The liquid filling machine market is experiencing steady growth driven by the rising need for efficient, precise, and automated filling solutions across food and beverage, pharmaceutical, and cosmetic industries. Increasing production volumes and growing emphasis on operational efficiency are encouraging manufacturers to adopt advanced filling technologies. Market growth is further supported by the transition from manual to automated filling systems, which improve speed, accuracy, and product consistency.

The adoption of Industry 4.0 and smart manufacturing practices is enhancing machine performance and real-time monitoring capabilities. Additionally, regulatory requirements for product quality and hygiene are prompting companies to upgrade to modern equipment with improved control systems.

The future outlook remains positive as demand for customized and high-capacity filling machines grows, especially in emerging economies with expanding manufacturing infrastructure Overall, continuous technological innovation and integration of automation and digital control systems are expected to sustain market expansion and strengthen competitiveness among key players.

| Metric | Value |

|---|---|

| Liquid Filling Machine Market Estimated Value in (2025E) | USD 1.0 billion |

| Liquid Filling Machine Market Forecast Value in (2035F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

The market is segmented by Automation, Dosage Range, Filling Application, and End Use and region. By Automation, the market is divided into Automatic and Semi-Automatic. In terms of Dosage Range, the market is classified into 26 250 ml, Up to 25 ml, 250 1,000 ml, and 1000 ml And Above. Based on Filling Application, the market is segmented into Bottles, Jars, Vials & Ampoules, Pouches, Aseptic Cartons, Cans & Jerry Cans, Drums & Barrels, and Others (Bag in Box, Bulk Containers, etc.). By End Use, the market is divided into Beverage, Alcoholic Beverage, Non Alcoholic, Food, Dairy Products, Edible Oil, Sauces & Condiments, Others Liquid Food, Healthcare & Pharmaceuticals, Cosmetic & Personal Care, Chemicals, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

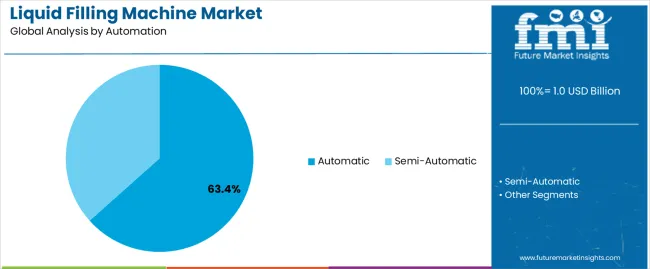

The automatic segment, accounting for 63.4% of the automation category, has maintained its leadership position due to its ability to enhance productivity, reduce human error, and ensure precision in liquid dispensing. Manufacturers are increasingly adopting automatic systems to streamline production lines and minimize operational downtime.

The segment’s dominance is supported by advancements in servo-driven controls, programmable logic controllers, and touchscreen interfaces that enable high-speed operations with greater accuracy. Automatic machines also ensure product uniformity, making them ideal for industries where precision and hygiene are critical.

Ongoing innovations such as robotic integration and real-time data analytics are further enhancing system reliability and efficiency The scalability of automatic machines for different container sizes and liquid viscosities has contributed to their widespread use, and continuous upgrades in automation technology are expected to reinforce their leading market share over the forecast period.

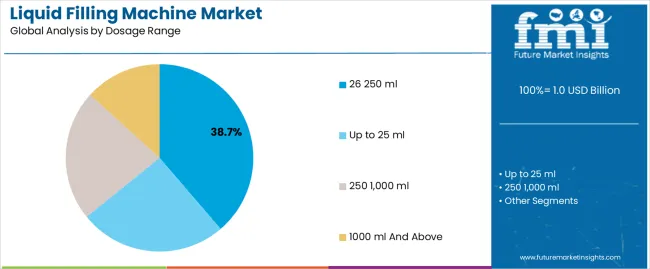

The 26–250 ml dosage range segment, representing 38.7% of the dosage category, has emerged as the leading range owing to its wide applicability in packaging beverages, pharmaceuticals, and personal care products. Demand is driven by the growing consumption of small to medium-sized packaging formats that cater to on-the-go lifestyles and unit-dose applications. Manufacturers prefer this dosage range as it offers flexibility in handling various product viscosities and packaging materials while maintaining high precision.

The use of volumetric and gravimetric filling technologies has improved accuracy within this range, reducing wastage and enhancing production throughput. Equipment designed for this dosage capacity is often modular, allowing easy changeovers for different products.

Continuous advancements in filling nozzle design and flow control systems are ensuring better speed and reliability These factors collectively support the dominance of this dosage range segment and its sustained adoption across multiple end-use industries.

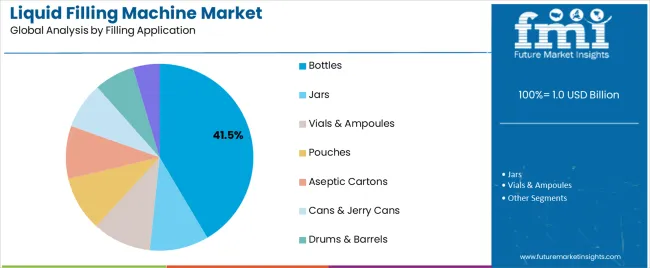

The bottles segment, holding 41.5% of the filling application category, has been leading due to extensive use across beverage, pharmaceutical, and household product industries. Bottles provide versatility, durability, and compatibility with various liquid viscosities, making them a preferred choice for packaging. The widespread use of plastic and glass bottles in both mass and premium product categories has maintained high equipment utilization rates.

Automatic bottle-filling systems have been increasingly integrated with capping, labeling, and sealing functions to optimize efficiency. The segment’s growth is also supported by consumer demand for convenient and tamper-proof packaging solutions.

Advancements in multi-head filling systems and non-contact dispensing technologies have improved speed and cleanliness during operations As sustainability trends continue to influence packaging choices, innovations in recyclable bottle materials and eco-friendly designs are expected to strengthen the segment’s position and support consistent growth in the global liquid filling machine market.

The global demand for the liquid filling machine market was estimated to reach a valuation of USD 0.9 million in 2020. From 2020 to 2025, the liquid filling machine market witnessed a CAGR of 2.20%.

| Historical CAGR from 2020 to 2025 | 2.20% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 2.70% |

The introduction of modular and adaptable machine designs has been a game changer in the liquid filling machine market. These designs make it simple for producers to modify and reorganize their filling machinery to suit various product types, sizes, and forms of containers.

Modular filling machines provide flexibility and scalability that help businesses manage shifting production demands, optimize operational efficiency, and serve many customer needs across many sectors.

Companies to Gain Enhanced Operational Efficiency with Liquid Filling Machines

The market for liquid filling machines is driven by factors such as the growing need for products to be versatile and customized to meet the various needs and preferences of consumers concerning packaging.

The increasing integration of Industry 4.0 and automation into production processes necessitates innovative liquid filling systems with improved accuracy, efficiency, and integration capabilities. These factors promote market expansion by raising productivity, reducing manufacturing costs, and boosting companies' overall operational efficiency.

High Installation and Maintenance Costs can impede Market Growth

This section provides a detailed analysis of two particular market segments for the liquid filling machine, the dominant automation, and the filling application. The two main segments discussed below are the jerky meat and poultry meat.

| Automation | Automatic |

|---|---|

| Market Share in 2025 | 78.1% |

In 2025, the automatic liquid filling machines to gain a significant market share of 78.1%. Automatic machines are expected to gain momentum in the liquid filling market because they simplify production processes and increase efficiency.

Comparing these devices to manual or semi-automatic alternatives, they are more accurate, faster, and more consistent, which increases output and reduces costs. They are becoming increasingly appealing to companies looking for efficient production solutions since they limit human mistakes, depend less on personnel, and guarantee accurate filling.

| Filling Application | Bottles |

|---|---|

| Market Share in 2025 | 47.1% |

In 2025, liquid filling machines will be greatly used to fill up bottles, with an anticipated 47.1% market share. These machines are utilized for bottles since they can accurately and consistently pour liquids into containers effectively. They may be used with various bottle shapes and sizes as they have adjustable filling volumes and rates.

Their automated capabilities also lessen the need for manual labor and lower the chance of contamination, guaranteeing clean and high quality filling processes essential for sectors like pharmaceuticals and food & beverage.

This section will detail the liquid filling machine markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea. The below section will emphasize the reasons that are pushing growth in each of the regions.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 0.5% |

| The United Kingdom | 0.6% |

| China | 3.7% |

| Japan | 0.90% |

| South Korea | 2.2% |

The United States liquid filling machine industry to gain a CAGR of 0.5% through 2035. An increasing number of states have legalized cannabis for both medicinal and recreational purposes, which has LED to a need for liquid filling equipment. This demand is for packaging cannabis infused goods, including tinctures, oils, and drinks.

For filling machine manufacturers, this offers a significant market opportunity to meet the unique needs of the cannabis sector while maintaining regulatory compliance.

The liquid filling machine market in the United Kingdom is expected to expand with a 0.6% CAGR through 2035. The emphasis on automation and sustainability in manufacturing processes may encourage companies to invest in state of the art filling machinery to boost output and lessen environmental effects.

Companies may be encouraged to use innovative liquid filling equipment to maintain their competitiveness in the global market by the UK's primary focus on innovation and technology adoption.

The liquid filling machine ecosystem in China is anticipated to develop with a 3.7% CAGR from 2025 to 2035. The rapid expansion of the retail and e commerce industries in China is one of the factors driving the need for liquid filling machines.

Companies are investing in liquid filling equipment to improve supply chain operations and expedite packaging processes. This will be in response to the growing popularity of online shopping and the necessity for effective packaging solutions to fulfill customer demands for quick delivery and a wide selection of products.

The liquid filling machine industry in Japan is anticipated to reach a 0.9% CAGR from 2025 to 2035. Companies may be encouraged to invest in modern liquid filling machines by concentrating on technical innovation and automation in production processes.

This in turn will enhance operational effectiveness and sustain competitiveness. Liquid filling machines may also be required in the pharmaceutical and medical industries due to Japan's aging population and rising healthcare product demand.

The liquid filling machine ecosystem in South Korea will likely evolve with a 2.2% CAGR during the forecast period. The robust manufacturing industry of the nation, especially in sectors like food and beverage, pharmaceuticals, and cosmetics needs effective liquid packaging solutions to drive growth.

Technological developments in automation and Industry 4.0 might incentivize businesses to invest in state of the art liquid filling machinery to boost efficiency and competitiveness.

Companies that offer liquid filling machine may set themselves apart from the competition by emphasizing unique flavor profiles, quality ingredients, and innovative package designs.

Companies may attract consumers looking for enhanced snacking experiences and establish brand loyalty in a competitive market by offering different taste combinations, sourcing high quality meats, and utilizing sustainable packaging materials.

The key players in this market include:

Key Development by Market Players

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2.70% from 2025 to 2035 |

| Market value in 2025 | USD 987.7 million |

| Market value in 2035 | USD 1.2 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million/billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Automation, Dosage range, Filling Application, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Filling Equipment Co. Inc.; APACKS; Accutek Packaging Equipment Companies Inc.; OPTIMA packaging group GmbH; CDA USA; Ronchi Mario S.p.A.; Karmelle Liquid Filling & Capping Solutions Limited; Neostarpack Co., Ltd.; Metalnova S.p.a.; Inline Filling Systems; Others |

| Customisation Scope | Available on Request |

The global liquid filling machine market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the liquid filling machine market is projected to reach USD 1.3 billion by 2035.

The liquid filling machine market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in liquid filling machine market are automatic and semi-automatic.

In terms of dosage range, 26 250 ml segment to command 38.7% share in the liquid filling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Capsule Filling Machines Market Trends – Growth & Forecast 2025 to 2035

Automatic Liquid Filling Machines Market

Injectable Liquid Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Hardgel Liquid Capsule Filling Machines Market

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Paste Filling Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Liquid Pouch Packing Machine Companies

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Granule Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA