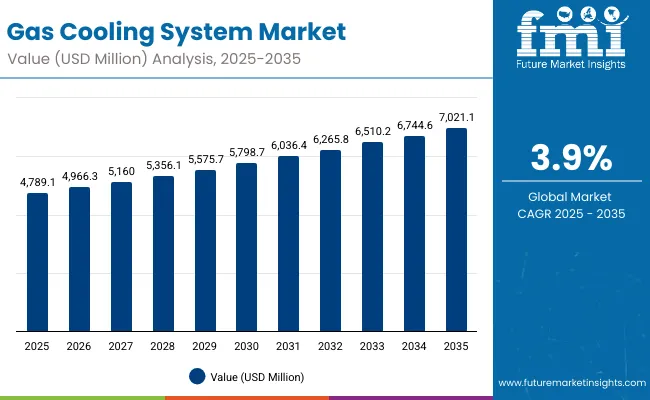

The gas cooling system market is projected to grow from USD 4,789.1 million in 2025 to approximately USD 7,021.1 million by 2035, recording an absolute increase of USD 2,232.0 million over the forecast period. This translates into a total growth of 46.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.9% between 2025 and 2035. The overall market size is expected to grow by nearly 1.47X during the same period, supported by the rising adoption of advanced cooling technologies and increasing demand for energy-efficient heat exchange solutions following industrial expansion and infrastructure development.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4,789.1 million |

| Industry Value (2035F) | USD 7,021.1 million |

| CAGR (2025 to 2035) | 3.9% |

Between 2025 and 2030, the Gas Cooling System market is projected to expand from USD 4,789.1 million to USD 5,794.3 million, resulting in a value increase of USD 1,005.2 million, which represents 45.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of advanced cooling technologies in industrial facilities, increasing manufacturing activities requiring efficient heat management, and growing awareness among operators about the importance of energy-efficient cooling solutions. Service providers are expanding their capabilities to address the growing complexity of modern industrial thermal management systems.

From 2030 to 2035, the market is forecast to grow from USD 5,794.3 million to USD 7,021.1 million, adding another USD 1,226.8 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of greenfield industrial installations, integration of smart cooling technologies, and development of standardized cooling protocols across different industrial sectors. The growing adoption of high-capacity cooling systems will drive demand for more sophisticated cooling solutions and specialized technical expertise.

Between 2020 and 2025, the Gas Cooling System market experienced steady expansion, driven by increasing industrialization in emerging economies and growing awareness of cooling requirements in oil and gas processing facilities. The market developed as industrial facilities recognized the need for specialized equipment and training to properly manage high-temperature processes. Energy companies and manufacturing facilities began emphasizing proper cooling procedures to maintain operational efficiency and equipment longevity.

Market expansion is being supported by the rapid increase in industrial processing activities worldwide and the corresponding need for specialized cooling solutions in high-temperature environments. Modern industrial facilities rely on precise temperature control and heat management to ensure proper functioning of manufacturing processes including petrochemical refining, power generation, and chemical processing. Even minor temperature fluctuations can require comprehensive cooling systems to maintain optimal process performance and equipment safety.

The growing complexity of industrial cooling requirements and increasing liability concerns are driving demand for professional cooling solutions from certified providers with appropriate equipment and expertise. Environmental agencies are increasingly requiring proper thermal management documentation following industrial installations to maintain compliance and ensure operational safety. Regulatory requirements and industrial specifications are establishing standardized cooling procedures that require specialized tools and trained technicians.

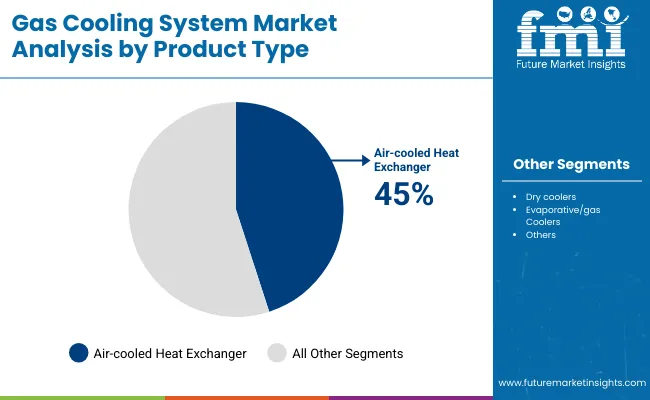

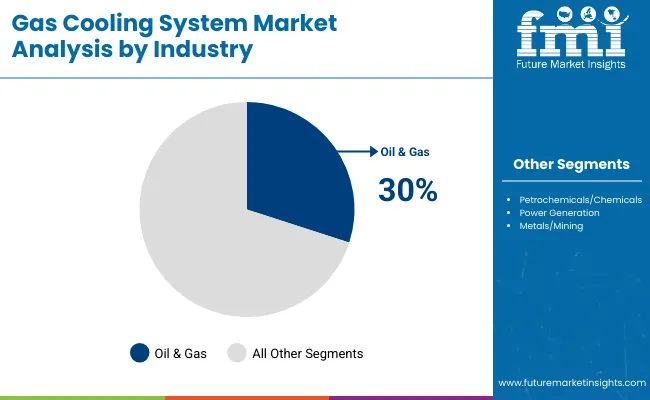

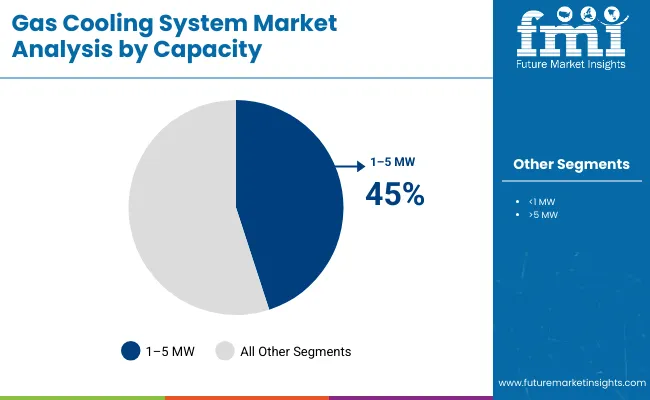

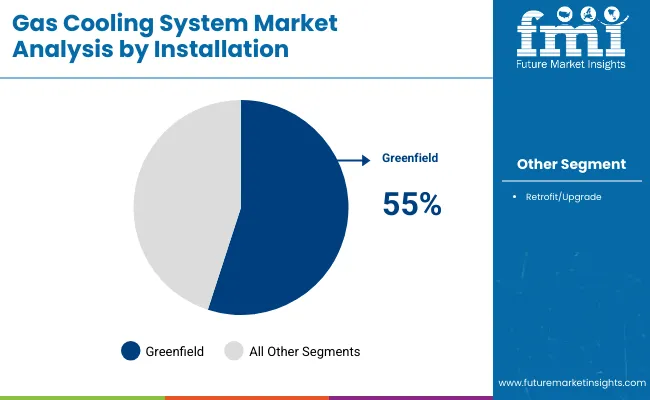

The market is segmented by product type, industry, capacity, installation, and region. By product type, the market is divided into air-cooled heat exchanger, dry coolers, evaporative/gas coolers, and others. Based on industry, the market is categorized into oil and gas, petrochemicals/chemicals, power generation, and metals/mining. In terms of capacity, the market is segmented into less than 1 MW, 1-5 MW, and greater than 5 MW. By installation, the market is classified into greenfield and retrofit/upgrade. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Air-cooled heat exchangers are expected to command a 45% share of the global gas cooling system market in 2025, making them the leading product type. Their dominance stems from their widespread adoption in industrial process applications where direct air circulation provides reliable and cost-efficient cooling. Unlike water-cooled systems, which face challenges in water-scarce regions or facilities with high environmental compliance needs, air-cooled heat exchangers use ambient air as the cooling medium eliminating dependency on water supply and reducing operating risks.

This approach has become the standard choice across oil and gas facilities, petrochemical plants, and power generation units, where large-scale process streams demand consistent thermal management. The technology benefits from decades of proven operating procedures, a deep supplier ecosystem, and a well-established aftermarket network for parts and services. As industries continue to prioritize energy efficiency and reduced environmental footprint, the use of air-cooled exchangers is expected to expand further, reinforcing the segment’s stronghold in the market.

The oil and gas industry is projected to account for 30% of gas cooling system demand in 2025, underscoring its position as the single largest application segment. Thermal management is a critical requirement across upstream production fields, midstream transportation networks, and downstream refining operations, making cooling systems indispensable to nearly every stage of the value chain.

In many facilities, multiple gas cooling systems are integrated to manage fluctuations in gas composition, pressure, and throughput. After any maintenance, process modification, or infrastructure upgrade, coordinated cooling is required to restore operational stability and safety compliance. The sector’s reliance on cooling solutions is further reinforced by stricter environmental regulations mandating efficient gas handling and thermal control to limit emissions. With oil and gas operators continuing to modernize infrastructure, upgrade LNG terminals, and integrate higher-capacity pipelines, demand for advanced gas cooling systems is expected to remain steady and resilient.

Medium-capacity systems in the 1-5 MW range are projected to hold 45% of the market in 2025. These installations strike an ideal balance between energy efficiency, footprint, and thermal load management, making them highly suitable for petrochemical complexes, independent power producers, and large-scale manufacturing plants. They are engineered to meet the requirements of both continuous and intermittent industrial operations, ensuring flexibility across use cases.

The segment’s growth is supported by the increasing push for standardized, modular cooling units that allow quick deployment, easy scalability, and lower maintenance costs. In industries where process uptime and reliability are non-negotiable, medium-scale cooling installations provide an optimal blend of capacity and cost-efficiency. Their adaptability across different industrial sectors gives this category a structural edge over both small-capacity niche systems and very large-scale specialized installations.

Greenfield installations are forecast to account for 55% of the gas cooling system market in 2025, driven by the steady pipeline of new industrial projects and expansions worldwide. In such projects, operators prefer to integrate cooling solutions at the design stage, enabling system optimization for performance, energy efficiency, and long-term scalability. Unlike retrofit or brownfield installations, greenfield projects allow for seamless integration with plant layout, process flow, and automation frameworks, reducing complexity and operational risks.

This preference is particularly evident in regions investing heavily in new energy infrastructure, LNG terminals, and petrochemical clusters, where operators prioritize tailor-made, end-to-end cooling solutions. For equipment providers, greenfield projects offer opportunities for higher-value contracts, as they encompass not just equipment delivery but also engineering, system design, and lifecycle services. Consequently, the dominance of greenfield installations reflects both the project-driven expansion of heavy industries and the inherent benefits of building optimized cooling infrastructure from the ground up.

The global gas cooling system market is advancing steadily, underpinned by robust industrial expansion, rising energy demand, and the growing recognition of thermal management as a mission-critical function across sectors. As manufacturing, petrochemicals, and power generation facilities operate at higher capacity levels, the importance of efficient and reliable gas cooling has become non-negotiable. Operators are increasingly viewing cooling systems not as auxiliary equipment, but as core infrastructure that directly influences operational safety, process continuity, and energy efficiency.

At the same time, the market faces a set of structural challenges that restrain growth. High equipment costs remain a significant barrier, particularly for small and mid-scale operators who find it difficult to invest in advanced cooling technologies with long payback periods. Continuous training and upskilling are another bottleneck, as technicians must keep pace with emerging cooling technologies, automation platforms, and environmental compliance requirements. Adding to this complexity is the lack of universal standards: cooling requirements vary widely across industrial applications, forcing providers to customize solutions and limiting economies of scale. Ongoing efforts around certification programs and standardization are shaping market development, but the pace remains uneven across geographies.

Expansion of Smart Cooling Technology Integration

One of the most transformative shifts in the market is the rapid adoption of smart cooling technologies. Modern industrial facilities, power generation plants, and petrochemical centers are deploying automated systems equipped with advanced sensors, AI-driven algorithms, and adaptive control platforms. These solutions enable real-time temperature monitoring, automated adjustment of cooling loads, and predictive maintenance, thereby improving precision while cutting energy consumption. For operators, this translates into higher reliability, reduced downtime, and lower total cost of ownership.

Smart cooling is particularly valuable in large-scale operations and high-temperature environments where even minor inefficiencies can escalate into costly disruptions. By enabling seamless integration with plant automation and energy management systems, smart cooling platforms are redefining thermal management as a digital, data-driven discipline rather than a purely mechanical process.

Integration of Advanced Heat Recovery and Energy Efficiency Technologies

Another defining trend is the integration of advanced heat recovery and energy efficiency solutions into modern gas cooling systems. Equipment providers are increasingly embedding automated energy management modules, regenerative cooling mechanisms, and IoT-based monitoring tools. These technologies not only improve cooling precision but also recycle waste heat, optimize energy utilization, and provide comprehensive documentation for compliance with energy efficiency standards.

This approach aligns closely with global sustainability goals and decarbonization mandates. Industrial operators are under mounting pressure to reduce energy intensity and carbon emissions, and advanced cooling systems provide a practical pathway by lowering operating costs while enhancing environmental performance. The capability to support next-generation applications ranging from renewable energy installations to advanced manufacturing processes positions these systems as enablers of industrial transition rather than just maintenance equipment.

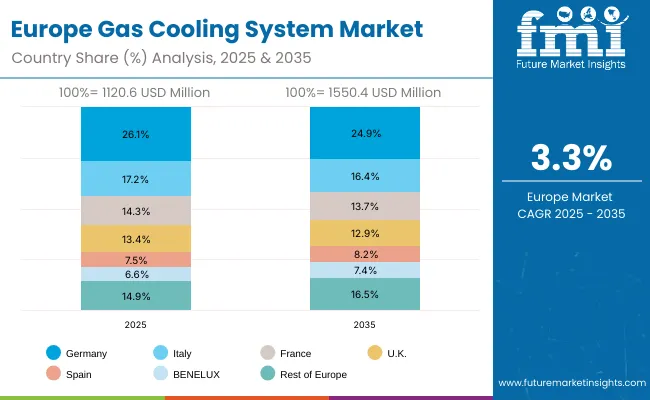

The Gas Cooling System market in Europe is projected to grow from USD 1,120.6 million in 2025 to USD 1,550.4 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership with a 26.1% share in 2025 declining slightly to 24.9% by 2035, supported by its expansive industrial infrastructure and advanced manufacturing network.

The Rest of Europe region is projected to maintain its position, with its share remaining stable at 16.5% by 2035, attributed to steady cooling system adoption in Eastern and Nordic regions. BENELUX and Italy will see minor gains in market share, while France and the UK show marginal declines, likely due to mature cooling infrastructure and slower growth in industrial facility development.

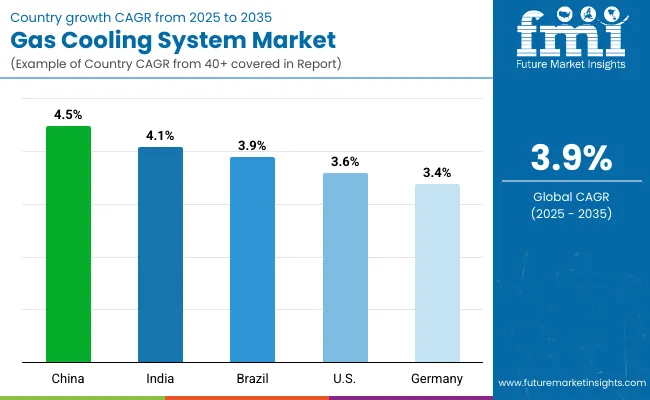

The gas cooling system market is growing rapidly, with China leading at a 4.5% CAGR through 2035, driven by strong industrial expansion, government infrastructure investments, and expanding cooling networks. India follows at 4.1%, supported by rising manufacturing activity in power generation and petrochemical sectors and increasing certified service availability. Brazil grows steadily at 3.9%, integrating cooling systems into its established industrial base. Germany records 3.4%, emphasizing precision engineering, quality standards, and advanced technical expertise. The USA shows growth at 3.6%, focusing on energy efficiency, standardization, and environmental compliance. Overall, China and India emerge as the leading drivers of global gas cooling system market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from gas cooling systems in China is projected to exhibit the highest growth rate with a CAGR of 4.5% through 2035, driven by rapid expansion of manufacturing facilities and increasing demand for advanced thermal management solutions. The country's expanding industrial sector and growing petrochemical industry are creating significant demand for cooling systems. Major industrial manufacturers and equipment providers are establishing comprehensive cooling networks to support the growing population of high-temperature processes across urban and rural industrial areas.

Revenue from gas cooling systems in India is expanding at a CAGR of 4.1%, supported by increasing industrial development in power generation and petrochemical sectors and growing awareness of cooling system requirements. The country's expanding manufacturing base and increasing power generation activities are driving demand for professional cooling solutions. Authorized service centers and specialized cooling facilities are gradually establishing capabilities to serve the growing population of industrial facilities requiring thermal management.

Revenue from gas cooling systems in Brazil is growing at a CAGR of 3.9%, driven by increasing industrial activity in oil and gas sectors and growing recognition of cooling system importance in manufacturing processes. The country's established industrial base is gradually integrating advanced cooling capabilities to serve modern facility technologies. Manufacturing centers and petrochemical facilities are investing in cooling equipment and training to address growing market demand.

Demand for gas cooling systems in Germany is projected to grow at a CAGR of 3.4%, supported by the country's emphasis on industrial technology innovation and precision engineering delivery. German industrial service providers are implementing comprehensive cooling capabilities that meet stringent quality standards and manufacturer specifications. The market is characterized by focus on technical excellence, advanced equipment integration, and compliance with comprehensive environmental safety regulations.

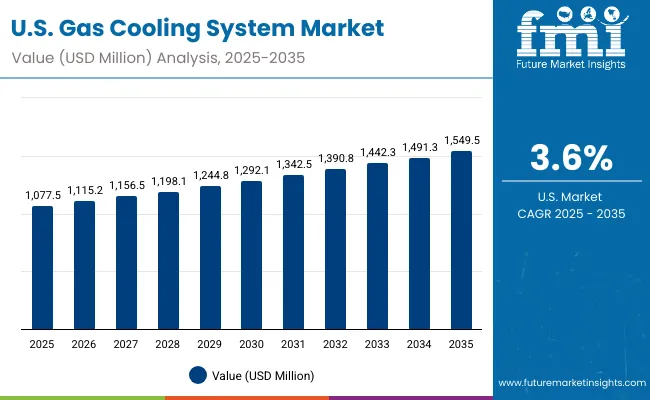

Demand for gas cooling systems in the USA is expanding at a CAGR of 3.6%, driven by increasing industrial activity across manufacturing sectors and growing emphasis on energy-efficient cooling procedures. Large industrial networks and specialized service providers are establishing comprehensive cooling capabilities to serve diverse operational needs. The market benefits from environmental agency requirements for proper thermal management documentation and manufacturer compliance following installations and maintenance activities.

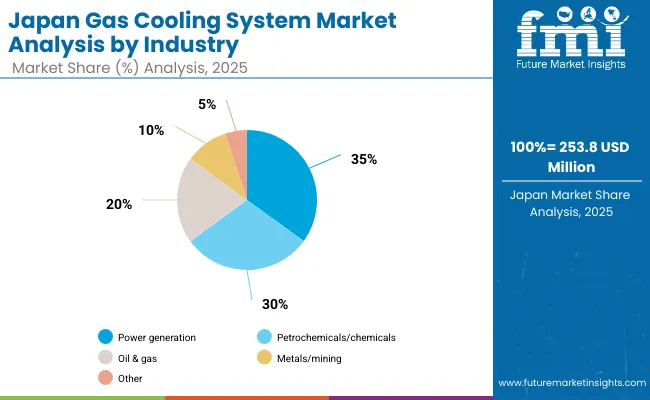

In Japan, the gas cooling system market is largely driven by the power generation segment, which accounts for 35% of total service revenues in 2025. The high penetration of advanced cooling technologies in domestic industrial facilities and stringent thermal management protocols mandated for industrial operations are key contributing factors. Petrochemicals/chemicals follow with a 30% share, primarily in manufacturing facilities that integrate advanced cooling and heat recovery systems. Metals/mining and other industries contribute 35% as cooling adoption in these categories continues expanding across diverse applications.

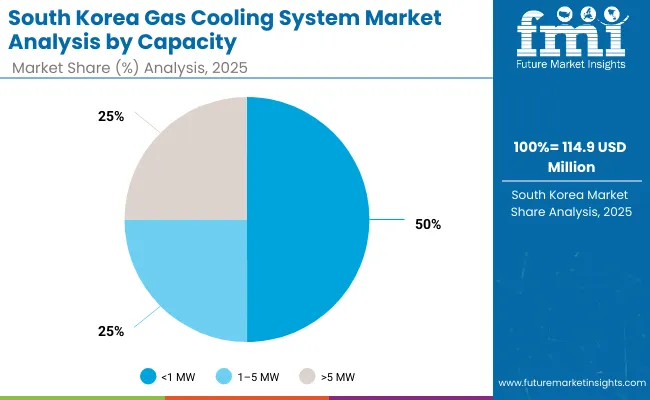

In South Korea, the market is expected to remain dominated by <1 MW capacity systems, which hold a 50% share in 2025. These systems are typically the optimal choice for industrial facilities requiring balanced cooling capacity and energy efficiency, where medium-scale cooling solutions provide comprehensive thermal management capabilities. Greater than 5 MW systems account for the remaining 25%, serving large-scale industrial complexes and power generation facilities requiring high-capacity cooling solutions.

The gas cooling system market is defined by competition among specialized equipment manufacturers, industrial cooling system providers, and thermal management companies. Companies are investing in advanced cooling technologies, energy-efficient solutions, standardized installation procedures, and technical training to deliver precise, reliable, and cost-effective cooling solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

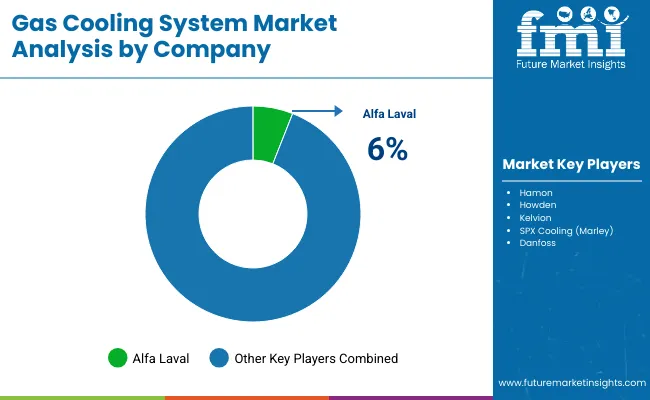

The Gas Cooling System market is characterized by fragmentation, with no clear dominant player exerting control. Alfa Laval, despite being a recognized global engineering company with significant presence across process industries, accounts for just 6% of the total market share. This small but visible share underlines two realities: Alfa Laval has the credibility and reach to secure presence, but the market’s structural dynamics make it difficult for any single company to build commanding dominance. For a sector where reliability and efficiency are non-negotiable, this dispersion reflects how buyers spread risk by diversifying supplier bases and how regional competitors carve niches in geographies or applications.

Such dispersion inherently points to opportunity. With the balance of 94% share held by a long tail of competitors, the white space lies in consolidation, scaling, or specialization. A firm with the ability to integrate advanced cooling technologies while ensuring cost efficiency could reshape the market’s power structure. Bain-style analysis would call this "the consolidation play" turning a fragmented field into a platform for share capture. However, this is easier said than done. The entrenched position of companies like Hamon, Howden, Kelvion, SPX Cooling (Marley), and Danfoss ensures that competitive intensity remains high. Each brings differentiated strengths whether engineering design, regional depth, or service networks that make share gains a slow and expensive pursuit. The path forward will demand clarity of focus: either niche leadership in specialized applications or aggressive consolidation to create scale. Both routes require sharp execution and investment discipline, but without them, firms risk remaining marginal players in a crowded market.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Air-cooled Heat Exchanger, dry coolers, evaporative/gas coolers, and others |

| Industry | Oil & Gas, petrochemicals/chemicals, power generation, and metals/mining |

| Capacity | <1 MW, 1-5 MW, and >5 MW |

| Installation | Greenfield and retrofit/upgrade |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Howden, Kelvion, SPX Cooling (Marley), Danfoss, Alfa Laval |

| Additional Attributes | Dollar sales by product type, industry, and capacity, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging suppliers, buyer preferences for energy-efficient versus conventional systems, integration with smart control and digital monitoring platforms, innovations in heat recovery capabilities and closed-loop cooling systems, and adoption of environmental compliance solutions with advanced efficiency features for enhanced operational performance. |

The global gas cooling system market is valued at USD 4,789.1 million in 2025.

The size for the gas cooling system market is projected to reach USD 7,021.1 million by 2035.

The gas cooling system market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product type segments in the gas cooling system market are air-cooled heat exchanger, dry coolers, evaporative/gas coolers, and others.

In terms of industry, oil and gas segment is set to command 30.0% share in the gas cooling system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA