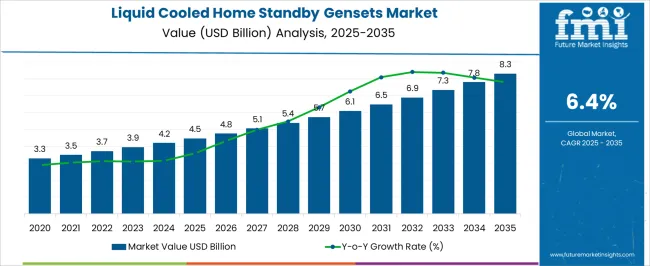

The liquid cooled home standby gensets market is projected to grow from USD 4.5 billion in 2025 to USD 8.3 billion in 2035, reflecting a CAGR of 6.4%. This represents an absolute dollar opportunity of USD 3.8 billion over the decade. The market is expected to expand steadily, reaching USD 4.8 billion in 2026, USD 5.4 billion in 2029, USD 6.1 billion in 2031, and USD 7.8 billion in 2034. The consistent growth trajectory highlights rising demand for home standby power solutions, offering manufacturers and investors the opportunity to capture incremental revenue and strengthen their market presence over ten years.

From an absolute dollar perspective, annual incremental growth begins at approximately USD 0.2–0.3 billion in the early years and increases to around USD 0.5 billion in the later stages, culminating in USD 3.8 billion by 2035. Intermediate values such as USD 4.2 billion in 2025, USD 5.7 billion in 2030, and USD 7.3 billion in 2033 illustrate a predictable and steady expansion. This enables stakeholders to plan production, distribution, and marketing strategies effectively.

| Metric | Value |

|---|---|

| Liquid Cooled Home Standby Gensets Market Estimated Value in (2025 E) | USD 4.5 billion |

| Liquid Cooled Home Standby Gensets Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

Continuing with the liquid cooled home standby gensets market, a breakpoint analysis highlights key phases of growth. Between 2025 and 2027, the market rises from USD 4.5 billion to USD 4.8 billion, marking the early adoption phase where demand begins to establish a solid base. Another significant breakpoint occurs around 2029–2031, as the market grows from USD 5.4 billion to USD 6.1 billion, reflecting a period of stronger expansion and higher incremental revenue.

These stages are pivotal for manufacturers and investors to optimize production, align distribution channels, and capture revenue during periods of accelerated market growth. The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 7.8 billion to USD 8.3 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 5.7 billion to USD 7.3 billion, acting as bridging periods to maintain momentum.

The liquid cooled home standby gensets market is experiencing robust growth, driven by increasing demand for reliable and efficient backup power solutions in residential settings. The growing frequency of power outages and the need for an uninterrupted power supply have emphasized the importance of home standby generators, especially in regions prone to extreme weather conditions and grid instability.

Technological advancements in liquid cooling systems have enhanced the operational efficiency and lifespan of gensets, making them more attractive to end users. Rising urbanization and the expansion of smart homes are further fueling market adoption.

Additionally, stringent regulations related to noise and emission control have prompted manufacturers to develop quieter and cleaner liquid-cooled gensets. The future outlook is promising as energy security concerns and investments in home automation continue to rise, creating a fertile environment for innovative, high-capacity standby power solutions.

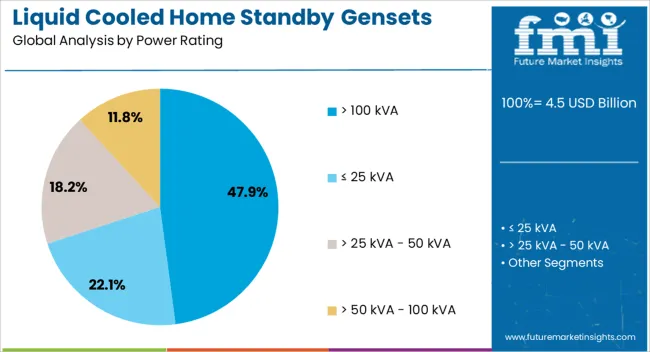

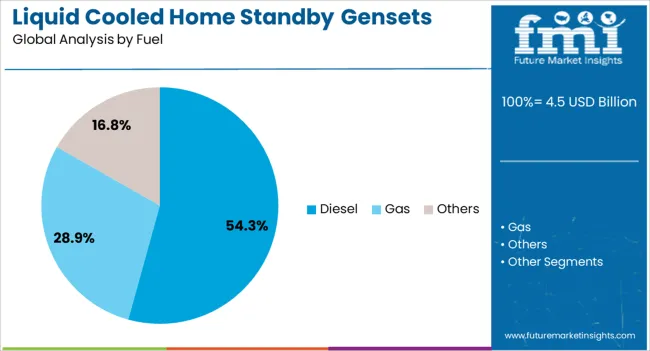

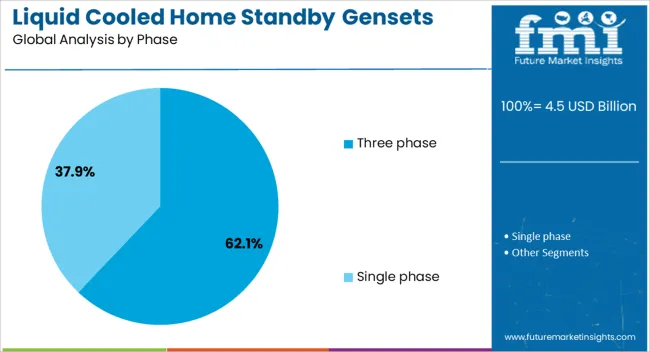

The liquid cooled home standby gensets market is segmented by power rating, fuel, phase, and geographic regions. By power rating, liquid cooled home standby gensets market is divided into > 100 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, and > 50 kVA - 100 kVA. In terms of fuel, liquid cooled home standby gensets market is classified into Diesel, Gas, and Others. Based on phase, liquid cooled home standby gensets market is segmented into Three phase and Single phase.

Regionally, the liquid cooled home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment above 100 kVA is anticipated to hold 47.9% of the liquid cooled home standby gensets market revenue in 2025, making it the leading segment. This prominence is attributed to the increasing preference for high-capacity generators capable of powering larger residential properties and small commercial establishments.

The demand is also driven by consumers seeking backup solutions that can support multiple high-power appliances simultaneously during outages. High-power rating gensets benefit from enhanced reliability and efficiency due to liquid cooling technology, which better manages heat dissipation under heavy loads.

As home automation and energy demands rise, the segment’s growth is supported by the necessity for resilient power systems that maintain continuous operation without overheating or performance degradation.

Diesel-fueled gensets are expected to represent 54.3% of the market share in 2025, maintaining their lead within the fuel type segment. This dominance is based on diesel’s advantages of higher energy density, fuel efficiency, and longer engine life, which are essential for standby power applications.

Diesel gensets have been widely adopted for their robustness and ability to provide continuous power over extended periods, making them preferred for residential backup during prolonged outages. The availability of diesel fuel infrastructure and relatively lower operational costs further reinforce this segment’s growth.

Liquid cooling complements diesel engines by improving thermal management, enhancing system durability, and reducing maintenance needs, which appeals to end users looking for reliable and cost-effective standby power solutions.

The three-phase segment is projected to hold 62.1% of the liquid cooled home standby gensets market revenue in 2025, positioning it as the dominant phase type. The preference for three-phase gensets is driven by their capability to supply balanced power loads to homes with complex electrical systems and small businesses requiring consistent three-phase power for sensitive equipment.

Three-phase systems provide improved efficiency, reduced energy losses, and better voltage regulation, making them suitable for high-capacity backup applications. The integration of liquid cooling enhances their performance by maintaining optimal operating temperatures, thus extending equipment life and ensuring reliability during peak load conditions.

Increasing adoption of three-phase gensets reflects growing consumer demand for stable and efficient power solutions that meet modern residential and commercial electrical requirements.

The liquid cooled home standby gensets market is expanding as homeowners seek reliable, uninterrupted power supply during outages and grid instability. Liquid cooled gensets use water or coolant circulation to maintain optimal engine temperatures, enabling higher efficiency, quieter operation, and longer lifespan compared to air-cooled alternatives. Rising residential electrification, smart home adoption, and extreme weather events increase demand.

Manufacturers offering compact, low-noise, fuel-efficient, and digitally monitored gensets gain a competitive edge. Integration with smart home energy management systems, automatic transfer switches, and renewable energy hybrid setups further enhances adoption. Global trends toward energy security, convenience, and home automation support growth in liquid cooled home standby generators across developed and emerging markets.

Market growth is restrained by high upfront costs and ongoing maintenance requirements of liquid cooled home standby gensets. Compared to air-cooled systems, liquid cooled engines require additional components such as radiators, pumps, and coolant circulation systems, increasing capital investment. Regular maintenance, including coolant replacement, filter cleaning, and inspection of pumps and hoses, is essential to ensure reliability and prevent overheating. Homeowners may face higher operational expenses due to fuel consumption and servicing. Noise, space, and installation considerations also add complexity for residential adoption. Until manufacturers develop more cost-effective, low-maintenance, and compact solutions, adoption may remain concentrated in high-income households and regions with frequent power outages.

Technological advancements and smart integration are shaping trends in liquid cooled home standby gensets. Modern systems feature IoT-enabled monitoring, remote diagnostics, and predictive maintenance alerts, improving reliability and convenience. Integration with smart home energy systems allows automatic load management, energy optimization, and hybrid operation with solar or battery storage. Low-noise designs, vibration reduction technologies, and fuel-efficient engines improve residential suitability. Compact modular designs simplify installation in limited spaces such as basements or garages. Manufacturers are also exploring eco-friendly fuels and emissions reduction technologies to meet regulatory standards and consumer preference. These trends emphasize the convergence of efficiency, sustainability, and digital intelligence in the home standby genset segment.

Opportunities in the liquid cooled home standby gensets market are driven by rising electricity demand, grid instability, and growth in home automation. Extreme weather events, power outages, and load-shedding in certain regions increase the need for reliable residential power backup. The adoption of smart homes, energy-efficient appliances, and connected devices raises the importance of uninterrupted power supply. Manufacturers offering compact, fuel-efficient, and smartly controlled gensets can capture high-value residential segments. Additionally, emerging markets with expanding electrification and rising disposable incomes present significant growth potential. Collaborations with home automation companies, renewable energy providers, and real estate developers further strengthen long-term adoption opportunities.

Market growth is restrained by intense competition, fuel price volatility, and regulatory compliance challenges. Numerous global and regional suppliers compete on price, reliability, and technology features, affecting margins. Dependence on diesel or natural gas exposes consumers and manufacturers to fluctuating fuel costs, impacting operating expenses. Compliance with emissions standards, noise regulations, and safety codes adds complexity and costs for manufacturers. Additionally, space constraints, installation challenges, and awareness gaps in certain regions limit residential adoption. Until manufacturers optimize cost, emissions performance, and digital integration, growth may remain concentrated in premium homes and regions with supportive policies for reliable backup power solutions.

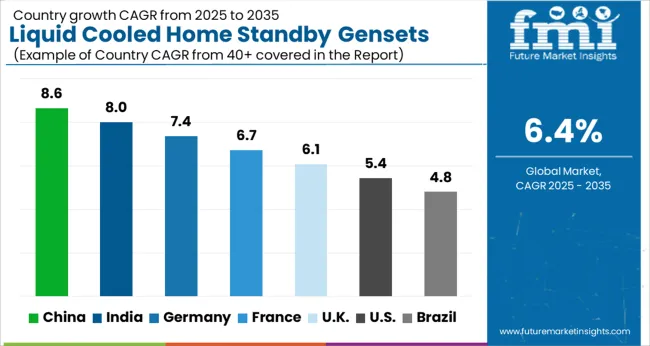

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

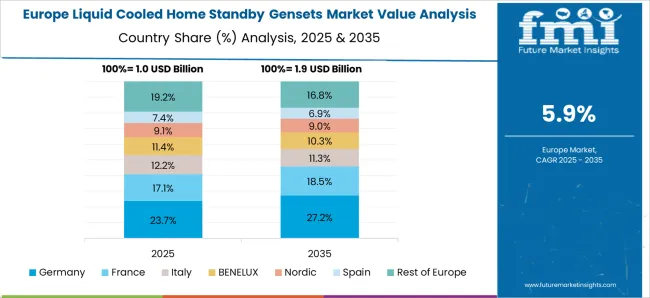

The global liquid cooled home standby gensets market was projected to grow at a 6.4% CAGR through 2035, driven by demand in residential, commercial, and backup power applications. Among BRICS nations, China recorded 8.6% growth as large-scale production and assembly facilities were commissioned and compliance with electrical and safety standards was enforced, while India at 8.0% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 7.4% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 6.1% relied on moderate-scale operations for residential and commercial backup power solutions. The USA, expanding at 5.4%, remained a mature market with steady demand across home and small commercial segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The liquid cooled home standby gensets market in China is growing at a CAGR of 8.6% due to rising demand for reliable home power solutions. Consumers and businesses are adopting liquid cooled gensets for uninterrupted electricity supply in residential areas, commercial complexes, and small industrial setups. These gensets offer efficient cooling, long operational life, and quiet operation suitable for home environments. Growth is supported by increasing urbanization, rising disposable incomes, and expanding housing and commercial infrastructure. Manufacturers are focusing on energy efficient designs, durable components, and low maintenance requirements. Distribution networks including retail outlets, online platforms, and partnerships with electrical solution providers enhance market accessibility. Government initiatives promoting energy security and incentives for backup power solutions further support adoption. Increasing awareness of reliable energy systems in households and small businesses makes China a key growth market for liquid cooled home standby gensets.

India is witnessing growth at a CAGR of 8.0% in the liquid cooled home standby gensets market due to increasing need for uninterrupted electricity in residential and commercial areas. Consumers and small businesses are adopting liquid cooled gensets for efficiency, quiet operation, and long service life. Growth is driven by urban expansion, rising disposable incomes, and frequent power interruptions in certain regions. Manufacturers focus on designing energy efficient, durable, and low maintenance gensets suitable for homes and small commercial setups. Distribution through retail stores, online platforms, and partnerships with electrical solution providers improves accessibility across urban and semi-urban markets. Rising awareness of reliable power supply and government incentives for energy backup solutions further support adoption. Demand is also encouraged by expanding housing projects and commercial infrastructure development, making India a key market for liquid cooled home standby gensets.

Germany is growing at a CAGR of 7.4% in the liquid cooled home standby gensets market due to rising adoption in residential and commercial sectors. Consumers value gensets that provide uninterrupted electricity, quiet operation, and long-term reliability. Manufacturers are offering energy efficient and durable liquid cooled gensets suitable for homes, small offices, and commercial properties. Growth is supported by increasing focus on energy security, power backup solutions, and modernization of residential areas. Distribution through retail suppliers, online platforms, and partnerships with electrical contractors ensures broad accessibility. Manufacturers focus on low maintenance, high performance, and environmentally friendly operation to meet consumer expectations. Adoption is further driven by government regulations encouraging energy efficiency and reliable electricity infrastructure. Germany continues to see stable demand for home standby gensets as consumers and businesses seek reliable and durable power backup solutions.

The United Kingdom market is expanding at a CAGR of 6.1% due to increasing demand for reliable home and small business power backup solutions. Liquid cooled home standby gensets are adopted for their efficiency, quiet operation, and long-term reliability. Consumers value gensets that maintain uninterrupted electricity in homes, small offices, and commercial spaces. Manufacturers provide energy efficient, low maintenance, and durable gensets designed for domestic and small-scale commercial use. Growth is supported by urban expansion, rising disposable incomes, and increasing awareness of reliable power supply solutions. Distribution through retail chains, online platforms, and partnerships with electrical service providers ensures availability across key regions. Seasonal promotions, product bundles, and government-backed initiatives for power security further support market adoption. Rising focus on home comfort, commercial reliability, and operational efficiency continues to drive growth in the United Kingdom market.

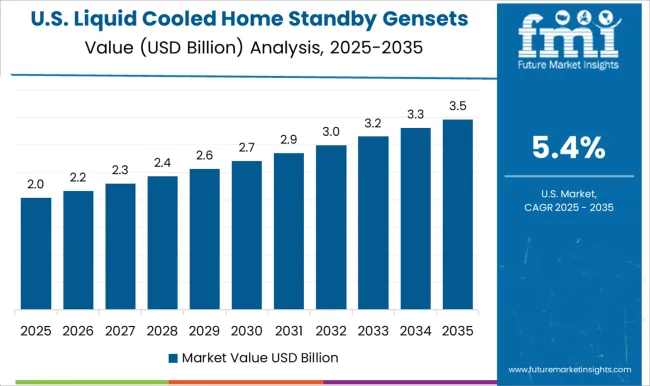

The United States market is growing at a CAGR of 5.4%, supported by demand for reliable home and commercial power solutions. Liquid cooled home standby gensets are used to ensure uninterrupted electricity supply, quiet operation, and long-term durability. Consumers and small businesses adopt gensets to protect homes, offices, and small commercial facilities from power outages. Manufacturers provide energy efficient, low maintenance, and high performance gensets suitable for varied environments. Growth is driven by urban and suburban expansion, increasing disposable incomes, and awareness of reliable power backup solutions. Distribution through retail chains, online platforms, and partnerships with electrical service providers improves accessibility. Government incentives and programs promoting energy reliability further encourage adoption. As demand for convenient, efficient, and durable home power solutions continues, the United States market for liquid cooled home standby gensets is expected to expand steadily.

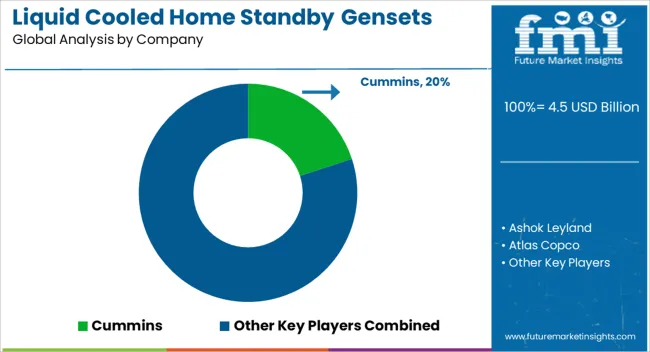

The liquid cooled home standby gensets market is supplied by major players including Cummins, Ashok Leyland, Atlas Copco, Briggs & Stratton, Eaton, Generac Power Systems, Gillette Generators, Kirloskar, Mitsubishi Heavy Industries, Multiquip, Rehlko, TRANE, Volvo Penta, WINCO, and Yamaha Motor. Product brochures highlight features such as continuous power output, fuel efficiency, automatic transfer switch integration, low-noise operation, and compatibility with residential electrical systems. Emphasis is placed on cooling efficiency, engine durability, emissions compliance (observed industry pattern), and ease of installation. Technical specifications typically include kW ratings, voltage compatibility, fuel type, runtime at full load, and maintenance intervals to guide residential users and installers. Competition is primarily based on engine performance, reliability, and after-sales support. Cummins and Mitsubishi Heavy Industries focus on high-performance engines with long service life and advanced monitoring systems.

Generac Power Systems and Briggs & Stratton emphasize compact designs and user-friendly control interfaces for easy integration into homes. Atlas Copco and Eaton leverage strong service networks and customizable solutions for various residential power demands. Ashok Leyland and Kirloskar position their products on cost efficiency, ease of maintenance, and robust cooling systems suitable for tropical climates. Volvo Penta, TRANE, and WINCO offer technically advanced units for high-load households, often bundled with warranties and support contracts. Multiquip and Rehlko highlight modularity and transportability for flexible home installation. Market strategies focus on product differentiation, regional penetration, and customer education.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Power Rating | > 100 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, and > 50 kVA - 100 kVA |

| Fuel | Diesel, Gas, and Others |

| Phase | Three phase and Single phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Ashok Leyland, Atlas Copco, Briggs & Stratton, Eaton, Generac Power Systems, Gillette Generators, Kirloskar, MITSUBISHI HEAVY INDUSTRIES, Multiquip, Rehlko, TRANE, Volvo Penta, WINCO, and Yamaha Motor |

| Additional Attributes | Dollar sales vary by product type, including Type N, Type S, and Type M masonry cement; by application, such as residential construction, commercial buildings, and infrastructure projects; by end-use, spanning masonry units, plastering, and mortar production; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by urbanization, infrastructure investment, and rising demand for durable, cost-effective construction materials. |

The global liquid cooled home standby gensets market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the liquid cooled home standby gensets market is projected to reach USD 8.3 billion by 2035.

The liquid cooled home standby gensets market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in liquid cooled home standby gensets market are > 100 kva, ≤ 25 kva, > 25 kva - 50 kva and > 50 kva - 100 kva.

In terms of fuel, diesel segment to command 54.3% share in the liquid cooled home standby gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA