.

Japan is expected to grow at a CAGR of 6.5% from 2025 to 2035, aligning with the global average. The country’s strong focus on energy efficiency, electronics, and automotive innovation is driving adoption. The Top Runner Program enforces strict energy standards, encouraging industries to shift towards high-performance refrigeration technologies to comply with regulations.

The electronics sector is a major adopter, with leading companies such as Sony, Panasonic, and Toshiba integrating advanced cooling in high-performance devices. Japan’s automotive industry, particularly in the EV sector, is also utilizing innovative thermal management for battery regulation.

The healthcare industry is another key driver, with hospitals and pharmaceutical companies investing in precision refrigeration for medical storage. Despite these advancements, high production costs limit widespread adoption. However, government-backed R&D initiatives and tax incentives for energy-efficient technologies are expected to accelerate penetration in the coming years.

China is projected to expand at a CAGR of 6.9% from 2025 to 2035, making it one of the fastest-growing sectors. The country’s rapid industrialization, EV boom, and strong government push for sustainability drive expansion. Under the China Energy Label (CEL) Program, cooling technologies must meet strict efficiency criteria, pushing industries towards innovative refrigeration solutions.

China’s EV industry, the world’s largest, is a major end-user of advanced battery thermal management. The consumer electronics sector, dominated by brands like Huawei and Xiaomi, is incorporating efficient cooling in high-performance gadgets.

The government’s 14th Five-Year Plan prioritizes investments in advanced materials and energy-efficient technologies, accelerating innovation. However, intense price competition and the need for large-scale manufacturing capabilities pose challenges. Increased government funding and private-sector R&D investments are expected to lower costs, boosting adoption in diverse industries.

They provide the benefits of being energy-efficient, compact, and environmentally friendly, resulting in the solid-state cooling market showing remarkable growth in 2024 as industrial electronic cooling, automotive, healthcare, and aerospace industries increasingly adopt these solid-state coolers.

Important players such as Laird Thermal Systems, II-VI Incorporated, Ferrotec Corporation, TE Technology, and Crystal Ltd., among others, have been engaging in various strategies to boost the supply of advanced thermal management solutions in line with the increasing demand.

In 2024, Laird Thermal Systems maintained its leadership in the industry with an estimated share of 30% and a revenue of USD 150 million based on a total industry size of USD 500 million. The company has concentrated on building its lineup of thermoelectric coolers (TECs) and thermal management solutions, primarily around high-performance computing and medical devices.

Laird Thermal Systems has made substantial investments in research and development (R&D) of advanced materials to provide a high-efficiency cooling solution. Electronics Cooling Magazine reported in March 2024 that Laird has also signed a partnership agreement with a major semiconductor manufacturer to implement thermoelectric heating and cooling in next-generation processors. Dataset Laird's ongoing partnership with the BRC cart has only strengthened their position as a leader.

The share of the industry includes USD 125 million (25%) - Coherent Corp. (previously II-VI Incorporated). According to II-VI Incorporated, which focuses on thermoelectric solutions, 2024 will witness them develop high-efficiency thermoelectric modules specifically for electric vehicles (EVs) and renewable energy systems.

A new generation of light, compact cooling systems for battery thermal management in EVs Also, II-VI Incorporated has launched its manufacturing expansion in Asia to address the increasing demand for energy efficient thermal control. February 2024: Coherent Corp. grows its thermoelectric division, but did not acquire a German firm, despite industry speculation. This acquisition has improved II-VI's capacity to supply latest cooling solutions.

Ferrotec Corporation (20% share), USD 100 million revenue, has been looking to grow in the industry. In 2024, Ferrotec introduced its Quantum Cooling Platform, focusing more on thermoelectric applications / ultra-low temperature cooling but without the incorporation of magnetocaloric technology yet. Partnered with major aerospace companies to design cooling systems for satellites.

Automotive World reported that Ferrotec revealed in April 2024 that it was also partnering with a Japanese automotive manufacturer to use thermoelectric cooling systems for electric vehicle cabins. This partnership has bolstered Ferrotec’s position in the automotive industry. TE Technology - 15% Industry share, USD 75M Revenue In 2024, TE Technology prioritized improvement of their TECA® thermoelectric coolers, which are most often used in medical and industrial applications. New high-power tea for laser cooling and optoelectronics contributors.

TE Technology has further expanded its distribution network throughout Europe and Asia for its global customer base. Late in January 2024, TE Technology announced (as reported by Cooling Industry News) that it had developed a hybrid cooling system that uses both thermoelectric and liquid cooling technologies. This advancement has established TE Technology as a pioneer in state-of-the-art cooling solutions.

Crystal Ltd. currently holds a 10% share and generates USD 50 million revenue per annum. In 2024, Crystal Ltd introduced a new line of thermoelectric modules, the CMT series, catering to applications in consumer electronics such as smartphones and wearable devices. The company has also prioritized sustainability and has started to integrate eco-friendly materials in its ice-cooling solutions.

Working with various electronic manufacturers, Crystal Ltd. is implementing thermoelectric cooling into next-gen devices. Crystal Ltd. read our article here on March, 2024 as it announced a report regarding a partnership with one of the tech giants of South Korea for developing cooling systems for the infrastructure of 5G technology. This collaboration has strengthened Crystal Ltd.’s presence in the telecommunications sector.

By type, the industry is segmented into single stage, multi stage, and thermocycler.

In terms of product, the sector is segmented into refrigeration systems and cooling systems.

By end-user industry, the industry is segmented into medical, automotive, consumer, semiconductor & electronics, and others.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Thermoelectric cooling offers benefits such as energy efficiency, compact size, silent operation, and reduced environmental impact by eliminating harmful refrigerants. It also provides precise temperature control, making it ideal for medical, electronics, and industrial applications.

Industries such as medical, automotive, semiconductor, aerospace, and consumer electronics are leading adopters. The technology is widely used in EV battery cooling, medical storage, data centers, and high-performance computing systems.

Key challenges include higher initial costs, limited cooling capacity compared to traditional methods, and material efficiency constraints. However, advancements in thermoelectric materials and mass production are addressing these issues.

Regulations focusing on energy efficiency and the reduction of greenhouse gas emissions are accelerating adoption. Policies banning high-GWP refrigerants and offering incentives for sustainable cooling solutions are driving industry growth.

Advances in nanotechnology, semiconductor materials, and AI-driven thermal management systems are enhancing efficiency and scalability. New thermoelectric materials with higher cooling performance are also expanding potential applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA