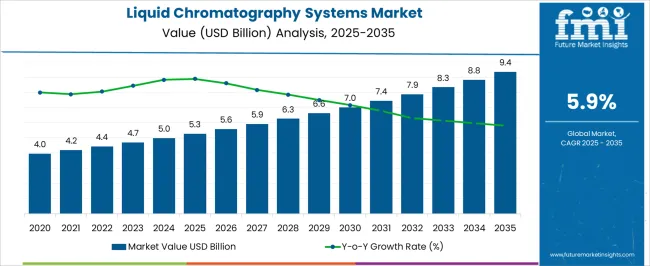

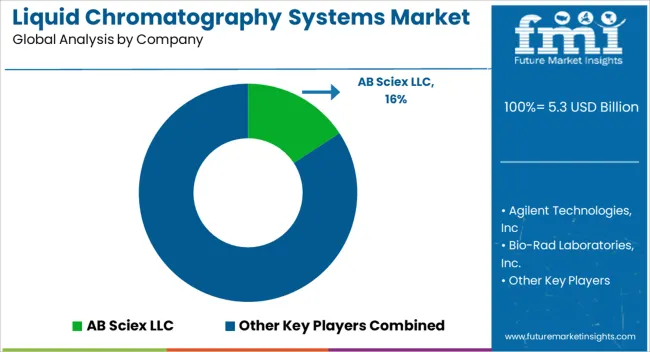

The Liquid Chromatography Systems Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Liquid Chromatography Systems Market Estimated Value in (2025 E) | USD 5.3 billion |

| Liquid Chromatography Systems Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The liquid chromatography systems market is experiencing notable growth, driven by its critical role in pharmaceutical development, biomedical research, food safety testing, and environmental analysis. The increasing demand for precise separation, identification, and quantification of complex compounds is fueling widespread adoption across research and industrial domains. Rising investments in biopharmaceutical research and the growing emphasis on quality assurance in drug manufacturing are major factors accelerating market expansion.

Technological advancements, including automated platforms, miniaturization, and integration with mass spectrometry, are enhancing system capabilities, offering higher throughput and improved accuracy. The market is also benefiting from regulatory guidelines that mandate stringent testing in healthcare, food, and environmental sectors. Expanding applications in proteomics, metabolomics, and biomarker discovery are broadening usage across both academic and industrial laboratories.

The increasing shift toward personalized medicine and targeted therapies is further supporting growth, as liquid chromatography systems provide reliable and reproducible results With continuous innovations, strong research funding, and rising demand for advanced analytical solutions, the market is expected to maintain steady long-term growth across global regions.

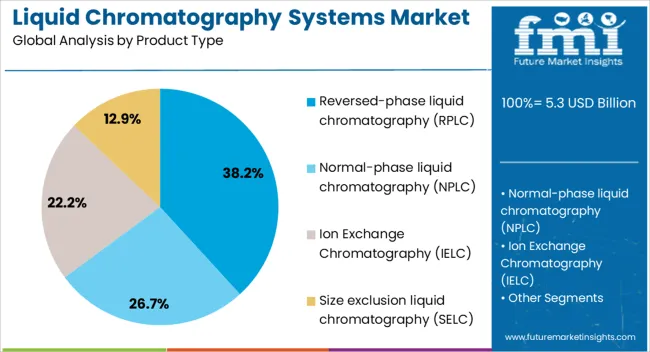

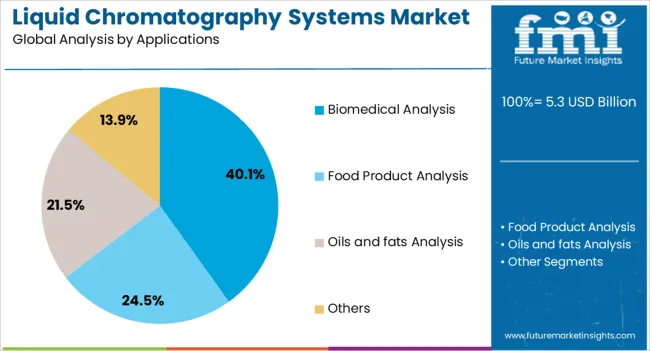

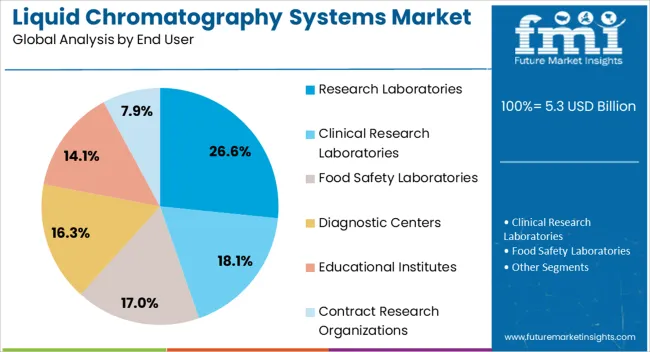

The liquid chromatography systems market is segmented by product type, applications, end user, and geographic regions. By product type, liquid chromatography systems market is divided into Reversed-phase liquid chromatography (RPLC), Normal-phase liquid chromatography (NPLC), Ion Exchange Chromatography (IELC), and Size exclusion liquid chromatography (SELC). In terms of applications, liquid chromatography systems market is classified into Biomedical Analysis, Food Product Analysis, Oils and fats Analysis, and Others. Based on end user, liquid chromatography systems market is segmented into Research Laboratories, Clinical Research Laboratories, Food Safety Laboratories, Diagnostic Centers, Educational Institutes, and Contract Research Organizations. Regionally, the liquid chromatography systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reversed-phase liquid chromatography segment is projected to account for 38.2% of the liquid chromatography systems market revenue share in 2025, establishing itself as the leading product type. Its dominance is being driven by the broad applicability of reversed-phase techniques in separating nonpolar and moderately polar compounds, which represent a significant portion of biomedical and pharmaceutical research. The method’s versatility in handling diverse analytes has made it an essential tool in drug development, quality control, and biomolecule purification.

Improved column chemistries, enhanced stationary phase materials, and compatibility with advanced detection systems are further supporting adoption. Researchers and manufacturers benefit from the reproducibility and scalability offered by this technique, enabling consistent results across different applications.

Rising global demand for efficient, cost-effective, and widely validated analytical approaches is reinforcing its position as the preferred method The strong presence of RPLC in regulatory-approved protocols and its integration into advanced liquid chromatography platforms ensure that it remains the most widely utilized segment in the overall market.

The biomedical analysis segment is expected to represent 40.1% of the liquid chromatography systems market revenue share in 2025, making it the leading application area. Its leadership is being supported by increasing demand for high-precision tools in clinical diagnostics, biomarker research, and therapeutic monitoring. Liquid chromatography systems are widely employed to analyze complex biological samples such as proteins, metabolites, and nucleic acids, offering superior resolution and sensitivity.

The segment is benefiting from the rising prevalence of chronic diseases, which is encouraging the development of personalized therapies and companion diagnostics. Growing collaborations between pharmaceutical companies, clinical research organizations, and academic institutes are also driving adoption. The integration of liquid chromatography with mass spectrometry is enabling detailed molecular profiling, thereby advancing disease understanding and drug discovery.

Strict regulatory requirements for bioanalytical testing are further accelerating demand As biomedical research continues to expand and precision medicine gains prominence, the use of liquid chromatography in biomedical analysis is expected to remain the leading application segment globally.

The research laboratories segment is anticipated to account for 26.6% of the liquid chromatography systems market revenue share in 2025, establishing itself as the leading end-user category. This leadership is being reinforced by the increasing adoption of liquid chromatography in academic institutions, government research centers, and private laboratories conducting advanced scientific studies. The segment is benefiting from strong research funding across biotechnology, pharmaceuticals, and life sciences, where chromatography systems are indispensable for analytical accuracy and reproducibility.

Widespread use in proteomics, genomics, metabolomics, and environmental sciences is expanding laboratory reliance on these systems for complex analyses. Continuous technological advancements, including automation, user-friendly interfaces, and integration with advanced detection systems, are making the technology more accessible for research environments.

The growing demand for scalable systems that can be customized for different study requirements is further driving adoption As global scientific research activity continues to expand, research laboratories are expected to remain the largest end-user group, sustaining steady demand for high-performance liquid chromatography systems.

The liquid chromatography systems market can be briefly classified, based on the product, into Instruments, Accessories, and Software. Large-scale applications of high-performance liquid chromatography across laboratories have made the instruments segment of the market the most profitable one, with a revenue share of over 40%. This is due to rampant innovation in the technology, which has produced highly accurate HPLC-based detectors for labs.

A few recent innovations in the instruments segment are Shimadzu Corporation's I-Series LC-2050/LC-2060 integrated HPLC system and Activated Research Company's Solvere carbon selective detector. The likes of Agilent Technologies are driving growth in the accessories segment through launches like the new AdvanceBio SEC PEEK-lined stainless-steel column.

In the software segment, Shimadzu Corporation recently launched the LabSolutions MD software. This is further boosted by an improvement in column chemistry and filtration techniques used for the accessories. Corporations such as Axcend are developing portable systems based on HPLC with wide-ranging utility across different industries.

In the pharma industry, there is a rise in the usage of chiral compounds, which demands greater innovations in the existing liquid chromatography systems. Since a majority of new pharmaceutical developments indicate the presence of chiral compounds, this could prove detrimental to the growth of the liquid chromatography systems market.

The different technologies used in liquid chromatography systems are High-Performance Liquid Chromatography (HPLC), Ultra High-Pressure Liquid Chromatography (UHPLC), and Low-Pressure Liquid Chromatography (LPLC). Amongst these, HPLC is the most widely employed technique.

North America is at the helm of the race, accounting for more than 30% of the global market valuation. Technological and scientific advancement, coupled with high investment in research and development activities, has led to a boom in the liquid chromatography systems market in the North American region. Several giants in the market are based out of this region, including Thermo Fisher Scientific and Agilent Technologies. The growing geriatric population and those in need of medical care in the Asia Pacific region have led to the market's growth in the region. This growth is further enhanced by the production of biosimilars in countries like India and China.

Liquid chromatography is a less expensive procedure than HPLC and Gas Chromatography. This could be considered as a most significant driving factor responsible for the growth of liquid chromatography systems market. Moreover some instruments for liquid chromatography are readily available in laboratories which is further providing boost to the growth of growing liquid chromatography systems market.

However, limited sensitive and specific of detectors in applications involving complex samples could be the major restraints for liquid chromatography systems market.

In partition chromatography method, the stationary phase and the mobile phase both are liquid. The stationary phase liquid would be an incompatible liquid with the mobile phase. Liquid-solid chromatography is related to partition chromatography.

The only difference is that the stationary phase has been substituted with a bonded rigid silica or silica based component. Ion-exchange chromatography technique is used to separate and determine ions on columns that have a low ion exchange capacity.

Size exclusion chromatography separates molecules by their size. Further technological advancements have improved the convenience and ease of use of liquid chromatography devices.

The global liquid chromatography systems marketis classified into seven regions namely, North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific excluding Japan (APEJ), Japan, Middle East and Africa (MEA).

North America is expected to dominate the liquid chromatography systems market in terms of both revenue and demand generation owing to greater awareness on technological advancement followed by Western Europe. However, markets in Latin America and Asia-Pacific could prove lucrative in terms of market opportunities considering factors like organized healthcare structure in terms of disease diagnosis, increasing initiatives for food safety and food detection and increasing healthcare spending.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

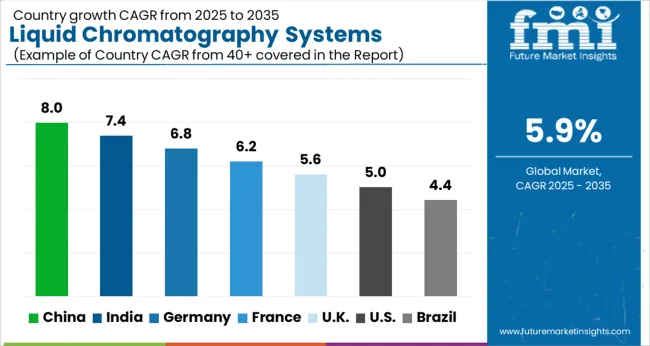

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The Liquid Chromatography Systems Market is expected to register a CAGR of 5.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.0%, followed by India at 7.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Liquid Chromatography Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.8%. The USA Liquid Chromatography Systems Market is estimated to be valued at USD 1.8 billion in 2025 and is anticipated to reach a valuation of USD 3.0 billion by 2035. Sales are projected to rise at a CAGR of 5.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 253.5 million and USD 167.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Product Type | Reversed-phase liquid chromatography (RPLC), Normal-phase liquid chromatography (NPLC), Ion Exchange Chromatography (IELC), and Size exclusion liquid chromatography (SELC) |

| Applications | Biomedical Analysis, Food Product Analysis, Oils and fats Analysis, and Others |

| End User | Research Laboratories, Clinical Research Laboratories, Food Safety Laboratories, Diagnostic Centers, Educational Institutes, and Contract Research Organizations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AB Sciex LLC, Agilent Technologies, Inc, Bio-Rad Laboratories, Inc., BÜCHI Labortechnik AG, Gilson, Inc., JASCO, Inc., KNAUER Wissenschaftliche Geräte GmbH, Malvern Panalytical Ltd, Orochem Technologies Inc, and Restek Corporation |

The global liquid chromatography systems market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the liquid chromatography systems market is projected to reach USD 9.4 billion by 2035.

The liquid chromatography systems market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in liquid chromatography systems market are reversed-phase liquid chromatography (rplc), normal-phase liquid chromatography (nplc), ion exchange chromatography (ielc) and size exclusion liquid chromatography (selc).

In terms of applications, biomedical analysis segment to command 40.1% share in the liquid chromatography systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA