Liquid carton packaging market is transforming as sustainability, convenience, and extended shelf-life are becoming top agendas. Brands and consumers are insisting on eco-friendly, lightweight, and high-barrier packaging solutions to replace glass and plastic bottles. As demand for dairy, plant-based drinks, and RTD products surges, brands are turning towards recyclable, biodegradable, and aseptic carton packaging in order to keep up with environmental and regulatory needs.

Firms are investing in sustainable materials, intelligent packaging functions, and AI-based production to enhance efficiency and lower carbon footprints. The sector is moving towards fiber-based cartons, plant-based coatings, and digital printing technologies to optimize branding and performance.

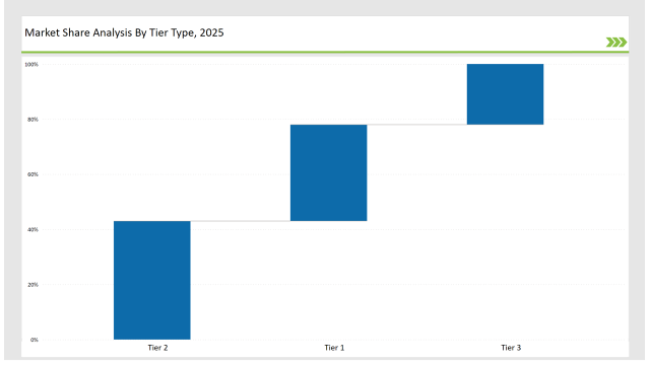

Tier 1 players like Tetra Pak, SIG Combibloc, and Elopak own 35% of the market with their leadership in aseptic and paperboard-based liquid packaging solutions, established distribution networks, and tie-ups with large beverage companies.

Tier 2 players like Greatview Aseptic Packaging, Evergreen Packaging, and Nippon Paper account for 43% of the market with cost-efficient and flexible liquid cartons for dairy, juice, and non-dairy drinks.

Tier 3 consists of regional and niche players specializing in biodegradable liquid cartons, lightweight materials, and digitally printed packaging, holding 22% of the market. These companies focus on localized production, innovative coatings, and sustainable printing solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Tetra Pak, SIG Combibloc, Elopak) | 16% |

| Rest of Top 5 (Greatview Aseptic Packaging, Evergreen Packaging) | 11% |

| Next 5 of Top 10 (Nippon Paper, Mondi Group, BillerudKorsnäs, Adam Pack, IPI Srl) | 8% |

The liquid carton packaging industry serves multiple sectors where freshness, shelf-life, and sustainability are key factors. Companies are developing high-barrier, lightweight, and resealable carton solutions to meet consumer demands.

Manufacturers are optimizing liquid carton packaging with renewable materials, improved closures, and digital printing.

Sustainability and consumer convenience are driving the liquid carton packaging industry. Companies are integrating AI-driven quality control, digital customization, and plant-based coatings to enhance recyclability and product performance. Businesses are developing water-based barrier coatings to replace plastic laminations. Manufacturers are expanding smart packaging solutions, such as temperature-sensitive inks, to improve supply chain transparency. Additionally, firms are optimizing lightweight designs to lower transportation emissions and reduce material waste.

Technology suppliers should focus on automation, sustainable coatings, and AI-driven customization to support the evolving liquid carton packaging market. Collaborating with food and beverage brands will accelerate market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Tetra Pak, SIG Combibloc, Elopak |

| Tier 2 | Greatview Aseptic Packaging, Evergreen Packaging, Nippon Paper |

| Tier 3 | Mondi Group, BillerudKorsnäs, Adam Pack, IPI Srl |

Leading manufacturers are advancing liquid carton packaging technology with sustainable coatings, AI-powered production, and lightweight material innovations.

| Manufacturer | Latest Developments |

|---|---|

| Tetra Pak | Launched fiber-based liquid cartons with plant-derived coatings in March 2024. |

| SIG Combibloc | Developed ultra-lightweight aseptic packaging in April 2024. |

| Elopak | Expanded fully recyclable Pure-Pak® carton solutions in May 2024. |

| Greatview Aseptic | Released cost-effective digitally printed aseptic cartons in June 2024. |

| Evergreen Packaging | Strengthened FSC-certified liquid packaging solutions in July 2024. |

| Nippon Paper | Introduced biodegradable, heat-resistant carton solutions in August 2024. |

| Mondi Group | Pioneered smart packaging cartons with NFC-enabled tracking in September 2024. |

The liquid carton packaging market is evolving as companies invest in sustainable materials, automation, and innovative branding solutions.

The industry will continue integrating AI-driven quality control, sustainable coatings, and lightweight material innovations. Manufacturers will refine plant-based coatings to improve barrier properties. Businesses will adopt digital printing to enhance branding and reduce material waste. Companies will develop resealable liquid cartons with biodegradable closures. Smart packaging will enable real-time product tracking and freshness monitoring. Additionally, firms will optimize supply chains with blockchain technology to ensure transparency and sustainability.

Leading players include Tetra Pak, SIG Combibloc, Elopak, Greatview Aseptic Packaging, Evergreen Packaging, Nippon Paper, and Mondi Group.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 35%.

Key drivers include sustainability, automation, lightweight design, and smart packaging technology.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA