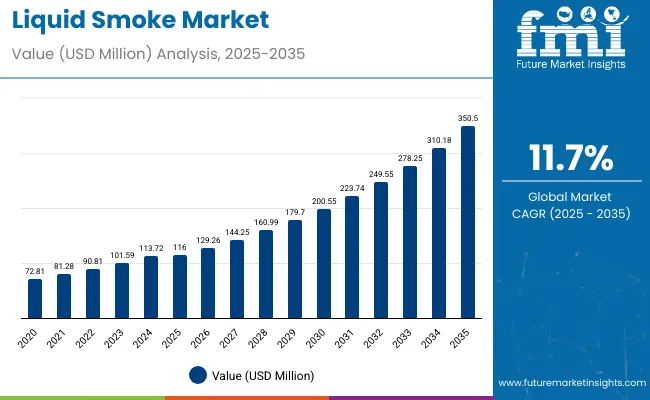

The liquid smoke market is estimated to be valued at USD 116 million in 2025. It is projected to reach USD 350.5 million by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 234.5 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 116 million |

| Projected Value (2035F) | USD 350.5 million |

| CAGR (2025 to 2035) | 11.7% |

This reflects a 3.02 times growthat a compound annual growth rate of 11.7%. The market's evolution is expected to be shaped by rising demand for natural smoke flavoring, increasing meat processing activities, and growing preference for convenient cooking solutions, particularly in applications where authentic smoky taste and food preservation are required.

By 2030, the market is likely to reach USD 213.1 million, accounting for USD 97.1 million in incremental value over the first half of the decade. The remaining USD 137.4 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product innovation in concentrated liquid smoke formulations and specialty wood-type variants is gaining traction due to liquid smoke's versatility in culinary applications and food manufacturing.

Companies such as Colgin, Inc. and B&G Foods, Inc. are advancing their competitive positions through investment in production technologies and premium product formulations. Growing barbecue culture and processed food demand are supporting expansion into food service, retail, and industrial applications. Market performance will remain anchored in quality standards, flavor authenticity, and food safety compliance benchmarks.

The market holds a growing share across its parent markets. Within the food flavoring market, it accounts for 2.1% due to its specialized nature. In the meat processing additives segment, it commands a 4.8% share, supported by rising meat consumption. It contributes nearly 1.9% to the natural food preservatives market and 3.4% to the barbecue sauce ingredients category. In convenience cooking products, liquid smoke holds around a 2.6% share, driven by its time-saving benefits. Across the specialty food ingredients market, its share is close to 3.7%, owing to its use in gourmet and artisanal food applications.

The market is undergoing a strategic transformation driven by rising demand for authentic, natural, and convenient smoking solutions. Advanced production technologies using controlled pyrolysis, membrane filtration, and innovative concentration techniques have enhanced flavor profiles, shelf stability, and product consistency, making liquid smoke products viable alternatives to traditional smoking processes.

Manufacturers are introducing specialized formulations, including organic variants and wood-specific blends tailored for particular culinary applications, expanding their role beyond basic flavoring functionality. Clean-label positioning and natural ingredient transparency have widened consumer acceptance across diverse demographics, reshaping traditional food flavoring patterns and forcing conventional smoking suppliers to diversify their portfolios.

Liquid smoke's authentic smoky flavor, convenience, and versatile applications make it an attractive ingredient for food manufacturers and consumers seeking efficient smoking alternatives without traditional wood-burning processes. Its natural production method, food preservation properties, and ability to deliver consistent flavor profiles appeal to consumers prioritizing authentic taste and time-saving cooking solutions.

Growing awareness of barbecue culture, convenience cooking trends, and processed food consumption is further propelling adoption, especially in meat processing, food service, and home cooking sectors. Rising disposable incomes, expanding e-commerce channels, and increasing meat consumption in emerging markets are also enhancing product accessibility and market penetration.

As convenience trends accelerate across demographics and authentic flavor becomes critical, the market outlook remains favorable. With consumers and manufacturers prioritizing natural ingredients, consistent quality, and efficient production methods, liquid smoke is well-positioned to expand across various culinary, food processing, and industrial applications.

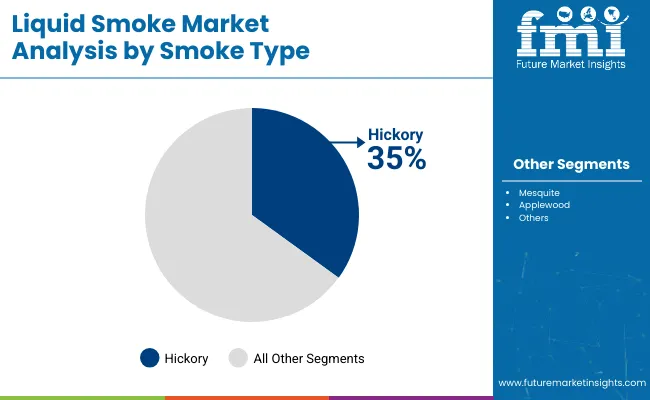

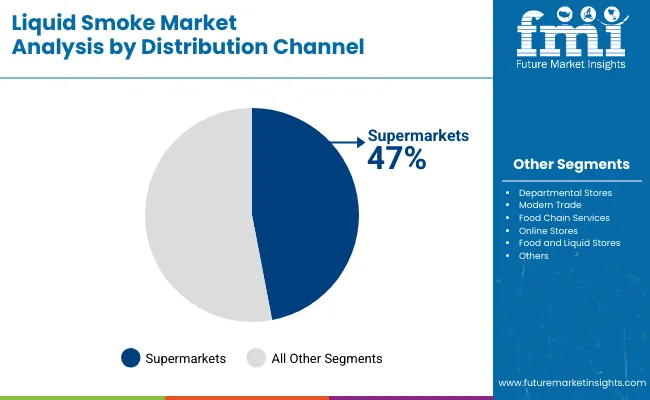

The market is segmented by smoke type, application, distribution channel, and region. By product type, the market is divided into hickory, mesquite, applewood, and others. By application, the market is categorized into bakeries, beverages, dairy, meat and sea food, pet food, and others. Based on distribution channel, the market is divided into supermarkets, departmental stores, modern trade, food chain services, online stores, food and liquid stores, and others. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia & Pacific, the Middle East & Africa.

The hickory segment holds a dominant position with 35% of the market share in the smoke type category, owing to its robust flavor profile, widespread culinary acceptance, and versatility across multiple food applications. Hickory liquid smoke is widely used in meat processing, barbecue sauce production, and gourmet cooking due to its distinctive smoky character and compatibility with various protein types.

It enables manufacturers and consumers to deliver authentic smoky flavor while maintaining production efficiency and flavor consistency in final products. As demand for natural flavoring agents and authentic taste experiences grows, the hickory variant continues to gain preference in both commercial food production and home cooking applications.

Manufacturers are investing in advanced extraction technologies, quality control systems, and sustainable sourcing practices to enhance flavor intensity, purity, and shelf stability. The segment is poised to expand further as global consumer preferences favor traditional wood smoke flavors and authentic culinary experiences.

Supermarkets remain a core distribution channel with 47% of the market share in 2025, as they provide convenient accessibility, widespread product availability, and strategic placement alongside cooking essentials for consumer convenience. Their comprehensive distribution networks support market penetration across diverse demographic segments and geographic regions.

Supermarkets also enhance product visibility through promotional activities, shelf placement strategies, and cross-merchandising with related cooking ingredients. This makes them indispensable in modern retail environments and consumer shopping patterns.

Ongoing demand for convenient shopping experiences and the integration of liquid smoke into mainstream cooking practices are key trends driving the sustained relevance of supermarkets in this distribution category.

In 2024, global liquid smoke consumption grew by 12% year-on-year, with North America accounting for 38% of the market. Applications include meat processing, barbecue sauce production, and convenience food manufacturing. Manufacturers are introducing specialized extraction methods and wood-specific variants that deliver superior flavor profiles and cooking versatility. Natural production processes now support clean-label positioning. Growing barbecue culture and convenience cooking trends support consumer confidence. Technology providers increasingly supply ready-to-use liquid smoke formulations with integrated flavor systems to reduce production complexity.

Natural Flavor Authentication Accelerates Liquid Smoke Demand

Food manufacturers and restaurants are increasingly adopting liquid smoke to achieve authentic smoky flavor profiles, enhance product positioning, and meet consumer demand for natural, time-saving cooking solutions. In flavor testing, liquid smoke delivers a consistent smoky taste compared to traditional smoking methods, with 40-60% reduced preparation time.

Products formulated with liquid smoke maintain flavor stability throughout processing and extended shelf life cycles. In ready-to-use formats, concentrated liquid smoke helps reduce ingredient complexity while maintaining authentic taste by up to 85%. Liquid smoke applications are now being deployed for organic certification, increasing adoption in sectors demanding natural flavor enhancement. These advantages help explain why liquid smoke adoption rates in food processing rose 22% in 2024 across North America and Europe.

Production Costs, Quality Consistency and Wood Sourcing Limitations Limit Growth

Market expansion faces constraints due to wood chip price volatility, specialized production equipment requirements, and quality standardization challenges. Raw wood costs can vary from USD 180 to USD 320 per ton, depending on wood type and seasonal factors, impacting production pricing and leading to supply disruptions of up to 15% in commercial applications.

Controlled pyrolysis technology requirements and flavor consistency standards add 4 to 6 weeks to product development cycles. Specialized storage conditions and natural positioning extend distribution costs by 20-25% compared to artificial flavorings. Limited availability of certified organic wood sources restricts scalable organic production, especially for premium certification projects. These constraints make liquid smoke adoption challenging in price-sensitive markets despite growing flavor benefits and commercial interest.

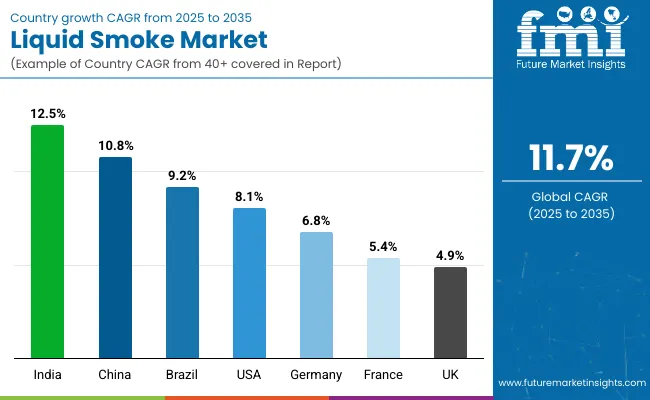

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 12.5% |

| China | 10.8% |

| Brazil | 9.2% |

| USA | 8.1% |

| Germany | 6.8% |

| France | 5.4% |

| UK | 4.9% |

In the liquid smoke market, India leads with the highest projected CAGR of 12.5% from 2025 to 2035, driven by rapid urbanization and the expanding food processing industry. China follows with a CAGR of 10.8%, supported by growing meat consumption and Western culinary influences. Brazil shows strong growth at 9.2%, benefiting from robust barbecue culture and meat processing expansion. The USA demonstrates steady growth at 8.1%, driven by established processed food demand and convenience cooking trends. Germany, France, and the UK show moderate growth at 6.8%, 5.4%, and 4.9% respectively, supported by gourmet food applications and natural ingredient preferences. The varied growth rates reflect regional differences in food processing development, culinary traditions, and market maturity levels.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from liquid smoke in India is projected to grow at a CAGR of 12.5% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by rapid urbanization, the expanding food processing industry, and increasing meat consumption across major cities, including Mumbai, Delhi, and Bangalore. Indian consumers are increasingly adopting Western cooking methods and convenience food products as disposable incomes rise and urban lifestyles evolve. E-commerce platforms and modern retail chains are driving market penetration.

The liquid smoke market in China is anticipated to expand at a CAGR of 10.8% from 2025 to 2035, exceeding the global rate significantly. Growth is centered on urbanization trends and Western culinary adoption in Beijing, Shanghai, and Guangzhou regions. Advanced food processing technologies and quality standards are being deployed for meat processing, restaurant applications, and convenience food manufacturing. Government support for food industry modernization supports practical liquid smoke application development across diverse culinary markets.

Sales of liquid smoke in Brazil are slated to flourish at a CAGR of 9.2% from 2025 to 2035, reflecting strong regional barbecue culture. Growth has been concentrated in meat processing expansion and export market development in São Paulo, Rio de Janeiro, and Minas Gerais regions. Liquid smoke adoption is shifting from limited specialty use toward mainstream barbecue sauce production and meat processing applications. Local meat processing advantages and competitive production costs lead commercial deployment strategies. Domestic food technology partnerships have strengthened, with increased collaboration between Brazilian meat processors and international flavor companies.

Demand for liquid smoke in the United States is expected to increase at a CAGR of 8.1% from 2025 to 2035, reflecting market maturity combined with sustained demand. Growth is driven by established barbecue culture and convenience food applications in Texas, California, and North Carolina markets. Health-conscious consumers and food manufacturers are increasingly adopting liquid smoke for product differentiation and authentic flavor positioning. Established distribution networks and regulatory compliance support broader market accessibility.

Revenue from liquid smoke in Germany is projected to rise at a CAGR of 6.8% from 2025 to 2035, supported by strong demand for natural food ingredients and gourmet applications. Urban markets like Berlin, Munich, and Hamburg are experiencing growth in premium food manufacturing, clean-label formulations, and artisanal food production. Domestic sausage manufacturers are leveraging liquid smoke to meet quality expectations for traditional German meat products while reducing production complexity.

Demand for liquid smoke in France is projected to rise at a CAGR of 5.4% from 2025 to 2035, supported by strong demand for gourmet cooking oils and artisanal food applications. Urban markets like Paris, Lyon, and Marseille are experiencing growth in premium food manufacturing, clean-label formulations, and traditional French cuisine adaptation. Domestic food companies are leveraging liquid smoke to meet quality expectations for charcuterie and premium-positioned products while maintaining authentic French culinary standards.

The liquid smoke market in the UK is expected to grow at a CAGR of 4.9% from 2025 to 2035, reflecting moderate growth constrained by regulatory complexity and market maturity. Growth is driven by health-conscious cooking trends and clean-label food preferences in the London, Manchester, and Edinburgh regions. Premium retail channels and organic food stores are expanding liquid smoke accessibility, while food manufacturers incorporate it into health-positioned products. Brexit-related supply chain complexities and stringent food regulations maintain elevated pricing levels and slower adoption rates.

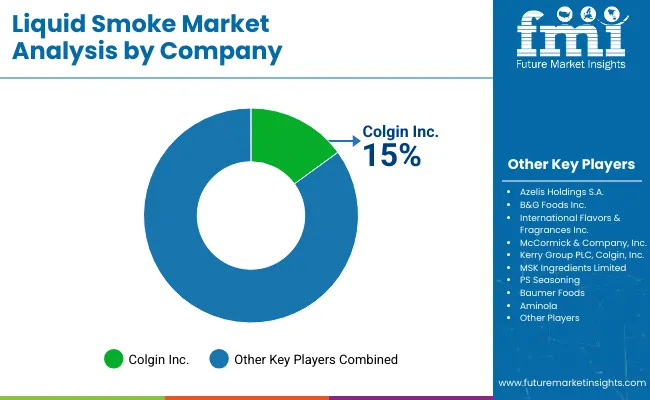

The market is moderately consolidated, featuring a mix of established flavor ingredient producers, specialty liquid smoke manufacturers, and regional processors with varying degrees of production technology, product innovation, and distribution expertise. Colgin, Inc. leads with an estimated 15% market share, supplying authentic liquid smoke products for retail, food service, and industrial applications. Their strength lies in comprehensive product portfolios, established brand recognition, and long-standing relationships with major food retailers and processors.

B&G Foods, Inc. and Azelis Holdings S.A. differentiate through large-scale production capabilities, diversified product offerings, and strategic acquisition strategies that cater to commercial food manufacturing and industrial segments. Kerry Group PLC focuses on innovation-driven solutions, application-specific formulations, and technical support services, addressing growing demand from premium food manufacturers and specialty applications.

McCormick & Company, Inc. emphasizes processing innovation, quality consistency, and global distribution networks, creating value in retail markets and food service applications through strategic acquisitions and product development initiatives.

Entry barriers remain significant, driven by challenges in production technology, wood sourcing integration, and compliance with food safety and quality standards across multiple application categories. Competitiveness increasingly depends on production efficiency, flavor consistency capabilities, and market access expertise for diverse culinary and food manufacturing environments.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 116 million |

| Smoke Type | Hickory, Mesquite, Applewood, Others |

| Application | Meat and Seafood, Bakeries, Beverages, Dairy, Pet Food, Others |

| Distribution Channel | Supermarkets, Departmental Stores, Modern Trade, Food Chain Services, Online Stores, Food and Liquid Stores, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ countries |

| Key Players | Azelis Holdings S.A., B&G Foods, Inc., International Flavors & Fragrances, Inc., McCormick & Company, Inc., Kerry Group PLC, Colgin, Inc., MSK Ingredients Limited, PS Seasoning, Baumer Foods, Aminola, and Sacchetto SpA . |

| Additional Attributes | Dollar sales by smoke type and application, regional demand trends, competitive landscape, consumer preferences for natural versus artificial alternatives, integration with sustainable sourcing practices, innovations in production technology and quality standardization for diverse culinary applications |

The global liquid smoke market is estimated to be valued at USD 116 million in 2025.

The market size for the liquid smoke is projected to reach USD 350.5 million by 2035.

The liquid smoke market is expected to grow at a CAGR of 11.7% between 2025 and 2035.

The hickory segment is projected to lead the liquid smoke market with a 35% market share in 2025.

In terms of distribution channel, supermarkets are expected to command a 47% share in the liquid smoke market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA