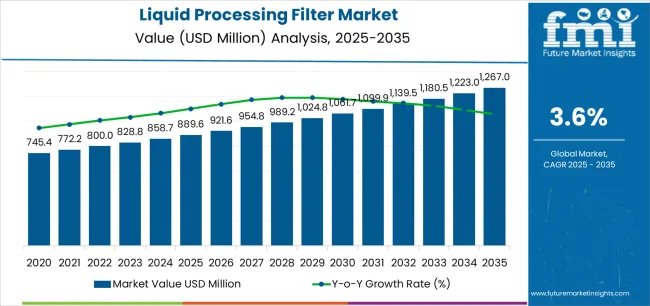

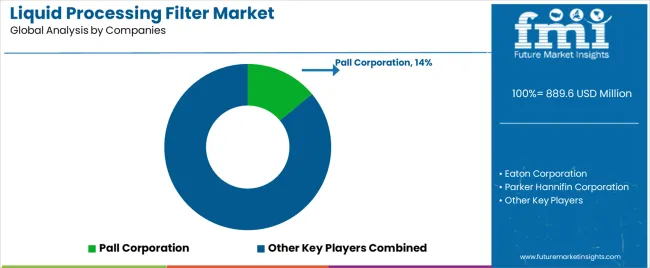

The global liquid processing filter market is valued at USD 889.6 million in 2025 and is projected to reach USD 1,267.0 million by 2035, recording a CAGR of 3.6%. The rolling CAGR assessment indicates steady expansion, supported by industrial process optimization, stricter quality control requirements, and continuous upgrades to filtration technologies across the food, beverage, pharmaceutical, and chemical manufacturing sectors. Liquid filtration systems remain essential for maintaining product purity, equipment integrity, and regulatory compliance within closed-loop processing environments.

Manufacturers are advancing membrane and depth filtration media to achieve improved retention efficiency and longer operational life. Automation of filter monitoring and replacement cycles is gaining traction, particularly in facilities adopting digital process control. Stainless steel and polymer-based filter housings with higher chemical compatibility are replacing traditional materials to meet evolving industrial hygiene and safety standards.

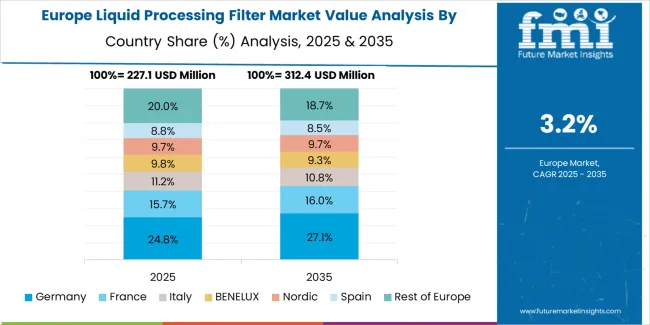

Regional growth patterns show dominant consumption in North America and Europe, where established processing industries continue to invest in equipment modernization. Asia Pacific displays the fastest expansion, driven by rapid industrialization and capacity additions in food processing and biopharmaceutical production. Raw material sourcing, pressure performance, and cleaning validation protocols remain central factors determining cost-effectiveness and operational reliability through the 2035 forecast period.

Between 2025 and 2030, the Liquid Processing Filter Market is projected to expand from USD 889.6 million to USD 1,061.7 million, reflecting a 19.3% increase and accounting for 46.1% of the total market growth anticipated over the decade. This phase will be driven by increasing demand from the food and beverage, pharmaceutical, and chemical processing industries, where filtration precision and product purity are critical. The shift toward advanced membrane technologies and automated filtration systems will enhance process efficiency. Manufacturers are focusing on sustainability by developing recyclable filter media and energy-efficient filtration units to align with environmental and regulatory standards.

From 2030 to 2035, the market is forecast to grow from USD 1,061.7 million to USD 1,267.0 million, registering a 19.3% rise and contributing 53.9% of the decade’s overall expansion. Growth during this period will be supported by the increasing integration of smart monitoring systems that provide real-time performance analytics and predictive maintenance. Expansion in water treatment, bioprocessing, and specialty chemical manufacturing will further strengthen market demand. Strategic partnerships among filtration technology providers and industrial automation firms will promote the development of intelligent, high-capacity filtration solutions designed to meet evolving industrial process requirements and global sustainability goals.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 889.6 million |

| Market Forecast Value (2035) | USD 1,267.0 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The liquid processing filter market is expanding as industries emphasize fluid purity, equipment protection, and compliance with strict regulatory standards. These filters remove particulates and contaminants during chemical production, food processing, pharmaceutical formulation, and water treatment. Manufacturers develop advanced membrane, cartridge, and depth filter systems designed to maintain consistent flow rates under variable pressure conditions. Rising industrial automation and precision manufacturing amplify the need for reliable filtration performance to safeguard downstream operations. Increasing adoption of clean-in-place and sterilizable filter assemblies in biopharmaceutical production further reinforces market growth through reduced downtime and contamination risk.

Growth is also driven by infrastructure modernization and the transition toward environmentally responsible fluid management. Food and beverage processors adopt multi-stage filtration to ensure product consistency, while petrochemical plants employ high-efficiency filters to extend component life and minimize waste. Technological developments in polymer materials and nanofiber media improve contaminant retention and filtration lifespan, reducing operational costs. Regional water treatment initiatives, particularly in Asia-Pacific, increase demand for industrial-scale filtration units designed for high throughput and low maintenance. However, fluctuating raw material prices and limited filter reusability constrain smaller operators. Continued investment in sustainable materials and automated monitoring technologies supports steady expansion across industrial and municipal filtration applications.

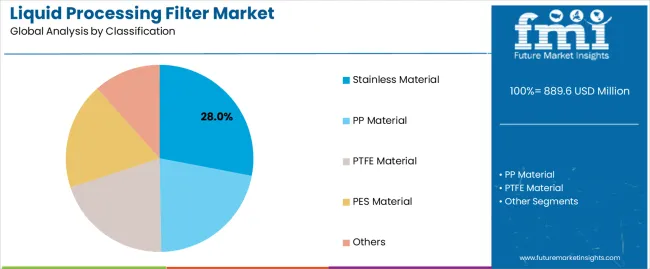

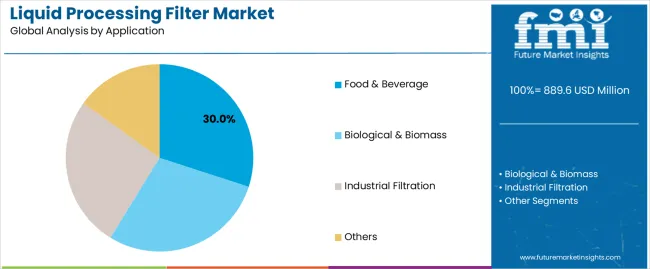

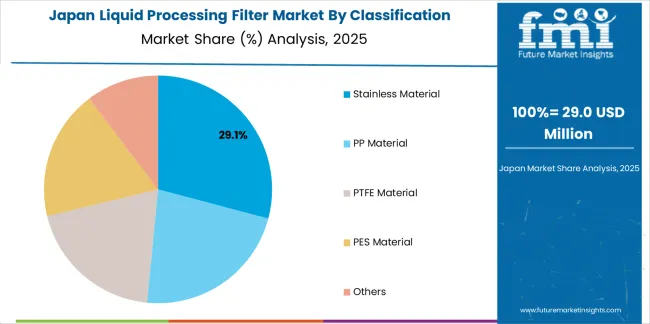

The liquid processing filter market is segmented by classification, application, and region. By classification, the market is divided into stainless material, PP material, PTFE material, PES material, and others. Based on application, it is categorized into food and beverage, biological and biomass, industrial filtration, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions outline material composition, process compatibility, and end-use adoption patterns influencing filtration system demand across industries.

The stainless material segment accounts for approximately 28.0% of the global liquid processing filter market in 2025, representing the leading classification category. Its leadership is driven by extensive use in high-pressure and sanitary applications where corrosion resistance and structural durability are essential. Stainless filters provide consistent mechanical strength and chemical stability, making them suitable for critical liquid processing operations across food, beverage, pharmaceutical, and industrial sectors.

These filters are commonly integrated into systems requiring frequent sterilization, high-temperature operation, or exposure to aggressive cleaning agents. The segment benefits from growing adoption in industries implementing hygienic process standards and long-life filtration components to minimize maintenance frequency. Stainless steel materials also enable reusability through backflushing or thermal cleaning, reducing long-term operational costs. The segment maintains dominance in both static and dynamic filtration setups where structural reliability outweighs disposable material convenience. Continuous advances in welded mesh, sintered media, and multi-layer filter designs have expanded application versatility. The stainless material segment remains central to the liquid processing filter market due to its balance of durability, reusability, and compliance with international process safety regulations.

The food and beverage segment represents about 30.0% of the total liquid processing filter market in 2025, making it the largest application category. This leadership reflects the continuous requirement for hygienic filtration in beverage clarification, dairy processing, brewing, and water treatment operations. Liquid processing filters are essential for ensuring microbial safety, particle removal, and product consistency across regulated production environments.

The segment’s demand is reinforced by global standards mandating high-quality process control in food-grade filtration systems. Stainless steel and polymer-based filters are widely used for removing suspended solids, yeast, and bacterial contaminants while maintaining flavor and composition integrity. Growth in this segment is supported by modernization of food and beverage manufacturing facilities, particularly in East Asia and Europe, where filtration automation and process validation are expanding. Manufacturers continue to develop filter media with improved flow rates and reduced fouling tendencies to enhance operational efficiency. The food and beverage segment remains the dominant end-use category due to sustained regulatory oversight, consumer demand for quality assurance, and industry investment in advanced hygienic liquid processing technologies.

The liquid processing filter market is growing as industries seek solutions to separate particles, contaminants and microorganisms from liquids in manufacturing and water treatment applications. Increased regulatory requirements around fluid quality, rising industrial wastewater flows and expanding demand for clean water in municipal systems support expansion of filtration equipment and media. However, high installation costs, maintenance complexity and competition from alternative fluid-treatment technologies limit faster uptake in some segments. A central trend is the shift toward advanced filter media, digital monitoring and modular filter systems that support flexible deployment and efficient operation.

Growth is driven by a combination of increasing industrialization, strict environmental regulations and growing demand for purified liquids in sectors such as pharmaceuticals, food & beverage, chemicals and water treatment. Manufacturing processes require reliable filter systems to ensure product quality and regulatory compliance, which fuels demand for advanced liquid-processing filters. Urbanization and increased wastewater production also pressurize infrastructure to adopt more robust filtration solutions. These factors collectively encourage investments in filtration equipment, filter media upgrades and system expansions across multiple end-use industries.

Market growth is constrained by high upfront costs, operational complexity and the need for skilled maintenance of filtration systems. Advanced filter systems often require precise installation, regular monitoring and timely media replacement, which increases lifecycle costs. In some applications, variability in liquid composition, temperature or pressure complicates filter selection and performance, reducing reliability. Alternative technologies such as membrane separations or chemical treatments may offer lower entry cost in certain cases, limiting adoption of conventional filter systems. These economic and technical factors slow market penetration, particularly in cost-sensitive regions or smaller operations.

A key trend is the adoption of smarter, more modular filtration systems with enhanced media and digital connectivity. Filters are increasingly being designed with monitorable sensors, predictive maintenance capabilities and modular elements that allow quick change-out and scalability. Advanced materials such as high-performance polymers, nonwoven fabrics and coated media are gaining traction for improved durability and selectivity. The trend toward sustainability is influencing design choices, encouraging lower energy consumption, longer filter life and reduced waste. Growth is especially strong in regions with rapid industrial expansion and infrastructure investment, driving both demand and innovation.

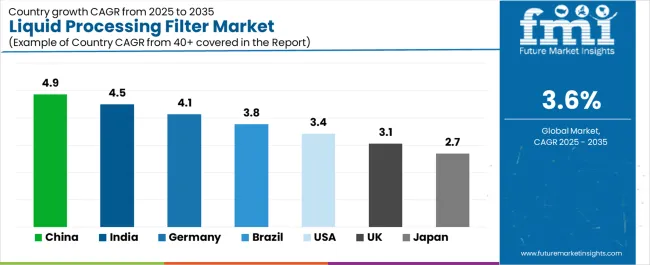

| Country | CAGR (%) |

|---|---|

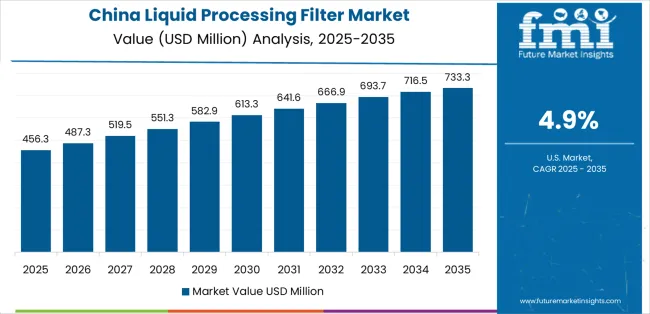

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

The Liquid Processing Filter Market is expanding steadily across major global economies, with China leading at a 4.9% CAGR through 2035, driven by industrial fluid management advancements, water treatment initiatives, and increased manufacturing automation. India follows at 4.5%, supported by infrastructure development, pharmaceutical processing growth, and government-backed environmental initiatives. Germany records 4.1%, leveraging engineering innovation and high-quality filtration system production. Brazil, growing at 3.8%, benefits from industrial modernization and the expansion of food and beverage processing facilities. The USA posts a 3.4% CAGR, emphasizing technological refinement and environmental compliance, while the UK (3.1%) and Japan (2.7%) maintain stable progress through adoption of precision filtration technologies and focus on sustainable and energy-efficient processing systems.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from liquid processing filters in China is projected to grow at a CAGR of 4.9% through 2035, supported by significant expansion in food processing, pharmaceuticals, and water treatment sectors. Manufacturers are increasing production capacity for high-efficiency filters to comply with national standards on product purity and environmental safety. Continuous development in polymer and membrane technologies is improving flow uniformity, pressure stability, and filtration precision. Expanding industrial automation across process plants encourages integration of advanced filter monitoring systems, ensuring consistent operational performance and reduced maintenance downtime.

Revenue from liquid processing filters in India is increasing at a CAGR of 4.5%, supported by robust expansion in beverage, dairy, biopharmaceutical, and water treatment industries. Demand for efficient filtration systems is rising as manufacturers prioritize hygienic production and process optimization. Domestic producers are expanding capacity for membrane, cartridge, and depth filters to meet growing consumption. Government programs promoting clean water and food quality are accelerating adoption in industrial facilities. Increasing investment in wastewater recycling and water management infrastructure continues to reinforce the market’s long-term stability.

Revenue from liquid processing filters in Germany is advancing at a CAGR of 4.1%, driven by the country’s engineering expertise and stringent production quality standards. Manufacturers focus on high-performance filtration systems offering precision, durability, and automated cleaning capabilities. Adoption across pharmaceutical, food, and chemical processing sectors ensures consistent market activity. Emphasis on modular designs and advanced materials improves adaptability across industrial lines. Continuous investments in R&D and energy-efficient filtration media further strengthen competitive positioning, supporting long-term operational reliability and environmental compliance across domestic and export markets.

Revenue from liquid processing filters in Brazil is projected to grow at a CAGR of 3.8%, supported by modernization in manufacturing, beverage production, and wastewater treatment facilities. Local industries are adopting high-capacity filtration systems to meet regulatory standards and improve product uniformity. Partnerships with international manufacturers provide access to advanced designs and maintenance training. Growing emphasis on water reuse and pollution control drives continuous replacement demand. Domestic initiatives promoting industrial automation enhance process integration, ensuring stable filtration performance and reduced operational costs across production networks.

Revenue from liquid processing filters in the United States is increasing at a CAGR of 3.4%, supported by strict hygiene and manufacturing quality regulations across food, biotech, and pharmaceutical sectors. The industry’s focus on contamination control and operational efficiency continues to drive procurement of advanced membrane systems. Technological advancements in polymer filtration media and automated monitoring improve throughput consistency. Replacement cycles remain frequent due to regulatory maintenance schedules. Growing environmental awareness and digital control integration further strengthen the adoption of intelligent filtration units across major industrial facilities.

Revenue from liquid processing filters in the United Kingdom is advancing at a CAGR of 3.1%, supported by process efficiency initiatives and industrial modernization across manufacturing sectors. Food, beverage, and chemical producers are adopting automated filtration systems to improve consistency and reduce waste. Manufacturers emphasize sustainable filter designs using recyclable materials and energy-saving configurations. Continuous research into filter membrane chemistry supports product advancement. Growing demand for clean manufacturing and regulatory compliance sustains steady procurement of high-efficiency filtration units across small and medium-sized facilities.

Revenue from liquid processing filters in Japan is projected to grow at a CAGR of 2.7%, supported by advanced precision manufacturing and focus on high-quality process control. Domestic producers specialize in fine filtration for electronics, pharmaceuticals, and specialty chemicals. Emphasis on product miniaturization, chemical resistance, and long-term durability drives continuous innovation. Integration of automated cleaning and real-time monitoring enhances reliability and operational lifespan. Demand remains consistent due to rigorous quality standards, stable industrial base, and emphasis on product uniformity across domestic and export markets.

The global liquid processing filter market presents intense competition among established industrial filtration manufacturers and specialized process system developers. Pall Corporation holds a prominent position through its advanced filtration technologies and broad product portfolio serving pharmaceuticals, food processing, and fine chemicals. Eaton Corporation and Parker Hannifin Corporation follow with diversified filter solutions integrated across hydraulic, industrial, and sanitary systems. Donaldson Company, Inc. and MANN+HUMMEL Group sustain strong market coverage through innovative filter media, modular design, and global distribution. Filtration Group Corporation and Camfil AB enhance competitiveness by delivering sustainable filtration systems designed for energy efficiency and process reliability across industrial liquid applications.

Lenntech B.V. and Veolia Water Technologies focus on membrane-based liquid purification and process water management, combining filtration efficiency with environmental compliance. Shibata and HYDAC Technology GmbH emphasize precision fluid conditioning for manufacturing and energy operations. Freudenberg Filtration Technologies SE & Co. KG and Porvair Filtration Group provide high-performance filter elements engineered for durability and contaminant control. Shelco Filters, Clean Liquid Systems, Pargreen Process Technologies, and Engineered Filtration, Inc. target specialized and regional process markets with customized systems. Competition in this market depends on operational longevity, material innovation, and compliance with safety standards, while strategic differentiation increasingly relies on digital monitoring integration, modular scalability, and optimized lifecycle performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Stainless Material, PP Material, PTFE Material, PES Material, Others |

| Application | Food & Beverage, Biological & Biomass, Industrial Filtration, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Pall Corporation, Eaton Corporation, Parker Hannifin Corporation, Donaldson Company, Inc., MANN+HUMMEL Group, Filtration Group Corporation, Camfil AB, Lenntech B.V., Veolia Water Technologies, Shibata, HYDAC Technology GmbH, Freudenberg Filtration Technologies, Porvair Filtration Group |

| Additional Attributes | Dollar sales by material type and application; industrial adoption trends in food, biopharma, and water treatment sectors; integration of digital monitoring systems; clean-in-place and sterilizable filter assemblies; modular scalability for automated process lines; sustainability initiatives in polymer and stainless filter design; regulatory compliance and lifecycle cost optimization. |

The global liquid processing filter market is estimated to be valued at USD 889.6 million in 2025.

The market size for the liquid processing filter market is projected to reach USD 1,267.0 million by 2035.

The liquid processing filter market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in liquid processing filter market are stainless material, pp material, ptfe material, pes material and others.

In terms of application, food & beverage segment to command 30.0% share in the liquid processing filter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA