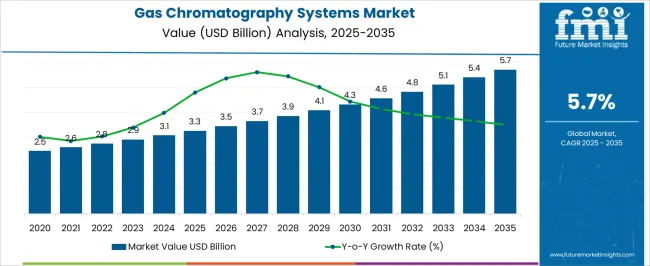

The Gas Chromatography Systems Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Gas Chromatography Systems Market Estimated Value in (2025 E) | USD 3.3 billion |

| Gas Chromatography Systems Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The Gas Chromatography Systems market is experiencing steady growth, driven by the increasing need for precise analytical instrumentation across chemical, pharmaceutical, environmental, and food industries. In 2025, the market is characterized by rising demand for high-resolution, reliable, and rapid detection systems capable of handling complex mixtures with minimal sample preparation.

Growth is being influenced by stricter regulatory standards for quality control, safety, and environmental monitoring, which are prompting organizations to adopt advanced chromatography solutions. Technological advancements in detector sensitivity, automation, and data integration are enabling laboratories to perform faster and more accurate analyses.

Additionally, increased investment in research and development, coupled with the expansion of pharmaceutical manufacturing and chemical production, has supported market expansion The global emphasis on analytical accuracy, high throughput, and compliance with international standards is expected to continue driving demand for gas chromatography systems, while future opportunities are anticipated in the development of integrated, multi-detector platforms and software-enabled solutions that optimize laboratory workflows and enhance operational efficiency.

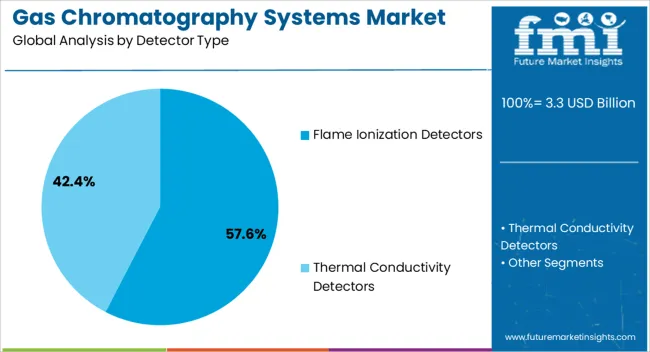

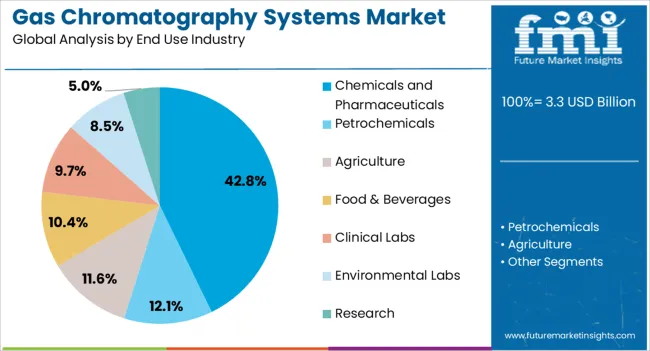

The gas chromatography systems market is segmented by detector type, end use industry, and geographic regions. By detector type, gas chromatography systems market is divided into Flame Ionization Detectors and Thermal Conductivity Detectors. In terms of end use industry, gas chromatography systems market is classified into Chemicals and Pharmaceuticals, Petrochemicals, Agriculture, Food & Beverages, Clinical Labs, Environmental Labs, and Research. Regionally, the gas chromatography systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Flame Ionization Detectors segment is projected to account for 57.60% of the Gas Chromatography Systems market revenue in 2025, making it the leading detector type. This prominence is being attributed to its high sensitivity, broad linear dynamic range, and reliability in detecting organic compounds in diverse sample matrices. Adoption has been accelerated in applications such as chemical process monitoring, pharmaceutical quality control, and environmental testing, where precise quantification of hydrocarbons is critical.

The growth of this segment is being reinforced by the detectors’ capability to integrate seamlessly with automated systems, allowing high-throughput and reproducible analyses. Laboratories are increasingly preferring flame ionization detectors because they provide consistent performance while minimizing maintenance requirements.

Furthermore, improvements in signal stability and response time have enhanced their applicability across routine and specialized analytical workflows As industries continue to prioritize operational efficiency, regulatory compliance, and accurate compound characterization, the flame ionization detector segment is expected to maintain its leading position due to its proven performance and adaptability.

The Chemicals and Pharmaceuticals end-use industry segment is anticipated to hold 42.80% of the Gas Chromatography Systems market revenue in 2025, positioning it as the largest consumer among all sectors. This leadership is being driven by stringent quality control standards, increasing production of active pharmaceutical ingredients, and the necessity for precise chemical analysis in drug formulation and research. The segment’s growth has been further supported by regulatory mandates requiring comprehensive testing for impurities, degradation products, and volatile organic compounds in both chemical and pharmaceutical products.

Adoption is being accelerated due to the requirement for high-resolution, reliable, and reproducible analytical data that can inform critical process decisions and ensure compliance with safety standards. Laboratories in this industry prefer gas chromatography systems for their ability to handle complex mixtures with consistent accuracy.

The integration of advanced detectors and automated workflows has further enhanced throughput and data reliability As pharmaceutical development and chemical manufacturing continue to expand globally, the Chemicals and Pharmaceuticals sector is expected to remain the dominant end-user, reinforcing demand for state-of-the-art chromatography solutions.

Increasing investments by governments related to chromatography technologies, coupled with increasing collaborations between chromatography manufacturers and research laboratories, is a major factor driving the growth of the gas chromatography systems market. Also, the rising concerns about food safety and technological advancements are creating the need for gas chromatography systems. Moreover, gas chromatography systems are considered as cost-effective alternatives to micro-extraction and electrophoresis analytical separation methods, and therefore, the demand for gas chromatography systems is rapidly increasing.

Gas chromatography systems are common chromatography systems that are used in analytical chemistry for separating and analysing compounds that can be vaporized without decomposition. Gas chromatography systems comprise a group of techniques that enable the separation of individual components from a sample mixture. The widespread adoption of gas chromatography systems in laboratory instrumentation is one of the major factors that is driving their adoption.

Also, gas chromatography systems are becoming essential components in the life science research, agriculture, biotechnology, and pharmaceutical industries, and due to this factor, the gas chromatography systems market is expected to witness high growth rates during the forecast period.

Drivers

The increasing demand for petroleum, petrochemicals, fine & specialty chemicals, natural gas, and fuel cells is driving the growth of the gas chromatography systems market. Thus, wide-ranging application areas of gas chromatography systems are increasing the use of the gas chromatography technique, and eventually, driving the growth of the market. Moreover, the rising focus on addressing environmental and food safety issues is also creating potential growth opportunities for this market.

Apart from this, increasing government investments and funds, and increasing research activities in the field of medicine, proteomics, and metabolomics are fuelling the growth of the gas chromatography systems market. Furthermore, the rising demand for technologically advanced gas chromatography systems for enhanced chromatographic performance is a major factor driving the growth of the market.

Challenges

The high costs associated with gas chromatography systems is the major factor hampering the growth of the market. Also, the lack of skilled personnel that are required to handle gas chromatography systems and alternative separation techniques are also contributing in hindering the growth of the market.

Key Players

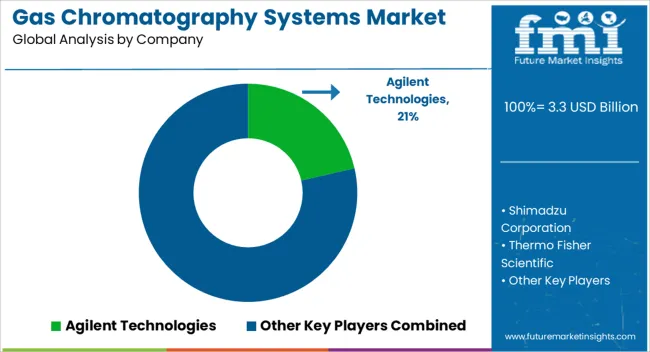

Prominent players in the global gas chromatography systems market are Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., Yokogawa Electric Corporation, Siemens AG, Regis Technologies, Inc., Illumina, Inc., APIX, OI Analytical, and PerkinElmer.

On the basis of geography, Asia Pacific is expected to capture the largest market share in terms of revenue in the gas chromatography systems market, owing to a rise in the adoption of gas chromatography systems in various industries, and the presence of various gas chromatography system manufacturers in the region. Asia Pacific and Europe are expected to witness high growth in the global gas chromatography systems market, due to increasing government investments in chromatography technologies. Rising concerns about food safety in the various countries of Asia Pacific, such as China and India, is also a major factor that is driving the growth of the gas chromatography systems market in the region.

The market in North America is also expected to grow at a high CAGR, owing to various initiatives taken by the governments in research activities in the field of medicine, proteomics, and metabolomics. The gas chromatography systems markets in MEA and Latin America are also expected to gain substantial market shares in terms of revenue in the coming period, due to the increasing penetration of petroleum, petrochemical, fine & specialty chemical, natural gas, and fuel cell industries in these regions.

The report is a compilation of first-hand information, qualitative, and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. The report also maps the qualitative impact of various market factors on market segments and geographies.

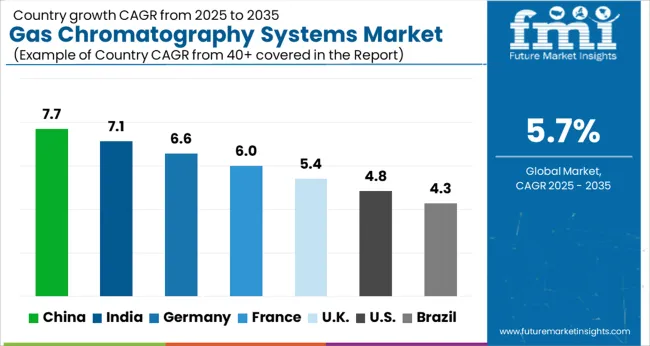

| Countries | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The Gas Chromatography Systems Market is expected to register a CAGR of 5.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.7%, followed by India at 7.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.3%, yet still underscores a broadly positive trajectory for the global Gas Chromatography Systems Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.6%. The USA Gas Chromatography Systems Market is estimated to be valued at USD 1.2 billion in 2025 and is anticipated to reach a valuation of USD 1.9 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 178.1 million and USD 97.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Detector Type | Flame Ionization Detectors and Thermal Conductivity Detectors |

| End Use Industry | Chemicals and Pharmaceuticals, Petrochemicals, Agriculture, Food & Beverages, Clinical Labs, Environmental Labs, and Research |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific, PerkinElmer, Bruker Corporation, Restek Corporation, LECO Corporation, Danaher Corporation, Merck KGaA, JEOL Ltd., Dani Instruments, Scion Instruments, Ellutia Chromatography Solutions, and Trajan Scientific and Medical |

The global gas chromatography systems market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the gas chromatography systems market is projected to reach USD 5.7 billion by 2035.

The gas chromatography systems market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in gas chromatography systems market are flame ionization detectors and thermal conductivity detectors.

In terms of end use industry, chemicals and pharmaceuticals segment to command 42.8% share in the gas chromatography systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Chromatography Columns Market

Gas Chromatography Detector Market

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Gas Generating Systems Market Size, Growth, and Forecast 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gastro-retentive Drug Delivery Systems Market - Trends & Demand 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Charging Nitrogen Gas Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Resin Market Forecast and Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA