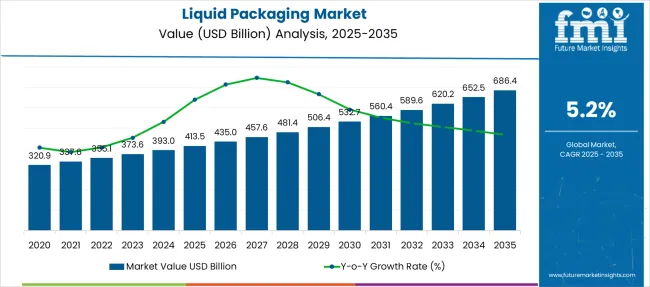

The Liquid Packaging Market is estimated to be valued at USD 413.5 billion in 2025 and is projected to reach USD 686.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Market share erosion or gain analysis shows significant realignment among packaging formats driven by performance and cost efficiency. Rigid packaging currently dominates due to its strong presence in beverages, dairy, and household liquids. Still, gradual share erosion is expected as flexible packaging gains momentum with advantages such as lower material usage, reduced logistics costs, and superior design adaptability. From 2025 to 2030, the market climbs to USD 532.7 billion, with rigid formats maintaining their lead yet losing some ground to pouches and cartons. Between 2030 and 2035, when the market reaches USD 686.4 billion, flexible packaging secures notable share gains through advanced barrier properties, lightweight formats, and compatibility with high-speed filling lines, while glass and metal containers lose competitiveness in mid-range applications. Growth will further concentrate in categories requiring portability, on-the-go convenience, and longer shelf stability for processed liquids. Companies developing innovative dispensing systems, high-barrier laminates, and smart labeling technologies will outperform rivals as the industry shifts toward value-added features and optimized supply chain economics.

| Metric | Value |

|---|---|

| Liquid Packaging Market Estimated Value in (2025 E) | USD 413.5 billion |

| Liquid Packaging Market Forecast Value in (2035 F) | USD 686.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The liquid packaging market occupies a prominent share within multiple parent segments. In the packaging industry, it contributes around 10–12%, driven by high usage across food, beverage, and healthcare applications. Within the flexible packaging market, the share is about 14–16%, owing to growing adoption of pouches and laminated films for liquid food and personal care products. In the rigid packaging market, liquid packaging accounts for nearly 18–20%, as glass and plastic bottles dominate beverage and dairy applications. The food and beverage packaging market records the highest contribution at 45–50%, given that most beverage and liquid-based food products rely heavily on specialized packaging.

For the pharmaceutical and healthcare packaging market, liquid packaging represents approximately 12–14%, driven by demand for syrups, injectables, and sterile fluid packaging. Market growth is supported by rising consumption of ready-to-drink products, innovations in aseptic carton systems, and increasing demand for high-barrier containers in sensitive product categories. Rapid expansion in dairy alternatives, functional beverages, and liquid-based nutraceuticals further enhances the requirement for advanced packaging solutions. These factors position liquid packaging as an indispensable part of multiple industries, ensuring product integrity, convenience, and safety throughout distribution and consumption channels.

The liquid packaging market is witnessing sustained growth, supported by the expansion of the food & beverage, pharmaceutical, and personal care industries. Increasing consumer preference for convenience, hygiene, and extended shelf-life is influencing manufacturers to adopt advanced packaging formats for both perishable and shelf-stable liquids.

A growing emphasis on recyclable and renewable materials has further strengthened the market's momentum, particularly as global regulatory pressures mount around single-use plastics and carbon emissions. Brand owners are focusing on lightweight, space-saving, and tamper-proof formats that enhance consumer safety and sustainability goals.

Furthermore, rapid urbanization and rising demand for on-the-go liquid consumption are prompting investment in smarter, multi-layer packaging technologies. The integration of aseptic filling, RFID tracking, and smart labeling is expected to shape next-generation packaging innovations, with manufacturers aligning their strategies toward circular economy principles and digital supply chain efficiency..

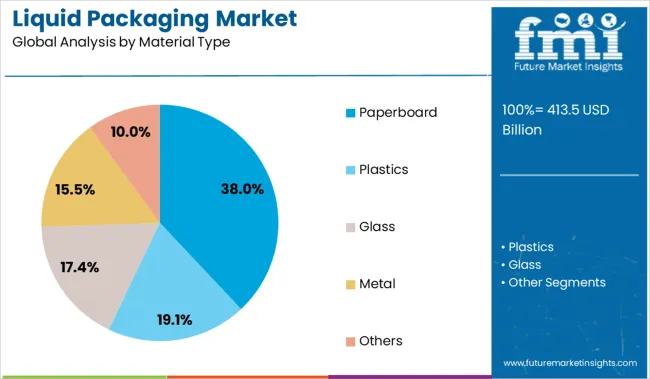

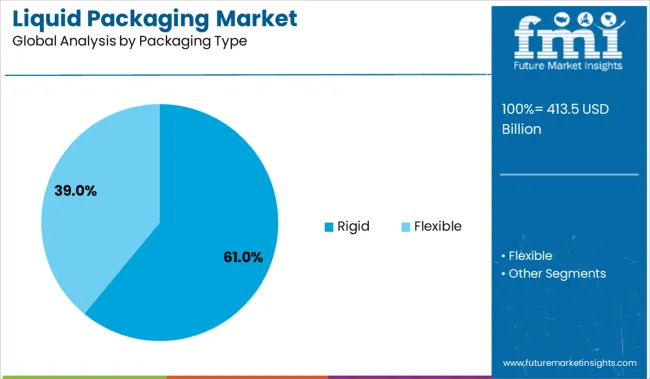

The liquid packaging market is segmented by material type, packaging type, technology type, end user, and geographic regions. By material type of the liquid packaging market is divided into Paperboard, Plastics, Glass, Metal, and Others. In terms of packaging type of the liquid packaging market is classified into Rigid and Flexible. Based on technology type of the liquid packaging market is segmented into Aseptic Liquid Packaging, Blow Molding, and Form Fill Seal. By end user of the liquid packaging market is segmented into Food & Beverage, Personal Care, Pharmaceutical, Household Care, Industrial, and Others. Regionally, the liquid packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Paperboard is projected to hold 38.0% of the total revenue in the liquid packaging market by 2025, making it the leading material type segment. Its growth has been fueled by the rising demand for renewable, lightweight, and biodegradable packaging options in both developed and emerging economies.

Paperboard’s compatibility with multi-layer barrier coatings allows for secure containment of liquid products while maintaining recyclability—a combination that appeals to sustainability-conscious brands and consumers alike. The increasing shift toward fiber-based alternatives in dairy, juice, and plant-based beverage packaging has also supported paperboard’s adoption.

Additionally, improvements in moisture resistance, printability, and structural strength have enabled it to perform well in high-volume production environments, strengthening its commercial appeal across foodservice and retail packaging channels..

Rigid packaging formats are expected to account for 61.0% of the total liquid packaging market revenue in 2025, positioning this segment as the dominant packaging type. The preference for rigid formats has been driven by their durability, product protection, and ease of storage during transportation and retail handling.

Consumer trust in rigid containers for spill resistance and longer shelf-life is encouraging manufacturers to scale investment in blow-molded bottles, cans, and cartons. Rigid packaging is also being favored for its compatibility with tamper-evident closures and precision dosing mechanisms, which are essential in pharmaceutical and household liquid categories.

The ability to incorporate reusable and recyclable materials such as PET and HDPE within rigid formats is further aligning this segment with broader sustainability targets, enhancing its market position..

Liquid packaging includes cartons, bottles, pouches, and flexible films used for beverages, dairy products, edible oils, household chemicals, and pharmaceuticals. It ensures product safety, extended shelf life, and ease of handling during transportation and storage. Manufacturers have prioritized leak resistance, barrier properties, and cost efficiency to meet diverse application needs. Expansion in ready-to-drink beverages, health drinks, and liquid food categories has reinforced market adoption. Integration of lightweight materials and innovative dispensing systems has shaped product differentiation. Digital printing for branding and design customization has gained importance for enhancing shelf appeal and consumer engagement across global markets.

Market growth has been driven by rising demand for packaged beverages, dairy products, and liquid foods requiring extended shelf life and superior barrier properties. Urban lifestyles and growing preference for convenient, on-the-go consumption have supported adoption of flexible pouches, cartons, and lightweight bottles. Aseptic packaging technology has been widely used to maintain freshness and prevent contamination without refrigeration. Consumer preference for safe, tamper-proof designs has reinforced reliance on advanced packaging formats. Brand owners have focused on enhancing shelf appeal through customizable graphics and functional closures. Integration of high-speed filling and sealing systems has improved efficiency, supporting large-scale distribution. Health-conscious purchasing trends and expanding retail networks in emerging economies have further contributed to the growing demand for liquid packaging solutions across multiple product categories.

Market expansion has been restricted by high costs associated with raw materials such as polymers, aluminum, and paperboard, which create pricing pressures for packaging manufacturers. Complex multi-layer structures in flexible pouches and aseptic cartons have presented significant recycling challenges, limiting circular economy initiatives. Regional variability in waste management infrastructure has added complexity for producers aiming to meet compliance requirements. Regulatory restrictions on single-use plastics have accelerated the need for alternative materials, increasing R&D costs and time-to-market. Operational constraints linked to high energy requirements during production and storage have further impacted cost efficiency. Logistics challenges, particularly in bulk transportation of rigid containers, have increased distribution expenses. These factors combined have posed barriers for companies seeking to optimize performance while maintaining competitive pricing models.

Significant opportunities have emerged in aseptic packaging for plant-based beverages, dairy alternatives, and health drinks, where extended shelf life without refrigeration is essential. Growing penetration of e-commerce grocery platforms and direct-to-home delivery services has accelerated demand for tamper-proof and durable liquid packaging solutions. Premium beverage categories, including fortified juices and nutritional supplements, present strong prospects for high-barrier and visually appealing packaging designs. Investment in mono-material solutions for improved recyclability has opened pathways for meeting compliance mandates and reducing disposal costs. Smart packaging integration, featuring QR codes and interactive labeling, is being explored to enhance consumer engagement. Partnerships between packaging firms and FMCG companies for customized designs have created added value. Market opportunities in emerging economies remain significant due to rapid growth in packaged food and beverage consumption.

Recent trends have highlighted a surge in digital printing technologies that enable brand personalization, short production runs, and quick design changes for seasonal promotions. Development of lightweight and durable packaging formats using advanced polymer blends and paper-laminate structures has gained traction for cost optimization. Smart packaging solutions integrating QR codes, NFC tags, and traceability features have become increasingly popular for consumer engagement and supply chain transparency. Bio-based coatings and resins are being explored to meet regulatory compliance without compromising product protection. Automation in filling and sealing operations with integrated quality control systems has improved operational efficiency. Collaborative innovations between material suppliers and beverage companies for functional closures and ergonomic designs are influencing market adoption. These evolving trends are reshaping product differentiation and sustainability-focused business strategies.

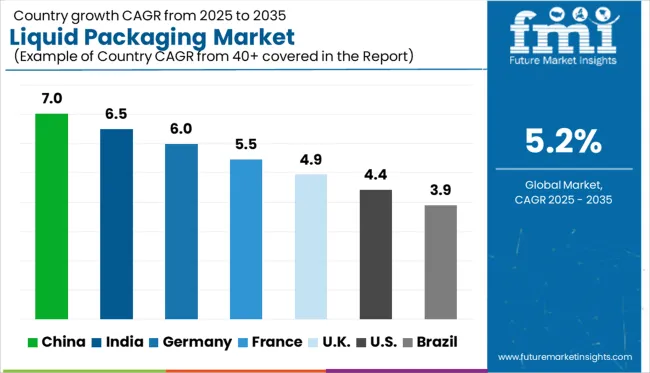

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

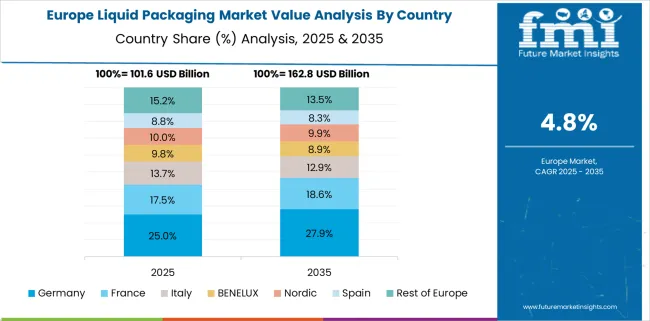

The liquid packaging market is projected to grow at a CAGR of 5.2% through 2035, driven by rising demand in food, beverage, pharmaceutical, and personal care industries. China leads with 7.0%, supported by high consumption of packaged beverages and dairy products. India follows at 6.5%, driven by expanding FMCG distribution networks and increasing adoption of flexible liquid packaging across both urban and rural markets. Among OECD nations, Germany posts 6.0%, while the United Kingdom records 4.9% and the United States grows at 4.4%, influenced by premium packaging adoption, product differentiation strategies, and advanced material innovations. Strong investments in smart packaging technologies, barrier coatings, and recyclable formats are expected to shape the competitive landscape globally. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 7.0% through 2035, driven by strong demand from the beverage, dairy, and pharmaceutical sectors. Rapid urbanization and changing lifestyles are accelerating the consumption of packaged drinks, ready-to-use liquid food, and health beverages. Domestic manufacturers are focusing on high-barrier, multilayer flexible packaging to extend product shelf life and ensure safety. Expansion of e-commerce channels has further boosted the need for durable liquid packaging formats that minimize spillage and leakage during transit. Adoption of aseptic packaging technologies for dairy products and liquid nutritional supplements is also gaining momentum. The country is investing heavily in eco-friendly packaging solutions, such as recyclable cartons and bio-based plastics, to meet rising environmental compliance standards.

India is forecasted to grow at a CAGR of 6.5% through 2035, supported by strong demand for packaged milk, juices, edible oils, and personal care liquids. The rise in disposable incomes and the shift toward branded products have significantly influenced the adoption of advanced liquid packaging solutions. Flexible packaging formats, including pouches and laminated cartons, are witnessing strong growth due to cost-effectiveness and ease of distribution. Pharmaceutical applications are also expanding with increased production of syrups and oral solutions. Domestic manufacturers are investing in aseptic and retort packaging technologies to maintain product safety during transportation across diverse climatic conditions. Innovations in lightweight, recyclable plastic bottles and paper-based alternatives are emerging as a major trend.

Germany is projected to grow at a CAGR of 6.0% through 2035, supported by increasing demand for premium packaging solutions in beverages, pharmaceuticals, and cosmetics. German manufacturers are adopting advanced liquid packaging technologies featuring multilayer laminates, high-barrier coatings, and recyclable polymers to comply with stringent regulatory guidelines. The dairy industry is a major consumer, with innovations in aseptic packaging enhancing shelf life for milk and yogurt-based drinks. Growth in ready-to-drink coffee, plant-based beverages, and functional drinks is fueling the adoption of lightweight PET bottles and paper-based cartons. Packaging companies are focusing on integrating digital features, such as QR codes, for traceability and consumer engagement.

The United Kingdom is forecasted to achieve a CAGR of 4.9% through 2035, driven by strong adoption in premium beverage packaging and pharmaceutical applications. Growing consumer demand for eco-friendly and convenient packaging formats is influencing manufacturers to invest in recyclable plastics and paper-based solutions. The rise in e-commerce for groceries and personal care items is boosting demand for leak-proof and durable liquid packaging. Alcoholic beverages, including craft spirits and premium wines, are seeing increased adoption of glass-alternative packaging for lightweight shipping efficiency. Digital printing and smart packaging technologies integrated with QR codes are gaining momentum to enhance brand engagement and product traceability.

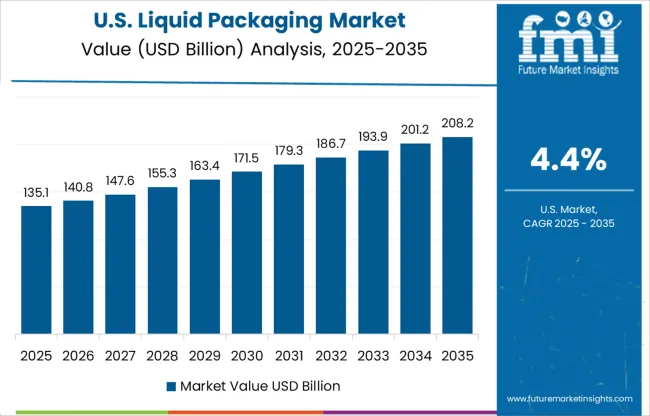

The United States is expected to grow at a CAGR of 4.4% through 2035, supported by robust demand for packaged beverages, dairy alternatives, and pharmaceutical liquids. The rising popularity of plant-based drinks, functional beverages, and on-the-go meal replacements has increased the need for lightweight and high-barrier packaging formats. Manufacturers are introducing recyclable PET bottles, laminated cartons, and bio-based plastics to align with consumer expectations for sustainable solutions. E-commerce growth has driven the development of impact-resistant, spill-proof packaging for safe delivery of liquid products. The pharmaceutical sector is also expanding its use of specialized liquid packaging formats for injectables and oral solutions, emphasizing sterility and durability.

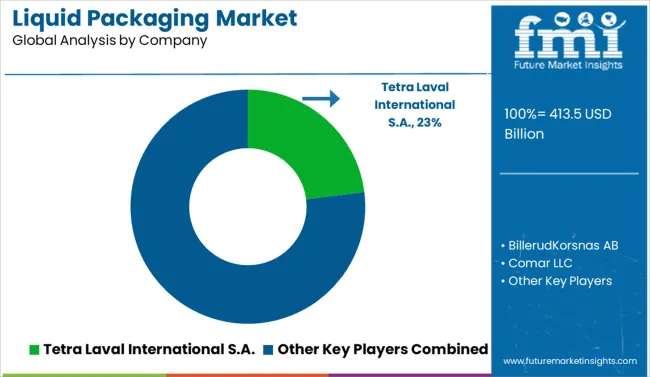

The liquid packaging market is driven by leading global players specializing in flexible, rigid, and paper-based solutions designed for beverages, dairy, edible oils, and industrial liquids. Tetra Laval International S.A. dominates with aseptic and carton-based packaging systems for milk, juices, and liquid foods, supported by advanced filling technology and strong distribution capabilities.

BillerudKorsnäs AB and Smurfit Kappa Group emphasize sustainable fiber-based liquid packaging cartons, targeting the dairy and plant-based beverage sectors. International Paper Company and Klabin Paper focus on paperboard solutions integrating barrier coatings for moisture resistance, while Evergreen Packaging Inc. caters to gable-top carton formats for refrigerated dairy applications. Liqui-Box Corporation stands out in flexible liquid packaging with bag-in-box systems for water, wine, and foodservice products. Mondi PLC brings expertise in flexible pouches with high-barrier films, meeting demand for convenience and extended shelf life.

Nippon Paper Industries Co., Ltd. serves the Asian market with liquid cartons and eco-friendly coatings, while The DOW Chemical Company provides advanced resins and sealants to enhance structural integrity and recyclability of liquid packaging solutions. Comar LLC complements the landscape with specialized rigid bottles for pharmaceuticals and healthcare liquids.

Competitive differentiation focuses on material innovation, barrier performance, lightweighting, and recyclability. High entry barriers stem from regulatory compliance for food-contact safety, capital-intensive production lines, and stringent quality standards. Strategic moves include investments in renewable raw materials, bio-based barrier coatings, and partnerships for closed-loop recycling systems.

On June 5, 2024, Smurfit Kappa announced the acquisition of Artemis, a Bulgarian bag-in-box packaging facility. This move strengthens Smurfit Kappa’s footprint in Eastern Europe, enhancing its liquid packaging portfolio for wine and other beverages through expanded bag, film, and cap production capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 413.5 Billion |

| Material Type | Paperboard, Plastics, Glass, Metal, and Others |

| Packaging Type | Rigid and Flexible |

| Technology Type | Aseptic Liquid Packaging, Blow Molding, and Form Fill Seal |

| End User | Food & Beverage, Personal Care, Pharmaceutical, Household Care, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tetra Laval International S.A., BillerudKorsnas AB, Comar LLC, Evergreen Packaging Inc., International Paper Company, Klabin Paper, Liqui-Box Corporation, Mondi PLC, Nippon Paper Industries Co., Ltd., Smurfit Kappa Group, and The DOW Chemical Company |

The global liquid packaging market is estimated to be valued at USD 413.5 billion in 2025.

The market size for the liquid packaging market is projected to reach USD 686.4 billion by 2035.

The liquid packaging market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in liquid packaging market are paperboard, plastics, glass, metal and others.

In terms of packaging type, rigid segment to command 61.0% share in the liquid packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Liquid Packaging Bag Manufacturers

Market Share Breakdown of Liquid Packaging Board Manufacturers

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Liquid Carton Packaging

Bulk Liquid Transport Packaging Market from 2025 to 2035

Aseptic Liquid Packaging Boards Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Spout & Non-Spout Liquid Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Gable Top Packaging for Liquid Food Market Size and Share Forecast Outlook 2025 to 2035

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA