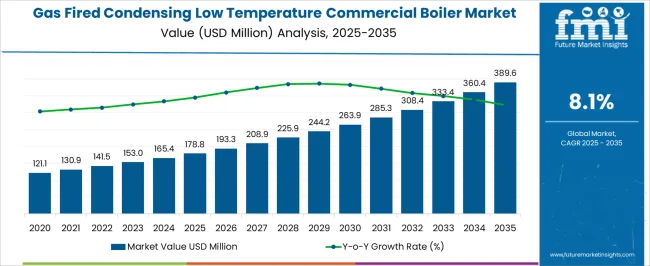

The gas fired condensing low temperature commercial boiler market is projected to grow at a CAGR of 8.1% from 2025 to 2035, with revenue increasing from USD 178.8 million in 2025 to USD 389.6 million by 2035. The market demonstrates a pronounced upward growth trajectory, initially showing moderate adoption in the early years, followed by accelerated expansion as awareness of energy-efficient heating solutions rises across commercial establishments.

Factors such as government incentives, regulatory mandates on emissions, and rising energy costs are driving end-users to adopt condensing boilers for lower operating expenses and improved thermal efficiency. Early adoption is concentrated in regions with stringent energy codes, while later stages see broader deployment across hotels, hospitals, office complexes, and educational institutions. Manufacturers are investing in modular designs, scalable capacity units, and smart control systems to address diverse commercial applications.

Strategic partnerships with distributors, service providers, and energy management companies are increasing market penetration, while retrofit projects and replacements of aging conventional boilers are contributing to sustained demand. Overall, the market growth curve resembles a steady S-shaped trajectory, highlighting gradual initial uptake followed by rapid mainstream adoption and continued expansion through the forecast period.

| Metric | Value |

|---|---|

| Gas Fired Condensing Low Temperature Commercial Boiler Market Estimated Value in (2025 E) | USD 178.8 million |

| Gas Fired Condensing Low Temperature Commercial Boiler Market Forecast Value in (2035 F) | USD 389.6 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The gas fired condensing low temperature commercial boiler market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The commercial building heating market holds the largest share at 40%, as offices, hotels, hospitals, and educational institutions increasingly adopt energy-efficient boilers to reduce fuel consumption and meet stringent energy codes.

The industrial process heating market contributes 25%, with small- to medium-scale manufacturing facilities utilizing low-temperature condensing boilers for space heating, hot water generation, and process support, improving operational efficiency and lowering emissions. The retrofit and replacement segment accounts for 15%, driven by aging conventional boiler systems being upgraded to condensing models to achieve better thermal performance and compliance with environmental regulations. The public infrastructure market, including government buildings, transport hubs, and healthcare facilities, holds a 12% share, as facility managers prioritize long-term operational savings and reduced carbon footprints.

The distribution and service network represents 8%, facilitating installation, maintenance, and spare parts supply, enhancing market accessibility and adoption. Commercial, industrial, and retrofit segments account for 80% of overall demand, highlighting that energy efficiency, regulatory compliance, and operational cost savings are the primary growth drivers, while public infrastructure and service channels provide incremental opportunities for market expansion globally.

The gas fired condensing low temperature commercial boiler market is experiencing steady growth, driven by rising energy efficiency requirements, stringent emission reduction policies, and the modernization of heating infrastructure across commercial facilities. Industry publications and HVAC sector updates have emphasized the adoption of condensing technology due to its ability to extract maximum heat from combustion gases, resulting in lower operating costs and reduced greenhouse gas emissions.

Government incentives and building regulations mandating high-efficiency heating systems have further accelerated market penetration, particularly in developed economies. Additionally, the shift towards natural gas as a cleaner alternative to oil-based heating has increased the relevance of condensing low temperature systems in commercial applications.

Technological advancements in heat exchanger design, digital controls, and modular configurations have improved reliability and system performance. In the coming years, growth is expected to be supported by retrofitting initiatives in aging commercial buildings, increasing demand for temperature-optimized systems, and the need for capacity ranges suitable for diverse applications such as offices, retail complexes, and institutional facilities.

The gas fired condensing low temperature commercial boiler market is segmented by temperature, capacity, application, and geographic regions. By temperature, gas fired condensing low temperature commercial boiler market is divided into ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F. In terms of capacity, gas fired condensing low temperature commercial boiler market is classified into ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr. Based on application, gas fired condensing low temperature commercial boiler market is segmented into Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others. Regionally, the gas fired condensing low temperature commercial boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

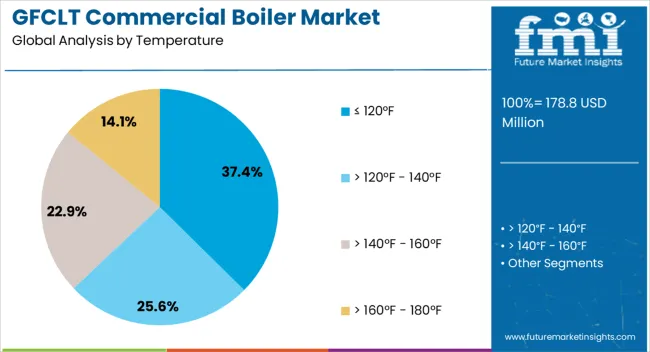

The ≤ 120°F temperature segment is projected to account for 37.4% of the gas fired condensing low temperature commercial boiler market revenue in 2025, maintaining its leadership in the temperature category. This growth has been supported by its compatibility with low-temperature heating applications, which maximize condensing efficiency and reduce energy consumption.

Building efficiency studies have shown that operating boilers at lower return water temperatures enables optimal latent heat recovery, resulting in higher seasonal efficiency ratings. The ≤ 120°F range is particularly favored in systems integrated with underfloor heating, fan coil units, and modern radiator networks designed for low-temperature output.

Additionally, this operating range aligns with regulatory frameworks encouraging reduced flow temperatures to minimize system losses. As facility managers increasingly prioritize operational cost savings and long-term sustainability, the ≤ 120°F segment is expected to remain a preferred choice in both new installations and retrofit projects.

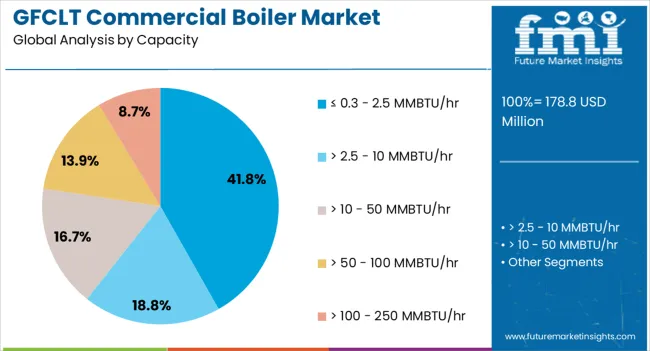

The ≤ 0.3 - 2.5 MMBTU/hr capacity segment is projected to hold 41.8% of the market revenue in 2025, emerging as the leading capacity range. This dominance has been attributed to its suitability for a wide spectrum of small to medium-sized commercial applications, including offices, retail spaces, and educational institutions.

Energy performance assessments have indicated that boilers within this capacity range offer an optimal balance between heating output and fuel efficiency, making them cost-effective for facilities with moderate heating demands.

Manufacturers have focused on developing modular and scalable solutions in this range, allowing for flexible system design and future capacity adjustments. The prevalence of building sizes and layouts that match this capacity range has further reinforced its market presence. With retrofitting activities and building upgrades continuing in the commercial sector, demand for boilers in this capacity range is expected to remain strong.

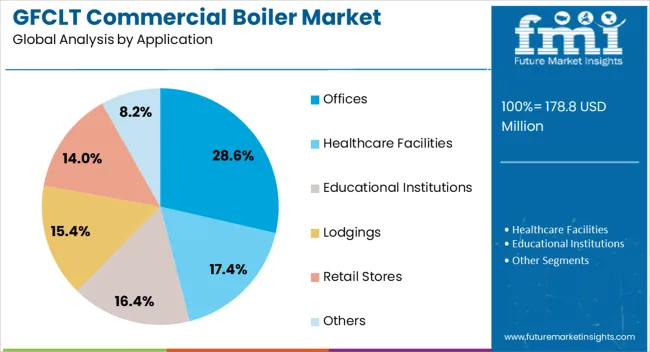

The Offices segment is projected to contribute 28.6% of the market revenue in 2025, retaining its position as the largest application category. Growth in this segment has been driven by the need for reliable, energy-efficient heating solutions in office environments, where consistent indoor comfort is critical to occupant productivity and satisfaction.

Facilities management reports have highlighted the adoption of condensing low temperature boilers in office buildings as part of broader energy management strategies aimed at reducing operational costs and carbon footprints.

The integration of advanced control systems and zoning capabilities has allowed office buildings to fine-tune heating output to occupancy patterns, further enhancing efficiency. Additionally, ongoing retrofits in older office buildings and compliance with energy performance certifications have encouraged the replacement of conventional boilers with high-efficiency condensing units. As commercial real estate operators continue to invest in sustainable infrastructure, the Offices segment is expected to sustain its leading role in market demand.

The gas fired condensing low temperature commercial boiler market is primarily driven by commercial building adoption, industrial process heating, and retrofit initiatives. Public infrastructure and regulatory compliance further support sustained market expansion globally.

The gas fired condensing low temperature commercial boiler market is witnessing strong adoption in commercial buildings such as hotels, hospitals, offices, and educational facilities. Facility managers are prioritizing energy efficiency, fuel cost reduction, and compliance with national energy regulations. The demand is further driven by the need for consistent hot water supply, climate control, and heating reliability across large-scale operations. Retrofit projects in older buildings are accelerating market penetration, as conventional boilers are replaced with low-temperature condensing units to optimize thermal efficiency. Property developers and commercial real estate operators are increasingly specifying condensing boilers in new constructions to achieve operational cost savings and meet green building certifications. This segment’s growth is supported by centralized heating systems and scalable boiler designs.

Industrial and manufacturing facilities are a key driver for low-temperature condensing boiler adoption, particularly for process heating, space heating, and hot water generation. Facilities in food processing, textiles, chemical, and beverage industries require precise temperature control while maintaining energy efficiency and reducing emissions. Companies are investing in condensing boilers to lower operational costs, improve heat recovery, and meet environmental compliance standards. Retrofit and expansion projects in older plants are fueling incremental growth. Moreover, industrial boiler suppliers are offering modular systems to cater to facility-specific needs, including flexible fuel options and integration with existing heating infrastructure. Rising industrial output and increased regulatory scrutiny on emissions are key catalysts for sustained adoption.

The replacement of conventional boilers with gas fired condensing low temperature units is a major growth dynamic. Aging boiler systems in commercial, industrial, and public infrastructure are being upgraded to improve thermal efficiency, reduce energy bills, and comply with emission standards. Facility operators benefit from government incentives and energy rebates that make retrofitting economically attractive. The segment emphasizes modular, compact, and scalable designs suitable for diverse heating requirements. Contractors and maintenance service providers play a crucial role in facilitating installation, inspection, and performance verification. This trend not only enhances market penetration but also drives aftermarket revenue through maintenance contracts, spare parts, and efficiency upgrades, creating long-term business opportunities for suppliers.

Government buildings, healthcare facilities, educational campuses, and transportation hubs are increasingly deploying condensing low-temperature boilers to reduce operational energy costs and achieve environmental targets. Public sector procurement policies favor boilers that comply with stringent efficiency and emission standards. Lifecycle cost benefits, lower maintenance requirements, and reliable performance under variable loads enhance adoption rates. Policy frameworks and building codes in Europe, North America, and the Asia-Pacific are influencing specification decisions. Facility managers prioritize operational safety, ease of control, and integration with existing heating infrastructure. Collaborative programs between local authorities, contractors, and boiler manufacturers facilitate large-scale deployment in municipal and public infrastructure projects, stimulating consistent market growth.

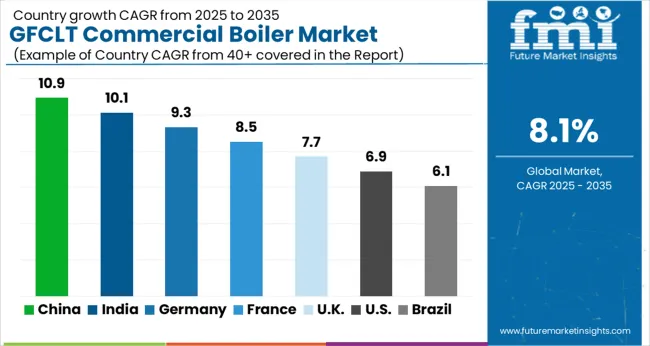

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

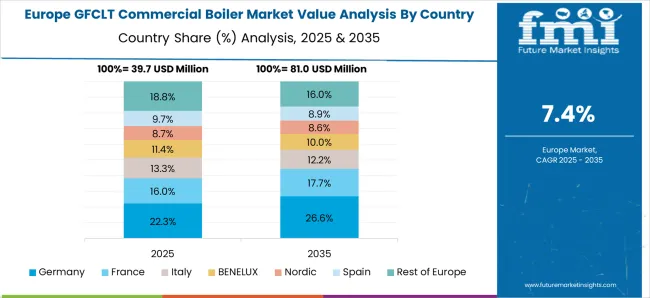

The global gas fired condensing low temperature commercial boiler market is projected to grow at a CAGR of 8.1% from 2025 to 2035, led by China at 10.9% and India at 10.1%, driven by commercial infrastructure growth, industrial expansion, and increasing demand for energy-efficient heating solutions. Germany, the UK, and the USA, as major OECD members, are expanding adoption through stringent emission regulations, retrofit initiatives, and sustainability mandates in commercial and public facilities. Growth is further fueled by demand in hotels, hospitals, educational institutions, and industrial process heating, along with incentives for energy-efficient equipment. Integration with smart heating systems and modular designs enhances operational efficiency, while government policies, building codes, and cost-saving measures accelerate large-scale deployment globally. The analysis covers over 40 countries, with the leading markets shown below.

The gas fired condensing low temperature commercial boiler market in China is projected to grow at a CAGR of 10.9% from 2025 to 2035, fueled by rapid industrialization, expanding commercial real estate, and the need for energy-efficient heating systems in hotels, hospitals, and institutional buildings. Government policies promoting clean energy and emission reduction are driving adoption of condensing boilers over traditional gas or coal-fired systems. Domestic manufacturers are scaling production capacities while incorporating advanced heat recovery, modular designs, and smart monitoring features. Retrofit projects for older commercial facilities are generating significant demand, while collaboration with international technology providers is enhancing boiler efficiency, reliability, and compliance with global standards.

The market in India is expected to grow at a CAGR of 10.1% from 2025 to 2035, supported by the rise in commercial and institutional construction projects, energy efficiency mandates, and environmental regulations. Hotels, hospitals, and large commercial buildings are increasingly installing condensing low-temperature boilers for superior thermal efficiency and lower operating costs. Domestic boiler manufacturers are investing in R&D to develop high-capacity, modular, and digitally monitored systems. Government initiatives promoting energy savings, carbon reduction, and modernization of legacy heating infrastructure further drive adoption. Partnerships with global suppliers facilitate technology transfer and enhance product reliability and compliance.

Germany’s market is projected to grow at a CAGR of 9.3% from 2025 to 2035, fueled by strict environmental regulations and a strong focus on reducing carbon emissions in commercial buildings. Retrofit demand for aging heating systems in offices, hotels, and industrial facilities is high, with condensing low-temperature boilers providing significant energy savings. Manufacturers focus on modular, high-efficiency units that integrate with building automation systems for optimized performance. Incentives for green energy adoption and compliance with European energy directives encourage widespread adoption. Collaboration between German companies and international technology providers enhances product innovation, durability, and integration with sustainable energy solutions.

The UK market is expected to grow at a CAGR of 7.7% from 2025 to 2035, driven by energy efficiency standards in commercial properties, government schemes for low-carbon heating, and increasing demand in institutional facilities. Hotels, schools, hospitals, and offices are adopting condensing low-temperature boilers to reduce energy bills and carbon footprint. Domestic and European manufacturers provide high-efficiency, low-emission systems with advanced control features. Retrofit programs in older buildings and new construction projects contribute to steady growth. Government incentives, such as tax credits and energy efficiency grants, further accelerate adoption of modern condensing boilers across commercial and industrial sectors.

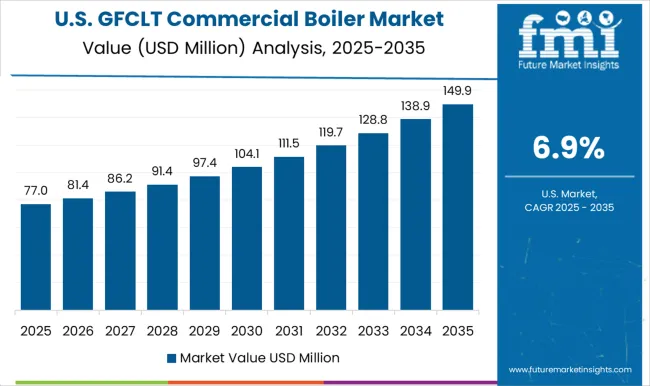

The USA market is projected to grow at a CAGR of 6.9% from 2025 to 2035, supported by increasing commercial infrastructure, modernization of institutional heating systems, and energy efficiency initiatives. Condensing low-temperature boilers are preferred for their high thermal efficiency, lower emissions, and cost savings. Manufacturers focus on integrating smart controls, modular designs, and durable components for hotels, hospitals, and commercial complexes. Incentives for energy-efficient equipment, green building certifications, and state-level rebate programs promote adoption. Retrofit projects in older buildings, combined with new commercial developments, ensure steady market growth. Partnerships with international suppliers help bring advanced technologies and maintain compliance with federal and state regulations.

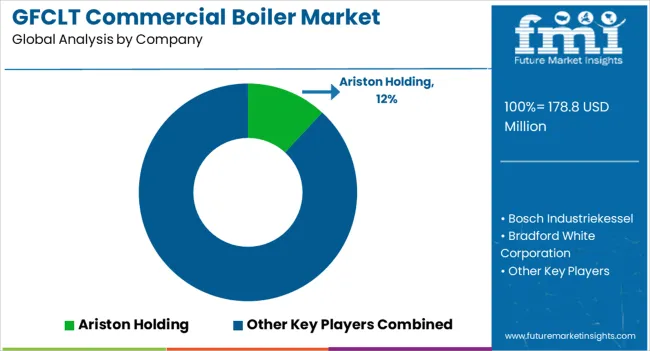

Competition in the gas fired condensing low temperature commercial boiler market is defined by energy efficiency, emission reduction, and system reliability. Ariston Holding leads with modular, high-efficiency boilers emphasizing low emissions, digital control, and space-saving designs suitable for commercial buildings. Bosch Industriekessel competes through large-capacity, industrial-grade boilers optimized for high thermal efficiency, long operational life, and integration with building management systems. Bradford White Corporation and Burnham Commercial Boilers focus on durability, consistent heat output, and cost-effective maintenance, catering to institutional and hotel applications. Cleaver-Brooks differentiates by providing scalable, fully packaged solutions with advanced monitoring and automated control systems for industrial and commercial installations. Mid-tier and regional players, including De Dietrich, Ferroli, Fondital, Fulton, Hoval, Hurst Boiler & Welding, Precision Boilers, Vaillant Group International, Viessmann, Weil-McLain, and Wolf, provide niche and customizable solutions such as compact condensing units, low-temperature designs, and smart monitoring systems. Strategies emphasize compliance with regional energy efficiency and emissions standards, service reliability, and retrofitting capabilities. Partnerships with EPC contractors and facility operators enable accelerated adoption, while product differentiation is achieved through modularity, heat recovery integration, and lifecycle support.

| Item | Value |

|---|---|

| Quantitative Units | USD 178.8 Million |

| Temperature | ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F |

| Capacity | ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Application | Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ariston Holding, Bosch Industriekessel, Bradford White Corporation, Burnham Commercial Boilers, Cleaver-Brooks, De Dietrich, Ferroli, Fondital, Fulton, Hoval, Hurst Boiler & Welding, Precision Boilers, Vaillant Group International, Viessmann, Weil-McLain, and Wolf |

| Additional Attributes | Dollar sales, share by type, capacity, application, regional demand, CAGR trends, competitor strategies, pricing benchmarks, regulatory standards, energy efficiency adoption, retrofit vs new installations, and growth drivers across commercial, industrial, and institutional sectors. |

The global gas fired condensing low temperature commercial boiler market is estimated to be valued at USD 178.8 million in 2025.

The market size for the gas fired condensing low temperature commercial boiler market is projected to reach USD 389.6 million by 2035.

The gas fired condensing low temperature commercial boiler market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in gas fired condensing low temperature commercial boiler market are ≤ 120°f, > 120°f - 140°f, > 140°f - 160°f and > 160°f - 180°f.

In terms of capacity, ≤ 0.3 - 2.5 mmbtu/hr segment to command 41.8% share in the gas fired condensing low temperature commercial boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA