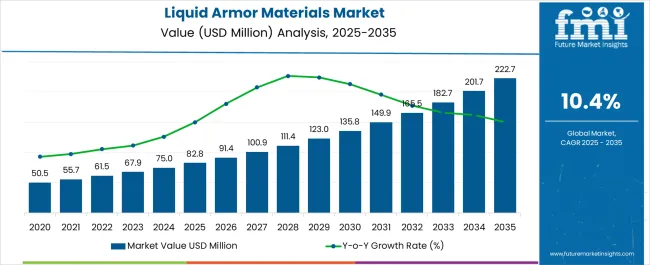

The liquid armor materials market, valued at USD 82.8 million in 2025 and projected to reach USD 222.7 million by 2035, is expanding at a CAGR of 10.4%, with growth distributed across distinct five-year blocks. From 2021 to 2025, the market increases from USD 50.5 million to USD 82.8 million, adding USD 32.3 million, driven by rising defense and law enforcement demand for lightweight, flexible armor solutions offering ballistic and stab resistance. This phase is shaped by early adoption of shear-thickening fluids (STFs) and nanocomposite-based armor, emphasizing enhanced protection and mobility.

Between 2026 and 2030, the market grows from USD 91.4 million to USD 135.8 million, contributing USD 44.4 million, as applications broaden to include military vehicle armor, aerospace defense, and protective gear for industrial and sports use. Increased R&D in material science, coupled with strategic defense procurement programs, accelerates commercialization.

The final block, from 2031 to 2035, marks the strongest expansion, rising from USD 149.9 million to USD 222.7 million and contributing USD 72.8 million. This phase reflects mainstream adoption, driven by integration of smart materials, self-healing coatings, and multifunctional protection systems that appeal across defense, civilian, and industrial markets. Overall, the market shows consistent acceleration, with later years delivering the greatest gains, underscoring its long-term potential across multiple sectors.

| Metric | Value |

|---|---|

| Liquid Armor Materials Market Estimated Value in (2025 E) | USD 82.8 million |

| Liquid Armor Materials Market Forecast Value in (2035 F) | USD 222.7 million |

| Forecast CAGR (2025 to 2035) | 10.4% |

The liquid armor materials market accounts for a crucial place within the global advanced protective materials segment, accounting for nearly 33–36% share due to its role in enhancing ballistic resistance and flexibility in protective gear. Within the wider defense and personal protection equipment industry, liquid armor contributes around 20–22% share, reflecting its importance in lightweight body armor and tactical equipment designed for military and law enforcement use. In vehicle protection applications, such as armored vehicles and combat platforms, liquid armor materials command nearly 15–17% share, offering mobility advantages without compromising safety.

Within the nanomaterials and smart polymers domain, liquid armor secures an estimated 12–14% share, owing to its unique shear-thickening fluid (STF) technology that hardens upon impact. Growth momentum is strongly supported by rising defense budgets, increasing demand for next-generation personal protective equipment, and collaborations between material science innovators and defense contractors.

The market is also witnessing adoption in non-defense applications such as sports safety gear and industrial protective clothing, expanding its potential reach. Despite high R&D costs and challenges in large-scale production, liquid armor is gaining traction due to its ability to deliver flexibility, comfort, and superior impact absorption.

Innovations in material science and nanotechnology are enabling the development of armor systems that provide enhanced mobility without compromising protection levels. The growing need for lightweight, adaptive armor is being driven by both defense and law enforcement sectors, where operational efficiency and wearer comfort are critical. Research efforts are increasingly focusing on improving the molecular properties of liquid armor materials to respond dynamically to force, allowing them to absorb and disperse energy effectively.

Global security challenges, modernization of military equipment, and rising investments in next-generation protective gear are also contributing to market expansion. As industries seek to integrate high-performance protective materials into diverse applications, from personal body armor to vehicle and structural reinforcement, the market is expected to benefit from sustained innovation, cross-sector collaborations, and increased defense budgets across multiple regions.

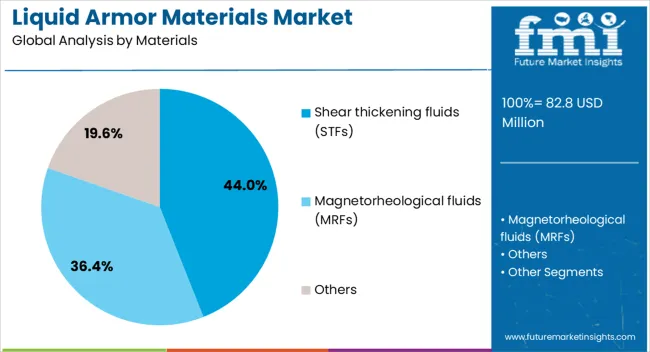

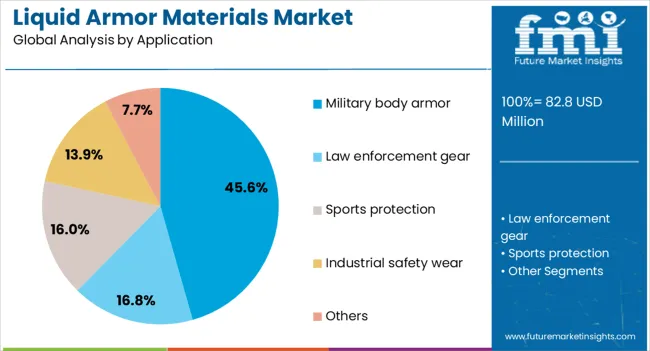

The liquid armor materials market is segmented by materials, application, and geographic regions. By materials, the liquid armor materials market is divided into Shear thickening fluids (STFs), Magnetorheological fluids (MRFs), and Others. In terms of application, liquid armor materials market is classified into Military body armor, Law enforcement gear, Sports protection, Industrial safety wear, and Others. Regionally, the liquid armor materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shear thickening fluids materials segment is projected to account for 44% of the liquid armor materials market revenue share in 2025, positioning it as the leading material type. The segment’s prominence has been supported by the unique property of shear thickening fluids to instantly transition from a liquid to a rigid state upon high-velocity impact. This transformation enhances protection while maintaining flexibility during regular movement, making it suitable for modern armor requirements.

The adaptability of these fluids to various substrates and fabrics has facilitated their integration into advanced protective gear. The ability to provide enhanced ballistic resistance without significantly increasing weight has been recognized as a key advantage in defense and security applications. Continuous research to improve viscosity control and impact absorption has further reinforced market acceptance. As demand for multifunctional armor solutions grows, the shear thickening fluids segment is expected to maintain its leadership due to its proven performance and compatibility with evolving armor technologies.

The military body armor application segment is estimated to hold 45.60% of the liquid armor materials market revenue share in 2025, making it the leading application. Growth in this segment has been driven by the critical need to protect personnel in increasingly complex and high-threat operational environments. Liquid armor materials, particularly those with shear thickening fluid properties, have been incorporated into body armor systems to enhance mobility while offering superior ballistic and stab resistance.

The ability to adapt protection levels without compromising comfort has been a significant factor in adoption by defense forces. Advancements in material integration techniques have enabled lighter designs with improved durability, reducing fatigue for personnel during extended operations.

Rising defense budgets, coupled with modernization programs aimed at equipping soldiers with state-of-the-art protective gear, have further supported the segment’s expansion. The focus on reducing injury risk while improving operational readiness ensures that military body armor remains the dominant application in the market.

Liquid armor materials are gaining traction due to rising defense needs, law enforcement adoption, vehicle integration, and collaborative R&D efforts. Their unique ability to provide lightweight yet reliable protection secures their long-term relevance.

The demand for liquid armor materials has been rising as militaries prioritize lightweight yet high-strength protective solutions for soldiers in combat zones. These materials provide flexibility for movement while hardening on impact, making them highly suited for body armor, helmets, and tactical shields. Governments across Asia-Pacific, North America, and Europe are investing in next-generation protective gear, which has increased funding for research programs. The growing need to safeguard personnel against modern ballistic and stab threats has placed liquid armor at the center of defense procurement strategies. Its ability to combine comfort with superior impact resistance differentiates it from conventional heavy armor solutions.

Law enforcement agencies have become prominent adopters of liquid armor materials due to increasing requirements for reliable yet lightweight protective wear. Police and security forces benefit from armor that is less restrictive during long hours of active duty. Riot control units and counterterrorism squads are especially considering liquid armor-based vests and shields, which enable enhanced mobility during rapid-response operations. The integration of shear-thickening fluids into textiles has allowed law enforcement to replace heavier alternatives with flexible options. This expansion demonstrates the ability of liquid armor to meet the growing demands of urban policing environments, where both safety and agility are critical.

Liquid armor materials are being increasingly integrated into military vehicles, transport carriers, and protective shields for sensitive equipment. Their capability to reduce overall vehicle weight while providing high ballistic protection makes them valuable in both land and air defense platforms. Armored vehicles fitted with liquid armor composites achieve better fuel efficiency and maneuverability. Beyond vehicles, protective casings for electronic and communication equipment are also adopting liquid armor solutions, ensuring durability during hostile conditions. These integrations reinforce liquid armor’s role not just in personal protection but also in shielding critical assets, broadening its scope of influence across defense and industrial applications.

Collaboration between material science companies, defense contractors, and research institutes has been instrumental in advancing liquid armor technologies. Partnerships focus on improving shear-thickening fluid formulations, extending their durability, and optimizing performance across various textile blends.

Defense ministries and academic institutions are funding pilot programs to test large-scale applications of liquid armor, ensuring scalability and cost efficiency. These collaborations have accelerated the transition from experimental use to commercial deployment. Industry partnerships are also helping to develop hybrid armor solutions, combining liquid armor with advanced fabrics for maximum protective value. Such cooperative efforts are expanding adoption across multiple sectors beyond defense.

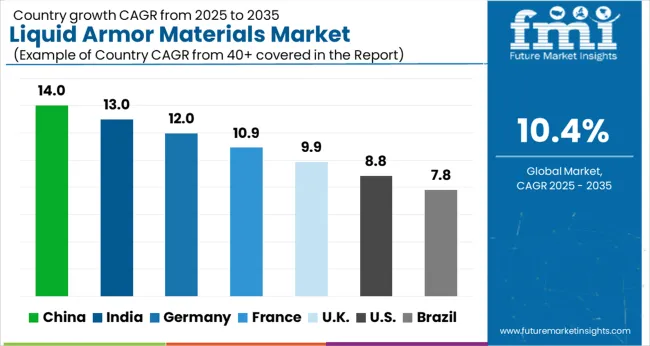

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

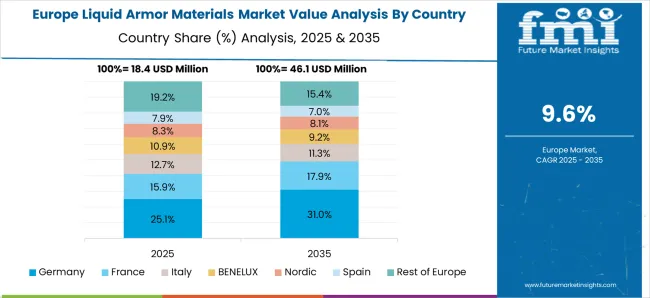

The liquid armor materials market is projected to expand globally at a CAGR of 10.4% from 2025 to 2035, driven by rising demand for advanced protective solutions across defense, law enforcement, and specialized industrial applications. China leads with a CAGR of 14.0%, supported by heavy defense spending, large-scale modernization of soldier gear, and integration of liquid armor in armored vehicles and tactical equipment. India follows at 13.0%, propelled by defense procurement programs, increasing demand for law enforcement protective gear, and government-backed initiatives to strengthen domestic manufacturing of advanced textiles. . France posts 10.9%, driven by demand in defense modernization and adoption of innovative textile blends for ballistic protection. The United Kingdom grows at 9.9%, reflecting steady adoption in specialized law enforcement units and testing programs for military applications. The United States registers 8.8%, influenced by mature procurement cycles, cost considerations, and gradual integration of liquid armor in next-generation protective gear and industrial safety equipment. The analysis demonstrates Asia-Pacific as the fastest-growing hub, Europe as a compliance-driven adopter, and North America as a steady but slower market focused on innovation and long-term adoption.

China is projected to post a CAGR of 14.0% during 2025–2035, up from about 12.6% in 2020–2024, far above the 10.4% global pace. The step up is tied to larger defense budgets, accelerated procurement for soldier systems, and expanded trials in armored vehicle liners. Police forces have adopted lighter vests that use shear-thickening fluid impregnated fabrics for crowd control and high-risk interventions. Tier-one textile clusters in Zhejiang and Guangdong have scaled coated fabric capacity, which improves delivery times for military and domestic security customers. Partnerships between research institutes and material suppliers are advancing durability, stab resistance, and multi-hit performance. In my view, repeat orders from provincial agencies will keep utilization high and reduce unit costs through volume learning.

India is forecasted to register a CAGR of 13.0% for 2025–2035, compared with nearly 11.8% in 2020–2024, exceeding the 10.4% global average. The improvement is linked to Make in India sourcing rules that favor domestic armor production, steady police modernization, and rigorous trials for paramilitary units. Body armor tenders increasingly specify mobility and comfort, which favors liquid armor textiles over rigid plates in several roles. Private fabric mills and defense public sector units are collaborating on field validation to speed certifications. My assessment is that rising orders for law enforcement and border protection, coupled with exports to friendly nations, will keep growth elevated and broaden supplier bases.

France is expected to deliver a CAGR of 10.9% through 2025–2035, advancing from around 10.1% in 2020–2024 and slightly above the 10.4% global guide. Demand has expanded beyond infantry vests into gendarmerie equipment, protective gloves, and modular panels for critical gear. Procurement agencies favor lighter ensembles for longer missions, which suits shear-thickening fluid systems embedded in aramid or UHMWPE fabrics. National programs supporting dual-use materials have improved funding access for textile innovators and testing laboratories. In my opinion, tighter specifications for comfort and blunt-impact protection will keep liquid armor competitive against heavier alternatives while sustaining premium pricing where performance margins are proven.

The United Kingdom is projected to record a CAGR of 9.9% during 2025–2035, compared with an estimated 8.9% in 2020–2024, trailing the 10.4% global rate but improving meaningfully. The earlier period sat lower as programs focused on trials, budget phasing, and wear-life testing across police units. Momentum is now rising because special operations forces and specialist police teams favor flexible vests and limb guards that maintain agility. Pilot fits on vehicle spall liners and equipment cases are broadening use. The climb from 8.9% to 9.9% is explained by better procurement visibility, supplier qualification of STF laminates, and inclusion of lightweight specs in new tenders. I expect cluster purchasing through regional forces to lift throughput and lower costs.

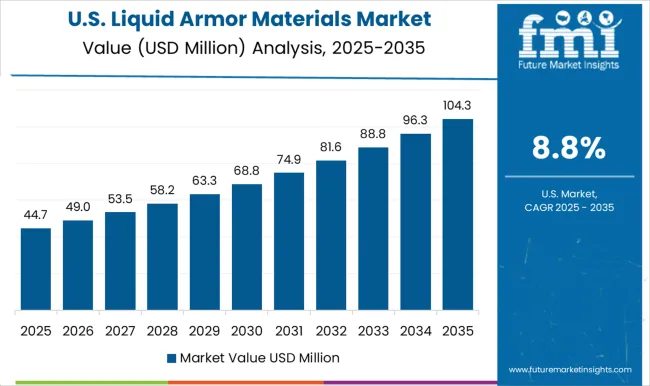

The United States is anticipated to grow at a CAGR of 8.8% in 2025–2035, up from roughly 8.0% during 2020–2024 and below the 10.4% global mark. Procurement is steady but deliberate because agencies prioritize lifecycle evidence, comfort in hot climates, and compatibility with existing plate carriers. Liquid armor finds roles in layered ensembles, soft armor inserts, and protective sleeves for K-9 units and bomb squads. Industrial safety applications are adding demand for cut and impact resistant apparel. From my perspective, unit growth stays measured as budgets cycle, yet long test histories, improved abrasion resistance, and blunt-impact performance should secure incremental share within soft armor programs.

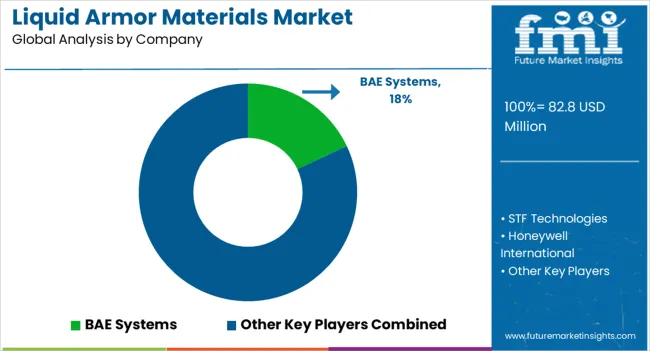

Global defense contractors and specialized advanced material innovators such as BAE Systems, STF Technologies, Honeywell International, NanoSonic, BASF, D3O, ArmaJet International, Avient Corporation, and other regional players lead the liquid armor materials market. These companies compete on shear-thickening fluid (STF) formulations, ballistic protection efficiency, textile integration, and durability under field conditions.

BAE Systems maintains a strong position by leveraging its expertise in soldier protection systems and vehicle armor solutions, integrating liquid armor into next-generation body protection. STF Technologies focuses exclusively on advanced fluid-based formulations, tailoring materials for flexible textiles that harden on impact. Honeywell International utilizes its strong presence in aramid fibers, especially Kevlar, to blend with liquid armor materials for enhanced performance. NanoSonic develops innovative nanostructured materials that improve shock absorption and extend the life cycle of protective equipment. BASF plays a critical role as a chemical supplier, offering proprietary polymer blends to improve energy absorption and fluid performance.

D3O is recognized for its application-oriented products, supplying impact protection gear for defense, law enforcement, and industrial safety. ArmaJet International emphasizes high-performance armor fabrics that complement STF technologies. Avient Corporation brings strong polymer engineering expertise, offering customized solutions to enhance ballistic and stab resistance. Regional and niche players also add value by creating tailored solutions for law enforcement and localized defense markets. The competitive environment is shaped by partnerships between defense agencies and material science innovators, continuous R&D investment in STF formulations, and expansion into civilian protective gear such as sports and industrial equipment. Future competitiveness will depend on cost reduction, field testing validation, and scaling production capabilities to meet growing demand in defense and security applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 82.8 Million |

| Materials | Shear thickening fluids (STFs), Magnetorheological fluids (MRFs), and Others |

| Application | Military body armor, Law enforcement gear, Sports protection, Industrial safety wear, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, STF Technologies, Honeywell International, NanoSonic, BASF, D3O, ArmaJet International, Avient Corporation, and Others |

| Additional Attributes | Dollar sales, share, adoption across defense and law enforcement, demand in vehicle protection, R&D progress, regional procurement trends, competitive positioning, and export opportunities. |

The global liquid armor materials market is estimated to be valued at USD 82.8 million in 2025.

The market size for the liquid armor materials market is projected to reach USD 222.7 million by 2035.

The liquid armor materials market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in liquid armor materials market are shear thickening fluids (STFs), magnetorheological fluids (MRFs) and others.

In terms of application, military body armor segment to command 45.6% share in the liquid armor materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA