The Liquid Synthetic Rubber Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 16.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. During the early adoption phase from 2020 to 2024, the market grew from USD 9.5 billion to USD 11.0 billion. This stage was driven by niche applications in automotive, construction, and industrial products, where manufacturers explored the benefits of enhanced elasticity, chemical resistance, and ease of processing. Early adopters focused on product testing, pilot projects, and integration into specialized applications, creating foundational awareness for broader market adoption.

The scaling phase begins in 2025 when the market reaches USD 11.4 billion and continues through 2030, growing to approximately USD 13.3 billion. This period is characterized by increasing adoption across mainstream applications, supported by process optimization, cost efficiency, and wider recognition of performance advantages. Demand rises from automotive seals, adhesives, and coatings, while manufacturers expand production capacities and supply chain networks, driving broader industry penetration.

From 2030 to 2035, the market enters the consolidation phase, with growth advancing steadily to USD 16.8 billion. The market becomes more competitive, with leading players focusing on efficiency, innovation, and customer retention. Smaller competitors face pressure to merge, exit, or differentiate. Consolidation stabilizes the market, with adoption widely established across industries and incremental innovations sustaining growth.

| Metric | Value |

|---|---|

| Liquid Synthetic Rubber Market Estimated Value in (2025 E) | USD 11.4 billion |

| Liquid Synthetic Rubber Market Forecast Value in (2035 F) | USD 16.8 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The liquid synthetic rubber market is witnessing a robust expansion, primarily driven by the surge in demand from the tire and automotive sectors. With increasing emphasis on enhancing fuel efficiency and reducing rolling resistance, manufacturers are prioritizing materials that offer superior flexibility and resilience, where liquid synthetic rubber has emerged as a vital component. The market is also gaining traction due to its adaptability in formulations that support reduced VOC emissions and improved thermal stability.

Advancements in synthetic rubber processing technologies and the rising utilization of high-purity rubber variants in adhesives, sealants, and coatings are further strengthening its adoption. Strategic collaborations between chemical companies and tire OEMs are enabling innovation in compound design, especially in applications where enhanced grip and performance are required.

As sustainability regulations intensify, the demand for custom-formulated elastomers with low environmental impact is expected to propel the market forward The outlook remains optimistic, with expanded use cases anticipated in specialty applications such as electrical insulation and high-performance polymers.

The liquid synthetic rubber market is segmented by product, application, and geographic regions. By product, the liquid synthetic rubber market is divided into Polybutadiene, Isoprene, SBR, and Others. In terms of application, the liquid synthetic rubber market is classified into Tires, Adhesive, IRM, Polymer modification, and Others. Regionally, the liquid synthetic rubber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polybutadiene is projected to account for 47.6% of the total revenue share in the liquid synthetic rubber market in 2025, establishing it as the leading product segment. This position has been supported by the exceptional elasticity, abrasion resistance, and low-temperature performance of polybutadiene, making it highly suitable for dynamic applications.

The segment’s growth has been further influenced by its compatibility with tire compounding formulations, particularly in tread and sidewall structures where high rebound resilience is critical. Improved polymerization techniques and the availability of liquid grades tailored for specific molecular weights and viscosities have allowed manufacturers to fine-tune performance characteristics in rubber blends.

Additionally, the segment benefits from a well-established global supply base and technological maturity, which support cost-effective production and quality consistency. The widespread preference for polybutadiene in high-wear environments has reinforced its continued dominance across sectors seeking enhanced durability and energy efficiency in end-use applications.

The tires application segment is expected to hold 52.4% of the overall revenue share in the liquid synthetic rubber market by 2025, making it the most dominant use case. This growth is being driven by the automotive industry's increasing emphasis on fuel-efficient and high-performance tires. Liquid synthetic rubber, when used in tire formulations, improves flexibility, wet grip, and rolling resistance, resulting in enhanced vehicle safety and lower energy consumption.

The ability to blend seamlessly with other rubber components and to enable precise control over compound properties has made it a preferred material in both passenger and commercial tire segments. OEMs are increasingly utilizing advanced rubber technologies to meet evolving regulatory standards and consumer expectations for performance and durability.

The segment has also gained momentum due to growing demand for all-season and electric vehicle tires, where customized rubber formulations play a critical role. These trends have collectively contributed to the segment’s leading share and are expected to sustain its growth trajectory in the foreseeable future.

The liquid synthetic rubber (LSR) market is experiencing strong growth driven by rising demand from automotive, healthcare, electronics, and consumer goods sectors. LSR is valued for its flexibility, high-temperature resistance, chemical stability, and precision molding capabilities, making it ideal for seals, gaskets, medical devices, and electronic components. Growth is fueled by increasing adoption in electric vehicles, medical-grade products, and smart electronics.

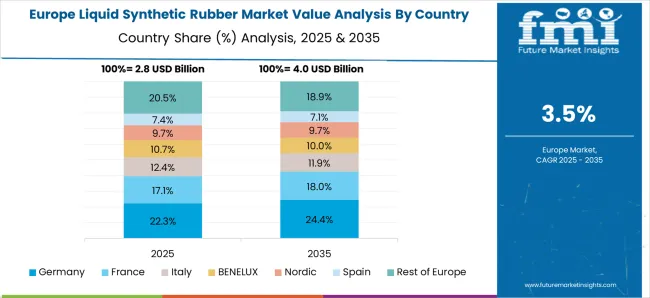

North America and Europe dominate due to established manufacturing bases and high-quality standards, while Asia-Pacific shows rapid growth owing to industrial expansion and rising healthcare demand. Market players focus on improving material formulations, processing efficiency, and sustainability by developing bio-based or low-VOC LSR. Strategic collaborations with OEMs and research institutions drive innovation in high-performance applications, enabling manufacturers to capture specialized and premium market segments.

A key challenge in the LSR market is managing the complex processing requirements. LSR requires precise mixing, injection molding, and curing under controlled temperature and pressure to achieve consistent product quality. Variations in curing time, mold design, or silicone formulation can affect mechanical properties, color uniformity, and surface finish. Scaling production for high-volume applications, such as automotive seals or electronic components, demands specialized equipment and skilled operators. Controlling shrinkage, flow characteristics, and demolding issues is critical for maintaining tolerances and performance.

Manufacturers investing in automated injection systems, advanced curing technologies, and quality monitoring gain a competitive advantage by reducing defects and improving throughput. Until process standardization and operator expertise improve, maintaining consistent quality and scaling production efficiently remain significant challenges for market players.

Technological advancements are propelling the LSR market forward. Development of high-consistency LSR formulations allows precise molding of complex geometries with excellent surface finish and mechanical properties. Innovations in bio-based and low-VOC LSR improve sustainability while maintaining performance for automotive, medical, and consumer applications. Multi-component injection systems and micro-molding technologies enable the production of micro-sized components with high accuracy. Advanced curing techniques reduce cycle times and enhance productivity. Integration with automation and real-time process monitoring ensures consistent quality in large-scale production. Companies leveraging these innovations can meet the stringent requirements of medical devices, electronics, and EV components, differentiating themselves through performance, reliability, and environmental compliance. Continuous R&D in material science and processing technology is essential to meet evolving application demands.

The LSR market is influenced by regulatory and safety requirements, particularly in medical, food, and automotive applications. Materials must comply with standards such as FDA, ISO 10993, REACH, and RoHS, ensuring biocompatibility, chemical resistance, and environmental safety. Non-compliance can lead to product recalls, legal penalties, and loss of market trust. Automotive and aerospace sectors impose stringent quality and performance specifications, including thermal stability, tensile strength, and flame retardancy. Companies must implement rigorous testing, documentation, and traceability systems to satisfy regulatory and OEM requirements. Increasing environmental and safety regulations encourage the adoption of bio-based and low-emission LSR formulations. Until global harmonization of rules is achieved, manufacturers must navigate regional differences in safety, environmental, and quality standards, balancing compliance with operational efficiency and innovation.

The LSR market is highly competitive, featuring multinational chemical manufacturers, regional suppliers, and specialty silicone producers. Companies differentiate through product quality, formulation expertise, processing support, and after-sales service. Supply chain stability for silicone feedstocks, catalysts, and additives is critical for consistent production. Price fluctuations in raw materials and logistics challenges can affect costs and lead times. Strategic collaborations with OEMs, automation equipment providers, and R&D institutions strengthen market positioning. Manufacturers investing in local production, integrated supply chains, and technical support services gain reliability and faster time-to-market. Until raw material availability and process standardization improve, competitive rivalry and supply chain efficiency remain key factors influencing adoption, pricing, and customer retention in automotive, medical, electronics, and consumer applications.

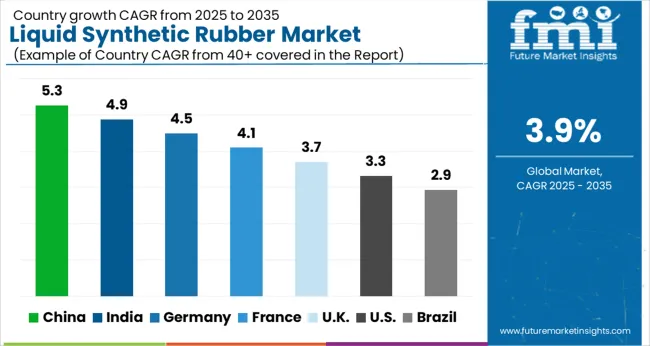

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global Liquid Synthetic Rubber Market is projected to grow at a CAGR of 3.9% through 2035, supported by increasing demand across automotive, industrial, and construction applications. Among BRICS nations, China has been recorded with 5.3% growth, driven by large-scale production and deployment in automotive and industrial components, while India has been observed at 4.9%, supported by rising utilization in manufacturing and construction sectors. In the OECD region, Germany has been measured at 4.5%, where production and adoption for automotive, industrial, and construction applications have been steadily maintained. The United Kingdom has been noted at 3.7%, reflecting consistent use in industrial and automotive applications, while the USA. has been recorded at 3.3%, with production and utilization across manufacturing and construction sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The liquid synthetic rubber market in China is expanding at a CAGR of 5.3%, driven by rising demand in automotive, construction, and industrial sectors. Manufacturers increasingly prefer liquid synthetic rubber due to its flexibility, chemical resistance, and ease of processing for coatings, sealants, adhesives, and molded products. Growth in automotive components, construction materials, and electrical insulation applications supports steady adoption. Local companies are investing in R&D to develop high-performance, durable, and eco-friendly rubber solutions that meet industrial requirements. The demand for lightweight and energy-efficient automotive components further accelerates market expansion. Additionally, government initiatives to support industrial manufacturing and chemical production enhance supply chain stability. Continuous advancements in polymer chemistry enable improved product performance and broader application areas for liquid synthetic rubber across China.

The liquid synthetic rubber market in India is growing at a CAGR of 4.9%, fueled by rising consumption in automotive, industrial, and construction applications. Increasing demand for high-performance adhesives, sealants, coatings, and molded rubber components contributes to steady market growth. Indian manufacturers are investing in research and development to improve the durability, elasticity, and thermal stability of liquid synthetic rubber products. Expanding automotive production and electrical insulation requirements in the country support sustained adoption. Government programs promoting industrial growth, construction development, and chemical manufacturing encourage production and supply chain efficiency. Technological advancements, including new formulations for enhanced chemical and heat resistance, are boosting product applications. The combination of domestic demand, export opportunities, and investment in polymer research positions India’s liquid synthetic rubber market for consistent growth.

Germany’s liquid synthetic rubber market is expanding at a CAGR of 4.5%, supported by industrial manufacturing, automotive applications, and construction requirements. The market benefits from the demand for flexible, durable, and chemically resistant materials used in coatings, adhesives, sealants, and molded components. German manufacturers emphasize quality standards, product consistency, and advanced formulations for improved thermal and chemical resistance. Automotive OEMs and industrial sectors increasingly adopt liquid synthetic rubber for lightweight and energy-efficient components. Government initiatives promoting innovation, chemical safety, and sustainable production further enhance market stability. Collaborations between research institutions and manufacturers encourage technological advancements and application diversification. Export demand for high-quality liquid synthetic rubber also contributes to steady growth. The combination of industrial demand, technological innovation, and regulatory compliance supports a consistent expansion of the liquid synthetic rubber market in Germany.

The liquid synthetic rubber market in the United Kingdom is growing at a CAGR of 3.7%, driven by demand in automotive, construction, and industrial applications. Manufacturers use liquid synthetic rubber for adhesives, sealants, coatings, and molded products that require flexibility and chemical resistance. Technological improvements in polymer formulation enhance product durability, thermal stability, and elasticity. Government programs encouraging industrial manufacturing and chemical innovation contribute to market growth. Automotive and construction sectors are adopting lightweight, energy-efficient materials, further driving demand. Increasing emphasis on product quality, safety standards, and performance reliability supports expansion. R&D initiatives focusing on eco-friendly and high-performance liquid synthetic rubber solutions are increasing adoption across multiple end-use industries.

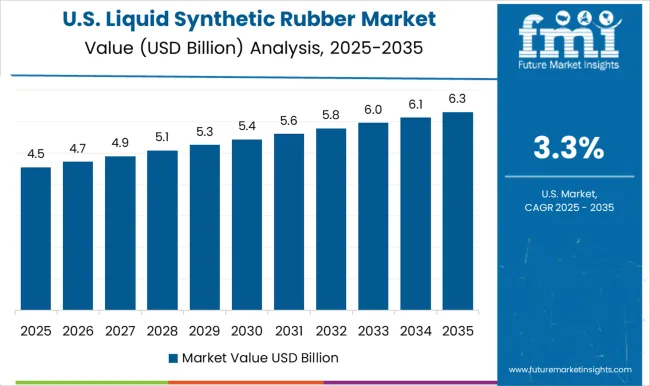

The liquid synthetic rubber market in the United States is expanding at a CAGR of 3.3%, fueled by industrial, automotive, and construction applications. Demand is driven by the need for high-performance adhesives, sealants, coatings, and molded components that offer flexibility and chemical resistance. Manufacturers focus on developing formulations with improved thermal stability, elasticity, and longevity. Industrial and automotive sectors are adopting liquid synthetic rubber for lightweight, energy-efficient, and durable components. Government programs promoting chemical manufacturing standards, product safety, and innovation support market growth. Research and development investments encourage improved formulations and application diversification. Export opportunities and growing demand for high-quality, reliable rubber products further strengthen the USA. market. As industries prioritize performance, durability, and safety, the liquid synthetic rubber market is expected to maintain steady growth.

The liquid synthetic rubber (LSR) market is experiencing substantial growth due to rising applications in automotive, medical, electronics, and consumer goods sectors. LSR is valued for its high elasticity, chemical resistance, thermal stability, and biocompatibility, making it ideal for seals, gaskets, medical devices, electrical components, and molded products.

Key players driving the market include Asahi Kasei, which offers advanced LSR formulations for automotive and industrial applications, and JSR Corporation, a major supplier of silicone-based and specialty liquid rubbers for electronics and medical industries. Sinopec and Evonik Industries AG provide high-performance LSRs tailored for chemical and industrial applications, while Kumho Petrochemical and ENEOS Corporation focus on innovative elastomer solutions with superior durability and thermal properties.

Synthomer PLC, Kuraray Co., Ltd., and Nippon Soda Co., Ltd. are expanding their portfolios to serve increasing demand in healthcare, consumer, and automotive sectors. Emerging suppliers like Puyang Linshi Chemical New Material Co., Ltd. and Royal Adhesives & Sealants are introducing cost-effective and specialized LSR products targeting industrial and commercial applications.

Market growth is driven by trends such as automotive electrification, miniaturization of electronics, and the rising need for lightweight, chemically resistant, and high-performance elastomers. With ongoing R&D efforts and development of tailored LSR formulations, these manufacturers are strengthening their positions to meet the increasing global demand for versatile liquid synthetic rubber products.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.4 Billion |

| Product | Polybutadiene, Isoprene, SBR, and Others |

| Application | Tires, Adhesive, IRM, Polymer modification, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AsahiKasei, JSRCorporation, Sinopec, EvonikIndustriesAG, KumhoPetrochemical, ENEOSCorporation, SynthomerPLC, KurarayCo.,Ltd, NipponSodaCo.,Ltd, PuyangLinshiChemicalNewMaterialCo.,Ltd, and RoyalAdhesives&Sealants |

| Additional Attributes | Dollar sales vary by type, including styrene-butadiene, nitrile, and ethylene-propylene-diene monomer (EPDM) liquid synthetic rubber; by application, such as automotive, adhesives & sealants, coatings, footwear, and industrial products; by end-use industry, including automotive, construction, and consumer goods; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising automotive demand, flexible manufacturing, and high-performance material adoption. |

The global liquid synthetic rubber market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the liquid synthetic rubber market is projected to reach USD 16.8 billion by 2035.

The liquid synthetic rubber market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in liquid synthetic rubber market are polybutadiene, isoprene, sbr and others.

In terms of application, tires segment to command 52.4% share in the liquid synthetic rubber market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Liquid Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA