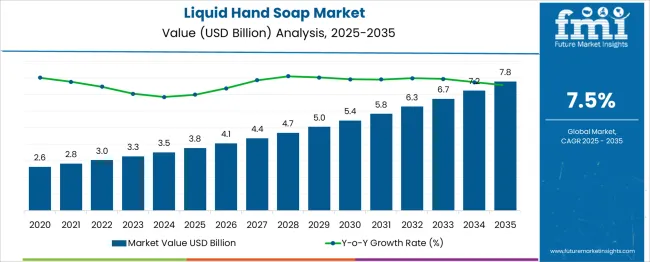

The Liquid Hand Soap Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Liquid Hand Soap Market Estimated Value in (2025 E) | USD 3.8 billion |

| Liquid Hand Soap Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Liquid Hand Soap market is experiencing robust growth supported by rising consumer awareness of hygiene and cleanliness across both developed and emerging regions. The current market landscape is marked by increased demand for convenient and effective handwashing solutions, with heightened emphasis on germ protection and skin care.

Corporate press releases and investor presentations have highlighted growing adoption of liquid hand soaps in institutional and residential settings due to their perceived superiority over traditional bar soaps in terms of hygiene and ease of use. The future outlook remains positive as sustainability initiatives, such as refillable packaging and biodegradable formulations, gain prominence in response to regulatory and consumer pressure.

The market is also benefiting from innovation in fragrance, skin-friendly ingredients, and antibacterial properties, as reflected in product launches and technology showcases.

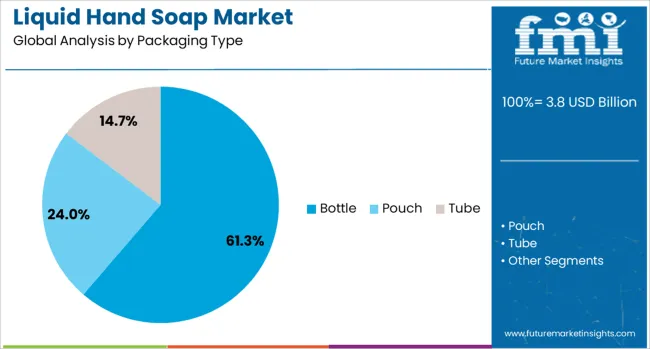

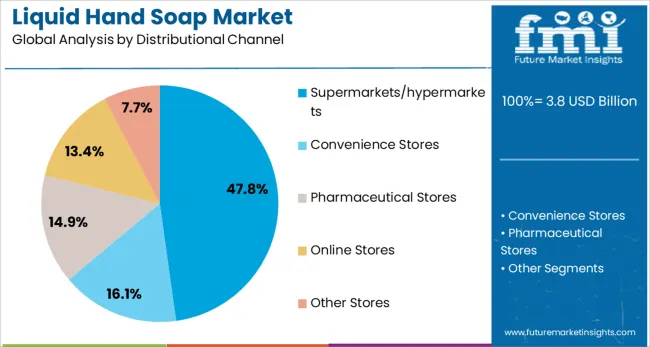

The liquid hand soap market is segmented by packaging type, distributional channel, nature, application, and geographic regions. The liquid hand soap market is divided into Bottles, Pouches, and Tubes. In terms of distributional channels, the liquid hand soap market is classified into Supermarkets/hypermarkets, Convenience Stores, Pharmaceutical Stores, Online Stores, and Other Stores.

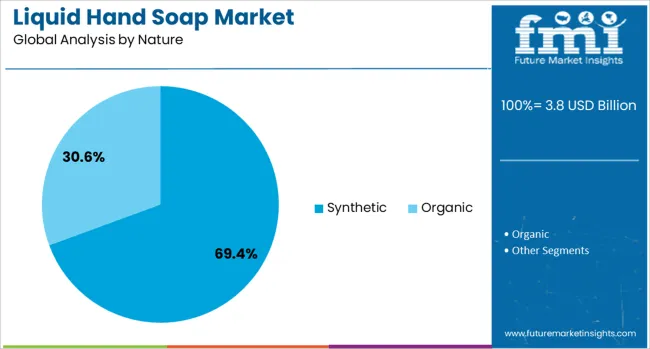

Based on the nature of the liquid hand soap market, it is segmented into Synthetic and Organic. The liquid hand soap market is segmented into Household and Commercial. Regionally, the liquid hand soap industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bottle packaging type is expected to hold 61.3% of the Liquid Hand Soap market revenue share in 2025, making it the leading packaging segment. This leadership is attributed to its practicality, durability, and consumer familiarity, as emphasized in packaging industry journals and product announcements. Bottles are being favored by consumers and institutions alike for their ease of dispensing, hygienic design, and ability to be sealed, reducing contamination risk.

Additionally, their compatibility with a variety of dispenser types and refill programs has reinforced their prominence, particularly as sustainability concerns influence packaging choices. Investor briefings have highlighted how bottles enable clear branding and product differentiation through design and labeling, enhancing consumer appeal at retail shelves.

The segment’s dominance is further supported by widespread availability, cost-effectiveness, and the ability to accommodate a range of liquid viscosities and formulations. These factors have ensured the bottle segment’s continued growth and strong presence in the Liquid Hand Soap market.

The supermarkets and hypermarkets distribution channel is projected to account for 47.8% of the Liquid Hand Soap market revenue share in 2025, maintaining its position as the largest distribution segment. This dominance has been driven by the high visibility, accessibility, and trust associated with these retail formats, as noted in retail industry news and corporate reports.

Consumers have preferred supermarkets and hypermarkets for offering a wide selection of brands, competitive pricing, and the ability to examine products before purchase. Trade publications have observed that promotional campaigns, in-store displays, and bulk purchasing options available in these outlets have further strengthened their appeal.

Companies have leveraged these channels to launch new products and capture impulse buyers through strategic shelf placement. The segment’s leadership has been reinforced by its extensive reach, convenience for consumers, and alignment with shopping habits that favor one-stop solutions, ensuring its strong position in the Liquid Hand Soap market.

The synthetic nature segment is expected to capture 69.4% of the Liquid Hand Soap market revenue share in 2025, securing its status as the dominant segment. This leadership is being attributed to the widespread availability, cost efficiency, and proven efficacy of synthetic formulations, as highlighted in product specifications and corporate presentations.

Synthetic hand soaps have been widely adopted due to their ability to deliver consistent antimicrobial performance while offering appealing fragrances and textures. Industry journals have noted that synthetic ingredients enable manufacturers to tailor formulations for diverse skin types and market preferences while maintaining affordability.

Press releases have also emphasized their longer shelf life and ease of mass production, which have contributed to widespread adoption in both residential and institutional markets. The segment’s continued dominance has been supported by strong supply chains, scalability, and regulatory compliance advantages associated with synthetic components, ensuring its robust position in the Liquid Hand Soap market.

The liquid hand soap sector benefits from rising hygiene awareness, diversified product offerings, and robust demand from commercial institutions. Retail and e-commerce expansion further strengthen its position, ensuring sustained growth opportunities across multiple consumer and business segments.

Growing hygiene awareness has driven the adoption of liquid hand soap across households, institutions, and commercial facilities. Consumers are shifting from bar soaps to liquid formats due to convenience, perceived cleanliness, and reduced cross-contamination risks. Formulations with antibacterial properties, natural extracts, and moisturizing agents are gaining traction, appealing to both health-conscious and skincare-focused buyers. Marketing campaigns promoting hand hygiene, coupled with increased product placement in retail and online channels, have accelerated market penetration. Seasonal demand spikes during flu outbreaks and health emergencies continue to boost category performance. As personal hygiene becomes a daily lifestyle habit, liquid hand soap’s role as an essential household item strengthens its growth trajectory across varied demographic segments.

Manufacturers are expanding product lines to cater to diverse skin types, fragrance preferences, and functional needs. Premium segments featuring organic ingredients, dermatologically tested formulas, and aesthetically designed packaging are appealing to higher-income consumers. The growing preference for sulfate-free, paraben-free, and hypoallergenic options reflects an increasing focus on skin health. Seasonal and limited-edition fragrances help brands maintain consumer engagement and brand loyalty. Refillable packaging and bulk purchase options are gaining attention in the premium space, targeting cost-conscious yet quality-driven buyers. Partnerships with influencers and health professionals are boosting brand credibility, while cross-promotions with skincare lines are expanding the product’s market appeal across retail and e-commerce platforms.

Liquid hand soap demand in the commercial sector has surged, particularly in healthcare, hospitality, and foodservice industries. Regulatory guidelines for hygiene in workplaces and public facilities have compelled bulk procurement and long-term supply agreements. Hospitals and clinics prioritize antimicrobial and fragrance-free formulas to meet patient safety standards. Hotels and restaurants are integrating branded dispensers and premium formulations to enhance guest experiences. Educational institutions, airports, and retail complexes maintain continuous supply to meet high footfall hygiene needs. This institutional demand ensures a stable revenue stream for manufacturers, while also encouraging innovation in high-capacity dispensers, concentrated refills, and cost-effective bulk formulations for large-scale applications.

The retail landscape for liquid hand soap has expanded significantly, with supermarket chains, pharmacies, and specialty stores dedicating more shelf space to the category. E-commerce platforms have further fueled growth by offering a wider variety of products, subscription models, and doorstep delivery convenience. Discount campaigns, combo offers, and targeted digital ads are increasing conversion rates for online purchases. Smaller brands are leveraging direct-to-consumer strategies to compete with established players by offering unique formulations and niche scents. Cross-border e-commerce has opened opportunities for global distribution, especially for premium and artisanal brands. With both brick-and-mortar and online channels thriving, manufacturers can diversify their distribution strategies to reach broader and more segmented customer bases.

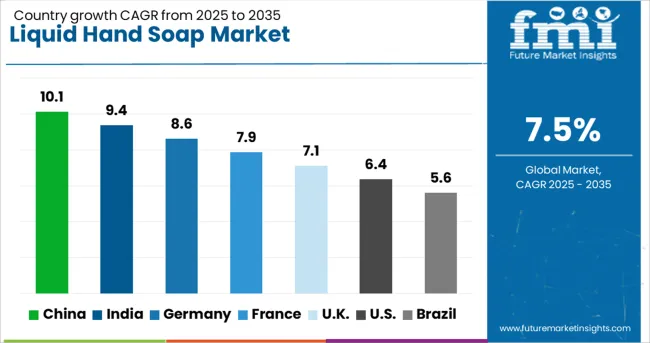

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The liquid hand soap market is projected to grow globally at a CAGR of 7.5% from 2025 to 2035, supported by rising hygiene awareness, expanded product portfolios, and increasing penetration in both retail and commercial sectors. China leads with a CAGR of 10.1%, driven by high urban population density, premium segment adoption, and institutional procurement growth. India follows at 9.4%, fueled by strong demand in household and hospitality sectors, along with expansion in rural retail access. France records 7.9%, with growth supported by premium brand positioning and strong pharmacy-led sales. The United Kingdom posts 7.1%, with e-commerce acceleration and niche fragrance launches boosting demand, while the United States records 6.4%, reflecting steady adoption across healthcare, education, and commercial facilities. The analysis spans over 40 countries, positioning these markets as benchmarks for product innovation, retail network expansion, and strategic marketing investments to capture evolving hygiene-conscious consumer segments.

China is projected to post a 10.1% CAGR during 2025-2035, well above global growth. Market lift comes from pharmacy-led premiumization, dispenser programs in offices and transit hubs, and refill pouches that lower per-wash cost. Hospital procurement favors fragrance-free SKUs for sensitive skin, while supermarkets expand shelf space for natural extracts and moisturizing variants. E-commerce bundles with wipes and sanitizers push multi-unit purchases, raising basket value. Private labels copy leading fragrances and textures, pressuring price while growing the base. Institutional contracts in education, airports, and rail add volume stability across seasons. As consumer routines normalize post-surge, brands that balance skin feel, germ-kill, and value are taking share from bar formats.

India is expected to record a 9.4% CAGR for 2025-2035. Momentum stems from rising household penetration in Tier-2 and Tier-3 towns, hotel and quick-service expansion, and sachet trials that convert users to pump packs. Ayurveda-inspired blends, glycerin-rich formulas, and mild surfactants broaden appeal across family use. Modern trade promotes twin-pack deals, while kirana stores push pocket refills that keep price points accessible. Corporate parks and hospitals order high-capacity refills for closed dispensers, cutting shrink and improving hygiene control. Influencer content on hand-care routines sustains awareness through festivals and school seasons. With localized manufacturing of pumps, caps, and PET preforms, lead times and costs are improving, helping regional brands scale beyond home states.

France is set to grow at 7.9% CAGR during 2025-2035. Pharmacy and para-pharmacy outlets emphasize dermo-tested formulations, which encourages upgrades from basic lines. Boutique fragrances and minimalist bottles cater to design-led kitchens and bathrooms. Workplace hygiene programs continue to mandate touch-free dispensers, favoring foam concentrates that reduce waste per wash. Travel retail and hotel amenities reintroduce larger wall-mounted packs, replacing miniature bottles to reduce restocking cycles. Retailers curate seasonal scents and limited editions that keep repeat buyers engaged. Digital subscriptions with customizable delivery windows lift retention for premium brands. The category benefits from cross-selling with hand creams and sanitizers, which positions hand care as a simple, daily ritual across age groups.

The United Kingdom is projected at 7.1% CAGR for 2025-2035. Using proportional scaling to the new global benchmark of 4.3%, the 2020-2024 UK CAGR is estimated at about 4.1%. Earlier performance was tempered by cautious trade-down to value pumps, limited dispenser upgrades in small businesses, and a channel mix still adjusting between grocery and online. The step-up to 7.1% is linked to office re-openings that upgraded to closed-cartridge systems, hotel refurbishments that specified wall units with high-capacity refills, and strong online adoption of family-size packs. Category data also show faster rotation for gentle, fragrance-forward SKUs suited to frequent washing. Retail media and subscription bundles improved repeat rates, while better warehouse coverage shortened delivery to independent pharmacies.

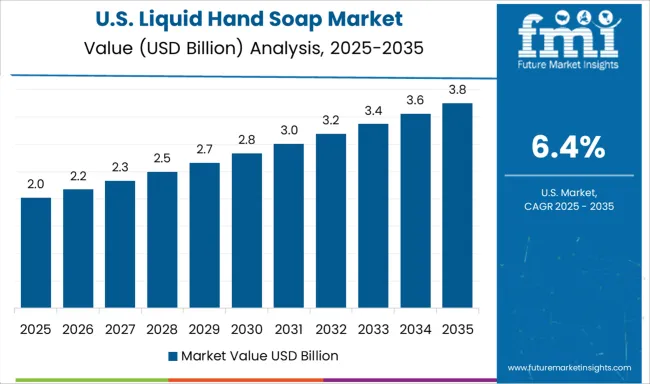

The United States is expected to post a 6.4% CAGR in 2025-2035. Healthcare networks favor non-irritant formulas and NSF-listed products, supporting consistent institutional pull. Grocery and mass retail continue to promote family-size refills, which increases units per trip. Specialty retailers and direct-to-consumer brands differentiate with shea, aloe, and essential oil blends, capturing gift purchases during holiday peaks. Schools and stadiums rely on bulk containers for touch-free dispensers, creating predictable orders ahead of event calendars. Private label remains strong in club stores, anchoring value tiers as premium brands target texture and scent. With warehouses closer to metro regions, lead times for e-commerce are falling, keeping churn low among subscription customers.

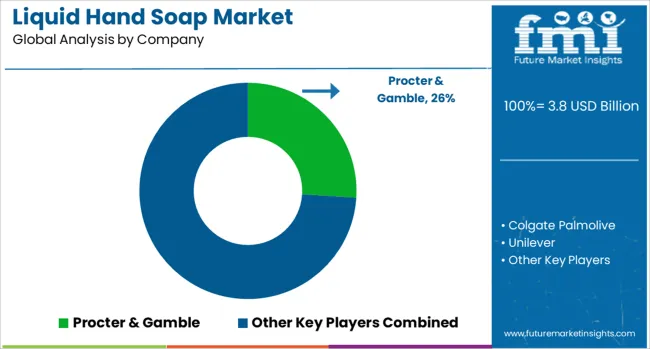

The liquid hand soap sector features a diverse mix of multinational corporations, regional leaders, and niche-focused innovators. Prominent global players include Procter & Gamble, Colgate Palmolive, Unilever, Henkel AG & Co KGaA, Lion Corporation, Godrej Consumer Products Ltd, 3M, and Reckitt Benckiser, each leveraging scale and brand equity to command shelf space across channels.

Johnson & Johnson and Kimberly-Clark emphasize dermatologically tested formulations and sensitive skin variants, while Kao Corporation and Method Products stand out with fragrance-led and design-centric offerings. Gojo Industries, Medline Industries, and Cleenol Group maintain strong institutional supply chains catering to healthcare and commercial hygiene needs. The Himalaya Drug Company, Pental Products, and Wipro Consumer Care & Lighting, ITC Ltd integrate herbal, plant-derived, and ayurvedic concepts to differentiate in wellness-conscious segments.

JR Watkins & Co and Avon Products target premium and lifestyle categories with curated scent portfolios. Competitive priorities in this space include scaling refill systems to lower per-use costs, enhancing e-commerce subscription penetration, formulating skin-friendly antibacterial blends, and expanding into emerging markets with localized packaging formats. Established FMCG conglomerates rely on distribution breadth, while specialty players build loyalty through targeted branding, product innovation, and sustainability-linked sourcing in line with retailer and consumer preferences.

In July 2025, Procter & Gamble (P&G) announced price increases on ~25% of USA products to offset tariff-related costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Packaging Type | Bottle, Pouch, and Tube |

| Distributional Channel | Supermarkets/hypermarkets, Convenience Stores, Pharmaceutical Stores, Online Stores, and Other Stores |

| Nature | Synthetic and Organic |

| Application | Household and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble, Colgate Palmolive, Unilever, Henkel AG & Co KGaA, Lion Corporation, Godrej Consumer Products Ltd, 3M, Reckitt Benckiser, Johnson & Johnson, Cleenol Group, Kao Corporation, Kimberly‑Clark, Method Products, The Himalaya Drug Company, Gojo Industries, Pental Products, Medline Industries, Wipro Consumer Care & Lighting, ITC Ltd, JR Watkins & Co, and Avon Products |

| Additional Attributes | Dollar sales, share, category growth trends, competitive brand performance, pricing strategies, consumer buying behavior, regional demand variations, raw material cost shifts, product innovation pipelines, regulatory changes, distribution channel dynamics. |

The global liquid hand soap market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the liquid hand soap market is projected to reach USD 7.8 billion by 2035.

The liquid hand soap market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in liquid hand soap market are bottle, pouch and tube.

In terms of distributional channel, supermarkets/hypermarkets segment to command 47.8% share in the liquid hand soap market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Soap Market Trends & Forecast 2025-2035

Powdered Hand Soap Market

Automated Liquid Handling Systems Market

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA