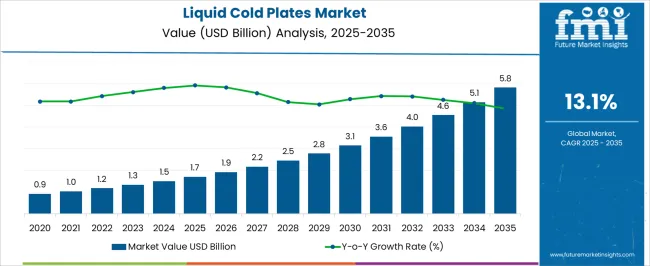

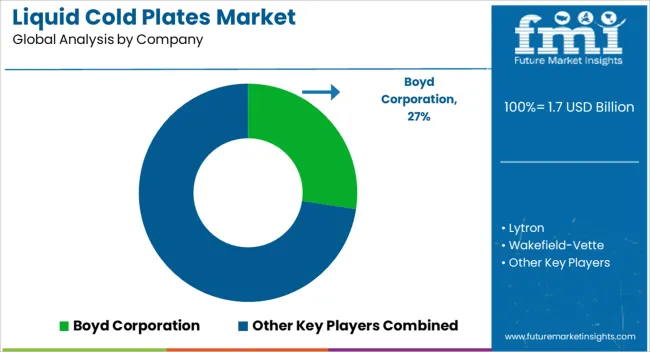

The Liquid Cold Plates Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 13.1% over the forecast period.

| Metric | Value |

|---|---|

| Liquid Cold Plates Market Estimated Value in (2025 E) | USD 1.7 billion |

| Liquid Cold Plates Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The Liquid Cold Plates market is experiencing strong momentum as industries increasingly rely on advanced thermal management solutions to ensure the efficiency and reliability of electronic systems. Growth is being fueled by the rising demand for high-performance computing, electric mobility, renewable energy systems, and aerospace applications where effective heat dissipation is critical.

The market in 2025 reflects a solid foundation built on the adoption of liquid cooling over traditional air-based methods, driven by the need for higher power density handling and improved energy efficiency. Manufacturers are prioritizing design innovations that allow plates to handle larger heat fluxes while maintaining cost efficiency and operational durability.

Future outlook is defined by the growing use of copper and aluminum-based liquid plates, paired with modular and scalable designs suited for evolving electronics With regulatory emphasis on sustainable energy systems and the ongoing electrification of transport, the market is positioned for sustained expansion, offering opportunities for both established players and new entrants.

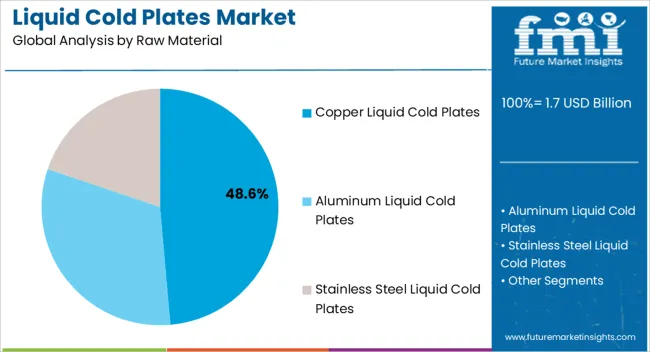

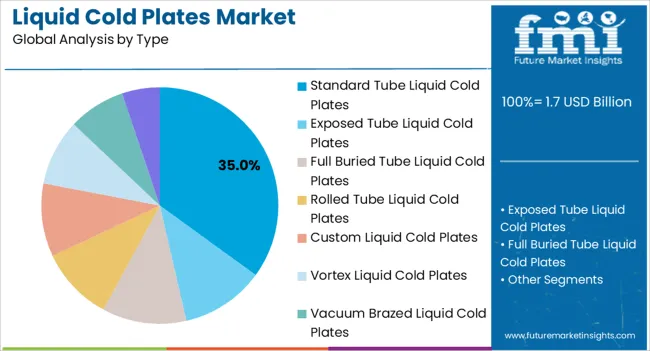

The liquid cold plates market is segmented by raw material, type, flow options, application, and geographic regions. By raw material, liquid cold plates market is divided into Copper Liquid Cold Plates, Aluminum Liquid Cold Plates, and Stainless Steel Liquid Cold Plates. In terms of type, liquid cold plates market is classified into Standard Tube Liquid Cold Plates, Exposed Tube Liquid Cold Plates, Full Buried Tube Liquid Cold Plates, Rolled Tube Liquid Cold Plates, Custom Liquid Cold Plates, Vortex Liquid Cold Plates, Vacuum Brazed Liquid Cold Plates, and Cab Brazed Liquid Cold Plates.

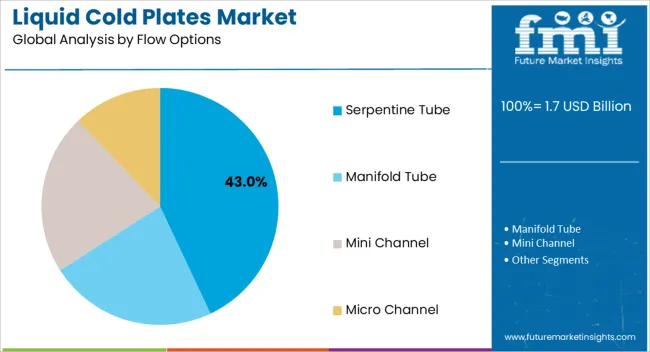

Based on flow options, liquid cold plates market is segmented into Serpentine Tube, Manifold Tube, Mini Channel, and Micro Channel. By application, liquid cold plates market is segmented into High Powered Electronics, IGBT Modules, Lasers, Wind Turbines, Motor Devices, Automotive Components, and Medical Equipment. Regionally, the liquid cold plates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Copper Liquid Cold Plates segment is projected to hold 48.60% of the Liquid Cold Plates market revenue in 2025, making it the dominant raw material choice. This leading share is being attributed to copper’s superior thermal conductivity, which ensures efficient heat dissipation in high-intensity applications. Copper plates are particularly favored in industries such as defense, aerospace, and power electronics where performance reliability is a critical requirement.

Their durability and ability to sustain higher thermal loads compared to alternative materials have positioned copper as a preferred choice for mission-critical equipment. The segment has further benefited from advancements in manufacturing processes that optimize design precision while reducing weight and overall cost.

As electronics continue to demand compact solutions with enhanced power density, copper cold plates provide the right balance of conductivity and structural integrity The ability to integrate with complex cooling circuits without compromising performance is reinforcing the segment’s growth, making it the top contributor within the raw material category.

The Standard Tube Liquid Cold Plates segment is expected to account for 35.00% of the Liquid Cold Plates market revenue in 2025, making it the leading type. This growth is being influenced by the widespread adoption of standard tube designs that balance cost-effectiveness with reliable cooling performance. The ability of these designs to manage thermal loads across a variety of medium to high-powered electronics has made them popular in both industrial and commercial settings.

Manufacturers have been able to scale production efficiently due to the straightforward architecture of standard tube plates, enabling consistent performance while keeping costs manageable. The segment’s growth is further supported by its compatibility with diverse raw materials such as copper and aluminum, offering flexibility to end-users.

As demand grows across electric vehicles, renewable power systems, and industrial electronics, the use of standard tube configurations is expected to remain dominant Their proven reliability and adaptability in mass-market applications will continue to reinforce their position as the preferred type in liquid cold plates.

The Serpentine Tube configuration is anticipated to hold 43.00% of the Liquid Cold Plates market revenue in 2025, highlighting its leadership in the flow options category. This dominance is being driven by the efficiency of serpentine pathways in maximizing heat transfer and fluid coverage within the plate. The continuous winding structure allows for longer fluid residence time, ensuring uniform cooling and minimizing hotspots in high-powered devices.

This configuration is being increasingly adopted in applications that demand precise temperature regulation and consistent thermal performance, such as electric vehicles, industrial automation equipment, and advanced computing systems. The design also provides structural flexibility, allowing manufacturers to adapt plates for custom applications without compromising cooling efficiency.

As industries continue to prioritize high-performance liquid cooling systems that can manage escalating power densities, serpentine tube designs are expected to remain at the forefront Their ability to provide enhanced cooling without substantially increasing size or material usage has solidified their position as a key growth driver in the flow options category.

Liquid cold plates are primarily use to provide a cooling operating environment to an equipment and assembly. Numerous high-end applications that are subjected to be operated in very high operating temperature conditions such as power electronics, automotive component, medical equipment to name a few require an efficient amount of cooling supply for efficient working.

In the above-said applications when conventional cooling method i.e. air cooling is not efficient enough to remove or handle the heat load that is a requisite to keep equipment under their harmless elevated operating temperature, liquid cold plates are implemented to draw down higher level of performance & reliability.

Liquid cold plates are made up of a based plate material such as copper & aluminum and a passage or a tube from where the cooling liquid or coolant circulates. The choice of coolant in the liquid cold plate is totally dependent on the choice of material. Antifreeze fluid, ethylene glycol, propylene glycol, industrial water, pure water, and city water are some of the preferred coolants.

Liquid cold plates operate in the principle that heat generates through the assembly or an equipment is come into the contact of the cooling fluid circulating into the tubes or passage & subsequently cools down & excessive heat is dissipated into the environment, thus reducing the heat load.

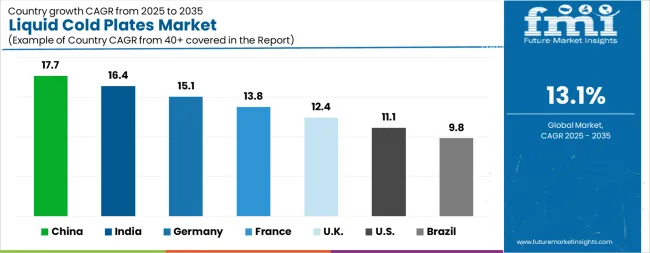

| Country | CAGR |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| France | 13.8% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The Liquid Cold Plates Market is expected to register a CAGR of 13.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 17.7%, followed by India at 16.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 9.8%, yet still underscores a broadly positive trajectory for the global Liquid Cold Plates Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 15.1%.

The USA Liquid Cold Plates Market is estimated to be valued at USD 603.3 million in 2025 and is anticipated to reach a valuation of USD 1.7 billion by 2035. Sales are projected to rise at a CAGR of 11.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 80.4 million and USD 57.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Raw Material | Copper Liquid Cold Plates, Aluminum Liquid Cold Plates, and Stainless Steel Liquid Cold Plates |

| Type | Standard Tube Liquid Cold Plates, Exposed Tube Liquid Cold Plates, Full Buried Tube Liquid Cold Plates, Rolled Tube Liquid Cold Plates, Custom Liquid Cold Plates, Vortex Liquid Cold Plates, Vacuum Brazed Liquid Cold Plates, and Cab Brazed Liquid Cold Plates |

| Flow Options | Serpentine Tube, Manifold Tube, Mini Channel, and Micro Channel |

| Application | High Powered Electronics, IGBT Modules, Lasers, Wind Turbines, Motor Devices, Automotive Components, and Medical Equipment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boyd Corporation, Lytron, Wakefield-Vette, Wieland MicroCool, Aavid Thermalloy (Boyd Corporation), Advanced Thermal Solutions, Inc. (ATS), Mikros Technologies, and COFAN-USA |

The global liquid cold plates market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the liquid cold plates market is projected to reach USD 5.8 billion by 2035.

The liquid cold plates market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in liquid cold plates market are copper liquid cold plates, aluminum liquid cold plates and stainless steel liquid cold plates.

In terms of type, standard tube liquid cold plates segment to command 35.0% share in the liquid cold plates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA